Asia Pacific Aluminum Foil Market

Market Size in USD Billion

CAGR :

%

USD

37.73 Billion

USD

97.50 Billion

2024

2032

USD

37.73 Billion

USD

97.50 Billion

2024

2032

| 2025 –2032 | |

| USD 37.73 Billion | |

| USD 97.50 Billion | |

|

|

|

Aluminum Foil Market Analysis

Aluminum foil is used in a wide range of products all around the world. Due to a increasing awareness of the pollution generated by plastics in the environment. Customers can use aluminum foil in both traditional and fan-assisted ovens, providing them the choice to utilize it in both. They also protect rock samples from organic solvents by forming a seal.

Aluminum Foil Market Size

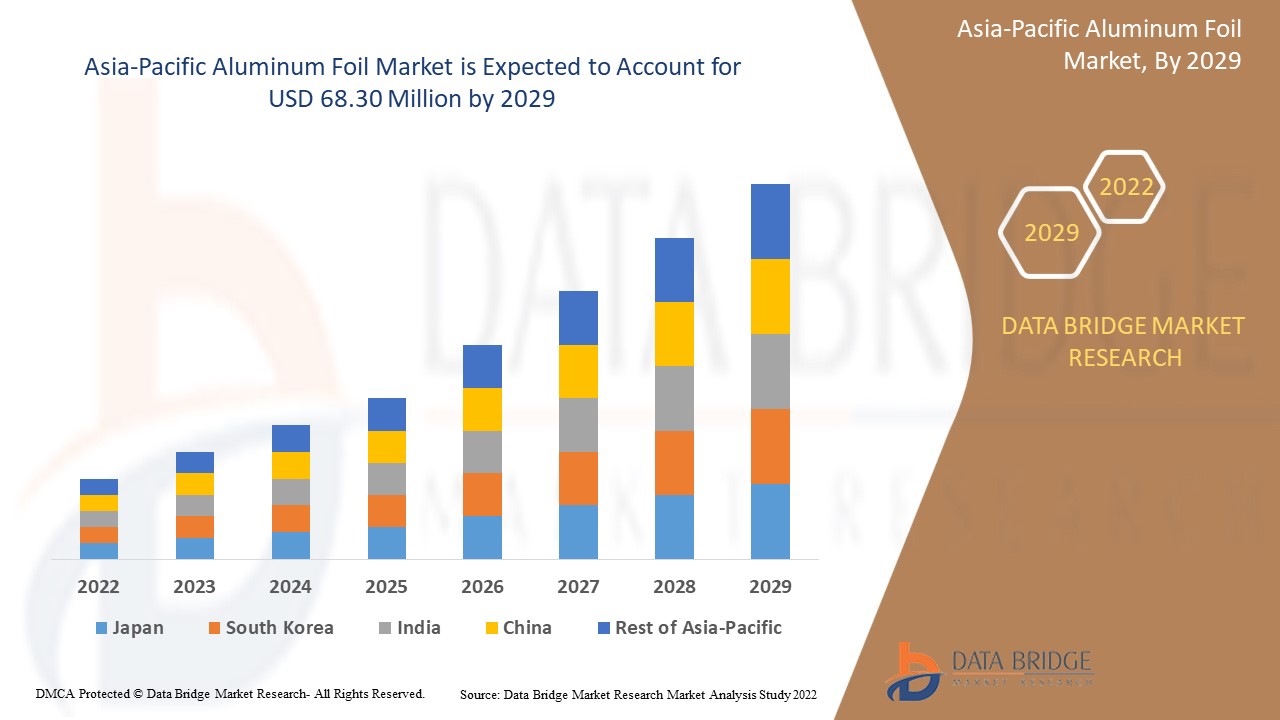

Asia-Pacific aluminum foil market size was valued at USD 37.73 billion in 2024 and is projected to reach USD 97.50 billion by 2032, with a CAGR of 12.6% during the forecast period of 2025 to 2032.

Report Scope and Market Segmentation

|

Attributes |

Aluminum Foil Key Market Insights |

|

Segmentation |

|

|

Countries Covered |

Japan, China, India, South Korea, Australia and New Zealand, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific. |

|

Key Market Players |

Amcor PLC (Switzerland), Constantia Flexibles (Austria), Coppice Alupack Limited (UK), Aditya Birla management corporation Pvt ltd (Mumbai), Eurofoil (Luxembourg), Hulamin Limited (South Africa), Novelis Aluminum (US), Tetra Pak SA (Switzerland), RUSAL (Russia), Wyda Packaging (Pty) LTD (South Africa), Alufoil Products Pvt Ltd (India), Assan Aluminyum Sanavi ve Ticaret AS (Istanbul), Constellium SE (France), Norsk Hydro ASA (Norway), Reynolds Consumer Products (US), Raviraj Foils Ltd (India), Zhangjiagang Goldshine Aluminum Foil Co. (China), Aliberico (Spain) |

|

Market Opportunities |

|

Aluminum Foil Market Definition

Aluminum foil is a key component of laminates and is commonly found in food packaging. It offers a higher barrier function against moisture, oxygen, and other gases, as well as volatile smell and light, than any plastic laminate material. Aluminum foil is also used to make sterilised packaging. Aluminum foils deliver many advantages to the packaging and food industries and the consumer, including consumer-friendliness & recyclability.

Aluminum Foil Market Dynamics

Drivers

- Rising government initiatives for spreading consumer awareness

Due to increased government activities to raise awareness about food safety, the market is being pushed by increased demand for aluminum foil from end-users such as food, pharmaceuticals, and cosmetics.

- Stringent rules and regulations toward food safety

The progress of the household aluminum foil industry is due to government regulations toward food safety and quality standards, which encourage manufacturers to create effective packaging solutions that prevent food contamination.

- Increase the demand of E-retailing

Changing retail industry dynamics are likely to boost the demand for different retail products, therefore positively propelling the growth of the ready-to-use packaging products. Furthermore, the development of the e-retailing segment has moved consumers to online stores from retail stores. The online food industry will likely remain a key consumer market for aluminum foil products.

- Increasing demand of biologics

Development in biotechnology and the increasing demand for biologics are expected to drive the demand for aluminum foil in goods, such as powders, liquids and tablets in the country.

Opportunities

- Rise in product innovations

For the market's growth pace, the increasing number of product innovations would enhance new market prospects. Aluminum is a recyclable material that represents a lucrative opportunity for manufacturers as rising collection and recovery rates for the product mean less production price and improved profitability.

- Demand for producing lightweight packages

Use of aluminum foil accompanied by flexible films to produce lightweight packages has been increasing reasonably. This is probable to offer new opportunities for the market sellers over the short term. These packages can be used in food, coffee, and fish packaging.

Restraints/ Challenges

The global market is growing enormously. However, there are some difficulties in the paths of growth. These hindrances include a lack of proper packaging techniques; some countries are still stuck to traditional methods. Due to the changing lifestyle of people, there is still a major part of the world that does not have enough money to buy packaged food. These are the major market restraints that will obstruct the market's growth rate.

This aluminum foil market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the aluminum foil market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Asia-Pacific Aluminum Foil Market Scope

The aluminum foil market is segmented on the basis of products, types, thickness and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Products

- Foil Wrappers

- Pouches

- Blister Packs

- Collapsible Tubes

- Trays/Containers

- Capsules

- Laminated Lids

- Foil Lined Bags

- Chocolate Foils

- Foil Round Seals

- Others

Type

- Printed

- Unprinted

Thickness

- 0.07 MM

- 0.09 MM

- 0.2 MM

- 0.4 MM

End-User

- Food

- Pharmaceuticals

- Cosmetics

- Insulation

- Electronics

- Geochemical Sampling

- Automotive Components

- Others

Aluminum Foil Market Regional Analysis

The aluminum foil market is analyzed and market size insights and trends are provided by country, products, types, thickness and end-user as referenced above.

The countries covered in the aluminum foil market report are Japan, China, India, South Korea, Australia and New Zealand, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific,

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Aluminum Foil Market Share

The aluminum foil market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to aluminum foil market.

Aluminum Foil Market Leaders Operating in the Market Are:

- Amcor PLC (Switzerland)

- Constantia Flexibles (Austria)

- Coppice Alupack Ltd. (UK)

- Aditya Birla Management Corporation Pvt Ltd (India)

- Eurofoil (Luxembourg)

- Hulamin Limited (South Africa)

- Novelis Aluminum (US)

- Tetra Pak International SA (Switzerland)

- RUSAL (Russia)

- Wyda Packaging (Pty) LTD (South Africa)

- Alufoil Products Pvt Ltd (India)

- Assan Aluminyum Sanavi ve Ticaret AS (Istanbul)

- Constellium SE (France)

- Norsk Hydro ASA (Norway)

- Reynolds Consumer Products (US)

- Raviraj Foils Ltd (India)

- Zhangjiagang Goldshine Aluminum Foil Co. (China)

- Aliberico (Spain)

Latest Developments in Aluminum Foil Market

- In November 2021, ProAmpac declared that their parent company, IFP Investments Limited had developed Irish Flexible Packaging and Fispak. These are Ireland based producers and suppliers of sustainable, flexible packaging serving the fish, dairy, bakery, meat and cheese markets in Ireland and globally

- In September 2021, Flex Films, the film manufacturing arm of flexible packaging company Uflex, launched its BOPET high barrier film F-UHB-M. The film is planned to replace aluminum foil in flexible packaging applications to resolve the tasks of the Industry that have weak integrity, material availability, high material price amongst others. These alternatives in the market which can lead food production to substitute aluminum foil for packaging the products which is expected to challenge the market growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Aluminum Foil Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Aluminum Foil Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Aluminum Foil Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.