Asia-Pacific Anti-Money Laundering Market Segmentation, By Offering (Solution and Services), Function (Compliance Management, Customer Identity Management, Transaction Monitoring, Currency Transaction Reporting, and Others), Deployment (Cloud and On-Premise), Enterprise Size (Large Enterprises and Small & Medium Enterprises), End Use (Banks & Financial Institution, Insurance Providers, Government, Gaming & Gambling, and Others) - Industry Trends and Forecast to 2031.

Asia-Pacific Anti-Money Laundering Market Analysis

The Asia Pacific anti-money laundering market has witnessed growth due to an increase in demand for transaction monitoring systems that assess financial crime patterns. This can be used in various other applications for detecting financial crimes such as terrorist financing, fraud, drug trafficking, bribery, corruption, and identity theft, which can significantly affect the country's economy. In recent times, AML solutions are gaining popularity among various financial institutions such as insurance companies, commercial banks, internet banks, retail banking, insurance companies, and mortgage companies, among others. Moreover, its gaining popularity among various industries such as the gaming & gambling industry, real estate industry, currency exchange (MSB), payment industry, the investment industry, and government bodies across the globe.

Asia-Pacific Anti-Money Laundering Market Size

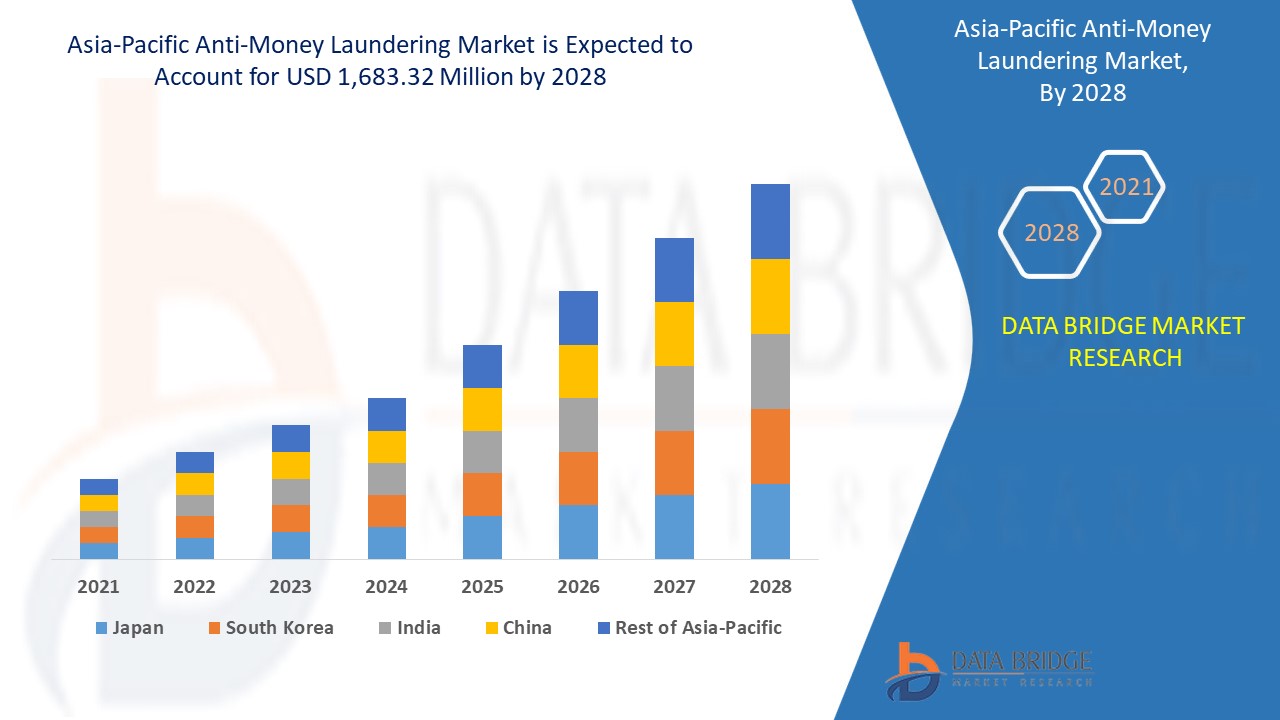

Data Bridge Market Research analyses that Asia-Pacific anti-money laundering market is expected to reach USD 2330.37 million by 2031 from USD 803.54 million in 2023, growing with a CAGR of 14.4% in the forecast period of 2024 to 2031.

Asia-Pacific Anti-Money Laundering Market Trends

“Increased Financial Crimes Detection Efforts”

Increased financial crimes detection efforts have intensified scrutiny on Anti-Money Laundering (AML) measures, focusing on enhancing compliance and monitoring systems trends. Financial institutions are implementing more rigorous procedures to identify suspicious transactions and patterns indicative of money laundering. These measures include strengthening internal controls, improving transaction reporting practices, and enhancing collaboration with regulatory bodies. The push for greater transparency and accountability aims to disrupt financial crime networks and reduce illicit financial flows. By adopting comprehensive AML frameworks, organizations seek to mitigate risks and protect the integrity of the financial system. This proactive approach reflects a broader commitment to combatting financial crime and maintaining regulatory compliance.

Report Scope and Anti-Money Laundering Market segmentation

|

Report Metric

|

Asia-Pacific Anti-Money Laundering Market Insights

|

|

Segments Covered

|

|

|

Countries Covered

|

China, Japan, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Taiwan, Vietnam, and Rest of Asia-Pacific

|

|

Key Market Players

|

BAE Systems, NICE, SAP SE, Open Text Corporation, ACI Worldwide, Accenture, Oracle, Cognizant, Intel Corporation, and IBM among others.

|

|

Market Opportunities

|

|

|

Value Added Data

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis.

|

Asia-Pacific Anti-Money Laundering Market Definition

Anti-money Laundering (AML) solutions are used to detect and warn the institutions regarding money laundering, terrorist financing, fraud, electronic crime, bribery and corruption, tax evasion, embezzlement, information security, illegal cross border transactions, among others that hugely impact the economy of the country and can hamper its reputation. AML is a term that is generally used to depict the fight against money laundering & financial crimes. Anti-money Laundering (AML) solutions comply with various policies, laws, and regulations that help in preventing financial crimes. These guidelines, policies, and laws are set local regulators present worldwide, which aims to strengthen the functioning of AML solutions.

Asia-Pacific Anti-Money Laundering Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Increased Financial Crimes Detection Efforts

Increased financial crimes detection efforts have intensified scrutiny on anti-money laundering (AML) measures, focusing on enhancing compliance and monitoring systems. Financial institutions are implementing more rigorous procedures to identify suspicious transactions and patterns indicative of money laundering. These measures include strengthening internal controls, improving transaction reporting practices, and enhancing collaboration with regulatory bodies. The push for greater transparency and accountability aims to disrupt financial crime networks and reduce illicit financial flows. By adopting comprehensive AML frameworks, organizations seek to mitigate risks and protect the integrity of the financial system.

For instance,

- In August 2024, according to the blog Informa PLC, ThetaRay, an Israeli provider of AI-driven transaction monitoring, acquired Belgian fintech Screena. It offers an AI-powered AML screening solution for financial institutions (FIs). This acquisition aims to enhance ThetaRay’s ability to provide a comprehensive view of transactional and customer screening risks. It supports increased financial crime detection efforts, including gambling-related illegal activities, and strengthens ThetaRay's cloud-based, end-to-end financial crime detection platform

- Increasing Stringent Regulations and Compliance Related to AML

An anti-money laundering compliance program is a set of regulations or rules a financial institution must follow to prevent and detect money laundering and terrorist funding activities. Financial crime against financial institutions such as banks and credit unions has recently increased. There was a ~50- 60% increment in financial fraud cases in 2019 from 2018, and it is expected to grow in the coming years. The losses incurred by the banks across Europe are quite significant.

For instance,

- In July 2024, according to the article published by The Good Returns, governments extended Anti-Money Laundering (AML) regulations beyond traditional financial institutions to include non-financial sectors like real estate and virtual assets. This expansion aimed to address vulnerabilities in these sectors due to their high-value transactions and opacity. Stricter penalties for non-compliance were also introduced, enhancing the compliance culture and reducing the risk of financial exploitation. For gambling companies, these increased regulations foster a more robust AML framework, promoting integrity and reducing legal risks

Opportunities

- Increasing Adoption of Advanced Analytics In AML

Advanced analytics is the autonomous or semi-autonomous system that analyzes data or content using sophisticated techniques and tools, which is quite different from traditional business intelligence. These analytics give a deeper analysis using which the system predicts and generates recommendations. Advanced analytics in AML solutions can play a vital role in detecting money laundering, financial crimes, identity theft, and cross-border transactions. Moreover, Advanced Analytics can play a vital role in advanced transaction monitoring.

According to the United Nations office on drugs and crime (UNODC), USD 2 trillion worth of illegal money is annual. Another survey conducted by Basel anti-money laundering (AML) in 2018 pointed out that 64% of countries in the 2018 ranking (83/129) have a risk score of 5.0 or above and can be loosely classified as having a significant risk of money laundering and terrorist financing.

For instance,

- In May 2024, according to the article published by NDTV Profit, Pine Labs-owned Setu launched India's first large language model (LLM) application tailored for the BFSI sector. This LLM, trained on extensive datasets, can recognize and generate text. The introduction of this advanced analytics tool aims to enhance AML (anti-money laundering) efforts by improving text processing and analysis capabilities in financial services. For Setu, this move positions it as a leader in integrating cutting-edge AI into the BFSI sector, offering advanced solutions for compliance and risk management

- Integration of Ai and ML in Developing AML Solutions

Money Laundering has become a very important financial issue that financial authorities are trying to stop. According to the survey, money laundering is estimated to be 2 to 5% of the Europe GDP, or a net worth of USD 2 trillion is being laundered. There are various other issues, such as identity theft and cross-border transactions.

In 2020 according to a survey, 1.4 million complaints about identity theft cases were registered. In 2020, Cross-border transactions across Europe were estimated at around USD 23.21 trillion. All financial crimes are happening because of weak AML solutions and hesitancy to follow the guidelines set by the regulators. According to Fenergo's research, Regulators/agencies hit banks with a near-record USD 10 billion worth of fines in 2019; it also pointed out that 60.5% of the penalties came from banks violating anti-money laundering rules.

For instance,

- In March, ACI Worldwide, Inc. announced the launch of ACI fraud scoring for financial institutions. It is a platform launched for delivering next-generation machine learning capabilities. This launch will help the company expand its solution portfolio for its customer base. This solution will help financial institutions to protect their payment servers

Restraints/Challenges

- Privacy Concerns in Customer Data Monitoring

The rise in online gambling platforms has heightened privacy concerns regarding customer data monitoring. As operators implement advanced anti-money laundering (AML) measures, they collect and analyse extensive personal information to detect suspicious activities. This scrutiny raises significant privacy issues, as users’ sensitive data is increasingly subject to detailed tracking and examination. Balancing effective fraud prevention with robust data protection is crucial, as excessive monitoring can lead to breaches of privacy and erode customer trust.

For instance,

- In October 2023, according to the article published by Mondaq Ltd., India's Digital Personal Data Protection Act, 2023, introduced new privacy regulations impacting the online gaming industry. The act emphasized stricter data protection measures, requiring gaming platforms to ensure explicit consent for data processing, provide rights to data access and correction, and enforce robust security practices. The regulations also addressed concerns related to targeted marketing, especially towards minors, and set higher compliance standards for platforms handling large volumes of user data

Deploying AML Software is Expensive

According to the survey conducted by the Government Accountability Office (GAO). U.K. banks spent between 0.4% and 2.4% of their total 2018 operating expenses on anti-money laundering software. Banks in the survey spent an average of USD 15 per new account on due diligence requirements, even though the actual cost ranged from USD 5 to USD 44 depending on the type of bank. It was observed that banks spend the most on CDD, 29%, and reporting costs of 28% on average. In comparison, 18% was associated with training, testing, internal controls, software, and third-party costs, which accounted for 17% of AML solutions on average. In Europe, a survey conducted by LexisNexis risk solution in 2019 stated the true cost of anti-money laundering (AML) software is very high in European countries as the demand for the product is high.

For instance,

- In September 2023, according to the article published by The Investopedia, HSBC was fined USD 1.9 billion for severe lapses in its anti-money laundering (AML) controls, notably for laundering money for Mexican drug cartels. The scandal highlighted weaknesses in HSBC's compliance mechanisms and led to the imposition of additional $665 million in civil penalties. This case underscores the high cost of deploying effective AML software and compliance measures in banking. Investing in advanced AML solutions helps prevent costly penalties and maintains regulatory compliance, benefiting financial institutions by reducing legal risks and enhancing operational integrity

Asia-Pacific Anti-Money Laundering Market Scope

The Asia-Pacific anti-money laundering market is segmented into five notable segments on the basis of the offering, function, deployment, enterprise size, and end use. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Offering

- Solution

- KYC/CDD and Watchlist

- Transaction Screening and Monitoring

- Case Management

- Regulatory Reporting

- Services

- Type

- Professional Service

- Managed Service

- Type

- Services

- Type

- Integration

- Support and Maintenance

- Training and Consulting

- Type

By Function

- Supervisory Compliance Management

- Currency Transaction Reporting

- Customer Identity Management

- Transaction Monitoring

By Deployment

- Cloud

- On-Premise

By Enterprise Size

- Large Enterprises

- Small & Medium-Sized Enterprises

By End Use

- Banks & Financial Institutions

- Insurance Providers

- Gaming & Gambling

- Gambling Type

- Casino

- Type

- Live Casinos

- Poker

- Blackjack

- Baccarat

- Slots

- Others

- Type

- Casino

- Application

- Live Entertainment/Online

- Type

- Hotels

- Multiple Dining Options

- Others

- Type

- Offline/Land Based

- Type

- Mobile

- Desktop

- Type

- Sports Betting

- Type

- Football

- E-sports

- Horse racing

- Others

- Type

- Lottery

- Bingo

- Raffles/Pools

- Live Entertainment/Online

- Gambling Type

- Government

- Others

Asia-Pacific Anti-Money Laundering Market Regional Analysis

The Asia-Pacific anti-money laundering market is segmented five notable segments on the basis of the offering, function, deployment, enterprise size, and end Use.

The countries covered in the Asia-Pacific anti-money laundering market report are China, Japan, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Taiwan, Vietnam, and rest of Asia-Pacific.

China is expected to dominate and fastest growing country in the region due to rise in online gambling platforms.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Asia-Pacific Anti-Money Laundering Market Share

Asia Pacific Anti-Money Laundering Market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus.

The Asia-Pacific anti-money laundering market leaders operating in the market are :

- NICE (Israel)

- IBM (U.S.)

- sanctions.io (U.S.)

- Intel Corporation (U.S.)

- Oracle (U.S.)

- SAP SE (Germany)

- Accenture (U.S.)

- Experian Information Solution

- Inc. (Ireland)

- Open Text Corporation (Canada)

- BAE Systems (U.K.)

- SAS Institute Inc (U.S.)

- ACI Worldwide (U.S.)

- Cognizant (U.S.)

- Trulioo (Canada)

- Temenos Headquarters SA (Switzerland)

- WorkFusion, Inc, (U.S.)

- Vixio Regulatory Intelligence (England)

Latest Developments in Anti-Money Laundering Market

- In September 2023, IBM announced that its Payments Center joined the Swift Partner Programme, creating new collaboration opportunities with over 11,000 Swift members worldwide. This partnership allowed IBM to offer enhanced payment solutions and end-to-end cloud-based Swift connectivity, reducing the need for clients to manage Swift hardware and software. The collaboration helped financial institutions modernize payment platforms, access AI technologies, and improve efficiency without high development and compliance costs

- In April 2024, Oracle introduced the Financial Services Compliance Agent, an AI-powered cloud service designed to help banks mitigate anti-money laundering (AML) risks. This service allows banks to conduct cost-effective scenario testing to adjust controls, identify suspicious transactions, and enhance compliance. It also helps banks assess and optimize transaction monitoring systems, evaluate new product risks, and proactively address high-risk typologies. This solution aims to reduce compliance costs and improve the effectiveness of AML programs

- In January, Oracle highlighted its comprehensive cloud solutions for banks through Oracle Financial Services. The company emphasized that banks are increasingly adopting cloud services driven by AI and ML advancements. Oracle provides a full suite of fintech solutions that are cloud-ready, scalable, and secure, offering banks a single vendor solution without the need for multiple fintech partnerships. Oracle's platform supports over 3,000 microservices and open APIs, helping banks transition from legacy systems and stay competitive

- In September, Oracle and Quantifind announced a strategic collaboration to enhance anti-money laundering (AML) processes. Quantifind’s SaaS solutions for investigations, customer due diligence, and alerts management integrated with Oracle's Financial Crime and Compliance Management platform. This partnership aimed to improve AML efficiency by up to 30% and streamline workflows with advanced AI and machine learning. The integration allowed Oracle clients to access comprehensive data and enhance their AML compliance capabilities through a unified platform

SKU-