Global Thermoplastic Polyurethane Market For Medical Applications

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

1.17 Billion

USD

1.81 Billion

2023

2031

USD

1.17 Billion

USD

1.81 Billion

2023

2031

| 2024 –2031 | |

| USD 1.17 Billion | |

| USD 1.81 Billion | |

|

|

|

|

Global Thermoplastic Polyurethane Market for Medical Applications– By Type (Polyester-based, Polyether-based, and Polycaprolactone-based), Application (Medical Tubing, Wound Care, Medical Devices and Components, and Orthopedic Devices), End User (Hospitals and Clinics, Medical Device Manufacturers, and Home Healthcare) - Industry Trends and Forecast to 2031.

Thermoplastic Polyurethane Market for Medical Applications Market Analysis and Size

Growing demand for advanced medical devices, driven by an aging population coupled with a higher focus on patient care and treatment, is expected to promote the market movement. Thermoplastic polyurethane can induce superior versatility and properties, making it ideal for manufacturing various medical devices, including catheters, implants, and wearable devices.

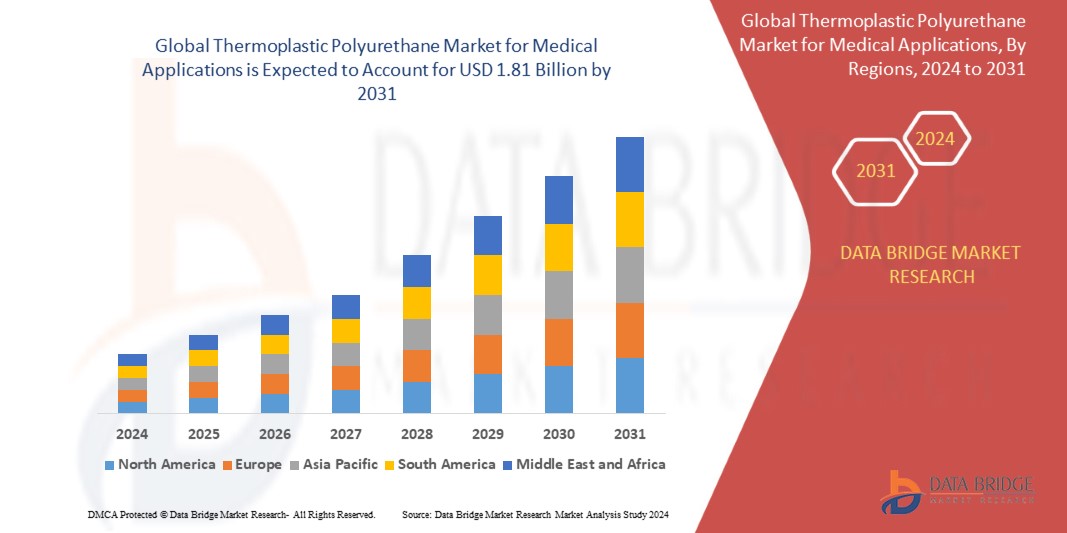

Data Bridge Market Research analyses that the global thermoplastic polyurethane market for medical applications was valued at USD 1.17 Billion in 2023 is expected to reach the value of USD 1.81 Billion by 2031, at a CAGR of 5.6% during the forecast period of 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2024 to 2031 |

|

Base Year |

2023 |

|

Historic Years |

2022 (Customizable to 2016 - 2021) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Polyester-based, Polyether-based, and Polycaprolactone-based), Application (Medical Tubing, Wound Care, Medical Devices and Components, and Orthopedic Devices), End User (Hospitals and Clinics, Medical Device Manufacturers, and Home Healthcare) |

|

Countries Covered |

U.S., Canada, Mexico, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, U.A.E., Saudi Arabia, Oman, Qatar, Kuwait, South Africa, and Rest of Middle East and Africa |

|

Market Players Covered |

Lubrizol Corporation (U.S.), Covestro AG ( Germany), Huntsman Corporation (U.S.), BASF SE (Germany), Wanhua Chemical Group Co., Ltd. (China), DSM Engineering Plastics (Netherlands), American Polyfilm, Inc. (U.S.), PolyOne Corporation (U.S.), Kuraray Co., Ltd. (Japan), and Tosoh Corporation (Japan) |

|

Market Opportunities |

|

Market Definition

Thermoplastic Polyurethane (TPU) is a class of polyurethane plastics with many useful properties, including elasticity, transparency, and resistance to oil, grease, and abrasion. TPUs are unique among thermoplastics because they possess characteristics of both rubber and plastic. This versatile material can be soft and flexible or rigid and strong, depending on the methods and components used in its production. TPUs are linear segmented block copolymers composed of hard and soft segments. The hard segments are typically made from diisocyanate and short-chain diols, in contrast, the soft segments are usually derived from long-chain diols.

Thermoplastic Polyurethane Market for Medical Applications Dynamics

Driver

- Increasing Demand for Advanced Medical Devices

The escalating need for advanced medical devices is propelled by several factors: an aging populace, surging chronic disease rates, and a heightened emphasis on patient-centric care. T. TPU's flexibility and durability render it ideal for crafting various medical devices such as catheters, implants, and wearable devices. Its biocompatibility ensures minimal adverse reactions, while its ability to withstand rigorous sterilization procedures maintains hygiene standards. Consequently, TPU is a pivotal material in meeting the burgeoning demand for innovative and effective medical solutions.

- Growing Acceptance of TPU as Biocompatible Materials

Biocompatibility is considered a hallmark of TPUs, ensuring their safe use in medical applications involving direct contact with human tissues or fluids without adverse effects. This inherent property is paramount in medical device manufacturing, assuring patient safety and minimizing risks of complications or reactions. TPUs' compatibility with the body's biological systems underscores their reliability in diverse medical contexts, from implants to catheters. Manufacturers prioritize TPUs due to their proven track record of safety, enhancing the trust and confidence of healthcare professionals and patients. Consequently, TPUs emerge as a pivotal material, facilitating the development of advanced and secure medical devices to meet evolving healthcare needs.

Opportunities

- Innovation and Technological Advancements

The growing demand of innovation in material science has led to remarkable advancements in thermoplastic polyurethane (TPU) formulations tailored to meet precise medical demands. Through meticulous research and development, TPUs with enhanced microbial resistance, heightened flexibility, and superior durability have emerged. These refined properties address specific medical requirements and broaden the scope of potential applications in healthcare. From antimicrobial coatings on medical devices to flexible implants and durable wearable sensors, these technological breakthroughs in TPUs foster greater versatility and efficacy in medical solutions. Consequently, the continuous evolution of TPU formulations catalyzes further adoption and integration of this material in the medical field.

- Rise in Minimally Invasive Surgeries

The surge in minimally invasive surgeries led to the demand for flexible and durable medical devices, notably catheters and guidewires crafted from thermoplastic polyurethane (TPU). Unlike traditional surgical approaches, minimally invasive procedures offer patients shorter recovery periods and reduced post-operative discomfort. Consequently, patients benefit from faster recuperation and enhanced comfort, while healthcare providers appreciate the precision and efficiency afforded by TPU-based instruments. This convergence of patient satisfaction and procedural efficacy propels the rising preference for minimally invasive surgeries and TPU-based medical devices.

Restraints/Challenges

- Fluctuation in Prices of Raw Materials

Thermoplastic polyurethane production heavily relies on diisocyanates and polyols, which are the key building blocks of polyurethane polymers. Any fluctuations in the prices of these raw materials directly influence the overall production cost of thermoplastic polyurethane. Diisocyanates, such as MDI (Methylene Diphenyl Diisocyanate) and TDI (Toluene Diisocyanate), and polyols, including polyester and polyether polyols, are derived from petrochemical feedstocks. Therefore, their prices are susceptible to changes in crude oil prices, supply-demand dynamics, and geopolitical factors. When the prices of diisocyanates and polyols increase, the cost of thermoplastic polyurethane production rises accordingly. This increase in production costs can pressure manufacturers' profit margins, especially if they cannot pass on the cost increase to customers through higher product prices.

Conversely, when raw material prices decrease, manufacturers may have more flexibility to adjust their pricing strategies to remain competitive. Price volatility in raw materials can also lead to supply chain disruptions. Manufacturers may face difficulties in securing a stable and reliable supply of diisocyanates and polyols at consistent prices. This uncertainty in the supply chain can further exacerbate pricing challenges and impact production planning and delivery schedules.

- Competition from Alternative Materials

Thermoplastic Polyurethane has competition with rubber, PVC, and traditional thermoplastics in diverse applications. Rubber excels in elasticity, PVC offers low cost, and traditional thermoplastics boast strength. Thermoplastic Polyurethane provides flexibility, durability, and environmental benefits. Material selection hinges on specific application needs, cost-effectiveness, and existing supply chains, affecting the market penetration of thermoplastic polyurethane. Despite its advantages, thermoplastic polyurethane may face hurdles in cost-sensitive markets and industries with entrenched material preferences, constraining its growth potential.

This thermoplastic polyurethane market for medical applications report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the global thermoplastic polyurethane market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Development

- In March 2024, ICP DAS-BMP secured significant TPU contracts with top medical materials companies in the U.S. and Japan, enhancing product reliability. This development strengthens the company's market position and fosters growth opportunities

Thermoplastic Polyurethane Market for Medical Applications Scope

The thermoplastic polyurethane market for medical applications is segmented into type, application, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Polyester-based Thermoplastic Polyurethane

- Polyether-based Thermoplastic Polyurethane

- Polycaprolactone-based Thermoplastic Polyurethane

Application

- Medical Tubing

- Wound Care

- Medical Devices and Components

- Orthopedic Devices

End User

- Hospitals and Clinics

- Medical Device Manufacturers

- Home healthcare

Thermoplastic Polyurethane Market for Medical Applications Regional Analysis/Insights

The global thermoplastic polyurethane market for medical applications is analyzed and market size insights and trends are provided by type, application, and end-user as referenced above.

The countries covered in the thermoplastic polyurethane market for medical applications report are U.S., Canada, Mexico, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, UAE, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, and Rest of Middle East and Africa.

North America is expected to dominate the market applications, holding the highest share as driven by advanced healthcare infrastructure, high healthcare expenditure, and strong demand for innovative medical technologies.

The U.S is expected to be one of the leading buyers in the market and is expected to witness rapid growth due to a strong foothold of healthcare infrastructure on a domestic level.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Thermoplastic Polyurethane Market for Medical Applications Share Analysis

The market for medical applications competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the market.

Some of the major players operating in the market are:

- Lubrizol Corporation (U.S.)

- Covestro AG ( Germany)

- Huntsman Corporation (U.S.)

- BASF SE (Germany)

- Wanhua Chemical Group Co., Ltd. (China)

- DSM Engineering Plastics (Netherlands)

- American Polyfilm, Inc. (U.S.)

- PolyOne Corporation (U.S.)

- Kuraray Co.,Ltd. (Japan)

- Tosoh Corporation ( Japan)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1. INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL THERMOPLASTIC POLYURETHANE MARKET FOR MEDICAL APPLICATIONS

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2. MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL THERMOPLASTIC POLYURETHANE MARKET SIZE FOR MEDICAL APPLICATIONS

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.4.1 KEY PLAYERS

2.2.4.2 DISRUPTORS

2.2.4.3 NICHE PLAYERS

2.2.4.4 PROSPECT LEADERS

2.2.5 COMPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 TOP TO BOTTOM ANALYSIS

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL THERMOPLASTIC POLYURETHANE MARKET SIZE FOR MEDICAL APPLICATIONS: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3. MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4. EXECUTIVE SUMMARY

5. PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 IMPORT EXPORT SCENARIO

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

5.8.1 PRODUCT CODES

5.8.2 CERTIFIED STANDARDS

5.8.3 SAFETY STANDARDS

2.2.4.5 MATERIAL HANDLING & STORAGE

2.2.4.6 TRANSPORT & PRECAUTIONS

2.2.4.7 HARAD IDENTIFICATION

6. PRICE INDEX

7. PRODUCTION CAPACITY OVERVIEW

8. SUPPLY CHAIN ANALYSIS

8.1 OVERVIEW

8.2 LOGISTIC COST SCENARIO

8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

9. CLIMATE CHANGE SCENARIO

9.1 ENVIRONMENTAL CONCERNS

9.2 INDUSTRY RESPONSE

9.3 GOVERNMENT’S ROLE

9.4 ANALYST RECOMMENDATIONS

10. GLOBAL THERMOPLASTIC POLYURETHANE MARKET FOR MEDICAL APPLICATIONS, BY PRODUCT, (2022-2031), (USD MILLION) (KILO TONS)

10.1 OVERVIEW

10.2 POLYESTER

10.3 POLYETHER

10.4 POLYCAPROLACTONE

11. GLOBAL THERMOPLASTIC POLYURETHANE MARKET FOR MEDICAL APPLICATIONS, BY CHEMISTRY, (2022-2031), (USD MILLION) (KILO TONS)

11.1 OVERVIEW

11.2 AROMATIC

11.3 ALIPHATIC

12. GLOBAL THERMOPLASTIC POLYURETHANE MARKET FOR MEDICAL APPLICATIONS, BY GRADE, (2022-2031), (USD MILLION) (KILO TONS)

12.1 OVERVIEW

12.2 EXTRUSION

12.3 INJECTION MOLDING

13. GLOBAL THERMOPLASTIC POLYURETHANE MARKET FOR MEDICAL APPLICATIONS, BY SOLUBILITY, (2022-2031), (USD MILLION) (KILO TONS)

13.1 OVERVIEW

13.2 SOLUTION GRADE

13.3 NON-SOLUTION GRADE

14. GLOBAL THERMOPLASTIC POLYURETHANE MARKET FOR MEDICAL APPLICATIONS, BY BIO-STABILITY, (2022-2031), (USD MILLION) (KILO TONS)

14.1 OVERVIEW

14.2 LESS THAN 30 DAYS

14.3 MORE THAN 30 DAYS

15. GLOBAL THERMOPLASTIC POLYURETHANE MARKET FOR MEDICAL APPLICATIONS, BY VERTICAL, (2022-2031), (USD MILLION) (KILO TONS)

15.1 OVERVIEW

15.2 CARDIOLOGY

15.2.1 PACEMAKER HEADERS AND LEADS

15.2.2 HEART PUMPS

15.2.3 CARDIAC CATHETERS AND GUIDEWIRES

15.2.4 STRUCTURAL HEALTH DEVICES

15.2.5 OTHERS

15.3 DRUG/DEVICE COMBINATION PRODUCTS (DDCPS)

15.3.1 DRUG-ELUTING PACE MAKER LEADS

15.3.2 ANTIRETROVIRAL-LOADED INTRAVAGINAL RINGS

15.3.3 BALLOON CATHETERS

15.3.4 HORMONAL SUBCUTANEOUS IMPLANTS

15.3.5 OTHERS

15.4 VASCULAR DEVICES

15.4.1 CENTRAL VENOUS CATHETERS (CVC)

15.4.2 PERIPHERAL INTRAVENOUS CATHETERS (PIVC)

15.4.3 PERIPHERALLY INSERTED CENTRAL CATHETERS (PICC)

15.4.4 DIALYSIS CATHETERS

15.4.5 OTHERS

15.5 DENTAL DEVICES

15.6 WOUND CARE

15.6.1 MEDICAL FILMS AND TAPES

15.6.2 MEMBRANES AND BACKINGS

15.6.3 DRESSINGS

15.6.4 SURGICAL WOUND THERAPY DRAPES

15.6.5 OTHERS

15.7 UROLOGY

15.7.1 URETERAL STENTS

15.7.2 BPH ABLATION CATHETERS

15.7.3 INTERMITTENT CATHETERS

15.7.4 URETHRAL CATHETERS

15.7.5 SELF CATHETERS

15.7.6 OTHERS

15.8 MEDICAL INSTRUMENT CABLES

15.9 OTHERS

16. GLOBAL THERMOPLASTIC POLYURETHANE MARKET FOR MEDICAL APPLICATIONS, BY GEOGRAPHY, (2022-2031), (USD MILLION) (KILO TONS)

16.1 OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

16.2 NORTH AMERICA

16.2.1 U.S.

16.2.2 CANADA

16.2.3 MEXICO

16.3 EUROPE

16.3.1 GERMANY

16.3.2 U.K.

16.3.3 ITALY

16.3.4 FRANCE

16.3.5 SPAIN

16.3.6 SWITZERLAND

16.3.7 NETHERLANDS

16.3.8 BELGIUM

16.3.9 RUSSIA

16.3.10 TURKEY

16.3.11 REST OF EUROPE

16.4 ASIA-PACIFIC

16.4.1 JAPAN

16.4.2 CHINA

16.4.3 SOUTH KOREA

16.4.4 INDIA

16.4.5 AUSTRALIA

16.4.6 SINGAPORE

16.4.7 THAILAND

16.4.8 INDONESIA

16.4.9 MALAYSIA

16.4.10 PHILIPPINES

16.4.11 REST OF ASIA-PACIFIC

16.5 SOUTH AMERICA

16.5.1 BRAZIL

16.5.2 ARGENTINA

16.5.3 REST OF SOUTH AMERICA

16.6 MIDDLE EAST AND AFRICA

16.6.1 SOUTH AFRICA

16.6.2 UAE

16.6.3 SAUDI ARABIA

16.6.4 KUWAIT

16.6.5 REST OF MIDDLE EAST AND AFRICA

17. GLOBAL THERMOPLASTIC POLYURETHANE MARKET FOR MEDICAL APPLICATIONS, COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: GLOBAL

17.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

17.3 COMPANY SHARE ANALYSIS: EUROPE

17.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

17.5 MERGERS & ACQUISITIONS

17.6 NEW PRODUCT DEVELOPMENT & APPROVALS

17.7 EXPANSIONS & PARTNERSHIP

17.8 REGULATORY CHANGES

18. SWOT ANALYSIS

19. GLOBAL THERMOPLASTIC POLYURETHANE MARKET FOR MEDICAL APPLICATIONS, COMPANY PROFILES

19.1 THE LUBRIZOL CORPORATION

19.1.1 COMPANY OVERVIEW

19.1.2 REVENUE ANALYSIS

19.1.3 PRODUCT PORTFOLIO

19.1.4 RECENT DEVELOPMENTS

19.2 BASF

19.2.1 COMPANY OVERVIEW

19.2.2 REVENUE ANALYSIS

19.2.3 PRODUCT PORTFOLIO

19.2.4 RECENT DEVELOPMENTS

19.3 COVESTRO AG

19.3.1 COMPANY OVERVIEW

19.3.2 REVENUE ANALYSIS

19.3.3 PRODUCT PORTFOLIO

19.3.4 RECENT DEVELOPMENTS

19.4 DSM-FIRMENICH

19.4.1 COMPANY OVERVIEW

19.4.2 REVENUE ANALYSIS

19.4.3 PRODUCT PORTFOLIO

19.4.4 RECENT DEVELOPMENTS

19.5 ZHEJIANG HUAFON THERMOPLASTIC POLYURETHANE CO., LTD.

19.5.1 COMPANY OVERVIEW

19.5.2 REVENUE ANALYSIS

19.5.3 PRODUCT PORTFOLIO

19.5.4 RECENT DEVELOPMENTS

19.6 AVIENT CORPORATION

19.6.1 COMPANY OVERVIEW

19.6.2 REVENUE ANALYSIS

19.6.3 PRODUCT PORTFOLIO

19.6.4 RECENT DEVELOPMENTS

19.7 WANHUA CHEMICAL GROUP CO. LTD

19.7.1 COMPANY OVERVIEW

19.7.2 REVENUE ANALYSIS

19.7.3 PRODUCT PORTFOLIO

19.7.4 RECENT DEVELOPMENTS

19.8 KUNSUN POLYMER MATERIAL (FUJIAN) CO., LTD.

19.8.1 COMPANY OVERVIEW

19.8.2 REVENUE ANALYSIS

19.8.3 PRODUCT PORTFOLIO

19.8.4 RECENT DEVELOPMENTS

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

20. RELATED REPORTS

21. CONCLUSION

22. QUESTIONNAIRE

23. ABOUT DATA BRIDGE MARKET RESEARCH

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.