Asia Pacific Clinical Microscopes Market

Market Size in USD Billion

CAGR :

%

USD

1.04 Billion

USD

1.82 Billion

2025

2033

USD

1.04 Billion

USD

1.82 Billion

2025

2033

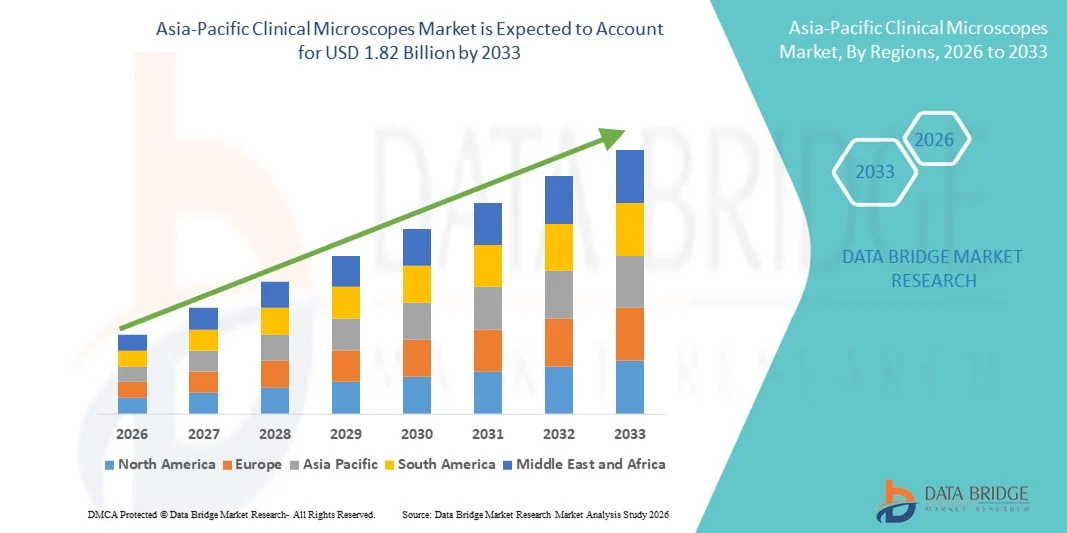

| 2026 –2033 | |

| USD 1.04 Billion | |

| USD 1.82 Billion | |

|

|

|

|

Asia-Pacific Clinical Microscopes Market Size

- The Asia-Pacific clinical microscopes market size was valued at USD 1.04 billion in 2025 and is expected to reach USD 1.82 billion by 2033, at a CAGR of 7.3% during the forecast period

- The market is growth is largely fueled by rising healthcare infrastructure investment, increasing diagnostic demand, and expanding applications in pathology and clinical research

- Furthermore, advancements in microscope technologies coupled with growing focus on clinical diagnostics, disease screening, and research activities across countries such as China, Japan, India, and Australia, strengthen the adoption of clinical microscopes

Asia-Pacific Clinical Microscopes Market Analysis

- Clinical microscopes, offering high-precision imaging and diagnostic capabilities, are increasingly vital components of modern laboratories, hospitals, and research institutions in both clinical and research settings due to their essential role in disease diagnosis, pathology, and biomedical research

- The escalating demand for clinical microscopes is primarily fueled by rising healthcare infrastructure investments, increasing prevalence of chronic and infectious diseases, and growing focus on advanced medical diagnostics and research activities

- China dominated the clinical microscopes market in 2025 with the largest revenue share of 38.5%, characterized by a large patient population, rapid expansion of hospitals and diagnostic centers, and strong government initiatives promoting healthcare modernization

- India is expected to be the fastest-growing country during the forecast period due to rising healthcare expenditure, growing medical research facilities, and increasing demand for affordable and reliable diagnostic equipment

- Optical microscopes segment dominated the clinical microscopes market across these countries with a market share of 45.9% in 2025, driven by their established reliability, cost-effectiveness, and ease of use in hospitals, clinical laboratories, and educational institutions

Report Scope and Asia-Pacific Clinical Microscopes Market Segmentation

|

Attributes |

Asia-Pacific Clinical Microscopes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Clinical Microscopes Market Trends

Advancements in Digital Imaging and Automation

- A significant and accelerating trend in the Asia-Pacific clinical microscopes market is the integration of digital imaging and automated microscopy systems, which are enhancing diagnostic accuracy, workflow efficiency, and data management in laboratories and hospitals

- For instance, the Olympus BX53 microscope allows seamless integration with digital cameras and software, enabling high-resolution imaging and image analysis for pathology and clinical research applications

- Automation in microscopes enables features such as auto-focus, slide scanning, and AI-assisted cell counting, providing more precise results and reducing manual errors. For instance, Leica Microsystems offers AI-powered analysis for tissue samples that can detect abnormalities faster than manual observation

- The integration of digital platforms with laboratory information systems allows centralized control and storage of diagnostic data, supporting efficient workflow management, remote consultation, and collaborative research activities across institutions

- This trend toward more intelligent, automated, and interconnected microscopy solutions is reshaping expectations for laboratory diagnostics. Consequently, companies such as Nikon are developing fully digital microscopes with automated scanning and analysis capabilities for clinical applications

- The demand for microscopes with advanced imaging, automation, and digital integration is growing rapidly across hospitals, diagnostic labs, and research centers as laboratories increasingly prioritize efficiency, accuracy, and data-driven workflows

- Collaborations between microscope manufacturers and software providers to deliver AI-based image analytics platforms are becoming prevalent, further driving the trend toward comprehensive digital laboratory solutions

Asia-Pacific Clinical Microscopes Market Dynamics

Driver

Rising Healthcare Investment and Diagnostic Demand

- The increasing healthcare infrastructure investment, growing prevalence of chronic and infectious diseases, and expansion of diagnostic facilities are significant drivers for the heightened demand for clinical microscopes

- For instance, in March 2025, Carl Zeiss announced expansion of digital microscopy solutions in India, focusing on enhancing hospital diagnostics and research capabilities, which is expected to drive market growth

- Clinical microscopes provide advanced imaging, high-resolution analysis, and efficient slide management, offering significant advantages over traditional optical systems in diagnostics and research

- The growing focus on research and development, educational institutions, and clinical laboratories is making microscopes an integral component of healthcare ecosystems, facilitating advanced studies and disease monitoring

- The convenience of automated imaging, remote data sharing, and integration with laboratory information systems are key factors propelling adoption in hospitals and research centers. The trend toward digital pathology and AI-assisted microscopy further contributes to market growth

- For instance, government initiatives in China and Japan to modernize hospital laboratories are driving procurement of digital and automated microscope systems, further accelerating adoption

- Rising demand for personalized medicine and molecular diagnostics is prompting hospitals and research centers to invest in high-resolution and AI-enabled microscopes to improve diagnostic accuracy and treatment planning

- Strategic partnerships between microscope manufacturers and hospital networks to offer customized solutions for clinical workflows are also boosting adoption rates across the region

Restraint/Challenge

High Equipment Costs and Maintenance Complexity

- The relatively high initial cost of advanced clinical microscopes, combined with ongoing maintenance and calibration requirements, poses a challenge to broader adoption, particularly in smaller hospitals and diagnostic labs

- For instance, high-end digital microscopes from Leica or Olympus can cost several times more than standard optical microscopes, making them less accessible to budget-constrained institutions

- Addressing these cost barriers through financing solutions, cost-effective models, and government or institutional support is crucial for expanding market penetration. In addition, technical training and skilled personnel are required to operate advanced systems, which can limit adoption

- While prices for some entry-level digital microscopes are decreasing, the perceived premium for high-end features still hinders widespread adoption in developing countries. Institutions may delay upgrades until absolutely necessary

- Overcoming these challenges through affordable solutions, training programs, and simplified maintenance protocols will be vital for sustained growth and broader integration of advanced microscopy in clinical settings

- For instance, lack of standardized training programs for operating automated and AI-enabled microscopes in rural or semi-urban areas may delay adoption of advanced models

- Limited access to technical support and replacement parts in certain countries can also slow the deployment of high-end microscopes, particularly for smaller labs and regional hospitals

- Collaborative efforts by manufacturers to provide remote assistance, online training, and modular microscope options are emerging strategies to mitigate these challenges and support adoption

Asia-Pacific Clinical Microscopes Market Scope

The market is segmented on the basis of product, ergonomics, modality, application, end user, and distribution channel.

- By Product

On the basis of product, the Asia-Pacific clinical microscopes market is segmented into optical microscopes, electron microscopes, scanning probe microscopes, and others. The optical microscopes segment dominated the market with the largest revenue share of 45.9% in 2025, owing to their proven reliability, cost-effectiveness, and ease of use in hospitals, diagnostic laboratories, and academic institutions. Optical microscopes are widely used for routine pathology, microbiology, and cell biology studies, making them essential tools in clinical diagnostics and research. The segment also benefits from high adoption in developing countries due to lower acquisition and maintenance costs compared with high-end digital or electron microscopes. Furthermore, optical microscopes continue to see incremental innovation, including LED illumination and improved lens systems, enhancing image quality and operational efficiency. Hospitals and research centers often prefer optical microscopes for teaching and routine diagnostic applications, cementing their dominance in the market.

The electron microscopes segment is expected to witness the fastest growth rate of 14.8% CAGR from 2026 to 2033, driven by increasing demand for high-resolution imaging at cellular and molecular levels in research institutions and specialized laboratories. Electron microscopes provide unparalleled magnification and resolution, enabling detailed analysis of pathogens, cellular structures, and nanomaterials. The growing investment in biotechnology, pharmaceuticals, and advanced medical research in countries such as China, Japan, and India is fueling adoption. Electron microscopes also play a critical role in advanced cancer research, neuroscience studies, and drug development, where precision and detail are crucial. Rising funding for molecular diagnostics and nanotechnology research is further accelerating adoption across academic and private research facilities.

- By Ergonomics

On the basis of ergonomics, the market is segmented into inverted microscopes and upright microscopes. The upright microscope segment dominated the market with the largest revenue share of 46% in 2025, favored for its straightforward design, user-friendly operation, and widespread use in pathology, microbiology, and clinical laboratories. Upright microscopes allow easy access to specimens and support routine laboratory workflows efficiently. They are compatible with multiple imaging modalities and accessories, enabling broad versatility in clinical and research applications. Hospitals and teaching laboratories prefer upright microscopes due to their reliability, robust construction, and suitability for large-scale routine diagnostics. Continuous improvements, such as LED illumination and ergonomic eyepiece designs, further strengthen their market position. In addition, upright microscopes remain cost-effective compared to inverted systems, making them accessible to a wide range of institutions.

The inverted microscope segment is expected to witness the fastest growth rate of 12.6% CAGR from 2026 to 2033, primarily driven by increasing use in cell culture, live-cell imaging, and research applications. Inverted microscopes are particularly suited for observing cells in petri dishes or flasks, facilitating advanced cell biology studies. The segment benefits from rising demand for automated and fluorescence imaging solutions in biomedical research and biotechnology. Pharmaceutical companies and academic institutions are adopting inverted microscopes for drug discovery, stem cell research, and tissue engineering. Advanced features such as motorized stages, digital imaging, and environmental control are further enhancing the growth potential of this segment.

- By Modality

On the basis of modality, the market is segmented into digital and optical microscopes. The optical modality dominated the market with a revenue share of 44% in 2025, supported by established adoption in hospitals, clinical labs, and universities for routine diagnostic work and educational purposes. Optical microscopes provide reliable imaging for histology, microbiology, and cytology studies. They are also cost-effective, easy to maintain, and widely compatible with standard laboratory workflows. The segment benefits from continuous incremental improvements, such as better optics, LED illumination, and camera integration, which enhance performance without requiring a full shift to digital systems. Many institutions in Asia-Pacific continue to rely on optical microscopes for high-volume diagnostic applications, reinforcing their dominance.

The digital modality segment is expected to witness the fastest CAGR of 15.2% from 2026 to 2033, driven by increasing demand for high-resolution image capture, AI-assisted analysis, and remote consultation capabilities. Digital microscopes allow seamless integration with laboratory information systems, enabling real-time data sharing and collaborative research. The segment is also supported by growing telemedicine and digital pathology initiatives in countries such as Japan, China, and India. Features such as automated image capture, software-based measurements, and AI-assisted anomaly detection are making digital microscopes indispensable for modern clinical and research workflows. The rising trend of centralized laboratory networks and remote diagnostics is further accelerating adoption of digital modality systems.

- By Application

On the basis of application, the market is segmented into microbiology, cell biology, pathology, neuroscience, and others. The pathology segment dominated the market with the largest revenue share of 36% in 2025, due to the essential role of microscopes in tissue examination, disease diagnosis, and cancer detection. Pathology labs heavily rely on high-resolution imaging and analysis to support accurate diagnoses and treatment planning. The segment is further strengthened by government programs and hospital investments in modern diagnostic laboratories. Continuous adoption of automated and digital pathology solutions is also enhancing efficiency and reducing manual errors. Academic institutions and research centers use pathology microscopes extensively for training and clinical studies. The growing burden of chronic diseases and cancer in Asia-Pacific continues to drive the pathology microscope market.

The cell biology segment is expected to witness the fastest growth rate of 13.5% CAGR from 2026 to 2033, driven by increasing research on stem cells, regenerative medicine, and molecular biology in academic and pharmaceutical institutions. Cell biology applications require advanced imaging, live-cell monitoring, and fluorescence microscopy, all of which are supporting adoption of both inverted and digital microscope systems. Rising investment in biotechnology research and drug development in countries such as China, India, and Japan is further propelling demand. The segment also benefits from collaboration between microscope manufacturers and research labs to provide specialized imaging solutions.

- By End User

On the basis of end user, the market is segmented into hospitals, research and academic institutions, outpatient facilities, and others. The hospitals segment dominated the market with a revenue share of 48% in 2025, supported by widespread adoption of microscopes for clinical diagnostics, routine laboratory work, and pathology. Hospitals prefer reliable, easy-to-use microscopes for high-volume workflows and diagnostic accuracy. Integration with laboratory information systems and availability of automated imaging solutions further strengthen adoption in hospital laboratories. Government-funded and private hospitals continue to invest in upgrading clinical laboratory infrastructure, reinforcing dominance. Hospital laboratories also serve as training centers, further boosting microscope usage.

The research and academic institutions segment is expected to witness the fastest CAGR of 14% from 2026 to 2033, driven by rising biotechnology, life sciences, and pharmaceutical research across Asia-Pacific countries. Universities and research centers require advanced microscopes with digital imaging, AI capabilities, and fluorescence modules to support complex studies. Collaboration with microscope manufacturers to provide specialized research solutions is accelerating adoption. Increasing focus on molecular diagnostics, cell biology, and neuroscience research is creating significant demand for high-end microscopes. The trend toward remote learning and virtual labs is also encouraging adoption of digital microscopy systems in academic settings.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender and retail sales. The direct tender segment dominated the market with a revenue share of 55% in 2025, driven by large hospital networks, government procurement programs, and research institutions that prefer direct contracts for advanced microscopes. Direct tender ensures competitive pricing, customized solutions, and after-sales support for complex systems such as digital and electron microscopes. Long-term service agreements and installation support are additional advantages, making direct tender the preferred channel for high-value equipment. Institutions also benefit from bundled solutions, training programs, and warranty coverage. Direct procurement allows manufacturers to maintain closer relationships with end users and better understand their technical requirements.

The retail sales segment is expected to witness the fastest CAGR of 16% from 2026 to 2033, fueled by increasing demand from small laboratories, outpatient facilities, and academic institutions seeking cost-effective and entry-level microscopes. Retail channels provide quick access to standard optical and digital microscopes without lengthy procurement processes. Manufacturers are leveraging e-commerce platforms and distributors to expand reach in semi-urban and rural areas. The segment also benefits from growing awareness of affordable microscope options for educational and small-scale research purposes. Retail sales enable flexible purchasing, faster delivery, and easier access to accessories and replacement part

Asia-Pacific Clinical Microscopes Market Regional Analysis

- China dominated the clinical microscopes market in 2025 with the largest revenue share of 38.5%, characterized by a large patient population, rapid expansion of hospitals and diagnostic centers, and strong government initiatives promoting healthcare modernization

- Hospitals, diagnostic centers, and research institutions in China highly value advanced imaging capabilities, automation features, and digital integration offered by modern clinical microscopes, which enhance diagnostic accuracy, workflow efficiency, and research productivity

- This widespread adoption is further supported by a large patient population, rising prevalence of chronic and infectious diseases, and increasing focus on biomedical research and academic training, establishing clinical microscopes as essential tools for healthcare and research applications across the country

The China Clinical Microscopes Market Insight

China dominated the Asia-Pacific clinical microscopes market with the largest revenue share of 38.5% in 2025, fueled by rapid expansion of hospitals, diagnostic laboratories, and research centers, alongside strong government investment in healthcare infrastructure and laboratory modernization. Hospitals and laboratories in China highly value advanced imaging, automation, and digital integration offered by modern microscopes to improve diagnostic accuracy and research efficiency. The country’s large patient population and rising prevalence of chronic and infectious diseases are driving consistent demand. For instance, public and private hospitals are upgrading pathology labs with digital and fluorescence microscopes for cancer diagnostics. China is also witnessing increased adoption of microscopes in academic and research institutions due to government-funded biotechnology and life sciences programs.

Japan Clinical Microscopes Market Insight

The Japan clinical microscopes market is witnessing steady growth due to the country’s advanced healthcare infrastructure, high adoption of digital and automated microscopy systems, and emphasis on research and clinical precision. Japanese hospitals and research centers prioritize high-resolution imaging, live-cell monitoring, and integration with laboratory information systems. For instance, hospitals and pharmaceutical research labs are increasingly adopting digital microscopy for molecular diagnostics and pathology studies. Japan’s aging population and the need for efficient laboratory diagnostics in both residential and commercial medical facilities are further propelling demand. The country also emphasizes technologically advanced microscopes that support telemedicine and remote diagnostics initiatives.

India Clinical Microscopes Market Insight

The India clinical microscopes market accounted for the largest revenue share in Asia-Pacific outside China in 2025, attributed to the country’s rapidly expanding healthcare infrastructure, urbanization, and growing adoption of advanced laboratory equipment. India is witnessing strong demand for clinical microscopes in hospitals, diagnostic laboratories, academic institutions, and research centers. For instance, rising government initiatives to establish modern laboratories in public hospitals and universities are boosting adoption. The push towards biotechnology research, digital pathology, and life sciences education, combined with the availability of affordable microscope solutions, is further driving market growth. Domestic manufacturers and international collaborations are also expanding access to both optical and digital microscope systems.

South Korea Clinical Microscopes Market Insight

The South Korea clinical microscopes market is expected to grow at a substantial CAGR, driven by technological innovation in microscopy, increasing healthcare expenditure, and rising R&D in biotechnology and pharmaceuticals. Hospitals and research institutes are rapidly adopting digital and fluorescence microscopes to improve workflow efficiency and diagnostic accuracy. For instance, private laboratories and university research centers are leveraging AI-assisted microscopes for advanced cellular and molecular studies. Government support for precision medicine and laboratory modernization is further stimulating demand. The trend toward telemedicine and centralized laboratory networks is also fostering the use of high-resolution microscopes across clinical and research settings.

Asia-Pacific Clinical Microscopes Market Share

The Asia-Pacific Clinical Microscopes industry is primarily led by well-established companies, including:

- Nikon Instruments Inc. (U.S.)

- Leica Microsystems (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- Bruker Corporation (U.S.)

- JEOL Ltd. (Japan)

- ACCU SCOPE Inc. (U.S.)

- Hitachi High Tech Corporation (Japan)

- KEYENCE CORPORATION (Japan)

- Motic (Hong Kong)

- Meiji Techno Co., Ltd (Japan)

- Labomed Inc (U.S.)

- COXEM Co., Ltd (South Korea)

- Euromex Microscopen BV (Netherlands)

- Radical Scientific Equipments Pvt Ltd (India)

- Vision Engineering Ltd (U.K.)

- Oxford Instruments (U.K.)

- Hitachi Ltd (Japan)

- Agilent Technologies, Inc. (U.S.)

- Ken A Vision, Inc. (U.S.)

What are the Recent Developments in Asia-Pacific Clinical Microscopes Market?

- In September 2025, Monash University and Nikon established a Nikon Centre of Excellence, introducing next‑generation light microscopy facilities into the university’s research infrastructure. The centre will provide state‑of‑the‑art microscopes and imaging tools to support cutting‑edge research in biomedical sciences and life sciences, enabling hundreds of researchers to access faster, higher‑resolution imaging systems. This development strengthens microscopy research capabilities in Australia and the broader Asia‑Pacific scientific community

- In August 2025, OptraSCAN launched its AI‑powered CytoSiA platform at the 9th Digital Pathology & AI Congress in Singapore, marking a major introduction of advanced digital cytology and AI‑assisted slide scanning into the Asian market. CytoSiA combines high‑resolution imaging with artificial intelligence to support rapid, scalable cervical cancer screening, significantly improving diagnostic clarity and access in remote or resource‑limited areas a critical advancement for pathology workflows in Asia‑Pacific labs

- In April 2025, Leica Microsystems launched the Proveo 8x 3D digital ophthalmic surgical microscope, featuring real‑time 3D visualization and enhanced digital imaging capabilities designed to improve surgical precision and comfort for ophthalmic procedures. The system integrates advanced imaging technology with ergonomic design and flexible viewing options, enabling surgeons to perform complex eye surgeries with enhanced depth perception and actionable insights

- In February 2025, the 13th Asia Pacific Microscopy Congress (APMC13) was held in Brisbane, Australia, bringing together scientists, researchers, and microscope manufacturers from across the region. The congress served as a platform to share cutting‑edge microscopy techniques, new instrument demonstrations, and innovations in electron, light, and imaging spectroscopy, fostering collaboration and accelerating adoption of advanced microscopy technology throughout Asia‑Pacific research and clinical institutions

- In February 2024, MediWorks showcased its SM621 Ophthalmic Surgical Microscope at the APAO 2024 Congress in Bali, highlighting the company’s expanding portfolio of clinical microscopes in the Asia‑Pacific region. The introduction of SM621, with features such as motorized zoom, high‑resolution 4K video, and optimized optics, represents a milestone for domestic innovation and competitiveness in surgical microscope technology, particularly in China

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.