Us Ship Repair And Maintenance Services Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

11.94 Million

USD

13.13 Million

2024

2032

USD

11.94 Million

USD

13.13 Million

2024

2032

| 2025 –2032 | |

| USD 11.94 Million | |

| USD 13.13 Million | |

|

|

|

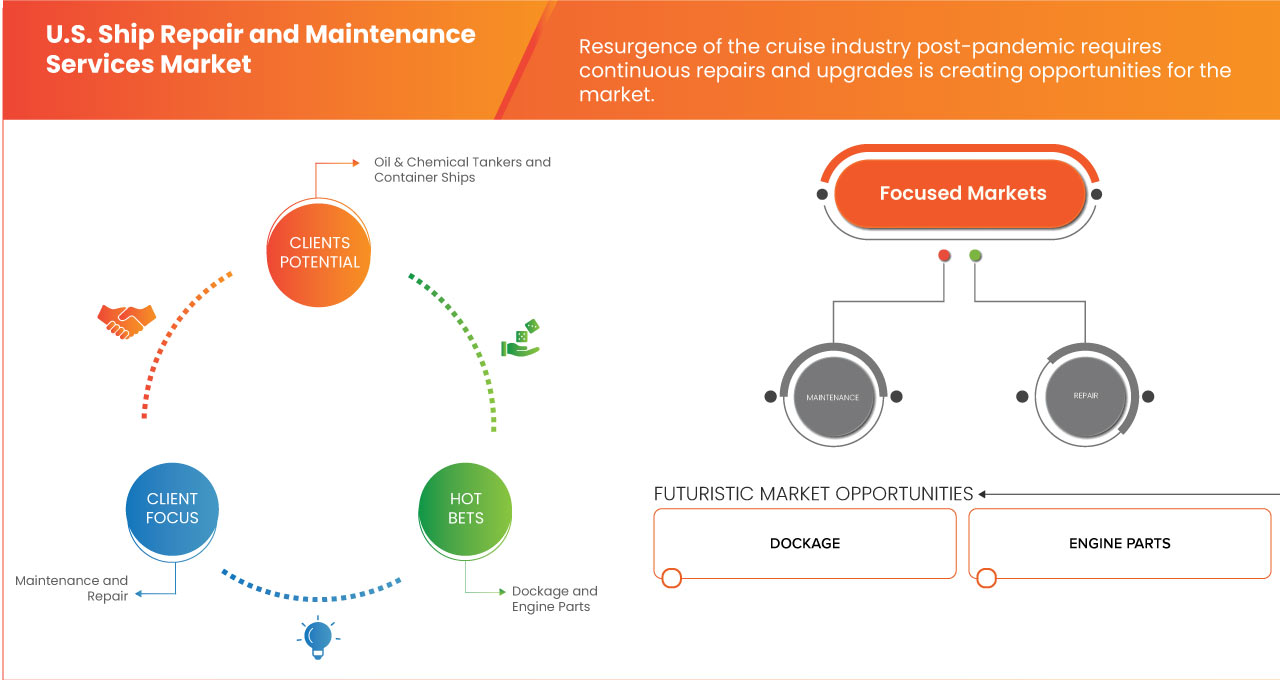

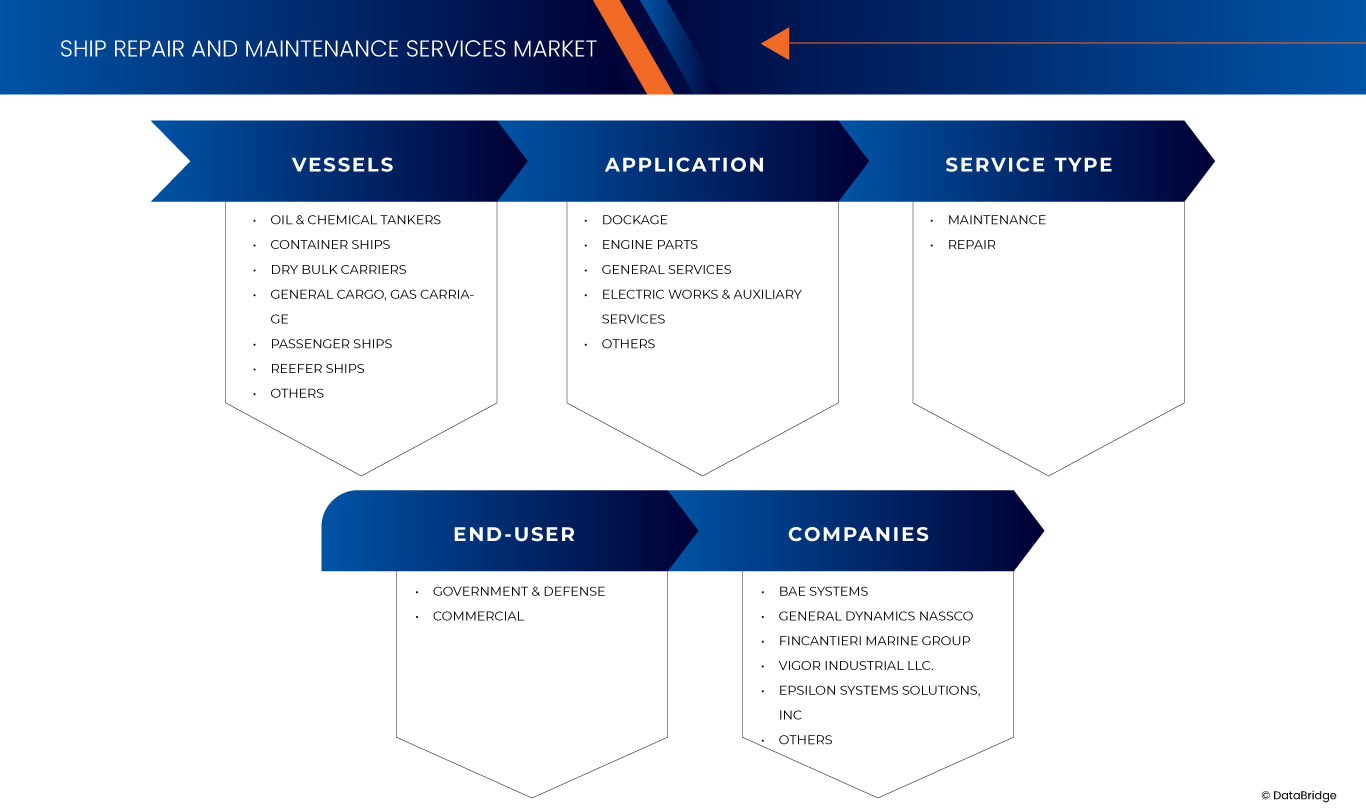

U.S. Ship Repair and Maintenance Services Market Segmentation, By Vessel (Oil & Chemical Tankers, Container Ships, Dry Bulk Carriers, General Cargo, Gas Carriage, Passenger Ships, Reefer Ships and Others), Service Type (Maintenance and Repair), Application (Dockage, Engine Parts, General Services, Electric Works & Auxiliary Services and Others), End-User (Government & Defense and Commercial) – Industry Trends and Forecast to 2031

Ship Repair and Maintenance Services Market Analysis

The ship repair and maintenance market is experiencing robust growth, driven by growing maritime trade and fleet expansion. As the U.S. ship repair and maintenance services industry continues to expand, due to the aging fleet of vessels in the U.S. adoption of advanced digital technologies, like predictive maintenance through IoT and AI and increased investments in military and defense ships are providing opportunities for the market. Market dynamics are also influenced by high costs of labor and facilities. Overall, the market is expected to continue expanding, with a focus on innovation and sustainability to meet evolving industrial demands.

Ship Repair and Maintenance Services Market Size

U.S. ship repair and maintenance services market size was valued at USD 11.90 billion in 2023 and is projected to reach USD 12.98 billion by 2031, with a CAGR of 1.2% during the forecast period of 2024 to 2031.

U.S. Ship Repair and Maintenance Services Market Trends

“Growth in Offshore Oil and Gas Activities”

As the demand for energy increases globally, offshore drilling and production operations have expanded, creating a robust need for specialized vessels and the services that maintain them. As offshore oil and gas exploration intensifies, there is a corresponding increase in the number and diversity of vessels required to support these operations. This includes supply ships, drilling rigs, and specialized construction vessels, all of which require regular maintenance and repairs to remain operational. The rising trend of offshore activities leads to an increased demand for ship repair services as companies seek to ensure their fleets are equipped to handle the rigors of challenging marine environments.

Vessels operating in offshore oil and gas sectors often face unique operational challenges, including exposure to harsh weather conditions and corrosive environments. This necessitates specialized maintenance and repair services that can address these challenges effectively. For instance, the integrity of hulls, propulsion systems, and safety equipment must be meticulously maintained to prevent accidents and ensure compliance with safety regulations. Shipyards that can provide specialized services tailored to the needs of offshore vessels are increasingly valuable, driving growth in the repair and maintenance sector.

The offshore oil and gas industry is subject to stringent regulatory standards designed to protect both the environment and human safety. Compliance with these regulations requires regular inspections and maintenance of vessels. Ship operators must ensure that their vessels meet the latest safety and environmental regulations, which often necessitates upgrades and repairs. This ongoing need for compliance creates a steady stream of work for shipyards, as operators seek to avoid penalties and maintain operational licenses.

The offshore sector is at the forefront of technological advancements, including the adoption of more sophisticated drilling and extraction techniques. As these technologies evolve, the vessels supporting them must also be updated and maintained to incorporate new systems and equipment. This creates opportunities for ship repair and maintenance companies to offer innovative solutions that can enhance operational efficiency and safety. Facilities that invest in advanced technologies and skilled labor to service these vessels are well-positioned for growth.

For instance,

- In 2021, according to an article published by J-Stage, as onshore energy sources deplete, offshore energy has become a vital strategic resource, prompting countries to accelerate research and development. The offshore oil and gas industry has evolved significantly, advancing from coastal areas to shallow and deep waters, with substantial increases in production. This paper reviews the industry's history concerning time, water depth, and output, explores technological advancements and equipment in offshore exploitation, and identifies current challenges. It concludes that the future of the industry will focus on deep water, automation, and gas hydrates, providing insights into the sector's evolution and prospects

The growth in offshore oil and gas activities is a crucial driver for the U.S. ship repair and maintenance services market. The increased demand for specialized vessels, the need for rigorous maintenance to withstand harsh conditions, compliance with regulatory standards, and the integration of advanced technologies collectively fuel the market's expansion. As offshore operations continue to grow, the importance of reliable repair and maintenance services will only intensify, providing significant opportunities for shipyards across the U.S.

Report Scope and Market Segmentation

|

Attributes |

Ship Repair and Maintenance Services Ingredients Key Market Insights |

|

Segments Covered |

· Vessel: Oil & Chemical Tankers, Container Ships, Dry Bulk Carriers, General Cargo, Gas Carriage, Passenger Ships, Reefer Ships and Others · Service Type: Maintenance and Repair · Application: Dockage, Engine Parts, General Services, Electric Works & Auxiliary Services and Others · End-User: Government & Defense and Commercial |

|

Countries Covered |

U.S. |

|

Key Market Players |

BAE Systems (U.K.), General Dynamics NASSCO (U.S.), Fincantieri Marine Group (U.S.), Vigor Industrial LLC. (U.S.), Epsilon Systems Solutions, INC (U.S.), Bludworth Marine, L.L.C. (U.S.), Colonna's Shipyard, INC (U.S.), Conrad Shipyards (U.S.), Detyens Shipyards (U.S.), Gulf Copper & Manufacturing Corporation (U.S.), HSD Marine and Shiprepair Pte LTD. (Singapore) among others |

|

Market Opportunities |

· Adoption of advanced digital technologies, like predictive maintenance through IOT and ai · Increased investments in military and defense ships |

|

Value Added Data Info sets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis. |

Ship Repair and Maintenance Services Market Definition

Ship repair and maintenance services encompass a range of activities aimed at ensuring the operational efficiency, safety, and longevity of maritime vessels. This market includes routine maintenance, emergency repairs, retrofitting, and refurbishment of ships, encompassing both commercial and military vessels. Key services involve hull repairs, machinery overhauls, electrical and electronic system upgrades, and the application of protective coatings. The industry serves ship-owners, operators, and managers, responding to regulatory compliance and environmental standards. Market growth is driven by increasing global trade, aging fleets, and advancements in repair technologies. Additionally, the rise of sustainability initiatives prompts the adoption of eco-friendly practices in ship maintenance, further shaping the landscape of this essential maritime sector.

Ship Repair and Maintenance Services Market Dynamics

Drivers

- Growing Maritime Trade and Fleet Expansion

The exponential growth in global trade has led to a marked increase in shipping volume. As economies around the world become more interconnected, the demand for shipping services rises accordingly. This increase means that shipping companies are expanding their fleets to accommodate a higher volume of goods. More vessels in operation translate to a greater need for regular maintenance and repair services. As ships log more miles, they face wear and tear that necessitates scheduled dry-dock repairs and maintenance work. This continuous cycle of repair not only ensures that vessels remain compliant with operational standards but also enhances their longevity, which is critical for shipping companies looking to maximize their investment. Consequently, U.S. shipyards that can offer reliable and timely maintenance services find themselves in high demand, thus driving the market's growth.

O setor marítimo é fortemente regulamentado, com normas rigorosas que regem a segurança, o impacto ambiental e a eficiência operacional. Estes regulamentos exigem inspeções regulares e rotinas de manutenção para garantir a conformidade. À medida que as estruturas regulamentares se tornam mais rigorosas, os operadores de navios enfrentam pressão para manter as suas frotas de acordo com as diretrizes em evolução. Isto cria uma procura consistente por serviços de reparação e manutenção de navios, uma vez que a conformidade não é apenas uma obrigação legal, mas um factor crítico para manter as licenças operacionais e evitar penalizações dispendiosas. Os estaleiros navais dos EUA que conseguem demonstrar conhecimento em conformidade e um histórico de cumprimento dos requisitos regulamentares posicionam-se como parceiros essenciais para as empresas de transporte marítimo, impulsionando assim um maior crescimento do mercado. A dinâmica geopolítica desempenha um papel significativo na influência dos padrões de comércio marítimo e das exigências de transporte. As alterações nas políticas comerciais, as sanções ou a instabilidade política podem levar a alterações nas rotas de transporte e no volume geral de mercadorias transportadas. Por exemplo, as disputas comerciais podem perturbar as rotas estabelecidas, exigindo que as empresas se adaptem rapidamente e, possivelmente, expandam as suas frotas para explorar novos mercados. Esta imprevisibilidade exige uma rede de reparação e manutenção robusta, capaz de responder a mudanças rápidas. Os estaleiros navais dos EUA que oferecem serviços flexíveis e responsivos são cruciais para garantir a prontidão da frota num ambiente volátil, aumentando assim a sua importância no ecossistema marítimo. A capacidade de adaptação a mudanças geopolíticas não só garante um fluxo constante de negócios para serviços de reparação, como também reforça a resiliência geral da indústria marítima dos EUA.

Por exemplo,

- Em novembro de 2020, de acordo com um artigo publicado pela Elsevier BV, o comércio marítimo e o acesso a territórios de águas profundas são cruciais para o sucesso económico de uma nação, sendo que aproximadamente 75% do comércio internacional é conduzido pelo mar devido à sua eficiência de combustível. Questões de geografia económica, como a ausência de litoral, impactam diretamente os padrões de desenvolvimento global. A participação de um país no comércio internacional e a sua capacidade de transportar mercadorias são vitais na economia global de hoje. Este estudo examina a ligação entre cinco factores-chave de dependência marítima e prosperidade económica, revelando uma correlação significativa entre a dependência marítima e o PIB per capita, levando à criação de um Índice de Dependência Marítima mapeado geograficamente.

A interação entre o aumento do volume de envios, o envelhecimento da frota, os avanços tecnológicos, a conformidade regulamentar e os fatores geopolíticos impulsionam coletivamente o crescimento do mercado de serviços de manutenção e reparação de navios dos EUA. À medida que estas dinâmicas evoluem, apresentam oportunidades contínuas de inovação e investimento neste setor crítico.

- Frota envelhecida de navios nos EUA

À medida que muitos navios em operação atingem ou excedem a sua vida útil prevista, a necessidade de serviços de reparação e manutenção abrangentes torna-se cada vez mais urgente. As embarcações mais antigas geralmente requerem manutenção mais frequente devido ao desgaste. Componentes como motores, cascos e equipamentos de segurança deterioram-se com o tempo, exigindo inspeções e reparações regulares para garantir a segurança e a eficiência operacional. Esta procura crescente por serviços de reparação significa que os estaleiros estão a registar um aumento no número de pedidos de docagem seca e trabalhos de manutenção de rotina. Como as embarcações antigas necessitam frequentemente de estar em conformidade com normas regulamentares atualizadas, isto intensifica ainda mais a necessidade de serviços de manutenção especializados, adaptados a tecnologias mais antigas.

O setor marítimo é regido por rigorosas regulamentações ambientais e de segurança. À medida que os navios envelhecem, precisam de ser atualizados ou reparados para cumprir estes padrões em evolução. Por exemplo, as embarcações mais antigas podem necessitar de modernização com tecnologias modernas de controlo de emissões ou equipamentos de segurança. As complexidades envolvidas na garantia da conformidade com estas regulamentações significam que os operadores de navios recorrem frequentemente a serviços de reparação especializados, gerando assim uma procura consistente para o mercado de reparação de navios. Isto cria um nicho para as empresas que podem fornecer experiência em conformidade regulamentar e atualizações de segurança, reforçando a importância dos serviços de reparação de navios na manutenção da integridade da frota.

Manter uma frota antiga exige, geralmente, competências e conhecimentos específicos, principalmente para reparações que envolvem tecnologias ultrapassadas. A mão-de-obra qualificada é essencial para equipar navios mais antigos com componentes modernos ou reparar sistemas especializados que podem já não estar em produção. Como resultado, a procura por formação e desenvolvimento da força de trabalho em estaleiros cresce, alimentando ainda mais o mercado de serviços de reparação. As empresas que investem na formação da sua força de trabalho para lidar com as complexidades de embarcações mais antigas, provavelmente ganharão uma vantagem competitiva, posicionando-se como líderes neste nicho de mercado.

Embora as embarcações antigas criem procura por serviços de reparação, também apresentam oportunidades de modernização. Muitos armadores procuram prolongar a vida útil das suas embarcações através de atualizações, como a instalação de sistemas de eficiência energética ou a modernização para conformidade com as novas regulamentações ambientais. Esta tendência não só exige serviços de reparação, como também abre caminhos para a inovação no mercado. As empresas que oferecem soluções de modernização encontrarão maiores oportunidades de colaborar com os proprietários de embarcações, procurando equilibrar a relação custo-benefício com a conformidade regulamentar.

Por exemplo,

- Em maio de 2023, de acordo com um artigo publicado pelo gCaptain, os navios de carga envelhecidos, com uma média superior a 20 anos, representam riscos para a segurança das tripulações e do comércio global. Embora alguns navios possam durar 25 a 30 anos com manutenção adequada, muitos enfrentam problemas como a corrosão do casco e tecnologia ultrapassada. Desastres notáveis, como o naufrágio do El Faro em 2015 e do SS Marine Electric em 1983, realçam os perigos das embarcações negligenciadas. Apesar dos apelos para regulamentos mais rigorosos e modernização, os navios mais antigos continuam em funcionamento devido a factores económicos. As partes interessadas do setor devem dar prioridade à melhoria dos padrões de segurança e à eliminação gradual das embarcações antigas para proteger os trabalhadores marítimos.

A frota envelhecida de embarcações nos EUA é um importante impulsionador do mercado de serviços de reparação e manutenção de navios. A crescente frequência de reparações, a necessidade de conformidade regulamentar, a procura de competências especializadas e as oportunidades de modernização criam colectivamente um ambiente robusto para o crescimento neste sector. À medida que os operadores de navios enfrentam os desafios de manter uma frota envelhecida, a importância de serviços de reparação fiáveis só aumentará.

Oportunidade

- Adoção de tecnologias digitais avançadas, como a manutenção preditiva através de IoT e IA

A manutenção preditiva é uma revolução no setor marítimo, aproveitando os sensores IoT e IA para fornecer monitorização em tempo real das condições da embarcação. Estes sensores podem ser instalados em máquinas e sistemas críticos, recolhendo dados sobre temperatura, pressão, vibração e outras métricas de desempenho. Ao analisar estes dados utilizando algoritmos de IA, os operadores de navios podem identificar padrões que indicam possíveis falhas antes que estas ocorram. Por exemplo, se um sensor detetar vibrações anormais num motor, o sistema pode alertar as equipas de manutenção para investigarem antes que ocorra uma avaria. Esta abordagem de manutenção proativa não só minimiza reparações não planeadas e dispendiosas, como também permite aos operadores de navios programar a manutenção durante janelas operacionais ideais, reduzindo assim o tempo de inatividade. Para os estaleiros, isto significa um fluxo de trabalho mais previsível, permitindo-lhes alocar os recursos de forma mais eficaz. Em vez de responder de forma reativa a pedidos de reparação de emergência, os estaleiros podem planear os seus horários em torno de necessidades de manutenção conhecidas, o que resulta numa maior eficiência e maior produtividade. Esta transformação pode também aumentar a satisfação do cliente, uma vez que os navios podem ser reparados de forma mais rápida e fiável.

A implementação de tecnologias de manutenção preditiva pode levar a poupanças significativas de custos a todos os níveis. Para os operadores de navios, a redução da frequência das reparações não planeadas traduz-se diretamente em menores despesas operacionais. As reparações de emergência geralmente acarretam custos inflacionados devido à necessidade de resposta rápida, horas de trabalho extra e possíveis perdas devido ao tempo de inatividade da embarcação. Ao mudar para um modelo de manutenção preditiva, as empresas podem otimizar os horários de manutenção com base em dados reais, em vez de verificações ou suposições de rotina. Para os estaleiros, esta mudança tecnológica representa também uma oportunidade para aumentar a produtividade sem um aumento correspondente dos custos indiretos. Ao otimizar as operações e melhorar a eficiência do processo de reparação, os estaleiros podem lidar com mais trabalhos em simultâneo, aumentando a sua rentabilidade.

Por exemplo,

- Em março de 2023, de acordo com um artigo publicado pela SINAY SAS, a indústria marítima está a assistir a inovações tecnológicas significativas destinadas a aumentar a sustentabilidade e a eficiência. Os principais avanços incluem robótica para manuseamento automatizado de cargas, análise de big data para otimizar rotas e reduzir emissões, e IoT para monitorização em tempo real e manutenção preditiva. A IA e a computação em nuvem estão a simplificar as operações, enquanto os navios autónomos prometem maior segurança e redução de custos. Além disso, as práticas de transporte ecológico, as soluções de energia renovável e a tecnologia blockchain estão a aumentar a transparência e a eficiência. Apesar destes avanços, desafios como a conformidade regulamentar, os riscos cibernéticos e a lacuna de competências continuam a ser preocupações críticas para a indústria

A adoção de tecnologias digitais avançadas, como a manutenção preditiva através de IoT e IA, apresenta oportunidades substanciais para o mercado de serviços de manutenção e reparação de navios dos EUA. Ao melhorar as práticas de manutenção, melhorar a segurança e a conformidade, permitir a tomada de decisões baseadas em dados e proporcionar uma vantagem competitiva, estas tecnologias estão prontas para transformar o setor. Adotar esta mudança digital será crucial para os estaleiros que procuram prosperar num cenário cada vez mais competitivo, posicionando-os para um crescimento sustentado e inovação.

Restrições/Desafios

- Regulamentação ambiental rigorosa relativa à gestão de resíduos e ao controlo de emissões

As regulamentações são essenciais para promover a sustentabilidade e proteger os ambientes marinhos, mas impõem desafios consideráveis aos estaleiros e às instalações de reparação. A necessidade de cumprir com regulamentos ambientais cada vez mais rigorosos exige frequentemente investimentos significativos de instalações de reparação de navios. Os estaleiros devem implementar sistemas avançados de gestão de resíduos para lidar com materiais perigosos, incluindo óleo, tinta e produtos químicos. Além disso, as tecnologias de controlo de emissões, como os depuradores e outros sistemas de filtragem, são geralmente necessárias para minimizar os poluentes libertados durante as atividades de reparação. Estas medidas de conformidade envolvem despesas de capital e custos operacionais substanciais, o que pode sobrecarregar os recursos financeiros dos estaleiros, especialmente os de menor dimensão. Como resultado, o custo global dos serviços de reparação pode aumentar, desencorajando potencialmente os armadores de optarem por trabalhos de manutenção.

As regulamentações ambientais podem impor restrições operacionais às instalações de reparação de navios. Por exemplo, as orientações rigorosas sobre o ruído, a qualidade do ar e as descargas de água podem limitar os tipos de reparações que podem ser realizadas ou as horas em que os trabalhos podem ocorrer. Estas restrições podem levar a tempos de resposta mais longos para trabalhos de reparação, afetando a eficiência e a capacidade dos estaleiros. Consequentemente, os operadores de navios podem enfrentar atrasos para colocar os seus navios novamente em serviço, o que pode perturbar os seus horários operacionais e afetar os seus resultados financeiros.

O cenário regulamentar em torno das questões ambientais é dinâmico e pode mudar rapidamente, levando ao aumento da responsabilidade dos estaleiros navais. O não cumprimento das regulamentações ambientais pode resultar em multas pesadas, processos judiciais e danos à reputação. Os estaleiros precisam de investir em formação e sistemas para garantir a conformidade, aumentando os custos operacionais. Este risco elevado pode impedir investimentos em expansão ou inovação, uma vez que os estaleiros priorizam a conformidade em detrimento do crescimento, limitando a sua capacidade de adaptação às mudanças do mercado.

Por exemplo,

- De acordo com um artigo publicado pela Academia Nacional de Ciências, o Comité de Controlo da Poluição a Bordo, estabelecido pelo Conselho de Estudos Navais, examinou a conformidade da Marinha dos EUA com o Anexo V da MARPOL referente aos resíduos sólidos não alimentares. Embora os navios de guerra estejam isentos da MARPOL, a legislação dos EUA exige conformidade. O comité avaliou a viabilidade técnica de eliminar descargas de resíduos sólidos até 2000 para navios de superfície e 2008 para submarinos, com foco nas tecnologias de gestão de resíduos. As recomendações incluem a utilização de compactadores, trituradores e incineradores modernos para reduzir o volume de resíduos e melhorar a conformidade, apesar dos desafios relacionados com o equipamento e das limitações de espaço

As regulamentações ambientais rigorosas relacionadas com a gestão de resíduos e o controlo de emissões impõem restrições significativas ao mercado de serviços de manutenção e reparação de navios dos EUA. Os elevados custos de conformidade, as limitações operacionais, o aumento da responsabilidade e as desvantagens competitivas desafiam coletivamente a rentabilidade e a sustentabilidade dos estaleiros navais dos EUA. À medida que o setor lida com estas complexidades, encontrar um equilíbrio entre conformidade e eficiência operacional será crucial para o crescimento futuro.

- Falta de mão-de-obra qualificada na indústria de reparação naval dos EUA

À medida que a procura por serviços de reparação continua a aumentar — impulsionada por factores como o envelhecimento da frota, o aumento dos investimentos militares e o ressurgimento da indústria de cruzeiros — os estaleiros navais estão a lutar para encontrar e reter trabalhadores qualificados, capazes de satisfazer estas demandas. O setor da reparação naval exige uma vasta gama de competências especializadas, incluindo soldadura, trabalho elétrico, manutenção mecânica e arquitetura naval. No entanto, muitos trabalhadores qualificados estão a reformar-se, e não tem havido investimento suficiente em programas de formação e aprendizagem para os substituir. Esta lacuna resultou numa escassez de mão-de-obra experiente, obrigando os estaleiros a operar com capacidade reduzida ou a comprometer a qualidade dos seus serviços. O desafio é agravado pela concorrência de outros setores, como a construção e a indústria transformadora, que também procuram mão-de-obra qualificada, mas geralmente oferecem melhores salários e benefícios.

A escassez de mão-de-obra qualificada afeta diretamente a eficiência operacional dos estaleiros. Com menos trabalhadores qualificados disponíveis, os estaleiros navais podem enfrentar tempos de resposta mais longos para projetos de reparação, o que leva a atrasos no regresso dos navios ao serviço. Esta ineficiência pode resultar na perda de oportunidades de negócio, uma vez que os armadores podem procurar serviços noutros locais, principalmente em regiões ou países com mão-de-obra qualificada mais facilmente disponível. Além disso, os horários prolongados dos projetos podem levar ao aumento dos custos para os estaleiros, uma vez que podem precisar de fazer horas extraordinárias ou contratar trabalhadores temporários, o que pode afetar a rentabilidade.

A resolução da lacuna de competências exige investimentos significativos em programas de formação e desenvolvimento, algo que muitos estaleiros podem ter dificuldade em pagar. O desenvolvimento de programas de formação abrangentes requer tempo e recursos, e os estaleiros mais pequenos podem não ter capacidade financeira para implementar estas iniciativas de forma eficaz. Além disso, atrair novos talentos para o setor pode ser desafiante, uma vez que as gerações mais jovens podem percecionar a reparação naval como uma opção de carreira menos atrativa em comparação com outros campos de alta tecnologia.

A falta de mão-de-obra qualificada também levanta preocupações sobre a garantia de qualidade na reparação de navios. Os trabalhadores com formação inadequada podem não conseguir realizar reparações de acordo com os padrões exigidos, aumentando o risco de acidentes e problemas de conformidade. Isto não só põe em risco a segurança da tripulação e dos passageiros, como também pode levar a repercussões jurídicas e financeiras dispendiosas para os estaleiros navais. É provável que os armadores procurem instalações de reparação com reputação de trabalho de alta qualidade, colocando pressão adicional sobre os estaleiros que enfrentam escassez de mão-de-obra.

Por exemplo,

- Em junho de 2024, de acordo com um artigo publicado pelo International Transport Journal, o setor marítimo enfrenta uma escassez significativa de mão-de-obra qualificada, agravada pelos avanços tecnológicos e pelos novos métodos de propulsão. Numa conferência recente em Berlim, organizada pela Associação Alemã de Armadores e pela Associação Náutica Alemã, os especialistas discutiram os desafios do recrutamento. Apesar de um aumento de 11% de novos ingressantes em 2023, a Bimco e a ICS estimam uma necessidade de quase 18.000 oficiais anualmente até 2026. Líderes da indústria como Erik Hirsch da Hapag-Lloyd enfatizam a necessidade de investir em formação e digitalização para aumentar a eficiência e atrair jovens talentos , vital para uma indústria marítima competitiva

A falta de mão-de-obra qualificada no setor de reparação naval dos EUA representa um desafio substancial para o mercado de serviços de manutenção e reparação naval. Esta escassez afecta a eficiência operacional, a garantia de qualidade e a capacidade dos estaleiros para satisfazer a procura crescente. Abordar estas questões através de iniciativas de formação direcionadas e estratégias de recrutamento melhoradas será crucial para o crescimento e a sustentabilidade do setor no futuro. Sem uma força de trabalho qualificada, os estaleiros navais dos EUA podem ter dificuldades em manter a competitividade num mercado cada vez mais exigente.

Impacto e cenário atual do mercado de escassez de matéria-prima e atrasos no envio

A Data Bridge Market Research oferece uma análise de alto nível do mercado e fornece informações tendo em conta o impacto e o ambiente atual do mercado de escassez de matérias-primas e atrasos nas remessas. Isto traduz-se em avaliar possibilidades estratégicas, criar planos de ação eficazes e auxiliar as empresas na tomada de decisões importantes.

Além do relatório padrão, também oferecemos uma análise aprofundada do nível de aquisição, desde atrasos previstos de expedição, mapeamento de distribuidores por região, análise de commodities, análise de produção, tendências de mapeamento de preços, sourcing, análise de desempenho de categoria, soluções avançadas de gestão de risco da cadeia de abastecimento.

Impacto esperado da desaceleração económica nos preços e na disponibilidade dos produtos

Quando a atividade económica abranda, as indústrias começam a sofrer. Os efeitos previstos da crise económica nos preços e na acessibilidade dos produtos são tidos em conta nos relatórios de informação de mercado e nos serviços de informações fornecidos pelo DBMR. Com isto, os nossos clientes conseguem geralmente manter-se um passo à frente dos seus concorrentes, projetar as suas vendas e receitas e estimar as suas despesas com lucros e perdas.

Âmbito de mercado dos serviços de reparação e manutenção de navios

O mercado é segmentado com base na embarcação, tipo de serviço, aplicação e utilizador final. O crescimento entre estes segmentos irá ajudá-lo a analisar segmentos de baixo crescimento nos setores e fornecerá aos utilizadores uma visão geral e informações valiosas do mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Navio

- Navios-cisterna de petróleo e produtos químicos

- Navios porta-contentores

- Transportadores de granéis secos

- Carga Geral

- Carruagem de gás

- Navios de passageiros

- Navios frigoríficos

- Outros

Tipo de serviço

- Manutenção

- Manutenção, Por Tipo de Serviço

- Manutenção preventiva

- Manutenção de condições

- Manutenção de avarias

- Manutenção, Por Tipo de Serviço

- Reparar

- Reparação, por tipo de serviço

- Reparações de emergência

- Reparos Mecânicos

- Reparações Elétricas e de Instrumentação

- Manutenção e reparações do motor principal

- Reparações de rebobinagem de motor

- Limpeza e reparações subaquáticas

- Outros

- Reparação, por tipo de serviço

Aplicação

- Atracação

- Atracação, por navio

- Navios-cisterna de petróleo e produtos químicos

- Navios porta-contentores

- Transportadores de granéis secos

- Carga Geral

- Carruagem de gás

- Navios de passageiros

- Navios frigoríficos

- Outros

- Atracação, por navio

- Peças do motor

- Peças de motor, por embarcação

- Navios-cisterna de petróleo e produtos químicos

- Navios porta-contentores

- Transportadores de granéis secos

- Carga Geral

- Carruagem de gás

- Navios de passageiros

- Navios frigoríficos

- Outros

- Peças de motor, por embarcação

- Serviços Gerais

- Serviços Gerais, Por Embarcação

- Navios-cisterna de petróleo e produtos químicos

- Navios porta-contentores

- Transportadores de granéis secos

- Carga Geral

- Carruagem de gás

- Navios de passageiros

- Navios frigoríficos

- Outros

- Serviços Gerais, Por Embarcação

- Trabalhos elétricos e serviços auxiliares

- Obras elétricas e serviços auxiliares, por embarcação

- Navios de passageiros

- Navios frigoríficos

- Navios-cisterna de petróleo e produtos químicos

- Navios porta-contentores

- Transportadores de granéis secos

- Carga Geral

- Carruagem de gás

- Outros

- Obras elétricas e serviços auxiliares, por embarcação

- Outros

- Outros, Por Embarcação

- Navios-cisterna de petróleo e produtos químicos

- Navios porta-contentores

- Carga Geral

- Transportadores de granéis secos

- Carruagem de gás

- Navios de passageiros

- Navios frigoríficos

- Outros

- Outros, Por Embarcação

Utilizador final

- Governo e Defesa

- Comercial

Participação no mercado de serviços de reparação e manutenção de navios

O cenário competitivo do mercado fornece detalhes por concorrentes. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença no país, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento do produto, amplitude e abrangência do produto, aplicação domínio. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas em relação ao mercado.

Os líderes de mercado em serviços de reparação e manutenção de navios que operam no mercado são:

- BAE Systems (EUA)

- General Dynamics NASSCO (EUA)

- Fincantieri Marine Group (EUA)

- Vigor Industrial, Lda. (NÓS)

- Epsilon Systems Solutions, INC (EUA)

- Bludworth Marine, LLC (EUA)

- Estaleiro Colonna, INC (EUA)

- Estaleiros Conrad (EUA)

- Estaleiros Detyens (EUA)

- Gulf Copper & Manufacturing Corporation (EUA)

- HSD Marine e Shiprepair Pte LTD. (Singapura)

Últimos desenvolvimentos no mercado de serviços de manutenção e reparação de navios dos EUA

- Em outubro de 2024, a BAE Systems recebeu um contrato de 92 milhões de dólares da Marinha dos EUA para produzir propulsores para submarinos da classe Virginia. Este contrato irá aumentar as capacidades da empresa em tecnologias submarinas avançadas e reforçar a sua posição no setor da defesa, contribuindo para o crescimento e inovação contínuos, ao mesmo tempo que apoia as iniciativas de segurança nacional.

- Em maio, a BAE Systems homenageou os seus principais fornecedores de reparação naval de 2023, reconhecendo o seu papel fundamental na entrega de qualidade e desempenho nos serviços marítimos. O evento realçou a importância de parcerias fortes para alcançar a excelência operacional. Ao reconhecer estes fornecedores, a BAE Systems reforça o seu compromisso com a colaboração e inovação no setor da reparação naval, garantindo que continuam a satisfazer as necessidades em evolução dos seus clientes e a melhorar a prestação global de serviços.

- Em outubro de 2023, a General Dynamics NASSCO recebeu um contrato da Marinha dos EUA, avaliado em até 754 milhões de dólares, para a manutenção, modernização e reparação do USS Chung-Hoon e do USS James E. Williams. A fase inicial, avaliada em 15,6 milhões de dólares, terá lugar em Norfolk e San Diego, com possíveis extensões até novembro de 2030, reforçando ainda mais as capacidades de serviço de reparação naval da NASSCO.

- Em julho de 2023, a Fincantieri Bay Shipbuilding e a Northeast Wisconsin Technical College estão a expandir a sua parceria para melhorar a formação da força de trabalho marítima. Após um programa piloto bem-sucedido, oferecerão mais cursos para satisfazer a crescente procura de profissionais qualificados na indústria de fabrico marítimo

- Em setembro de 2022, a Fincantieri Bay Shipbuilding deu início à construção de uma nova oficina mecânica de 19.000 pés quadrados em Sturgeon Bay. A instalação irá melhorar as operações de reparação com infraestruturas modernas, apoiando a frota dos Grandes Lagos e minimizando os impactos ambientais para a comunidade circundante

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.