Market Analysis and Insights

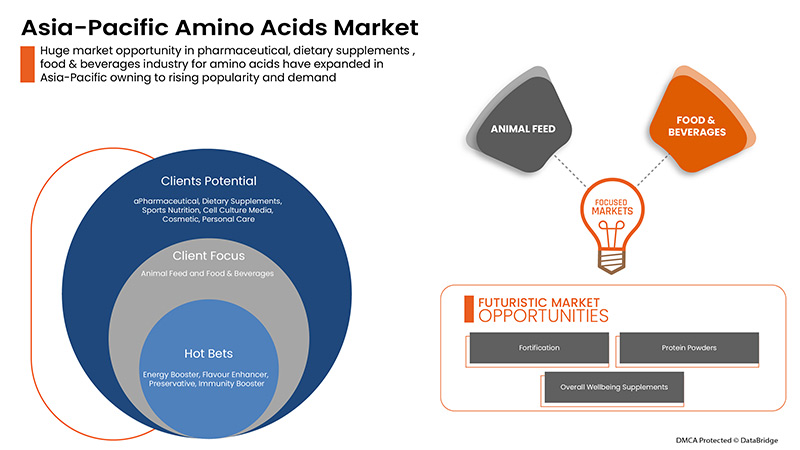

Increasing demand for Amino Acid in various industries such as food and beverages, dietary supplements, cosmetics, and animal feed is driving the global amino acids market growth. In addition, advancement in biotechnology used for amino acid production further enhances market growth. Furthermore, increasing the acceptability of amino acids for medicinal properties is boosting the sales and profit of the players operating in the market, which is expected further to drive the market growth for the amino acids market.

The major restraint impacting the market growth is the complicated manufacturing process. Further, the high logistic cost of amino acid production will also restrain the market growth. On the other hand, the availability of different types of amino acids is expected to act as an opportunity to grow the global amino acids market. In comparison, the challenge for the market growth is the implementation of strict regulations for the commercialization of amino acid products.

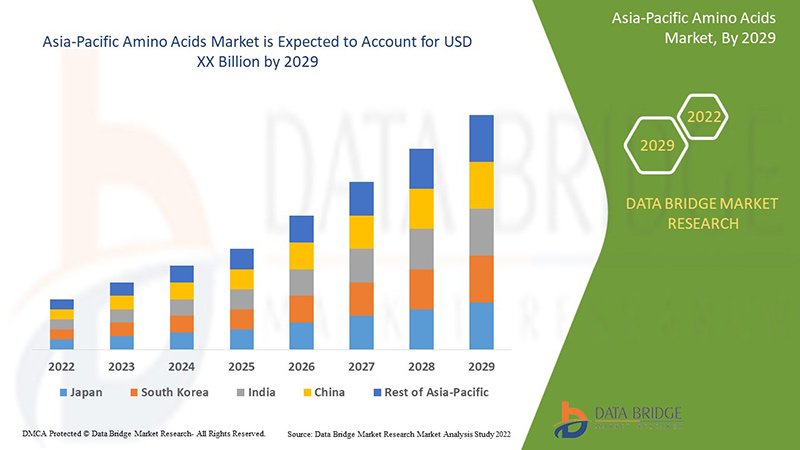

Data Bridge Market Research analyses that the Asia-Pacific amino acids market will grow at a CAGR of 7.2% from 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019- 2015) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Type of Amino Acid (Glutamic Acid, Methionine, Cysteine, Lysine, Arginine, Tyrosine, Alanine, Leucine, Histidine, Phenylalanine, Valine, Proline, Tryptophan, Glycine, Serine, Isoleucine Threonine, Glutamine, Aspartic Acid, Asparagine, and Others), Purity Level (Amino Acid 99%, Amino Acid More Than 99%, Amino Acid 90%, Amino Acid 80%, Amino Acid 70%, and Amino Acid Less Than 60%), Form (Powder, Granules, Liquid, Pellet, and Others), Product Category (Microbial Amino Acid, Plant-Based Amino Acid, and Synthetic Amino Acid), Function (Fortification, Energy Booster, Flavour Enhancer, Preservative, Muscle Growth, Immunity Booster, and Others), Application (Animal Feed, Food & Beverages, Pharmaceutical, Dietary Supplements, Sports Nutrition, Cell Culture Media, Cosmetic, and Personal Care), Distribution Channel (Direct and Indirect) |

|

CountriesCovered |

China, India, Japan, Australia, South Korea, Indonesia, Philippines, Thailand, Malaysia, Singapore and Rest of Asia-Pacific |

|

Market Players Covered |

Merck KGaA, Ajinomoto Co., Inc., KYOWA HAKKO BIO CO., LTD., Evonik Industries AG, ADM, Prinova Group LLC., NOVUS INTERNATIONAL, Qingdao Samin Chemical Co.,Ltd., PACIFIC RAINBOW INTERNATIONAL, INC., Daesang, Adisseo, CJ CheilJedang Corp., Global Bio-chem Technology Group Company Limited., Sunrise Nutrachem Group Co.,LTD, Kingchem Life Science LLC, NIPPON RIKA Co., LTD., Sichuan Tongsheng Amino acid Co., Ltd, FUFENG GROUP, Asiamerica Group, Inc., Sumitomo Chemical Co., Ltd. |

Market Definition

Amino acids are molecules that combine to form proteins. Amino acids and proteins are the building blocks of life. Amino acids form a substantial part of both animal and human nutrition. In the human body, they are necessary for vital processes such as synthesizing neurotransmitters and hormones. They are advantageous for nourishing the immune system, fighting arthritis and cancer, and treating rectal diseases and tinnitus. Nowadays, the demand for amino acids is increasing as they assist in improving conditions such as depression, sleep disorders, premenstrual dysphoric disorder (PMDD), smoking cessation, bruxism, and attention deficit-hyperactivity disorder (ADHD). Amino acids are also abundant in red meat, seafood, eggs, dairy products, and soy.

Asia-Pacific Amino Acids Market Dynamics

Drivers

- Strong supply chain

As the availability of quality raw materials is vital for the manufacturing of amino acids. To ensure a continuous supply of raw materials, prominent market participants are using forward and backward integration techniques to ensure high quality and reliable supply of raw materials. Such vertical integration processes provide reliability of raw material supply and chances for developing new and creative products from current raw materials. Therefore, a robust supply chain is established for the feasible production of amino acids.

Also, the strong and fast direct and indirect distribution channels established by the manufacturers ensure the timely delivery of products leading to increased demand for amino acids. Therefore, the strong supply chain is boosting the demand for amino acids in the market as it ensures the timely availability of amino acids.

- Availability of different types of amino acids in the market

Amino acids can be placed in three groups, non-essential amino acids, essential amino acids, and conditional amino acids. These groups consist of different types of amino acids based on their requirements. As each essential amino acid has a distinct function in the organism, the symptoms of shortage vary correspondingly. Therefore, the availability of different amino acids and their varying requirements has led to the production of products with different amino acids.

Therefore, the demand for different types of amino acids has led to the production of different products with different compositions and benefits, eventually leading to the growth of the amino acids market.

Opportunities

-

Increase in number of initiatives taken by amino acid manufacturers

An increase in the number of initiatives taken by the manufacturers for amino acids, such as product launches, expansion, investments, and others, will create an excellent opportunity for the growth of the global amino acids market. The demand for amino acids is increasing in various industries including food & beverages, cosmetics, dietary supplements, pharmaceuticals, and others owing to its various health benefits such as boosting the immune system, building muscle, helping in the repair of body tissue, maintaining healthy skin, nails, and hairs, and other benefits.

For instance,

-

In October 2020, Evonik announced to cluster its MetAMINO (DL-methionine) production at three international hubs (Americas, Europe, and Asia). The company takes the step to maximize economies of scale and utilize robust processes. The company aims to strengthen its position by improving its cost position

Thus, the increase in the number of amino acid launches, expansion, investment to increase the production, and other initiatives by manufacturers coupled with rising demand for amino acids in different industries, are expected to create a massive opportunity for amino acids in the market globally.

Restraint/Challenge

- High competition among the market players

The high competition among the already existing market players poses a significant challenge for the new players who wish to enter the market as several players are offering high-quality amino acids products for different end-users including food & beverages manufacturers, the pharmaceutical industry, dietary supplements manufacturers, and others.. Moreover, some local players and small-scale manufacturers offer low-quality products or counterfeit products at cheaper prices, which are affecting the global amino acids market. In addition, an increase in the number of manufacturers offering a wide range of amino acids for different applications will cause tough competition for the other players in the market.

An increase in the number of players offering high-quality amino acids for different applications is creating a major challenge in the global amino acids market.

Post-COVID-19 Impact on Asia-Pacific Amino Acids Market

Post the pandemic, the demand for health supplements and healthy food products has increased as there won't be any restrictions on movement; hence, the supply of products would be easy. The persistence of COVID-19 for a longer period has affected the supply chain as it got disrupted, and it became difficult to supply the food products to the consumers, initially decreasing the demand for products. However, post COVID, the demand for health and wellness food products has increased significantly owing to increased awareness about the benefits of amino acids in healthy and nutritious food in the long term, increasing the demand for amino acids products. Consumers are trying to lead a healthy lifestyle. They are more inclined toward the most beneficial food products, such as plant-based, vegan, and nutritional food and beverages, as they are fortified with amino acids.

Recent Developments

- In December 2021, Bayer introduced Ambition, the first amino acid biostimulant, to the Chinese market. The product investigates agricultural development potential, such that crops grow energetically with great stress resistance toward high yield and high quality, benefiting farmers' harvesting, soil protection, and consumer safety. Ambition is appropriate for organic farming

- In October 2017, Daesang, a South Korean food manufacturing company, claimed that it d successfully created L-Histidine, ahigh-value-added amino acid, for the first time in the nation. L-Histidine is abundant in red-flesh and exterior blue-colored fish. It is frequently utilized in pharmaceuticals, nutritional supplements, and animal feed

Asia-Pacific Amino Acids Market Scope

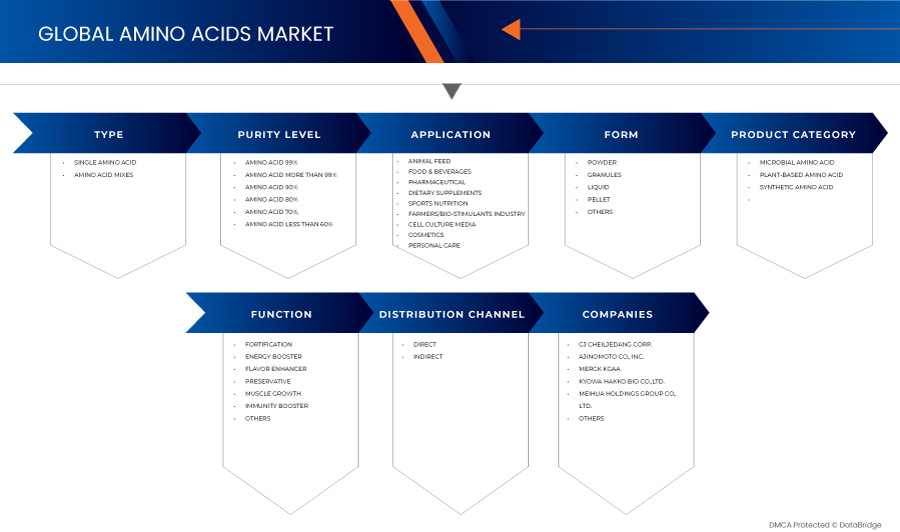

The Asia-Pacific amino acids market is segmented into seven notable segments: types of amino acids, purity level, form, product category, function, application and distribution channel.

The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Types of amino acids

- Glutamic Acid

- Methionine

- Cysteine

- Lysine

- Arginine

- Tyrosine

- Alanine

- Leucine

- Histidine

- Phenylalanine

- Valine

- Proline

- Tryptophan

- Glycine

- Serine

- Isoleucine

- Threonine

- Glutamine

- Aspartic Acid

- Asparagine

- Others

On the basis of types of amino acids, the Asia-Pacific amino acids market is segmented into alanine, arginine, aspartic acid, cysteine, glutamic acid, glutamine, glycine, histidine, isoleucine, leucine, lysine, methionine, phenylalanine, proline, serine, asparagine, threonine, tyrosine, tryptophan, valine, and others.

Purity level

- Amino Acid 99%

- Amino Acid More Than 99%

- Amino Acid 90%

- Amino Acid 80%

- Amino Acid 70%

- Amino Acid Less Than 60%

On the basis of purity level, the Asia-Pacific amino acids market is segmented into the amino acid less than 60%, amino acid 70%, amino acid 80%, amino acid 90%, amino acid 99%, and amino acid more than 99%.

Form

- Powder

- Granules

- Liquid

- Pellet

- Others

On the basis of form, the Asia-Pacific amino acids market is segmented into liquid, crystal, powder, pellet, and others.

Fat content

- No Fat

- Low Fat

- Reduced-Fat

On the basis of fat content, the Asia-Pacific amino acids market is segmented into no fat, low fat, and reduced-fat.

Product category

- Microbial Amino Acid

- Plant-Based Amino Acid

- Synthetic Amino Acid

On the basis of product category, the Asia-Pacific amino acids market is segmented into plant based amino acids, microbial based amino acids and synthetic amino acids.

Function

- Fortification

- Energy Booster

- Flavor Enhancer

- Preservative

- Muscle Growth

- Immunity Booster

- Others

On the basis of function, the amino acids market is divided into immunity booster, preservative, flavor enhancer, fortification, muscle growth, energy booster, and others.

Application

- Animal Feed

- Food & Beverages

- Pharmaceutical

- Dietary Supplements

- Sports Nutrition

- Cell Culture Media

- Cosmetic

- Personal Care

On the basis of application, the Asia-Pacific amino acids market is segmented into the food & beverages, dietary supplements, pharmaceutical, sports nutrition, animal feed, personal care, cosmetic and cell culture media.

Distribution Channel

- Direct

- Indirect

On the basis of distribution channel, Asia-Pacific amino acids market is segmented into direct and indirect.

Asia-Pacific Amino Acids Markets Regional Analysis/Insights

The Asia-Pacific amino acids market is analyzed, and market size insights and trends are provided based on as referenced above.

The countries covered in the Asia-Pacific health and wellness food Markets report are China, India, Japan, Australia, South Korea, Indonesia, Philippines, Thailand, Malaysia, Singapore and Rest of Asia-Pacific.

The China dominates the Asia-Pacific amino acids market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period. This is due to the livestock industry's industrialization and the country's economic growth. The Asia-Pacific region's demand for meat-based food items is increasing, boosting the region's amino acid market.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of Asia-Pacific brands, their challenges faced due to high competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Amino Acids Market Share Analysis

The competitive Asia-Pacific amino acids market details the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, and application dominance. The above data points only relate to the companies' focus on the Asia-Pacific amino acids market.

Some of the major players operating in the Asia-Pacific amino acids market are Merck KGaA, Ajinomoto Co., Inc., KYOWA HAKKO BIO CO., LTD., Evonik Industries AG, ADM, Prinova Group LLC., NOVUS INTERNATIONAL, Qingdao Samin Chemical Co.,Ltd., PACIFIC RAINBOW INTERNATIONAL, INC., Daesang, Adisseo, CJ CheilJedang Corp., Global Bio-chem Technology Group Company Limited., Sunrise Nutrachem Group Co.,LTD, Kingchem Life Science LLC, NIPPON RIKA Co., LTD., Sichuan Tongsheng Amino acid Co., Ltd, FUFENG GROUP, Asiamerica Group, Inc. and Sumitomo Chemical Co., Ltd. among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Asia-Pacific Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC AMINO ACIDS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SUPPLY CHAIN ANALYSIS

4.1.1 RAW MATERIAL PROCUREMENT

4.1.2 MANUFACTURING PROCESS

4.1.3 MARKETING AND DISTRIBUTION

4.1.4 END USERS

4.2 SUPPLY SHORTAGE

4.3 TECHNOLOGICAL ADVANCEMENT

4.4 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.5.1 MANUFACTURERS ARE DOING EXPANSIONS TO CATER TO THE DEMAND

4.5.2 LAUNCH OF DIFFERENT AMINO ACIDS BY MANUFACTURERS

4.5.3 MANUFACTURERS LAUNCHING NATURAL INGREDIENT BASED/PLANT-BASED AMINO ACIDS

4.5.4 FUTURE PERSPECTIVE

4.6 FACTOR INFLUENCING PURCHASE DECISION (B2B)

4.6.1 HIGH NUTRITIONAL VALUE

4.6.2 PRICING OF THE AMINO ACIDS

4.6.3 HIGH QUALITY

5 REGULATORY FRAMEWORK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR AMINO ACIDS IN VARIOUS INDUSTRIES

6.1.2 ADVANCEMENTS IN BIOTECHNOLOGY USED FOR THE PRODUCTION OF AMINO ACIDS

6.1.3 AVAILABILITY OF DIFFERENT TYPES OF AMINO ACIDS IN THE MARKET

6.1.4 STRONG SUPPLY CHAIN

6.2 RESTRAINTS

6.2.1 COMPLICATED MANUFACTURING PROCESS

6.2.2 STRICT GOVERNMENT REGULATIONS

6.3 OPPORTUNITIES

6.3.1 GROWING DEMAND FOR AMINO ACIDS FOR DIETARY SUPPLEMENTS

6.3.2 RISING DEMAND FOR NUTRITIOUS AND HEALTHY PRODUCTS

6.3.3 INCREASING NUMBER OF INITIATIVES TAKEN BY AMINO ACID MANUFACTURERS

6.4 CHALLENGES

6.4.1 HIGH COMPETITION AMONG THE MARKET PLAYERS

6.4.2 RISING AWARENESS REGARDING THE SIDE EFFECTS OF AMINO ACIDS

7 ASIA PACIFIC AMINO ACIDS MARKET, BY TYPE OF AMINO ACID

7.1 OVERVIEW

7.2 GLUTAMIC ACID

7.3 METHIONINE

7.4 CYSTEINE

7.5 LYSINE

7.6 ARGININE

7.7 TYROSINE

7.8 ALANINE

7.9 LEUCINE

7.1 HISTIDINE

7.11 PHENYLALANINE

7.12 VALINE

7.13 PROLINE

7.14 TRYPTOPHAN

7.15 GLYCINE

7.16 SERINE

7.17 ISOLEUCINE

7.18 THREONINE

7.19 GLUTAMINE

7.2 ASPARTIC ACID

7.21 ASPARAGINE

7.22 OTHERS

8 ASIA PACIFIC AMINO ACIDS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 ANIMAL FEED

8.2.1 ANIMAL FEED, BY ANIMAL TYPE

8.2.1.1 POULTRY FEED

8.2.1.1.1 BROILERS

8.2.1.1.2 BREEDERS

8.2.1.1.3 LAYERS

8.2.1.2 RUMINANT FEED

8.2.1.2.1 CALVES

8.2.1.2.2 DAIRY CATTLE

8.2.1.2.3 BEEF CATTLE

8.2.1.2.4 OTHERS

8.2.1.3 SWINE FEED

8.2.1.3.1 STARTER

8.2.1.3.2 GROWER

8.2.1.3.3 SOW

8.2.1.4 PET FOOD

8.2.1.4.1 DOGS

8.2.1.4.2 CATS

8.2.1.4.3 BIRDS

8.2.1.4.4 RABBIT

8.2.1.4.5 OTHERS

8.2.1.5 AQUACULTURE

8.2.1.5.1 FISH

8.2.1.5.2 CRUSTACEANS

8.2.1.5.3 MOLLUSKS

8.2.1.5.4 OTHERS

8.2.1.6 OTHERS

8.2.2 ANIMAL FEED, BY PRODUCT CATEGORY

8.2.2.1 PLANT-BASED AMINO ACID

8.2.2.2 MICROBIAL AMINO ACID

8.2.2.3 SYNTHETIC AMINO ACID

8.3 FOOD & BEVERAGES

8.3.1 FOOD & BEVERAGES, BY TYPE

8.3.1.1 BEVERAGES

8.3.1.1.1 BEVERAGES, BY TYPE

8.3.1.1.1.1 JUICES

8.3.1.1.1.2 SPORTS DRINKS

8.3.1.1.1.3 ENERGY DRINKS

8.3.1.1.1.4 DAIRY BASED DRINKS

8.3.1.1.1.4.1 REGULAR PROCESSED MILK

8.3.1.1.1.4.2 FLAVOURED MILK

8.3.1.1.1.4.3 MILK SHAKES

8.3.1.1.1.5 PLANT-BASED BEVERAGES

8.3.1.1.1.5.1 SOY MILK

8.3.1.1.1.5.2 ALMOND MILK

8.3.1.1.1.5.3 OAT MILK

8.3.1.1.1.5.4 CASHEW MILK

8.3.1.1.1.5.5 COCONUT MILK

8.3.1.1.1.5.6 OTHERS

8.3.1.1.1.6 SMOOTHIES

8.3.1.2 PROCESSED FOOD

8.3.1.2.1 PROCESSED FOOD, BY TYPE

8.3.1.2.1.1 SAUCES, DRESSINGS AND CONDIMENTS

8.3.1.2.1.2 JAMS, PRESERVES & MARMALADES

8.3.1.2.1.3 READY MEALS

8.3.1.2.1.4 SOUPS

8.3.1.2.1.5 OTHERS

8.3.1.3 BAKERY

8.3.1.3.1 BAKERY, BY TYPE

8.3.1.3.1.1 BREAD & ROLLS

8.3.1.3.1.2 BISCUIT, COOKIES & CRACKERS

8.3.1.3.1.3 CAKES, PASTRIES & TRUFFLE

8.3.1.3.1.4 TART & PIES

8.3.1.3.1.5 BROWNIES

8.3.1.3.1.6 OTHER

8.3.1.4 DAIRY PRODUCTS

8.3.1.4.1 DAIRY PRODUCTS, BY TYPE

8.3.1.4.1.1 ICE CREAM

8.3.1.4.1.2 CHEESE

8.3.1.4.1.3 YOGURT

8.3.1.4.1.4 OTHERS

8.3.1.5 CONVENIENCE FOOD

8.3.1.5.1 CONVENIENCE FOOD, BY TYPE

8.3.1.5.1.1 SNACKS & EXTRUDED SNACKS

8.3.1.5.1.2 PIZZA & PASTA

8.3.1.5.1.3 INSTANT NOODLES

8.3.1.5.1.4 OTHERS

8.3.1.6 FUNCTIONAL FOOD

8.3.1.7 FROZEN DESSERTS

8.3.1.7.1 FROZEN DESSERTS, BY TYPE

8.3.1.7.1.1 GELATO

8.3.1.7.1.2 CUSTARD

8.3.1.7.1.3 OTHERS

8.3.1.8 CONFECTIONERY

8.3.1.8.1 CONFECTIONARY, BY TYPE

8.3.1.8.1.1 GUMS & JELLIES

8.3.1.8.1.2 HARD-BOILED SWEETS

8.3.1.8.1.3 CHOCOLATE

8.3.1.8.1.4 CHOCOLATE SYRUPS

8.3.1.8.1.5 CARAMELS & TOFFEES

8.3.1.8.1.6 MINTS

8.3.1.8.1.7 OTHERS

8.3.1.9 INFANT FORMULA

8.3.1.9.1 INFANT FORMULA, BY TYPE

8.3.1.9.1.1 FIRST INFANT FORMULA

8.3.1.9.1.2 ANTI-REFLUX (STAY DOWN) FORMULA

8.3.1.9.1.3 COMFORT FORMULA

8.3.1.9.1.4 HYPOALLERGENIC FORMULA

8.3.1.9.1.5 FOLLOW-ON FORMULA

8.3.1.9.1.6 OTHERS

8.3.2 FOOD AND BEVERAGES, BY PRODUCT CATEGORY

8.3.2.1 PLANT-BASED AMINO ACID

8.3.2.2 MICROBIAL AMINO ACID

8.3.2.3 SYNTHETIC AMINO ACID

8.4 PHARMACEUTICAL

8.4.1 PHARMACEUTICAL, BY PRODUCT CATEGORY

8.4.1.1 PLANT-BASED AMINO ACID

8.4.1.2 MICROBIAL AMINO ACID

8.4.1.3 SYNTHETIC AMINO ACID

8.4.2 PHARMACEUTICAL, BY TYPE OF AMINO ACID

8.4.2.1 GLUTAMIC ACID

8.4.2.2 METHIONINE

8.4.2.3 CYSTEINE

8.4.2.4 LYSINE

8.4.2.5 ARGININE

8.4.2.6 TYROSINE

8.4.2.7 ALANINE

8.4.2.8 LEUCINE

8.4.2.9 HISTIDINE

8.4.2.10 PHENYLALANINE

8.4.2.11 VALINE

8.4.2.12 PROLINE

8.4.2.13 TRYPTOPHAN

8.4.2.14 GLYCINE

8.4.2.15 SERINE

8.4.2.16 ISOLEUCINE

8.4.2.17 THREONINE

8.4.2.18 GLUTAMINE

8.4.2.19 ASPARTIC ACID

8.4.2.20 ASPARAGINE

8.4.2.21 OTHERS

8.5 DIETARY SUPPLEMENTS

8.5.1 DIETARY SUPPLEMENTS, BY TYPE

8.5.1.1 IMMUNITY SUPPLEMENTS

8.5.1.2 BONE AND JOINT HEALTH SUPPLEMENTS

8.5.1.3 OVERALL WELLBEING SUPPLEMENTS

8.5.1.4 BRAIN HEALTH SUPPLEMENTS

8.5.1.5 SKIN HEALTH SUPPLEMENTS

8.5.1.6 OTHERS

8.5.2 DIETARY SUPPLEMENTS, BY PRODUCT CATEGORY

8.5.2.1 PLANT-BASED AMINO ACID

8.5.2.2 MICROBIAL AMINO ACID

8.5.2.3 SYNTHETIC AMINO ACID

8.5.3 DIETARY SUPPLEMENTS, BY TYPE OF AMINO ACID

8.5.3.1 GLUTAMIC ACID

8.5.3.2 METHIONINE

8.5.3.3 CYSTEINE

8.5.3.4 LYSINE

8.5.3.5 ARGININE

8.5.3.6 TYROSINE

8.5.3.7 ALANINE

8.5.3.8 LEUCINE

8.5.3.9 HISTIDINE

8.5.3.10 PHENYLALANINE

8.5.3.11 VALINE

8.5.3.12 PROLINE

8.5.3.13 TRYPTOPHAN

8.5.3.14 GLYCINE

8.5.3.15 SERINE

8.5.3.16 ISOLEUCINE

8.5.3.17 THREONINE

8.5.3.18 GLUTAMINE

8.5.3.19 ASPARTIC ACID

8.5.3.20 ASPARAGINE

8.5.3.21 OTHERS

8.6 SPORTS NUTRITION

8.6.1 SPORTS NUTRITION, BY TYPE

8.6.1.1 SPORT DRINK MIXES

8.6.1.2 ENERGY GELS

8.6.1.3 SPORTS NUTRITION BARS

8.6.1.4 PROTEIN POWDERS

8.6.1.5 OTHERS

8.6.2 SPORTS NUTRITION, BY PRODUCT CATEGORY

8.6.2.1 PLANT-BASED AMINO ACID

8.6.2.2 MICROBIAL AMINO ACID

8.6.2.3 SYNTHETIC AMINO ACID

8.6.3 SPORTS NUTRITION, BY TYPE OF AMINO ACID

8.6.3.1 GLUTAMIC ACID

8.6.3.2 METHIONINE

8.6.3.3 CYSTEINE

8.6.3.4 LYSINE

8.6.3.5 ARGININE

8.6.3.6 TYROSINE

8.6.3.7 ALANINE

8.6.3.8 LEUCINE

8.6.3.9 HISTIDINE

8.6.3.10 PHENYLALANINE

8.6.3.11 VALINE

8.6.3.12 PROLINE

8.6.3.13 TRYPTOPHAN

8.6.3.14 GLYCINE

8.6.3.15 SERINE

8.6.3.16 ISOLEUCINE

8.6.3.17 THREONINE

8.6.3.18 GLUTAMINE

8.6.3.19 ASPARTIC ACID

8.6.3.20 ASPARAGINE

8.6.3.21 OTHERS

8.7 CELL CULTURE MEDIA

8.7.1 CELL CULTURE MEDIA, BY PRODUCT CATEGORY

8.7.1.1 PLANT-BASED AMINO ACID

8.7.1.2 MICROBIAL AMINO ACID

8.7.1.3 SYNTHETIC AMINO ACID

8.7.2 CELL CULTURE MEDIA, BY TYPE OF AMINO ACID

8.7.2.1 GLUTAMIC ACID

8.7.2.2 METHIONINE

8.7.2.3 CYSTEINE

8.7.2.4 LYSINE

8.7.2.5 ARGININE

8.7.2.6 TYROSINE

8.7.2.7 ALANINE

8.7.2.8 LEUCINE

8.7.2.9 HISTIDINE

8.7.2.10 PHENYLALANINE

8.7.2.11 VALINE

8.7.2.12 PROLINE

8.7.2.13 TRYPTOPHAN

8.7.2.14 GLYCINE

8.7.2.15 SERINE

8.7.2.16 ISOLEUCINE

8.7.2.17 THREONINE

8.7.2.18 GLUTAMINE

8.7.2.19 ASPARTIC ACID

8.7.2.20 ASPARAGINE

8.7.2.21 OTHERS

8.8 COSMETIC

8.8.1 COSMETIC, BY TYPE

8.8.1.1 FACE SERUMS

8.8.1.2 FACE CREAM

8.8.1.3 LIP CARE AND LIPSTICK PRODUCTS

8.8.1.4 OTHERS

8.8.2 COSMETIC, BY PRODUCT CATEGORY

8.8.2.1 PLANT-BASED AMINO ACID

8.8.2.2 MICROBIAL AMINO ACID

8.8.2.3 SYNTHETIC AMINO ACID

8.8.3 COSMETIC, BY TYPE OF AMINO ACID

8.8.3.1 GLUTAMIC ACID

8.8.3.2 METHIONINE

8.8.3.3 CYSTEINE

8.8.3.4 LYSINE

8.8.3.5 ARGININE

8.8.3.6 TYROSINE

8.8.3.7 ALANINE

8.8.3.8 LEUCINE

8.8.3.9 HISTIDINE

8.8.3.10 PHENYLALANINE

8.8.3.11 VALINE

8.8.3.12 PROLINE

8.8.3.13 TRYPTOPHAN

8.8.3.14 GLYCINE

8.8.3.15 SERINE

8.8.3.16 ISOLEUCINE

8.8.3.17 THREONINE

8.8.3.18 GLUTAMINE

8.8.3.19 ASPARTIC ACID

8.8.3.20 ASPARAGINE

8.8.3.21 OTHERS

8.9 PERSONAL CARE

8.9.1 PERSONAL CARE, BY TYPE

8.9.1.1 SKIN CARE

8.9.1.2 HAIR CARE

8.9.2 PERSONAL CARE, BY PRODUCT CATEGORY

8.9.2.1 PLANT-BASED AMINO ACID

8.9.2.2 MICROBIAL AMINO ACID

8.9.2.3 SYNTHETIC AMINO ACID

9 ASIA PACIFIC AMINO ACIDS MARKET, BY PURITY LEVEL

9.1 OVERVIEW

9.2 AMINO ACID 99%

9.3 AMINO ACID MORE THAN 99%

9.4 AMINO ACID 90%

9.5 AMINO ACID 80%

9.6 AMINO ACID 70%

9.7 AMINO ACID LESS THAN 60%

10 ASIA PACIFIC AMINO ACIDS MARKET, BY FORM

10.1 OVERVIEW

10.2 POWDER

10.2.1 POWDER, BY TYPE

10.2.1.1 FINE POWDER

10.2.1.2 CRYSTALLINE POWDER

10.2.1.3 GRANULAR POWDER

10.3 GRANULES

10.4 LIQUID

10.5 PELLET

10.6 OTHERS

11 ASIA PACIFIC AMINO ACIDS MARKET, BY PRODUCT CATEGORY

11.1 OVERVIEW

11.2 MICROBIAL AMINO ACID

11.2.1 MICROBIAL AMINO ACID, BY TYPE

11.2.1.1 BACTERIA

11.2.1.2 FUNGI

11.2.1.3 YEAST

11.3 PLANT-BASED AMINO ACID

11.4 SYNTHETIC AMINO ACID

12 ASIA PACIFIC AMINO ACIDS MARKET, BY FUNCTION

12.1 OVERVIEW

12.2 FORTIFICATION

12.3 ENERGY BOOSTER

12.4 FLAVOR ENHANCER

12.5 PRESERVATIVE

12.6 MUSCLE GROWTH

12.7 IMMUNITY BOOSTER

12.8 OTHERS

13 ASIA PACIFIC AMINO ACIDS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT

13.3 INDIRECT

14 ASIA PACIFIC AMINO ACIDS MARKET, BY REGION

14.1 ASIA-PACIFIC

14.1.1 CHINA

14.1.2 INDIA

14.1.3 JAPAN

14.1.4 AUSTRALIA

14.1.5 SOUTH KOREA

14.1.6 INDONESIA

14.1.7 PHILIPPINES

14.1.8 THAILAND

14.1.9 MALAYSIA

14.1.10 SINGAPORE

14.1.11 REST OF ASIA-PACIFIC

15 COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 AJINOMOTO CO., INC.

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 CJ CHEILJEDANG CORP.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 MERCK KGAA

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 FUFENG GROUP

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 DAESANG

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 KYOWA HAKKO BIO CO., LTD.

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 COMPANY SHARE ANALYSIS

17.6.4 PRODUCT PORTFOLIO

17.6.5 RECENT DEVELOPMENTS

17.7 ADISSEO

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 ADM

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 AMINO GMBH

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 ASIAMERICA GROUP, INC.

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 EVONIK INDUSTRIES AG

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 ASIA PACIFIC BIO-CHEM TECHNOLOGY GROUP COMPANY LIMITED.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 KINGCHEM LIFE SCIENCE LLC

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 NIPPON RIKA CO., LTD.

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 NOVUS INTERNATIONAL

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 PANGAEA SCIENCES.

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 PACIFIC RAINBOW INTERNATIONAL, INC.

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 PRINOVA GROUP LLC.

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 QINGDAO SAMIN CHEMICAL CO., LTD.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 SICHUAN TONGSHENG AMINO ACID CO., LTD

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENTS

17.21 SUMITOMO CHEMICAL.

17.21.1 COMPANY SNAPSHOT

17.21.2 REVENUE ANALYSIS

17.21.3 PRODUCT PORTFOLIO

17.21.4 RECENT DEVELOPMENTS

17.22 SUNRISE NUTRACHEM GROUP CO.,LTD

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Figure

FIGURE 1 ASIA PACIFIC AMINO ACIDS MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC AMINO ACIDS MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC AMINO ACIDS MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC AMINO ACIDS MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC AMINO ACIDS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC AMINO ACIDS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC AMINO ACIDS MARKET : DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC AMINO ACIDS MARKET : VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC AMINO ACIDS MARKET: SEGMENTATION

FIGURE 10 NORTH AMERICA IS EXPECTED TO DOMINATE THE ASIA PACIFIC AMINO ACIDS MARKET AND GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 INCREASING USE OF AMINO ACIDS IN FOOD AND BEVERAGES, PERSONAL CARE, COSMETIC PRODUCTS, ANIMAL FEED AND PHARMACEUTICAL DRUGS IS LEADING THE GROWTH OF THE ASIA PACIFIC AMINO ACIDS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 TYPE OF AMINO ACID SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC AMINO ACIDS MARKET IN 2022 & 2029

FIGURE 13 SUPPLY CHAIN ANALYSIS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC AMINO ACIDS MARKET

FIGURE 15 ASIA PACIFIC AMINO ACIDS MARKET: BY TYPE OF AMINO ACID, 2021

FIGURE 16 ASIA PACIFIC AMINO ACIDS MARKET, BY APPLICATION

FIGURE 17 ASIA PACIFIC AMINO ACIDS MARKET: BY PURITY LEVEL, 2021

FIGURE 18 ASIA PACIFIC AMINO ACIDS MARKET: BY FORM, 2021

FIGURE 19 ASIA PACIFIC AMINO ACIDS MARKET: BY PRODUCT CATEGORY, 2021

FIGURE 20 ASIA PACIFIC AMINO ACIDS MARKET: BY FUNCTION, 2021

FIGURE 21 ASIA PACIFIC AMINO ACIDS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 22 ASIA-PACIFIC AMINO ACIDS MARKET: SNAPSHOT (2021)

FIGURE 23 ASIA-PACIFIC AMINO ACIDS MARKET: BY COUNTRY (2021)

FIGURE 24 ASIA-PACIFIC AMINO ACIDS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 ASIA-PACIFIC AMINO ACIDS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 ASIA-PACIFIC AMINO ACIDS MARKET: BY TYPE OF AMINO ACID (2022 & 2029)

FIGURE 27 ASIA PACIFIC AMINO ACIDS MARKET: COMPANY SHARE 2021 (%)

Asia Pacific Amino Acids Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Amino Acids Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Amino Acids Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.