North America Waterproofing Membranes Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

10.83 Billion

USD

15.51 Billion

2025

2033

USD

10.83 Billion

USD

15.51 Billion

2025

2033

| 2026 –2033 | |

| USD 10.83 Billion | |

| USD 15.51 Billion | |

|

|

|

|

Segmentação do mercado de membranas impermeabilizantes na América do Norte, por tipo (membranas aplicadas, membranas em folha, membranas multicamadas ou laminadas e impermeabilização injetável), matéria-prima (betume modificado, PVC, EPDM, TPO, HDPE, LDPE e outros), grau (grau 1, grau 2 e grau 3), aplicação (telhados e paredes, estruturas prediais, gestão de resíduos e água, mineração, revestimento de túneis, pontes e rodovias e outros) - Tendências e previsões do setor até 2033.

Qual é o tamanho e a taxa de crescimento do mercado de membranas impermeabilizantes na América do Norte?

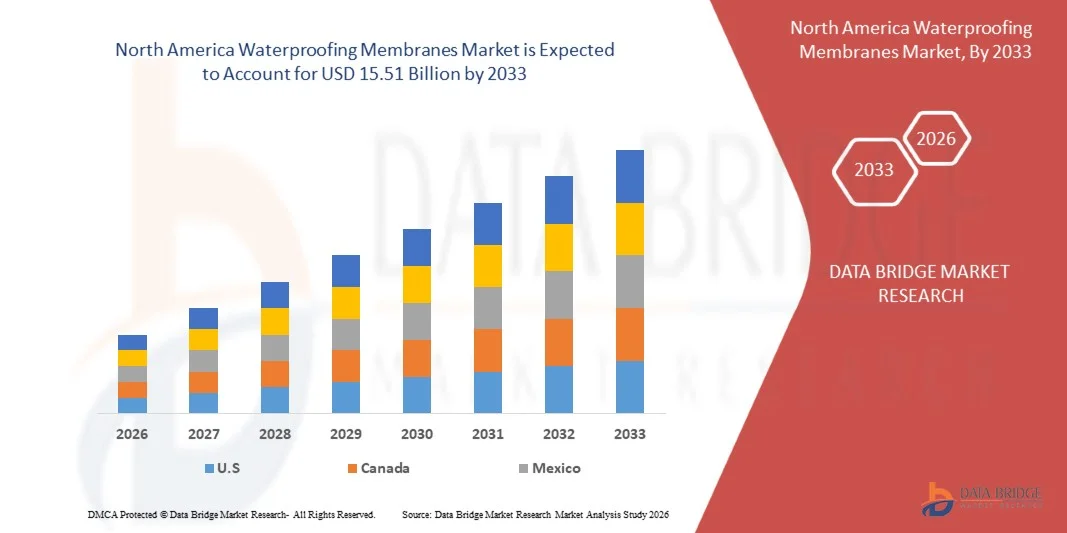

- O mercado de membranas impermeabilizantes na América do Norte foi avaliado em US$ 10,83 bilhões em 2025 e deverá atingir US$ 15,51 bilhões em 2033 , com uma taxa de crescimento anual composta (CAGR) de 4,6% durante o período de previsão.

- O aumento das atividades de construção e infraestrutura, incluindo projetos comerciais, residenciais e industriais, está impulsionando a demanda por membranas impermeabilizantes para proteger estruturas contra infiltrações de água, umidade e degradação ambiental, sustentando assim o crescimento do mercado.

- O elevado custo inicial das membranas premium e da instalação, aliado à necessidade de mão de obra qualificada e maquinário especializado, aumenta o custo total do projeto, o que pode limitar a sua adoção em projetos de pequena escala ou com orçamento limitado.

Quais são os principais pontos a serem considerados no mercado de membranas impermeabilizantes?

- Os avanços nas tecnologias de impermeabilização, como membranas autoadesivas, soluções líquidas e mantas sintéticas de alto desempenho, estão aprimorando a durabilidade e a facilidade de instalação, apresentando oportunidades significativas de crescimento para os participantes do mercado.

- Desafios como problemas de infiltração, instalação inadequada e requisitos de manutenção continuam a impactar a relação custo-benefício e o desempenho, representando obstáculos importantes para a adoção generalizada de membranas impermeabilizantes na América do Norte.

- Os EUA dominaram o mercado de membranas impermeabilizantes na América do Norte, com uma participação de 36,2% na receita em 2025, impulsionados pela ampla adoção de soluções de impermeabilização de alto desempenho em projetos comerciais, residenciais e de infraestrutura.

- Prevê-se que o Canadá registará a taxa de crescimento anual composta (CAGR) mais rápida, de 9,9%, entre 2026 e 2033, impulsionada pela adoção de tecnologias avançadas de membranas em projetos de construção comercial, residencial e civil.

- O segmento de membranas em folha dominou o mercado com uma participação de 45,6% da receita em 2025, impulsionado pela facilidade de instalação, espessura consistente, alta resistência à tração e adequação para projetos comerciais e residenciais de grande escala.

Escopo do relatório e segmentação do mercado de membranas impermeabilizantes

|

Atributos |

Principais informações de mercado sobre membranas impermeabilizantes |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marcas, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Qual é a principal tendência no mercado de membranas impermeabilizantes?

“ Crescente demanda por membranas impermeabilizantes sustentáveis e de alto desempenho ”

- O mercado de membranas impermeabilizantes está testemunhando uma tendência importante de crescente adoção de soluções de membrana ecológicas, duráveis e tecnologicamente avançadas. Essa tendência é impulsionada pela crescente conscientização sobre práticas de construção sustentáveis, eficiência energética e conformidade ambiental, especialmente na América do Norte.

- Por exemplo, empresas como a Sika AG e a GAF estão desenvolvendo membranas de alto desempenho com maior resistência aos raios UV, maior durabilidade e formulações ecológicas para atender aos rigorosos padrões de construção.

- A crescente demanda por membranas que melhoram a eficiência da impermeabilização, a proteção estrutural e a durabilidade está acelerando a adoção.

- Os fabricantes estão integrando misturas de polímeros avançados, tecnologias autoadesivas e camadas compostas leves em membranas impermeabilizantes para melhorar o desempenho e a eficiência da instalação.

- O aumento dos investimentos em pesquisa e desenvolvimento de materiais flexíveis, componentes de alta resistência e revestimentos sustentáveis está impulsionando a inovação.

- À medida que construtoras e incorporadoras priorizam soluções duradouras, ecológicas e de alto desempenho, espera-se que as membranas de impermeabilização modernas continuem sendo essenciais para a construção e o desenvolvimento de infraestrutura.

Quais são os principais fatores que impulsionam o mercado de membranas impermeabilizantes?

- A crescente ênfase na construção sustentável, nas certificações de edifícios verdes e na conformidade com as normas ambientais é um dos principais fatores de crescimento.

- Por exemplo, em 2025, a GAF e a SOPREMA SAS lançaram membranas de alta durabilidade com certificação ecológica, projetadas para reduzir os custos de manutenção e o impacto ambiental.

- A crescente demanda por membranas multicamadas de alto desempenho está impulsionando sua adoção em projetos comerciais, residenciais e de infraestrutura.

- Os avanços tecnológicos na formulação de polímeros, na tecnologia de autovedação e nos revestimentos resistentes aos raios UV estão permitindo que os fabricantes produzam membranas mais confiáveis e duráveis.

- A maior integração de membranas com sistemas de fácil instalação, a adesão aprimorada e as análises preditivas de desempenho impulsionam ainda mais a expansão do mercado.

- Com investimentos contínuos em P&D, materiais sustentáveis e formulações de alto desempenho, espera-se que o mercado de membranas impermeabilizantes mantenha um forte ritmo de crescimento nos próximos anos.

Que fator está dificultando o crescimento do mercado de membranas impermeabilizantes?

- O elevado investimento inicial em membranas impermeabilizantes de alta qualidade limita a sua adoção, especialmente em projetos de pequena escala e com restrições orçamentais.

- Por exemplo, durante o período de 2024–2025, as flutuações nos custos de matérias-primas, aditivos poliméricos e componentes avançados de revestimento afetaram a produção e os preços das principais empresas do setor.

- A conformidade com as normas regulamentares relativas a códigos de construção, certificações ambientais e padrões de segurança aumenta a complexidade operacional e os custos.

- O conhecimento limitado sobre tecnologias avançadas de membranas entre empreiteiros e construtores dificulta a sua adoção em larga escala.

- A concorrência de membranas de baixo custo, mantas asfálticas tradicionais e substitutos locais cria pressão sobre os preços e afeta a penetração no mercado.

- Para enfrentar esses desafios, os fabricantes estão se concentrando na produção com baixo custo, em programas de treinamento para instaladores, em produtos com certificação ecológica e em soluções de financiamento inovadoras para fornecer membranas de impermeabilização sustentáveis e de alta qualidade.

Como é segmentado o mercado de membranas impermeabilizantes?

O mercado está segmentado com base no tipo, matéria-prima, grau de qualidade e aplicação .

- Por tipo

Com base no tipo, o mercado de membranas impermeabilizantes é segmentado em membranas aplicadas, membranas em manta, membranas multicamadas ou laminadas e impermeabilização injetável. O segmento de membranas em manta dominou o mercado com uma participação de 45,6% da receita em 2025, impulsionado pela facilidade de instalação, espessura consistente, alta resistência à tração e adequação para projetos comerciais e residenciais de grande escala.

Prevê-se que a impermeabilização injetável apresente o crescimento anual composto mais rápido entre 2026 e 2033, impulsionada pela crescente adoção em projetos de retrofit, reparos de vazamentos e aplicações de reforço estrutural. A inovação contínua em mantas flexíveis, revestimentos líquidos e sistemas autoadesivos também contribui para a expansão do mercado. As soluções em manta continuam sendo as preferidas devido à sua durabilidade, custo-benefício e ampla aplicabilidade em telhados, paredes e estruturas subterrâneas.

- Por matéria-prima

Com base na matéria-prima, o mercado é segmentado em betume modificado, PVC, EPDM, TPO, HDPE, LDPE e outros. O segmento de betume modificado dominou o mercado com 41,2% da receita em 2025, devido à sua alta resistência térmica, impermeabilidade à água e ampla utilização em coberturas e infraestrutura civil.

Prevê-se que as membranas de TPO apresentem o crescimento anual composto mais rápido entre 2026 e 2033, impulsionadas pela conformidade ambiental, estabilidade aos raios UV, facilidade de instalação e crescente preferência por soluções de cobertura sustentáveis e de camada única. Os fabricantes estão focando em materiais leves, duráveis e recicláveis para atender aos padrões de desempenho e normas regulamentares, o que favorece uma adoção mais ampla em aplicações comerciais e industriais.

- Por série

Com base na classificação, o mercado é segmentado em Grau 1, Grau 2 e Grau 3. O segmento de Grau 1 dominou com 47,5% da receita em 2025, devido à sua resistência à tração superior, resistência química e longa vida útil, tornando-o ideal para projetos comerciais e industriais de alto padrão.

Prevê-se que as membranas de Grau 2 apresentem o crescimento mais rápido em termos de CAGR (Taxa de Crescimento Anual Composta) entre 2026 e 2033, à medida que projetos de construção de médio porte adotam soluções economicamente viáveis com durabilidade moderada e facilidade de instalação. O crescente foco em membranas certificadas de alta qualidade na construção urbana e infraestrutura impulsiona a adoção de soluções de Grau 1, enquanto o aumento de empreendimentos de médio porte impulsiona o crescimento do Grau 2.

- Por meio de aplicação

Com base na aplicação, o mercado é segmentado em Telhados e Paredes, Estruturas de Edifícios, Gestão de Resíduos e Água, Aplicações de Mineração, Revestimentos de Túneis, Pontes e Rodovias e Outros. O segmento de Telhados e Paredes dominou o mercado com uma participação de 52,3% da receita em 2025, impulsionado pela extensa construção urbana, edifícios altos e demanda por soluções à prova de vazamentos e resistentes às intempéries.

Prevê-se que os revestimentos de túneis apresentem o crescimento mais rápido em taxa composta de crescimento anual (CAGR) entre 2026 e 2033, impulsionados por projetos de infraestrutura, expansão do metrô e iniciativas de gestão de águas subterrâneas que exigem membranas duráveis e de alto desempenho. Os avanços em membranas multicamadas de alta resistência e a adoção de práticas de instalação sustentáveis estão impulsionando o crescimento geral do mercado em todas as aplicações.

Qual região detém a maior participação no mercado de membranas impermeabilizantes?

- Os Estados Unidos dominaram o mercado de membranas impermeabilizantes na América do Norte, com uma participação de 36,2% na receita em 2025, impulsionados pela ampla adoção de soluções de impermeabilização de alto desempenho em projetos comerciais, residenciais e de infraestrutura. Sistemas avançados de cobertura, envoltórios de edifícios e aplicações industriais impulsionam a demanda por membranas duráveis, energeticamente eficientes e sustentáveis.

- Incentivos governamentais para certificações de construção verde, práticas de construção sustentáveis e investimentos em P&D contribuem para a liderança regional. Os principais players alavancam inovações em mantas autoadesivas, membranas líquidas e formulações ecológicas para aprimorar a eficiência da instalação e o desempenho a longo prazo.

- A crescente urbanização, o desenvolvimento de infraestrutura e a expansão industrial, juntamente com a adoção cada vez maior de membranas multicamadas e de alto desempenho, aceleram ainda mais o crescimento do mercado em todo o país.

Análise do Mercado de Membranas Impermeabilizantes no Canadá

Prevê-se que o Canadá registre a taxa de crescimento anual composta (CAGR) mais rápida, de 9,9%, entre 2026 e 2033, impulsionada pela adoção de tecnologias avançadas de membranas em projetos de construção comercial, residencial e civil. Os incorporadores imobiliários estão cada vez mais implementando soluções de impermeabilização ecológicas, duráveis e resistentes às intempéries para atender aos padrões regulatórios e às diretrizes ambientais. A expansão da infraestrutura urbana, as iniciativas de construção sustentável e os projetos industriais impulsionam o crescimento sustentado do mercado no país.

Quais são as principais empresas no mercado de membranas impermeabilizantes?

O setor de membranas impermeabilizantes é liderado principalmente por empresas consolidadas, incluindo:

- SOPREMA SAS (França)

- SOLMAX (Canadá)

- RENOLIT SE (Alemanha)

- Flex Membranes International Corp. (EUA)

- GAF (EUA)

- LATICRETE International, Inc. (EUA)

- GCP Applied Technologies Inc. (EUA)

- Carlisle Construction Materials (uma subsidiária da Carlisle Companies, Inc.) (EUA)

- Sika AG (Suíça)

- Firestone Building Products (uma subsidiária da Bridgestone Americas, Inc.) (EUA)

- KEMPER SYSTEM AMERICA Inc. (EUA)

- DuPont (EUA)

- Revestimentos protetores CanSeal (EUA)

- Wacker Chemie AG (Alemanha)

- Johns Manville (EUA)

Quais são os desenvolvimentos recentes no mercado de membranas impermeabilizantes na América do Norte?

- Em março de 2024, a Mapei inaugurou uma nova fábrica em Cantanhede, Portugal, com um investimento de 13,89 milhões de dólares, equipada com tecnologia de ponta para expandir a capacidade de produção, diversificar a gama de produtos e atender os clientes locais. As instalações incluem também a Mapei Academy, que oferece eventos de formação gratuitos para revendedores, projetistas, instaladores e empresas, reforçando a presença e a especialização da empresa no mercado.

- Em março de 2023, a CertainTeed e a GCP, parte do Grupo Saint-Gobain, lançaram um novo sistema integrado de impermeabilização comercial que protege todas as seis faces de um edifício, aumentando a durabilidade e reduzindo as necessidades de manutenção, oferecendo assim uma solução completa para projetos de construção.

- Em agosto de 2021, a Tremco Incorporated lançou o Sistema Híbrido de Poliureia S5 para Aplicação por Aspersão, uma solução impermeabilizante e de revestimento bicomponente, 100% sólida e flexível, adequada para concreto, metal, plásticos e outros substratos com primers apropriados, proporcionando proteção versátil e de alto desempenho para múltiplas aplicações.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.