Asia-Pacific Aquaculture Equipment Market Analysis and Insights

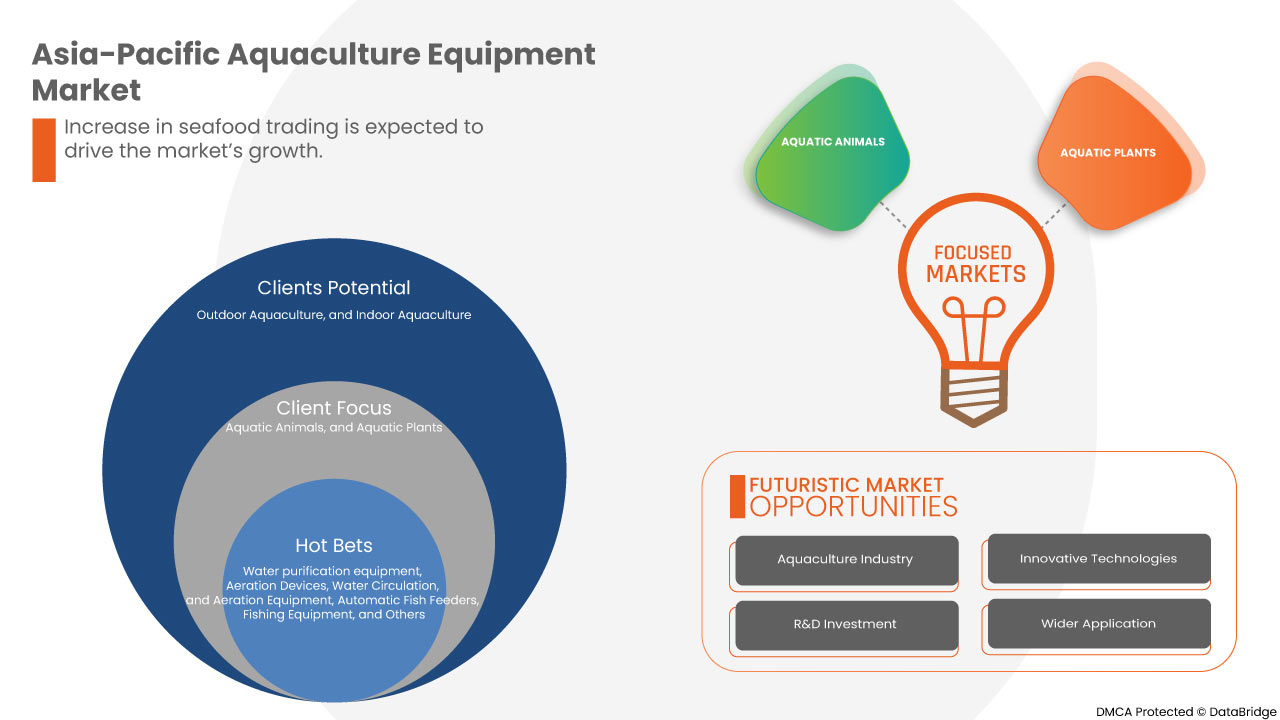

An increase in seafood trading and increasing demand for aquaponics are expected to drive the demand for the Asia-Pacific aquaculture equipment market. However, concerns about food safety in aquaculture and the spread of deadly diseases and parasites may further restrict the market's growth.

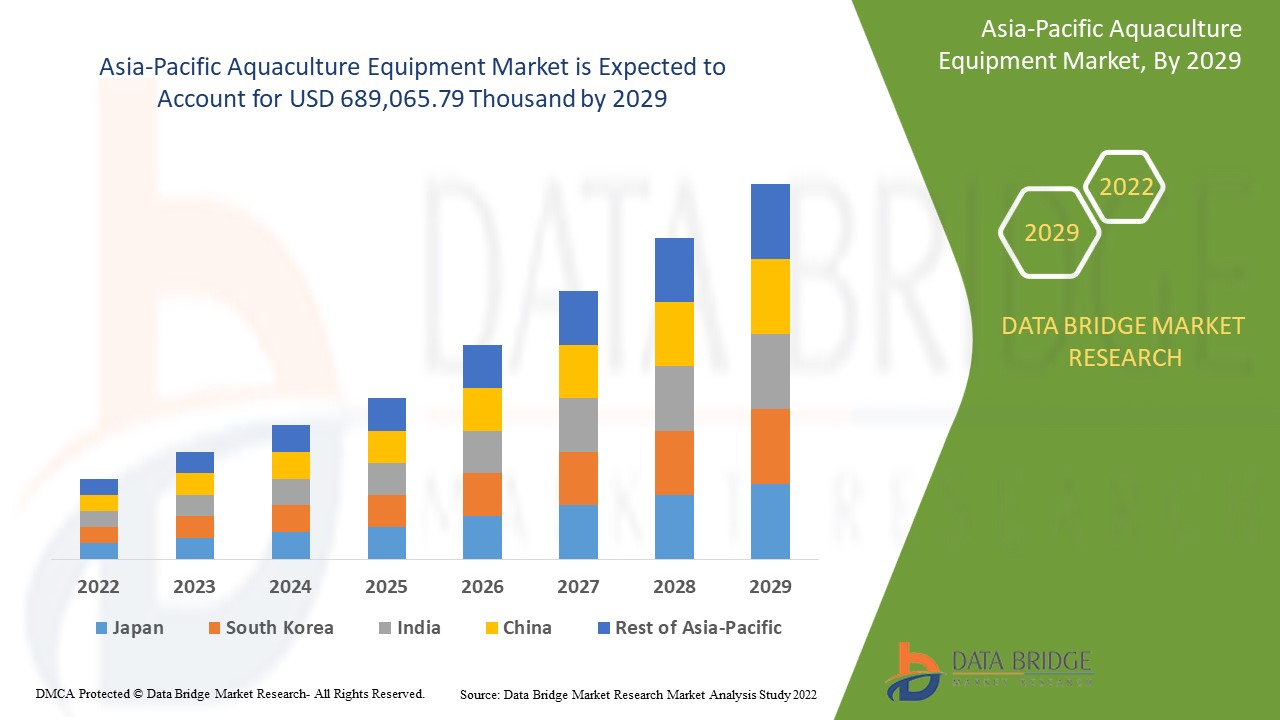

Data Bridge Market Research analyzes that the Asia-Pacific aquaculture equipment market is expected to reach a value of USD 689,065.79 thousand by 2029, at a CAGR of 4.6% during the forecast period. Water purification equipment accounts for the largest type segment in the Asia-Pacific aquaculture equipment market. The Asia-Pacific aquaculture equipment market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

By Type (Water Purification Equipment, Aeration Devices, Water Circulation and Aeration Equipment, Automatic Fish Feeder, Fishing Equipment, Containment Equipment, Seine Reels, Maintenance and Repair Equipment, Water Temperature Control Device, Water Quality Testing Instrument, Clear Pond Equipment, and Others), Application (Outdoor Aquaculture, Indoor Aquaculture) End Use (Aquatic Animals, Aquatic Plants), Distribution Channel (Direct, Indirect). |

|

Countries Covered |

China, India, Japan, South Korea, Thailand, Singapore, Indonesia, Australia & New Zealand, Philippines, Malaysia, Vietnam, and the rest of Asia-Pacific. |

|

Market Players Covered |

AquacuLture Systems Technologies, LLC, Aquaculture Equipment Ltd, SKAGINN 3X, Haosail, Norfab Equipment Ltd., Sino-Aqua Corporation, BAADER, FAIVRE Ets, Pioneer Group, Rastaquaculture, SRR Aqua Suppliers LLP, Cflow, Sagar Aquaculture Pvt Ltd, Aquaneering Incorporated, FishFarmFeeeder, Nanrong Shanghai Co., Ltd., DURA-TECH, HUNG STAR ENTERPRISE CORP., FREA SOLUTIONS, and AquaMof Aquaculture Technologies Ltd., among others. |

Market Definition

Aquaculture is the farming of aquatic plants, aquatic animals, and other aquatic organisms. It is the breeding, rearing, and harvesting of organisms in water environments. Therefore, aquaculture equipment refers to the equipment that is used in the process of aquaculture farming. Over the year, the aquaculture industry has gained significant momentum in its growth rate and has shown great potential for growth. As a result, more and more players are entering this field.

Asia-Pacific Aquaculture Equipment Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- The rise, expansion, and growth of the aquaculture industry

Aquaculture, or fish and seafood farming, is the fastest-growing area of the food animal business. The growth of aquaculture has been fueled by the expansion in Asia-Pacific trade, declines in the availability of wild fish, competitive product pricing, rising incomes, and urbanization—all of which contribute to the rising per capita consumption of seafood worldwide. Furthermore, making creative technical developments, investing in R&D, and cooperating with major industry players will extend and expand the aquaculture business's worldwide reach. This will also increase the growth of aquaculture equipment such as aerators, pumps, feeders, filters, and others that depend on the aquaculture industries. Thus, as a result of the growing aquaculture business, demand for aquaculture equipment will rise. In the foreseeable future, this is expected to drive the Asia-Pacific aquaculture equipment market.

- Increase in seafood trading

Thanks to decades of increased fishery and aquaculture yields and growing Asia-Pacific demand, seafood is one of the most-traded food categories in the world today. The fastest growth rate of trade of aquatic products reveals that a higher proportion of seafood trading volumes comprised various species. Developing countries play a major role in seafood exports as developed countries are increasingly reliant on developing countries for imports of high-value species, especially shrimps from India and Ecuador and salmonids from Chile. Thus, the increasing trade of seafood increases the growth of the aquaculture industries, and this will result in increasing demand for aquaculture equipment. This is expected to drive the aquaculture equipment market in the near future.

Opportunities

-

Rising government measures to boost aquaculture

Fisheries and aquaculture provide food for hundreds of millions of people around the world every day. It aids food production and assists endangered animals by serving a variety of functions. Governments' initiatives, such as regulations and programs that promote aquaculture sector expansion, merely serve to prepare the way for future development alongside technological solutions. This expansion will create additional chances for important industry participants and farmers in the foreseeable future, making aquaculture a sector to monitor. As a result of this, rising government measures to boost aquaculture are expected to provide a market growth opportunity for the aquaculture equipment market

Restraints/Challenges

- Concerns about food safety in aquaculture

Epidemiological data on foodborne infections shows that fish collected from open oceans are typically safe and healthy meals if they are refrigerated rapidly and handled appropriately. Aquaculture products, on the other hand, have been linked to certain food safety concerns, as the danger of contamination by chemical and biological agents is higher in freshwater and coastal habitats than in the open oceans. As a result, a lack of infrastructure and consistent government restrictions may limit market expansion. Aquaculture production will certainly become an increasingly important means of producing aquatic products for human consumption, but the risk related to food safety regarding aquaculture will get hard hit in the economy. This concerns food safety in aquaculture will hinder the growth of the aquaculture industry and, thus, restrict the growth of the aquaculture equipment market.

- Overfishing difficulties

With 90% of the world's wild 'fish stocks' fully fished, overexploited, or depleted, aquaculture is on the increase; yet, whether aquaculture is a solution to overfishing remains debatable. Overfishing is on the rise as seafood has become one of the most traded food commodities on the planet. When fish populations are overfished, the fragile marine ecosystems on which our planet depends are disturbed. Aquaculture, which covers both saltwater and freshwater species, is the technique of cultivating fish under controlled circumstances. It is the world's fastest-growing food production industry, accounting for around 44% of all fish consumed, but in order to maintain its expansion, it is primarily reliant on the capture of wild-caught fish. Thus, difficulties related to overfishing may act as a challenge for the aquaculture industry, and this may challenge the aquaculture equipment market growth.

Post-COVID-19 Impact on Asia-Pacific Aquaculture Equipment Market

COVID-19 impacted various manufacturing industries in the year 2020-2021 as it led to the closure of workplaces, disruption of supply chains, and restrictions on transportation. Due to the lockdown, the market has experienced a downfall in sales due to the retail outlets being shut and the restrictions on customer access over the past few years.

However, the growth of the market post-pandemic period is attributed to more health awareness and consciousness among consumers and growing demand for healthy and nutritious seafood. This has led to the increased popularity of aquaculture among people due to the various health benefits and growing popularity of protein-rich foods. The key market players are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple R&D activities to improve their offerings. They are enhancing their market share by exploring different retail channels and expanding into new regions.

Recent Developments

- In August 2022, SKAGINN 3X signed a contract with BlueWild, Norway, to supply a full fish processing factory onboard the company's innovative new trawler. The trawler is designed to deliver sustainability, quality, and efficiency on all levels. This is a milestone agreement for the organization.

- In April 2022, Cflow AS participated in the Nor-Shipping from the 4th to the 7th of April. Nor-Shipping is at the center of the oceans. This is where the maritime and ocean industries meet every two years – a natural hub for key decision-makers from across the world to connect, collaborate and do deals to unlock new business opportunities.

Asia-Pacific Aquaculture Equipment Market Scope

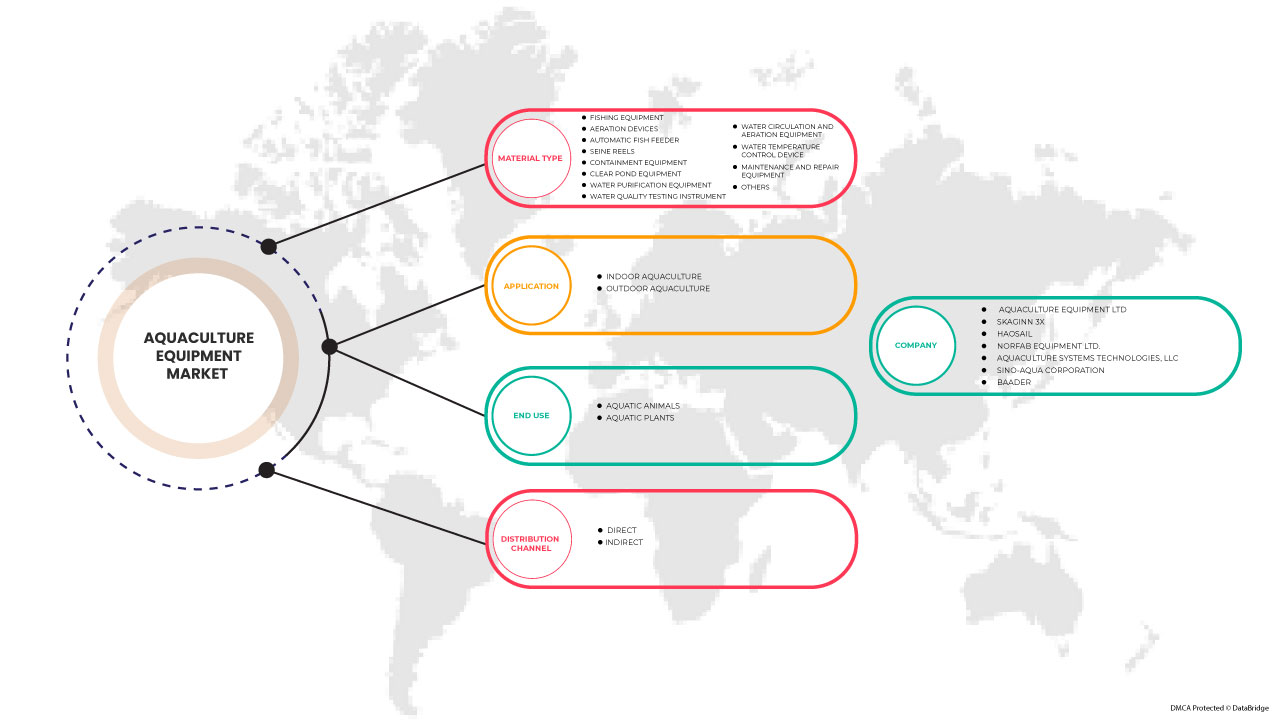

The Asia-Pacific aquaculture equipment market is segmented based on type, application, end use, and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Water Purification Equipment

- Aeration Devices

- Water Circulation and Aeration Equipment

- Automatic Fish Feeder

- Fishing Equipment

- Containment Equipment

- Seine Reels

- Maintenance and Repair Equipment

- Water Temperature Control Device

- Water Quality Testing Instrument

- Clear Pond Equipment

- Others

Based on type, the Asia-Pacific aquaculture equipment market is segmented into water purification equipment, aeration devices, water circulation and aeration equipment, automatic fish feeder, fishing equipment, containment equipment, seine reels, maintenance and repair equipment, water temperature control device, water quality testing instrument, clear pond equipment, and others.

Application

- Outdoor Aquaculture

- Indoor Aquaculture

Based on application, the Asia-Pacific aquaculture equipment market is segmented into outdoor aquaculture and indoor aquaculture.

End Use

- Aquatic Animals

- Aquatic Plants

Based on end use, the Asia-Pacific aquaculture equipment market is segmented into aquatic animals and aquatic plants.

Distribution Channel

- Direct

- Indirect

Based on distribution channel, the Asia-Pacific aquaculture equipment market is segmented into direct and indirect.

Asia-Pacific Aquaculture Equipment Market Regional Analysis/Insights

The Asia-Pacific aquaculture equipment market is analyzed, and market size insights and trends are provided by country, type, application, end use, and distribution channel, as referenced above.

The Asia-Pacific aquaculture equipment market covers countries such as China, India, Japan, South Korea, Thailand, Singapore, Indonesia, Australia & New Zealand, Philippines, Malaysia, Vietnam, and the rest of Asia-Pacific.

China is expected to dominate the Asia-Pacific aquaculture equipment market because of increasing seafood trading and the presence of a large consumer base. As a result of the fastest-growing economies, China shows robust growth, followed by the Indian market, which is slightly increasing. Japan and South Korea are two more countries where the demand is increasing due to the growing adoption and awareness regarding aquaculture among consumers.

The country section of the Asia-Pacific aquaculture equipment market report also provides individual market-impacting factors and domestic regulation changes that impact the market's current and future trends. Data points such as new sales, replacement sales, country demographics, disease epidemiology, and import-export tariffs are some of the significant pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Aquaculture Equipment Market Share Analysis

The Asia-Pacific aquaculture equipment market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, solution launch, product width and breadth, and application dominance. The above data points are only related to the companies focus on the Asia-Pacific aquaculture equipment market.

Some of the major players operating in the Asia-Pacific aquaculture equipment market are SKAGINN 3X, Haosail, Norfab Equipment Ltd., Sino-Aqua Corporation, BAADER, FAIVRE Ets, Pioneer Group, Rastaquaculture, SRR Aqua Suppliers LLP, Sagar Aquaculture Pvt Ltd, Nanrong Shanghai Co., Ltd., HUNG STAR ENTERPRISE CORP., FREA SOLUTIONS, AquaMof Aquaculture Technologies Ltd., and Sino-Aqua Corporation among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC AQUACULTURE EQUIPMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USE COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND OUTLOOK

4.1.1 COMPARATIVE BRAND ANALYSIS

4.1.2 PRODUCT VS BRAND OVERVIEW

4.2 FACTORS INFLUENCING PURCHASING DECISION OF CUSTOMER

4.2.1 ECONOMIC FACTOR

4.2.2 FUNCTIONAL FACTOR

4.3 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.4 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.4.1 INDUSTRY TRENDS FOR NORTHERN EUROPE

4.5 NEW PRODUCT LAUNCH STRATEGY

4.5.1 OVERVIEW

4.5.2 NUMBER OF NEW PRODUCT LAUNCHES

4.5.3 MEETING CONSUMER REQUIREMENT

4.6 IMPACT OF ECONOMIC SLOWDOWN

4.7 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.7.1 TECHNOLOGICAL ADVANCMENTS IN NORTHERN EUROPE

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 RAW MATERIAL PROCUREMENT

4.8.2 MANUFACTURING AND PACKING

4.8.3 MARKETING AND DISTRIBUTION

4.8.4 END USERS

4.9 VALUE CHAIN ANALYSIS

5 REGULATORY FRAMEWORK AND GUIDELINES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 THE RISE, EXPANSION, AND GROWTH OF THE AQUACULTURE INDUSTRY

6.1.2 INCREASE IN SEAFOOD TRADING

6.1.3 DEMAND FOR AQUAPONICS IS INCREASING

6.1.4 SMART FISH FARMING IS BECOMING MORE POPULAR

6.2 RESTRAINTS

6.2.1 CONCERNS ABOUT FOOD SAFETY IN AQUACULTURE

6.2.2 THE SPREAD OF DEADLY DISEASES AND PARASITES

6.3 OPPORTUNITIES

6.3.1 RISING GOVERNMENT MEASURES TO BOOST AQUACULTURE

6.3.2 CONCENTRATING ON THE DEVELOPMENT OF INNOVATIVE TECHNOLOGY SOLUTIONS

6.3.3 ADEQUATE AND AFFORDABLE CREDIT AVAILABILITY AND FINANCING INSTRUMENTS

6.4 CHALLENGES

6.4.1 OVERFISHING DIFFICULTIES

6.4.2 AQUACULTURE'S ENVIRONMENTAL DIFFICULTIES AND CONCERNS

7 ASIA PACIFIC AQUACULTURE EQUIPMENT MARKET, BY TYPE

7.1 OVERVIEW

7.2 WATER PURIFICATION EQUIPMENT

7.2.1 WATER PUMPS AND FILTERS

7.2.2 AERATORS

7.2.3 FEEDERS

7.2.4 PROTEIN SKIMMER

7.3 AERATION DEVICES

7.4 WATER CIRCULATION AND AERATION EQUIPMENT

7.5 AUTOMATIC FISH FEEDER

7.6 FISHING EQUIPMENT

7.7 CONTAINMENT EQUIPMENT

7.8 SEINE REELS

7.9 MAINTENANCE AND REPAIR EQUIPMENT

7.9.1 DIGGING TOOLS

7.9.2 LEVELLING TOOLS

7.9.3 DESILTING EQUIPMENT

7.9.4 OTHERS

7.1 WATER TEMPERATURE CONTROL DEVICES

7.11 WATER QUALITY TESTING INSTRUMENT

7.12 CLEAR POND EQUIPMENT

7.13 OTHERS

8 ASIA PACIFIC AQUACULTURE EQUIPMENT MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 OUTDOOR AQUACULTURE

8.2.1 BRACKISH WATER

8.2.2 MARINE

8.3 INDOOR AQUACULTURE

9 ASIA PACIFIC AQUACULTURE EQUIPMENT MARKET, BY END USE

9.1 OVERVIEW

9.2 AQUATIC ANIMALS

9.2.1 FISH

9.2.2 MOLLUSKS

9.2.3 CRUSTACEAN

9.2.4 OTHERS

9.3 AQUATIC PLANTS

9.3.1 SUBMERGED (SEAWEED)

9.3.2 FLOATING (ALGAE)

9.3.3 EMERGED

10 ASIA PACIFIC AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 DIRECT

10.3 INDIRECT

11 ASIA PACIFIC AQUACULTURE EQUIPMENT MARKET, BY GEOGRAPHY

11.1 ASIA-PACIFIC

11.1.1 CHINA

11.1.2 INDIA

11.1.3 JAPAN

11.1.4 SOUTH KOREA

11.1.5 THAILAND

11.1.6 SINGAPORE

11.1.7 INDONESIA

11.1.8 AUSTRALIA & NEW ZEALAND

11.1.9 PHILIPPINES

11.1.10 MALAYSIA

11.1.11 VIETNAM

11.1.12 REST OF ASIA-PACIFIC

12 ASIA PACIFIC AQUACULTURE EQUIPMENT MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

12.1.1 NEW PRODUCTION FACILITY

12.1.2 EVENT

12.1.3 NEW PRODUCT LAUNCH

12.1.4 COLLABORATION

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 BAADER

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT UPDATES

14.2 SKAGINN 3X

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PORTFOLIO

14.2.4 RECENT UPDATES

14.3 AQUAMAOF AQUACULTURE TECHNOLOGIES LTD.

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT UPDATES

14.4 NANRONG SHANGHAI CO., LTD.

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT UPDATES

14.5 CFLOW

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT UPDATES

14.6 AQUACULTURE EQUIPMENT LTD

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATES

14.7 AQUACULTURE SYSTEMS TECHNOLOGIES, LLC

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT UPDATES

14.8 AQUANEERING INCORPORATED

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATES

14.9 DURA-TECH

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT UPDATES

14.1 FAIVRE ETS

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT UPDATES

14.11 FISHFARMFEEDER

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT UPDATES

14.12 FREA SOLUTIONS

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT UPDATES

14.13 HAOSAIL

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT UPDATES

14.14 HUNG STAR ENTERPRISE CORP.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT UPDATES

14.15 NORFAB EQUIPMENT LTD.

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT UPDATES

14.16 PIONEER GROUP

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT UPDATES

14.17 RASTAQUACULTURE

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT UPDATES

14.18 SAGAR AQUACULTURE PVT LTD

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT UPDATES

14.19 SINO-AQUA CORPORATION

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT UPDATES

14.2 SRR AQUA SUPPLIERS LLP

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT UPDATES

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF AIR PUMPS, AIR OR OTHER GAS COMPRESSORS AND VENTILATING OR RECYCLING HOODS, AND OTHER AQUACULTURE EQUIPMENT; HS CODE – 841480 (USD THOUSAND)

TABLE 2 EXPORT DATA OF AIR PUMPS, AIR OR OTHER GAS COMPRESSORS AND VENTILATING OR RECYCLING HOODS AND OTHER AQUACULTURE EQUIPMENT; HS CODE – 841480 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 ASIA PACIFIC AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 ASIA PACIFIC AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 6 ASIA PACIFIC WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 ASIA PACIFIC WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 8 ASIA PACIFIC AERATION DEVICES IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 ASIA PACIFIC WATER CIRCULATION AND AERATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 ASIA PACIFIC AUTOMATIC FISH FEEDER IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 ASIA PACIFIC FISHING EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 ASIA PACIFIC CONTAINMENT EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 ASIA PACIFIC SEINE REELS IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 ASIA PACIFIC MAINTENANCE AND REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 ASIA PACIFIC MAINTENANCE AND REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 16 ASIA PACIFIC WATER TEMPERATURE CONTROL DEVICES IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 ASIA PACIFIC WATER QUALITY TESTING INSTRUMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 ASIA PACIFIC CLEAR POND EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 ASIA PACIFIC OTHERS IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 ASIA PACIFIC AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 21 ASIA PACIFIC OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 ASIA PACIFIC OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 23 ASIA PACIFIC INDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 ASIA PACIFIC AQUACULTURE EQUIPMENT MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 25 ASIA PACIFIC AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 ASIA PACIFIC AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 27 ASIA PACIFIC AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 ASIA PACIFIC AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 29 ASIA PACIFIC AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 30 ASIA PACIFIC DIRECT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 ASIA PACIFIC INDIRECT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC AQUACULTURE EQUIPMENT MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC AQUACULTURE EQUIPMENT MARKET, BY COUNTRY, 2020-2029 (THOUSAND UNITS)

TABLE 34 ASIA-PACIFIC AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 36 ASIA-PACIFIC WATER PURIFICATION IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 39 ASIA-PACIFIC OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 43 ASIA-PACIFIC AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 44 CHINA AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 CHINA AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 46 CHINA WATER PURIFICATION IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 CHINA MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 CHINA AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 49 CHINA OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 50 CHINA AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 51 CHINA AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 52 CHINA AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 53 CHINA AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 54 INDIA AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 INDIA AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 56 INDIA WATER PURIFICATION IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 INDIA MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 INDIA AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 59 INDIA OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 60 INDIA AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 61 INDIA AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 62 INDIA AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 63 INDIA AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 64 JAPAN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 JAPAN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 66 JAPAN WATER PURIFICATION IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 JAPAN MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 68 JAPAN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 69 JAPAN OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 70 JAPAN AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 71 JAPAN AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 72 JAPAN AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 73 JAPAN AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 74 SOUTH KOREA AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 SOUTH KOREA AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 76 SOUTH KOREA WATER PURIFICATION IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 SOUTH KOREA MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 78 SOUTH KOREA AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 79 SOUTH KOREA OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 80 SOUTH KOREA AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 81 SOUTH KOREA AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 82 SOUTH KOREA AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 83 SOUTH KOREA AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 84 THAILAND AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 85 THAILAND AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 86 THAILAND WATER PURIFICATION IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 87 THAILAND MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 88 THAILAND AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 89 THAILAND OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 90 THAILAND AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 91 THAILAND AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 92 THAILAND AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 93 THAILAND AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 94 SINGAPORE AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 95 SINGAPORE AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 96 SINGAPORE WATER PURIFICATION IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 97 SINGAPORE MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 98 SINGAPORE AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 99 SINGAPORE OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 100 SINGAPORE AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 101 SINGAPORE AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 102 SINGAPORE AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 103 SINGAPORE AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 104 INDONESIA AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 105 INDONESIA AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 106 INDONESIA WATER PURIFICATION IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 107 INDONESIA MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 108 INDONESIA AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 109 INDONESIA OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 110 INDONESIA AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 111 INDONESIA AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 112 INDONESIA AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 113 INDONESIA AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 114 AUSTRALIA & NEW ZEALAND AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 115 AUSTRALIA & NEW ZEALAND AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 116 AUSTRALIA & NEW ZEALAND WATER PURIFICATION IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 117 AUSTRALIA & NEW ZEALAND MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 118 AUSTRALIA & NEW ZEALAND AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 119 AUSTRALIA & NEW ZEALAND OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 120 AUSTRALIA & NEW ZEALAND AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 121 AUSTRALIA & NEW ZEALAND AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 122 AUSTRALIA & NEW ZEALAND AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 123 AUSTRALIA & NEW ZEALAND AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 124 PHILIPPINES AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 125 PHILIPPINES AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 126 PHILIPPINES WATER PURIFICATION IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 127 PHILIPPINES MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 128 PHILIPPINES AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 129 PHILIPPINES OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 130 PHILIPPINES AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 131 PHILIPPINES AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 132 PHILIPPINES AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 133 PHILIPPINES AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 134 MALAYSIA AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 135 MALAYSIA AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 136 MALAYSIA WATER PURIFICATION IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 137 MALAYSIA MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 138 MALAYSIA AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 139 MALAYSIA OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 140 MALAYSIA AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 141 MALAYSIA AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 142 MALAYSIA AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 143 MALAYSIA AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 144 VIETNAM AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 145 VIETNAM AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 146 VIETNAM WATER PURIFICATION IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 147 VIETNAM MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 148 VIETNAM AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 149 VIETNAM OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 150 VIETNAM AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 151 VIETNAM AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 152 VIETNAM AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 153 VIETNAM AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 154 REST OF ASIA-PACIFIC AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 155 REST OF ASIA-PACIFIC AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

List of Figure

FIGURE 1 ASIA PACIFIC AQUACULTURE EQUIPMENT MARKET

FIGURE 2 ASIA PACIFIC AQUACULTURE EQUIPMENT MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC AQUACULTURE EQUIPMENT MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC AQUACULTURE EQUIPMENT MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC AQUACULTURE EQUIPMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC AQUACULTURE EQUIPMENT MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 ASIA PACIFIC AQUACULTURE EQUIPMENT MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC AQUACULTURE EQUIPMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC AQUACULTURE EQUIPMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC AQUACULTURE EQUIPMENT MARKET: MARKET END USE COVERAGE GRID

FIGURE 11 ASIA PACIFIC AQUACULTURE EQUIPMENT MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 ASIA PACIFIC AQUACULTURE EQUIPMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 ASIA PACIFIC AQUACULTURE EQUIPMENT MARKET: SEGMENTATION

FIGURE 14 RISING, EXPANSION, AND GROWTH OF THE AQUACULTURE INDUSTRY IS EXPECTED TO DRIVE THE ASIA PACIFIC AQUACULTURE EQUIPMENT MARKET GROWTH IN THE FORECAST PERIOD OF 2022 -2029

FIGURE 15 WATER PURIFICATION EQUIPMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC AQUACULTURE EQUIPMENT MARKET IN 2022 & 2029

FIGURE 16 SUPPLY CHAIN ANALYSIS- ASIA PACIFIC AQUACULTURE EQUIPMENT MARKET

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC AQUACULTURE EQUIPMENT MARKET

FIGURE 18 ASIA PACIFIC AQUACULTURE EQUIPMENT MARKET: BY TYPE, 2021

FIGURE 19 ASIA PACIFIC AQUACULTURE EQUIPMENT MARKET: BY APPLICATION, 2021

FIGURE 20 ASIA PACIFIC AQUACULTURE EQUIPMENT MARKET: BY END-USE, 2021

FIGURE 21 ASIA PACIFIC AQUACULTURE EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 22 ASIA-PACIFIC AQUACULTURE EQUIPMENT MARKET: SNAPSHOT (2021)

FIGURE 23 ASIA-PACIFIC AQUACULTURE EQUIPMENT MARKET: BY COUNTRY (2021)

FIGURE 24 ASIA-PACIFIC AQUACULTURE EQUIPMENT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 ASIA-PACIFIC AQUACULTURE EQUIPMENT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 ASIA-PACIFIC AQUACULTURE EQUIPMENT MARKET: BY TYPE (2022-2029)

FIGURE 27 ASIA PACIFIC AQUACULTURE EQUIPMENT MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.