Us Office Seating Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

8.48 Billion

USD

10.36 Billion

2024

2032

USD

8.48 Billion

USD

10.36 Billion

2024

2032

| 2025 –2032 | |

| USD 8.48 Billion | |

| USD 10.36 Billion | |

|

|

|

Segmentação do mercado de assentos de escritório nos EUA, por produto (cadeira, sofás, tapetes para cadeiras de escritório, acessórios e outros), material (plástico, metal, madeira, couro e outros), intervalo de preços (económico, médio, premium e luxo), fim Utilizador (Gabinetes Comerciais, Escolas e Universidades, Hospitais, Hotéis e Restaurantes, Pontos de Venda, Casas Residenciais e Outros), Canal de Distribuição (Retalho e Directo) – Tendências e Previsão do Sector até 2031.

Análise de mercado de assentos de escritório

Assentos de escritório A crescente procura de assentos para escritório em casa, impulsionada pelos modelos de trabalho híbridos, está a influenciar significativamente o mercado de assentos de escritório. Os acordos de trabalho híbridos, que combinam o trabalho remoto e o trabalho presencial, têm vindo a tornar-se cada vez mais populares à medida que as organizações procuram flexibilidade e um melhor equilíbrio entre a vida pessoal e profissional dos colaboradores. Esta mudança criou um mercado crescente para mobiliário de escritório doméstico de alta qualidade, especialmente soluções de assentos ergonómicos. À medida que as organizações e os colaboradores se tornam mais conscientes dos efeitos a longo prazo do trabalho sedentário e da ergonomia deficiente, a procura por soluções de assentos de escritório ergonómicas e saudáveis aumentou. O panorama dos escritórios modernos reconhece cada vez mais a ligação entre o design ergonómico e a saúde dos colaboradores. A maior consciencialização sobre os impactos na saúde também se reflete nos programas de bem-estar corporativo, que incorporam cada vez mais avaliações ergonómicas e investimentos em assentos de escritório de alta qualidade.

Tamanho do mercado de assentos de escritório

O tamanho do mercado de assentos de escritório dos EUA foi avaliado em 8,48 mil milhões em 2024 e está projetado para atingir 10,11 mil milhões de dólares até 2031, com um CAGR de 2,57% durante o período previsto de 2025 a 2031. Para além dos insights sobre os cenários de mercado, tais como o valor de mercado , a taxa de crescimento, a segmentação, a cobertura geográfica e os principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research incluem também análises aprofundadas de especialistas, análises de preços, análises de quota de marca, inquéritos aos consumidores, análises demográficas, análises da cadeia de abastecimento, análise da cadeia de valor, visão geral da matéria-prima/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e enquadramento regulamentar.

Tendências do mercado de assentos de escritório

“Aumento da procura de lugares para home office impulsionado por modelos de trabalho híbridos”

À medida que as empresas e os colaboradores adotam cada vez mais acordos de trabalho flexíveis que combinam trabalho remoto e presencial, há uma procura crescente por soluções de assentos para escritório em casa. Esta mudança está a transformar o cenário tradicional de mobiliário de escritório, com um foco notável em opções de assentos ergonómicos e versáteis, concebidos para aumentar o conforto e a produtividade num ambiente doméstico. Os modelos de trabalho híbridos exigem mobiliário de escritório que suporte longas horas de utilização e que acomode vários estilos de trabalho. Consequentemente, há uma maior ênfase nas cadeiras ergonómicas que oferecem características ajustáveis, apoio lombar e melhor alinhamento postural para evitar desconforto e tensão. Além disso, o apelo estético e a integração do mobiliário de escritório nos ambientes domésticos estão a tornar-se importantes, com muitos a optar por designs elegantes e funcionais que complementam a decoração das suas casas.

Os fabricantes estão a responder a estas necessidades inovando com novos materiais e tecnologias e oferecendo soluções personalizáveis que vão ao encontro de diversas preferências. À medida que o trabalho remoto continua a consolidar o seu lugar no panorama profissional, a procura por assentos ergonómicos e de alta qualidade para o escritório em casa deverá manter-se forte, impulsionando o crescimento no mercado de assentos para escritório.

Âmbito do Relatório e Segmentação do Mercado de Assentos de Escritório

|

Atributos |

Insights sobre o mercado de assentos de escritório |

|

Segmentos abrangidos |

|

|

Principais participantes do mercado |

Haworth, Inc. (EUA), Steelcase Inc. (EUA), HNI Corp. (EUA), KI (EUA), Herman Miller, Inc (EUA), LA-Z-BOY INCORPORATED (EUA), Teknion (Canadá), Português UCHIDA YOKO GLOBAL LIMITED / UCHIDA YOKO GLOBAL CO., LTD. (Hong Kong), OFS (EUA), Kinnarps AB (Suécia), OKAMURA CORPORATION (Japão), Humanscale (EUA), Itoki Corporation (Japão), Kimball International (EUA), Hooker Furniture (EUA), Flexsteel Industries, Inc. (EUA), JASPER GROUP (EUA), Wilkhahn Wilkening+Hahne GmbH+Co. KG (Alemanha), Fursys Inc. (Coreia do Sul), Virco Inc. (EUA), Groupe Lacasse (Canadá), Affordable Interior Systems (EUA), ACTIU Berbegal y Formas SA (Espanha), Berco Designs (EUA), UPLIFT DESK (EUA), HOWE-MOVING DESIGN (Dinamarca), Trendway Corporation (EUA), Great Openings (EUA) e INTER IKEA SYSTEMS BV (Holanda), entre outros |

|

Oportunidades de Mercado |

|

|

Conjuntos de informações de dados de valor acrescentado |

Para além dos insights sobre os cenários de mercado, tais como o valor de mercado, a taxa de crescimento, a segmentação, a cobertura geográfica e os principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research incluem também análises aprofundadas de especialistas, análises de preços, análises de quota de marca, inquérito ao consumidor, análise demográfica, análise da cadeia de abastecimento, análise da cadeia de valor, visão geral da matéria-prima/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e enquadramento regulamentar . |

Definição de mercado de assentos de escritório

O mercado de assentos de escritório abrange a oferta e a procura de vários tipos de cadeiras de escritório e soluções de assentos, incluindo cadeiras de trabalho, cadeiras executivas, cadeiras de conferência e modelos ergonómicos. Inclui produtos concebidos para conforto, funcionalidade e apelo estético em ambientes de trabalho. Este mercado serve empresas de todas as dimensões, desde pequenas startups a grandes corporações, e é influenciado pelas tendências no design do local de trabalho, inovações ergonómicas e a crescente ênfase no bem-estar dos colaboradores. A dinâmica do mercado é impulsionada por factores como os avanços tecnológicos, as condições económicas e os estilos de trabalho em evolução.

Dinâmica do mercado de assentos de escritório

Motoristas

- Aumento da procura de lugares para home office impulsionado por modelos de trabalho híbridos

A crescente procura de lugares para escritórios em casa, impulsionada pelos modelos de trabalho híbridos, está a influenciar significativamente o mercado de lugares para escritórios nos EUA. Os acordos de trabalho híbridos, que combinam o trabalho remoto e o trabalho presencial, têm vindo a tornar-se cada vez mais populares à medida que as organizações procuram flexibilidade e um melhor equilíbrio entre a vida pessoal e profissional dos colaboradores. Esta mudança criou um mercado crescente para mobiliário de escritório doméstico de alta qualidade, especialmente soluções de assentos ergonómicos. À medida que mais colaboradores trabalham em casa, há uma necessidade crescente de configurações de escritório em casa confortáveis e funcionais. A tradicional cadeira de escritório está a ser substituída por assentos de escritório mais sofisticados, concebidos para uma utilização prolongada, refletindo um maior foco na ergonomia e no bem-estar. Os colaboradores estão agora a investir em cadeiras que oferecem características ajustáveis, apoio lombar e materiais duráveis para imitar o conforto e o suporte dos ambientes de escritório. Além disso, o aumento dos modelos de trabalho híbridos levou ao aumento dos gastos com a configuração de escritório em casa, aumentando a procura por diversas opções de assentos, desde cadeiras de trabalho a cadeiras de estilo executivo. Este mercado crescente está também a atrair novos participantes e inovações, com os fabricantes a oferecerem características avançadas, como tecnologia integrada e designs personalizáveis.

Por exemplo,

De acordo com um artigo publicado pela Steelcase Inc., a investigação da Steelcase mostra que os modelos de trabalho híbridos, que ganharam força durante a pandemia, são agora amplamente adotados, com 89% dos líderes empresariais globais a esperar oferecer opções híbridas. Os colaboradores valorizam a flexibilidade de trabalhar remotamente, com 78% a desejar opções contínuas de trabalho remoto. A Steelcase sublinha que uma abordagem de trabalho híbrido bem concebida deve equilibrar o trabalho presencial e remoto, proporcionando escolha e controlo, mantendo ao mesmo tempo a cultura organizacional. Os seus estudos revelam que o trabalho híbrido eficaz requer espaços que promovam o foco, a colaboração e o bem-estar dos colaboradores, tornando o escritório uma opção atrativa e funcional.

- Maior consciencialização sobre os impactos na saúde

À medida que as organizações e os colaboradores se tornam mais conscientes dos efeitos a longo prazo do trabalho sedentário e da ergonomia deficiente, a procura por soluções de assentos de escritório ergonómicas e saudáveis aumentou. O panorama dos escritórios modernos reconhece cada vez mais a ligação entre o design ergonómico e a saúde dos colaboradores. Estar sentado durante muito tempo em cadeiras não ergonómicas tem sido associado a uma série de problemas de saúde, incluindo distúrbios músculo-esqueléticos, dores nas costas e má postura. Isto levou a uma ênfase crescente no mobiliário de escritório que promove uma postura adequada e reduz o esforço físico. Como resultado, as cadeiras de escritório ergonómicas — concebidas para oferecer ajuste, apoio lombar e melhor alinhamento postural — tornaram-se muito procuradas.

A maior consciencialização sobre os impactos na saúde também se reflete nos programas de bem-estar corporativo, que incorporam cada vez mais avaliações ergonómicas e investimentos em assentos de escritório de alta qualidade. As empresas estão a reconhecer que investir na saúde dos colaboradores pode levar à redução do absentismo, ao aumento da produtividade e a uma melhor satisfação geral no trabalho.

Por exemplo,

- Em agosto de 2024, de acordo com um artigo publicado pela Wirecutter, as melhores cadeiras de escritório enfatizam a mudança para designs ergonómicos impulsionados por uma maior consciencialização sobre a saúde. As escolhas em destaque incluem o Steelcase Gesture pela sua excecional capacidade de ajuste e conforto, o Herman Miller Aeron pela sua respirabilidade e durabilidade, e o Herman Miller Sayl pelo seu design único e suporte a um preço mais baixo. O económico HON Ignition 2.0 é conhecido por oferecer bons ajustes e conforto por menos de 500 dólares. Estas recomendações refletem a crescente procura de mobiliário de escritório que promova a saúde e a produtividade a longo prazo.

Oportunidades

- Aumentar a consciencialização sobre a sustentabilidade para oferecer opções de assentos de escritório ecológicos

O crescente foco na sustentabilidade representa uma oportunidade de crescimento significativa para o mercado de assentos de escritório dos EUA. À medida que as preocupações ambientais se tornam mais proeminentes, as empresas estão sob crescente pressão para adotar práticas sustentáveis, incluindo a escolha de mobiliário de escritório. Esta tendência é impulsionada por uma combinação de requisitos regulamentares, como a Agência de Proteção Ambiental (EPA), o Conselho de Construção Verde dos EUA (USGBC) e muitos outros, preferências dos consumidores e valores corporativos centrados na responsabilidade ambiental. No mercado de assentos de escritório dos EUA, as opções ecológicas incluem cadeiras feitas de materiais reciclados, madeira certificada como sustentável e acabamentos com baixo teor de COV. Os designs ergonómicos e modulares prolongam os ciclos de vida dos produtos, enquanto o fabrico com eficiência energética e as embalagens recicladas reduzem ainda mais o impacto ambiental. Certificações como GREENGUARD e Cradle to Cradle garantem a sustentabilidade. As cinco empresas americanas que fabricam cadeiras de escritório ecológicas incluem a Herman Miller, Steelcase, Humanscale, Knoll e HON.

Por exemplo,

De acordo com um artigo publicado pela Herman Mille, a empresa há muito que prioriza a administração ambiental, refletindo o seu compromisso com a sustentabilidade. Os principais marcos incluem atingir zero resíduos para aterros sanitários em 1993, tornar-se membro fundador da NextWave Plastics em 2018 para desenvolver cadeias de abastecimento de plástico destinadas ao oceano e lançar uma coleção de têxteis 100% reciclados em 2021. A cadeira Mirra da empresa valeu à Cradle o prémio Certificação Cradle, e as suas cadeiras Aeron e Sayl incorporam agora plásticos provenientes dos oceanos. Estas iniciativas sublinham a dedicação da Herman Miller em reduzir o impacto ambiental e, ao mesmo tempo, em satisfazer a crescente procura dos consumidores por soluções de escritório sustentáveis.

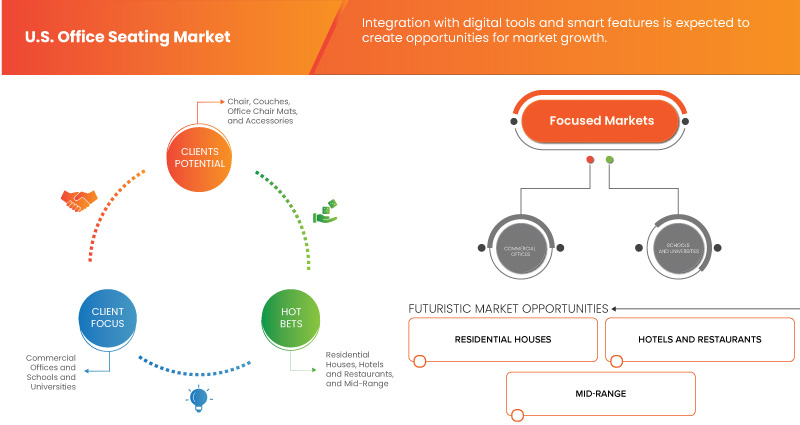

- Integração com ferramentas digitais e recursos inteligentes

A integração de ferramentas digitais e características inteligentes nos assentos de escritório representa uma oportunidade significativa para o mercado de assentos de escritório dos EUA. À medida que os ambientes de trabalho evoluem e a tecnologia continua a avançar, há uma procura crescente por mobiliário de escritório que não só forneça suporte ergonómico, mas também aumente a produtividade e o bem-estar através de tecnologia inteligente. As soluções de assentos inteligentes para escritórios integram ferramentas digitais, como sensores , conectividade e capacidades de ajuste que respondem às necessidades do utilizador em tempo real. Por exemplo, as cadeiras equipadas com sensores podem monitorizar e analisar a postura, alertando os utilizadores para ajustarem a sua posição sentada para evitar desconforto e melhorar a ergonomia. Alguns modelos até se ligam a aplicações móveis, permitindo aos utilizadores monitorizar os seus hábitos de sentar e receber recomendações personalizadas para uma melhor postura e movimento ao longo do dia.

Por exemplo,

- Em maio de 2023, de acordo com um artigo publicado pelo IEEE Xplore, uma cadeira de escritório padrão equipada para monitorizar parâmetros fisiológicos — como a postura, a temperatura corporal e a frequência respiratória — e fatores ambientais como a temperatura, humidade, níveis de CO2, ruído e luz . O sistema fornece dados em tempo real e recursos interativos para ajustar o conforto, aconselhar sobre pausas e reposicionamento. Testada com seis utilizadores, a cadeira atingiu 100% de precisão na deteção da postura e até 18% de erro nas medições fisiológicas, demonstrando o seu potencial para prevenir problemas relacionados com a postura e aumentar a produtividade.

Restrições/Desafios

- Interrupções na cadeia de abastecimento que afetam a disponibilidade atempada e os custos dos lugares de escritório

Certos assentos de escritório, como a oxibenzona e o octocrileno, têm suscitado preocupações devido aos seus potenciais impactos na saúde. Pesquisas indicaram que estes compostos podem ter efeitos desreguladores endócrinos, o que pode interferir com os sistemas hormonais nos humanos. Isto levou a um maior escrutínio e regulamentação, à medida que os consumidores se tornam mais conscientes dos potenciais riscos associados a estes produtos químicos. Consequentemente, a procura por assentos de escritório é impactada pela crescente preferência por produtos com ingredientes mais seguros e naturais. As questões ambientais também contribuem para a restrição do mercado de assentos de escritório. Descobriu-se que muitos assentos de escritório têm efeitos nocivos para os ecossistemas marinhos. Por exemplo, alguns produtos químicos podem contribuir para o branqueamento dos recifes de coral e prejudicar a vida aquática, causando impactos ambientais adversos. Isto levou a regulamentos mais rigorosos e a proibições de certos assentos de escritório em várias regiões, especialmente em locais com ambientes marinhos sensíveis. Estas preocupações ecológicas resultam em maiores custos de conformidade regulamentar e limitam a capacidade do mercado de utilizar determinados assentos de escritório, impactando o crescimento global do mercado.

Por exemplo,

- Em outubro de 2023, de acordo com um artigo publicado pela Truecommerce, a indústria do mobiliário enfrentou graves interrupções com encerramentos e aumento da procura, causando problemas significativos na cadeia de abastecimento. As fábricas tiveram dificuldades em acompanhar o aumento da procura de mobiliário para o lar, o que levou a grandes atrasos e confusão devido a vários reconhecimentos de ordens de compra e à escassez de matéria-prima. À medida que o setor se adaptava a um novo normal, a TrueCommerce Home ofereceu soluções como EDI e entrega direta para otimizar as operações, melhorando a visibilidade e aumentando a sua eficiência. Os retalhistas começaram a investir em tecnologia para gerir melhor as cadeias de abastecimento e satisfazer as crescentes expectativas dos consumidores.

Interrupções na cadeia de abastecimento que afetam a disponibilidade atempada e os custos dos lugares de escritório

À medida que a tecnologia evolui, evoluem também as expectativas em relação ao mobiliário de escritório, principalmente em relação à forma como se integra nos ambientes de trabalho modernos e suporta novas formas de trabalhar. Um dos principais desafios é a necessidade de assentos de escritório para acompanhar a crescente procura de designs ergonómicos e multifuncionais. Os locais de trabalho modernos estão a adotar cada vez mais arranjos de trabalho flexíveis, como mesas partilhadas e espaços colaborativos, o que exige soluções de assentos adaptáveis e personalizáveis. Os móveis não devem apenas oferecer conforto, mas também apoiar uma variedade de atividades, desde o trabalho tradicional de secretária até às reuniões colaborativas. A integração de características avançadas, como a conectividade integrada para dispositivos ou mecanismos de ajuste inteligentes, aumenta a complexidade e os custos para os fabricantes. Além disso, o aparecimento dos modelos de trabalho remoto e híbrido introduziu uma nova camada de competição. Os fabricantes de assentos de escritório precisam de inovar para atender tanto aos ambientes de escritório tradicionais como aos escritórios domésticos. Isto significa desenvolver produtos que sejam esteticamente agradáveis, mas funcionais para ambientes diversos, o que pode sobrecarregar os recursos e exigir investimentos significativos em investigação e desenvolvimento.

Por exemplo,

De acordo com um artigo publicado pela Steelcase Inc., o caso de estudo da Steelcase e da Microsoft é altamente relevante para o mercado de assentos de escritório. Mostra a mudança para espaços de trabalho flexíveis e criativos que integram tecnologia para suportar diversos modos de trabalho. Esta adaptação aborda o desafio de evoluir os designs de escritórios em resposta às rápidas mudanças tecnológicas e às novas necessidades dos colaboradores. A ênfase em espaços como o Maker Commons e o Focus Studios destaca a mudança para ambientes que melhoram a colaboração e a criatividade. No geral, reflete a tendência crescente de projetar escritórios para promover a produtividade e o bem-estar num cenário de trabalho em rápida mudança.

Este relatório de mercado fornece detalhes de novos desenvolvimentos recentes, regulamentos comerciais, análise de importação e exportação, análise de produção, otimização da cadeia de valor, quota de mercado, impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações do mercado, análise estratégica do crescimento do mercado, tamanho do mercado, crescimento do mercado das categorias, nichos de aplicação e dominância, aprovações de produtos, lançamentos de produtos, expansões geográficas, inovações tecnológicas no mercado. Para mais informações sobre o mercado, contacte a Data Bridge Market Research para obter um briefing de analista.

Conteúdo do Quadro Regulatório

Regulamentações O mercado de assentos de escritório é regido por regulamentos que garantem normas de segurança, ergonomia e ambiente. As principais estruturas incluem as normas ANSI/BIFMA (American National Standards Institute/Business and Institutional Furniture Manufacturers Association) para desempenho e segurança, e a adesão às diretrizes da OSHA (Occupational Safety and Health Administration) para a segurança ergonómica no local de trabalho.

Abaixo está uma cobertura detalhada dos regulamentos e normas que afetam o mercado de assentos de escritório dos EUA:

Regulamentos nos EUA

De acordo com o Regulamento da Administração de Segurança e Saúde no Trabalho (OSHA), as cadeiras de escritório devem suportar a segurança ergonómica e a produtividade. Devem ter um encosto ajustável que esteja alinhado com a coluna, um assento confortável que permita que os pés fiquem totalmente apoiados, apoios de braços ajustáveis para apoio dos braços e uma base estável de cinco pernas com rodízios. Os ajustes adequados da cadeira são cruciais para uma estação de trabalho bem concebida.

De acordo com a Lei Lacey, aplicada pelo USDA APHIS, pelo Serviço de Pesca e Vida Selvagem dos EUA e pelo Serviço Nacional de Pesca Marinha, regula o comércio de plantas, peixes e vida selvagem, incluindo produtos de madeira, como cadeiras estofadas em teca e utensílios de mesa em madeira. Os importadores devem ter o devido cuidado e enviar declarações para produtos que contenham plantas que cumpram critérios específicos.

De acordo com as normas de formaldeído para produtos de madeira composta (40 CFR Parte 770) – TSCA, 40 CFR Parte 770 da TSCA, gerida pela EPA, regula as emissões de formaldeído dos produtos de madeira composta. Define limites de emissão para contraplacado de madeira nobre, painéis de fibras de média densidade, painéis de fibras finas de média densidade e painéis de partículas. Os importadores devem obter a certificação de um certificador externo aprovado, incluindo documentação relevante e relatórios de ensaio.

Além disso, de acordo com a Lei de Segurança dos Produtos de Consumo (CPSA), a Lei de Segurança dos Produtos de Consumo, promulgada a 27 de outubro de 1972, foi promulgada para estabelecer a Comissão de Segurança dos Produtos de Consumo e definir a sua autoridade com o propósito de proteger o público contra riscos irracionais de lesões associadas a produtos de consumo; auxiliar os consumidores na avaliação da segurança comparativa dos produtos de consumo, desenvolvendo normas de segurança uniformes para os produtos de consumo; e promover a investigação e investigação sobre as causas e a prevenção de mortes, doenças e ferimentos relacionados com os produtos.

Impacto e cenário atual do mercado de escassez de matéria-prima e atrasos no envio

A Data Bridge Market Research oferece uma análise de alto nível do mercado e fornece informações tendo em conta o impacto e o ambiente atual do mercado de escassez de matérias-primas e atrasos nas remessas. Isto traduz-se em avaliar possibilidades estratégicas, criar planos de ação eficazes e auxiliar as empresas na tomada de decisões importantes.

Além do relatório padrão, também oferecemos uma análise aprofundada do nível de aquisição, desde atrasos previstos de expedição, mapeamento de distribuidores por região, análise de commodities, análise de produção, tendências de mapeamento de preços, sourcing, análise de desempenho de categoria, soluções avançadas de gestão de risco da cadeia de abastecimento.

Impacto esperado da desaceleração económica nos preços e na disponibilidade dos produtos

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Office Seating Market Scope

The market is segmented on the basis of product, material, price range, end user and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Chair

- Task Chairs

- Ergonomic Chair

- Executive chairs

- Mesh Office Chair

- Swivel Office Chair

- Ball Chair

- Drafting Chair/Stool

- Kneeling Chair

- Folding chair

- Stack folding chair

- Gaming Chair

- Specialty Chair

- Others

- Couches

- Sectional

- Modular

- Loveseat

- Recliner

- Chesterfield

- Sleeper

- Tuxedo

- Lawson

- Mid-century

- English Roll Arm

- Track Arm

- Camelback

- Convertible

- Cabriole

- Deep-seated

- Low-seated

- Office Chair Mats

- Light Bulb

- Lip

- Rectangular

- Accessories

- Others

Material

- Plastic

- Polypropylene

- ABS

- Polyethylene

- PVC

- Polycarbonate

- Nylon

- Others

- Metal

- Steel

- Aluminum

- Iron

- Brass

- Others

- Wood

- Hardwood

- Oak

- Maple Wood

- Cherry Wood

- Walnut

- Mahogany

- Teak Wood

- Ash

- Birch

- Pine Wood

- Rosewood

- Others

- Engineered Wood

- Solid Wood

- Softwood

- Hardwood

- Leather

- Pigmented

- Top Grain

- Bonded

- Aniline

- Nubuck

- Full Grain

- Bi-cast

- Split Grain

- Others

- Others

Price Range

- Economy

- Mid-Range

- Premium

- Luxury

End User

- Commercial Offices

- Schools and Universities

- Hospitals

- Hotels and Restaurants

- Retail Outlets

- Residential Houses

- Others

Distribution Channel

- Retail

- Offline

- Furniture Outlets

- Mono-Branded

- Multi-Branded

- Specialty Stores

- Supermarkets and Hypermarkets

- Others

- Furniture Outlets

- Online

- Third-Party Websites

- Company-Owned

- Offline

- Direct

Office Seating Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, U.S. presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Office Seating Market Leaders Operating in the Market Are:

- Haworth, Inc. (U.S.)

- Steelcase Inc. (U.S.)

- HNI Corp. (U.S.)

- KI (U.S.)

- Herman Miller, Inc (U.S.)

- LA-Z-BOY INCORPORATED (U.S.)

- Teknion (Canada)

- UCHIDA YOKO GLOBAL LIMITED / UCHIDA YOKO GLOBAL CO., LTD. (Hong Kong)

- OFS (U.S.)

- Kinnarps AB (Sweden)

- OKAMURA CORPORATION (Japan)

- Humanscale (U.S.)

- Itoki Corporation (Japan)

- Kimball International (U.S.)

- Hooker Furniture (U.S.)

- Flexsteel Industries, Inc. (U.S.)

- JASPER GROUP (U.S.)

- Wilkhahn Wilkening+Hahne GmbH+Co. KG (Germany)

- Fursys Inc. (South Korea)

- Virco Inc. (U.S.)

- Groupe Lacasse (Canada)

- Affordable Interior Systems (U.S.)

- ACTIU Berbegal y Formas S.A. (Spain)

- Berco Designs (EUA)

- MESA UPLIFT (EUA)

- DESIGN DE MOVIMENTO (Dinamarca)

- Trendway Corporation (EUA)

- Grandes Aberturas (EUA)

- INTER IKEA SYSTEMS BV (Holanda)

Últimos desenvolvimentos no mercado de assentos de escritório

- Em abril de 2024, a Steelcase Inc. transformou os espaços de trabalho em toda a China ao revelar desenvolvimentos pioneiros em design e sustentabilidade, incluindo a Coleção de Primavera da Vicar. Esta colaboração teve como objetivo melhorar a funcionalidade, a ressonância cultural e a inovação, abordando as necessidades dos espaços de trabalho asiáticos em rápida evolução.

- Em agosto de 2024, a Haworth lançou a nova cadeira de escritório Breck, que conta com a inovadora tecnologia Geostretch para um suporte ergonómico e conforto superiores. Pesando 13,6 kg e sem necessidade de ferramentas para montar, o Breck oferece características premium e sustentabilidade com mais de 50% de conteúdo reciclado. Este desenvolvimento reforça a posição de mercado da Haworth, combinando um design avançado com uma produção ecológica

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.