Asia Pacific Active Medical Implantable Devices Market

Market Size in USD Billion

CAGR :

%

USD

5.06 Billion

USD

11.83 Billion

2025

2033

USD

5.06 Billion

USD

11.83 Billion

2025

2033

| 2026 –2033 | |

| USD 5.06 Billion | |

| USD 11.83 Billion | |

|

|

|

|

Asia-Pacific Active Medical Implantable Devices Market Size

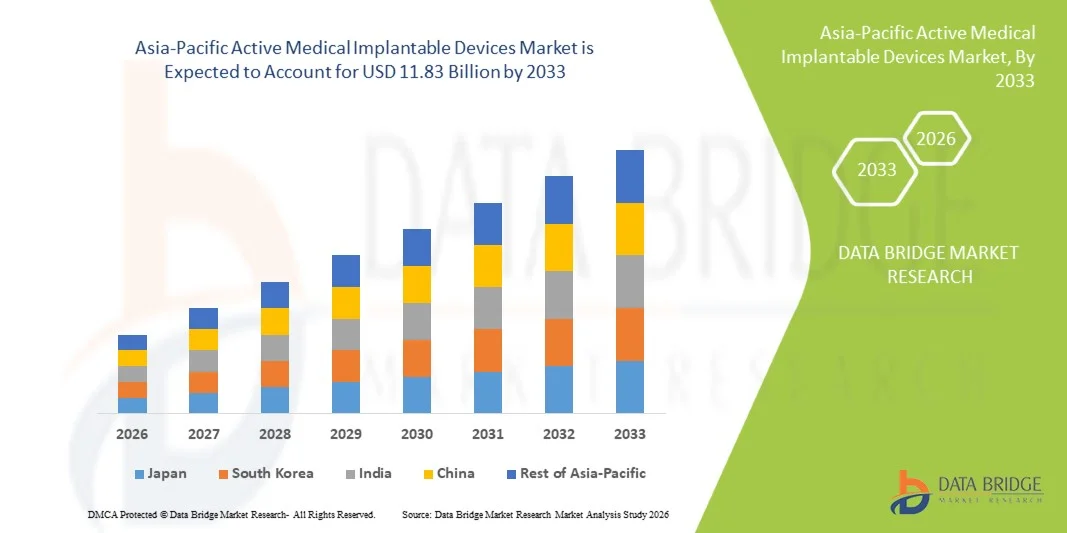

- The Asia-Pacific Active Medical Implantable Devices Market size was valued at USD 5.06 billion in 2025 and is expected to reach USD 11.83 billion by 2033, at a CAGR of 11.2% during the forecast period

- The market growth is largely fueled by the rapid increase in chronic diseases expanding healthcare infrastructure, and rising adoption of advanced implantable technologies across key countries like China, India, and Japan, which in turn supports higher procedural volumes and device uptake

- Furthermore, growing awareness among patients, improvements in surgical and implant technologies and supportive policy reforms enhancing access and affordability are establishing active implantable devices as critical components of modern therapeutic strategies in the region. These converging factors are accelerating the uptake of active medical implants, thereby significantly boosting the industry’s growth

Asia-Pacific Active Medical Implantable Devices Market Analysis

- Active medical implantable devices, including cardiac resynchronization therapy devices, implantable cardioverter defibrillators, pacemakers, neurostimulators, and active hearing implants, are increasingly vital for managing chronic and life-threatening conditions across hospitals, specialty clinics, and ambulatory surgical centers due to their therapeutic efficacy, minimally invasive implantation procedures, and integration with advanced monitoring technologies

- The escalating demand for these devices is primarily fueled by the rising prevalence of cardiovascular, neurological, and sensory disorders, expanding healthcare infrastructure, and growing patient awareness of advanced implantable solutions

- China dominated the Asia‑Pacific Asia-Pacific Active Medical Implantable Devices Market with the largest revenue share of 38.1% in 2025, driven by government healthcare initiatives, increasing procedural volumes, and rapid adoption of technologically advanced implants

- India is expected to be the fastest-growing country in the region due to rising geriatric populations, expanding healthcare access, and increased adoption of minimally invasive surgical procedures

- Implantable cardioverter defibrillators segment dominated the market with a share of 28.9% in 2025, driven by the high prevalence of cardiac disorders, well-established clinical procedures, and strong efficacy evidence

Report Scope and Asia-Pacific Active Medical Implantable Devices Market Segmentation

|

Attributes |

Asia-Pacific Active Medical Implantable Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Active Medical Implantable Devices Market Trends

“Advancements in Remote Monitoring and IoT-Enabled Implants”

- A significant and accelerating trend in the Asia-Pacific Active Medical Implantable Devices Market is the integration of remote monitoring and IoT-enabled functionalities in devices such as pacemakers, ICDs, and neurostimulators, enhancing continuous patient care and post-operative management

- For instance, Medtronic’s pacemakers now support remote data transmission to clinicians, allowing for timely intervention and follow-up without frequent hospital visits, improving patient outcomes and clinical efficiency

- IoT-enabled implantable devices allow real-time tracking of vital parameters and device performance, enabling predictive maintenance, early detection of complications, and personalized treatment adjustments based on patient-specific data trends

- The integration of implantable devices with mobile applications and hospital information systems facilitates centralized monitoring, enabling physicians to manage multiple patients remotely and optimize treatment plans through a single digital platform

- This trend towards smarter, connected, and patient-centric implantable solutions is reshaping clinician and patient expectations, driving innovation in device features such as automated alerts, adaptive therapy adjustments, and telemedicine compatibility

- The demand for remote monitoring and IoT-enabled implantable devices is growing rapidly across both hospitals and specialty clinics, as healthcare providers increasingly prioritize continuous patient monitoring and improved clinical outcomes

- The development of AI-powered implantable devices capable of analyzing patient data for predictive therapy adjustments is emerging as a key trend, improving personalized treatment and clinical decision-making

Asia-Pacific Active Medical Implantable Devices Market Dynamics

Driver

“Increasing Prevalence of Chronic Diseases and Aging Population”

- The rising prevalence of cardiovascular, neurological, and sensory disorders, along with an expanding geriatric population, is a significant driver for the increased adoption of active medical implantable devices in the region

- For instance, Abbott announced the expansion of its cardiac rhythm management solutions in India in 2025, focusing on increasing device availability and procedural support for hospitals and specialty clinics

- As chronic disease incidence grows, implantable devices offer advanced therapeutic benefits, including precise pacing, defibrillation, and neurostimulation, improving patient survival rates and quality of life compared to conventional treatments

- Furthermore, expanding healthcare infrastructure and investments in medical technology adoption are making hospitals and specialty clinics better equipped to perform implantable device procedures efficiently

- Increasing patient awareness of advanced therapeutic options, combined with government initiatives supporting implantable device accessibility, is further driving adoption across emerging markets in the Asia-Pacific region

- Rising demand for home-based patient monitoring solutions is also fueling growth, as implantable devices with remote connectivity reduce hospital visits and support chronic disease management

- Technological advancements in battery life and device miniaturization are enhancing device performance and patient comfort, creating new adoption opportunities across the region

Restraint/Challenge

“High Device Cost and Regulatory Compliance Hurdles”

- The relatively high cost of active medical implantable devices compared to traditional treatment options poses a significant barrier to adoption in price-sensitive populations across emerging Asia-Pacific economies

- For instance, advanced ICDs and neurostimulators with remote monitoring capabilities are often cost-prohibitive for smaller hospitals or outpatient clinics, limiting access in rural or low-income regions

- Compliance with strict regional regulatory requirements and device approval processes can delay market entry, adding complexity and cost for manufacturers and potentially slowing adoption rates

- Furthermore, concerns regarding device safety, long-term implantation risks, and post-operative complications necessitate rigorous clinical trials and monitoring, which can increase both cost and patient hesitancy

- Overcoming these challenges through cost-effective device innovation, streamlined regulatory pathways, and patient education on clinical benefits is essential to sustaining market growth in the Asia-Pacific active medical implantable devices sector

- Limited skilled medical professionals and trained surgeons in some countries create adoption challenges, as specialized training is required for safe device implantation and follow-up care

- Supply chain complexities and component shortages for advanced implantable devices may disrupt timely availability, especially for remote or smaller markets, posing another challenge to market expansion

Asia-Pacific Active Medical Implantable Devices Market Scope

The market is segmented on the basis of product, surgery type, procedure, and end user.

- By Product

On the basis of product, the market is segmented into implantable cardioverter defibrillators (ICDs), cardiac resynchronization therapy devices (CRT-D), implantable pacemakers, neurostimulators, active implantable hearing devices, ventricular assist devices, implantable heart monitors/insertable loop recorders, eye implants, brachytherapy devices, implantable glucose monitors, dropped foot implants, shoulder implants, implantable infusion pumps, and implantable accessories. The implantable cardioverter defibrillators (ICDs) segment dominated the market with the largest market revenue share of 28.9% in 2025, driven by the high prevalence of cardiovascular disorders such as arrhythmias and heart failure. Hospitals and specialty clinics prioritize ICDs for their proven clinical efficacy in preventing sudden cardiac death and improving patient survival rates. The well-established procedural workflow for ICD implantation and strong clinical evidence further support market dominance. In addition, increasing awareness among cardiologists and patients about advanced arrhythmia management is boosting ICD adoption. High procedural volumes in countries like China and Japan also contribute to its leading share. The segment benefits from continuous technological advancements, including remote monitoring and MRI-compatible models, enhancing clinical utility and patient comfort.

The implantable pacemakers segment is anticipated to witness the fastest growth rate of 10.8% from 2026 to 2033, fueled by the rising geriatric population and increasing incidence of bradycardia and conduction disorders in emerging countries like India. Pacemakers are increasingly adopted due to their minimally invasive implantation techniques and long-term clinical benefits. The segment’s growth is further supported by innovations such as leadless pacemakers, remote monitoring capabilities, and smaller device sizes that improve patient compliance and comfort. Expanding healthcare infrastructure and reimbursement policies in Asia-Pacific are enabling broader access to pacemaker procedures. Growing awareness campaigns about cardiovascular health are also driving early adoption among at-risk patients.

- By Surgery Type

On the basis of surgery type, the market is segmented into traditional surgical methods and minimally invasive surgery. The minimally invasive surgery segment dominated the market in 2025, accounting for the largest revenue share due to reduced recovery times, lower complication rates, and improved patient comfort. Hospitals increasingly prefer minimally invasive approaches for cardiac, neurovascular, and orthopedic implantable procedures. The availability of advanced imaging, robotic-assisted guidance, and catheter-based implantation systems is accelerating adoption. Minimally invasive techniques allow outpatient procedures and shorter hospital stays, which is particularly advantageous in high-volume healthcare settings. Clinicians value these procedures for their precision and reduced procedural trauma, enhancing patient outcomes. Government initiatives promoting advanced surgical technologies also support the dominance of this segment.

The traditional surgical methods segment is expected to witness moderate growth from 2026 to 2033, as it continues to serve complex cases requiring open procedures or multi-device implantation. While slower than minimally invasive methods, traditional surgeries remain crucial for certain orthopedic, vascular, and oncology-related implants. Hospitals with experienced surgical teams and infrastructure continue to rely on these methods for high-risk patients. In addition, training programs in emerging countries are emphasizing minimally invasive adoption, but traditional procedures still have a strong foothold due to familiarity and clinical trust.

- By Procedure

On the basis of procedure, the market is segmented into cardiovascular, neurovascular, hearing, and others. The cardiovascular segment dominated the market with the largest revenue share of 45% in 2025, driven by high incidences of heart failure, arrhythmias, and other cardiac disorders in Asia-Pacific. ICDs, CRT-D devices, and pacemakers constitute the majority of cardiovascular procedures. Hospitals and specialty clinics prefer cardiovascular implants due to established clinical protocols, proven survival benefits, and patient demand. The segment also benefits from reimbursement schemes in countries like Japan and Australia, facilitating broader access. Continuous technological innovations, such as remote monitoring, MRI compatibility, and improved battery life, further enhance adoption. Growing awareness of cardiac disease prevention and treatment is increasing procedure volumes across the region.

The hearing segment is anticipated to witness the fastest growth rate of 12.3% from 2026 to 2033, driven by the rising prevalence of hearing impairment, aging populations, and increased adoption of active implantable hearing devices such as cochlear implants. Emerging countries like India are witnessing increased government support for hearing restoration programs. Advances in device miniaturization, wireless connectivity, and integration with mobile apps are enhancing patient experience. The segment is further supported by initiatives to raise awareness of early diagnosis and intervention for hearing loss. Expanding ENT specialty clinics and hospitals equipped with implantation facilities are contributing to accelerated adoption rates.

- By End User

On the basis of end user, the market is segmented into hospitals, specialty clinics, ambulatory surgical centers, and clinics. The hospitals segment dominated the market with the largest revenue share of 50% in 2025, due to their ability to perform high-volume implantable device procedures across cardiovascular, neurovascular, and orthopedic specialties. Hospitals offer access to specialized surgeons, advanced operating rooms, and post-operative care units, making them the preferred choice for complex implant procedures. The segment also benefits from insurance coverage and reimbursement policies, particularly in developed Asia-Pacific countries. Large hospitals often adopt the latest implantable device technologies and remote monitoring solutions, enhancing patient outcomes and market demand. In addition, partnerships with device manufacturers for training and awareness programs further strengthen hospital dominance.

The specialty clinics segment is expected to witness the fastest growth rate of 11% from 2026 to 2033, driven by the rising number of cardiac, neurological, and ENT-focused centers across emerging markets. These clinics provide focused expertise, minimally invasive implantation options, and outpatient follow-up services, making procedures more accessible to patients. Government and private initiatives promoting specialty care in India, China, and Southeast Asia are encouraging rapid adoption. Patients increasingly prefer specialized clinics for convenient scheduling, personalized care, and shorter waiting times. Innovations in device technology and remote monitoring further enhance specialty clinic adoption.

Asia-Pacific Active Medical Implantable Devices Market Regional Analysis

- China dominated the Asia‑Pacific Asia-Pacific Active Medical Implantable Devices Market with the largest revenue share of 38.1% in 2025, driven by government healthcare initiatives, increasing procedural volumes, and rapid adoption of technologically advanced implants

- Patients and healthcare providers in the region increasingly value advanced therapeutic benefits, such as improved survival rates, minimally invasive implantation procedures, and remote monitoring capabilities, which enhance clinical outcomes and patient quality of life

- This widespread adoption is further supported by government initiatives promoting access to advanced medical technologies, rising healthcare expenditure, and growing awareness among clinicians and patients, establishing implantable devices as essential solutions in both hospitals and specialty clinics

The China Asia-Pacific Active Medical Implantable Devices Market Insight

The China Asia-Pacific Active Medical Implantable Devices Market captured the largest revenue share of 38.1% in 2025, driven by the high prevalence of cardiovascular and neurological disorders and rapid adoption of advanced implantable technologies. Hospitals and specialty clinics increasingly prioritize devices such as ICDs, CRT-Ds, and pacemakers for their proven clinical efficacy and survival benefits. The growing focus on minimally invasive procedures, coupled with government healthcare initiatives and reimbursement support, is further boosting device adoption. In addition, rising patient awareness and large procedural volumes in urban centers are driving strong market demand across both public and private healthcare facilities.

India Asia-Pacific Active Medical Implantable Devices Market Insight

The India Asia-Pacific Active Medical Implantable Devices Market is expected to grow at the fastest CAGR during the forecast period, fueled by the rising geriatric population, increasing incidence of chronic cardiovascular and neurological diseases, and expanding healthcare infrastructure. India’s growing number of specialty clinics and cardiac centers is facilitating access to implantable procedures such as pacemakers, ICDs, and neurostimulators. Government initiatives promoting advanced healthcare technologies, coupled with increasing adoption of minimally invasive procedures, are accelerating market penetration. Additionally, improvements in device affordability and domestic manufacturing support wider availability across urban and semi-urban regions.

Japan Asia-Pacific Active Medical Implantable Devices Market Insight

The Japan Asia-Pacific Active Medical Implantable Devices Market is witnessing steady growth due to the country’s aging population, high healthcare expenditure, and preference for technologically advanced implantable solutions. Devices such as pacemakers, ICDs, and cochlear implants are increasingly adopted for their proven clinical benefits and long-term patient outcomes. Hospitals and specialty clinics in Japan are integrating these devices with remote monitoring and digital healthcare platforms, enhancing patient follow-up and treatment efficacy. Cultural emphasis on health and wellness, combined with rapid urbanization and smart hospital initiatives, is contributing to continued demand in the residential and clinical settings.

Australia Asia-Pacific Active Medical Implantable Devices Market Insight

The Australia market is expanding steadily, supported by a well-developed healthcare system, high patient awareness, and favorable reimbursement policies. Cardiovascular and neurovascular implantable devices dominate procedural volumes in hospitals and specialty clinics. Minimally invasive implantation methods are widely preferred, reducing recovery times and improving patient comfort. Government initiatives to support advanced therapeutic devices, coupled with high adoption of digital health solutions, are driving the use of connected and remotely monitored implantable devices. The market also benefits from growing collaborations between hospitals and device manufacturers for training and technology adoption.

Asia-Pacific Active Medical Implantable Devices Market Share

The Asia-Pacific Active Medical Implantable Devices industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Abbott (U.S.)

- Boston Scientific Corporation (U.S.)

- Cochlear Ltd (Australia)

- Biotronik (Germany)

- LivaNova PLC (U.K.)

- MED EL Medical Electronics (Austria)

- Sonova (Switzerland)

- Axonics, Inc. (U.S.)

- NeuroPace, Inc. (U.S.)

- NEVRO CORP (U.S.)

- Zhejiang Nurotron Biotechnology Co., Ltd (China)

- Demant A/S (Denmark)

- Oticon Medical (Denmark)

- Sonova Holding AG (Switzerland)

- Microson (Australia)

- Nano Retina (Israel)

- GluSense (U.S.)

- Second Sight (U.S.)

What are the Recent Developments in Asia-Pacific Active Medical Implantable Devices Market?

- In November 2025, real‑world clinical data from the Aurora EV‑ICD™ system were presented at the Asia-Pacific Heart Rhythm Society session, demonstrating high anti‑tachycardia pacing success and reduced complication rates, reinforcing the safety and performance of this novel extravascular ICD in diverse patient populations across the region

- In July 2025, Cochlear Limited announced FDA approval and global launch of the Cochlear™ Nucleus® Nexa™ System, the world’s first smart cochlear implant with upgradeable firmware and built‑in memory, enabling users to receive future technological updates without surgery and significantly enhancing long‑term hearing outcomes

- In June 2025, Cochlear celebrated 30 years in China with the regional rollout of the Nucleus® Nexa™ System, introducing the smart cochlear implant in the Boao Lecheng International Medical Tourism Pilot Zone to improve access to advanced hearing restoration technology for millions with severe hearing loss across China

- In March 2025, Medtronic Japan launched the Aurora EV‑ICD™ MRI system and Epsila EV™ MRI Lead in Japan, marking the commercial introduction of a novel extravascular implantable cardioverter defibrillator system designed to treat ventricular arrhythmias with reduced vascular complications, expanding treatment options for patients at risk of sudden cardiac death in Asia‑Pacific medical centers

- In March 2024, Medtronic partnered with India’s Apollo Hospitals to expand access to its Micra AV leadless pacemaker in India and Japan, introducing the miniaturized pacemaker with integrated atrioventricular (AV) sensing technology that improves heart rhythm management without traditional leads, aimed at enhancing patient comfort and accessibility of advanced cardiac care in key Asia‑Pacific markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.