Global Minimally Invasive Medical Robotics Imaging Visualization Systems Surgical Instruments Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

50.69 Billion

USD

109.45 Billion

2024

2032

USD

50.69 Billion

USD

109.45 Billion

2024

2032

| 2025 –2032 | |

| USD 50.69 Billion | |

| USD 109.45 Billion | |

|

|

|

|

Global Minimally Invasive Medical Robotics, Imaging and Visualization Systems and Surgical Instruments Market Segmentation, By Product (Surgical Devices, Imaging and Visualization Systems, Electrosurgical Devices, Endoscopy Devices, and Medical Robotics), Technology (Surgical Devices and Imaging Devices Technology), Application (Cardio-Thoracic Surgery, Vascular Surgery, Neurological Surgery, ENT/Respiratory Surgery, Cosmetic Surgery, Gastrointestinal Surgery, Gynecological Surgery, Urological Surgery, Orthopedic Surgery, Oncology Surgery, and Dental Surgery) - Industry Trends and Forecast to 2032

Minimally Invasive Medical Robotics, Imaging and Visualization Systems and Surgical Instruments Market Size

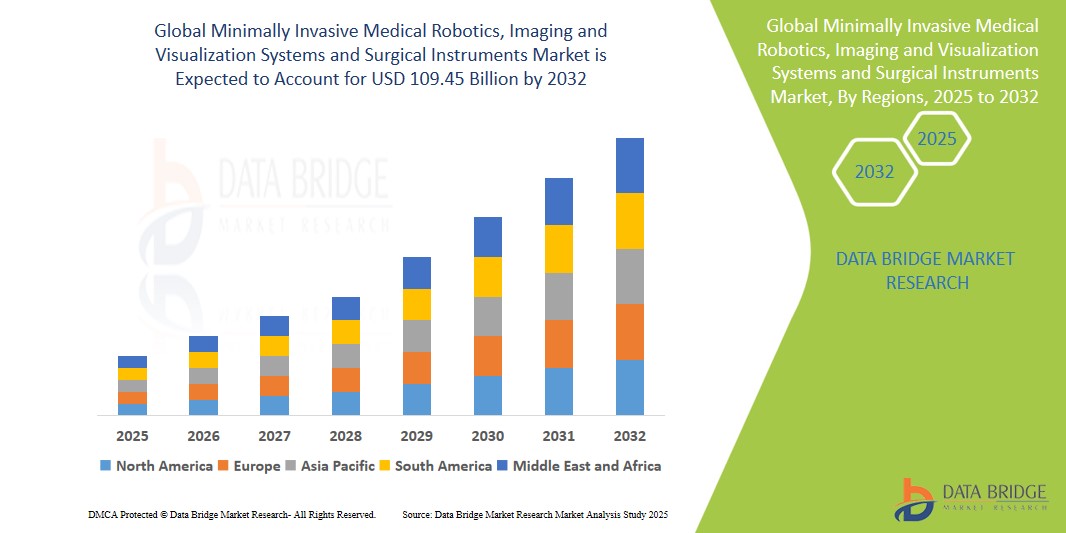

- The global minimally invasive medical robotics, imaging and visualization systems and surgical instruments market size was valued atUSD 50.69 billionin 2024 and is expected to reachUSD 109.45 billionby 2032, at aCAGR of 10.10% during the forecast period

- This growth is driven by increasing prevalence of chronic diseases

Minimally Invasive Medical Robotics, Imaging and Visualization Systems and Surgical Instruments Market Analysis

- Minimally invasive medical robotics, imaging and visualization systems, and surgical instruments are vital medical technologies used in surgical procedures to provide real-time visualization of anatomical structures, enhancing precision, reducing complications, and improving patient outcomes. These systems include robotic-assisted surgery, intraoperative imaging technologies, and surgical instruments such as robotic arms, endoscopic visualization systems, and minimally invasive tools

- The rising demand for these systems is driven by the increasing complexity of surgeries, a growing preference for minimally invasive techniques, and significant advancements in imaging technology that enable higher resolution, faster processing, and better integration with robotic surgery platforms. These innovations allow for more accurate and efficient surgical procedures

- North America is expected to dominate the minimally invasive medical robotics, imaging and visualization systems, and surgical instruments market with the largest market share of 30.12%, supported by advanced healthcare infrastructure, the widespread adoption of cutting-edge robotic surgery technologies, favorable reimbursement policies, and a concentration of leading industry players in the region

- Asia-Pacific is projected to experience the highest growth rate in this market during the forecast period, fueled by rapid healthcare infrastructure improvements, increasing investments in surgical technologies, and the growing demand for image-guided surgeries in emerging markets such as China and India. The region is experiencing heightened healthcare spending, leading to greater adoption of advanced surgical robotics and imaging systems

- The handheld instruments segment is anticipated to capture the largest market share of 23.29%, as it minimize damage to surrounding tissues, promoting faster patient recovery while decreasing discomfort and other potential adverse effects. Most handheld instruments used in minimally invasive surgeries (MIS) are designed for single-use

Report Scope and Minimally Invasive Medical Robotics, Imaging and Visualization Systems and Surgical Instruments Market Segmentation

|

Attributes |

Minimally Invasive Medical Robotics, Imaging and Visualization Systems and Surgical Instruments Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Minimally Invasive Medical Robotics, Imaging and Visualization Systems and Surgical Instruments Market Trends

“Integration ofArtificial Intelligence (AI) in Minimally Invasive Surgeries”

- A significant trend in the minimally invasive medical robotics, imaging and visualization systems and surgical instruments market is the integration of artificial intelligence (AI) to enhance the precision, speed, and outcome of surgeries. AI is being used to process real-time data from robotic systems and imaging technologies, allowing for more accurate decisions during complex procedures

- AI-powered systems are capable of recognizing patterns and anomalies in imaging data, assisting surgeons by providing valuable insights in real-time and improving surgical outcomes

- This trend is further supported by the growing development of AI-based software for robotic systems that can automate complex tasks, reducing human error and improving the consistency of surgeries

- For instance, in 2023, Intuitive Surgical introduced AI-powered features in its da Vinci robotic surgery system to assist surgeons by predicting the best surgical approach based on patient-specific data

- The adoption of AI is expected to improve the overall efficiency of surgeries, reducing recovery times and enhancing the safety of patients undergoing minimally invasive procedures

Minimally Invasive Medical Robotics, Imaging and Visualization Systems and Surgical Instruments Market Dynamics

Driver

“Surge in Demand for Minimally Invasive Procedures”

- A key driver in the minimally invasive medical robotics, imaging and visualization systems and surgical instruments market is the increasing demand for minimally invasive procedures across various surgical disciplines. These procedures are preferred by both patients and surgeons due to reduced recovery times, lower risks of complications, and minimal scarring

- With advancements in robotic technology and imaging systems, minimally invasive surgeries now offer better precision, making them more feasible for a wider range of procedures, from neurosurgery to cardiothoracic surgery

- These technologies are becoming essential in offering high-definition real-time imaging, supporting surgeons with the most accurate information possible to make decisions during surgeries

- For instance, in 2023, Medtronic launched its new HawkVision system, which combines robotic-assisted surgical tools with AI-powered imaging to provide surgeons with enhanced visualization during minimally invasive procedures

- As patients increasingly opt for procedures with shorter recovery times and less discomfort, the demand for minimally invasive medical robotics and imaging systems is expected to continue its upward trajectory

Opportunity

“Expanding Access to Surgical Care in Emerging Markets”

- An exciting opportunity in the minimally invasive medical robotics, imaging and visualization systems and surgical instruments market is the expansion of surgical care access in emerging markets. These regions are increasingly investing in healthcare infrastructure, which includes adopting robotic surgery systems, advanced imaging technologies, and minimally invasive instruments

- In these markets, the growing awareness of the benefits of minimally invasive surgeries is driving demand for modern surgical tools and technologies. Furthermore, public-private partnerships and government-funded healthcare programs are helping to make these technologies more accessible

- The opportunity to reach underserved populations, especially in Asia-Pacific and Africa, is significant, as more hospitals and clinics in these regions are incorporating robotic-assisted surgery and advanced imaging into their practices

- For instance, in 2023, GE Healthcare partnered with a government hospital in India to provide affordable robotic surgery systems and advanced imaging tools, supporting the rapid adoption of minimally invasive technologies

- The rising investments and government support in emerging markets are expected to foster growth in the global minimally invasive medical robotics and imaging market, particularly in countries such as India, China, and Brazil

Restraint/Challenge

“High Costs of Robotic Surgery Systems”

- A major challenge in the minimally invasive medical robotics, imaging and visualization systems and surgical instruments market is the high cost of robotic surgery systems and advanced imaging tools. These systems are often expensive to acquire and maintain, making them inaccessible to many healthcare providers, particularly in emerging markets and smaller healthcare facilities

- The costs associated with robotic surgery systems, including upfront investments, maintenance, and training, can deter some hospitals and clinics from adopting this technology. In addition, reimbursement policies for these high-cost procedures are not always favorable, further limiting access

- These high expenses create a barrier for the widespread adoption of robotic-assisted surgeries and advanced imaging systems, despite their benefits

- For instance, in 2023, Stryker faced challenges in penetrating lower-cost markets due to the high price of its robotic-assisted orthopedic surgical systems

- The need for cost-effective solutions and better reimbursement frameworks will be critical in overcoming these barriers to market growth

Minimally Invasive Medical Robotics, Imaging and Visualization Systems and Surgical Instruments Market Scope

The market is segmented on the basis of product, technology, and application.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Technology |

|

|

By Application |

|

In 2025, the handheld instruments is projected to dominate the market with a largest share in product segment

The handheld instruments segment is expected to dominate the minimally invasive medical robotics, imaging and visualization systems and surgical instruments market with the largest market share of 23.29% in 2025 as it minimize damage to surrounding tissues, promoting faster patient recovery while decreasing discomfort and other potential adverse effects. Most handheld instruments used in minimally invasive surgeries (MIS) are designed for single-use.

The orthopedic surgery is expected to account for the largest share during the forecast period in application segment

In 2025, the orthopedic surgery segment is expected to dominate the market with the largest market share of 24.51% due to growing prevalence of musculoskeletal disorders, increasing demand for joint replacement surgeries, and advancements in minimally invasive surgical techniques.

Minimally Invasive Medical Robotics, Imaging and Visualization Systems and Surgical Instruments Market Regional Analysis

“North America Holds the Largest Share in the Minimally Invasive Medical Robotics, Imaging and Visualization Systems and Surgical Instruments Market”

- North America is expected to dominate the minimally invasive medical robotics, imaging and visualization systems, and surgical instruments market with the largest market share of 30.12%, driven by a robust presence of key industry players, highly advanced healthcare infrastructure, the widespread adoption of cutting-edge surgical technologies, and supportive reimbursement policies for intraoperative procedures

- The U.S. holds the largest share within the region due to the extensive use of advanced imaging systems such as intraoperativeMRI, CT, and ultrasound, the rising number of complex surgeries, and continuous innovations in real-time surgical navigation technologies

- Increasing investments inneurosurgery, orthopedic surgery, and oncology applications, along with favorable regulatory approvals and a growing demand for precision surgeries, are expected to further strengthen North America’s leadership in the global market

“Asia-Pacific is Projected to Register the Highest CAGR in the Minimally Invasive Medical Robotics, Imaging and Visualization Systems and Surgical Instruments Market”

- Asia-Pacific is expected to register the highest growth rate in the minimally invasive medical robotics, imaging and visualization systems, and surgical instruments market, driven by rapid advancements in healthcare infrastructure, rising surgical volumes, growing awareness of advanced surgical imaging technologies, and increasing access to healthcare services in emerging markets

- Countries such as China, India, and Japan are key contributors to regional growth, fueled by government initiatives aimed at modernizing healthcare, growing investments in hospital facilities, and the rising burden of chronic diseases that require surgical intervention

- China and India are witnessing a surge in demand due to healthcare reforms, public-private partnerships, and enhanced training for medical professionals in image-guided surgeries

Minimally Invasive Medical Robotics, Imaging and Visualization Systems and Surgical Instruments Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- GE HealthCare (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- CONMED Corporation (U.S.)

- Siemens (Germany)

- Masimo (U.K.)

- Applied Medical Resources Corporation (U.S.)

- CNSystems Medizintechnik GmbH (Austria)

- Uscom (Australia)

- Smith + Nephew (U.K.)

- Getinge (Sweden)

- ICU Medical, Inc. (U.S.)

- ATEC Spine, Inc. (U.S.)

- Baxter (U.S.)

- Abbott (U.S.)

- Edwards Lifesciences Corporation (U.S.)

- Olympus Corporation (Japan)

- CooperSurgical Inc. (U.S.)

- Zimmer Biomet (U.S.)

- Drägerwerk AG & Co. KGaA (Germany)

- FUJIFILM Corporation (Japan)

- OSYPKA MEDICAL (Germany)

Latest Developments in Global Minimally Invasive Medical Robotics, Imaging and Visualization Systems and Surgical Instruments Market

- In November 2023, J&J's MONARCH Platform became the first minimally invasive, robotic-assisted technology approved for bronchoscopy in China, where the burden of lung cancer is significant. This approval highlights the growing demand for advanced surgical tools in oncology

- In February 2023, Stryker’s Q Guidance System received US FDA clearance for supporting cranial surgeries, making it a key tool for enhancing precision in cranial procedures. This clearance paves the way for broader adoption of robotic guidance in neurosurgery

- In January 2023, PENTAX Medical obtained CE marks for its PENTAX Medical INSPIRA, a new premium video processor, and the i20c video endoscope series. This new generation of video endoscopes sets new standards while maintaining compatibility with recent endoscope models

- In June 2022, Boston Scientific entered into a deal with South Korea’s Synergy Innovation to acquire a majority stake in M.I.Tech, a company specializing in the manufacturing and distribution of non-vascular metal stents for endoscopic and urologic procedures. This strategic acquisition enhances Boston Scientific's portfolio in minimally invasive treatments

- In August 2022, Sight Sciences, Inc. announced the launch of SION, a surgical instrument designed to remove trabecular meshwork in ocular surgeries. SION is engineered with specialized lasers that allow tissue excision without cutting, offering a precise, continuous motion for surgeons. This launch enhances Sight Sciences' offering in ocular surgery innovations

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.