Us Business Travel Accident Insurance Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

3.27 Billion

USD

11.81 Billion

2024

2032

USD

3.27 Billion

USD

11.81 Billion

2024

2032

| 2025 –2032 | |

| USD 3.27 Billion | |

| USD 11.81 Billion | |

|

|

|

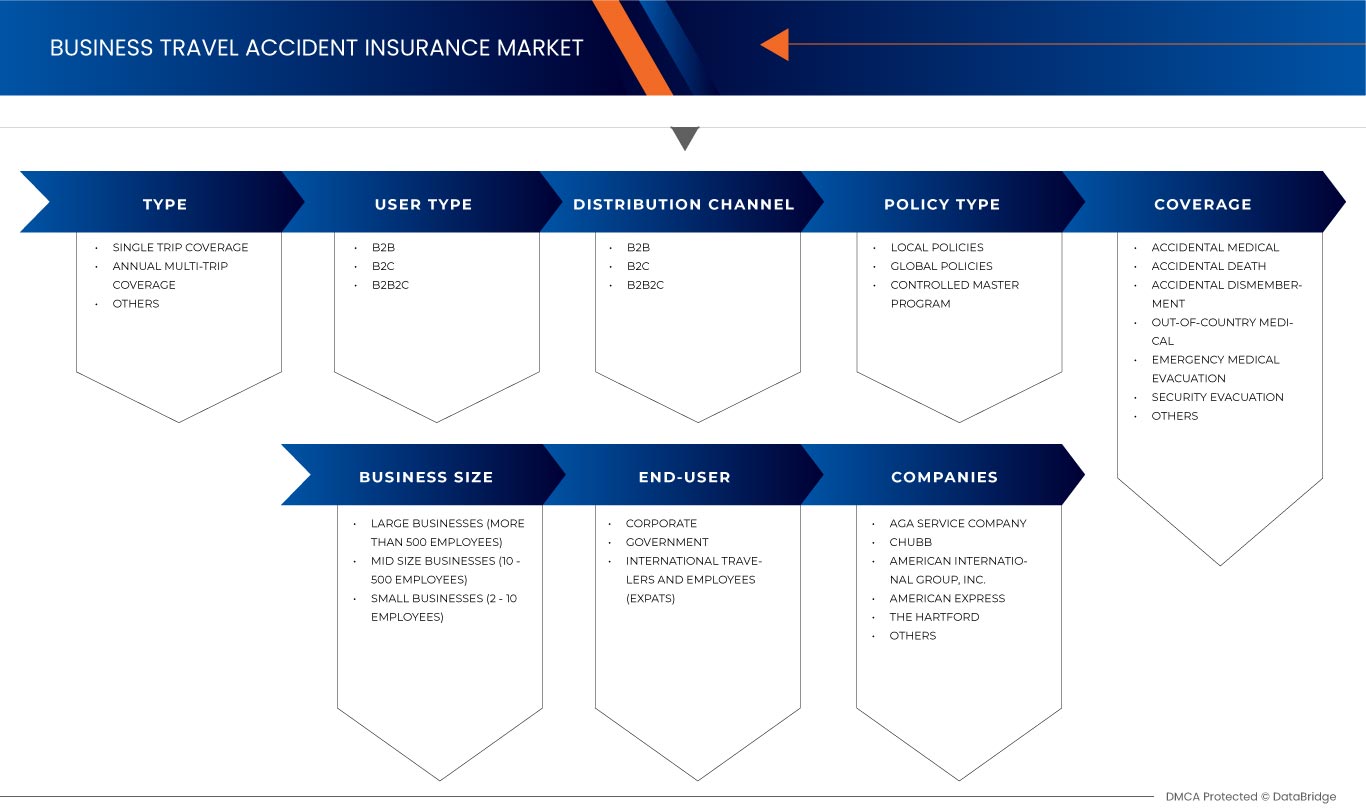

Segmentação do mercado de seguros de acidentes em viagens de negócios nos EUA, por tipo (cobertura de viagem única, cobertura anual de várias viagens e outros), tipo de utilizador (B2B, B2C e B2B2C), canal de distribuição (corretores de seguros, agregadores de seguros, seguradora, banco, e outros), Cobertura (Acidente Médico, Morte Acidental, Desmembramento Acidental, Assistência Médica Fora do País, Evacuação Médica de Emergência, Evacuação de Segurança e Outros), Tipo de Apólice (Apólices Locais, Apólices Globais e Programa Mestre Controlado), Tamanho do Negócio (Grandes empresas (mais de 500 colaboradores), empresas de média dimensão (10 a 500 colaboradores) e pequenas empresas (2 a 10 colaboradores)), utilizador final (empresarial, governo, viajantes internacionais e colaboradores (expatriados)) – Tendências e previsões da indústria até 2031

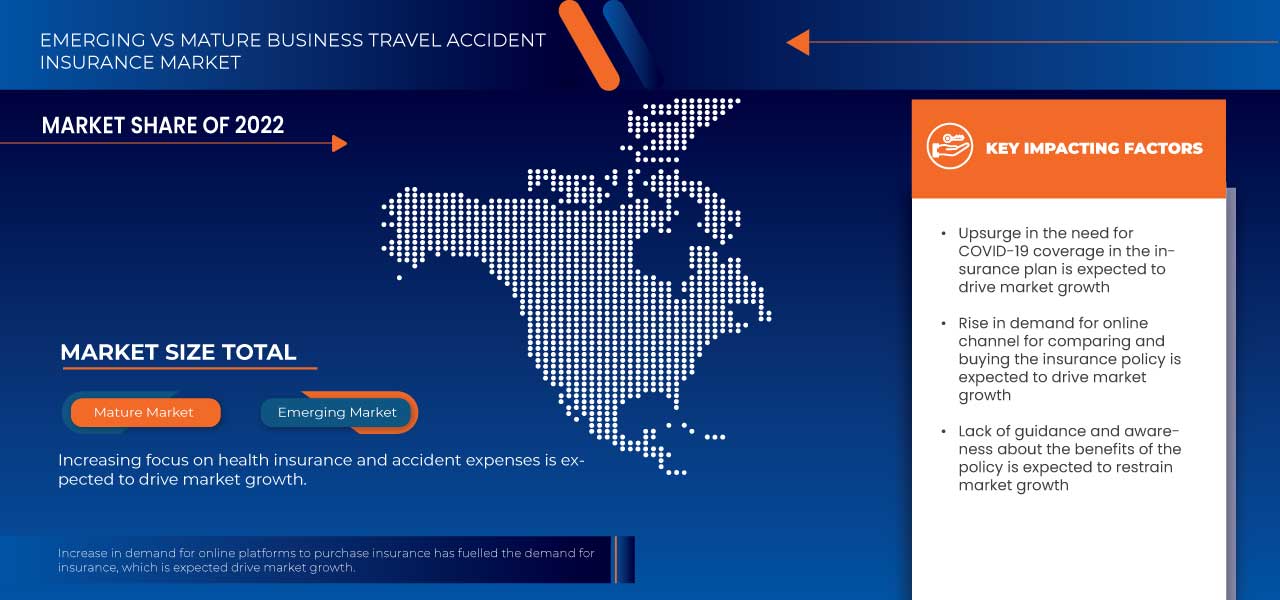

Análise do mercado de seguros de acidentes em viagens de negócios nos EUA

The US business travel accident insurance market is driven by increase in demand for online platforms to purchase insurance also rise in international trade and business expansion globally enhance market growth, while low consumer experiences in terms of and rise in concern regarding data posses emerging challenges for future desenvolvimento.

Tamanho do mercado de seguros de acidentes em viagens de negócios nos EUA

O mercado de seguros contra acidentes em viagens corporativas dos EUA deverá atingir os 10,07 mil milhões de dólares até 2031, face aos 2,84 mil milhões de dólares em 2023, crescendo com um CAGR substancial de 17,4% no período previsto de 2024 a 2031.

Tendências do mercado de seguros de acidentes em viagens de negócios nos EUA

“Aumento do comércio internacional e expansão empresarial a nível global”

A globalização aumentou a integração da economia mundial através do crescimento do comércio internacional. Assim, tanto os consumidores como as empresas podem agora escolher entre uma gama mais ampla de produtos e serviços. Além disso, muitas empresas estão a expandir o seu alcance geográfico investindo em empresas estrangeiras e estabelecendo filiais noutros países. Têm de viajar de um lugar para outro inúmeras vezes para expandir os seus negócios e monitorizar o fluxo de operações. Muitas seguradoras estão a criar planos diferentes, como planos de proteção de viagens multiviagens, ajudando os seus clientes a obter a cobertura necessária. Além disso, as empresas estão a criar um plano que pode proporcionar total segurança nas suas viagens.

Âmbito do Relatório e Segmentação de Mercado

|

Atributos |

Principais insights do mercado de seguros de acidentes em viagens de negócios nos EUA |

|

Segmentação |

|

|

Principais participantes do mercado |

Chubb (EUA), AGA Service Company (Allianz Partners) (EUA), American International Group, Inc. (AIG) (EUA), AXA Partners USA SA (EUA), The Hartford (EUA), American Express (EUA), MetLife Services and Solutions, LLC (EUA), Berkshire Hathaway Specialty Insurance (EUA), Arch Capital Group Ltd. (Bermudas), Generali Global Assistance (EUA), Jokio Marine HCC (EUA), Travel Insured International (EUA), International Medical Group , Inc. (Uma subsidiária da SiriusPoint Ltd.) (EUA), Berkley Accident and Health (EUA), Travelex Insurance Services Inc. (EUA), Visitors Coverage Inc (EUA), Insubuy, LLC (EUA) |

|

Oportunidades de Mercado |

|

|

Conjuntos de informações de dados de valor acrescentado |

Para além dos insights sobre os cenários de mercado, tais como o valor de mercado, a taxa de crescimento, a segmentação, a cobertura geográfica e os principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research incluem também a análise de importação e exportação, a visão geral da capacidade de produção, análise de consumo de produção, análise de tendências de preço, cenário de alterações climáticas, análise da cadeia de abastecimento, análise da cadeia de valor, visão geral das matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Definição do mercado de seguros de acidentes em viagens de negócios nos EUA

O seguro contra acidentes em viagens de negócios oferece proteção financeira para os colaboradores que sofram ferimentos acidentais, doenças ou morte durante as viagens de trabalho. Geralmente cobrindo custos como despesas médicas, evacuação de emergência, morte acidental ou desmembramento, este seguro protege tanto os colaboradores como os empregadores de riscos de viagem imprevistos. A cobertura pode estender-se a atrasos de transporte, repatriamento e despesas específicas associadas a acidentes ocorridos durante viagens de trabalho, dependendo da apólice. O seguro de acidentes em viagens de negócios ajuda as organizações a cumprir as obrigações de dever de cuidado, garantindo o bem-estar e a tranquilidade dos colaboradores durante as viagens de negócios, além de oferecer aos empregadores proteção contra responsabilidades financeiras ligadas a incidentes relacionados com viagens .

Dinâmica do mercado de seguros de acidentes em viagens de negócios nos EUA

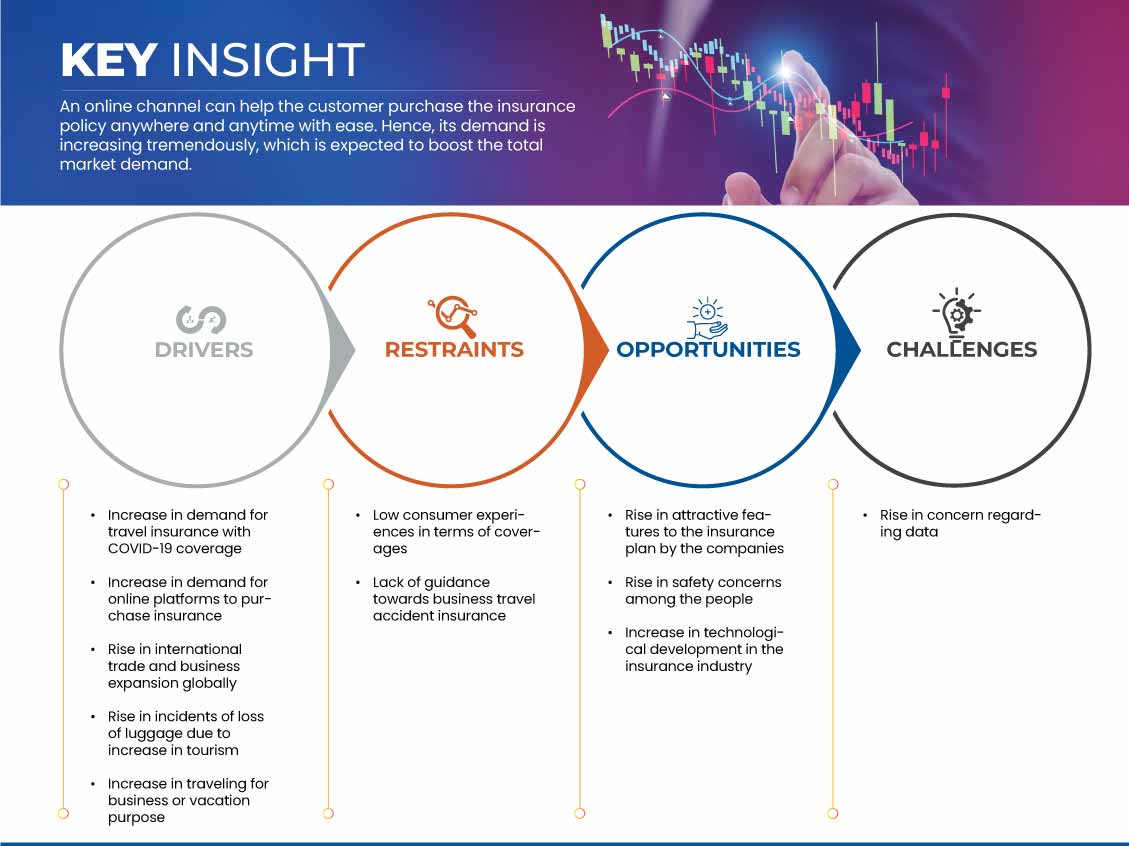

Motoristas

- Aumento de incidentes de perda de bagagem devido ao aumento do turismo

O aumento do turismo nos EUA levou a um aumento notável do volume de viajantes, resultando numa incidência crescente de bagagem perdida e maltratada. Esta tendência está a impulsionar significativamente a procura de seguros contra acidentes em viagens corporativas, à medida que mais empresas e indivíduos procuram protecção contra as repercussões financeiras e logísticas da perda de bens pessoais e essenciais para o negócio. Para os viajantes de negócios que transportam frequentemente artigos valiosos, a bagagem perdida pode perturbar os horários, reduzir a produtividade e incorrer em custos de substituição inesperados. Consequentemente, as organizações estão a investir cada vez mais em seguros abrangentes de acidentes em viagens corporativas para mitigar estas potenciais perdas, com o objetivo de garantir experiências de viagem tranquilas para os colaboradores e aumentar a responsabilidade corporativa.

A crescente complexidade da logística global de viagens, impulsionada pelo maior volume de passageiros e pela expansão das rotas internacionais, aumentou a probabilidade de incidentes com bagagem perdida. Os fornecedores de seguros contra acidentes em viagens corporativas estão a responder com soluções personalizadas que atendem às necessidades específicas do segmento empresarial, incluindo processos de reclamação rápidos, cobertura de alto valor para artigos comerciais essenciais e serviço ao cliente dedicado para uma resolução rápida. Estas melhorias não só proporcionam tranquilidade aos viajantes corporativos, como também permitem às empresas apoiar eficazmente os seus colaboradores em momentos de interrupção, protegendo-os contra os riscos financeiros e operacionais associados à perda de bagagem.

Por exemplo,

- A Organização Mundial do Turismo (OMT) anunciou que foram registadas 1,5 mil milhões de chegadas de turistas internacionais em 2019 em todo o mundo. Além disso, de acordo com o Barómetro Mundial do Turismo da OMT, previa-se que haveria um aumento de 4% no turismo em 2020. Em 2019, as Américas apresentaram um quadro de crescimento misto, uma vez que muitos destinos insulares nas Caraíbas consolidaram a sua recuperação após os furacões de 2017. A OMT afirmou ainda que, mesmo num cenário de desaceleração económica mundial, os gastos com o turismo continuaram a crescer. A França reportou o maior aumento de 11%, enquanto o turismo nos EUA aumentou 6%

Em resumo, o aumento dos incidentes de bagagem perdida devido ao aumento do turismo está a impulsionar o crescimento do mercado de seguros contra acidentes em viagens corporativas nos EUA. À medida que as empresas procuram proteger os colaboradores e mitigar os riscos financeiros associados a interrupções de viagens, a procura por soluções de seguro abrangentes está a aumentar. Esta tendência sublinha a importância de um seguro de viagem robusto como um componente vital da gestão de riscos empresariais, posicionando o mercado de seguros de acidentes em viagens empresariais para uma expansão contínua.

- Aumento de viagens para fins comerciais ou de férias

O crescimento sustentado das viagens nacionais e internacionais, impulsionado pela expansão do negócio e pelo aumento das viagens de férias entre profissionais, impulsiona significativamente o mercado de seguros de acidentes em viagens corporativas nos EUA. Com a economia dos EUA a favorecer as viagens de negócios, à medida que as organizações reforçam as relações com os clientes, exploram novos mercados e aumentam a gestão no local, a procura de seguros de viagem abrangentes aumenta para garantir a proteção da força de trabalho. À medida que as empresas adotam um modelo operacional globalizado, os colaboradores são obrigados a viajar com maior frequência, expondo-os a vários riscos, incluindo acidentes, emergências médicas e incidentes relacionados com o transporte. Desta forma, as empresas estão cada vez mais a oferecer seguros contra acidentes em viagens de negócios para mitigar estas responsabilidades e proteger o bem-estar dos colaboradores.

Da mesma forma, tem-se registado um aumento significativo na combinação de viagens de negócios com viagens de lazer, muitas vezes chamadas de viagens "bleisure", à medida que os colaboradores aproveitam os horários de trabalho flexíveis e os acordos de trabalho remoto para prolongar as viagens para além dos objetivos principais do negócio. O aumento das viagens de lazer sublinha uma necessidade crescente de produtos de seguro que cubram os riscos de viagens pessoais e empresariais, levando as seguradoras a desenvolver apólices flexíveis e inclusivas. Além disso, à medida que os destinos de viagem se diversificam e incluem regiões de maior risco, os produtos de seguro de viagem estão a alargar as suas opções de cobertura, incluindo evacuação médica, morte acidental e benefícios por desmembramento, adaptados às necessidades dos viajantes frequentes. A crescente consciencialização sobre os riscos para a saúde, as preocupações com a segurança e os incidentes imprevisíveis levou as empresas e os indivíduos a encarar o seguro de acidentes de viagem como uma necessidade e não como uma opção.

Por exemplo,

- Uma pesquisa feita pela TravelPerk SLU mostra que antes do surto da pandemia do coronavírus, as viagens de negócios estavam avaliadas em 1,28 triliões de dólares americanos em 2019. Também se observou que as viagens de negócios caíram 90%, o corona estava num pico elevado, enquanto antes -pandemia, observou-se que algumas empresas viram a atividade de viagens de negócios regressar a cerca de 80% dos níveis quando as restrições foram flexibilizadas no verão. O seguro de viagem pré-pandemia consiste em funcionalidades como cancelamento ou alteração de voo, acesso a faixas de segurança rápidas, entre outras

Em resposta, as seguradoras estão a oferecer apólices cada vez mais sofisticadas, muitas vezes acompanhadas de serviços de apoio abrangentes, para satisfazer as necessidades evolutivas dos viajantes corporativos. Este aumento das viagens de negócios e de férias impulsiona significativamente o mercado de seguros contra acidentes em viagens de negócios nos EUA, à medida que as empresas priorizam a gestão de riscos e a segurança dos colaboradores, no meio da expansão das rotinas de viagens.

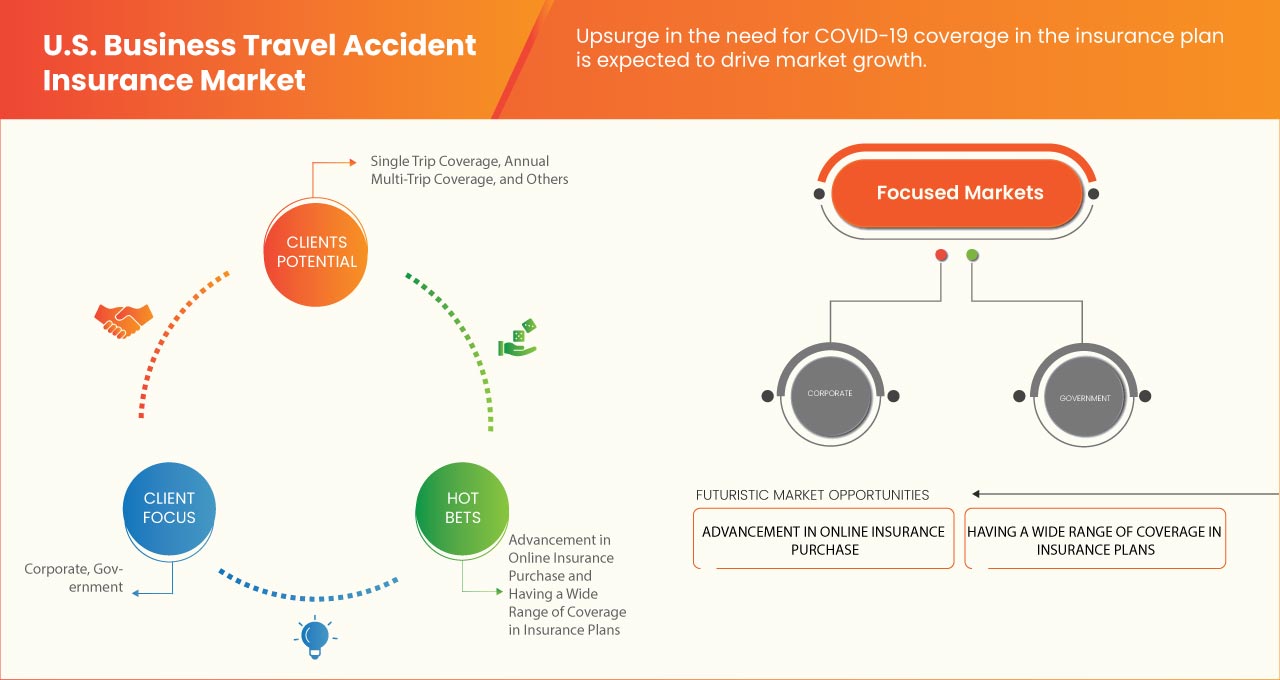

Oportunidades

- Aumento dos Atrativos no Plano de Seguros pelas Empresas

A introdução de características melhoradas e atrativas nos planos de seguro contra acidentes em viagens de negócios (BTA) oferece oportunidades substanciais de crescimento no mercado dos EUA. À medida que as empresas de todos os setores intensificam o seu foco na segurança dos colaboradores, no bem-estar e no apoio abrangente às viagens, as seguradoras estão a responder expandindo e adaptando os seus planos de BTA para se alinharem com esta procura em evolução. Com benefícios adicionais, como cobertura médica alargada, evacuação de emergência, acesso global a cuidados de saúde e até apoio de bem-estar durante as viagens, as seguradoras podem aumentar o valor percebido das apólices de BTA. Este valor acrescentado vai ao encontro das crescentes expectativas das empresas que procuram fornecer pacotes robustos e competitivos para reter e apoiar os colaboradores em funções com muitas viagens.

As melhorias nos planos BTA podem também servir como fator diferenciador para as seguradoras que procuram estabelecer ou reforçar a sua presença no mercado dos EUA. A procura por opções de seguro mais flexíveis e personalizáveis levou um maior número de pequenas e médias empresas (PME) a explorar apólices de BTA. Ao integrar opções personalizáveis e ao oferecer níveis de cobertura diferenciados, as seguradoras podem satisfazer diversos requisitos corporativos e atrair uma base de clientes mais ampla. Por exemplo, a cobertura específica para os setores da tecnologia, saúde e energia pode atender a riscos de viagem específicos, criando uma vantagem competitiva e reforçando a lealdade do cliente.

Além disso, a digitalização e a prestação de serviços possibilitada pela tecnologia estão a proporcionar às seguradoras formas de otimizar os processos de reclamações, melhorar a experiência do cliente e aproveitar a análise de dados para antecipar as necessidades dos clientes. Com a inclusão de aplicações móveis, assistência 24 horas por dia, 7 dias por semana e alertas em tempo real para riscos globais, os fornecedores de seguros da BTA podem agora oferecer um suporte integrado e fácil de utilizar para os colaboradores que viajam. Isto não só aumenta a satisfação do cliente, como também posiciona as seguradoras como progressivas e adaptáveis ao ambiente empresarial moderno.

Por exemplo,

- Em julho de 2021, a American Express anunciou que os seus titulares dos cartões US Platinum e Business Platinum teriam acesso a ainda mais salas VIP de aeroportos e comodidades premium quando viajassem. Este membro receberá serviços de viagens e estilo de vida de classe mundial e terá acesso a programas de viagens, benefícios e ofertas exclusivas. Com isto, a empresa está a preparar o seu cartão para iniciar o regresso às viagens

À medida que as viagens corporativas continuam a recuperar, a inovação e a melhoria dos planos de seguro BTA apresentam caminhos claros para a expansão do mercado, melhor retenção de clientes e maior potencial de receitas nos EUA.

- Aumento das preocupações com a segurança entre as pessoas

The increasing safety concerns among American travelers present a substantial opportunity for the U.S. Business Travel Accident (BTA) Insurance market. Rising awareness around personal safety and health security during business trips is influencing companies to prioritize comprehensive travel protection for employees. This shift is driven by several factors: heightened global political instability, potential exposure to health risks, and natural disaster concerns. Companies are focusing on their duty of care obligations to ensure employees are protected against unexpected risks while traveling, which is fueling demand for customized, high-coverage BTA policies.

For the BTA insurance market, this evolving landscape offers opportunities to innovate and broaden offerings to align with the growing emphasis on safety. Insurers can leverage this trend by developing policies that address specific risks, such as international medical emergencies, acts of terrorism, and trip interruptions. Furthermore, advancements in data analytics and digitalization are enabling insurers to offer real-time risk assessment and assistance, enhancing the appeal of such policies for corporate clients who prioritize quick and comprehensive responses in crisis situations.

Another significant growth area is the increase in remote and hybrid work models, which often require more frequent travel to maintain team cohesion and manage decentralized workforces. As businesses expand operations across wider geographies, their employees’ exposure to travel risks also grows, thus prompting the need for broader, flexible BTA insurance policies. Companies are now more inclined to offer these policies as part of their employee benefits packages, positioning BTA insurance as an essential component of corporate travel programs.

For instance,

- In July 2021, Generali Global Assistance announced that they have partnered with FootprintID to enhance its Trip Mate Travel Protection Plans. The partnership will allow travellers with Trip Mate protection plans to have access to FootprintID’s Portable Personal Health Records, which allow them to take their medical information with them anywhere. With this, the company will be able to elevate its level of care to its clients

- Travelex Insurance Services partnered with Berkshire Hathaway Specialty Insurance Company’s Berkshire Hathaway Travel Protection (BHTP) to provide innovative travel protection plans. With this partnership, the companies are e intent on bringing a high level of service, product innovation, and claims handling expertise and expediency to travel professionals and their clients. Thus, the company will be able to provide quality travel protection plans to its customers

In conclusion, the rising focus on traveler safety, coupled with an increase in remote work-induced travel, presents a ripe environment for the U.S. Business Travel Accident Insurance market to expand. By addressing these concerns with tailored and responsive solutions, insurers can meet market demands and capture a growing share of corporate clients focused on protecting their workforce.

Restraints/Challenges

- Rise in Concern Regarding Data

The U.S. business travel accident insurance market is facing significant challenges stemming from increasing concerns about data privacy and security. As businesses expand their global footprint, they rely heavily on data-driven insights to enhance travel safety and improve risk management strategies. However, the rising frequency of data breaches and growing public awareness surrounding data protection regulations—such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA)—are creating a complex environment for insurers.

This heightened concern about data security poses several challenges to the business travel accident insurance sector. First, insurers are now tasked with not only providing comprehensive coverage but also ensuring robust data protection measures are in place. Failure to do so can result in reputational damage and financial repercussions due to non-compliance with evolving legal frameworks. Moreover, businesses are increasingly scrutinizing their insurance partners for their data handling practices. Insurers that cannot demonstrate strong data governance and security protocols risk losing clients to competitors who prioritize these aspects. As a result, insurance providers must invest in advanced technologies and training to enhance their data protection capabilities, which can strain resources and affect profitability.

Additionally, the growing concern about data privacy may lead to more stringent underwriting criteria, potentially increasing costs for businesses seeking coverage. Insurers may face difficulties in accurately assessing risk when clients are hesitant to share critical data. This disconnect can result in gaps in coverage and higher premiums, further complicating the relationship between businesses and their insurers.

For Instances,

- California Consumer Privacy Act (CCPA) implemented in January 2020, the CCPA requires businesses to enhance transparency regarding data collection and usage practices. Companies in the business travel sector must comply with this regulation or face penalties, which affects how insurers assess risks and set premiums. A business may choose not to share certain data with insurers, complicating the underwriting process and potentially leading to increased costs or gaps in coverage

- According to an article published on Vox Media, LLC website, Marriott revealed a data breach affecting approximately 500 million guests, exposing personal details such as names, addresses, phone numbers, and passport numbers. As travel companies like Marriott collect vast amounts of data, incidents like these raise concerns for insurers about the safety of travelers’ information, making it critical for travel accident insurers to enhance their data security protocols

In summary, the rise in concern regarding data privacy and security presents multifaceted challenges for the U.S. Business Travel Accident Insurance Market, necessitating a proactive approach to data management and compliance to ensure sustainable growth in an increasingly competitive landscape.

- Low Consumer Experiences in Terms of Coverages

In the U.S. business travel accident insurance market, low consumer experiences related to coverage options are a notable restraint. Many business travelers, especially those navigating insurance for the first time, encounter policies that appear complex or insufficient in addressing the unique risks and diverse needs of business travel. Coverage limitations can often fail to encompass critical aspects, such as comprehensive medical assistance, loss of personal effects, emergency medical evacuation, and trip interruption protections. This lack of comprehensiveness in available policies can lead to consumer dissatisfaction and discouragement from purchasing these insurance products.

One of the primary restraints lies in the perceived gap between what consumers expect and what policies deliver. This gap creates a barrier to adoption, as potential clients may hesitate to invest in policies they perceive as lacking in value or relevance. Often, policies are presented with standardized terms and limited options for customization, making them less attractive for businesses with unique travel requirements. As a result, companies seeking to secure tailored coverage for diverse employee roles or international travel needs may find themselves underserved, driving them to explore alternative or self-insured options.

For instance,

- A study done by Wonderflow shows that the insurance industry struggles with a reputation issue. Customers feel distant from the insurance company as they are often believed to be self-interested and opportunistic. Because of the customer's opinion, nearly 44% of customers have had no interactions with their insurers in the last 18 months. Also, about 40% of the insurance customer are dissatisfied with the company’s services

- O ValuePenguin, em 50 apólices de seguro de viagem, mostra que o custo médio do seguro de viagem nos EUA foi de 148 dólares. Mas todas as apólices de seguro de viagem não são iguais. Uns são muito mais abrangentes do que outros e, consequentemente, a variação de custos entre eles pode ser ampla. Descobriram também que o custo de uma apólice de seguro de viagem abrangente era 56% mais elevado, em média, do que uma apólice de seguro de viagem básica. Além disso, a idade do segurado tem impacto no custo da apólice; quanto maior a idade, maior o custo da apólice. O custo da apólice varia entre USD 82 a USD 415

Em resumo, as baixas experiências do consumidor devido a opções de cobertura restritivas e não transparentes estão a restringir significativamente o crescimento do mercado de seguros de acidentes em viagens corporativas dos EUA.

Impacto e cenário atual do mercado de escassez de matéria-prima e atrasos no envio

A Data Bridge Market Research oferece uma análise de alto nível do mercado e fornece informações tendo em conta o impacto e o ambiente atual do mercado de escassez de matérias-primas e atrasos nas remessas. Isto traduz-se em avaliar possibilidades estratégicas, criar planos de ação eficazes e auxiliar as empresas na tomada de decisões importantes.

Além do relatório padrão, também oferecemos uma análise aprofundada do nível de aquisição, desde atrasos previstos de expedição, mapeamento de distribuidores por região, análise de commodities, análise de produção, tendências de mapeamento de preços, sourcing, análise de desempenho de categoria, soluções avançadas de gestão de risco da cadeia de abastecimento.

Impacto esperado da desaceleração económica nos preços e na disponibilidade dos produtos

Quando a atividade económica abranda, as indústrias começam a sofrer. Os efeitos previstos da crise económica nos preços e na acessibilidade dos produtos são tidos em conta nos relatórios de informação de mercado e nos serviços de informações fornecidos pelo DBMR. Com isto, os nossos clientes conseguem geralmente manter-se um passo à frente dos seus concorrentes, projetar as suas vendas e receitas e estimar as suas despesas com lucros e perdas.

Âmbito do mercado de seguros de acidentes em viagens de negócios nos EUA

O mercado é segmentado com base no tipo, tipo de utilizador, canal de distribuição, cobertura, tipo de apólice, dimensão do negócio e utilizador final. O crescimento entre estes segmentos irá ajudá-lo a analisar segmentos de baixo crescimento nos setores e fornecerá aos utilizadores uma visão geral e informações valiosas do mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Tipo

- Cobertura de viagem única

- Cobertura anual multiviagem

- Outros

Tipo de utilizador

- B2B

- B2C

- B2B2C

Canal de Distribuição

- Mediadores de Seguros

- Agregadores de seguros

- Companhia de seguros

- Banco

- Outros

Cobertura

- Acidente Médico

- Cobertura de viagem única

- Cobertura anual multiviagem

- Outros

- Morte acidental

- Cobertura de viagem única

- Cobertura anual multiviagem

- Outros

- Desmembramento acidental

- Cobertura de viagem única

- Cobertura anual multiviagem

- Outros

- Assistência médica fora do país

- Cobertura de viagem única

- Cobertura anual multiviagem

- Outros

- Evacuação Médica de Emergência

- Cobertura de viagem única

- Cobertura anual multiviagem

- Outros

- Evacuação de Segurança

- Cobertura de viagem única

- Cobertura anual multiviagem

- Outros

- Outros

- Cobertura de viagem única

- Cobertura anual multiviagem

Tipo de política

- Políticas locais

- Políticas Globais

- Programa Mestre Controlado

Tamanho do negócio

- Grandes empresas (mais de 500 colaboradores)

- Acidente Médico

- Morte acidental

- Desmembramento acidental

- Assistência médica fora do país

- Evacuação Médica de Emergência

- Evacuação de Segurança

- Outros

- Empresas de média dimensão (10 a 500 colaboradores)

- Acidente Médico

- Morte acidental

- Desmembramento acidental

- Assistência médica fora do país

- Evacuação Médica de Emergência

- Evacuação de Segurança

- Outros

- Pequenas empresas (2 a 10 colaboradores)

- Acidente Médico

- Morte acidental

- Desmembramento acidental

- Assistência médica fora do país

- Evacuação Médica de Emergência

- Evacuação de Segurança

- Outros

Utilizador final

- Corporativo

- Governo

- Viajantes e funcionários internacionais (expatriados)

Participação no mercado de seguros de acidentes em viagens de negócios nos EUA

O cenário competitivo do mercado fornece detalhes por concorrentes. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento de produto, amplitude e abrangência do produto, domínio da aplicação. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas em relação ao mercado.

Os líderes em seguros de acidentes em viagens de negócios nos EUA que operam no mercado são:

- Chubb (EUA)

- AGA Service Company (Allianz Partners) (EUA)

- American International Group, Inc. (AIG) (EUA)

- AXA Partners USA SA (EUA)

- The Hartford (EUA), American Express (EUA)

- MetLife Services and Solutions, LLC (EUA)

- Berkshire Hathaway Specialty Insurance (EUA)

- Arch Capital Group Ltd. (Bermudas)

- Generali Global Assistance (EUA)

Últimos desenvolvimentos no mercado de seguros de acidentes de viagens de negócios nos EUA

- Em julho de 2022, a Chubb concluiu a aquisição das seguradoras de vida e não vida que albergam os negócios de acidentes pessoais, saúde suplementar e seguros de vida da Cigna em vários mercados asiáticos. A Chubb pagou aproximadamente 5,4 mil milhões de dólares em dinheiro pelas operações, que incluem os negócios de acidentes e saúde (A&H) e vida da Cigna na Coreia, Taiwan, Nova Zelândia, Tailândia, Hong Kong e Indonésia, coletivamente designados por negócios da Cigna na Ásia. Esta aquisição estratégica complementar expande a nossa presença e faz avançar a nossa oportunidade de crescimento a longo prazo na Ásia. A partir de 1 de julho de 2022, os resultados das operações deste negócio adquirido são reportados principalmente no nosso segmento de Seguros de Vida e, em menor medida, no nosso segmento de Seguros Gerais no Estrangeiro.

- Em julho de 2023, a American International Group, Inc. (NYSE: AIG) anunciou o fecho bem-sucedido do seu acordo definitivo com fundos geridos pela Stone Point Capital LLC (Stone Point) para formar uma Agência Geral de Gestão (MGA) independente especializada em High Net Mercados de capital próprio e de ultra-alto capital próprio denominado Private Client Select Insurance Services (PCS)

- Em julho de 2021, a AXA Partners USA SA anunciou que assinou um acordo com o Club Med para oferecer uma apólice de seguro concebida para cobrir eventos imprevistos que os viajantes possam encontrar antes, durante ou depois da sua viagem, incluindo a COVID-19. A apólice de seguro do Plano de Proteção Serenity inclui cobertura para contaminação por COVID, podendo o seguro reembolsar a estadia e o transporte. Além disso, a apólice fornecerá cobertura para eventos como “voo perdido”, seguro de bagagem e indemnização em caso de interrupção da estadia. Desta forma, a empresa proporcionará ao seu cliente uma política que lhe permitirá desfrutar das suas férias com segurança e tranquilidade.

- Em maio de 2021, a Hartford anunciou a sua participação na Conferência Virtual de Investidores em Serviços Financeiros da Wells Fargo de 2021. O presidente e CEO da empresa, Christopher Swift, e a diretora financeira, Beth Costello, vão participar num chat e falar sobre serviços financeiros. Isto ajudará a empresa a ser reconhecida na plataforma global e a melhorar a sua imagem de marca

- Em julho de 2021, a American Express Company anunciou que os seus titulares dos cartões US Platinum e Business Platinum teriam acesso a ainda mais salas VIP de aeroportos e comodidades premium quando viajassem. Este membro receberá serviços de viagens e estilo de vida de classe mundial, bem como acesso a programas de viagens, benefícios e ofertas exclusivas. Com isto, a empresa está a preparar os seus portadores para iniciar o regresso às viagens

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.