Market Analysis and Insights: Africa Underground Mining Equipment Market

Africa underground mining equipment market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 4.6% in the forecast period of 2022 to 2029 and is expected to reach USD 2,560.23 million by 2029. Increasing demand for coal in energy sector is boosting the Africa underground mining equipment market.

The process of obtaining resources from under the surface utilizing various subsurface methods is underground mining. Driving heavy machineries underground, breaking up the rocks, and putting them into a vat or tank below ground is a common mining process. Underground mining is used in a variety of sectors, including gold panning, iron ore panning, limestone mining, slate mining, coal mining, petroleum prospecting, and others. The technological advancement in the mining operation has made all the mining process easier and safe. Different equipment used in undergrounding mining are heavy-duty trucks, large dozers, hydraulic mining shovels, electric rope shovels, motor graders, drillers, loaders among others.

Growing demand for metal in different industries acts as a driver in the Africa Underground mining equipment market. Lack of skilled workforce prove to be a challenge. However, technological advancement and innovation in mining industry are expected to provide opportunities for the Africa underground mining equipment market. The stringent regulations for mining can prove to be a restrain for the market.

The Africa underground mining equipment market report provides details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the Africa Underground mining equipment market scenario, contact Data Bridge Market Research for an Analyst Brief; our team will help you create a revenue impact solution to achieve your desired goal.

Africa Underground Mining Equipment Market Scope and Market Size

The Africa Underground mining equipment market is segmented based on mining equipment, power output, mining method, movement based, drive type, application, purchase mode, operating weight and propulsion type. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

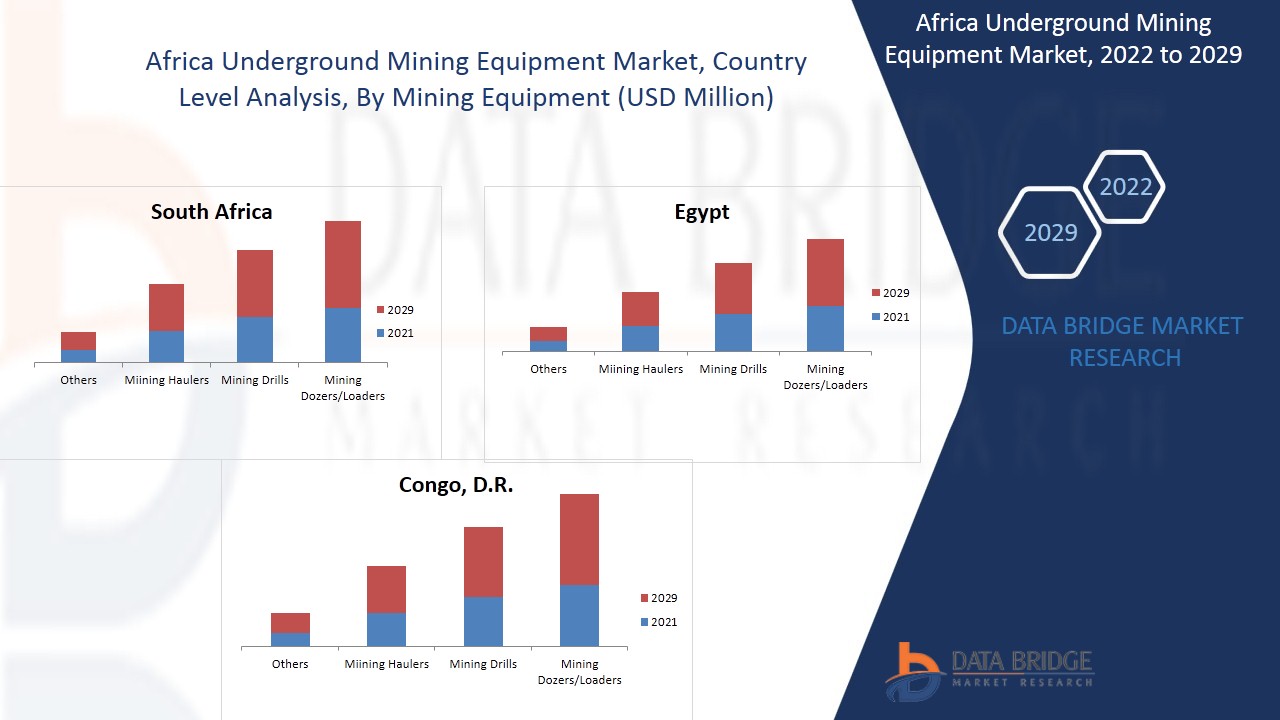

- Based on mining equipment, the Africa underground mining equipment market is segmented into mining dozers/loaders, mining drills, mining haulers and others. In 2022, mining dozers/loaders is expected to dominate the Africa underground mining equipment market as it is fast and effective in underground loading which rise the demand for mining dozers/loaders in the market.

- Based on power output, the Africa underground mining equipment market is segmented into less than 500 hp, 500-2000hp and greater than 2000hp. In 2022, less than 500 hp segment is anticipated to dominate as it enhances engine reliability and provide superior performance in the most demanding underground mining applications.

- Based on mining method, the Africa underground mining equipment market is segmented into longwall mining, room and pillar, block caving, shrinkage stopping, sublevel caving, cut and fill mining and others. In 2022, longwall mining segment is anticipated to dominate the market as it provide better resource recovery which is about 80% compared with room and pillar method. In addition, it provide safety to the miners under the hydraulic roof supports when they are extracting coal.

- Based on movement based, the Africa underground mining equipment market is segmented into wheeled and crawler. In 2022, wheeled segment is anticipated to dominate the market as it is high flexible and can travel rapidly among different jobsites. Also low heat resistance of tyre’s provide stability and safety which rise its demand in the market.

- Based on drive type, the Africa underground mining equipment market is segmented into human drivers and autonomous. In 2022, human drivers is anticipated to dominate the market as it increase the employment which further lead to growth in the country’s economy.

- Based on application, the Africa underground mining equipment market is segmented into metal mining, coal mining and non-metal mining. In 2022, metal mining segment is anticipated to dominate the market as the metal is used as a raw material for production of different electronic appliances, also use in the manufacturing of valuable jewelry.

- Based on purchase mode, the Africa underground mining equipment market is segmented into rented/leased and new purchase. In 2022, rented/leased segment is anticipated to dominate the market, as renting is the most practical and cost-effective way to acquire equipment.

- Based on operating weight, the Africa underground mining equipment market is segmented into more than 14,000kg and less than 14000 kg. In 2022, more than 14,000kg segment is anticipated to dominate the market as they are more versatile and can perform heavy dirt hauling jobs. In addition, they can provide excellent ground hold and mobility through very rough terrain at the mining site.

- On the basis of propulsion type, the Africa underground mining equipment market is segmented into diesel, electric and CNG/LNG/RNG. In 2022, diesel segment is anticipated to dominate the market as they are more rugged and reliable. Also massive drills and other machinery used for excavating, along with belts, pulleys, and carts works on diesel, which rise its demand in the market.

Africa Underground Mining Equipment Market Country Level Analysis

The Africa underground mining equipment market is analyzed, and market size mining equipment, power output, mining method, movement based, drive type, application, purchase mode, operating weight and propulsion type as referenced above.

The countries covered in the Africa underground mining equipment market report are South Africa, Congo, D.R., Egypt, Zimbabwe, Kenya and Rest of Africa.

The mining dozers/loaders segment is expected to grow with the highest growth rate in the forecast period of 2022 to 2029 due to the higher demand with the consumer. South Africa dominates the Africa underground mining equipment market due to the higher investment in the country and major reserves of gold and platinum. Congo, D.R. dominates the region due to the increasing investments in cobalt, copper, diamond. Egypt dominates the mining with presence of gold, copper, silver and zinc.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of sales channels are considered while providing forecast analysis of the country data.

Rising demand for Electrified Mining Equipment is boosting the Market Growth of Africa Underground Mining Equipment Market

The Africa Underground mining equipment market also provides you with a detailed market analysis for every country's growth in a particular market. Additionally, it provides detailed information regarding the market players’ strategy and their geographical presence. The data is available for the historical period 2011 to 2020.

Competitive Landscape and Africa Underground Mining Equipment Market Share Analysis

The Africa Underground mining equipment market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width, and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to the Africa Underground mining equipment market.

The major companies which are dealing in the Africa Underground mining equipment are AARD Mining Equipment, AB Volvo, BELAZ, Boart Longyear, Caterpillar, Epiroc AB, FLSmidth, Hitachi Construction Machinery Co., Ltd, Hyundai Doosan Infracore, Komatsu Ltd., Liebherr, Liugong Machinery Co., Ltd., Metso Outotec, MINE MASTER LTD, QINGDAO FAMBITION HEAVY MACHINERY CO., LTD., RDH-SCHARF, Sandvik AB, SANY Groups, Terex Corporation, XCMG Group among others in domestic players. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many contracts and agreements are also initiated by the companies worldwide, which accelerates the Africa Underground mining equipment market.

For instances,

- In September 2021, Liebherr partners with Hexagon to deliver next generation mine automation. With this agreement, Liebherr demonstrates the interoperability of its autonomous offering. Integrating the power of Hexagon’s technologies with Liebherr’s state-of-art autonomous solutions delivers higher levels of on-board intelligence, with reduced dependency on site infrastructure and centralized supervisory systems. This partnership benefited the company in improving the product portfolio with respect to automation systems. Thereby, improvements in artificial intelligence and machine learning.

- In June 2021, Hyundai Doosan Infracore unveiled the DL380-7, one of its new -7 Series wheel loaders at World of Concrete 2021. The Doosan DL380-7 is the company's next-generation wheel loader, replacing the DL350-5. The standard bucket of the DL380-7 has a 7% larger capacity than the DL350- 5's. Thus, the company will be able to offer the loader with improved rear visibility and productivity.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF AFRICA UNDERGROUND MINING EQUIPMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR COAL IN ENERGY SECTOR

5.1.2 GROWING DEMAND FOR METAL IN DIFFERENT INDUSTRIES

5.1.3 RISING DEMAND FOR ELECTRIFIED MINING EQUIPMENT

5.1.4 INCREASING RENTAL SERVICE IN MINING INDUSTRY

5.2 RESTRAINTS

5.2.1 HIGH COST OF THE EQUIPMENT

5.2.2 STRINGENT REGULATIONS FOR MINING

5.3 OPPORTUNITIES

5.3.1 SUSTAINABILITY AND WASTE PREVENTION

5.3.2 TECHNOLOGICAL ADVANCEMENT AND INNOVATION IN MINING INDUSTRY

5.4 CHALLENGES

5.4.1 LACK OF SKILLED WORKFORCE

5.4.2 INCREASES IN THIRD-PARTY LOGISTICS SERVICES

6 IMPACT ANALYSIS OF COVID-19 ON CIS, SOUTH & NORTH AMERICA, AND AFRICA UNDERGROUND MINING EQUIPMENT MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 STRATEGIC DECISION BY MANUFACTURERS AND GOVERNMENT INITIATIVES AFTER COVID-19

6.3 IMPACT ON DEMAND

6.4 PRICE IMPACT

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY MINING EQUIPMENT

7.1 OVERVIEW

7.2 MINING DOZERS/LOADERS

7.2.1 BY CAPACITY

7.2.1.1 LESS THAN 10000KG

7.2.1.2 10000KG TO 20000KG

7.2.1.3 MORE THAN 20000KG

7.3 MINING DRILLS

7.3.1 BY TYPE

7.3.1.1 ROTARY DRILLS

7.3.1.2 ROCK BREAKERS

7.3.1.3 CRAWLER DRILLS

7.3.1.4 HYDRAULIC BREAKERS

7.3.2 BY POWER RANGE

7.3.2.1 0 to 300 HP

7.3.2.2 300 to 500 HP

7.3.2.3 MORE THAN 500 HP

7.4 MINING HAULERS

7.5 OTHERS

8 AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY POWER OUTPUT

8.1 OVERVIEW

8.2 LESS THAN 500 HP

8.3 500-2000 HP

8.4 GREATER THAN 2000 HP

9 AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY MINING METHOD

9.1 OVERVIEW

9.2 LONGWALL MINING

9.3 ROOM AND PILLAR

9.4 BLOCK CAVING

9.5 SHRINKAGE STOPING

9.6 SUBLEVEL CAVING

9.7 CUT AND FILL MINING

9.8 OTHERS

10 AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY MOVEMENT BASED

10.1 OVERVIEW

10.2 WHEELED

10.3 CRAWLER

11 AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY DRIVE TYPE

11.1 OVERVIEW

11.2 HUMAN DRIVERS

11.3 AUTONOMOUS

12 AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 METAL MINING

12.3 COAL MINING

12.4 NON – METAL MINING

13 AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY PURCHASE MODE

13.1 OVERVIEW

13.2 RENTED/LEASED

13.3 NEW PURCHASE

14 AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY OPERATING WEIGHT

14.1 OVERVIEW

14.2 MORE THAN 14,000KG

14.3 LESS THAN 14,000KG

15 AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY PROPULSION TYPE

15.1 OVERVIEW

15.2 DIESEL

15.3 ELECTRIC

15.3.1 BY TYPE

15.3.1.1 LITHIUM ION

15.3.1.2 LEAD-ACID

15.4 CNG/LNG/RNG

16 AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY REGION

16.1 AFRICA

16.1.1 SOUTH AFRICA

16.1.2 CONGO, D.R.

16.1.3 EGYPT

16.1.4 ZIMBABWE

16.1.5 KENYA

16.1.6 REST OF AFRICA

17 AFRICA UNDERGROUND MINING EQUIPMENT MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: AFRICA

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 KOMATSU LTD.

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENTS

19.2 SANDVIK AB

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENTS

19.3 AB VOLVO

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 COMPANY SHARE ANALYSIS

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENTS

19.4 XCMG GROUP

19.4.1 COMPANY SNAPSHOT

19.4.2 COMPANY SHARE ANALYSIS

19.4.3 PRODUCT PORTFOLIO

19.4.4 RECENT DEVELOPMENT

19.5 HYUNDAI DOOSAN INFRACORE

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 COMPANY SHARE ANALYSIS

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENTS

19.6 AARD MINING EQUIPMENT (SUBSIDIARY OF MATASIS INVESTMENT HOLDING)

19.6.1 COMPANY SNAPSHOT

19.6.2 PRODUCT PORTFOLIO

19.6.3 RECENT DEVELOPMENT

19.7 BELAZ

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 RECENT DEVELOPMENTS

19.8 BOART LONGYEAR

19.8.1 COMPANY SNAPSHOT

19.8.2 REVENUE ANALYSIS

19.8.3 PRODUCT PORTFOLIO

19.8.4 RECENT DEVELOPMENTS

19.9 CATERPILLAR

19.9.1 COMPANY SNAPSHOT

19.9.2 REVENUE ANALYSIS

19.9.3 PRODUCT PORTFOLIO

19.9.4 RECENT DEVELOPMENTS

19.1 EPIROC AB

19.10.1 COMPANY SNAPSHOT

19.10.2 REVENUE ANALYSIS

19.10.3 PRODUCT PORTFOLIO

19.10.4 RECENT DEVELOPMENTS

19.11 FLSMIDTH

19.11.1 COMPANY SNAPSHOT

19.11.2 REVENUE ANALYSIS

19.11.3 PRODUCT PORTFOLIO

19.11.4 RECENT DEVELOPMENT

19.12 HITACHI CONSTRUCTION MACHINERY CO., LTD.

19.12.1 COMPANY SNAPSHOT

19.12.2 REVENUE ANALYSIS

19.12.3 PRODUCT PORTFOLIO

19.12.4 RECENT DEVELOPMENTS

19.13 LIEBHERR

19.13.1 COMPANY SNAPSHOT

19.13.2 REVENUE ANALYSIS

19.13.3 PRODUCT PORTFOLIO

19.13.4 RECENT DEVELOPMENT

19.14 LIUGONG MACHINERY CO., LTD.

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENTS

19.15 METSO OUTOTEC

19.15.1 COMPANY SNAPSHOT

19.15.2 REVENUE ANALYSIS

19.15.3 PRODUCT PORTFOLIO

19.15.4 RECENT DEVELOPMENTS

19.16 MINE MASTER

19.16.1 COMPANY SNAPSHOT

19.16.2 PRODUCT PORTFOLIO

19.16.3 RECENT DEVELOPMENTS

19.17 QINGDAO FAMBITION HEAVY MACHINERY CO.,LTD.

19.17.1 COMPANY SNAPSHOT

19.17.2 PRODUCT PORTFOLIO

19.17.3 RECENT DEVELOPMENT

19.18 RDH-SCHARF

19.18.1 COMPANY SNAPSHOT

19.18.2 PRODUCT PORTFOLIO

19.18.3 RECENT DEVELOPMENTS

19.19 SANY GROUP

19.19.1 COMPANY SNAPSHOT

19.19.2 REVENUE ANALYSIS

19.19.3 PRODUCT PORTFOLIO

19.19.4 RECENT DEVELOPMENTS

19.2 TEREX CORPORATION

19.20.1 COMPANY SNAPSHOT

19.20.2 REVENUE ANALYSIS

19.20.3 PRODUCT PORTFOLIO

19.20.4 RECENT DEVELOPMENT

20 QUESTIONNAIRE

21 RELATED REPORTS

List of Table

TABLE 1 AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY MINING EQUIPMENT, 2020-2029 (USD MILLION)

TABLE 2 AFRICA MINING DOZERS/LOADERS IN UNDERGROUND MINING EQUIPMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 AFRICA MINING DOZERS/LOADERS IN UNDERGROUND MINING EQUIPMENT MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 4 AFRICA MINING DRILLS IN UNDERGROUND MINING EQUIPMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 AFRICA MINING DRILLS IN UNDERGROUND MINING EQUIPMENT MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 6 AFRICA MINING DRILLS IN UNDERGROUND MINING EQUIPMENT MARKET, BY POWER RANGE, 2020-2029 (USD MILLION)

TABLE 7 AFRICA MINING HAULERS IN UNDERGROUND MINING EQUIPMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 AFRICA OTHERS IN UNDERGROUND MINING EQUIPMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY POWER OUTPUT, 2020-2029 (USD MILLION)

TABLE 10 AFRICA LESS THAN 500 HP IN UNDERGROUND MINING EQUIPMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 AFRICA 500-2000 HP IN UNDERGROUND MINING EQUIPMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 AFRICA GREATER THAN 2000 HP IN UNDERGROUND MINING EQUIPMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY MINING METHOD, 2020-2029 (USD MILLION)

TABLE 14 AFRICA LONGWWALL MINING IN UNDERGROUND MINING EQUIPMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 AFRICA ROOM AND PILLAR IN UNDERGROUND MINING EQUIPMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 AFRICA BLOCK CAVING IN UNDERGROUND MINING EQUIPMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 AFRICA SHRINKAGE STOPING IN UNDERGROUND MINING EQUIPMENT MARKET, BY REGION 2020-2029 (USD MILLION)

TABLE 18 AFRICA SUBLEVEL CAVING IN UNDERGROUND MINING EQUIPMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 AFRICA CUT AND FILL MINING IN UNDERGROUND MINING EQUIPMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 AFRICA OTHERS IN UNDERGROUND MINING EQUIPMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY MOVEMENT BASED, 2020-2029 (USD MILLION)

TABLE 22 AFRICA WHEELED IN UNDERGROUND MINING EQUIPMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 AFRICA CRAWLER IN UNDERGROUND MINING EQUIPMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY DRIVE TYPE, 2020-2029 (USD MILLION)

TABLE 25 AFRICA HUMAN DRIVERS IN UNDERGROUND MINING EQUIPMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 AFRICA AUTONOMOUS IN UNDERGROUND MINING EQUIPMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 AFRICA METAL MINING IN UNDERGROUND MINING EQUIPMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 AFRICA COAL MINING IN UNDERGROUND MINING EQUIPMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 AFRICA NON-METAL MINING IN UNDERGROUND MINING EQUIPMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 32 AFRICA RENTED/LEASED IN UNDERGROUND MINING EQUIPMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 AFRICA NEW PURCHASE IN UNDERGROUND MINING EQUIPMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY OPERATING WEIGHT, 2020-2029 (USD MILLION)

TABLE 35 AFRICA MORE THAN 14,000KG IN UNDERGROUND MINING EQUIPMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 AFRICA LESS THAN 14,000KG IN UNDERGROUND MINING EQUIPMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 38 AFRICA DIESEL IN UNDERGROUND MINING EQUIPMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 AFRICA ELECTRIC IN UNDERGROUND MINING EQUIPMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 AFRICA ELECTRIC IN UNDERGROUND MINING EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 AFRICA CNG/LNG/RNG IN UNDERGROUND MINING EQUIPMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 43 AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY MINING EQUIPMENT, 2020-2029 (USD MILLION)

TABLE 44 AFRICA MINING DOZERS/LOADERS IN UNDERGROUND MINING EQUIPMENT MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 45 AFRICA MINING DRILLS IN UNDERGROUND MINING EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 AFRICA MINING DRILLS IN UNDERGROUND MINING EQUIPMENT MARKET, BY POWER RANGE, 2020-2029 (USD MILLION)

TABLE 47 AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY POWER OUTPUT, 2020-2029 (USD MILLION)

TABLE 48 AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY MINING METHOD, 2020-2029 (USD MILLION)

TABLE 49 AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY MOVEMENT BASED, 2020-2029 (USD MILLION)

TABLE 50 AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY DRIVE TYPE, 2020-2029 (USD MILLION)

TABLE 51 AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 52 AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 53 AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY OPERATING WEIGHT, 2020-2029 (USD MILLION)

TABLE 54 AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 55 AFRICA ELECTRIC IN UNDERGROUND MINING EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 SOUTH AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY MINING EQUIPMENT, 2020-2029 (USD MILLION)

TABLE 57 SOUTH AFRICA MINING DOZERS/LOADERS IN UNDERGROUND MINING EQUIPMENT MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 58 SOUTH AFRICA MINING DRILLS IN UNDERGROUND MINING EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 SOUTH AFRICA MINING DRILLS IN UNDERGROUND MINING EQUIPMENT MARKET, BY POWER RANGE, 2020-2029 (USD MILLION)

TABLE 60 SOUTH AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY POWER OUTPUT, 2020-2029 (USD MILLION)

TABLE 61 SOUTH AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY MINING METHOD, 2020-2029 (USD MILLION)

TABLE 62 SOUTH AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY MOVEMENT BASED, 2020-2029 (USD MILLION)

TABLE 63 SOUTH AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY DRIVE TYPE, 2020-2029 (USD MILLION)

TABLE 64 SOUTH AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 SOUTH AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 66 SOUTH AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY OPERATING WEIGHT, 2020-2029 (USD MILLION)

TABLE 67 SOUTH AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 68 SOUTH AFRICA ELECTRIC IN UNDERGROUND MINING EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 CONGO, D.R. UNDERGROUND MINING EQUIPMENT MARKET, BY MINING EQUIPMENT, 2020-2029 (USD MILLION)

TABLE 70 CONGO, D.R. MINING DOZERS/LOADERS IN UNDERGROUND MINING EQUIPMENT MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 71 CONGO, D.R. MINING DRILLS IN UNDERGROUND MINING EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 CONGO, D.R. MINING DRILLS IN UNDERGROUND MINING EQUIPMENT MARKET, BY POWER RANGE, 2020-2029 (USD MILLION)

TABLE 73 CONGO, D.R. UNDERGROUND MINING EQUIPMENT MARKET, BY POWER OUTPUT, 2020-2029 (USD MILLION)

TABLE 74 CONGO, D.R. UNDERGROUND MINING EQUIPMENT MARKET, BY MINING METHOD, 2020-2029 (USD MILLION)

TABLE 75 CONGO, D.R. UNDERGROUND MINING EQUIPMENT MARKET, BY MOVEMENT BASED, 2020-2029 (USD MILLION)

TABLE 76 CONGO, D.R. UNDERGROUND MINING EQUIPMENT MARKET, BY DRIVE TYPE, 2020-2029 (USD MILLION)

TABLE 77 CONGO, D.R. UNDERGROUND MINING EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 78 CONGO, D.R. UNDERGROUND MINING EQUIPMENT MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 79 CONGO, D.R. UNDERGROUND MINING EQUIPMENT MARKET, BY OPERATING WEIGHT, 2020-2029 (USD MILLION)

TABLE 80 CONGO, D.R. UNDERGROUND MINING EQUIPMENT MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 81 CONGO, D.R. ELECTRIC IN UNDERGROUND MINING EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 EGYPT UNDERGROUND MINING EQUIPMENT MARKET, BY MINING EQUIPMENT, 2020-2029 (USD MILLION)

TABLE 83 EGYPT MINING DOZERS/LOADERS IN UNDERGROUND MINING EQUIPMENT MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 84 EGYPT MINING DRILLS IN UNDERGROUND MINING EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 EGYPT MINING DRILLS IN UNDERGROUND MINING EQUIPMENT MARKET, BY POWER RANGE, 2020-2029 (USD MILLION)

TABLE 86 EGYPT UNDERGROUND MINING EQUIPMENT MARKET, BY POWER OUTPUT, 2020-2029 (USD MILLION)

TABLE 87 EGYPT UNDERGROUND MINING EQUIPMENT MARKET, BY MINING METHOD, 2020-2029 (USD MILLION)

TABLE 88 EGYPT UNDERGROUND MINING EQUIPMENT MARKET, BY MOVEMENT BASED, 2020-2029 (USD MILLION)

TABLE 89 EGYPT UNDERGROUND MINING EQUIPMENT MARKET, BY DRIVE TYPE, 2020-2029 (USD MILLION)

TABLE 90 EGYPT UNDERGROUND MINING EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 91 EGYPT UNDERGROUND MINING EQUIPMENT MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 92 EGYPT UNDERGROUND MINING EQUIPMENT MARKET, BY OPERATING WEIGHT, 2020-2029 (USD MILLION)

TABLE 93 EGYPT UNDERGROUND MINING EQUIPMENT MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 94 EGYPT ELECTRIC IN UNDERGROUND MINING EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 ZIMBABWE UNDERGROUND MINING EQUIPMENT MARKET, BY MINING EQUIPMENT, 2020-2029 (USD MILLION)

TABLE 96 ZIMBABWE MINING DOZERS/LOADERS IN UNDERGROUND MINING EQUIPMENT MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 97 ZIMBABWE MINING DRILLS IN UNDERGROUND MINING EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 ZIMBABWE MINING DRILLS IN UNDERGROUND MINING EQUIPMENT MARKET, BY POWER RANGE, 2020-2029 (USD MILLION)

TABLE 99 ZIMBABWE UNDERGROUND MINING EQUIPMENT MARKET, BY POWER OUTPUT, 2020-2029 (USD MILLION)

TABLE 100 ZIMBABWE UNDERGROUND MINING EQUIPMENT MARKET, BY MINING METHOD, 2020-2029 (USD MILLION)

TABLE 101 ZIMBABWE UNDERGROUND MINING EQUIPMENT MARKET, BY MOVEMENT BASED, 2020-2029 (USD MILLION)

TABLE 102 ZIMBABWE UNDERGROUND MINING EQUIPMENT MARKET, BY DRIVE TYPE, 2020-2029 (USD MILLION)

TABLE 103 ZIMBABWE UNDERGROUND MINING EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 104 ZIMBABWE UNDERGROUND MINING EQUIPMENT MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 105 ZIMBABWE UNDERGROUND MINING EQUIPMENT MARKET, BY OPERATING WEIGHT, 2020-2029 (USD MILLION)

TABLE 106 ZIMBABWE UNDERGROUND MINING EQUIPMENT MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 107 ZIMBABWE ELECTRIC IN UNDERGROUND MINING EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 KENYA UNDERGROUND MINING EQUIPMENT MARKET, BY MINING EQUIPMENT, 2020-2029 (USD MILLION)

TABLE 109 KENYA MINING DOZERS/LOADERS IN UNDERGROUND MINING EQUIPMENT MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 110 KENYA MINING DRILLS IN UNDERGROUND MINING EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 KENYA MINING DRILLS IN UNDERGROUND MINING EQUIPMENT MARKET, BY POWER RANGE, 2020-2029 (USD MILLION)

TABLE 112 KENYA UNDERGROUND MINING EQUIPMENT MARKET, BY POWER OUTPUT, 2020-2029 (USD MILLION)

TABLE 113 KENYA UNDERGROUND MINING EQUIPMENT MARKET, BY MINING METHOD, 2020-2029 (USD MILLION)

TABLE 114 KENYA UNDERGROUND MINING EQUIPMENT MARKET, BY MOVEMENT BASED, 2020-2029 (USD MILLION)

TABLE 115 KENYA UNDERGROUND MINING EQUIPMENT MARKET, BY DRIVE TYPE, 2020-2029 (USD MILLION)

TABLE 116 KENYA UNDERGROUND MINING EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 117 KENYA UNDERGROUND MINING EQUIPMENT MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 118 KENYA UNDERGROUND MINING EQUIPMENT MARKET, BY OPERATING WEIGHT, 2020-2029 (USD MILLION)

TABLE 119 KENYA UNDERGROUND MINING EQUIPMENT MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 120 KENYA ELECTRIC IN UNDERGROUND MINING EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 REST OF AFRICA UNDERGROUND MINING EQUIPMENT MARKET, BY MINING EQUIPMENT, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 AFRICA UNDERGROUND MINING EQUIPMENT MARKET: SEGMENTATION

FIGURE 2 AFRICA UNDERGROUND MINING EQUIPMENT MARKET: DATA TRIANGULATION

FIGURE 3 AFRICA UNDERGROUND MINING EQUIPMENT MARKET: DROC ANALYSIS

FIGURE 4 AFRICA UNDERGROUND MINING EQUIPMENT MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 AFRICA UNDERGROUND MINING EQUIPMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 AFRICA UNDERGROUND MINING EQUIPMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 AFRICA UNDERGROUND MINING EQUIPMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 AFRICA UNDERGROUND MINING EQUIPMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 AFRICA UNDERGROUND MINING EQUIPMENT MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 AFRICA UNDERGROUND MINING EQUIPMENT MARKET: SEGMENTATION

FIGURE 11 INCREASING DEMAND OF COAL IN ENERGY SECTOR IS EXPECTED TO DRIVE AFRICA UNDERGROUND MINING EQUIPMENT MARKETIN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF AFRICA UNDERGROUND MINING EQUIPMENT MARKETIN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE AND IS THE FASTEST GROWING REGION IN THE AFRICA UNDERGROUND MINING EQUIPMENT MARKETIN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF AFRICA UNDERGROUND MINING EQUIPMENT MARKET

FIGURE 15 AFRICA UNDERGROUND MINING EQUIPMENT MARKET: BY MINING EQUIPMENT, 2021

FIGURE 16 AFRICA UNDERGROUND MINING EQUIPMENT MARKET: BY POWER OUTPUT, 2021

FIGURE 17 AFRICA UNDERGROUND MINING EQUIPMENT MARKET: BY MINING METHOD, 2021

FIGURE 18 AFRICA UNDERGROUND MINING EQUIPMENT MARKET: BY MOVEMENT BASED, 2021

FIGURE 19 AFRICA UNDERGROUND MINING EQUIPMENT MARKET: BY DRIVE TYPE, 2021

FIGURE 20 AFRICA UNDERGROUND MINING EQUIPMENT MARKET: BY APPLICATION, 2021

FIGURE 21 AFRICA UNDERGROUND MINING EQUIPMENT MARKET: BY PURCHASE MODE, 2021

FIGURE 22 AFRICA UNDERGROUND MINING EQUIPMENT MARKET: BY OPERATING WEIGHT, 2021

FIGURE 23 AFRICA UNDERGROUND MINING EQUIPMENT MARKET: BY PROPULSION TYPE, 2021

FIGURE 24 AFRICA UNDERGROUND MINING EQUIPMENT MARKET: SNAPSHOT (2021)

FIGURE 25 AFRICA UNDERGROUND MINING EQUIPMENT MARKET: BY COUNTRY (2021)

FIGURE 26 AFRICA UNDERGROUND MINING EQUIPMENT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 AFRICA UNDERGROUND MINING EQUIPMENT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 AFRICA UNDERGROUND MINING EQUIPMENT MARKET: BY MINING EQUIPMENT (2022-2029)

FIGURE 29 AFRICA UNDERGROUND MINING EQUIPMENT MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.