Us Lubricants Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

22.86 Billion

USD

28.91 Billion

2024

2032

USD

22.86 Billion

USD

28.91 Billion

2024

2032

| 2025 –2032 | |

| USD 22.86 Billion | |

| USD 28.91 Billion | |

|

|

|

|

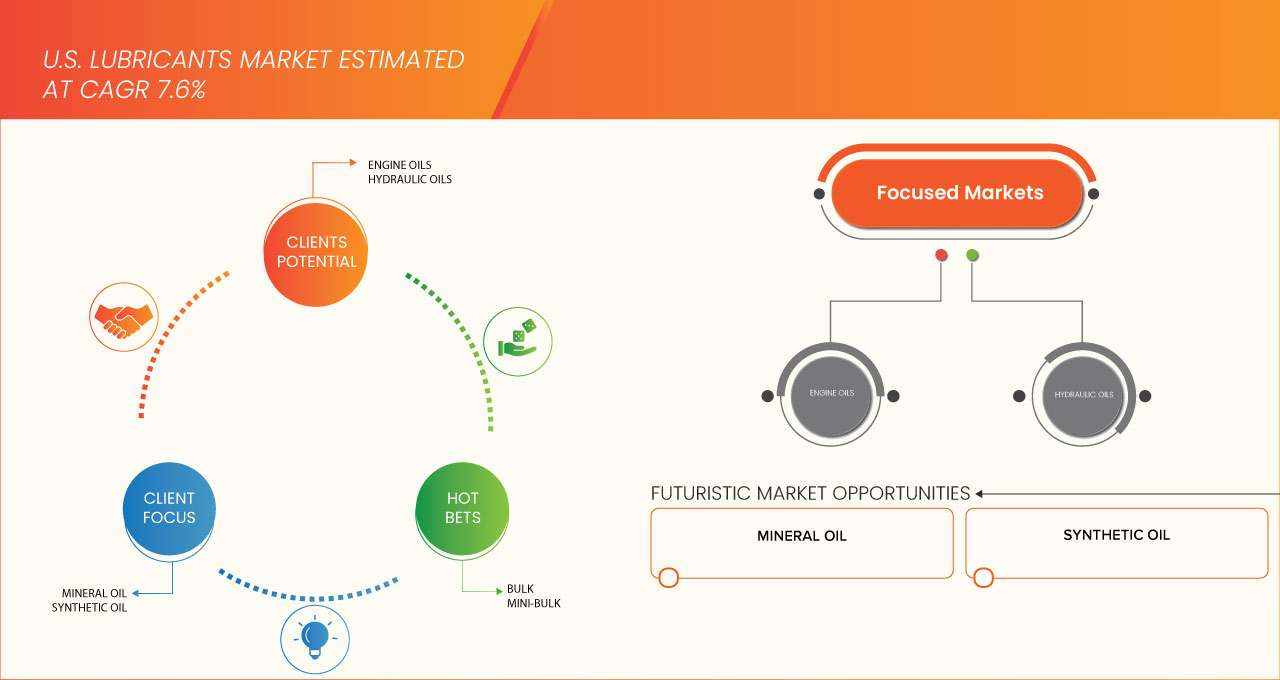

Segmentação do mercado de lubrificantes dos EUA, por produto (óleos de motor, óleos hidráulicos, fluidos de circulação, óleo de engrenagem, graxa, fluidos de usinagem, óleos de turbina eólica, óleos de compressor, óleos de turbina a gás, óleos de transferência de calor, óleos antiferrugem e outros), óleo base (óleo mineral, óleo sintético, óleo semissintético e óleo de base biológica), grau (grau industrial e alimentício), formato (grau a granel, minigrau, embalagem pequena e outros), canal de vendas (distribuidores, varejo, comércio eletrônico e direto ao usuário final), uso final (automóvel e transporte, marítimo, energia e geração de energia, metalurgia e usinagem de metais, fabricação de produtos químicos, máquinas de construção, equipamentos pesados, mineração, máquinas industriais, aeroespacial, aviação e defesa, ferrovias, agricultura, eletricidade/serviços públicos, equipamentos de fabricação, petróleo e gás, alimentos e bebidas, cimento, processamento de plásticos e borracha, têxtil, celulose e papel, consumidor/faça você mesmo, outros), - tendências e previsões do setor até 2032

Tamanho do mercado de lubrificantes

- O tamanho do mercado de lubrificantes dos EUA foi avaliado em US$ 22,86 bilhões em 2024 e deve atingir US$ 28,91 bilhões até 2032 , com um CAGR de 3,01% durante o período previsto.

- O número crescente de veículos nas estradas dos EUA — incluindo carros com motor de combustão interna (ICE) e caminhões comerciais — continua a impulsionar a demanda por lubrificantes para óleos de motor, fluidos de transmissão e serviços de manutenção.

- À medida que o uso de veículos elétricos e híbridos aumenta, lubrificantes especializados (por exemplo, para caixas de câmbio e sistemas de transmissão) estão em maior demanda, estimulando a inovação e o crescimento do segmento.

Análise de Mercado de Lubrificantes

- Maior estabilidade térmica, menor atrito, intervalos de troca mais longos e desempenho em condições extremas impulsionaram uma mudança em direção aos óleos sintéticos, especialmente nos setores automotivo e industrial.

- Automação industrial, IoT e manutenção preditiva aumentam o uso de lubrificantes em máquinas pesadas. Sistemas de monitoramento de condições e lubrificação inteligente estão ganhando força.

- Lubrificantes são essenciais em usinas eólicas, solares e hidrelétricas para reduzir o atrito e o tempo de inatividade, apoiando a transição para energia verde.

- O segmento de óleos de motor domina o mercado de lubrificantes com uma participação de mercado de 31,83% em 2024, impulsionado por formulações aprimoradas com melhor estabilidade térmica, resistência à oxidação e intervalos de troca de óleo mais longos que estão substituindo cada vez mais os óleos minerais convencionais em ambientes automotivos e industriais.

Escopo do Relatório e Segmentação do Mercado de Lubrificantes

|

Atributos |

Insights do mercado de lubrificantes |

|

Segmentos abrangidos |

|

|

Países abrangidos |

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de lubrificantes

“ Crescente demanda por lubrificantes sustentáveis e de alto desempenho ”

- O mercado de lubrificantes dos EUA está passando por uma mudança em direção a lubrificantes sintéticos e de base biológica de alto desempenho, impulsionado por regulamentações ambientais mais rigorosas e pela necessidade de maior eficiência dos equipamentos.

- A crescente industrialização, juntamente com o aumento nas vendas de automóveis — especialmente veículos elétricos e híbridos — está alimentando a demanda por lubrificantes avançados com intervalos de troca mais longos e estabilidade térmica superior.

- Consumidores e indústrias estão priorizando cada vez mais a sustentabilidade, levando os fabricantes de lubrificantes a investir em formulações ecológicas e opções biodegradáveis que reduzem o impacto ambiental.

Dinâmica do mercado de lubrificantes

Motorista

“Avanços tecnológicos e demanda por eficiência de combustível”

- Um grande impulsionador do crescimento no mercado de lubrificantes dos EUA é a demanda por lubrificantes que melhorem o desempenho do motor, reduzam o atrito e contribuam para a eficiência de combustível em aplicações automotivas e industriais.

- Avanços na tecnologia de óleos básicos, química de aditivos e formulações sintéticas estão levando ao desenvolvimento de lubrificantes que apresentam bom desempenho sob temperaturas e pressões extremas.

- Padrões mais rigorosos de economia de combustível e regulamentações de emissões estão levando OEMs e operadores de frotas a optar por lubrificantes premium que prolongam a vida útil do equipamento e melhoram a limpeza do motor.

- A crescente conscientização sobre manutenção entre os usuários finais também está impulsionando a adoção de lubrificantes especiais, principalmente em setores como aeroespacial, energia e manufatura.

Restrição/Desafio

“ Preços voláteis de matérias-primas e preocupações ambientais ”

- As flutuações nos preços do petróleo bruto afetam diretamente o custo dos lubrificantes à base de petróleo, causando instabilidade de preços e pressão de margem para fabricantes e distribuidores.

- Preocupações ambientais relacionadas ao descarte e à reciclagem de lubrificantes usados representam desafios regulatórios e logísticos, especialmente para usuários industriais e empresas de gerenciamento de resíduos.

- Apesar do crescente interesse em biolubrificantes, seu custo mais alto e desempenho inferior em certas aplicações em comparação às opções convencionais podem impedir sua adoção generalizada.

- A falta de conscientização do consumidor sobre os benefícios dos lubrificantes sintéticos e ecológicos em alguns segmentos de mercado pode retardar a transição de produtos tradicionais à base de minerais.

Escopo do mercado de lubrificantes

O mercado é segmentado com base em Produto, Óleo Base, Grau, Formato, Canal de Vendas e Uso Final.

- Por produto

Com base no produto, o mercado de lubrificantes é segmentado em óleos de motor, óleos hidráulicos, fluidos de circulação, óleo de engrenagem, graxa, fluidos para usinagem, óleos para turbinas eólicas, óleos para compressores, óleos para turbinas a gás, óleos para transferência de calor, óleos antiferrugem e outros. O segmento de óleos de motor domina a maior fatia da receita de mercado, com 31,83% em 2024, impulsionado pelo crescente número de veículos nas estradas dos EUA — incluindo carros com motor de combustão interna (ICE) e caminhões comerciais —, o que continua a impulsionar a demanda por lubrificantes para óleos de motor, fluidos de transmissão e serviços de manutenção.

O segmento de óleos de motor deverá testemunhar a taxa de crescimento mais rápida de 3,59% de 2025 a 2032, impulsionado por formulações aprimoradas com melhor estabilidade térmica, resistência à oxidação e intervalos de troca de óleo mais longos que estão substituindo cada vez mais os óleos minerais convencionais em ambientes automotivos e industriais.

- Por Óleo Base

Com base no óleo base, o mercado de lubrificantes é segmentado em óleo mineral, óleo sintético, óleo semissintético, óleo de base biológica e outros. O segmento de óleo mineral deteve a maior participação de mercado na receita em 2024, impulsionado pela pressão regulatória e ambiental.

Espera-se que o segmento de óleo mineral testemunhe o CAGR mais rápido de 2025 a 2032, impulsionado pela mudança para óleos sintéticos e de alto desempenho.

- Por Grau

Com base na classificação, o mercado de lubrificantes é segmentado em grau industrial e grau alimentício. O segmento industrial deteve a maior participação na receita de mercado em 2024, impulsionado pelas rigorosas regulamentações da EPA sobre emissões e biodegradabilidade, além de iniciativas de sustentabilidade, que estão impulsionando o mercado para formulações ecologicamente corretas, incluindo lubrificantes de base biológica.

- Por formato

Com base no formato de processamento, o mercado de lubrificantes é segmentado em granel, mini-granel, embalagens pequenas e outros. O segmento a granel deteve a maior fatia da receita de mercado em 2024, impulsionado pelo ressurgimento da indústria nos EUA — abrangendo maquinário pesado, mineração, construção e geração de energia —, o que cria uma demanda contínua por lubrificantes industriais para garantir a confiabilidade operacional.

- Por canal de vendas

Com base no Canal de Vendas, o Mercado de Lubrificantes é segmentado em Pós-Venda e OEM. O segmento de Pós-Venda deteve a maior participação de mercado na receita em 2024, impulsionado por usinas de energia eólica, hidrelétrica e solar que precisam de lubrificantes especializados para turbinas, geradores e equipamentos auxiliares, apoiando a expansão do mercado.

- Por uso final

Com base no uso final, o mercado de lubrificantes é segmentado em Automotivo e Transporte, MRO (Manutenção, Reparo e Operações) Industrial, Marítimo, Metalurgia e Metalurgia, Aeroespacial, Fabricação Química, Alimentos e Bebidas (A&B), Consumo/Faça Você Mesmo (Faça Você Mesmo) e Outros. O segmento de Grau Alimentício deteve a maior participação de mercado na receita em 2024, impulsionado por aditivos que reduzem a corrosão, o desgaste e o atrito, ao mesmo tempo em que aumentam a resistência ao calor, permitindo lubrificantes mais confiáveis e específicos para aplicações automotivas, aeroespaciais e industriais.

Participação no mercado de lubrificantes

O mercado de lubrificantes é liderado principalmente por empresas bem estabelecidas, incluindo:

- Exxon Mobil Corporation

- Chevron Corporation

- Concha

- DuPont de Nemours, Inc.

- Lukoil

- Energias Totais

- Corporação ENEOS

- Empresa Phillips 66

- Motul

- FUCHS

- valvolina

- BASF SE

- Castrol Limitada

- WD-40

- Lubrificantes Blue Sky

- Óleo Sintético Red Line

- Lubrificantes Mystik

- Carl Bechem GmbH

- Calumet, Inc.

Últimos desenvolvimentos no mercado de lubrificantes dos EUA

- Em 2024, a ExxonMobil lançou o Mobil EV™, uma nova linha de lubrificantes avançados projetados especificamente para veículos elétricos (VEs). Inclui fluidos e graxas de gerenciamento térmico adaptados às necessidades específicas de motores e sistemas de transmissão de VEs, atendendo à crescente demanda no setor de mobilidade elétrica.

- Em fevereiro de 2024, a Chevron anunciou a expansão de sua linha Havoline® Pro-RS™, uma linha de óleos de motor 100% sintéticos renováveis, feitos a partir de óleos básicos vegetais. A iniciativa apoia a estratégia de sustentabilidade da Chevron e atrai consumidores e operadores de frotas com consciência ambiental.

- Em setembro de 2023, firmamos parceria com fabricantes de equipamentos originais (OEMs) para desenvolver conjuntamente lubrificantes de última geração otimizados para motores híbridos e turboalimentados. Essas formulações visam atender aos padrões de economia de combustível em constante evolução, ao mesmo tempo em que estendem os intervalos de troca de óleo e aumentam a vida útil do motor.

- Em julho de 2023, a Royal Dutch Shell concluiu a modernização de sua planta de mistura de lubrificantes na Louisiana, aumentando a capacidade e integrando sistemas automatizados de controle de qualidade. A modernização apoia a distribuição regional e atende à crescente demanda por lubrificantes de alto desempenho na América do Norte.

- Em janeiro de 2022, a Fuchs Lubricants Co., uma importante fabricante independente de lubrificantes, expandiu suas operações nos EUA com um novo centro de P&D de última geração no Kansas. A instalação se concentra no desenvolvimento de lubrificantes especializados para aplicações industriais, alimentícias e de energia renovável.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE U.S. LUBRICANTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END-USE COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES ANALYSIS

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTE PRODUCTS

4.1.5 INDUSTRY RIVALRY

4.2 BRAND OUTLOOK

4.3 PRODUCTION CONSUMPTION ANALYSIS

4.4 PRICING ANALYSIS

4.5 PATENT ANALYSIS

4.5.1 PATENT QUALITY AND STRENGTH

4.5.2 PATENT FAMILIES

4.5.3 LICENSING AND COLLABORATIONS

4.5.4 REGIONAL PATENT LANDSCAPE

4.5.5 IP STRATEGY AND MANAGEMENT

4.6 PRODUCTION & CONSUMPTION ANALYSIS

4.7 VENDOR SELECTION CRITERIA

4.7.1 QUALITY AND CONSISTENCY

4.7.2 TECHNICAL EXPERTISE

4.7.3 SUPPLY CHAIN RELIABILITY

4.7.4 COMPLIANCE AND SUSTAINABILITY

4.7.5 COST AND PRICING STRUCTURE

4.7.6 FINANCIAL STABILITY

4.7.7 FLEXIBILITY AND CUSTOMIZATION

4.7.8 RISK MANAGEMENT AND CONTINGENCY PLANS

4.8 CLIMATE CHANGE SCENARIO

4.8.1 ENVIRONMENTAL CONCERNS

4.8.1.1 CARBON EMISSIONS FROM PRODUCTION

4.8.1.2 NON-RENEWABLE RESOURCE DEPLETION

4.8.1.3 WATER AND AIR POLLUTION

4.8.2 INDUSTRY RESPONSE

4.8.2.1 DEVELOPMENT OF BIO-BASED AND SYNTHETIC LUBRICANTS

4.8.2.2 RECYCLING AND RE-REFINING INITIATIVES

4.8.2.3 ENERGY EFFICIENCY IMPROVEMENTS

4.8.3 GOVERNMENT’S ROLE

4.8.3.1 REGULATIONS AND ENVIRONMENTAL STANDARDS

4.8.3.2 INCENTIVES FOR SUSTAINABLE PRODUCTS

4.8.3.3 PROMOTING PUBLIC-PRIVATE PARTNERSHIPS

4.8.4 ANALYST RECOMMENDATIONS

4.8.4.1 INVEST IN SUSTAINABLE PRODUCT DEVELOPMENT

4.8.4.2 ENHANCE RECYCLING AND RE-REFINING CAPABILITIES

4.8.4.3 COLLABORATE WITH REGULATORS AND INDUSTRY PEERS

4.8.4.4 LEVERAGE GOVERNMENT INCENTIVES

4.9 CONSUMER BUYING BEHAVIOUR

4.1 INNOVATION TRACKER AND STRATEGIC ANALYSIS – U.S. LUBRICANTS MARKET

4.10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.10.1.1 JOINT VENTURES

4.10.1.2 MERGERS AND ACQUISITIONS

4.10.1.3 LICENSING AND PARTNERSHIP

4.10.1.4 TECHNOLOGY COLLABORATIONS

4.10.1.5 STRATEGIC DIVESTMENTS

4.10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.10.3 STAGE OF DEVELOPMENT

4.10.4 TIMELINES AND MILESTONES

4.10.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.10.6 RISK ASSESSMENT AND MITIGATION

4.10.7 FUTURE OUTLOOK

4.11 INDUSTRY ECOSYSTEM ANALYSIS: U.S. LUBRICANTS MARKET

4.12 OVERVIEW OF TECHNOLOGICAL INNOVATIONS IN THE U.S. LUBRICANT MARKET

4.13 RAW MATERIAL COVERAGE

4.14 SUPPLY CHAIN ANALYSIS

4.14.1 OVERVIEW OF THE U.S. LUBRICANTS MARKET SUPPLY CHAIN

4.14.1.1 SUPPLY CHAIN CHALLENGES:

4.14.2 LOGISTICS COST SCENARIO

4.14.2.1 TRANSPORTATION COSTS

4.14.2.2 WAREHOUSING AND STORAGE COSTS

4.14.2.3 HANDLING AND PACKAGING COSTS

4.14.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.14.3.1 TRANSPORTATION MANAGEMENT

4.14.3.2 WAREHOUSING AND DISTRIBUTION SERVICES

4.14.3.3 REGULATORY AND COMPLIANCE EXPERTISE

4.15 VALUE CHAIN ANALYSIS

5 TARIFFS & IMPACT ON THE MARKET

6 REGULATION COVERAGE

6.1 OVERVIEW

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 THE SURGE IN VEHICLE MANUFACTURING AND SALES

7.1.2 GROWING INDUSTRIALIZATION FUELS LUBRICANT USAGE IN MACHINERY AND EQUIPMENT

7.1.3 THE EXPANSION OF TRANSPORTATION NETWORKS CONTRIBUTES TO HIGHER LUBRICANT CONSUMPTION

7.1.4 THE EXPANDING AEROSPACE AND DEFENSE SECTORS DEMAND HIGH-PERFORMANCE LUBRICANT

7.2 RESTRAINTS

7.2.1 FLUCTUATIONS IN CRUDE OIL PRICES AFFECT THE COST OF LUBRICANT PRODUCTION

7.2.2 INCREASING ENVIRONMENTAL CONSCIOUSNESS

7.3 OPPORTUNITIES

7.3.1 ESCALATING DEMAND FOR SUSTAINABLE AND BIO-BASED LUBRICANTS

7.3.2 CONTINUED INDUSTRIAL EXPANSION OFFERS A SUBSTANTIAL MARKET GROWTH OPPORTUNITY

7.3.3 THE CONTINUOUS EVOLUTION OF LUBRICANT TECHNOLOGY

7.4 CHALLENGES

7.4.1 HIGHLY COMPETITIVE LUBRICANT INDUSTRY MANUFACTURERS REQUIRES CONSTANT INNOVATION AND DIFFERENTIATION

7.4.2 RESISTANCE TO SWITCHING FROM CONVENTIONAL LUBRICANTS TO MORE EXPENSIVE ALTERNATIVES

8 U.S. LUBRICANTS MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 ENGINE OILS

8.2.1 MINERAL OIL

8.2.2 SYNTHETIC OIL

8.2.2.1 SYNTHETIC BLEND OIL

8.2.2.2 FULL SYNTHETIC OIL

8.2.3 SEMI-SYNTHETIC OIL

8.2.4 BIO-BASED OIL

8.2.5 OTHERS

8.2.5.1 INDUSTRIAL

8.2.5.2 FOOD GRADE

8.2.5.2.1 GASOLINE ENGINE OIL

8.2.5.2.2 DIESEL ENGINE OIL

8.3 HYDRAULIC OILS

8.3.1 MINERAL OIL

8.3.1.1 PARAFFINIC OILS

8.3.1.2 NAPHTHENIC OILS

8.3.1.3 AROMATIC OILS

8.3.2 SYNTHETIC OIL

8.3.2.1 SYNTHETIC BLEND OIL

8.3.2.2 FULL SYNTHETIC OIL

8.3.3 SEMI-SYNTHETIC OIL

8.3.4 BIO-BASED OIL

8.3.5 OTHERS

8.3.5.1 INDUSTRIAL

8.3.5.2 FOOD GRADE

8.4 CIRCULATION FLUIDS

8.4.1 MINERAL OIL

8.4.1.1 PARAFFINIC OILS

8.4.1.2 NAPHTHENIC OILS

8.4.1.3 AROMATIC OILS

8.4.2 SYNTHETIC OIL

8.4.2.1 SYNTHETIC BLEND OIL

8.4.2.2 FULL SYNTHETIC OIL

8.4.3 SEMI-SYNTHETIC OIL

8.4.4 BIO-BASED OIL

8.4.5 OTHERS

8.4.5.1 INDUSTRIAL

8.4.5.2 FOOD GRADE

8.5 GEAR OIL

8.5.1 MINERAL OIL

8.5.1.1 PARAFFINIC OILS

8.5.1.2 NAPHTHENIC OILS

8.5.1.3 AROMATIC OILS

8.5.2 SYNTHETIC OIL

8.5.2.1 SYNTHETIC BLEND OIL

8.5.2.2 FULL SYNTHETIC OIL

8.5.3 SEMI-SYNTHETIC OIL

8.5.4 BIO-BASED OIL

8.5.5 OTHERS

8.5.5.1 INDUSTRIAL

8.5.5.2 FOOD GRADE

8.6 GREASE

8.6.1 LITHIUM-BASED

8.6.2 CALCIUM-BASED

8.6.3 BENTONE-BASED

8.6.4 BARIUM COMPLEX

8.6.5 OTHERS

8.6.5.1 MINERAL OIL

8.6.5.1.1 PARAFFINIC OILS

8.6.5.1.2 NAPHTHENIC OILS

8.6.5.1.3 AROMATIC OILS

8.6.5.2 SYNTHETIC OIL

8.6.5.2.1 SYNTHETIC BLEND OIL

8.6.5.2.2 FULL SYNTHETIC OIL

8.6.5.3 SEMI-SYNTHETIC OIL

8.6.5.4 BIO-BASED OIL

8.6.5.5 OTHERS

8.6.5.5.1 INDUSTRIAL

8.6.5.5.2 FOOD GRADE

8.7 METALWORKING FLUIDS

8.7.1 MINERAL OIL

8.7.1.1 PARAFFINIC OILS

8.7.1.2 NAPHTHENIC OILS

8.7.1.3 AROMATIC OILS

8.7.2 SYNTHETIC OIL

8.7.2.1 SYNTHETIC BLEND OIL

8.7.2.2 FULL SYNTHETIC OIL

8.7.3 SEMI-SYNTHETIC OIL

8.7.4 BIO-BASED OIL

8.7.5 OTHERS

8.7.5.1 INDUSTRIAL

8.7.5.2 FOOD GRADE

8.8 WIND TURBINE OILS

8.8.1 MINERAL OIL

8.8.1.1 PARAFFINIC OILS

8.8.1.2 NAPHTHENIC OILS

8.8.1.3 AROMATIC OILS

8.8.2 SYNTHETIC OIL

8.8.2.1 SYNTHETIC BLEND OIL

8.8.2.2 FULL SYNTHETIC OIL

8.8.3 SEMI-SYNTHETIC OIL

8.8.4 BIO-BASED OIL

8.8.5 OTHERS

8.8.5.1 INDUSTRIAL

8.8.5.2 FOOD GRADE

8.9 COMPRESSOR OILS

8.9.1 MINERAL OIL

8.9.1.1 PARAFFINIC OILS

8.9.1.2 NAPHTHENIC OILS

8.9.1.3 AROMATIC OILS

8.9.2 SYNTHETIC OIL

8.9.2.1 SYNTHETIC BLEND OIL

8.9.2.2 FULL SYNTHETIC OIL

8.9.3 SEMI-SYNTHETIC OIL

8.9.4 BIO-BASED OIL

8.9.5 OTHERS

8.9.5.1 INDUSTRIAL

8.9.5.2 FOOD GRADE

8.1 GAS TURBINE OILS

8.10.1 MINERAL OIL

8.10.1.1 PARAFFINIC OILS

8.10.1.2 NAPHTHENIC OILS

8.10.1.3 AROMATIC OILS

8.10.2 SYNTHETIC OIL

8.10.2.1 SYNTHETIC BLEND OIL

8.10.2.2 FULL SYNTHETIC OIL

8.10.3 SEMI-SYNTHETIC OIL

8.10.4 BIO-BASED OIL

8.10.5 OTHERS

8.10.5.1 INDUSTRIAL

8.10.5.2 FOOD GRADE

8.11 HEAT TRANSFER OILS

8.11.1 MINERAL OIL

8.11.1.1 PARAFFINIC OILS

8.11.1.2 NAPHTHENIC OILS

8.11.1.3 AROMATIC OILS

8.11.2 SYNTHETIC OIL

8.11.2.1 SYNTHETIC BLEND OIL

8.11.2.2 2 FULL SYNTHETIC OIL

8.11.3 SEMI-SYNTHETIC OIL

8.11.4 BIO-BASED OIL

8.11.5 OTHERS

8.11.5.1 INDUSTRIAL

8.11.5.2 FOOD GRADE

8.12 RUST PREVENTIVE OILS

8.12.1 MINERAL OIL

8.12.1.1 PARAFFINIC OILS

8.12.1.2 NAPHTHENIC OILS

8.12.1.3 AROMATIC OILS

8.12.2 SYNTHETIC OIL

8.12.2.1 SYNTHETIC BLEND OIL

8.12.2.2 FULL SYNTHETIC OIL

8.12.3 SEMI-SYNTHETIC OIL

8.12.4 BIO-BASED OIL

8.12.5 OTHERS

8.12.5.1 INDUSTRIAL

8.12.5.2 FOOD GRADE

8.13 PENETRANTS

8.13.1 MINERAL OIL

8.13.1.1 PARAFFINIC OILS

8.13.1.2 NAPHTHENIC OILS

8.13.1.3 AROMATIC OILS

8.13.2 SYNTHETIC OIL

8.13.2.1 SYNTHETIC BLEND OIL

8.13.2.2 FULL SYNTHETIC OIL

8.13.3 SEMI-SYNTHETIC OIL

8.13.4 BIO-BASED OIL

8.13.5 OTHERS

8.13.5.1 INDUSTRIAL

8.13.5.2 FOOD GRADE

8.14 OTHERS

8.14.1 MINERAL OIL

8.14.1.1 PARAFFINIC OILS

8.14.1.2 NAPHTHENIC OILS

8.14.1.3 AROMATIC OILS

8.14.2 SYNTHETIC OIL

8.14.2.1 SYNTHETIC BLEND OIL

8.14.2.2 FULL SYNTHETIC OIL

8.14.3 SEMI-SYNTHETIC OIL

8.14.4 BIO-BASED OIL

8.14.5 OTHERS

8.14.5.1 INDUSTRIAL

8.14.5.2 FOOD GRADE

9 U.S. LUBRICANTS MARKET, BY BASE OIL

9.1 OVERVIEW

9.2 MINERAL OIL

9.2.1 PARAFFINIC OILS

9.2.2 NAPHTHENIC OILS

9.2.3 AROMATIC OILS

9.3 SYNTHETIC OIL

9.3.1 SYNTHETIC BLEND OIL

9.3.2 FULL SYNTHETIC OIL

9.4 SEMI-SYNTHETIC OIL

9.5 BIO-BASED OIL

9.6 OTHERS

10 U.S. LUBRICANTS MARKET, BY GRADE

10.1 OVERVIEW

10.2 INDUSTRIAL

10.3 FOOD GRADE

11 U.S. LUBRICANTS MARKET, BY FORMAT

11.1 OVERVIEW

11.2 BULK

11.3 MINI-BULK

11.4 SMALL PACK

11.5 OTHERS

12 U.S. LUBRICANTS MARKET, BY SALES CHANNEL

12.1 OVERVIEW

12.2 AFTERMARKET

12.2.1 VEHICLE SERVICE CENTERS

12.2.2 AUTOMOBILE SPARE PART SHOPS

12.2.3 LUBRICANTS STORES

12.2.3.1 MULTI-BRANDED

12.2.3.2 SINGLE-BRANDED

12.2.3.3 COMPANY-OWNED

12.2.4 HARDWARE AND DIY STORES

12.2.5 GAS STATIONS

12.2.6 ONLINE

12.2.6.1 THIRD PARTY WEBSITES

12.2.6.2 COMPANY-OWNED

12.2.6.2.1 ENGINE OILS

12.2.6.2.2 HYDRAULIC OILS

12.2.6.2.3 CIRCULATION FLUIDS

12.2.6.2.4 GREASE

12.2.6.2.5 GEAR OIL

12.2.6.2.6 COMPRESSOR OILS

12.2.6.2.7 GAS TURBINE OILS

12.2.6.2.8 WIND TURBINE OILS

12.2.6.2.9 HEAT TRANSFER OILS

12.2.6.2.10 RUST PREVENTIVE OILS

12.2.6.2.11 METALWORKING FLUIDS

12.2.6.2.12 PENETRANTS

12.2.6.2.13 OTHERS

12.3 OEM

12.3.1 ENGINE OILS

12.3.2 HYDRAULIC OILS

12.3.3 CIRCULATION FLUIDS

12.3.4 GREASE

12.3.5 GEAR OIL

12.3.6 COMPRESSOR OILS

12.3.7 GAS TURBINE OILS

12.3.8 WIND TURBINE OILS

12.3.9 HEAT TRANSFER OILS

12.3.10 RUST PREVENTIVE OILS

12.3.11 METALWORKING FLUIDS

12.3.12 PENETRANTS

12.3.13 OTHERS

13 U.S. LUBRICANTS MARKET, BY END USE

13.1 OVERVIEW

13.2 AUTOMOBILE & TRANSPORTATION

13.2.1 COMMERCIAL VEHICLES

13.2.1.1 TRUCKS

13.2.1.1.1 HEAVY WEIGHT TRUCKS

13.2.1.1.2 LIGHT WEIGHT TRUCKS

13.2.1.2 BUSES

13.2.1.3 OTHERS

13.2.2 PASSENGER VEHICLES

13.2.2.1 CARS

13.2.2.2 MOTORCYCLES

13.2.2.3 THREE WHEELERS

13.2.2.4 OTHERS

13.3 INDUSTRIAL MRO (MAINTENANCE, REPAIR, AND OPERATIONS)

13.3.1 MANUFACTURING EQUIPMENT

13.3.2 ENERGY AND POWER GENERATION

13.3.3 CONSTRUCTION MACHINERY AND HEAVY EQUIPMENT

13.3.4 INDUSTRIAL MACHINERY

13.3.5 AEROSPACE AND DEFENSE

13.3.6 OTHERS

13.4 MARINE

13.5 METALLURGY AND METALWORKING

13.6 AEROSPACE

13.7 CHEMICAL MANUFACTURING

13.8 FOOD & BEVERAGE (F&B)

13.9 CONSUMER / DIY (DO IT YOURSELF)

13.9.1 PERSONAL VEHICLE MAINTENANCE

13.9.2 HOUSEHOLD/DIY

13.9.3 OTHERS

13.1 OTHERS

13.10.1 TEXTILE

13.10.2 PLASTIC AND RUBBER PROCESSING

13.10.3 PULP & PAPER

13.10.4 OTHERS

14 U.S. LUBRICANTS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: U.S.

14.2 COMPANY SHARE ANALYSIS: U.S.

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 EXXON MOBIL CORPORATION

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 CHEVRON CORPORATION

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 SHELL PLC

16.3.1 COMPANY SNAPSHOT

16.3.2 RECENT FINANCIALS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT UPDATES

16.4 DUPONT

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 LUKOIL

16.5.1 COMPANY SNAPSHOT

16.5.2 BRAND PORTFOLIO

16.5.3 RECENT DEVELOPMENTS /NEWS

16.6 BASF

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENTS/NEWS

16.7 BLUESKY LUBRICANTS

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT UPDATES

16.8 CARL BECHEM GMBH

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 CASTROL LIMITED

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 ENEOS CORPORATION

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENT

16.11 ESSEX BROWNELL

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 FUCHS

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENT/NEWS

16.13 MOTION INDUSTRIES , INC

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 MOTUL

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 MYSTIK LUBRICANTS

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 PHILLIPS 66 COMPANY

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENT/NEWS

16.17 RED LINE SYNTHETIC OIL CORPORATION

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 RELADYNE LLC.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 ROYAL PURPLE

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT UPDATES

16.2 SUN COAST RESOURCES, LLC

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 TOTALENERGIES

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS

16.21.3 PRODUCT PORTFOLIO

16.21.4 RECENT DEVELOPMENT

16.22 VALVOLINE

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCT PORTFOLIO

16.22.4 RECENT DEVELOPMENT

16.23 WD-40

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tabela

TABLE 1 CONSUMER GROUPS BREAKDOWN

TABLE 2 PREFERENCE CRITERIA ACROSS CONSUMER GROUPS

TABLE 3 REGULATION COVERAGE

TABLE 4 U.S. LUBRICANTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 5 U.S. LUBRICANTS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 6 U.S. LUBRICANTS MARKET, BY PRODUCT, 2018-2032 (USD/KG)

TABLE 7 U.S. ENGINE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD THOUSAND)

TABLE 8 U.S. MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 U.S. SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 U.S. ENGINE OILS IN LUBRICANTS MARKET, BY GRADE 2018-2032 (USD THOUSAND)

TABLE 11 U.S. ENGINE OILS IN LUBRICANTS MARKET, BY CATEGORY 2018-2032 (USD THOUSAND)

TABLE 12 U.S. HYDRAULIC OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD THOUSAND)

TABLE 13 U.S. MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 U.S. SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 U.S. HYDRAULIC OILS IN LUBRICANTS MARKET, BY GRADE 2018-2032 (USD THOUSAND)

TABLE 16 U.S. CIRCULATION FLUIDS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD THOUSAND)

TABLE 17 U.S. MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 U.S. SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 U.S. CIRCULATION FLUIDS IN LUBRICANTS MARKET, BY GRADE 2018-2032 (USD THOUSAND)

TABLE 20 U.S. GEAR OIL IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD THOUSAND)

TABLE 21 U.S. MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 U.S. SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 U.S. GEAR OILS IN LUBRICANTS MARKET, BY GRADE 2018-2032 (USD THOUSAND)

TABLE 24 U.S. GREASE IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 U.S. GREASE IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD THOUSAND)

TABLE 26 U.S. MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 U.S. SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 U.S. GREASE IN LUBRICANTS MARKET, BY GRADE 2018-2032 (USD THOUSAND)

TABLE 29 U.S. METALWORKING FLUIDS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD THOUSAND)

TABLE 30 U.S. MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 U.S. SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 U.S. METALWORKING FLUIDS IN LUBRICANTS MARKET, BY GRADE 2018-2032 (USD THOUSAND)

TABLE 33 U.S. WIND TURBINE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD THOUSAND)

TABLE 34 U.S. MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 U.S. SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 U.S. WIND TURBINE OILS IN LUBRICANTS MARKET, BY GRADE 2018-2032 (USD THOUSAND)

TABLE 37 U.S. COMPRESSOR OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD THOUSAND)

TABLE 38 U.S. MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 U.S. SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 U.S. COMPRESSOR OILS IN LUBRICANTS MARKET, BY GRADE 2018-2032 (USD THOUSAND)

TABLE 41 U.S. GAS TURBINE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD THOUSAND)

TABLE 42 U.S. MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 U.S. SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 U.S. GAS TURBINE OILS IN LUBRICANTS MARKET, BY GRADE 2018-2032 (USD THOUSAND)

TABLE 45 U.S. HEAT TRANSFER OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD THOUSAND)

TABLE 46 U.S. MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 U.S. SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 U.S. HEAT TRANSFER OILS IN LUBRICANTS MARKET, BY GRADE 2018-2032 (USD THOUSAND)

TABLE 49 U.S. RUST PREVENTIVE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD THOUSAND)

TABLE 50 U.S. MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 U.S. SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 U.S. RUST PREVENTIVE OILS IN LUBRICANTS MARKET, BY GRADE 2018-2032 (USD THOUSAND)

TABLE 53 U.S. PENETRANTS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD THOUSAND)

TABLE 54 U.S. MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 U.S. SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 U.S. PENETRANTS IN LUBRICANTS MARKET, BY GRADE 2018-2032 (USD THOUSAND)

TABLE 57 U.S. OTHERS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD THOUSAND)

TABLE 58 U.S. MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 U.S. SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 U.S. OTHERS IN LUBRICANTS MARKET, BY GRADE 2018-2032 (USD THOUSAND)

TABLE 61 U.S. LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD THOUSAND)

TABLE 62 U.S. MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 U.S. MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 U.S. LUBRICANTS MARKET, BY GRADE, 2018-2032 (USD THOUSAND)

TABLE 65 U.S. LUBRICANTS MARKET, BY FORMAT, 2018-2032 (USD THOUSAND)

TABLE 66 U.S. LUBRICANTS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 67 U.S. AFTERMARKET IN LUBRICANTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 68 U.S. LUBRICANTS STORES IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 U.S. ONLINE IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 U.S. AFTERMARKET IN LUBRICANTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 71 U.S. OEM IN LUBRICANTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 72 U.S. LUBRICANTS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 73 U.S. AUTOMOBILE & TRANSPORTATION IN LUBRICANTS MARKET, BY VEHICLE TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 U.S. COMMERCIAL VEHICLES IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 U.S. TRUCKS IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 U.S. PASSENGER VEHICLES IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 U.S. INDUSTRIAL MRO (MAINTENANCE, REPAIR, AND OPERATIONS) IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 U.S. CONSUMER / DIY (DO IT YOURSELF) IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 U.S. OTHERS IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

Lista de Figura

FIGURE 1 U.S. LUBRICANTS MARKET: SEGMENTATION

FIGURE 2 U.S. LUBRICANTS MARKET: DATA TRIANGULATION

FIGURE 3 U.S. LUBRICANTS MARKET: DROC ANALYSIS

FIGURE 4 U.S. LUBRICANTS MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 5 U.S. LUBRICANTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. LUBRICANTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.S. LUBRICANTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 U.S. LUBRICANTS MARKET: MARKET END-USE COVERAGE GRID

FIGURE 9 EXECUTIVE SUMMARY U.S. LUBRICANTS MARKET

FIGURE 10 STRATEGIC DECISIONS

FIGURE 11 THE ENGINE OILS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. LUBRICANTS MARKET

FIGURE 12 U.S. LUBRICANTS MARKET: SEGMENTATION

FIGURE 13 THE SURGE IN VEHICLE MANUFACTURING AND SALES IS EXPECTED TO DRIVE THE GROWTH OF THE U.S. LUBRICANTS MARKET IN THE FORECAST PERIOD FROM 2025 TO 2032

FIGURE 14 THE ENGINE OILS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. LUBRICANTS MARKET IN 2025 AND 2032

FIGURE 15 PORTER’S FIVE FORCES ANALYSIS

FIGURE 16 BRAND OUTLOOK

FIGURE 17 PRODUCTION CONSUMPTION ANALYSIS

FIGURE 18 U.S. LUBRICANTS MARKET, 2023-2032, AVERAGE SELLING PRICE (USD/KG)

FIGURE 19 NUMBER OF PATENTS BY THE APPLICANTS

FIGURE 20 PUBLICATIONS DATE

FIGURE 21 VENDOR SELECTION CRITERIA

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE U.S. LUBRICANTS MARKET

FIGURE 23 UNITED STATES MOTOR VEHICLE SALES: PASSENGER CARS FROM 2020 TO 2024

FIGURE 24 U.S. LUBRICANTS MARKET: BY PRODUCT, 2024

FIGURE 25 U.S. LUBRICANTS MARKET: BY BASE OIL, 2024

FIGURE 26 U.S. LUBRICANTS MARKET: BY GRADE, 2024

FIGURE 27 U.S. LUBRICANTS MARKET: BY FORMAT, 2024

FIGURE 28 U.S. LUBRICANTS MARKET: BY SALES CHANNEL, 2024

FIGURE 29 U.S. LUBRICANTS MARKET: BY END USE, 2024

FIGURE 30 U.S. : COMPANY SHARE 2024 (%) (MANUFACTURER)

FIGURE 31 U.S. : COMPANY SHARE 2024 (%) (DISTRIBUTOR)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.