Us Self Checkout Systems Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

1.45 Billion

USD

4.06 Billion

2024

2032

USD

1.45 Billion

USD

4.06 Billion

2024

2032

| 2025 –2032 | |

| USD 1.45 Billion | |

| USD 4.06 Billion | |

|

|

|

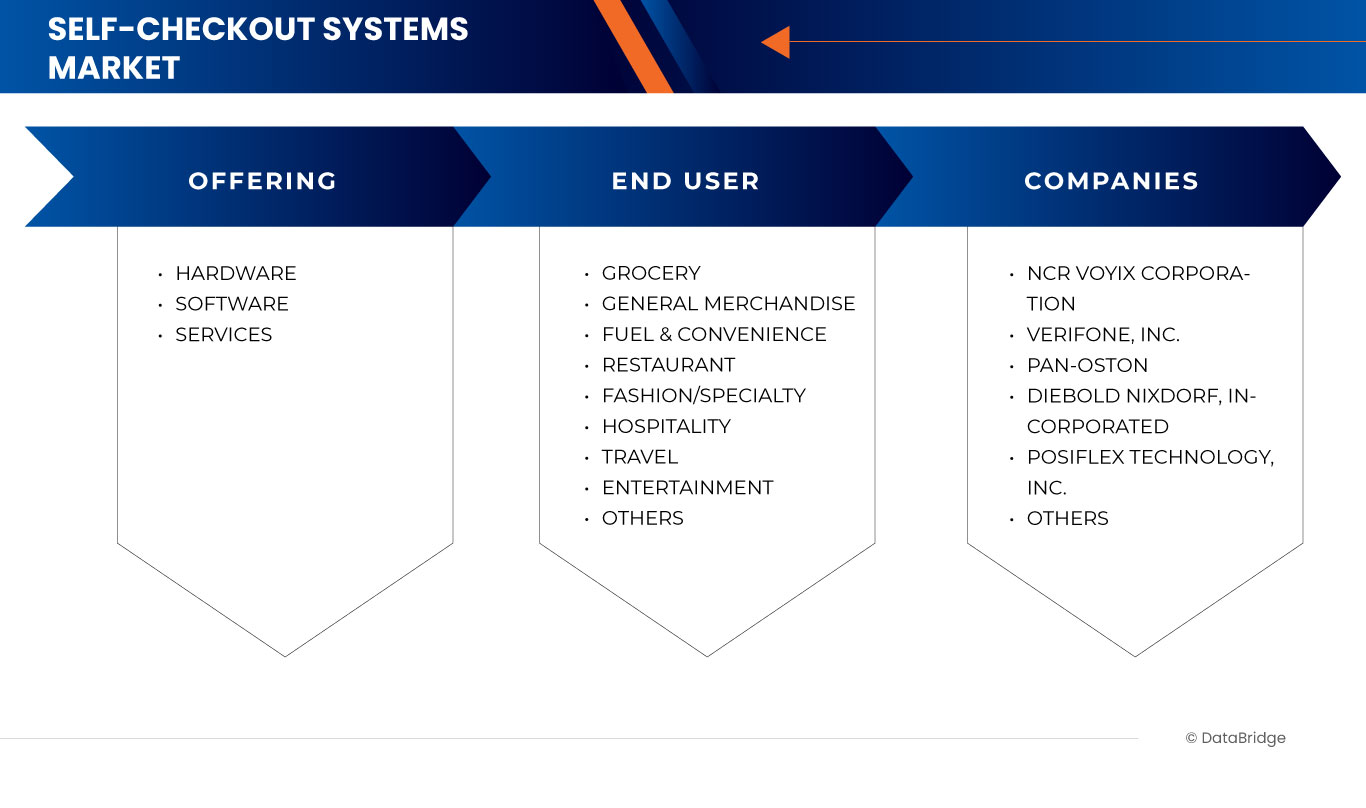

U.S. Self-Checkout Systems Market, By Offering (Hardware, Software, and Services), End User (Grocery, General Merchandise, Fuel & Convenience, Restaurant, Fashion/Specialty, Hospitality, Travel, Entertainment, and Others) - Industry Trends and Forecast to 2031.

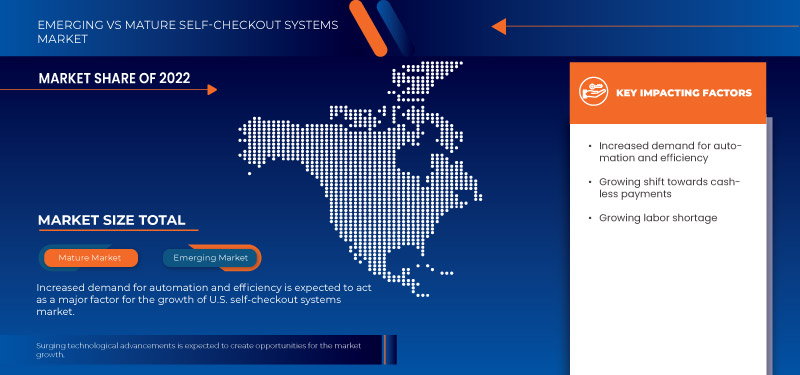

U.S. Self-Checkout Systems Market Analysis and Insights

U.S. self-checkout systems market is driven by several factors including increased demand for automation and efficiency, a growing shift towards cashless payments, and a notable labor shortage. However, rising security concerns regarding digital payments and the high initial investment coupled with hidden costs pose significant restraints to market growth. Nonetheless, the market presents opportunities driven by surging technological advancements, enabling data-driven optimization and omni-channel integration. Despite these opportunities, challenges persist, such as difficulties in handling certain items and customer resistance to self-checkout processes, requiring innovative solutions to address them effectively.

Data Bridge Market Research analyzes that U.S. self-checkout systems market is expected to reach USD 3.57 billion by 2031 from USD 1.31 billion in 2023, growing with a substantial CAGR of 13.7% in the forecast period of 2024 to 2031.

|

Report Metric |

Details |

|

Forecast Period |

2024 to 2031 |

|

Base Year |

2023 |

|

Historic Years |

2022 (Customizable to 2016–2021) |

|

Quantitative Units |

Revenue in USD Billion |

|

Segments Covered |

Offering (Hardware, Software, and Services), End User (Grocery, General Merchandise, Fuel & Convenience, Restaurant, Fashion/Specialty, Hospitality, Travel, Entertainment, and Others) |

|

Market Players Covered |

NCR Voyix Corporation, Diebold Nixdorf, Incorporated, Toshiba Global Commerce Solutions, VeriFone, Inc., Posiflex Technology, Inc., Invenco Group Ltd., ECR Software Corporation, 365 Retail Markets, Caper, and Pan-Oston among others |

Market Definition

Self-checkout systems are automated machines in retail environments that allow customers to scan, bag, and pay for their purchases without the assistance of a cashier. These systems typically consist of a touchscreen interface, barcode scanner, weighing scale, and payment terminal, enabling users to complete transactions independently. They offer convenience, speed, and efficiency for both customers and retailers. In the U.S. market, self-checkout systems encompass a range of hardware and software solutions tailored to various retail sectors, including grocery stores, convenience stores, department stores, and DIY retailers, aiming to streamline the checkout process and enhance the overall shopping experience.

U.S. Self-Checkout Systems Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Driver

- Increased Demand for Automation and Efficiency

The growing emphasis on automation and efficiency in retail operations is fuelling the expansion of the U.S. self-checkout systems market. Leveraging advanced technologies and catering to the evolving needs of retailers and consumers, self-checkout solution providers can capitalize on this trend to drive adoption and market penetration. A focus on delivering seamless, user-friendly experiences and addressing key challenges such as security and reliability, self-checkout systems have the potential to transform the retail landscape and drive sustainable growth in the years to come.

Restraint

- Rising Security Concerns

The escalating security concerns surrounding self-checkout systems pose a significant restraint for the U.S. self-checkout systems market. As evidenced by increasing instances of theft and fraud, coupled with consumer perceptions and technological challenges, businesses face mounting pressure to address these issues effectively. While self-checkout offers undeniable benefits in terms of convenience and operational efficiency, the need to bolster security measures to mitigate risks is paramount. Retailers must navigate this delicate balance between convenience and security to ensure the sustained adoption and success of self-checkout systems in the U.S. market. Failure to address these concerns comprehensively may hinder market growth and erode consumer trust, underscoring the urgency for proactive strategies and innovative solutions to safeguard against security threats.

Opportunity

-

Surging Technological Advancements

Self-checkout technology continues to evolve rapidly, offering retailers innovative solutions to enhance customer experiences, improve operational efficiency, and drive sales growth. The surging technological advancements present a significant opportunity for the US self-checkout systems market. With innovations such as touchless payments, artificial intelligence, virtual reality, research, biometric authentication, and smart carts, self-checkout systems are poised to revolutionize the retail landscape. By leveraging these advanced technologies, retailers can enhance the customer experience, streamline operations, and drive sales growth. As consumer preferences continue to evolve towards digital convenience and efficiency, self-checkout systems equipped with cutting-edge technology will play a pivotal role in meeting these demands and staying competitive in the market.

Challenge

- Challenges in Handling Certain Items

The inability of self-checkout systems to accurately process certain items can result in increased instances of errors and theft, further complicating the checkout process for both customers and retailers. Retailers may incur losses due to unscanned or mispriced items, while customers may become dissatisfied with the overall reliability of self-checkout technology. Addressing these challenges requires innovative solutions, such as improved image recognition technology or redesigned checkout interfaces, to enhance the functionality and efficiency of self-checkout systems, ultimately improving customer satisfaction and driving market growth.

Recent Developments

- In March 2024, NCR Voyix Corporation commissioned a survey through Incisiv, revealing a significant rise in the adoption of self-checkout systems among retail executives. According to the findings, 43% of retailers already have mature self-checkout implementations, with an additional 17% scaling up their deployments. The adoption of self-checkout systems can help companies improve customer satisfaction, reduce costs, and stay competitive in the retail market

- In February 2024, Toshiba Global Commerce Solutions is showcasing innovative solutions at EuroCIS 2024 to empower retailers to transform operations and customer experiences. The solutions focus on unified commerce, self-service, and connected services, leveraging advanced technologies like A.I., computer vision, and edge computing. Toshiba enables retailers to thrive by resiliently evolving with consumers and adapting to market conditions

U.S. Self-Checkout Systems Market Scope

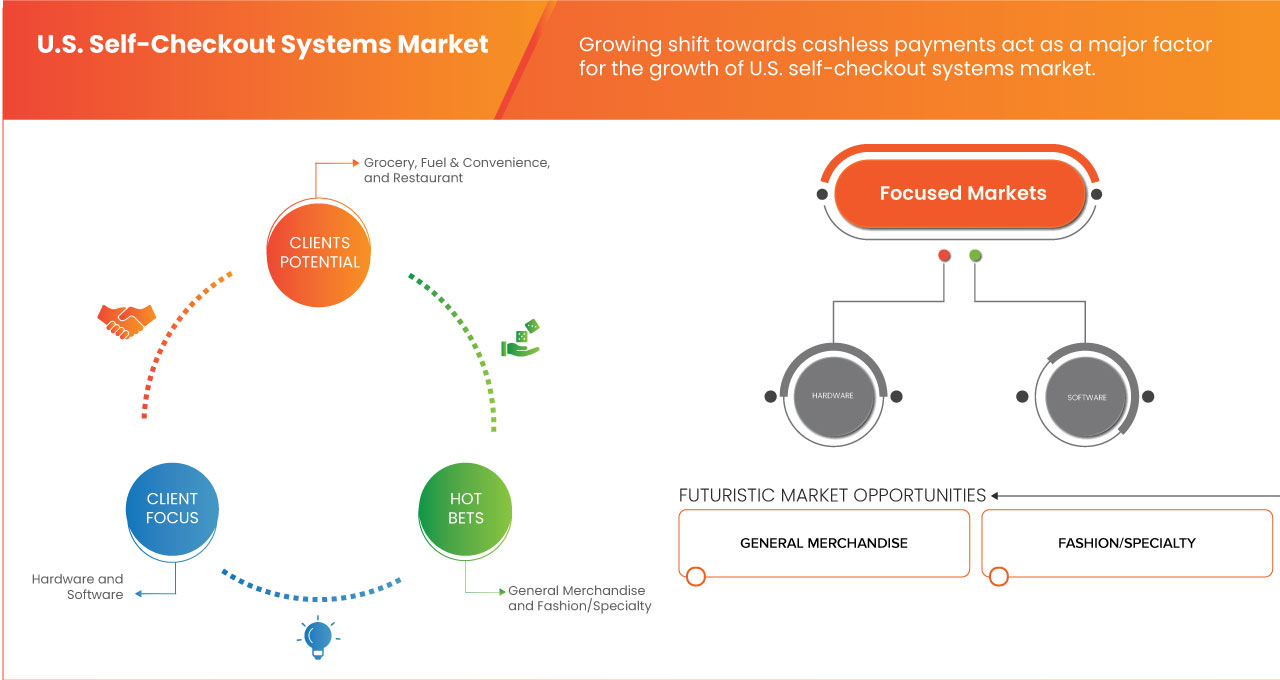

U.S. self-checkout systems market is segmented into two notable segments which are on the basis of offering and end user.

Offering

- Hardware

- Software

- Services

On the basis of offering, the U.S. self-checkout systems market is segmented into hardware, software, and services.

End User

- Grocery

- General Merchandise

- Fuel & Convenience

- Restaurant

- Fashion/Speciality

- Hospitality

- Travel

- Entertainment

- Others

On the basis of end user, the U.S. self-checkout systems market is segmented into grocery, general merchandise, fuel & convenience, restaurant, fashion/speciality, hospitality, travel, entertainment, and others.

Competitive Landscape and U.S. Self-Checkout Systems Market Share Analysis

U.S. self-checkout systems market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product approvals, product width and breadth, application dominance, and product type lifeline curve. The above data points provided are only related to the company’s focus on the U.S. self-checkout systems market.

Some of the major players operating in the U.S. self-checkout systems market are NCR Voyix Corporation, Diebold Nixdorf, Incorporated, Toshiba Global Commerce Solutions, VeriFone, Inc., Posiflex Technology, Inc., Invenco Group Ltd., ECR Software Corporation, 365 Retail Markets, Caper, and Pan-Oston among others.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.