Asia Pacific Biodegradable Paper Plastic Packaging Market

Market Size in USD Billion

CAGR :

%

USD

1.14 Billion

USD

2.66 Billion

2024

2032

USD

1.14 Billion

USD

2.66 Billion

2024

2032

| 2025 –2032 | |

| USD 1.14 Billion | |

| USD 2.66 Billion | |

|

|

|

|

Biodegradable Paper and Plastic Packaging Market Size

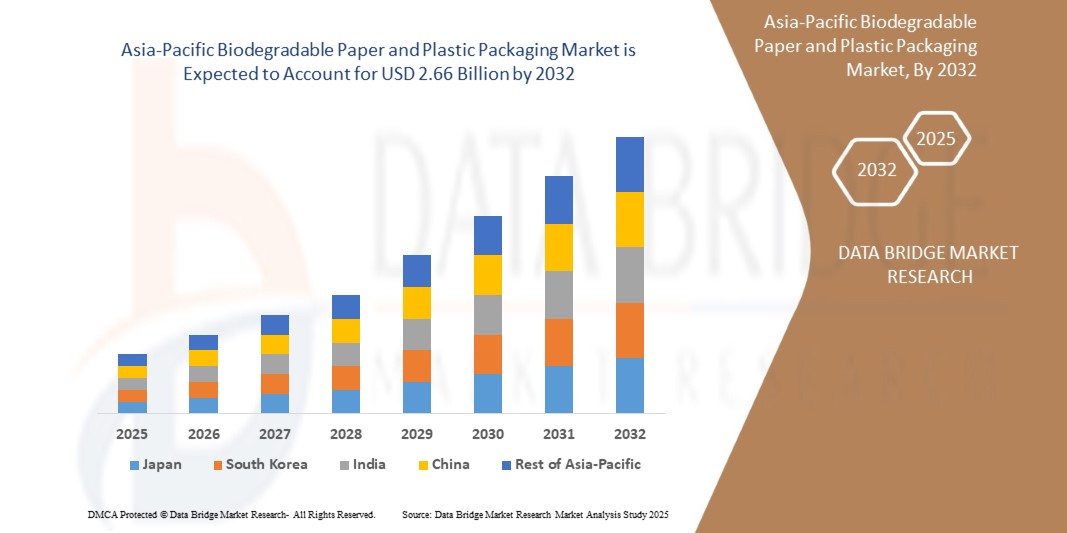

- The Asia-Pacific Biodegradable Paper and Plastic Packaging Market size was valued at USD 1.14 Billion in 2024 and is expected to reach USD 2.66 Billion by 2032, at a CAGR of 11.2% during the forecast period

- The market growth is largely fueled by increase in awareness about less carbon emitting materials

- Furthermore, the increase in urbanization in India and China which boosts the demand of biodegradable paper & plastic packaging among the consumers, are further anticipated to propel the growth of the Biodegradable Paper and Plastic Packaging Market

Biodegradable Paper and Plastic Packaging Market Analysis

- Increasing demand in personal care industry with easy high availability of raw materials for the manufacturing of biodegradable paper & plastic packaging is driving the market of biodegradable paper & plastic packaging

- China dominates the Biodegradable Paper and Plastic Packaging Market with the largest revenue share of 42.1% in 2024, characterized by stringent government policies targeting plastic waste reduction and promotion of bio-based alternatives.

- India is expected to be the fastest growing region in the Biodegradable Paper and Plastic Packaging Market during the forecast period due to rapid urbanization, a booming FMCG sector, and increased regulatory focus on single-use plastics

- The plastic segment is expected to dominate the Biodegradable Paper and Plastic Packaging Market with a market share of 54.2% in 2024, driven by its versatility, ease of processing, and application across various packaging formats such as pouches

Report Scope and Biodegradable Paper and Plastic Packaging Market Segmentation

|

Attributes |

Glass Fiber Reinforced Plastics Composites Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Biodegradable Paper and Plastic Packaging Market Trends

“Integration of Smart Packaging Technologies for Enhanced Sustainability and Traceability”

- A significant trend in the Asia-Pacific biodegradable packaging market is the adoption of smart packaging technologies, including RFID, QR codes, and IoT sensors, to improve product traceability and sustainability.

- For instance, companies in China are increasingly implementing RFID-enabled smart packaging solutions in logistics, enhancing supply chain efficiency and consumer engagement.

- In South Korea, the integration of NFC and IoT technologies into packaging solutions is gaining momentum, driven by the country's advanced technological infrastructure and innovation-focused industry landscape.

- The adoption of smart packaging aligns with the growing demand for transparency and efficiency in supply chains, particularly in sectors like e-commerce, food, and healthcare

Biodegradable Paper and Plastic Packaging Market Dynamics

Driver

“Rising Demand from E-commerce and Food Packaging Industries”

- The exponential growth of e-commerce and the food packaging industry in the Asia-Pacific region is a major driver for the biodegradable paper and plastic packaging market.

- Online retailers and food service providers are investing in sustainable and cost-effective packaging solutions to meet consumer preferences and regulatory requirements.

- The need for efficient, protective, and eco-friendly packaging in e-commerce and food delivery services has led to increased demand for biodegradable materials.

- This trend is further supported by the growing emphasis on environmental sustainability, leading to a higher demand for recyclable and compostable packaging options.

Restraint/Challenge

“Limited Availability of Raw Materials and Infrastructure for Biodegradable Packaging”

- The limited availability of raw materials, such as agricultural feedstocks like corn and sugarcane, poses a significant challenge for the market.

- These materials may be constrained by competing demands for food production or biofuel, affecting the consistent supply for packaging production.

- Additionally, the lack of proper infrastructure, such as industrial composting facilities, in many regions hampers the effective degradation of biodegradable materials.

- This infrastructural gap, coupled with the potential contamination of recycling streams when biodegradable plastics are mixed with conventional plastics, creates uncertainty for manufacturers and consumers.

Biodegradable Paper and Plastic Packaging Market Scope

The market is segmented on the basis of type, material, and end user.

- By Type

On the basis of type, the Asia-Pacific Biodegradable Paper and Plastic Packaging Market is segmented into Plastic and Paper. The Plastic segment dominates the largest market revenue share of 54.2% in 2025, driven by its versatility, ease of processing, and application across various packaging formats such as pouches, films, and containers. Biodegradable plastics like PLA, PHA, and PBS are gaining traction due to their compostability, performance, and rising adoption in FMCG and food delivery sectors. Government bans on single-use plastics further drive demand.

The Paper segment is anticipated to witness the fastest growth rate of 8.7% from 2025 to 2032, supported by growing environmental consciousness and consumer preference for renewable, recyclable materials. Paper-based biodegradable packaging is favored for its low carbon footprint and recyclability, especially in dry food, personal care, and retail applications. Expansion of e-commerce and green retailing also boosts demand.

- By Material

On the basis of material, the market is segmented into Plastic and Paper. The Plastic segment held the largest market revenue share in 2025, owing to the widespread use of bio-based polymers such as PLA and starch blends. These materials offer performance parity with conventional plastics while supporting environmental goals. Their use in flexible and rigid packaging solutions makes them suitable for varied applications across retail, personal care, and industrial packaging.

The Paper segment is projected to witness the fastest CAGR from 2025 to 2032, driven by rising demand for fiber-based alternatives and the implementation of plastic substitution mandates across Asia-Pacific countries. Paper materials offer high printability and biodegradability, making them ideal for sustainable branding and eco-labeling initiatives.

- By End-User

On the basis of end-user, the Asia-Pacific Biodegradable Paper and Plastic Packaging Market is segmented into Packaging, Food and Beverage, Catering Servicewares, Personal and Home Care, Healthcare, and Others. The Food and Beverage segment dominates the largest market revenue share of 42.1% in 2025, fueled by demand for sustainable packaging in fast food, ready-to-eat meals, and beverage applications. Brands are adopting biodegradable formats to align with green consumption and reduce plastic dependency.

The Healthcare segment is anticipated to witness the fastest growth rate of 9.8% from 2025 to 2032, driven by increasing regulatory scrutiny on waste disposal and the need for safe, single-use biodegradable materials. Applications in pharmaceutical blister packs, medical trays, and diagnostic kits support rapid adoption across regional health sectors.

Biodegradable Paper and Plastic Packaging Market Regional Analysis

- China dominates the Biodegradable Paper and Plastic Packaging Market with the largest revenue share of 42.1% in 2024, driven by stringent government policies targeting plastic waste reduction and promotion of bio-based alternatives.

- Expanding manufacturing capacity and rising awareness among consumers about sustainable packaging are key growth factors.

India Biodegradable Paper and Plastic Packaging Market Insight

India Biodegradable Paper and Plastic Packaging Market is growing rapidly with the highest CAGR of 6.7%, driven by rapid urbanization, a booming FMCG sector, and increased regulatory focus on single-use plastics. The government's Plastic Waste Management Rules 2023 are accelerating biodegradable packaging adoption.

Japan Biodegradable Paper and Plastic Packaging Market Insight

Japan Biodegradable Paper and Plastic Packaging Market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by consumer preference for eco-friendly packaging and strong corporate sustainability commitments. Technological advancements in biodegradable material formulations and government incentives are facilitating higher uptake of sustainable packaging solutions.

Biodegradable Paper and Plastic Packaging Market Share

The Glass Fiber Reinforced Plastics Composites Industry is primarily led by well-established companies, including:

- SmartSolve Industries (India)

- STOROPACK HANS REICHENECKER GMBH (Germany)

- Shanghai Disoxidation Enterprise Development Co. Ltd (China)

- Stora Enso (Finland)

- Tekpak Solutions (India)

- International Paper (U.S.)

- Be Green Packaging HQ (India)

- Hsing Chung Paper Ltd. (Taiwan)

- Ecoware (India)

Latest Developments in Asia-Pacific Biodegradable Paper and Plastic Packaging Market

- In October 2024, Australian start-up Earthodic raised $6 million in seed funding to advance its innovative recyclable protective coating for paper and cardboard packaging. The coating, made from lignin—a byproduct of the pulp and paper industry—strengthens boxes and makes them waterproof, offering an eco-friendly alternative to non-recyclable coatings. The funding will support the establishment of a U.S. headquarters and further research and development, including FDA certification for heat-sealable coffee cups.

- In 2024, Nestlé initiated a pilot program in Australia, introducing recyclable paper packaging for its KitKat four-finger 45g packs. Conducted exclusively with Coles supermarkets across Western Australia, South Australia, and the Northern Territory, this trial seeks public feedback to refine the packaging. Despite incorporating a thin metal barrier film to maintain chocolate freshness, the initiative marks a significant step in Nestlé's commitment to reducing virgin plastic use by one-third by 2025

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Biodegradable Paper Plastic Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Biodegradable Paper Plastic Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Biodegradable Paper Plastic Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.