Asia-Pacific Automotive Battery Thermal Management System Market Analysis and Insights

Electric vehicles are the promising renewable substitute to gasoline power-based vehicles for protecting the environment. Many governments take initiatives to promote electric vehicles and offer redemption tax rebates. The rise in the market of electric vehicles in the European and American markets as the technology is rapidly upgrading is increasing the demand for the Asia-Pacific automotive battery thermal management system market.

Some of the factors anticipated to propel the market growth are increasing demand for electric vehicles, incentives and subsidies by the government for electric vehicles, and increasing environmental concerns among others. However, high upfront costs and design complexities of the components are the restraints that may hamper the market's growth. Adopting new technologies such as solid-state batteries may act as market growth opportunities. Battery performance in different environmental conditions may challenge market growth.

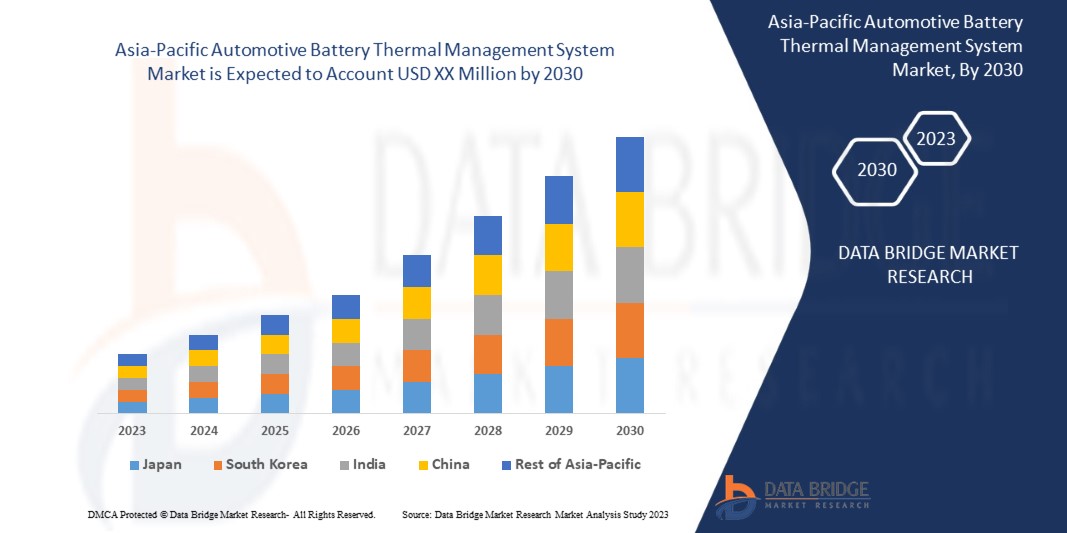

Data Bridge Market Research analyses that the Asia-Pacific automotive battery thermal management system market will grow at a CAGR of 23.1% during the forecast period of 2023 to 2030.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customisable to 2020-2016) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Battery Capacity (Less Than 100 kWh, 100 to 200 kWh, and More Than 200 kWh), Type (Liquid Cooling and Heating, PCM, and Air Cooling and Heating), Propulsion (Hybrid Electric Vehicle, Battery Electric Vehicle, PHEV & FCV), Technology (Active, Passive), Vehicle Type (Automotive, Military, and Others). |

|

Countries Covered |

China, South Korea, Japan, India, Australia, Singapore, Malaysia, Taiwan, Thailand, Philippines, and the rest of Asia-Pacific. |

|

Market Players Covered |

MAHLE GmbH, LG Energy Solution, Valeo, Dana Limited, Hanon Systems, Robert Bosch GmbH, Continental AG, VOSS Automotive GmbH, DENSO Corporation, MODINE MANUFACTURING COMPANY, GENTHERM, Grayson, Renesas Electronics Corporation, STMicroelectronics, SAMSUNG SDI CO.,LTD., LEM International SA, Orion BMS, Panasonic Holdings Corporation, Sensata Technologies, Inc., Infineon Technologies AG among others |

Market Definition

The thermal management system in an automotive battery is the solution that helps in managing the heat generated during the electrochemical processes occurring in cells, allowing the battery to operate safely and efficiently. An electric vehicle requires effective thermal management systems to keep battery temperatures in the correct range and prevent the temperature from fluctuating inside the battery pack. Thus, thermal management systems play a vital role in a vital role in the control of the battery's thermal behavior.

The adoption of electric vehicles is rising Asia-Pacificly due to their zero-emission and high tank-to-wheels efficiency. This has made it necessary to have a proper battery management system to reach maximum performance when operating under various conditions. In addition, the rising trend towards increasing charging rates, which would allow faster charging and longer trips, has raised the demand for more efficient thermal management in EVs.

Asia-Pacific Automotive Battery Thermal Management System Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

-

INCREASE IN DEMAND FOR ELECTRIC VEHICLES

The automotive industry has grown enormously due to the rising demand for luxurious electric vehicles. Some of the factors driving the sales of electric vehicles include stringent government regulations towards vehicle emissions and increasing demand for fuel-efficient, high-performance, and low-emission vehicles.

-

INCENTIVES AND SUBSIDIES BY THE GOVERNMENT FOR THERMAL BATTERIES IN ELECTRIC VEHICLES

An increase in pollution and scarcity of resources, particularly in the automotive sector, has enabled the government to take action for environmental protection. This is leading to the shift of trends in the automotive industry from normal motorized vehicles to electric hybrid vehicles for environmental protection.

Opportunity

-

INCREASE IN VARIOUS STRATEGIC DECISIONS BY THE COMPANIES

Strategic decisions such as partnerships and investments help companies to work toward the desired goal. As the marketplace is changing and evolving, customers are consistently looking for newly developed and advanced products.

Restraint/Challenge

- HIGH UPFRONT COST

Thermal batteries are best suited for electric vehicles as they have a less environmental impact and help control air pollution. However, the initial cost of thermal batteries used in automotive industries is higher than others because it includes technologically upgraded components that do not harm the environment. In contrast, the operational costs of thermal batteries in electric vehicles are cheaper than normal battery engine vehicles.

Recent Development

- In June 2021, GENTHERM announced they are the lead investor in Carrar, an Israel-based technology developer of advanced thermal management systems for the electric mobility market. The investment will help the company to expand its Battery Performance Solutions portfolio with a technology that can improve EV safety, performance, and charging speed.

Asia-Pacific Automotive Battery Thermal Management System Market Scope

The Asia-Pacific automotive battery thermal management system market is segmented based on battery capacity, type, propulsion, technology, and vehicle type. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Battery Capacity

- Less than 100 kWh

- 100 to 200 kWh

- More than 200 kWh

On the basis of battery capacity, the Asia-Pacific automotive battery thermal management system market is segmented into less than 100 kWh, 100 to 200 kWh, and more than 200 kWh.

Type

- Liquid Cooling and Heating

- PCM

- Air Cooling and Heating

On the basis of type, the Asia-Pacific automotive battery thermal management system market is segmented into liquid cooling and heating, PCM, and air cooling and heating.

Propulsion

- Hybrid Electric Vehicle

- Battery Electric Vehicle

- PHEV & FCV

On the basis of propulsion, the Asia-Pacific automotive battery thermal management system market is segmented into hybrid electric vehicle, battery electric vehicle, and PHEV & FCV.

Technology

- Active

- Passive

On the basis of technology, the Asia-Pacific automotive battery thermal management system market is segmented into active and passive.

Vehicle Type

- Automotive

- Military

- Others

On the basis of vehicle type, the Asia-Pacific automotive battery thermal management system market is segmented into automotive, military, and others.

Asia-Pacific Automotive Battery Thermal Management System Market Regional Analysis/Insights

The Asia-Pacific automotive battery thermal management system market is analyzed, and market size insights and trends are provided by country, battery capacity, type, propulsion, technology, and vehicle type.

Some countries covered in the Asia-Pacific automotive battery thermal management system market report are China, South Korea, Japan, India, Australia, Singapore, Malaysia, Taiwan, Thailand, Philippines, and the rest of Asia-Pacific.

China is expected to dominate the Asia-Pacific region as it is the leading country in the adoption of EVs and has a maximum number of electric vehicles registered Asia-Pacificly.

The country section of the report also provides individual market-impacting factors and changes in regulations in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, disease epidemiology, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Automotive Battery Thermal Management System Market Share Analysis

The Asia-Pacific automotive battery thermal management system market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, solution launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to Asia-Pacific automotive battery thermal management system market.

Some of the major players operating in the Asia-Pacific automotive battery thermal management system market are MAHLE GmbH, LG Energy Solution, Valeo, Dana Limited, Hanon Systems, Robert Bosch GmbH, Continental AG, VOSS Automotive GmbH, DENSO Corporation, MODINE MANUFACTURING COMPANY, GENTHERM, Grayson, Renesas Electronics Corporation, STMicroelectronics, SAMSUNG SDI CO.,LTD., LEM International SA, Orion BMS, Panasonic Holdings Corporation, Sensata Technologies, Inc., Infineon Technologies AG among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 THE MARKET CHALLENGE MATRIX

2.9 MULTIVARIATE MODELING

2.1 BATTERY CAPACITY TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 VOLUME (REGION-WISE)

4.2 PRICING ANALYSIS

4.3 VALUE CHAIN ANALYSIS

4.4 SUPPLY CHAIN OF ASIA PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET

4.5 REGULATORY STANDARDS

4.6 TECHNOLOGICAL ADVANCEMENTS

4.7 STRENGTH OF PRODUCT PORTFOLIO

4.8 BUSINESS STRATEGY EXCELLENCE

4.9 CASE STUDIES

4.9.1 CHALLENGES

4.9.2 ANSYS PRODUCTS USED

4.9.3 ENGINEERING SOLUTION

4.9.4 BENEFITS

4.9.5 CONCLUSION

5 REGIONAL REASONING

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASE IN DEMAND FOR ELECTRIC VEHICLES

6.1.2 INCENTIVES AND SUBSIDIES BY THE GOVERNMENT FOR THERMAL BATTERIES IN ELECTRIC VEHICLES

6.1.3 INCREASE IN ENVIRONMENTAL CONCERNS

6.1.4 RISE IN DEMAND FOR PHASE CHANGE MATERIAL (PCM) IN THE AUTOMOTIVE INDUSTRY

6.2 RESTRAINTS

6.2.1 HIGH UPFRONT COST

6.2.2 DESIGN COMPLEXITIES OF THE COMPONENTS

6.3 OPPORTUNITIES

6.3.1 INCREASE IN VARIOUS STRATEGIC DECISIONS BY THE COMPANIES

6.3.2 ADOPTION OF NEW TECHNOLOGIES SUCH AS SOLID-STATE BATTERY

6.4 CHALLENGES

6.4.1 BATTERY PERFORMANCE IN DIFFERENT ENVIRONMENTAL CONDITIONS

6.4.2 LACK OF CHARGING INFRASTRUCTURE FOR ELECTRIC VEHICLES IN UNDERDEVELOPED COUNTRIES

7 ASIA PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION

7.1 OVERVIEW

7.2 HYBRID ELECTRIC VEHICLE

7.3 BATTERY ELECTRIC VEHICLE

7.4 PHEV & FCV

8 ASIA PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 ACTIVE

8.3 PASSIVE

9 ASIA PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE

9.1 OVERVIEW

9.2 LIQUID COOLING AND HEATING

9.3 PCM

9.4 AIR COOLING AND HEATING

10 ASIA PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY

10.1 OVERVIEW

10.2 LESS THAN 100 KWH

10.3 100 TO 200 KWH

10.4 MORE THAN 200 KWH

11 ASIA PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE

11.1 OVERVIEW

11.2 AUTOMOTIVE

11.2.1 PASSENGER CAR

11.2.1.1 SUV

11.2.1.2 SEDAN

11.2.1.3 HATCHBACK

11.2.1.4 MPV

11.2.1.5 CROSSOVER

11.2.1.6 COUPE

11.2.1.7 CONVERTIBLE

11.2.1.8 OTHERS

11.3 LCV

11.3.1 VANS

11.3.1.1 PASSENGER VANS

11.3.1.2 CARGO VANS

11.3.1.3 PICK UP VANS

11.3.2 MINI BUS

11.3.3 COACHES

11.3.4 OTHERS

11.4 HCV

11.4.1 BUSES

11.4.2 TRUCKS

11.4.2.1 DUMP TRUCK

11.4.2.2 TOW TRUCK

11.4.2.3 CEMENT TRUCK

11.5 MILITARY

11.6 OTHERS

12 ASIA PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION

12.1 ASIA-PACIFIC

12.1.1 CHINA

12.1.2 JAPAN

12.1.3 SOUTH KOREA

12.1.4 AUSTRALIA

12.1.5 TAIWAN

12.1.6 SINGAPORE

12.1.7 INDIA

12.1.8 THAILAND

12.1.9 MALAYSIA

12.1.10 PHILIPPINES

12.1.11 REST OF ASIA PACIFIC

13 ASIA PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 ROBERT BOSCH GMBH

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 VALEO

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 DENSO CORPORATION

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 LG ENERGY SOLUTION

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 SAMSUNG SDI CO., LTD.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 CONTINENTAL AG

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 DANA LIMITED

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 GENTHERM

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.9 GRAYSON

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 HANON SYSTEMS

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 INFINEON TECHNOLOGIES AG

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 LEM INTERNATIONAL SA

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 MAHLE GMBH

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 MODINE MANUFACTURING COMPANY

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 ORION BMS

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 PANASONIC HOLDINGS CORPORATION

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 RENESAS ELECTRONICS CORPORATION.

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENT

15.18 STMICROELECTRONICS

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 SENSATA TECHNOLOGIES, INC.

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 VOSS AUTOMOTIVE GMBH

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 VARIOUS AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEMS' REGULATORY STANDARDS ARE AS GIVEN BELOW:

TABLE 2 LEVEL OF PRESENCE OF AIR POLLUTANTS IN MAJOR CITIES OF THE WORLD

TABLE 3 ASIA PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION, 2021-2030 (USD MILLION)

TABLE 4 ASIA PACIFIC HYBRID ELECTRIC VEHICLE IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 ASIA PACIFIC BATTERY ELECTRIC VEHICLE IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 ASIA PACIFIC PHEV & FCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 ASIA PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 8 ASIA PACIFIC ACTIVE IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 ASIA PACIFIC PASSIVE IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 ASIA PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 ASIA PACIFIC LIQUID COOLING AND HEATING IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 ASIA PACIFIC PCM IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 ASIA PACIFIC AIR COOLING AND HEATING IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 ASIA PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2021-2030 (USD MILLION)

TABLE 15 ASIA PACIFIC LESS THAN 100 KWH IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 ASIA PACIFIC 100 TO 200 KWH IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 ASIA PACIFIC MORE THAN 200 KWH IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 ASIA PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 19 ASIA PACIFIC AUTOMOTIVE IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 ASIA PACIFIC AUTOMOTIVE IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 ASIA PACIFIC PASSENGER CAR IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 22 ASIA PACIFIC LCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 23 ASIA PACIFIC VANS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 24 ASIA PACIFIC HCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 ASIA PACIFIC TRUCKS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 26 ASIA PACIFIC MILITARY IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 ASIA PACIFIC OTHERS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 ASIA-PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 29 ASIA-PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2021-2030 (USD MILLION)

TABLE 30 ASIA-PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 ASIA-PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION, 2021-2030 (USD MILLION)

TABLE 32 ASIA-PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 33 ASIA-PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 34 ASIA-PACIFIC AUTOMOTIVE IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 ASIA-PACIFIC PASSENGER CAR IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 36 ASIA-PACIFIC LCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 ASIA-PACIFIC VANS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 38 ASIA-PACIFIC HCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 ASIA-PACIFIC TRUCKS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 CHINA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2021-2030 (USD MILLION)

TABLE 41 CHINA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 CHINA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION, 2021-2030 (USD MILLION)

TABLE 43 CHINA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 44 CHINA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 45 CHINA AUTOMOTIVE IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 CHINA PASSENGER CAR IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 47 CHINA LCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 CHINA VANS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 CHINA HCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 CHINA TRUCKS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 JAPAN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2021-2030 (USD MILLION)

TABLE 52 JAPAN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 53 JAPAN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION, 2021-2030 (USD MILLION)

TABLE 54 JAPAN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 55 JAPAN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 56 JAPAN AUTOMOTIVE IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 57 JAPAN PASSENGER CAR IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 58 JAPAN LCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 JAPAN VANS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 JAPAN HCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 JAPAN TRUCKS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 62 SOUTH KOREA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2021-2030 (USD MILLION)

TABLE 63 SOUTH KOREA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 64 SOUTH KOREA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION, 2021-2030 (USD MILLION)

TABLE 65 SOUTH KOREA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 66 SOUTH KOREA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 67 SOUTH KOREA AUTOMOTIVE IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 SOUTH KOREA PASSENGER CAR IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 69 SOUTH KOREA LCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 SOUTH KOREA VANS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 SOUTH KOREA HCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 72 SOUTH KOREA TRUCKS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 73 AUSTRALIA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2021-2030 (USD MILLION)

TABLE 74 AUSTRALIA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 75 AUSTRALIA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION, 2021-2030 (USD MILLION)

TABLE 76 AUSTRALIA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 77 AUSTRALIA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 78 AUSTRALIA AUTOMOTIVE IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 79 AUSTRALIA PASSENGER CAR IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 80 AUSTRALIA LCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 81 AUSTRALIA VANS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 AUSTRALIA HCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 83 AUSTRALIA TRUCKS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 84 TAIWAN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2021-2030 (USD MILLION)

TABLE 85 TAIWAN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 TAIWAN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION, 2021-2030 (USD MILLION)

TABLE 87 TAIWAN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 88 TAIWAN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 89 TAIWAN AUTOMOTIVE IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 90 TAIWAN PASSENGER CAR IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 91 TAIWAN LCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 92 TAIWAN VANS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 93 TAIWAN HCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 94 TAIWAN TRUCKS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 95 SINGAPORE AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2021-2030 (USD MILLION)

TABLE 96 SINGAPORE AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 SINGAPORE AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION, 2021-2030 (USD MILLION)

TABLE 98 SINGAPORE AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 99 SINGAPORE AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 100 SINGAPORE AUTOMOTIVE IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 101 SINGAPORE PASSENGER CAR IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 102 SINGAPORE LCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 103 SINGAPORE VANS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 104 SINGAPORE HCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 105 SINGAPORE TRUCKS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 106 INDIA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2021-2030 (USD MILLION)

TABLE 107 INDIA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 108 INDIA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION, 2021-2030 (USD MILLION)

TABLE 109 INDIA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 110 INDIA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 111 INDIA AUTOMOTIVE IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 112 INDIA PASSENGER CAR IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 113 INDIA LCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 114 INDIA VANS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 115 INDIA HCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 116 INDIA TRUCKS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 117 THAILAND AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2021-2030 (USD MILLION)

TABLE 118 THAILAND AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 119 THAILAND AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION, 2021-2030 (USD MILLION)

TABLE 120 THAILAND AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 121 THAILAND AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 122 THAILAND AUTOMOTIVE IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 123 THAILAND PASSENGER CAR IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 124 THAILAND LCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 125 THAILAND VANS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 126 THAILAND HCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 127 THAILAND TRUCKS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 128 MALAYSIA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2021-2030 (USD MILLION)

TABLE 129 MALAYSIA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 130 MALAYSIA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION, 2021-2030 (USD MILLION)

TABLE 131 MALAYSIA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 132 MALAYSIA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 133 MALAYSIA AUTOMOTIVE IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 134 MALAYSIA PASSENGER CAR IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 135 MALAYSIA LCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 136 MALAYSIA VANS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 137 MALAYSIA HCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 138 MALAYSIA TRUCKS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 139 PHILIPPINES AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2021-2030 (USD MILLION)

TABLE 140 PHILIPPINES AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 141 PHILIPPINES AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION, 2021-2030 (USD MILLION)

TABLE 142 PHILIPPINES AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 143 PHILIPPINES AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 144 PHILIPPINES AUTOMOTIVE IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 145 PHILIPPINES PASSENGER CAR IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 146 PHILIPPINES LCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 147 PHILIPPINES VANS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 148 PHILIPPINES HCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 149 PHILIPPINES TRUCKS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 150 REST OF ASIA-PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 ASIA PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: SEGMENTATION

FIGURE 10 INCREASE IN DEMAND FOR ELECTRIC VEHICLES IS EXPECTED TO DRIVE THE ASIA PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET IN THE FORECAST PERIOD

FIGURE 11 LESS THAN 100 KWH SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET IN 2023 & 2030

FIGURE 12 VALUE CHAIN FOR ASIA PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET

FIGURE 13 TECHNOLOGICAL TRENDS IN AUTOMOTIVE BATTERY MANAGEMENT

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET

FIGURE 15 ASIA PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: BY PROPULSION, 2022

FIGURE 16 ASIA PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: BY TECHNOLOGY, 2022

FIGURE 17 ASIA PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: BY TYPE, 2022

FIGURE 18 ASIA PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: BY BATTERY CAPACITY, 2022

FIGURE 19 ASIA PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: BY VEHICLE TYPE, 2022

FIGURE 20 ASIA-PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: SNAPSHOT (2022)

FIGURE 21 ASIA-PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: BY REGION (2022)

FIGURE 22 ASIA-PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: BY REGION (2023 & 2030)

FIGURE 23 ASIA-PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: BY REGION (2022 & 2030)

FIGURE 24 ASIA-PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: BY BATTERY CAPACITY (2023-2030)

FIGURE 25 ASIA PACIFIC AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: COMPANY SHARE 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.