Market Analysis and Insights

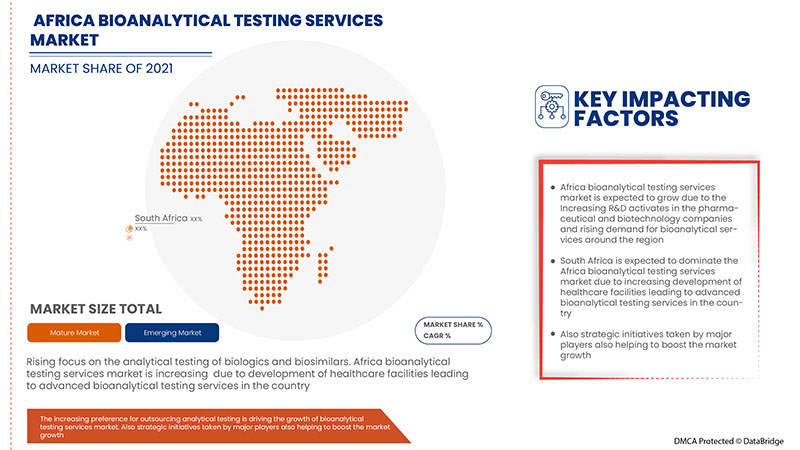

The rising focus on the analytical testing of biologics and biosimilar has enhanced the market's demand. The increasing healthcare expenditure for better health services also contributes to the market's growth. The major market players focus on various service launches and approvals during this crucial period. In addition, the increasing preference for outsourcing analytical testing also contributes to the rising demand for bioanalytical testing services in the region.

The Africa bioanalytical testing services market is growing in the forecast year due to the rise in market players and the availability of advanced services. Along with this, manufacturers are engaged in R&D activity for launching novel services in the market. The increasing demand for specialized bioanalytical testing services further boosts the market growth. However, the shortage of skilled professionals and pricing pressure faced by the major players might hamper the development of the Africa bioanalytical testing services market in the forecast period.

The rising healthcare expenditure and strategic initiatives by market players are giving opportunities to the market to enhance. However, innovative formulations demanding a unique bioanalytical testing approach and the growing need to improve the sensitivity of bioanalytical methods are key challenges for market growth.

Data Bridge Market Research shows that the Africa bioanalytical testing services market will grow at a CAGR of 6.8% from 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Thousand, Pricing in USD |

|

Segments Covered |

By Type (Bioanalytical Services For Preclinical and Clinical Studies, Small Molecule Bioanalytical Services and Large Molecule Bioanalytical Services), End User (Clinical Research Organizations, Pharmaceutical and Biotechnology Companies, Hospitals Labs, Academic and Research Institutes and Others) |

|

Countries Covered |

South Africa, Angola, Ethiopia, Nigeria and the Rest of Africa |

|

Market Players Covered |

FARMOVS (PTY) LTD (South Africa), SGS SA (Switzerland), Labcorp Drug Development (U.S.), Synexa Life Sciences BV (Netherlands), Q2 Solutions. (U.S.), Medpace (U.S.), BARC SOUTH AFRICA (South Africa), and Merieux NutriSciences Corporation (France) |

Market Definition

Bioanalytical testing is the quantitative determination of drugs and/or metabolites in biological matrices such as blood, serum, plasma, or urine, tissue, and skin samples specifically applied to toxicology, pharmacology, bioequivalence, pharmacokinetics, and bioavailability studies in animals or humans. Bioanalytical services are provided to researchers by contract research organizations with the resources, expertise, instrumentation, and technology to tackle the most complex programs across multiple modalities and therapeutic areas for clinical and preclinical bioanalysis.

Bioanalytical Testing Services Market Dynamics

Drivers

- Rise in focus on the analytical testing of biologics and biosimilar

Biologics represent one of the most promising new therapeutic areas and are becoming increasingly important in the pharmaceutical market; around 800 products are in the pipeline. One of the key reasons for this is the rising prevalence of chronic diseases.

According to the Biomed Central article in May 2020, it is reported that Africa faces a double burden of infectious and chronic diseases. Age-specific mortality rates from chronic diseases are higher in sub-Saharan Africa than in virtually all other regions, both men and women. Over the next ten years, the continent is projected to experience the most significant increase in death rates from cardiovascular disease, cancer, respiratory disease, and diabetes

The expected rise in biosimilar R&D will bring a growing demand for the associated bioanalytical testing services—compatibility studies for biosimilar, stability testing, product release testing, and protein analysis of biosimilar—to reduce the risks associated with drug development. Moreover, the introduction of biosimilar and the move toward continuous processing create the need for more rapid and sensitive analytical techniques.

- Increase in preference for outsourcing analytical testing

The outsourcing of bioanalytical testing services supports pharmaceutical companies lessen risks by avoiding significant funds in purchasing analytical equipment and maintaining the workforce, mainly when development efforts are in the initial stages. The accessibility of specialized analytical testing service providers with critical capabilities to deliver optimal results rapidly has led to growing consideration among pharmaceutical businesses to outsource testing services to third-party service providers.

Hence, the Increasing preference for outsourcing analytical testing is expected to drive the market in the forecasted period.

Opportunity

-

Rising adoption of the quality by design approach

A rising number of conferences, symposia, workshops, and training courses, especially in emerging countries, have played a crucial role in creating awareness about the benefits of adopting the QbD approach among pharmaceutical and biopharmaceutical manufacturers and research organizations.

The increasing acceptance and adoption of the QbD approach among pharmaceutical and biopharmaceutical companies across the region are expected to play a key role in the growth of the bioanalytical testing services market in the coming years.

Restraint/Challenge

- Dearth of skilled professionals

The shortage of skilled professionals to handle advanced equipment required for bioanalytical tests is a significant factor that is expected to restrain the growth of this market. In the African countries as there is less awareness among people to work in such industry and acquire specific skills related to this field

For instance,

As per the World Economic Forum article in September 2019, it is observed that the current lack of skills has real consequences. Of the CEOs highly concerned about the availability of key skills, 65% of African CEOs said the skills shortage prevented them from innovating effectively. In comparison, 59% conceded that their quality standards and customer experience were being undermined. In addition, 54% confirmed that they were missing their growth targets because of inadequate skills

This may hamper the adoption of new technologies and methodologies, thereby limiting the growth of the bioanalytical testing services market in the coming years.

Post-COVID-19 Impact on Africa Bioanalytical Testing Services Market

COVID-19 has negatively affected the market. Lockdowns and isolations during pandemics complicate clinical trials. The lack of access to healthcare facilities for routine treatment and medication administration will further impact the market.

Recent Development

- In January 2022, SGS SA announced that the company had collaborated Microsoft. The collaboration has integrated Microsoft's cross-industry expertise, advanced data solutions and productivity platforms, and the global network and leading industry competence to develop innovative solutions for the Testing, Inspection and Certification (TIC) industry's customers. This will help the company to increase its global presence and make strong foot-prints in the market

Africa Bioanalytical Testing Services Market Scope

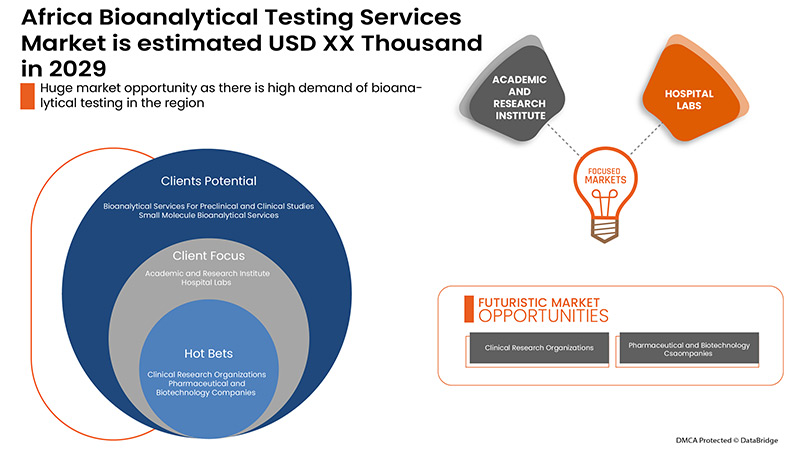

Africa bioanalytical testing services market is categorized into two notable segments, such as type and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

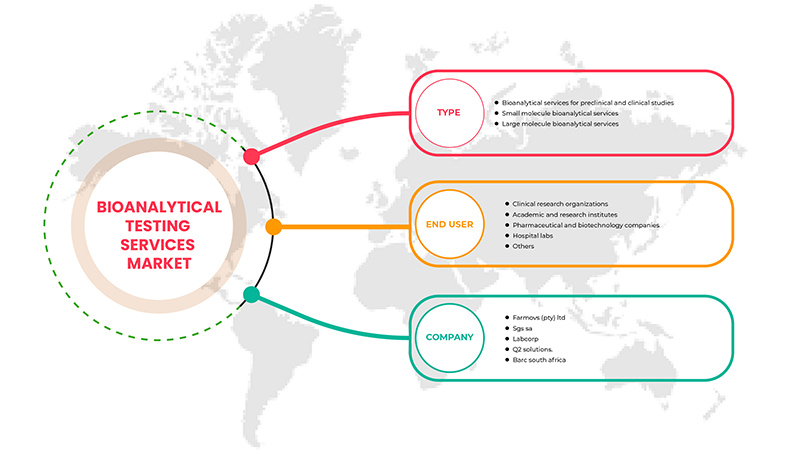

Type

- Bioanalytical Services For Preclinical And Clinical Studies

- Small Molecule Bioanalytical Services

- Large Molecule Bioanalytical Services

Based on type, the Africa bioanalytical testing services market is segmented into bioanalytical services for preclinical and clinical studies, small molecule bioanalytical services and large molecule bioanalytical services.

End User

- Clinical Research Organization

- Pharmaceutical And Biotechnology Companies

- Hospitals Labs

- Academic And Research Institutes

- Others

Based on end user, the Africa bioanalytical testing services market is segmented into clinical research organizations, pharmaceutical and biotechnology companies, hospitals labs, academic and research institutes and others.

Bioanalytical Testing Services Market Regional Analysis/Insights

The bioanalytical testing services market is analysed, and market size insights and trends are provided by type and end user, as referenced above.

The countries covered in the bioanalytical testing services market report are South Africa, Nigeria, Angola, Ethiopia and the rest of Africa.

The Africa bioanalytical testing services market is expected to grow due to the growing R&D expenditure in the pharmaceutical and biopharmaceutical industry. Also, an increase in preference for outsourcing analytical testing in the region will further boost the market growth in the forecast period.

South Africa is expected to dominate the Africa bioanalytical testing services market in terms of market share and market revenue. It will continue to flourish its dominance during the forecast period. This is due to the high demand for bioanalytical services.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, and import-export tariffs, are some of the significant pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of Africa brands, their challenges faced due to high competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Bioanalytical Testing Services Market Share Analysis

The bioanalytical testing services market competitive landscape provides details by a competitor. Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, European presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the bioanalytical testing services market.

Some major players in the Africa bioanalytical testing services market are FARMOVS (PTY) LTD, SGS SA, Labcorp, Synexa Life Sciences BV, Q2 Solutions., Medpace, BARC SOUTH AFRICA, Merieux NutriSciences Corporation among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analysed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Africa VS. Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF AFRICA BIOANALYTICAL TESTING SERVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES

4.2 PESTEL ANALYSIS

5 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: REGULATIONS

5.1 REGULATION IN AFRICA:

5.1.1 GUIDELINES FOR BIOANALYTICAL TESTING SERVICES BY SAHPRA:

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISE IN FOCUS ON THE ANALYTICAL TESTING OF BIOLOGICS AND BIOSMILARS

6.1.2 INCREASE IN PREFERENCE FOR OUTSOURCING ANALYTICAL TESTING

6.1.3 GROWING R&D EXPENDITURE IN THE PHARMACEUTICAL AND BIOPHARMACEUTICAL INDUSTRY

6.2 RESTRAINTS

6.2.1 DEARTH OF SKILLED PROFESSIONALS

6.2.2 PRICING PRESSURE FACED BY MAJOR PLAYERS

6.3 OPPORTUNITIES

6.3.1 RISE IN ADOPTION OF THE QUALITY BY DESIGN APPROACH

6.3.2 RISE IN DEMAND FOR SPECIALIZED BIOANALYTICAL TESTING SERVICES

6.3.3 STRATEGIC INITIATIVES OF KEY PLAYERS

6.4 CHALLENGES

6.4.1 INNOVATIVE FORMULATIONS DEMANDING A UNIQUE BIOANALYTICAL TESTING APPROACH

6.4.2 GROWING NEED TO IMPROVE THE SENSITIVITY OF BIOANALYTICAL METHODS

7 AFRICA BIOANALYTICAL TESTING SERVICES MARKET, BY TYPE

7.1 OVERVIEW

7.2 BIOANALYTICAL SERVICES FOR PRECLINICAL AND CLINICAL STUDIES

7.2.1 PHARMACOKINETIC (PK) ANALYSIS

7.2.2 BIOEQUIVALENCE STUDIES

7.2.3 BIOAVAILABILITY STUDIES

7.2.4 METHOD DEVELOPMENT & VALIDATION

7.2.5 LEAD OPTIMIZATION STUDIES

7.2.6 DOSE FORMULATION ANALYSIS

7.2.7 BIOANALYTICAL TECHNOLOGIES

7.2.8 OTHERS

7.3 SMALL MOLECULE BIOANALYTICAL SERVICES

7.3.1 METHOD DEVELOPMENT & VALIDATION

7.3.2 METABOLITE IDENTIFYING & SCREENING

7.3.3 SUPPORT FOR PRE-CLINICAL ANIMAL STUDIES

7.3.4 DRIED BLOOD SPOT ANALYSIS

7.3.5 TISSUE BIOANALYSIS

7.3.6 HAZARDOUS SAMPLE LABORATORY FOR HIV & HEPATITIS-B

7.3.7 BIOMARKERS ASSAY

7.3.8 OTHERS

7.4 LARGE MOLECULE BIOANALYTICAL SERVICES

7.4.1 IMMUNOCHEMISTRY SERVICES

7.4.2 BIOMARKER ASSAYS

7.4.3 METABOLITE IDENTIFYING & SCREENING

7.4.4 QUANTITATIVE IMMUNOASSAYS

7.4.5 IMMUNOGENICITY ASSAYS

7.4.6 PHARMACOKINETICS (PK) ANALYSIS

7.4.7 LIGAND-BINDING ASSAYS

7.4.8 OTHERS

8 AFRICA BIOANALYTICAL TESTING SERVICES MARKET, BY END USER

8.1 OVERVIEW

8.2 CLINICAL RESEARCH ORGANIZATIONS

8.3 ACADEMIC AND RESEARCH INSTITUTES

8.4 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

8.5 HOSPITALS LABS

8.6 OTHERS

9 AFRICA BIOANALYTICAL TESTING SERVICES MARKET, BY COUNTRY

9.1 SOUTH AFRICA

9.2 NIGERIA

9.3 ETHIOPIA

9.4 ANGOLA

9.5 REST OF AFRICA

10 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: AFRICA

11 SWOT ANALYSIS

12 COMPANY PROFILE

12.1 LABCORP

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT DEVELOPMENTS

12.2 FARMOVS (PTY) LTD

12.2.1 COMPANY SNAPSHOT

12.2.2 PRODUCT PORTFOLIO

12.2.3 RECENT DEVELOPMENTS

12.3 SGS SA

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENTS

12.4 BARC SOUTH AFRICA

12.4.1 COMPANY SNAPSHOT

12.4.2 PRODUCT PORTFOLIO

12.4.3 RECENT DEVELOPMENTS

12.5 Q2 SOLUTIONS.

12.5.1 COMPANY SNAPSHOT

12.5.2 PRODUCT PORTFOLIO

12.5.3 RECENT DEVELOPMENTS

12.6 MEDPACE

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENTS

12.7 MERIEUX NUTRISCIENCES CORPORATION

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENTS

12.8 SYNEXA LIFE SCIENCES BV

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 AFRICA BIOANALYTICAL TESTING SERVICES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 2 AFRICA BIOANALYTICAL SERVICES FOR PRECLINICAL AND CLINICAL STUDIES IN BIOANALYTICAL TESTING SERVICES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 3 AFRICA SMALL MOLECULE BIOANALYTICAL SERVICES IN BIOANALYTICAL TESTING SERVICES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 4 AFRICA LARGE MOLECULE BIOANALYTICAL SERVICES IN BIOANALYTICAL TESTING SERVICES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 AFRICA BIOANALYTICAL TESTING SERVICES MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 6 AFRICA BIOANALYTICAL TESTING SERVICES MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND )

TABLE 7 SOUTH AFRICA BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 8 SOUTH AFRICA BIOANALYTICAL SERVICES FOR PRECLINICAL AND CLINICAL STUDIES IN BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 9 SOUTH AFRICA SMALL MOLECULE BIOANALYTICAL SERVICES IN BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 10 SOUTH AFRICA LARGE MOLECULE BIOANALYTICAL SERVICES IN BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 11 SOUTH AFRICA BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 12 NIGERIA BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 13 NIGERIA BIOANALYTICAL SERVICES FOR PRECLINICAL AND CLINICAL STUDIES IN BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 14 NIGERIA SMALL MOLECULE BIOANALYTICAL SERVICES IN BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 15 NIGERIA LARGE MOLECULE BIOANALYTICAL SERVICES IN BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 16 NIGERIA BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 17 ETHIOPIA BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 18 ETHIOPIA BIOANALYTICAL SERVICES FOR PRECLINICAL AND CLINICAL STUDIES IN BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 19 ETHIOPIA SMALL MOLECULE BIOANALYTICAL SERVICES IN BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 20 ETHIOPIA LARGE MOLECULE BIOANALYTICAL SERVICES IN BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 21 ETHIOPIA BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 22 ANGOLA BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 23 ANGOLA BIOANALYTICAL SERVICES FOR PRECLINICAL AND CLINICAL STUDIES IN BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 24 ANGOLA SMALL MOLECULE BIOANALYTICAL SERVICES IN BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 25 ANGOLA LARGE MOLECULE BIOANALYTICAL SERVICES IN BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 26 ANGOLA BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 27 REST OF AFRICA BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

List of Figure

FIGURE 1 AFRICA BIOANALYTICAL TESTING SERVICESMARKET: SEGMENTATION

FIGURE 2 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: DATA TRIANGULATION

FIGURE 3 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: DROC ANALYSIS

FIGURE 4 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: SEGMENTATION

FIGURE 11 THE RISING FOCUS ON THE ANALYTICAL TESTING OF BIOLOGICS AND BIOSIMILARS AND RISE IN DEMAND FOR SPECIALIZED BIOANALYTICAL TESTING SERVICES ARE EXPECTED TO DRIVE THE AFRICA BIOANALYTICAL TESTING SERVICES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 BIOANALYTICAL SERVICES FOR PRECLINICAL AND CLINICAL STUDIES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE AFRICA BIOANALYTICAL TESTING SERVICES MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE AFRICA BIOANALYTICAL TESTING SERVICES MARKET

FIGURE 14 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: BY TYPE, 2021

FIGURE 15 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: BY TYPE, 2022-2029 (USD THOUSAND)

FIGURE 16 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 17 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: BY TYPE, LIFELINE CURVE

FIGURE 18 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: BY END USER, 2021

FIGURE 19 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: BY END USER, 2022-2029 (USD THOUSAND)

FIGURE 20 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: BY END USER, CAGR (2022-2029)

FIGURE 21 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: BY END USER, LIFELINE CURVE

FIGURE 22 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: SNAPSHOT (2021)

FIGURE 23 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: BY COUNTRY (2021)

FIGURE 24 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: BY TYPE (2022-2029)

FIGURE 27 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.