Asia-Pacific Capillary Blood Collection and Sampling Devices Treatment Market, By Product (Blood Sampling Devices and Capillary Blood Devices), Modality (Manual Sampling and Automated/Autoinjection Sampling), Material (Plastic, Glass, Stainless Steel, Ceramic, and Others), Puncture Type (Puncture and Incision), Procedure (Conventional and Point of Care Testing), Age Group (Geriatrics, Infant, Paediatric, and Adult), Test Type (Dried Blood Spot Tests, Plasma/Serum Protein Tests, Comprehensive Metabolic Panel (CMP) Tests, Liver Panel / Liver Profile/ Liver Function Tests, Whole Blood Test, and Others), Application (Cardiovascular Disease, Infectious Diseases, Respiratory Diseases, Metabolic Disorders, and Others), Technology (Volumetric Absorptive Microsampling, Capillary Electrophoresis-Based Chemical Analysis, and Others), End User (Hospitals, Pathology Laboratories, Clinics, Home Care Setting, Blood Banks, Research & Academic Laboratories, and Others) Distribution Channel (Direct Tender, Retail Sales, and Others) - Industry Trends and Forecast to 2030.

Asia-Pacific Capillary Blood Collection and Sampling Devices Treatment Market Analysis and Insights

The Asia-Pacific capillary blood collection and sampling devices treatment market is expected to grow from 2023 to 2030 due to the increased prevalence of chronic diseases. The rising geriatric population is also expected to drive market growth. Along with this, the demand for safe blood collection technologies is increasing in the market. However, the higher risk related to capillary blood assortment technologies is expected to restrain the market growth. Favorable medical device regulations are expected to provide market growth opportunities to enhance the treatment.

Product innovation and technological advancements in capillary blood collection devices are expected to boost market growth. However, the high chances of product recall and the use of venipuncture, an alternative to capillary blood collection procedures, are expected to challenge market growth.

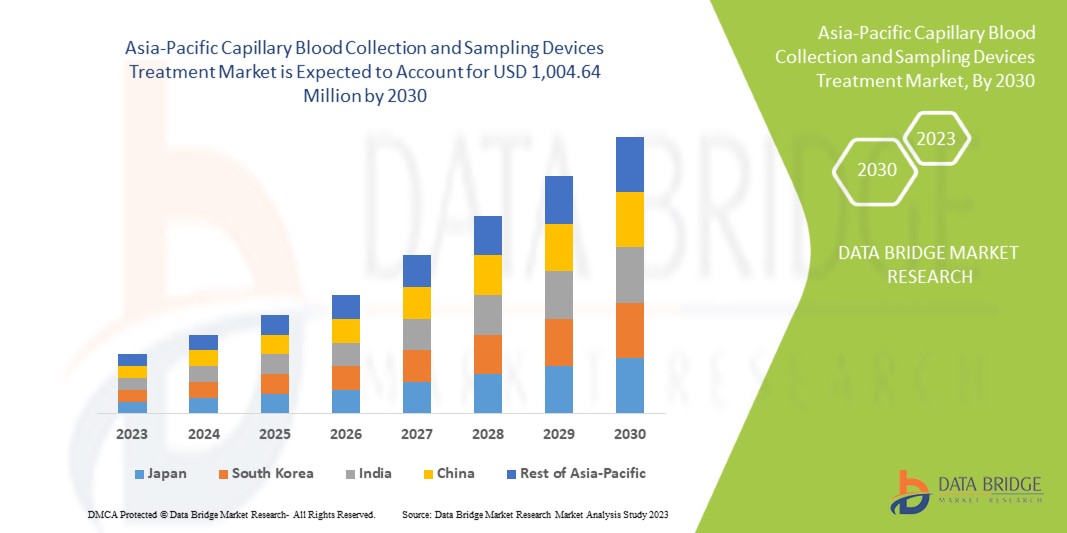

Data Bridge Market Research analyzes that the Asia-Pacific capillary blood collection and sampling devices treatment market is expected to reach a value of USD 1,004.64 million by 2030, at a CAGR of 7.2% during the forecast period. The product segment accounts for the largest segment in the market due to the rising number of chronic disorders among patients. This market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Year

|

2021 (Customizable to 2015 – 2020)

|

|

Quantitative Units

|

Revenue in USD Million

|

|

Segments Covered

|

Product (Blood Sampling Devices and Capillary Blood Devices), Modality (Manual Sampling and Automated/Autoinjection Sampling), Material (Plastic, Glass, Stainless Steel, Ceramic, and Others), Puncture Type (Puncture and Incision), Procedure (Conventional and Point of Care Testing), Age Group (Geriatrics, Infant, Paediatric, and Adult), Test Type (Dried Blood Spot Tests, Plasma/Serum Protein Tests, Comprehensive Metabolic Panel (CMP) Tests, Liver Panel / Liver Profile/ Liver Function Tests, Whole Blood Test, and Others), Application (Cardiovascular Disease, Infectious Diseases, Respiratory Diseases, Metabolic Disorders, and Others), Technology (Volumetric Absorptive Microsampling, Capillary Electrophoresis-Based Chemical Analysis, and Others), End User (Hospitals, Pathology Laboratories, Clinics, Home Care Setting, Blood Banks, Research & Academic Laboratories, and Others) Distribution Channel (Direct Tender, Retail Sales, and Others)

|

|

Countries Covered

|

Japan, India, Australia, South Korea, Singapore, Malaysia, Thailand, Indonesia, Philippines, and Rest of Asia-Pacific

|

|

Market Players Covered

|

BD, TERUMO Corporation, Thermo Fisher Scientific Inc., Cardinal Health, Owen Mumford Ltd, Abbott, Nipro, Greiner Bio-One International GmbH, SARSTEDT AG & Co. KG, Bio-Rad Laboratories, Inc., ICU Medical, Inc., CML Biotech, Narang Medical Limited, Hindustan Syringes & Medical Devices Ltd, Sparsh Mediplus, B. Braun SE

|

Market Definition

Capillary blood collection devices are defined as devices that are used for capillary blood withdrawal. Capillary blood can be obtained by puncturing in finger, earlobe, or heel. It can also be performed by giving an incision on the skin. Capillary blood collection and sampling procedure have gained wide attention as it withdraws an accurate amount of blood and reduces the chances of anemia. Market players offer various kinds of needle, lancets, and syringes for capillary blood collection.

As chronic disease prevalence is increasing, the need for blood tests is also growing. Moreover, the increasing geriatric population and neonates have put a challenge for invasive blood collection procedures because minimal invasive capillary blood collection procedure has gained wide attention. Nowadays volumetric microsampling technique has gained attention for capillary blood collection. Moreover, new technological advancements are taking place to fulfill the need for physicians and consumers.

Asia-Pacific Capillary Blood Collection and Sampling Devices Treatment Market Dynamics

This section deals with the understanding of market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Increased Prevalence of Chronic Diseases

The increased prevalence of chronic diseases is a significant global health concern. Chronic diseases are long-term conditions that progress slowly and require ongoing medical attention and management. These diseases can significantly impact the quality of life of individuals and place a substantial burden on healthcare systems.

Capillary blood collection is a common method to obtain small blood samples for various diagnostic tests, such as blood glucose monitoring for diabetes management.

For instance,

if the prevalence of diabetes is rising in a population, there may be an increased need for regular capillary blood collection for glucose monitoring in affected individuals.

Lower middle-income countries are the worst affected by chronic diseases therefore, the disease also becomes a financial burden for the underprivileged countries. The disease must be diagnosed accurately for the early detection and timely treatment of the disease. For this, efficient blood collection and sampling are necessary, creating a demand for technologically advanced capillary blood testing devices. Thus, the increased prevalence of infectious and chronic diseases is expected to drive the market growth.

- Rise in the Geriatric Population

The global population is experiencing a significant demographic shift characterized by an increasing number of older adults. The rising geriatric population in the Asia-Pacific is primarily attributed to several factors, such as increased life expectancy, advancements in healthcare, improved living conditions, and better access to medical services have contributed to increased life expectancy in China. This means that people are living longer, leading to a more significant proportion of older adults in the population. The older generation is prone to more chronic disease that requires regular blood tests and diagnostics tests, which is driving the market growth.

Restraint/ Challenge

- Higher Risk Associated With Capillary Blood Assortment Technologies

Innovations in remote sampling and point-of-care testing have led to the popularity of capillary finger-prick blood withdrawal. It has several advantages over traditional blood collection practices in clinic labs, hospital labs, and places requiring on-site sampling. Though they are safer and easier to use than conventional devices, they have their side effects.

Capillary blood collection involves puncturing the skin to access the capillaries. As the number of fingerstick procedures rises, the cases of accidental injuries and transmission of pathogens from infected blood are also increasing.

Lancing patients' fingers and handling their used test strips exposes the clinician to blood-borne infectious agents, which can lead transmission of diseases such as hepatitis B Infection. In 2010, there was a spread of the hepatitis B virus in an assisted living facility in Virginia due to the sharing of fingerstick devices by multiple residents. Moreover, they also risk injuries related to the use of sharps. According to CDC estimates, around 385,000 hospital workers annually are grasped by sharp injuries and potential exposure to infectious pathogens.

It is recommended not to share the fingerstick devices to prevent these side effects; they should also use reusable fingerstick devices to lessen the side effects. However, these side effects restrict the fingerstick method for blood withdrawal. Therefore, high risk related to capillary blood assortment technologies is expected to restrain the market growth.

Opportunity

- Favorable Medical Device Regulations

The U.S. Food and Drug Administration regulates all medical devices in the U.S. Any medical device manufactured, relabeled, imported, or repackaged by any company to sell in India has to meet Central Drugs Standard Control Organization (CDSCO) regulations.

Capillary sample devices used for diagnostics are regulated in India by the CDSCO, which operates under the purview of the Ministry of Health and Family Welfare. The regulatory framework for medical devices in India has been evolving, and recent changes have been introduced to strengthen the regulation and ensure the safety and efficacy of medical devices, including capillary sample devices.

In India, medical devices are classified into different categories On the basis of risk level, and the regulatory requirements vary accordingly. Capillary sample devices typically fall under the category of "in vitro diagnostic devices" (IVDs).

The Medical Device Rules 2017 is the primary regulation governing medical devices in India. Under these rules, manufacturers, importers, and distributors of medical devices, including capillary sample devices, are required to comply with the registration and licensing requirements as per the risk classification of the device. The regulatory process includes submitting technical documentation, clinical data (if applicable), and compliance with quality management system requirements. However, such regulations do not apply to self-administered personal tests by employees or residents of an establishment. Therefore, people who take regular blood- glucose using lancets are not covered under this law.

It is important to note that regulatory frameworks can change over time. It is recommended to refer to the most recent guidelines and regulations published by the CDSCO and other relevant regulatory authorities for the most up-to-date information on the favorable regulations for capillary sample devices in India, which provide a better opportunity for manufacturers to launch their products in the market.

Recent Developments

- In June 2023, Cardinal Health announced its collaboration with signify Health to offer in-home clinical and medication management services through its Outcomes business. The company believes that this collaboration will help reduce costs and eliminate gaps in care.

- In March 2023, Abbott received FDA clearance for the first commercially available lab-based blood test to help evaluate concussion. The company believes that this will provide clinicians with an objective way to quickly assess individuals with mild TBIs, also known as concussions

- In March 2022, ICU Medical, Inc Participated in the Raymond James 43rd Annual Institutional Investors Conference. The company believes that this will help in business expansion and strategy development.

Asia-Pacific Capillary Blood Collection and Sampling Devices Treatment Market Scope

Asia-Pacific capillary blood collection and sampling devices treatment market is segmented into eleven notable segments on the basis of product, modality, material, puncture type, procedure, age group, test type, technology, application, end user, and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

Product

- Blood Sampling Devices

- Capillary Blood Collection Devices

On the basis of product, the market is segmented into blood sampling devices and capillary blood collection devices.

Modality

- Manual sampling

- Automated/Autoinjection sampling

On the basis of modality, the market is segmented into manual sampling and automated/autoinjection sampling.

Material

- Plastic

- Glass

- Stainless steel

- Ceramic

- Others

On the basis of material, the market is segmented into plastic, glass, stainless steel, and ceramic.

Puncture type

- Puncture

- Incision

On the basis of puncture type, the market is segmented into puncture and incision.

Procedure

- Conventional

- Point of Care Testing

On the basis of procedure, the market is segmented into conventional and point of care testing.

Age group

- Geriatrics

- Infant

- Pediatric

- Adult

On the basis of age group, the market is segmented into geriatrics, infant, pediatric, and adult.

Test Type

- Dried Blood Spot Tests

- Plasma/ Serum Protein Tests

- Comprehensive Metabolic Panel (CMP) tests

- Liver Panel/Liver Profile/ Liver Function Tests

- Whole Blood Test

- Others

On the basis of test type, the market is segmented into dried blood spot tests, plasma/ serum protein tests, comprehensive metabolic panel (CMP) tests, liver panel/liver profile/ liver function tests, whole blood test, and others.

Application

- Cardiovascular Disease

- Infectious Diseases

- Respiratory Diseases

- Metabolic Disorders

- Others

On the basis of application, the market is segmented into cardiovascular disease, infectious disease, respiratory diseases, metabolic disorder, and others.

Technology

- Volumetric absorptive Microsampling

- Capillary Electrophoresis-Based Chemical Analysis

- Others

On the basis of technology, the market is segmented into volumetric absorptive microsampling, capillary electrophoresis-based chemical analysis, and others.

End User

- Hospitals

- Pathology Laboratories

- Clinics

- Home Care Setting

- Blood Banks

- Research & Academic Laboratories

- Others

On the basis of end user, the market is segmented into hospitals, pathology laboratories, clinics, home care setting, blood banks, research & academic laboratories, and others.

Distribution channel

- Retail sales

- Direct tender

- Others

On the basis of distribution channel, the market is segmented into direct tender, retail sales and others.

Asia-Pacific Capillary Blood Collection and Sampling Devices Treatment Market Regional Analysis/Insights

The Asia-Pacific capillary blood collection and sampling devices treatment market is analyzed and market size information is provided on the basis of product, modality, material, puncture type, procedure, age group, test type, technology, application, end user, and distribution channel.

The countries covered in this market report are Japan, India, Australia, South Korea, Singapore, Malaysia, Thailand, Indonesia, Philippines, and Rest of Asia-Pacific.

Japan is expected to dominate the Asia-Pacific region due to a rise in chronic diseases among the population and a rise in healthcare expenditure.

The country section of the report also provides individual market-impacting factors and domestic regulation changes that impact the market's current and future trends. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Capillary Blood Collection and Sampling Devices Treatment Market Share Analysis

Asia-Pacific capillary blood collection and sampling devices treatment market competitive landscape provide details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, and technology lifeline curve. The above data points provided are only related to the company's focus on the market.

Some of the major market players operating in the Asia-Pacific capillary blood collection and sampling devices treatment market are BD, TERUMO Corporation, Thermo Fisher Scientific Inc., Cardinal Health, Owen Mumford Ltd, Abbott, Nipro, Greiner Bio-One International GmbH, SARSTEDT AG & Co. KG, Bio-Rad Laboratories, Inc., ICU Medical, Inc., CML Biotech, Narang Medical Limited, Hindustan Syringes & Medical Devices Ltd, Sparsh Mediplus, B. Braun SE.

SKU-