Asia Pacific Closed System Transfer Devices Market

Market Size in USD Million

CAGR :

%

USD

200.07 Million

USD

746.95 Million

2025

2033

USD

200.07 Million

USD

746.95 Million

2025

2033

| 2026 –2033 | |

| USD 200.07 Million | |

| USD 746.95 Million | |

|

|

|

|

Asia-Pacific Closed System Transfer Devices Market Size

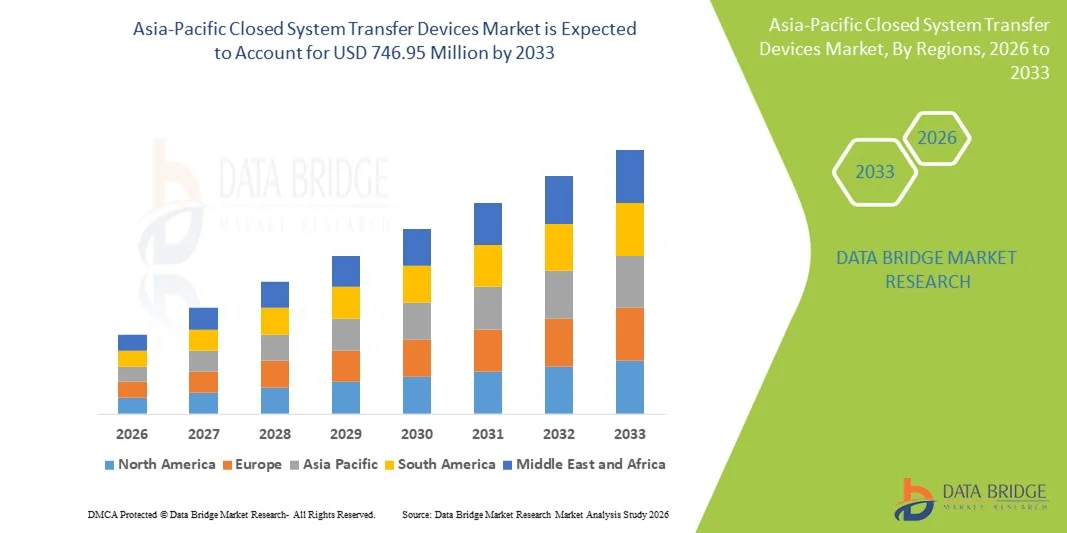

- The Asia-Pacific closed system transfer devices market size was valued at USD 200.07 million in 2025 and is expected to reach USD 746.95 million by 2033, at a CAGR of 17.9% during the forecast period

- The market growth is largely fueled by rapidly expanding healthcare infrastructure, increasing cancer incidence, and rising awareness of occupational safety in hazardous drug handling, leading to broader adoption of CSTDs in hospitals, oncology centers, and clinics

- Furthermore, government initiatives, technological advancements in CSTD design, and the need for safer drug transfer protocols are driving investment and demand across key countries such as China, India, Japan, and South Korea. These converging factors are establishing closed system transfer devices as essential components of modern healthcare safety practices, thereby significantly boosting the market’s growth in the region

Asia-Pacific Closed System Transfer Devices Market Analysis

- Closed system transfer devices (CSTDs), designed to prevent hazardous drug exposure during preparation and administration, are increasingly vital components of modern healthcare and oncology settings in hospitals, clinics, and research institutes due to their enhanced safety, regulatory compliance, and seamless integration into existing drug handling workflows

- The escalating demand for closed system transfer devices is primarily fueled by rising awareness of occupational safety among healthcare professionals, increasing cancer incidence, and strict regulatory guidelines enforcing safe handling of hazardous drugs

- China dominated the Asia-Pacific closed system transfer devices market in 2025, with the largest revenue share of 38.4% characterized by well-established healthcare infrastructure, high adoption of advanced safety protocols in hospitals and oncology centers, and strong presence of key industry players

- India is expected to be the fastest-growing country in the Asia-Pacific closed system transfer devices market during the forecast period due to rapidly expanding healthcare infrastructure and growing oncology patient populations

- Needle-Free closed system transfer device segment dominated the market with a market share of 62.5% in 2025, driven by its ability to minimize hazardous drug exposure, reduce contamination risk, and simplify safe drug handling in healthcare settings

Report Scope and Asia-Pacific Closed System Transfer Devices Market Segmentation

|

Attributes |

Asia-Pacific Closed System Transfer Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Closed System Transfer Devices Market Trends

Enhanced Safety Through Needle-Free Systems and Automation

- A significant and accelerating trend in the Asia-Pacific CSTD market is the growing adoption of needle-free closed system transfer devices, which reduce hazardous drug exposure and contamination risks while simplifying handling in hospitals, oncology centers, and research institutes

- For instance, the BD PhaSeal Needle-Free CSTD enables safe drug transfer without needles, minimizing potential occupational exposure and contamination during chemotherapy preparation and administration

- Automation features in modern CSTDs allow healthcare staff to handle drugs more efficiently while maintaining compliance with strict safety standards, reducing manual errors and improving overall workflow in clinical settings

- Integration of CSTDs with hospital safety protocols and training programs allows centralized monitoring of drug handling practices, enhancing compliance and reducing incidents of accidental exposure for healthcare workers

- This trend towards more efficient, intuitive, and safe drug handling systems is reshaping operational standards in oncology care, and companies such as Equashield are developing needle-free CSTDs with advanced sealing and automated safety mechanisms

- The demand for needle-free CSTDs is growing rapidly across hospitals and oncology centers in India, China, Japan, and South Korea, as healthcare providers increasingly prioritize worker safety, regulatory compliance, and operational efficiency

- Technological advancements, such as real-time monitoring and feedback systems in CSTDs, are enhancing usability and safety, driving wider adoption in clinical workflows

Asia-Pacific Closed System Transfer Devices Market Dynamics

Driver

Rising Need Due to Occupational Safety and Regulatory Compliance

- The increasing awareness of hazardous drug exposure risks among healthcare professionals, coupled with strict government and hospital regulations, is a key driver of the heightened demand for CSTDs

- For instance, in March 2025, BD announced enhancements to its PhaSeal Needle-Free CSTD, integrating advanced sealing technology to improve staff safety and reduce environmental contamination risks

- As hospitals and oncology centers adopt stricter safety protocols, CSTDs offer advanced protection for healthcare workers, minimizing exposure to cytotoxic drugs during preparation and administration

- Furthermore, the expansion of oncology services and chemotherapy treatments in countries such as India and China is driving higher adoption of CSTDs to comply with occupational safety standards

- Needle-free CSTDs provide safer and more efficient drug handling, reducing needlestick injuries, contamination, and procedural errors, further propelling adoption in hospitals, clinics, and research institutes

- Government initiatives promoting workplace safety and mandatory compliance with hazardous drug handling standards are accelerating adoption in public and private healthcare facilities

- Increasing awareness programs and training initiatives for healthcare workers are emphasizing the benefits of CSTDs, driving procurement and usage across oncology centers and hospitals

Restraint/Challenge

High Costs and Training Requirements

- The relatively high initial cost of advanced needle-free CSTDs compared to traditional drug transfer methods is a significant barrier, particularly for smaller clinics and budget-constrained hospitals in developing countries

- For instance, new users in India and Southeast Asia may hesitate to adopt CSTDs due to the upfront investment and perceived complexity of integrating devices into existing workflows

- Proper training for healthcare professionals is critical to ensure safe and correct use of CSTDs, which can be time-consuming and require additional resources for staff education

- While automation reduces manual errors, the need for consistent protocol adherence and monitoring can limit adoption speed, particularly in understaffed healthcare facilities

- Overcoming these challenges through cost-effective solutions, user-friendly designs, and structured training programs will be vital for sustained market growth and wider penetration in Asia-Pacific healthcare facilities

- Supply chain limitations and procurement delays, especially in remote areas, can hinder timely adoption and distribution of CSTDs, affecting market growth

- Limited awareness among smaller clinics and healthcare providers regarding the benefits of needle-free systems can slow adoption, requiring targeted education and marketing strategies

Asia-Pacific Closed System Transfer Devices Market Scope

The market is segmented on the basis of type, component, closing mechanism, technology, end user, and distribution channel.

- By Type

On the basis of type, the Asia-Pacific CSTD market is segmented into membrane-to-membrane systems and needle-free closed system transfer devices. The Needle-Free Closed System Transfer Device segment dominated the market with the largest revenue share of 62.5% in 2025, driven by its ability to minimize hazardous drug exposure, reduce contamination risk, and simplify drug handling in hospitals and oncology centers. These devices are preferred for their ease of use, compliance with stringent safety standards, and compatibility with multiple chemotherapy drug administration procedures. Needle-free systems also support safer workflows for healthcare professionals by eliminating needle sticks and reducing handling errors. In addition, their increasing adoption across China, India, Japan, and South Korea contributes to consistent market growth. Manufacturers such as BD and Equashield are expanding their product portfolios in this segment to meet rising safety and operational efficiency demands. The dominance of needle-free systems is further supported by regulatory mandates emphasizing occupational safety for healthcare workers.

The Membrane-to-Membrane System segment is expected to witness the fastest growth during the forecast period due to its precise drug transfer capabilities and suitability for specialized applications in hospital pharmacies and oncology centers. These systems provide enhanced sealing and reduced contamination risk, making them increasingly preferred in countries with expanding healthcare infrastructure such as India and Southeast Asia. Their adoption is also supported by awareness campaigns highlighting occupational safety and improved handling protocols. Membrane-to-membrane systems are compatible with various drug types and support workflow efficiency in clinical settings. Moreover, technological advancements and cost-effective designs are attracting smaller healthcare facilities to adopt this type, driving accelerated growth in the segment.

- By Component

On the basis of component, the market is segmented into devices and accessories. The Devices segment dominated the market in 2025, as the primary CSTD units are essential for safe drug transfer and exposure prevention. Hospitals and oncology centers invest heavily in these devices to ensure compliance with safety regulations and reduce occupational hazards. Device adoption is supported by robust technological features, including automation and integrated sealing mechanisms. Furthermore, devices form the core of hospital safety protocols, making them a critical component in oncology workflows. Leading manufacturers continue to enhance device functionality, driving sustained market demand. In addition, the durability and reliability of primary CSTD devices make them a preferred choice across Asia-Pacific healthcare facilities, further solidifying their dominant position.

The Accessories segment is anticipated to witness the fastest growth during the forecast period due to the increasing need for supporting components such as tubing sets, caps, connectors, and filters. These accessories enhance the safety, efficiency, and versatility of CSTD operations, making them critical in large-scale hospital pharmacies and oncology centers. Manufacturers are introducing cost-effective accessory kits to cater to smaller clinics and emerging markets. Growing awareness about the importance of complete CSTD systems, including accessories, is also accelerating adoption in India and Southeast Asia. In addition, regulatory guidance emphasizing complete system use is driving accessory demand. The segment benefits from compatibility with multiple device types, boosting its market growth.

- By Closing Mechanism

On the basis of closing mechanism, the market is segmented into push-to-turn systems, color-to-color alignment systems, luer-lock systems, and click-to-lock systems. The Push-to-Turn System segment dominated the market in 2025 due to its ease of use, reliability, and broad compatibility with needle-free CSTDs. Hospitals and oncology centers prefer push-to-turn mechanisms for their simplicity and minimal risk of improper closure, which reduces accidental exposure. This system ensures consistent drug transfer performance and supports compliance with safety regulations. Furthermore, push-to-turn mechanisms are widely adopted in China, India, and Japan due to established procurement practices in major healthcare facilities. Manufacturers continue to innovate on ergonomic designs to improve staff convenience. The dominance is further reinforced by strong regulatory approvals supporting its widespread usage.

The Luer-Lock System segment is expected to witness the fastest growth during the forecast period due to its secure connection, preventing leaks and contamination during drug transfer. Luer-lock systems are increasingly adopted in emerging hospitals and oncology centers in India and Southeast Asia, where safety protocols are becoming more stringent. The design provides versatility for different CSTD applications, supporting multiple drug types and syringe compatibility. In addition, training and awareness initiatives for staff promote its adoption. Manufacturers are introducing improved Luer-Lock variants with automation and feedback features to enhance usability and safety. The segment’s growth is further driven by increasing adoption in ambulatory surgical centers and research institutes.

- By Technology

On the basis of technology, the market is segmented into diaphragm-based devices, compartmentalized devices, and air cleaning/filtration devices. The Diaphragm-Based Device segment dominated the market in 2025 due to its simplicity, reliability, and compliance with occupational safety standards. These devices are widely used in hospitals and oncology centers across China, Japan, and South Korea. Diaphragm-based technology ensures minimal leakage, controlled drug transfer, and ease of integration with existing CSTD systems. Manufacturers continue to innovate diaphragm designs for durability and performance. Adoption is supported by regulatory requirements emphasizing exposure prevention. Hospitals prioritize diaphragm-based systems for routine chemotherapy preparation due to proven safety records. In addition, this segment is preferred for high-volume workflows where efficiency and consistent performance are critical.

The Compartmentalized Device segment is expected to witness the fastest growth during the forecast period due to its ability to handle multiple drug transfer operations simultaneously while preventing cross-contamination. Compartmentalized systems are increasingly adopted in India and Southeast Asia, where oncology services are expanding rapidly. Technological improvements in sealing and modularity make these systems attractive for multi-drug preparation setups. Training and awareness programs are supporting adoption in emerging hospitals. Manufacturers are focusing on designing cost-effective compartmentalized devices for broader accessibility. The segment benefits from rising demand for workflow efficiency and safety.

- By End User

On the basis of end user, the market is segmented into hospitals, oncology centers & clinics, ambulatory surgical centers, and academic & research institutes. The Hospitals segment dominated the market in 2025 due to the large patient volumes, higher adoption of safety protocols, and regulatory compliance requirements. Hospitals in China, Japan, and South Korea invest heavily in CSTDs to protect healthcare workers and maintain safe drug handling procedures. The adoption is further fueled by government safety mandates and institutional policies. Hospitals prefer needle-free devices for routine chemotherapy and high-volume drug preparation workflows. Leading manufacturers target hospital contracts to drive revenue growth. The segment remains dominant due to consistent procurement and operational integration.

The Oncology Centers & Clinics segment is expected to witness the fastest growth during the forecast period due to the rising incidence of cancer in India, China, and Southeast Asia, creating higher demand for safe drug handling solutions. Specialized oncology facilities prioritize needle-free and compartmentalized CSTDs to enhance occupational safety and improve workflow efficiency. Awareness campaigns and government initiatives further accelerate adoption. Clinics benefit from portable and easy-to-use systems that reduce operational complexity. Manufacturers are focusing on scalable solutions for small and mid-sized oncology centers. The growing patient base and expansion of outpatient oncology services support rapid segment growth.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender and retail sales. The Direct Tender segment dominated the market in 2025 as large hospitals, government health facilities, and oncology chains prefer bulk procurement of CSTDs through tenders. Direct tendering ensures consistent supply, competitive pricing, and long-term service contracts. Hospitals in China, India, and Japan rely on tender-based procurement to meet regulatory standards and maintain operational efficiency. Manufacturers often prioritize tender deals for high-volume sales. Bulk purchases through tenders ensure that safety protocols are uniformly implemented across multiple departments. This segment benefits from institutional adoption and government healthcare programs.

The Retail Sales segment is expected to witness the fastest growth during the forecast period due to the rising number of smaller clinics, outpatient centers, and research institutes procuring CSTDs directly from distributors. Retail channels provide flexibility for smaller facilities and support rapid adoption in emerging regions such as India and Southeast Asia. Manufacturers are expanding retail distribution networks to cater to growing demand. Retail sales also allow access to supplementary products and accessories, enhancing system usability. The segment growth is further driven by awareness campaigns and promotional initiatives highlighting occupational safety.

Asia-Pacific Closed System Transfer Devices Market Regional Analysis

- China dominated the Asia-Pacific closed system transfer devices market in 2025, with the largest revenue share of 38.4% characterized by well-established healthcare infrastructure, high adoption of advanced safety protocols in hospitals and oncology centers, and strong presence of key industry players

- Healthcare facilities in the region highly value the safety, efficiency, and compliance offered by needle-free CSTDs, which minimize hazardous drug exposure and reduce contamination risks during preparation and administration

- This widespread adoption is further supported by increasing cancer incidence, rapid expansion of healthcare services, and rising regulatory awareness, establishing CSTDs as a preferred solution for hospitals, oncology centers, and research institutes across India, Japan, South Korea, and China

The China Closed System Transfer Devices Market Insight

The China closed system transfer devices market captured the largest revenue share in Asia-Pacific in 2025, fueled by a well-established healthcare infrastructure, high adoption of safety protocols, and a strong presence of key industry players. Hospitals and oncology centers are increasingly prioritizing needle-free CSTDs to minimize hazardous drug exposure and contamination risks. The growing number of oncology patients and expansion of chemotherapy services are driving CSTD adoption. Furthermore, government regulations emphasizing occupational safety and safe drug handling are reinforcing demand. Integration with automated workflows and hospital safety programs is improving efficiency and compliance. China’s focus on advanced medical technology and centralized procurement strategies is expected to sustain market dominance.

India Closed System Transfer Devices Market Insight

The India closed system transfer devices market is expected to be the fastest-growing country in Asia-Pacific during the forecast period, driven by rapid urbanization, expanding healthcare infrastructure, and increasing cancer incidence. Hospitals, clinics, and oncology centers are increasingly adopting needle-free CSTDs to comply with occupational safety standards and improve workflow efficiency. Government initiatives promoting workplace safety and training programs for healthcare professionals are further accelerating adoption. Affordable and portable CSTD solutions are encouraging uptake in smaller clinics and outpatient centers. In addition, rising awareness of drug handling safety among healthcare providers is boosting demand. India’s growing middle-class population and expansion of oncology services support long-term market growth.

Japan Closed System Transfer Devices Market Insight

The Japan closed system transfer devices market is gaining momentum due to the country’s advanced healthcare system, stringent safety regulations, and growing focus on occupational safety in hospitals and oncology centers. Needle-free CSTDs are increasingly adopted to reduce contamination and prevent hazardous drug exposure during chemotherapy preparation and administration. Integration of CSTDs with hospital safety protocols and automation workflows is enhancing operational efficiency. Japan’s high-tech culture and preference for advanced medical devices further support market growth. In addition, an aging population and increasing cancer prevalence are driving demand for safer drug handling solutions. Hospitals and specialized oncology clinics continue to invest in modern CSTDs to comply with regulatory guidelines.

South Korea Closed System Transfer Devices Market Insight

The South Korea closed system transfer devices market is expected to expand steadily during the forecast period, fueled by growing adoption of needle-free systems and the country’s focus on healthcare safety and efficiency. Hospitals and oncology centers prioritize CSTDs to minimize occupational exposure to hazardous drugs. Government and institutional regulations are enforcing safe handling standards, promoting widespread adoption. The presence of advanced healthcare infrastructure and technologically capable medical staff supports integration of CSTDs in routine workflows. In addition, awareness campaigns and training programs for healthcare professionals are driving adoption. The market benefits from both public hospital tenders and private healthcare investments.

Asia-Pacific Closed System Transfer Devices Market Share

The Asia-Pacific Closed System Transfer Devices industry is primarily led by well-established companies, including:

- EQUASHIELD (U.S.)

- Simplivia (Israel)

- ICU Medical, Inc. (U.S.)

- B. Braun SE (Germany)

- Vygon (France)

- BD (U.S.)

- Baxter (U.S.)

- Terumo Corporation (Japan)

- CODAN Medizinische Geräte GmbH & Co KG (Germany)

- Corning Incorporated (U.S.)

- West Pharmaceutical Services, Inc. (U.S.)

- Yukon Medical LLC (U.S.)

- Corvida Medical Inc. (U.S.)

- Cardinal Health (U.S.)

- Caragen Ltd. (Ireland)

- JMS Co., Ltd. (Japan)

- Practivet, Inc. (U.S.)

- Amsino International, Inc. (U.S.)

- NIPRO CORPORATION (Japan)

- VICTUS Inc. (U.S.)

What are the Recent Developments in Asia-Pacific Closed System Transfer Devices Market?

- In May 2025, ICU Medical, Inc. and Otsuka Pharmaceutical Factory, Inc. completed a strategic joint venture to expand the CSTD product line, including the ChemoLock™ Needlefree Closed System Transfer Device (CSTD) and other transfer and safety solutions, strengthening the company’s global portfolio and supporting broader adoption in healthcare settings, including Asia‑Pacific

- In November 2024, ICU Medical expanded its CSTD product offerings by reinforcing its portfolio of ChemoLock and ChemoClave needle‑free devices, as well as ancillary reconstitution and infusion safety solutions moves that align with increasing hospital demand for safer hazardous drug workflows in Asia‑Pacific

- In December 2023, Equashield launched the Mundus Mini HD, a next‑generation closed system transfer device designed to enhance contamination control, reduce hazardous drug exposure, and improve efficiency in hazardous drug compounding environments. This new device represents an advancement in CSTD technology with broader application potential in hospital pharmacies and oncology centers across Asia‑Pacific

- In February 2023, BD announced that its next‑generation BD PhaSeal™ Optima System significantly reduced hazardous drug surface contamination in clinical use, demonstrating improved safety performance for healthcare workers handling chemotherapy drugs — a development likely to influence clinical practice and adoption in major Asia‑Pacific oncology centers

- In April 2021, Fresenius Kabi entered a U.S. distribution agreement with Corvida Medical to market the HALO CSTD, a closed system drug‑transfer device designed to improve safe handling of hazardous drugs, indicating expanded partnerships and distribution that can influence regional supply chains and adoption in Asia‑Pacific healthcare facilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.