Global Agricultural Pheromones Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

3.59 Billion

USD

12.16 Billion

2024

2032

USD

3.59 Billion

USD

12.16 Billion

2024

2032

| 2025 –2032 | |

| USD 3.59 Billion | |

| USD 12.16 Billion | |

|

|

|

|

Global Agricultural Pheromones Market, By Type (Sex Pheromones, Aggregation Pheromones, Repellent Pheromones and Others), Species (Moths, Beetles and Bugs, Armyworm, Butterflies and Others), Function (Mating Disruption, Mass Trapping, Detection and Monitoring and Others), Mode of Application (Dispenser, Traps, Sprays and Others), Crop Type (Fruits, Vegetables, Tea Plants, Turf and Ornaments, Oilseeds and Pulses, Cereals and Grains and Others), Distribution Channel (Direct, and Indirect) - Industry Trends and Forecast to 2031.

Agricultural Pheromones Market Analysis and Size

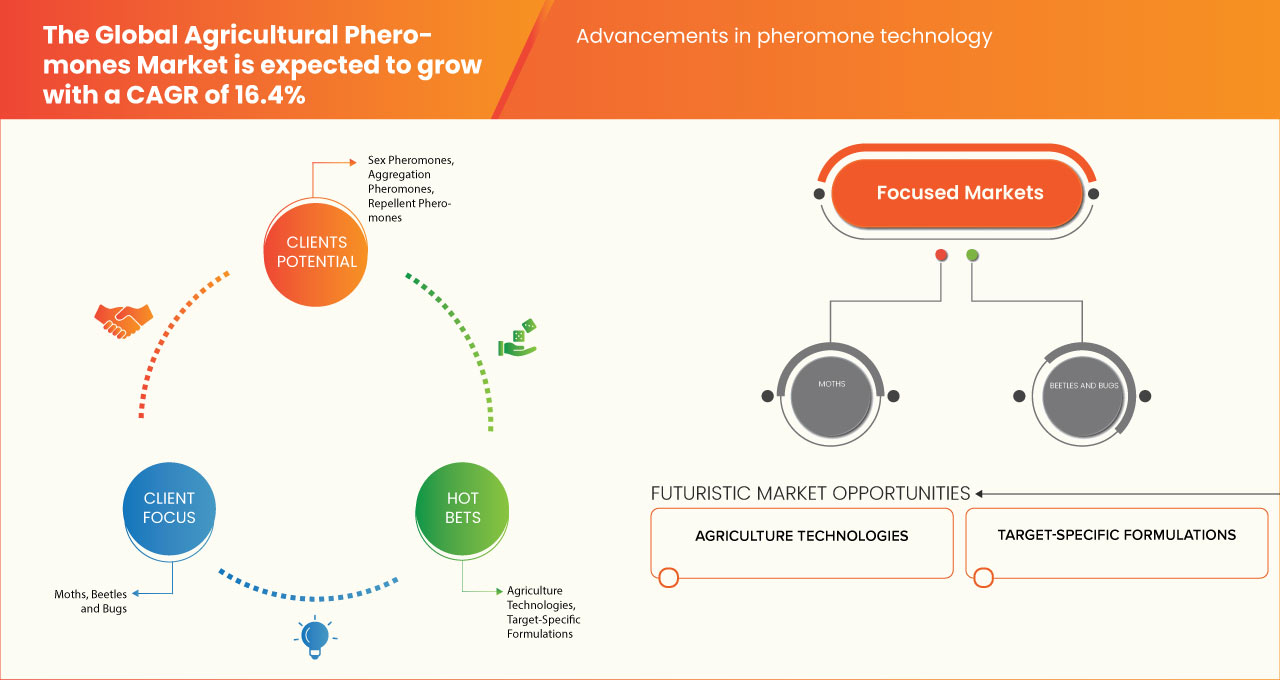

The global agricultural pheromones market is expected to grow significantly in the forecast period of 2024 to 2031. Data Bridge Market Research analyses that the market is growing with a CAGR of 16.4% in the forecast period of 2024 to 2031 from USD 3.15 billion in 2023 and is expected to reach USD 10.45 billion by 2031. With increasing concerns about the environmental impact of chemical pesticides, there's a growing demand for sustainable pest control methods. Pheromones offer an eco-friendly alternative, driving their adoption in agriculture which are some of the driving factors expected to propel the market growth.

The global agricultural pheromones market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an analyst brief. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2024 to 2031 |

|

Base Year |

2023 |

|

Historic Years |

2022 (Customizable to 2016 - 2021) |

|

Quantitative Units |

Revenue in USD Billion |

|

Segments Covered |

Type (Sex Pheromones, Aggregation Pheromones, Repellent Pheromones and Others), Species (Moths, Beetles and Bugs, Armyworm, Butterflies and Others), Function (Mating Disruption, Mass Trapping, Detection and Monitoring and Others), Mode of Application (Dispenser, Traps, Sprays and Others), Crop Type (Fruits, Vegetables, Tea Plants, Turf and Ornaments, Oilseeds and Pulses, Cereals and Grains and Others), Distribution Channel (Direct, and Indirect) |

|

Countries Covered |

U.S., Canada, Mexico, Germany, France, U.K., Italy, Spain, Russia, Netherlands, Belgium, Switzerland, Turkey, Rest of Europe, China, Japan, India, South Korea, Indonesia, Philippines, Thailand, Australia, Malaysia, Singapore, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, Saudi Arabia, U.A.E., South Africa, Kuwait and Rest of Middle East and Africa |

|

Market Players Covered |

Shin-Etsu Chemical Co., Ltd, FMC Corporation, BASF SE, Bioline AgroSciences Ltd., ISCA, BedoukianBio, Biobest Group NV, ChemTica Internacional, S. A., Hercon Environmental, Koppert, Laboratorios Agrochem S.L. , Nufarm , Pherobank , Russell IPM Ltd, Suttera (A Subsisdiary of The Wonderful Company LLC.), and Trécé Inc., among others |

Global Agricultural Pheromones Market Definition

Agricultural pheromones are chemical substances produced and released by organisms in the agricultural environment, particularly insects, to communicate with each other. These pheromones play a crucial role in various aspects of agricultural management, including pest control, mating behavior, and social organization. Additionally, agricultural pheromones can also be used to monitor pest populations by trapping insects attracted to specific pheromones. This information helps farmers and agricultural researchers track pest populations, assess the effectiveness of control measures, and make informed decisions about pest management strategies.

Global Agricultural Pheromones Market Dynamics

This section deals with understanding the market drivers, opportunities, challenges, and restrains. All of this is discussed in detail below:

Drivers

- Growing Demand for Sustainable Pest Management

Consumer and regulatory focus on environmental sustainability and food safety is driving demand for pest control methods with reduced chemical usage. Agricultural pheromones, natural compounds emitted by insects for communication, offer a sustainable alternative. They target pests specifically, minimizing harm to non-target organisms and beneficial insects, reducing pesticide residues, and preserving biodiversity. Integrated pest management (IPM) practices are contributing to the adoption of agricultural pheromones. By integrating pheromone-based methods with other pest control tactics, farmers can manage pest populations effectively while reducing reliance on chemical pesticides. Regulatory support and incentives for sustainable agriculture are further driving the adoption of agricultural pheromones. Governments worldwide are restricting conventional pesticide use and promoting environmentally-friendly alternatives, spurring market growth

- Regulatory Support for Integrated Pest Management (IPM)

With a focus on reducing reliance on chemical pesticides, governments worldwide are championing Integrated Pest Management (IPM), which integrates various pest control methods, including the strategic use of pheromones. By promoting sustainable farming practices, regulatory bodies contribute to environmental preservation and public health protection.

The recognition of pheromones' effectiveness in pest management by regulatory agencies is evident in the development of guidelines, regulations, and certification programs aimed at encouraging their adoption. These initiatives not only emphasize the importance of reducing pesticide usage but also provide incentives for farmers to implement environmentally-friendly alternatives like pheromones. Additionally, regulatory collaboration with industry stakeholders ensures the continuous improvement and standardization of pheromone-based products, instilling confidence in their safety and efficacy among farmers.

Moreover, regulatory support for IPM and pheromone use is driven by broader environmental concerns, including ecosystem conservation and biodiversity preservation. Governments recognize the need to safeguard natural resources and mitigate the adverse impacts of conventional pesticides on ecosystems and human health. By endorsing sustainable pest management practices like pheromone-based solutions, regulatory agencies contribute to the collective effort towards achieving a more environmentally-friendly and sustainable agricultural sector.

- Advancements in Pheromone Technology

The technological innovations encompass various aspects of pheromone production, formulation, and delivery systems, leading to improved efficacy, cost-effectiveness, and ease of use in pest management applications. One significant advancement is the development of synthetic pheromones, which offer several advantages over naturally-derived pheromones, including enhanced stability, purity, and scalability of production. Furthermore, advancements in formulation techniques allow for the encapsulation of pheromones into various matrices, such as microcapsules or controlled-release devices, prolonging their activity and efficacy in the field. Moreover, advancements in pheromone delivery systems, such as pheromone traps or dispensers, enhance their practicality and applicability in diverse agricultural settings.

Additionally, advancements in monitoring and detection technologies enable real-time monitoring of pest populations and assessment of pheromone efficacy, providing valuable insights for pest management decision-making. These technological advancements not only improve the overall efficacy and reliability of pheromone-based pest control methods but also contribute to the broader adoption of sustainable pest management practices in agriculture

Opportunity

- Expansion in Emerging Markets

Emerging markets, characterized by rapid industrialization, urbanization, and increasing agricultural intensification, offer untapped potential for the adoption and growth of pheromone-based pest control solutions. As these economies evolve, there is a growing recognition of the need for sustainable agricultural practices to address food security challenges, environmental concerns, and regulatory pressures.One major opportunity is the rising demand for environmentally-friendly pest management solutions in emerging markets. Traditional pest control methods in these regions often rely heavily on chemical pesticides, which can have detrimental effects on human health, biodiversity, and ecosystem services. Pheromone-based pest control offers a sustainable alternative that aligns with the increasing emphasis on eco-friendly farming practices and regulatory requirements for pesticide reduction and residue management. Furthermore, the diverse agricultural landscapes and pest profiles in emerging markets present opportunities for tailored pheromone solutions to address specific pest opportunity. By customizing pheromone formulations and deployment strategies to suit local conditions and crop production systems, manufacturers can meet the unique needs and preferences of farmers in these regions, fostering greater adoption and market penetration.

Restraints/Challenges

- Variable Environmental Conditions

Pheromone-based pest control relies on the precise manipulation of insect behaviour through the release of species-specific chemical signals. However, environmental factors such as temperature, humidity, and wind speed can influence the dispersion, longevity, and effectiveness of pheromones in the field.

High temperatures can accelerate the degradation of pheromones, reducing their efficacy and shortening their lifespan. Conversely, low temperatures can slow down pheromone release rates, limiting their effectiveness in attracting target pests. Similarly, fluctuations in humidity levels can affect the evaporation and dispersion of pheromones, altering their distribution and reducing their attractiveness to pests. Furthermore, variable environmental conditions can impact pest behavior and population dynamics, influencing the efficacy of pheromone-based pest control strategies. Moreover, environmental variability can pose logistical challenges for pheromone deployment and management. Extreme weather events such as heavy rainfall, strong winds, or drought conditions can damage pheromone dispensers, disrupt trapping efforts, or interfere with pheromone signal transmission, compromising pest control outcomes.

- Complexity of Implementation and Adoption

Pheromone-based pest control solutions offer promising benefits in terms of effectiveness, sustainability, and environmental safety, their adoption can be hindered by various factors related to complexity. Unlike conventional chemical pesticides, which are familiar and widely adopted by farmers, pheromone-based solutions require specialized knowledge and training for proper implementation. Farmers may face challenges in understanding the principles of pheromone-based pest control, selecting appropriate products, and implementing them effectively in the field.

Moreover, the adoption of pheromone-based pest control solutions often involves changes in farm management practices, crop production techniques, and pest monitoring protocols. This transition can be daunting for farmers, particularly those with limited resources, technical expertise, or access to information and training.

Recent Developments

- In December 2022, according to an article published by ResearchGate GmbH, the pivotal role of sex pheromones in addressing challenges in global agriculture posed by herbivorous insects. It emphasizes the need for sustainable alternatives to traditional chemical pesticides due to their environmental and health hazards. The chapter explores current pheromone usage for monitoring and controlling insect populations, highlighting their non-toxic and species-specific nature.

- According to a blog published by ISCA., East ISCA Inc. leads in applying safe insect pheromones to control invasive insects. The US Forest Service utilizes SPLAT GM, ISCA's pheromone control for the gypsy moth, across hundreds of thousands of acres in 10 states.

Global Agricultural Pheromones Market Scope

The agricultural pheromones market is categorized based on type, species, function, mode of application, crop type and distribution channel.The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Sex Pheromones

- Aggregation Pheromones

- Repellent Pheromones

- Others

On the basis of product type, the agricultural pheromones market is segmented into sex pheromones, aggregation pheromones, repellent pheromones and others.

Species

- Moths

- Beetles and Bugs

- Armyworm

- Butterflies

- Others

On the basis of species, the agricultural pheromones market is segmented into moths, beetles and bugs, armyworm, butterflies, others.

Function

- Mating Disruption

- Mass Trapping

- Detection and Monitoring

- Others

On the basis of function, the agricultural pheromones market is segmented into mating disruption, mass trapping, detection and monitoring and others.

Mode of Application

- Dispenser

- Traps

- Sprays

- Others

On the basis of mode of application, the agricultural pheromones market is segmented into dispenser, traps, sprays and others.

Crop Type

- Fruits

- Vegetables

- Tea Plants

- Turf and Ornaments

- Oilseeds and Pulses

- Cereals and Grains

- Others

On the basis of crop type, the agricultural pheromones market is segmented into fruits, vegetables, tea plants, turf and ornaments, oilseeds and pulses, cereals and grains and others

Distribution Channel

- Direct

- Indirect

On the basis of distribution channel, the agricultural pheromones market is segmented into direct and indirect.

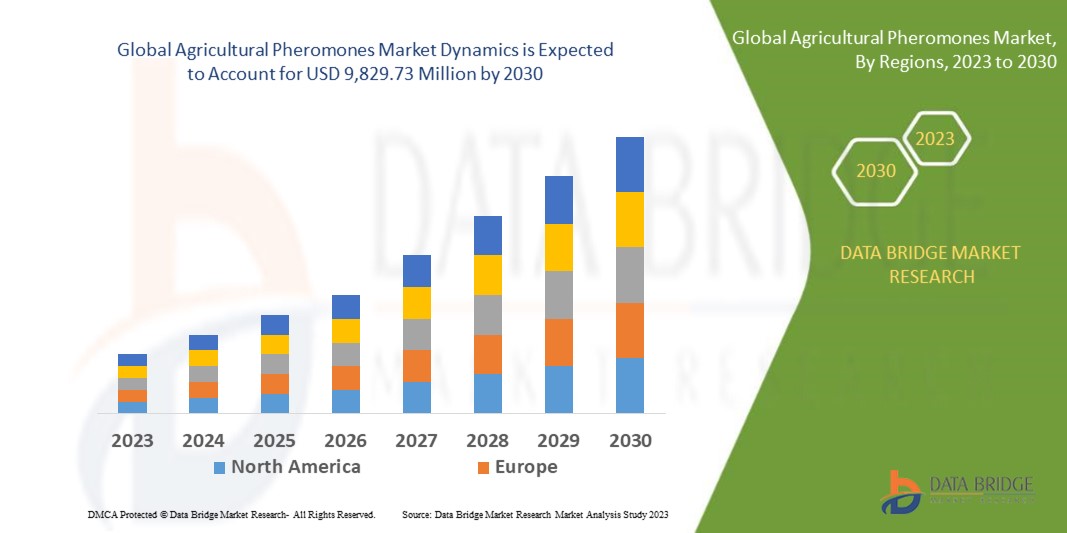

Global Agricultural Pheromones Market Regional Analysis/Insights

The agricultural pheromones market is segmented on the basis of type, species, function, mode of application, crop type and distribution channel.

The countries covered in global agricultural pheromones market report are U.S., Canada, Mexico, Germany, France, U.K., Italy, Spain, Russia, Netherlands, Belgium, Switzerland, Turkey, rest of Europe, China, Japan, India, South Korea, Indonesia, Philippines, Thailand, Australia, Malaysia, Singapore, rest of Asia-Pacific, Brazil, Argentina, rest of South America, Saudi Arabia, U.A.E., South Africa, Kuwait and rest of Middle East and Africa.

North America is dominating the market due to Availability of debt financing and investor capital influences the level of deal activity in the PE market. Favorable financing conditions can enable larger deals and higher valuations. U.S. in North America is expected to dominate the market and also fastest growing country in the region due to increasing demand for sustainable pest control. In Europe, France dominates the market due to growing advancements in pheromone technology. In Asia-Pacific, China dominates the market due to growing organic farming practices.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Cosmetics Market Share Analysis

The agricultural pheromones market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the market.

Some of the major players operating in the global agricultural pheromones market Shin-Etsu Chemical Co., Ltd, FMC Corporation, BASF SE, Bioline AgroSciences Ltd., ISCA, BedoukianBio, Biobest Group NV, ChemTica Internacional, S. A., Hercon Environmental, Koppert, Laboratorios Agrochem S.L. , Nufarm , Pherobank , Russell IPM Ltd, Suttera (A Subsisdiary of The Wonderful Company LLC.), and Trécé Inc., among others.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.