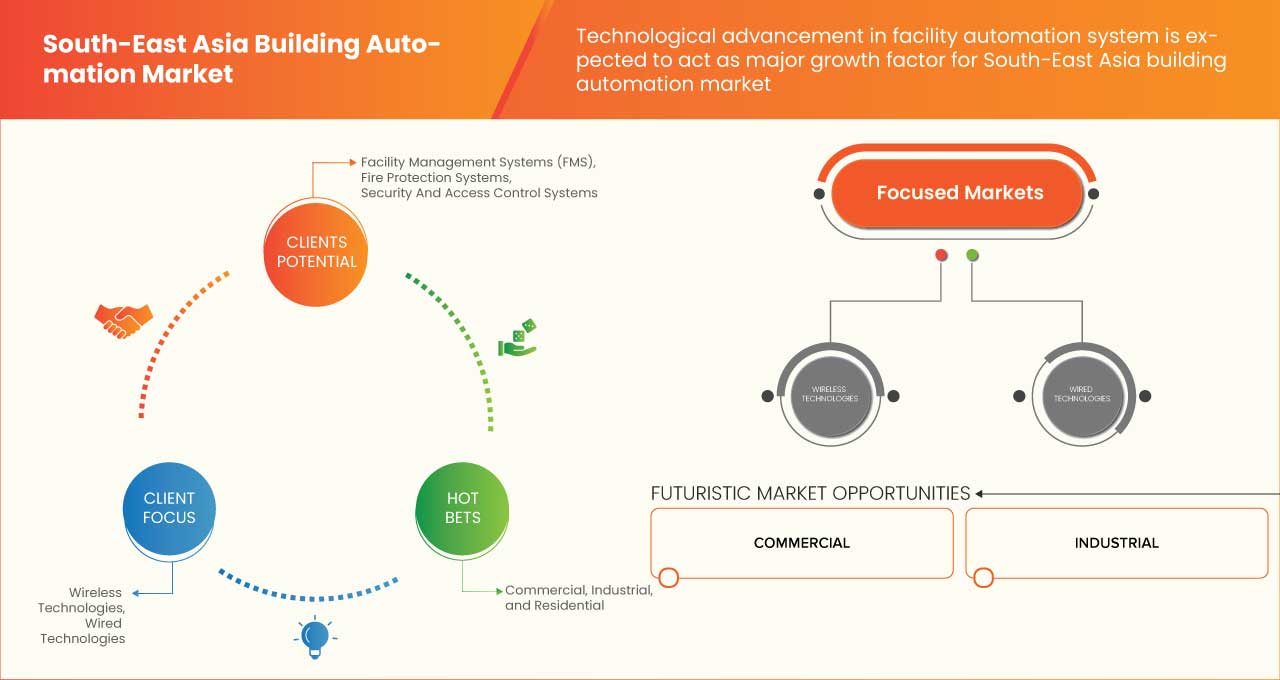

Mercado de sistemas de automação de edifícios do sudeste asiático, por tipo de sistema (sistemas de gestão de instalações (FMS), sistemas de proteção contra incêndio , sistemas de segurança e controlo de acessos, sistemas de gestão de energia, software de gestão de edifícios (BMS ) e outros), tecnologia (tecnologias sem fios e Tecnologias com fios), Aplicação (comercial, industrial e residencial), Tendências do setor e previsão até 2030.

Análise e insights do mercado de sistemas de automação de edifícios do Sudeste Asiático

Os sistemas de automação de edifícios combinam AVAC, iluminação, segurança e outros sistemas para interagir numa única plataforma. São sistemas inteligentes que incluem hardware e software. Nesta abordagem, o sistema de automatização melhora a segurança e o conforto dos ocupantes, ao mesmo tempo que fornece informações vitais sobre a eficiência operacional de um edifício. Os principais objetivos deste tipo de infraestrutura são aumentar a segurança, reduzir custos e aumentar a eficiência do sistema. Todos estes elementos se reúnem numa plataforma consolidada de gestão de edifícios.

A Data Bridge Market Research analisa que o mercado de sistemas de automação de edifícios do Sudeste Asiático crescerá a um CAGR de 6,2% durante o período previsto de 2023 a 2030.

|

Métrica de Reporte |

Detalhes |

|

Período de previsão |

2023 a 2030 |

|

Ano base |

2022 |

|

Anos históricos |

2021 (Personalizável para 2020-2016) |

|

Unidades quantitativas |

Receita em milhares de dólares americanos, volumes em unidades, preços em dólares americanos |

|

Segmentos abrangidos |

Por tipo de sistema (sistemas de gestão de instalações (FMS), sistemas de proteção contra incêndios, sistemas de segurança e controlo de acessos, sistemas de gestão de energia, software de gestão de edifícios (BMS) e outros), tecnologia (tecnologias sem fio e tecnologias com fio), aplicação (comercial, industrial , e Residencial). |

|

Países abrangidos |

Myanmar, Camboja, Indonésia, Laos, Malásia, Filipinas, Singapura, Tailândia, Vietname e o resto do Sudeste Asiático. |

|

Atores do mercado abrangidos |

Transportadora, Robert Bosch GmbH, Hubbell, ABB, Emersen Electric Co., Hitachi Ltd., Delta Electronics, Inc., Neckoff Automation, Rockwell Automation, Inc., Honeywell International Inc., Jhonson Controls, Siemens, Mitsubishi Electric Corporation, Azbil Vietnam Co., ltd., SYREFL HOLDINGS SDN BHD, Lutron Electronics Co., Inc, e Huawei Technologies Co., ltd. entre outros. |

Definição de Mercado

A automação de edifícios é o controlo automático centralizado por software ou aplicação que ajuda a controlar os sistemas de aquecimento, ventilação e ar condicionado (AVAC), eletricidade, iluminação, sombreamento, controlo de acessos, segurança e outros sistemas inter-relacionados de um edifício. Isto é feito através de um sistema de gestão de edifícios (BMS) ou sistema de automação de edifícios (BAS). Isto ajuda a melhorar o conforto dos ocupantes, a operação eficiente dos sistemas do edifício, a redução do consumo de energia e dos custos de operação e manutenção, garante uma maior segurança, recolha e preservação de dados históricos e acesso/controlo/operação remotos do sistema . Existem vários tipos de sistemas BAS.

Dinâmica do mercado de sistemas de automação de edifícios

Motoristas

-

Aumento da procura por soluções de automação para uma experiência perfeita do cliente

Atualmente, os edifícios para diversos fins têm sofrido uma evolução significativa nas últimas duas décadas. Nos edifícios modernos, há uma procura crescente por sistemas automatizados tecnologicamente avançados. A razão é que a análise preditiva é utilizada nestes sistemas para permitir que o sistema se adapte às mudanças nas condições, garantindo que os sistemas AVAC são geridos de forma eficaz através do controlo automático do equipamento para garantir que o clima dos edifícios se mantém dentro dos limites aceitáveis. A manutenção proativa de equipamentos defeituosos é outro benefício da automação de edifícios. Além disso, estas tecnologias podem aumentar os níveis de conforto dos ocupantes, resultando em trabalhadores mais felizes e eficazes.

-

Integração de sistemas de automação de edifícios na região

A tecnologia de sistemas de automação de edifícios tem feito avanços significativos nos últimos anos e está agora a ser integrada nas estruturas de edifícios antigos e novos em todo o mundo. A automação e os controlos de construção estão a tornar-se cada vez mais populares, o que deverá ajudar o mercado a expandir-se nos países emergentes, especialmente na região da Ásia-Pacífico, onde o setor da construção tem assistido a um crescimento nos últimos anos.

-

Avanço tecnológico no sistema de automatização de instalações

Semelhante ao crescimento da internet, os controlos digitais de construção também se expandiram. A adoção começou com um número relativamente pequeno de pessoas antes de se espalhar para um uso aparentemente universal. A forma como muitos de nós interagimos com a internet e com os nossos edifícios, por outro lado, é completamente diferente quando consideramos os smartphones. Os smartphones colocam o potencial da internet nas mãos das pessoas de uma forma utilizável e acessível, condensando e digerindo o enorme panorama de possibilidades em aplicações fáceis de utilizar. Quando se trata da forma como os seus edifícios e os dados que contêm interagem com eles, muitos gestores comparam-nos à antiga auto-estrada da informação, que era uma grande extensão de potencial e de dados sem qualquer ferramenta para os ajudar a compreendê-los.

-

Crescimento rápido em infraestrutura inteligente

Em termos de automatização e integração de edifícios, prevê-se que os próximos anos proporcionem acessibilidade. Isto inclui o acesso entre sistemas que historicamente operaram de forma independente, o acesso ao pessoal técnico que apoia os edifícios e o acesso dos decisores aos dados que o edifício mantém sobre a utilização e o desempenho. Este acesso ajudará os proprietários e operadores de edifícios a utilizar o espaço de forma mais inteligente, a melhorar a atmosfera para os utilizadores e a atingir metas de redução de energia e carbono.

Oportunidades

-

Introdução à inteligência artificial

Devido aos avanços tecnológicos, o setor da gestão de instalações está em constante evolução. As tecnologias de automatização estão atualmente a transformar os negócios ao otimizar e simplificar os processos de trabalho, além de eliminar as responsabilidades rotineiras dos gestores de instalações. Outras vantagens da implementação da tecnologia de automatização incluem a redução dos custos de reparação e manutenção em mais de 30%, a melhoria das relações com os empreiteiros e o aumento da fiabilidade e durabilidade dos ativos. Quando ligada ao sistema de software de gestão de instalações, a IA, ou inteligência artificial , permite notificações, alarmes e resolução de problemas em tempo real.

-

Necessidade crescente de tecnologias de construção conectadas

A infraestrutura inteligente é uma nova tecnologia que está a alterar cada vez mais a forma como as pessoas vivem e trabalham nos edifícios. Estas tecnologias de construção de ponta e as estruturas que produzem são mais procuradas do que nunca devido ao aumento constante do número de empresas de construção inteligente. Os edifícios inteligentes utilizam sistemas de eficiência energética, são mais ecológicos e promovem a segurança, o que pode melhorar tanto o bem-estar dos ocupantes como a estabilidade financeira dos proprietários. Tudo o que precisa de saber sobre estas estruturas será abordado neste livro, incluindo uma discussão completa sobre as vantagens, uma lista das principais características de segurança para infraestruturas inteligentes e detalhes sobre o procedimento de instalação.

Restrições/Desafios

- Complexidade na instalação/operação do sistema de automação de edifícios

As decisões de instalação tomadas podem ter um impacto significativo na durabilidade de um sistema de automação de edifícios. Para um sistema AVAC, por exemplo, o posicionamento das condutas, o posicionamento das aberturas, uma boa vedação e a ordenação adequada dos componentes são cruciais para que o sistema de automação de edifícios opere eficazmente ao longo do tempo. Portanto, uma instalação adequada e bem planeada deve vir em primeiro lugar. A formação insuficiente é um fator no baixo desempenho dos sistemas de automação de edifícios. A razão por trás disto é a sua complexidade. Os sistemas de automação e controlo de edifícios têm uma maior complexidade devido à sua maior funcionalidade. Um sistema mais complexo, no entanto, também exige uma formação mais completa para aqueles que o utilizam. Os operadores devem compreender o que a informação significa e se indica um sistema operativo ou componente adequado ou incorreto.

- Falta de sistemas de automação fáceis de utilizar

O utilizador final precisa de cuidar do sistema de automação predial. Os sistemas de automação e controlo de edifícios têm-se tornado cada vez mais complicados à medida que as suas capacidades aumentam. Sistemas mais controláveis, ambientes mais confortáveis e menos consumo de energia são resultados da complexidade.

Impacto da COVID-19 no mercado dos sistemas de automação de edifícios

A COVID-19 impactou fortemente todas as principais indústrias do mundo. Durante o período da pandemia, a maioria das indústrias esteve completamente encerrada. Além disso, o comportamento dos indivíduos certamente mudou durante a pandemia, o que levou a uma diminuição do processo de produção e fabrico. A pandemia trouxe uma enorme queda nas vendas do mercado de sistemas de automação de edifícios, uma vez que o lockdown prevaleceu na maioria das regiões. O bloqueio levou fabricantes e consumidores a interromper completamente os processos durante alguns meses. A procura por produtos de automação de infraestruturas sofreu uma queda drástica devido ao encerramento de vários setores. Além disso, o mercado de sistemas de automação de edifícios do Sudeste Asiático registou uma queda sem precedentes. No entanto, as coisas estão a normalizar a cada dia; a procura de automação e o crescimento no mercado de sistemas de automação de edifícios estão obsoletos.

Os fabricantes estão a tomar várias decisões estratégicas para recuperar após a COVID-19. Os jogadores estão a conduzir diversas atividades de investigação e desenvolvimento para melhorar o desempenho e as vendas. Com isto, as empresas levarão produtos avançados para o mercado.

Desenvolvimentos recentes

- Em novembro de 2022, a Siemens anunciou a sua parceria com a Qualcomm Technologies, Inc. A empresa irá trabalhar em conjunto para desenvolver a automatização através da aplicação de uma Rede Privada (PN) 5G. Isto ajudou a empresa a aumentar a sua presença no mercado.

- Em junho de 2022, a Mitsubishi Electric Corporation anunciou que iria investir aproximadamente 2,2 mil milhões de INR, ou 3,1 mil milhões de ienes, na sua subsidiária Mitsubishi Electric India Pvt. Lda. para estabelecer uma nova fábrica na Índia. Esta instalação produz inversores e outros produtos de sistema de controlo de automação de fábrica (FA). Isto ajudou a empresa a aumentar a sua presença nos mercados do Sul da Ásia e do Sudeste Asiático.

Âmbito de mercado do sistema de automação de edifícios do Sudeste Asiático

O mercado de sistemas de automação de edifícios está segmentado com base no tipo de sistema, tecnologia e aplicação. O crescimento entre estes segmentos irá ajudá-lo a analisar os principais segmentos de crescimento nos setores e fornecerá aos utilizadores uma visão geral e informações valiosas do mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Tipo de sistema

- Sistemas de Gestão de Instalações (FMS)

- Sistemas de Proteção contra Incêndio

- Sistemas de Segurança e Controlo de Acessos

- Sistemas de Gestão de Energia

- Software de gestão de edifícios (BMS)

- Outros

Com base no tipo de sistema, o mercado de sistemas de automação de edifícios está segmentado em sistemas de gestão de instalações (FMS), sistemas de proteção contra incêndio, sistemas de segurança e controlo de acessos, sistemas de gestão de energia, software de gestão de edifícios (BMS) e outros.

Tecnologia

- Tecnologias sem fios

- Tecnologias com fios

Com base na tecnologia, o mercado de sistemas de automação de edifícios está segmentado em tecnologias sem fios e tecnologias com fios.

Aplicação

- Comercial

- Industrial

- residencial

Com base na aplicação, o mercado de sistemas de automação de edifícios está segmentado em comercial, industrial e residencial.

Análise/Insights regionais do mercado de sistemas de automação de edifícios do Sudeste Asiático

O mercado de sistemas de automação de edifícios é analisado, e os insights e tendências sobre o tamanho do mercado são fornecidos pelo tipo de sistema, tecnologia, aplicação e países, conforme referenciado acima.

O mercado de sistemas de automação de edifícios do Sudeste Asiático abrange países como Myanmar, Camboja, Indonésia, Laos, Malásia, Filipinas, Singapura, Tailândia, Vietname e o resto do Sudeste Asiático. Espera-se que Singapura domine o mercado de sistemas de automação de edifícios do Sudeste Asiático, uma vez que é líder regional na adoção de produtos e soluções de automação de edifícios. Na Tailândia, a Delta Controls e a LOYTEC continuam a desenvolver produtos inovadores de gestão e controlo de edifícios. As sinergias das suas tecnologias de automação de edifícios com as principais capacidades de poupança de energia da Delta integram diversos sistemas de edifícios numa única plataforma de gestão, o que ajudará a ampliar o crescimento do mercado de automação de edifícios do país no mercado de sistemas de automação de edifícios do Sudeste Asiático. Todos estes fatores contribuíram para o crescimento do país no mercado de sistemas de automação de edifícios do Sudeste Asiático.

A secção de países do relatório de mercado de sistemas de automação de edifícios também fornece fatores individuais que impactam o mercado e alterações nas regulamentações do mercado nacional que impactam as tendências atuais e futuras do mercado. Pontos de dados como novas vendas, vendas de reposição, demografia do país, epidemiologia de doenças e tarifas de importação e exportação são alguns dos indicadores significativos utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade de marcas globais e os seus desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais e o impacto dos canais de vendas são considerados ao fornecer uma análise de previsão dos dados do país.

Análise do cenário competitivo e da quota de mercado do sistema de automação de edifícios do sudeste asiático

O panorama competitivo do mercado de sistemas de automação de edifícios fornece detalhes do concorrente. Os detalhes incluem a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença global, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento da solução, amplitude e abrangência do produto e aplicação domínio. Os pontos de dados acima estão apenas relacionados com o foco das empresas no mercado de sistemas de automação de edifícios.

Alguns dos principais participantes que operam no mercado de sistemas de automação de edifícios são a Carrier, Robert Bosch GmbH, Hubbell, ABB, Emersen Electric Co., Hitachi Ltd., Delta Electronics, Inc., Neckoff Automation, Rockwell Automation, Inc., Honeywell International Inc. ., Jhonson Controls, Siemens, Mitsubishi Electric Corporation, Azbil Vietnam Co., ltd., SYREFL HOLDINGS SDN BHD, Lutron Electronics Co., Inc, e Huawei Technologies Co., ltd. entre outros.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 VALUE CHAIN ANALYSIS:

4.2 PRICING ANALYSIS:

4.3 BUILDING AUTOMATION SYSTEM ECOSYSTEM :

4.3.1 IOT SENSORS

4.3.2 ANALYTICS SOFTWARE

4.3.3 USER INTERFACE

4.3.4 COMMUNICATION

4.4 REGULATORY FRAMEWORK AND STANDARDS:

4.4.1 ISO/IEC JOINT TECHNICAL COMMITTEE 1

4.5 PATENT ANALYSIS:

4.6 PORTER’S FIVE FORCES:

4.7 TOP WINNING STRATEGIES:

4.8 TECHNOLOGICAL TRENDS:

5 REGIONAL SUMMARY

5.1 SUMMARY WRITE-UP (SOUTH-EAST ASIA)

5.1.1 OVERVIEW

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISE IN DEMAND FOR AUTOMATION AND SOLUTION FOR SEAMLESS CUSTOMER EXPERIENCE

6.1.2 INTEGRATION OF BUILDING AUTOMATION SYSTEMS IN THE REGION

6.1.3 TECHNOLOGICAL ADVANCEMENT IN FACILITY AUTOMATION SYSTEM

6.1.4 RAPID GROWTH IN SMART INFRASTRUCTURE

6.2 RESTRAINTS

6.2.1 COMPLEXITY IN INSTALLATION/OPERATION OF BUILDING AUT0MATION SYSTEM

6.2.2 VERY HIGH COST ATTACHED

6.3 OPPORTUNITIES

6.3.1 INTRODUCTION OF ARTIFICIAL INTELLIGENCE

6.3.2 GROWING NEED FOR CONNECTED BUILDING TECHNOLOGIES

6.3.3 INCREASING CONSTRUCTION ACTIVITIES IN THE REGION

6.3.4 STRATEGIC ALLIANCES & PARTNERSHIP BETWEEN ORGANIZATIONS

6.4 CHALLENGES

6.4.1 LACK OF END-USER-FRIENDLY AUTOMATION SYSTEMS

6.4.2 VERY HIGH COMPETITION

7 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE

7.1 OVERVIEW

7.2 FACILITY MANAGEMENT SYSTEMS (FMS)

7.2.1 HVAC CONTROL SYSTEMS

7.2.1.1 SENSORS

7.2.1.2 ACTUATORS

7.2.1.2.1 ELECTRIC

7.2.1.2.2 HYDRAULIC

7.2.1.2.3 PNEUMATIC

7.2.1.3 CONTROL VALVES

7.2.1.4 HEATING AND COOLING COILS

7.2.1.5 SMART THERMOSTATS

7.2.1.6 PUMPS AND FANS

7.2.1.7 DAMPERS

7.2.1.7.1 PARALLEL AND OPPOSED BLADE DAMPERS

7.2.1.7.2 LOW-LEAKAGE DAMPERS

7.2.1.7.3 ROUND DAMPERS

7.2.1.8 OTHERS

7.2.2 SMART DEVICES

7.2.2.1 SMART APPLIANCES

7.2.2.2 ENVIRONMENT AND AIR QUALITY MONITORING SYSTEMS

7.2.2.3 SMART METER

7.2.3 LIGHTING CONTROL SYSTEMS

7.2.3.1 HARDWARE

7.2.3.1.1 RECEIVERS

7.2.3.1.2 ACTUATORS

7.2.3.1.3 TRANSMITTERS

7.2.3.1.4 SENSORS

7.2.3.1.5 TIMERS

7.2.3.1.6 RELAY

7.2.3.2 SOFTWARE

7.2.3.3 SERVICES

7.2.3.3.1 INSTALLATION

7.2.3.3.2 SUPPORT AND MAINTENANCE

7.3 SECURITY AND ACCESS CONTROL SYSTEMS

7.3.1 BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS

7.3.1.1 HARDWARE

7.3.1.1.1 MULTI FACTOR AUTHENTICATION

7.3.1.1.2 SINGLE FACTOR AUTHENTICATION

7.3.1.2 SOFTWARE

7.3.1.3 SERVICES

7.3.1.3.1 INSTALLATION

7.3.1.3.2 SUPPORT & MAINTENANCE

7.3.1.3.3 VIDEO SURVEILLANCE AS A SERVICE (VSAAS)

7.3.1.3.3.1 HARDWARE

7.3.1.3.3.2 CAMERAS

7.3.1.3.3.3 STORAGE SYSTEMS

7.3.1.3.3.4 ACCESSORIES

7.3.1.3.3.5 MONITORS

7.3.1.3.3.6 SOFTWARE

7.3.1.3.3.7 SERVICES

7.3.1.3.3.8 INSTALLATION

7.3.1.3.3.9 SUPPORT & MAINTENANCE

7.3.1.3.3.10 VIDEO SURVEILLANCE AS A SERVICE (VSAAS)

7.3.2 VIDEO SURVEILLANCE SYSTEMS

7.4 ENERGY MANAGEMENT SYSTEMS

7.5 BUILDING MANAGEMENT SOFTWARE (BMS)

7.6 FIRE PROTECTION SYSTEMS

7.6.1 SENSORS AND DETECTORS

7.6.1.1 SMOKE DETECTORS

7.6.1.2 FLAME DETECTORS

7.6.1.2.1 SINGLE IR /SINGLE UV

7.6.1.2.2 DUAL IR /SINGLE UV

7.6.1.2.3 MULTI IR /SINGLE UV

7.6.2 EMERGENCY LIGHTING AND PUBLIC ALERT DEVICES

7.6.3 FIRE ALARMS

7.6.4 FIRE SPRINKLERS

7.7 OTHERS

8 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 WIRELESS TECHNOLOGIES

8.2.1 ZIGBEE

8.2.2 Z–WAVE

8.2.3 ENOCEAN

8.2.4 WI-FI

8.2.5 THREAD

8.2.6 BLUETOOTH

8.2.7 INFRARED

8.3 WIRED TECHNOLOGIES

8.3.1 KNX

8.3.2 DIGITAL ADDRESSABLE LIGHTING INTERFACE (DALI)

8.3.3 BUILDING AUTOMATION AND CONTROL NETWORK (BACNET)

8.3.4 LONWORKS

8.3.5 MODBUS

9 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 RESIDENTIAL

9.2.1 RESIDENTIAL, BY TYPE

9.2.1.1 APARTMENTS

9.2.1.2 MULTI-FAMILY HOME

9.2.1.3 SINGLE-FAMILY HOME

9.2.1.4 OTHERS

9.2.2 RESIDENTIAL, BY SYSTEM

9.2.2.1 DOOR ENTRY SYSTEM

9.2.2.2 VIDEO SURVEILLANCE

9.2.2.3 INTRUSION ALARM SYSTEM

9.2.2.4 ACCESS CONTROL

9.2.2.5 OTHERS

9.2.3 RESIDENTIAL, BY SYSTEM TYPE

9.2.3.1 FACILITY MANAGEMENT SYSTEMS(FMS)

9.2.3.2 SECURITY AND ACCESS CONTROL SYSTEMS

9.2.3.3 ENERGY MANAGEMENT SYSTEMS

9.2.3.4 BUILDING MANAGEMENT SOFTWARE (BMS)

9.2.3.5 FIRE PROTECTION SYSTEMS

9.2.3.6 OTHERS

9.3 COMMERCIAL

9.3.1 COMMERCIAL, BY TYPE

9.3.1.1 AIRPORTS AND RAILWAY STATIONS

9.3.1.2 GOVERNMENT

9.3.1.3 HOSPITALS AND HEALTHCARE FACILITIES

9.3.1.4 HOSPITALITY

9.3.1.5 OFFICE BUILDINGS

9.3.1.6 RETAIL AND PUBLIC ASSEMBLY BUILDINGS

9.3.1.7 EDUCATION

9.3.1.8 OTHERS

9.3.2 COMMERCIAL, BY TECHNOLOGY

9.3.2.1 VENTILATION AND AIR CONDITIONING (HVAC)

9.3.2.2 LIGHTING

9.3.2.3 HEATING

9.3.2.4 SECURITY AND ACCESS CONTROLS

9.3.2.5 FIRE AND LIFE SAFETY

9.3.3 COMMERCIAL, BY SYSTEM TYPE

9.3.3.1 FACILITY MANAGEMENT SYSTEMS(FMS)

9.3.3.2 SECURITY AND ACCESS CONTROL SYSTEMS

9.3.3.3 ENERGY MANAGEMENT SYSTEMS

9.3.3.4 BUILDING MANAGEMENT SOFTWARE (BMS)

9.3.3.5 FIRE PROTECTION SYSTEMS

9.3.3.6 OTHERS

9.4 INDUSTRIAL

9.4.1 INDUSTRIAL, BY TYPE

9.4.1.1 OIL AND GAS

9.4.1.2 ENERGY AND UTILITIES

9.4.1.3 AUTOMOTIVE

9.4.1.4 FOOD AND BEVERAGES

9.4.1.5 METAL AND MINING

9.4.1.6 OTHERS

9.4.2 INDUSTRIAL, BY SYSTEM TYPE

9.4.2.1 FACILITY MANAGEMENT SYSTEMS(FMS)

9.4.2.2 SECURITY AND ACCESS CONTROL SYSTEMS

9.4.2.3 ENERGY MANAGEMENT SYSTEMS

9.4.2.4 BUILDING MANAGEMENT SOFTWARE (BMS)

9.4.2.5 FIRE PROTECTION SYSTEMS

9.4.2.6 OTHERS

10 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET, BY COUNTRY

10.1 SINGAPORE

10.2 THAILAND

10.3 INDONESIA

10.4 MALAYSIA

10.5 VIETNAM

10.6 PHILIPPINES

10.7 MYANMAR

10.8 CAMBODIA

10.9 LAOS

10.1 REST OF SOUTH-EAST ASIA

11 SWOT

12 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: SOUTH-EAST ASIA

13 COMPANY PROFILES

13.1 SIEMENS

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENTS

13.2 MITSUBISHI ELECTRIC CORPORATION

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT DEVELOPMENTS

13.3 JOHNSON CONTROLS.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.1 PRODUCT PORTFOLIO

13.3.2 RECENT DEVELOPMENTS

13.4 HUAWEI TECHNOLOGIES CO., LTD.

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 ROBERT BOSCH GMBH

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 SOLUTION PORTFOLIO

13.5.4 RECENT DEVELOPMENTS

13.6 ABB

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

13.7 AZBIL VIETNAM CO., LTD.

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENTS

13.8 BECKHOFF AUTOMATION

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENTS

13.9 CARRIER

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 SOLUTION PORTFOLIO

13.9.4 RECENT DEVELOPMENTS

13.1 DELTA ELECTRONICS (THAILAND) PCL.

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENTS

13.11 EMERSON ELECTRIC CO.

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENTS

13.12 HITACHI ENERGY LTD.

13.12.1 COMPANY SNAPSHOT

13.12.2 SOLUTION PORTFOLIO

13.12.3 RECENT DEVELOPMENTS

13.13 HONEYWELL INTERNATIONAL INC.

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 SOLUTION PORTFOLIO

13.13.4 RECENT DEVELOPMENTS

13.14 HUBBELL

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENTS

13.15 LUTRON ELECTRONICS CO., INC

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENTS

13.16 ROCKWELL AUTOMATION, INC.

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 SYREFL HOLDINGS SDN BHD

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tabela

TABLE 1 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 2 SOUTH-EAST ASIA FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 3 SOUTH-EAST ASIA HVAC CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 4 SOUTH-EAST ASIA ACTUATORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 SOUTH-EAST ASIA DAMPERS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 SOUTH-EAST ASIA SMART DEVICES IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 7 SOUTH-EAST ASIA LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 8 SOUTH-EAST ASIA HARDWARE LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 9 SOUTH-EAST ASIA SERVICES LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 10 SOUTH-EAST ASIA SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 11 SOUTH-EAST ASIA BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 12 SOUTH-EAST ASIA HARDWARE BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 13 SOUTH-EAST ASIA SERVICES BIOMETRIC SYSTEMS AND ACCESS CONTROL IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 14 SOUTH-EAST ASIA VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 15 SOUTH-EAST ASIA HARDWARE VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 16 SOUTH-EAST ASIA SERVICES VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 17 SOUTH-EAST ASIA FIRE PROTECTION SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 18 SOUTH-EAST ASIA SENSORS AND DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 19 SOUTH-EAST ASIA FLAME DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 20 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 21 SOUTH-EAST ASIA WIRELESS TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 22 SOUTH-EAST ASIA WIRED TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 23 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 24 SOUTH-EAST ASIA RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 25 SOUTH-EAST ASIA RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 26 SOUTH-EAST ASIA RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 27 SOUTH-EAST ASIA COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 28 SOUTH-EAST ASIA COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 29 SOUTH-EAST ASIA COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 30 SOUTH-EAST ASIA INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 SOUTH-EAST ASIA INDUSTRIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 33 SINGAPORE BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 SINGAPORE FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 SINGAPORE HVAC CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 SINGAPORE ACTUATORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 SINGAPORE DAMPERS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 SINGAPORE SMART DEVICES IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 SINGAPORE LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 40 SINGAPORE HARDWARE LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 41 SINGAPORE SERVICES LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 42 SINGAPORE SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 SINGAPORE BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 44 SINGAPORE HARDWARE BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 45 SINGAPORE SERVICES BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 46 SINGAPORE VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 47 SINGAPORE HARDWARE VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 48 SINGAPORE SERVICES VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 49 SINGAPORE FIRE PROTECTION SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 50 SINGAPORE SENSORS AND DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 SINGAPORE FLAME DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 SINGAPORE BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 53 SINGAPORE WIRELESS TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 54 SINGAPORE WIRED TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 SINGAPORE BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 56 SINGAPORE RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 SINGAPORE RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 58 SINGAPORE RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 SINGAPORE COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 60 SINGAPORE COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 61 SINGAPORE COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 62 SINGAPORE INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 SINGAPORE INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 THAILAND BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 THAILAND FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 THAILAND HVAC CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 THAILAND ACTUATORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 68 THAILAND DAMPERS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 69 THAILAND SMART DEVICES IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 70 THAILAND LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 71 THAILAND HARDWARE LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 72 THAILAND SERVICES LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 73 THAILAND SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 THAILAND BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 75 THAILAND HARDWARE BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 76 THAILAND SERVICES BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 77 THAILAND VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 78 THAILAND HARDWARE VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 79 THAILAND SERVICES VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 80 THAILAND FIRE PROTECTION SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 81 THAILAND SENSORS AND DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 82 THAILAND FLAME DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 83 THAILAND BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 84 THAILAND WIRELESS TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 85 THAILAND WIRED TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 86 THAILAND BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 87 THAILAND RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 88 THAILAND RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 89 THAILAND RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 90 THAILAND COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 91 THAILAND COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 92 THAILAND COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 93 THAILAND INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 94 THAILAND INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 95 INDONESIA BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 96 INDONESIA FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 97 INDONESIA HVAC CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 98 INDONESIA ACTUATORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 99 INDONESIA DAMPERS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 100 INDONESIA SMART DEVICES IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 101 INDONESIA LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 102 INDONESIA HARDWARE LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 103 INDONESIA SERVICES LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 104 INDONESIA SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 105 INDONESIA BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 106 INDONESIA HARDWARE BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 107 INDONESIA SERVICES BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 108 INDONESIA VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 109 INDONESIA HARDWARE VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 110 INDONESIA SERVICES VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 111 INDONESIA FIRE PROTECTION SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 112 INDONESIA SENSORS AND DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 113 INDONESIA FLAME DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 114 INDONESIA BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 115 INDONESIA WIRELESS TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 116 INDONESIA WIRED TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 117 INDONESIA BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 118 INDONESIA RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 119 INDONESIA RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 120 INDONESIA RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 121 INDONESIA COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 122 INDONESIA COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 123 INDONESIA COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 124 INDONESIA INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 125 INDONESIA INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 126 MALAYSIA BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 127 MALAYSIA FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 128 MALAYSIA HVAC CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 129 MALAYSIA ACTUATORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 130 MALAYSIA DAMPERS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 131 MALAYSIA SMART DEVICES IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 132 MALAYSIA LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 133 MALAYSIA HARDWARE LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 134 MALAYSIA SERVICES LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 135 MALAYSIA SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 136 MALAYSIA BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 137 MALAYSIA HARDWARE BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 138 MALAYSIA SERVICES BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 139 MALAYSIA VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 140 MALAYSIA HARDWARE VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 141 MALAYSIA SERVICES VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 142 MALAYSIA FIRE PROTECTION SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 143 MALAYSIA SENSORS AND DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 144 MALAYSIA FLAME DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 145 MALAYSIA BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 146 MALAYSIA WIRELESS TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 147 MALAYSIA WIRED TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 148 MALAYSIA BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 149 MALAYSIA RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 150 MALAYSIA RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 151 MALAYSIA RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 152 MALAYSIA COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 153 MALAYSIA COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 154 MALAYSIA COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 155 MALAYSIA INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 156 MALAYSIA INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 157 VIETNAM BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 158 VIETNAM FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 159 VIETNAM HVAC CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 160 VIETNAM ACTUATORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 161 VIETNAM DAMPERS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 162 VIETNAM SMART DEVICES IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 163 VIETNAM LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 164 VIETNAM HARDWARE LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 165 VIETNAM SERVICES LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 166 VIETNAM SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 167 VIETNAM BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 168 VIETNAM HARDWARE BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 169 VIETNAM SERVICES BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 170 VIETNAM VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 171 VIETNAM HARDWARE VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 172 VIETNAM SERVICES VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 173 VIETNAM FIRE PROTECTION SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 174 VIETNAM SENSORS AND DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 175 VIETNAM FLAME DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 176 VIETNAM BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 177 VIETNAM WIRELESS TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 178 VIETNAM WIRED TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 179 VIETNAM BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 180 VIETNAM RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 181 VIETNAM RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 182 VIETNAM RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 183 VIETNAM COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 184 VIETNAM COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 185 VIETNAM COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 186 VIETNAM INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 187 VIETNAM INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 188 PHILIPPINES BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 189 PHILIPPINES FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 190 PHILIPPINES HVAC CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 191 PHILIPPINES ACTUATORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 192 PHILIPPINES DAMPERS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 193 PHILIPPINES SMART DEVICES IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 194 PHILIPPINES LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 195 PHILIPPINES HARDWARE LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 196 PHILIPPINES SERVICES LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 197 PHILIPPINES SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 198 PHILIPPINES BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 199 PHILIPPINES HARDWARE BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 200 PHILIPPINES SERVICES BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 201 PHILIPPINES VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 202 PHILIPPINES HARDWARE VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 203 PHILIPPINES SERVICES VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 204 PHILIPPINES FIRE PROTECTION SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 205 PHILIPPINES SENSORS AND DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 206 PHILIPPINES FLAME DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 207 PHILIPPINES BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 208 PHILIPPINES WIRELESS TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 209 PHILIPPINES WIRED TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 210 PHILIPPINES BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 211 PHILIPPINES RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 212 PHILIPPINES RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 213 PHILIPPINES RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 214 PHILIPPINES COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 215 PHILIPPINES COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 216 PHILIPPINES COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 217 PHILIPPINES INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 218 PHILIPPINES INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 219 MYANMAR BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 220 MYANMAR FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 221 MYANMAR HVAC CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 222 MYANMAR ACTUATORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 223 MYANMAR DAMPERS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 224 MYANMAR SMART DEVICES IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 225 MYANMAR LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 226 MYANMAR HARDWARE LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 227 MYANMAR SERVICES LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 228 MYANMAR SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 229 MYANMAR BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 230 MYANMAR HARDWARE BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 231 MYANMAR SERVICES BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 232 MYANMAR VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 233 MYANMAR HARDWARE VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 234 MYANMAR SERVICES VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 235 MYANMAR FIRE PROTECTION SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 236 MYANMAR SENSORS AND DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 237 MYANMAR FLAME DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 238 MYANMAR BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 239 MYANMAR WIRELESS TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 240 MYANMAR WIRED TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 241 MYANMAR BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 242 MYANMAR RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 243 MYANMAR RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 244 MYANMAR RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 245 MYANMAR COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 246 MYANMAR COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 247 MYANMAR COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 248 MYANMAR INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 249 MYANMAR INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 250 CAMBODIA BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 251 CAMBODIA FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 252 CAMBODIA HVAC CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 253 CAMBODIA ACTUATORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 254 CAMBODIA DAMPERS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 255 CAMBODIA SMART DEVICES IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 256 CAMBODIA LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 257 CAMBODIA HARDWARE LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 258 CAMBODIA SERVICES LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 259 CAMBODIA SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 260 CAMBODIA BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 261 CAMBODIA HARDWARE BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 262 CAMBODIA SERVICES BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 263 CAMBODIA VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 264 CAMBODIA HARDWARE VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 265 CAMBODIA SERVICES VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 266 CAMBODIA FIRE PROTECTION SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 267 CAMBODIA SENSORS AND DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 268 CAMBODIA FLAME DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 269 CAMBODIA BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 270 CAMBODIA WIRELESS TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 271 CAMBODIA WIRED TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 272 CAMBODIA BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 273 CAMBODIA RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 274 CAMBODIA RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 275 CAMBODIA RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 276 CAMBODIA COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 277 CAMBODIA COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 278 CAMBODIA COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 279 CAMBODIA INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 280 CAMBODIA INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 281 LAOS BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 282 LAOS FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 283 LAOS HVAC CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 284 LAOS ACTUATORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 285 LAOS DAMPERS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 286 LAOS SMART DEVICES IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 287 LAOS LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 288 LAOS HARDWARE LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 289 LAOS SERVICES LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 290 LAOS SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 291 LAOS BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 292 LAOS HARDWARE BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 293 LAOS SERVICES BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 294 LAOS VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 295 LAOS HARDWARE VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 296 LAOS SERVICES VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 297 LAOS FIRE PROTECTION SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 298 LAOS SENSORS AND DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 299 LAOS FLAME DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 300 LAOS BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 301 LAOS WIRELESS TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 302 LAOS WIRED TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 303 LAOS BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 304 LAOS RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 305 LAOS RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 306 LAOS RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 307 LAOS COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 308 LAOS COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 309 LAOS COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 310 LAOS INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 311 LAOS INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 312 REST OF SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

Lista de Figura

FIGURE 1 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: SEGMENTATION

FIGURE 2 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: DATA TRIANGULATION

FIGURE 3 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: DROC ANALYSIS

FIGURE 4 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: PRODUCT LIFE LINE CURVE

FIGURE 7 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: MULTIVARIATE MODELLING

FIGURE 8 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: DBMR MARKET POSITION GRID

FIGURE 10 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: APPLICATION COVERAGE GRID

FIGURE 11 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: CHALLENGE MATRIX

FIGURE 12 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: SEGMENTATION

FIGURE 13 INCREASING DEMAND FOR WIRELESS SENSOR NETWORK TECHNOLOGY IS DRIVING THE SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 FACILITY MANAGEMENT SYSTEMS (FMS) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET IN 2022 & 2030

FIGURE 15 BUILDING AUTOMATION SYSTEM - VALUE CHAIN ANALYSIS

FIGURE 16 AVERAGE SELLING PRICE ANALYSIS FOR BUILDING AUTOMATION SYSTEM

FIGURE 17 INCREASING PATENT ACTIVITY RELATED TO BUILDING AUTOMATION FROM 2012 TO 2020

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES & CHALLENGES OF THE SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET

FIGURE 19 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: BY SYSTEM TYPE, 2022

FIGURE 20 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: BY TECHNOLOGY, 2022

FIGURE 21 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: BY APPLICATION, 2022

FIGURE 22 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: SNAPSHOT (2022)

FIGURE 23 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: BY COUNTRY (2022)

FIGURE 24 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: BY COUNTRY (2023 & 2030)

FIGURE 25 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: BY COUNTRY (2022 & 2030)

FIGURE 26 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: BY SYSTEM TYPE (2023-2030)

FIGURE 27 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: COMPANY SHARE 2022 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.