Asia Pacific Architectural Coatings Market

Market Size in USD Billion

CAGR :

%

USD

25.63 Billion

USD

40.24 Billion

2022

2030

USD

25.63 Billion

USD

40.24 Billion

2022

2030

| 2023 –2030 | |

| USD 25.63 Billion | |

| USD 40.24 Billion | |

|

|

|

|

Asia-Pacific Architectural Coatings Market Analysis and Size

The health of the construction and real estate industries is a major driver for architectural coatings. As these industries grow, the demand for coatings used in residential, commercial, and industrial buildings also increases. Rapid urbanization and population growth lead to increased construction activities, driving the need for architectural coatings for new structures and renovations.

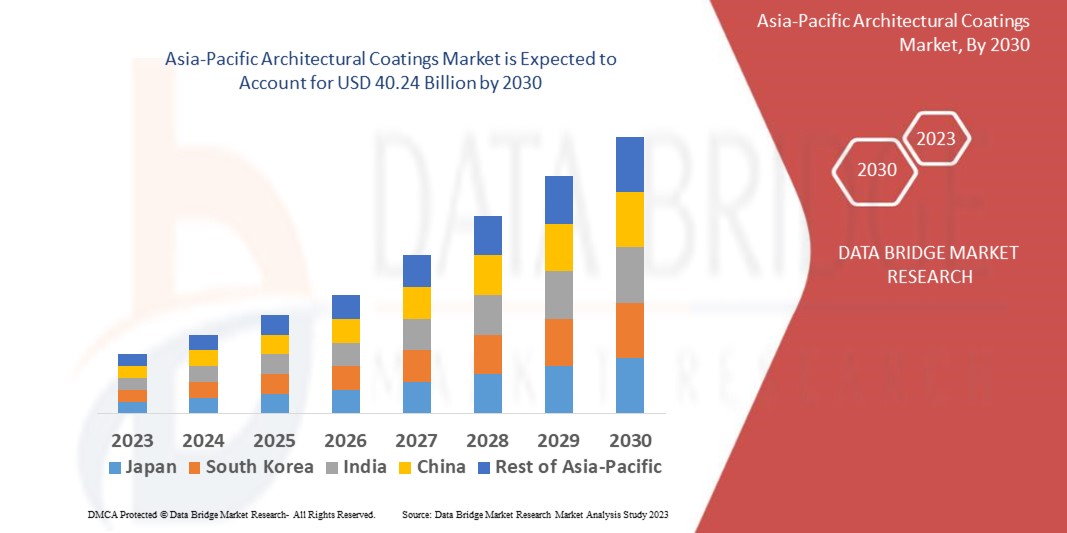

Data Bridge Market Research analyses that the Asia-Pacific architectural coatings market which was USD 25.63 billion in 2022, is expected to reach USD 40.24 billion by 2030, and is expected to undergo a CAGR of 5.6% during the forecast period of 2023 to 2030. “Acrylic” dominates the resin type segment of the Asia-Pacific architectural coatings market due to their versatility, durability, color retention, breathability properties. These technologies rely on physical interactions, such as adsorption or compression, to store hydrogen gas. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Asia-Pacific Architectural Coatings Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Billion, Volume in Units, Price in USD |

|

Segments Covered |

By Resin Type (Acrylic, Vinyl Acetate-Ethylene (VAE), Alkyds, Polyurethane, Epoxy, Polyesters, Others), Technology (Solvent-borne, Waterborne), Function (Paints, Primers, Varnishes, Stains, Sealers, Powder Coatings, Lacquers, Ceramics, Others), Application (Commercial, Residential, Coatings for Wood, Roof Coatings, Floor Coatings) |

|

Countries Covered |

Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC) |

|

Market Players Covered |

BASF Coatings GmbH (Germany), PPG Industries Inc. (U.S.), AkzoNobel N.V. ( Netherlands), Kelly-Moore Paint Company, Inc. ( U.S.), The Sherwin-William Company (U.S.), The Valspar Corporation (U.S.), Nippon Paint Co Ltd (Japan), RPM International Inc. (U.S.), Kansai Paint Co., Ltd (Japan) and Asian Paints Ltd (India) |

|

Market Opportunities |

|

Market Definition

Architectural coatings, also referred to as decorative coatings, are coating formulations used to coat buildings and homes. The term architectural coatings cover a wide range of different coatings such as varnishes, paints, primers, sealers, inks, ceramics, and several others. As they are applied on interior and exterior walls, floor, and ceilings of buildings, architectural coatings should be resistant to certain factors such as moisture, heat, changing weather, chemicals, and similar others.

Asia-Pacific Architectural Coatings Market Dynamics

Drivers

- Construction and Renovation Activities

The growth in construction and renovation projects worldwide drives the demand for architectural coatings, as these coatings are essential for protecting and enhancing the appearance of buildings. Construction and renovation activities encompass the application of architectural coatings to surfaces within buildings and structures. Coatings are used to protect, enhance, customize, and maintain the appearance of architectural elements, contributing to the overall aesthetics and longevity of the constructed or renovated space.

- Increasing Focus on Sustainability

There is a rising demand for eco-friendly and sustainable coatings that have low VOC (Volatile Organic Compound) content, are water-based, and offer improved energy efficiency. This driver is fueled by environmental regulations and consumer preferences. There is a growing focus on sustainability in architectural coatings due to increasing environmental awareness and the demand for more eco-friendly solutions. This focus encompasses various aspects of the coatings' lifecycle, from raw material sourcing to application, performance, and disposal.

- Urbanization and Infrastructure Development

Rapid urbanization and the need for new infrastructure projects, such as commercial buildings, residential complexes, and transportation systems, contribute to the demand for architectural coatings. Urbanization and infrastructure development often involve new construction projects and the expansion of existing buildings and structures. This leads to a higher demand for architectural coatings as these projects require coatings for both functional protection and aesthetic enhancement.

Opportunities

- Green Building Initiatives

As sustainable building practices gain traction, there are opportunities for architectural coatings manufacturers to develop and market environmentally friendly coatings that comply with green building certifications, such as LEED (Leadership in Energy and Environmental Design). Green building initiatives have significantly influenced the architectural coatings industry, driving the development and adoption of more sustainable and environmentally friendly coatings. These initiatives promote the use of coatings that have a reduced impact on human health, minimize resource consumption, and contribute to overall sustainability.

- Collaboration with Architects and Designers

Working closely with architects and designers to provide tailored coating solutions and offer technical expertise creates opportunities for manufacturers to be involved in high-profile projects and establish long-term partnerships. Collaboration with architects and designers is crucial for the architectural coatings industry. Architects and designers play a key role in specifying coatings for construction and renovation projects, as they are responsible for selecting coatings that meet the functional and aesthetic requirements of a building or space.

Restraints/Challenges

- Fluctuating Raw Material Prices

The prices of key raw materials used in architectural coatings, such as resins, pigments, and solvents, can be volatile, impacting the cost of production and potentially affecting profit margins. Fluctuating raw material prices have a significant impact on the architectural coatings industry. Raw materials, such as resins, pigments, solvents, and additives, are essential components of coatings, and their prices can vary due to a variety of factors.

- Stringent Environmental Regulations

Compliance with environmental regulations, such as restrictions on VOC emissions, can pose challenges for manufacturers in terms of reformulating products, investing in research and development, and meeting changing industry standards. Adhering to manufacturer guidelines and working with experienced HVAC professionals can provide valuable insights and ensure proper maintenance practices are followed. Also, the lack of favorable reimbursement scenarios and technology penetration in the developing economies, heavy custom duty imposed on medical devices, and lack of suitable infrastructure in low-income and middle-income countries are projected to challenge the market in the forecast period of 2023-2030.

This Asia-Pacific architectural coatings market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, and technological innovations in the market. To gain more info on the Asia-Pacific architectural coatings market contact Data Bridge Market Research for an Analyst Brief, our team will help you make an informed market decision to achieve market growth.

Recent Developments

- In August 2022, Nippon Paint China and BASF partnered to launch Joncryl HPB. It is the first water-based barrier coating that BASF has introduced for use in industrial packaging in China

- In August 2021, Dulux, a brand of AkzoNobel, introduced a USDA-certified super-premium interior emulsion in India. It is India’s first paint made from biomaterials that purify indoor air.

Asia-Pacific Architectural Coatings Market Scope

The Asia-Pacific architectural coatings market is segmented on the basis of resin type, technology, function, application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Resin Type

- Acrylic

- Vinyl Acetate-Ethylene (VAE)

- Alkyds

- Polyurethane

- Epoxy

- Polyesters

- Others

Technology

- Solvent-borne

- Waterborne

Function

- Paints

- Primers

- Varnishes

- Stains

- Sealers

- Powder Coatings

- Lacquers

- Ceramics

- Others

Application

- Commercial

- Residential

- Coatings for Wood

- Roof Coatings

- Floor Coating

Asia-Pacific Architectural Coatings Market Regional Analysis/Insights

The Asia-Pacific architectural coatings market is analysed and market size insights and trends are provided by country, resin type, technology, function, application as referenced above.

The countries covered in the Asia-Pacific architectural coatings market report are Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC).China is estimated to dominate the Asia-Pacific architectural coatings market because of the experienced significant urbanization and a construction boom in recent decades within the country.

India is expected to witness significant growth during the forecast period of 2023 to 2030 due to the increased construction activities in residential, commercial, and public sectors in the country.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Automotive Infrastructure Growth Installed Base and New Technology Penetration

The Asia-Pacific architectural coatings market also provides you with a detailed market analysis for every country's growth in automotive expenditure for capital equipment, installed base of different kinds of products for the Asia-Pacific architectural coatings market, the impact of technology using lifeline curves, and changes in automotive regulatory scenarios and their impact on the Asia-Pacific architectural coatings market. The data is available for the historic period 2015-2020.

Competitive Landscape and Asia-Pacific Architectural Coatings Market Share Analysis

The Asia-Pacific architectural coatings market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, application dominance. The above data points provided are only related to the companies' focus related to the Asia-Pacific architectural coatings market.

Some of the major players operating in the Asia-Pacific architectural coatings market are:

- BASF Coatings GmbH (Germany)

- PPG Industries Inc. (U.S.)

- AkzoNobel N.V. ( Netherlands)

- Kelly-Moore Paint Company, Inc. (U.S.)

- The Sherwin-William Company (U.S.)

- The Valspar Corporation (U.S.)

- Nippon Paint Co Ltd (Japan)

- RPM International Inc. (U.S.)

- Kansai Paint Co., Ltd (Japan)

- Asian Paints Ltd (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Architectural Coatings Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Architectural Coatings Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Architectural Coatings Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.