Mercado de perda de peso e gestão da obesidade da América do Norte, por tipo de produto ( suplementos alimentares e substitutos de refeições), forma de produto (géis moles, comprimidos, cápsulas, pós, gomas e geleias, pré-misturas, líquidos e outros), natureza (rótulo convencional e limpo ), categoria (prescrito e de venda livre (OTC)), demografia do utilizador final (menores de 18 anos, 18 a 35 anos, 35 a 50 anos e acima de 50 anos), canal de distribuição (baseado em loja e não armazenado), Tendências e previsões da indústria do país (EUA, México e Canadá) para 2029.

Análise de mercado e insights : Mercado de perda de peso e gestão da obesidade na América do Norte

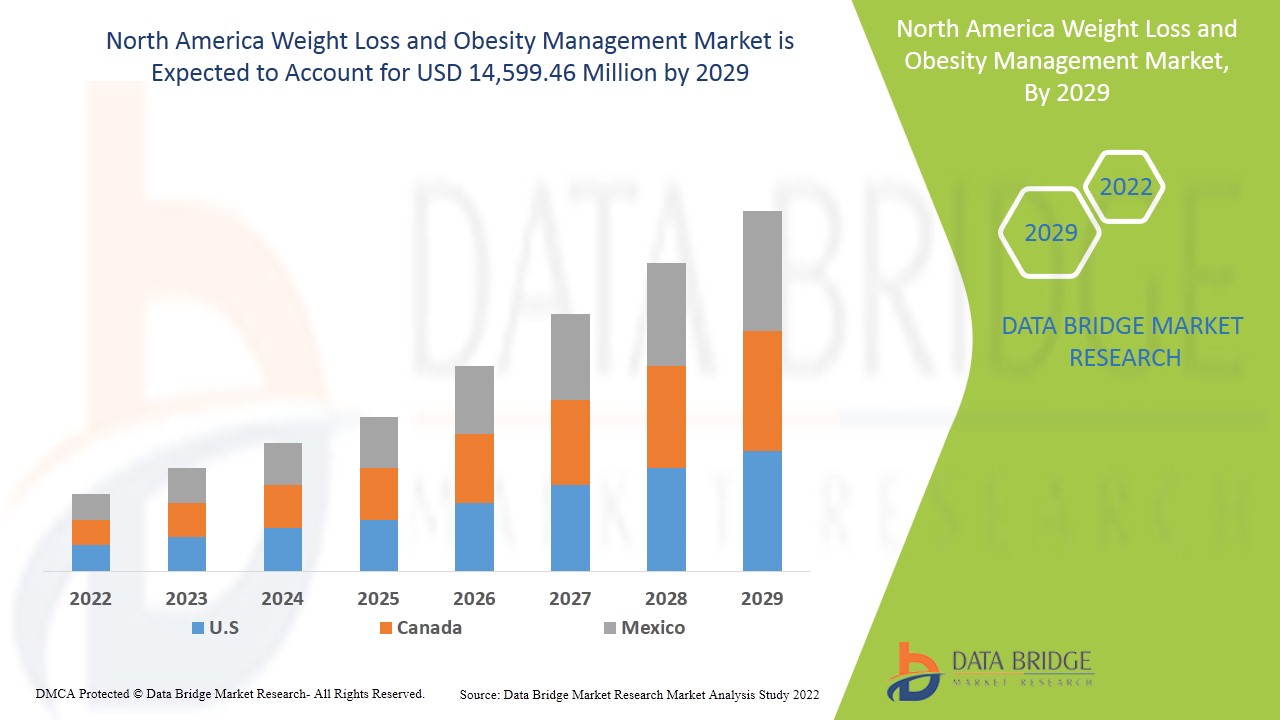

Espera-se que o mercado de perda de peso e gestão da obesidade da América do Norte ganhe um crescimento significativo no período de previsão de 2022 a 2029. A Data Bridge Market Research analisa que o mercado está a crescer com um CAGR de 9,5% no período de previsão de 2022 a 2029 e prevê-se que atinja os 14.599,46 milhões de dólares até 2029.

Espera-se que o aumento do número de casos de obesidade entre a população da América do Norte impulsione o crescimento do mercado de perda de peso e gestão da obesidade. Espera-se que o aumento da prevalência de doenças crónicas, como a hipertensão e a diabetes, causado pelo aumento da adoção de padrões de estilo de vida pouco saudáveis e sedentários e pelo aumento do número de cirurgias bariátricas, acelere o crescimento do mercado de perda de peso e gestão da obesidade.

- Além disso, o aumento da preferência por junk food, a inatividade física, a rotina agitada e o stress crescente estão a fazer com que as pessoas consumam fast food, o que influenciará ainda mais o crescimento do mercado de perda de peso e gestão da obesidade. Além disso, a crescente adoção de programas de perda e controlo de peso online, as iniciativas governamentais para criar consciência e o aumento do rendimento disponível nas economias em desenvolvimento afetarão positivamente o crescimento do mercado de perda de peso e gestão da obesidade. Além disso, o aumento da taxa de obesidade infantil e as nações emergentes estendem oportunidades lucrativas ao mercado da perda de peso e da gestão da obesidade.

No entanto, o elevado custo associado às dietas de baixas calorias e os problemas com práticas de marketing enganosas são os fatores que deverão obstruir o crescimento do mercado de perda de peso e gestão da obesidade. Espera-se que o aumento da implementação de regulamentos e normas rigorosas desafie ainda mais o crescimento do mercado.

O relatório do mercado de perda de peso e gestão da obesidade da América do Norte fornece detalhes da quota de mercado, novos desenvolvimentos e análise do pipeline de produtos, impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes , alterações nas regulamentações de mercado, aprovações de produtos, estratégias decisões, lançamentos de produtos, expansões geográficas e inovações tecnológicas no mercado. Para compreender a análise e o cenário do mercado contacte-nos para um Analyst Brief, a nossa equipa irá ajudá-lo a criar uma solução de impacto na receita para atingir o objetivo desejado.

Âmbito e dimensão do mercado de perda de peso e gestão da obesidade na América do Norte

O mercado de perda de peso e gestão da obesidade da América do Norte está segmentado em seis segmentos notáveis com base no tipo de produto, forma do produto, natureza, categoria, demografia do utilizador final e canal de distribuição.

- Com base no tipo de produto, o mercado norte-americano de perda de peso e controlo da obesidade está segmentado em suplementos alimentares e substitutos de refeição. Em 2022, prevê-se que o segmento dos suplementos alimentares domine o mercado devido ao aumento da população obesa, aumentando a consciencialização dos consumidores em relação aos alimentos e bebidas de baixas calorias nas economias em desenvolvimento.

- Com base na forma do produto, o mercado de perda de peso e gestão da obesidade da América do Norte está segmentado em géis moles, comprimidos, cápsulas, pós, gomas e geleias, pré-misturas, líquidos, entre outros. Em 2022, prevê-se que o segmento do pó domine o mercado devido à natureza fácil de utilizar da forma em pó em comparação com outras formas de perda de peso e controlo da obesidade.

- Com base na natureza, o mercado norte-americano de perda de peso e gestão da obesidade está segmentado em rótulos convencionais e limpos. Em 2022, prevê-se que o segmento convencional domine o mercado devido à crescente procura de produtos biológicos cultivados naturalmente.

- Com base na categoria, o mercado de perda de peso e gestão da obesidade da América do Norte está segmentado em prescrito e de venda livre (OTC). Em 2022, prevê-se que o segmento Over the Counter (OTC) domine o mercado devido à crescente popularidade dos OTC para a perda de peso e controlo da obesidade.

- Com base no utilizador final, o mercado norte-americano de perda de peso e gestão da obesidade está segmentado em menores de 18 anos, 18 a 35 anos, 35 a 50 anos e maiores de 50 anos. Em 2022, prevê-se que o segmento dos 18 aos 35 anos domine o mercado devido ao aumento da taxa de obesidade infantil.

- Com base no canal de distribuição, o mercado de perda de peso e gestão da obesidade da América do Norte está segmentado em lojas e não armazenadas. Em 2022, prevê-se que o segmento não armazenado domine o mercado devido à pandemia emergente de COVID-19.

Análise a nível de país do mercado de perda de peso e gestão da obesidade

O mercado de perda de peso e gestão da obesidade da América do Norte é analisado e são fornecidas informações sobre o tamanho do mercado com base no tipo de produto, forma do produto, natureza, categoria, demografia do utilizador final e canal de distribuição.

Os países abrangidos nesta região no mercado de gestão de perda de peso e obesidade reportados são os EUA, Canadá e México

Espera-se que a América do Norte cresça com a taxa de crescimento mais promissora no período de previsão de 2022 a 2029, à medida que os principais industriais se concentram no desenvolvimento de produtos de perda de peso para satisfazer as exigências dos consumidores.

Aumento da procura por perda de peso e controlo da obesidade

O mercado de perda de peso e gestão da obesidade da América do Norte também fornece análises de mercado detalhadas para o crescimento da indústria de cada país com vendas, vendas de componentes e impacto de lançamentos consistentes e mudanças nos cenários regulamentares com o seu apoio ao mercado. Os dados estão disponíveis para o período histórico de 2022 a 2029.

Análise do cenário competitivo e da participação na gestão da perda de peso e da obesidade

O panorama competitivo do mercado de perda de peso e gestão da obesidade da América do Norte fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença na América do Norte, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos, pipelines de testes de produtos, aprovações de produtos, patentes , largura e amplitude do produto, domínio da aplicação e curva de segurança da tecnologia. Os dados fornecidos acima estão apenas relacionados com o foco das empresas relacionado com o mercado de perda de peso e controlo da obesidade da América do Sul.

Alguns dos principais players que operam no mercado de perda de peso e gestão da obesidade são a Herbalife International of America, Inc., ABH Pharma Inc., Vitaco, Amway Corp., Stepan Company, GNC Holdings, LLC, GlaxoSmithKline plc., Glanbia PLC , Abbott , Shaklee Corporation, Nu Skin Enterprises, Atlantic Multipower UK Ltd., Nature's Sunshine Products, Inc., Ajinomoto Co., Inc., Bionova, DSM, American Health, Omega Protein Corporation, Integrated BioPharma, Inc., Bio-Tech Pharmacal, The Himalaya Drug Company, Pharmavite, Ricola, BLACKMORES, entre outros.

São também iniciados vários desenvolvimentos de produtos pelas empresas de todo o mundo, que também estão a acelerar o crescimento do mercado de perda de peso e controlo da obesidade.

Por exemplo,

- Em outubro de 2020, de acordo com a GlobeNewswire, Inc., a Meticore lançou um novo suplemento para emagrecer para homens e mulheres. O suplemento auxilia no aumento do metabolismo, uma vez que auxilia no aumento da temperatura das células internas, o que resulta na regeneração do metabolismo. A fórmula é feita com a ajuda de seis nutrientes vegetais e extratos de ervas de qualidade superior, juntamente com comprimidos Meticore.

As parcerias, joint ventures e outras estratégias aumentam a quota de mercado da empresa com maior cobertura e presença. Beneficia também as organizações ao melhorarem a sua oferta de produtos para a perda de peso e controlo da obesidade através de uma gama alargada de tamanhos.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 COMPARATIVE ANALYSIS (HERBAL SUPPLEMENTS VS SYNTHETIC SUPPLEMENTS)

4.2 PRICING ANALYSIS FOR WEIGHT LOSS & OBESITY MANAGEMENT SUPPLEMENTS-

4.3 VALUE CHAIN FOR NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET

4.4 SUPPLY CHAIN OF NORTH AMERICA WEIGHT LOSS & OBESITY MANAGEMENT MARKET

4.5 BRAND COMPARATIVE ANALYSIS

4.6 CLEAN LABELED PRODUCT LAUNCHES

4.7 CONSUMER TRENDS

4.8 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET- GROWTH STRATEGIES ADOPTED BY KEY PLAYERS

4.9 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET- INDUSTRY TRENDS AND FUTURE PERSPECTIVES

5 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET- REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING RATES IN CHRONIC DISEASES

6.1.2 INCREASING PREVALENCE OF OBESITY

6.1.3 INCREASE IN GERIATRIC POPULATION

6.1.4 INCREASING BARIATRIC SURGERIES

6.2 RESTRAINTS

6.2.1 STRINGENT RULES & REGULATIONS

6.2.2 HIGH COST ASSOCIATED WITH THE LOW-CALORIE DIETS

6.3 OPPORTUNITIES

6.3.1 RISING DISPOSABLE INCOME ENHANCING THE PURCHASING POWER OF RELATED WEIGHT LOSS PRODUCTS

6.3.2 GROWING CONSUMPTION OF PROCESSED FOOD

6.3.3 RISE IN STRATEGIC INITIATIVES BY MARKET PLAYERS

6.4 CHALLENGES

6.4.1 LACK OF AWARENESS IN LOWER INCOME COUNTRIES

6.4.2 INCREASE IN PRODUCT RECALL

7 IMPACT OF COVID-19 ON THE NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET

7.1 AFTERMATH OF COVID-19

7.2 IMPACT ON DEMAND AND SUPPLY CHAIN

7.3 IMPACT ON PRICE

7.4 CONCLUSION

8 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 DIETARY SUPPLEMENTS

8.2.1 SUPPLEMENT TYPE

8.2.1.1 Herbal/Natural

8.2.1.2 Synthetic

8.2.2 ACTIVE INGREDIENT TYPE

8.2.2.1 Green Tea Extract

8.2.2.2 Chitosan

8.2.2.3 Pyruvate

8.2.2.4 Probiotics

8.2.2.5 Conjugated Linoleic Acid

8.2.2.6 Green Coffee Bean Extract

8.2.2.7 Caffeine

8.2.2.8 Chromium

8.2.2.9 Bitter Orange (Citrus Aurantium L.)

8.2.2.10 Carnitine

8.2.2.11 African Mango (Irvingia Gabonensis)

8.2.2.12 White Kidney Bean (Phaseolus Vulgaris)

8.2.2.13 Others

8.3 MEAL REPLACEMENTS

8.3.1 POWDERED MIXES

8.3.2 READY TO DRINK BEVERAGES/SHAKES

8.3.3 PROTEIN BARS

8.3.4 OTHERS

9 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM

9.1 OVERVIEW

9.2 POWDERS

9.3 CAPSULE

9.4 LIQUIDS

9.5 TABLETS

9.6 PREMIXES

9.7 SOFT GELS

9.8 GUMMIES & JELLIES

9.9 OTHERS

10 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 STORE BASED

10.2.1 PHARMACIES

10.2.2 SPECIALTY STORES

10.2.3 HEALTH AND BEAUTY STORES

10.2.4 CONVENIENCE STORE

10.2.5 SUPERMARKET/HYPERMARKET

10.2.6 OTHERS

10.3 NON STORED BASED

10.3.1 ONLINE (THIRD PARTY ONLINE RETAILERS)

10.3.2 COMPANY OWNED WEBSITE

11 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY

11.1 OVERVIEW

11.2 TO 35 YEARS

11.3 TO 50 YEARS

11.4 ABOVE 50 YEARS

11.5 UNDER 18 YEARS

12 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 MEXICO

12.1.3 CANADA

13 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tabela

TABLE 1 MOST OBESE COUNTRIES OF ASIA-PACIFIC 2020

TABLE 2 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA POWDERS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA CAPSULE IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA LIQUIDS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA TABLETS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA PREMIXES IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA SOFT GELS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA GUMMIES & JELLIES IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA OTHERS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION))

TABLE 18 NORTH AMERICA STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA 18 TO 35 YEARS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA 35 TO 50 YEARS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA ABOVE 50 YEARS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA UNDER 18 YEARS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 36 NORTH AMERICA NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 37 U.S. WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 38 U.S. DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 39 U.S. DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 40 U.S. MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 41 U.S. WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 42 U.S. WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 43 U.S. WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 44 U.S. STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 45 U.S. NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 46 MEXICO WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 47 MEXICO DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 48 MEXICO DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 49 MEXICO MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 50 MEXICO WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 51 MEXICO WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 52 MEXICO WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 53 MEXICO STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 54 MEXICO NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 55 CANADA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 56 CANADA DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 57 CANADA DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 58 CANADA MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 59 CANADA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 60 CANADA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 61 CANADA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 62 CANADA STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 63 CANADA NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

Lista de Figura

FIGURE 1 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET : DROC ANALYSIS

FIGURE 4 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: SEGMENTATION

FIGURE 10 NORTH AMERICA REGION IS EXPECTED TO DOMINATE THE NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET WHEREAS ASIA-PACIFIC IS GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 INCREASE IN OBESE POPULATION IS DRIVING THE GROWTH OF NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 DIETARY SUPPLEMENTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC IS THE FASTEST-GROWING MARKET FOR WEIGHT LOSS AND OBESITY MANAGEMENT MANUFACTURERS IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 SUPPLY CHAIN OF WEIGHT LOSS & OBESITY MANAGEMENT MARKET

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET

FIGURE 16 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: BY PRODUCT TYPE, 2021

FIGURE 17 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: BY PRODUCT FORM, 2021

FIGURE 18 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 19 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2021

FIGURE 20 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: SNAPSHOT (2021)

FIGURE 21 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: BY COUNTRY (2021)

FIGURE 22 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 25 NORTH AMERICA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: COMPANY SHARE 2021 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.