North America Warehouse Management System Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

1.24 Billion

USD

4.03 Billion

2024

2032

USD

1.24 Billion

USD

4.03 Billion

2024

2032

| 2025 –2032 | |

| USD 1.24 Billion | |

| USD 4.03 Billion | |

|

|

|

|

Segmentação do mercado de sistemas de gerenciamento de armazéns na América do Norte, por componente (software e serviços), modo de implantação (nuvem e local), tipo de nível (avançado, intermediário e básico), função (sistema de gerenciamento de mão de obra, análise e otimização, gerenciamento de faturamento, controle de estoque, gerenciamento de pátio/doca), uso final (3PL, automotivo, manufatura, alimentos e bebidas, saúde, comércio eletrônico, produtos químicos, elétricos e eletrônicos, metais e máquinas, outros), tendências do setor e previsão até 2032

Tamanho do mercado de sistemas de gerenciamento de armazéns na América do Norte

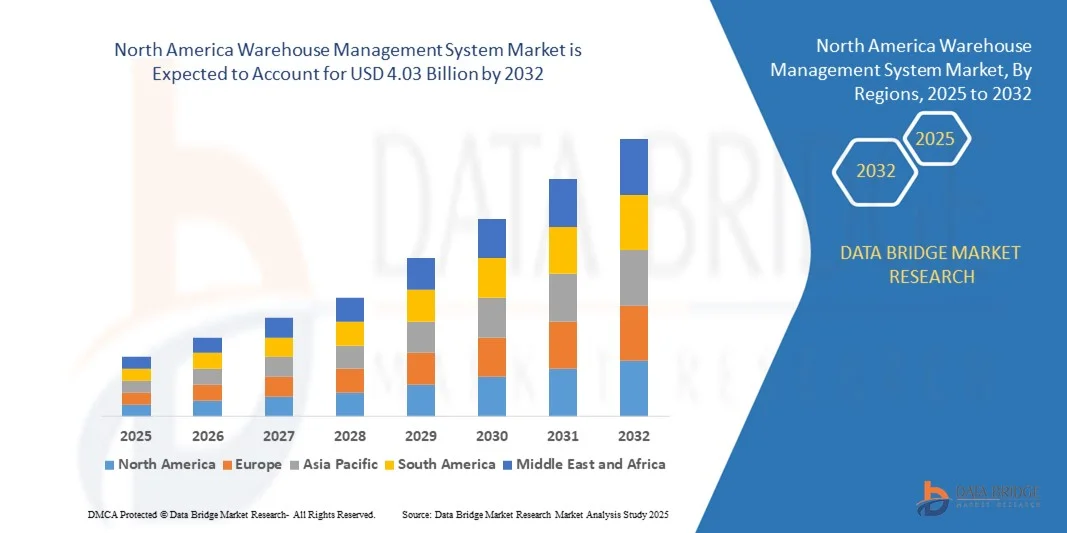

- O tamanho do mercado de sistemas de gerenciamento de armazéns da América do Norte foi avaliado em US$ 1,24 bilhão em 2024 e está projetado para atingir US$ 4,03 bilhões até 2032 , crescendo a um CAGR de 15,90% durante o período previsto.

- O crescimento do mercado é impulsionado principalmente pela rápida expansão do comércio eletrônico, distribuição omnicanal e crescente demanda por visibilidade de estoque em tempo real e operações eficientes da cadeia de suprimentos

- Além disso, os avanços nas soluções WMS baseadas em nuvem e a integração de automação e robótica em armazéns estão aumentando a eficiência operacional, acelerando assim a adoção do WMS em vários setores e impulsionando a expansão do mercado.

Análise de mercado de sistemas de gerenciamento de armazéns na América do Norte

- Os sistemas de gerenciamento de armazém (WMS), que oferecem soluções de software para otimizar as operações de armazém, como rastreamento de estoque, atendimento de pedidos e gerenciamento de mão de obra, estão se tornando essenciais nas cadeias de suprimentos modernas nos setores de varejo e industrial devido à sua capacidade de melhorar a precisão, a eficiência e a visibilidade de dados em tempo real.

- A crescente demanda por WMS é impulsionada principalmente pelo crescimento exponencial do comércio eletrônico, aumentando as expectativas do consumidor por entregas mais rápidas e pela necessidade de soluções de depósito escaláveis e automatizadas.

- Os EUA dominaram o mercado de sistemas de gerenciamento de armazéns com a maior participação na receita de 35% em 2024, apoiados pela infraestrutura logística avançada da região, adoção antecipada de tecnologia e forte presença de grandes players de comércio eletrônico; os EUA lideraram esse crescimento, impulsionados por investimentos em automação de armazéns, robótica e tecnologias de logística orientadas por IA

- Espera-se que o Canadá seja a região de crescimento mais rápido no mercado de sistemas de gerenciamento de armazéns durante o período previsto, impulsionado pela rápida industrialização, pelo crescimento do varejo online e pela crescente demanda por recursos logísticos modernizados.

- O segmento de software dominou o mercado com a maior participação de receita de 64,7% em 2024, impulsionado pela crescente dependência de plataformas WMS baseadas em nuvem e no local para visibilidade em tempo real, atendimento de pedidos e automação

Escopo do relatório e segmentação do mercado de sistemas de gerenciamento de armazém na América do Norte

|

Atributos |

Principais insights de mercado do sistema de gerenciamento de armazém |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências de mercado de sistemas de gerenciamento de armazéns na América do Norte

Eficiência aprimorada por meio de IA, automação e tecnologias de voz

- Uma tendência significativa e crescente no mercado de Sistemas de Gestão de Armazéns (WMS) na América do Norte é a profunda integração de inteligência artificial (IA), automação e tecnologias emergentes de armazém direcionadas por voz. Essas inovações estão transformando as operações de armazém, aprimorando a tomada de decisões em tempo real, otimizando fluxos de trabalho e aumentando a produtividade da mão de obra em centros de logística e distribuição.

- Por exemplo, plataformas WMS integradas com análises baseadas em IA podem prever a demanda, otimizar o posicionamento do estoque e reduzir erros de seleção. Empresas como Manhattan Associates e Blue Yonder oferecem módulos WMS baseados em IA que suportam alocação dinâmica, previsão de mão de obra e análises preditivas para melhorar a agilidade operacional.

- Soluções de armazenagem orientadas por voz, como as da Honeywell Voice ou da Lucas Systems, permitem que os funcionários do armazém recebam instruções de coleta e embalagem por meio de fones de ouvido, permitindo uma operação sem as mãos e com os olhos voltados para cima. Isso não só aumenta a velocidade e a precisão da coleta, como também melhora a segurança e a mobilidade dos trabalhadores em ambientes de ritmo acelerado.

- Os recursos de IA em WMS também podem aprender com dados históricos para sugerir a alocação ideal de mão de obra, detectar anomalias nas operações de armazém e automatizar tarefas repetitivas. Por exemplo, algumas plataformas WMS avançadas agora utilizam aprendizado de máquina para melhorar o processamento em lotes de pedidos e a otimização de rotas ao longo do tempo.

- A integração de tecnologias de voz e IA em plataformas WMS proporciona controle centralizado sobre funções complexas do armazém — da gestão de estoque à expedição — por meio de interfaces intuitivas e fáceis de usar e painéis em tempo real. Este sistema de controle unificado garante uma coordenação perfeita entre trabalhadores humanos, robótica e dados de estoque.

- À medida que as cadeias de suprimentos se tornam mais complexas e a demanda mais responsiva, a adoção de soluções WMS inteligentes que incorporam automação, IA e controle de voz está aumentando rapidamente na América do Norte. As organizações estão priorizando essas tecnologias para atender às crescentes expectativas dos consumidores, reduzir custos operacionais e permanecer competitivas em um cenário logístico digital.

Dinâmica de mercado de sistemas de gerenciamento de armazéns na América do Norte

Motorista

Necessidade crescente devido à crescente automação de armazéns e expansão do comércio eletrônico

- A crescente demanda por gestão eficiente de estoque e o aumento das atividades de comércio eletrônico na América do Norte são os principais impulsionadores da adoção de sistemas de gestão de armazéns (WMS). As empresas estão cada vez mais focadas na otimização das operações de armazém para aumentar a precisão, reduzir custos e atender às expectativas dos clientes por entregas mais rápidas.

- Por exemplo, em 2025, a Manhattan Associates anunciou o lançamento de um módulo WMS com tecnologia de IA, projetado para aprimorar a visibilidade do estoque em tempo real e a análise preditiva. Espera-se que tais inovações dos principais fornecedores de WMS contribuam significativamente para o crescimento do mercado durante o período previsto.

- À medida que os armazéns evoluem para ambientes altamente automatizados, as soluções WMS oferecem funcionalidades essenciais, como rastreamento em tempo real, coleta automatizada e integração perfeita com robótica e dispositivos IoT, proporcionando melhorias substanciais em relação aos métodos tradicionais de gerenciamento de armazéns.

- Além disso, a crescente popularidade do varejo omnicanal e dos modelos de entrega just-in-time está levando os armazéns a adotar plataformas WMS avançadas que permitem o fluxo de estoque sincronizado em vários canais e locais.

- A capacidade de otimizar as operações por meio do controle centralizado, reduzir erros humanos e obter insights práticos por meio da análise de dados são fatores-chave que impulsionam a adoção do WMS tanto em centros de distribuição de grande porte quanto em armazéns menores. Além disso, o crescente investimento em soluções WMS baseadas em nuvem e acessibilidade móvel está incentivando a adoção por empresas de médio e pequeno porte, apoiando a expansão geral do mercado.

Restrição/Desafio

Preocupações com a complexidade da implementação e os altos custos iniciais

- A complexidade da implantação e integração de soluções WMS com sistemas empresariais existentes, como ERP e sistemas de gestão de transporte (TMS), representa um desafio significativo que pode retardar a penetração no mercado. Armazéns frequentemente enfrentam interrupções operacionais durante a implementação do sistema, o que pode desencorajar potenciais adotantes.

- Por exemplo, relatos de atrasos na implementação e problemas de integração em grandes armazéns de varejo fizeram com que algumas empresas hesitassem antes de se comprometer com a adoção em larga escala do WMS.

- Para lidar com essas preocupações, fornecedores como SAP e Oracle enfatizam soluções escaláveis e modulares e oferecem serviços profissionais para otimizar implantações e minimizar interrupções. No entanto, o alto investimento inicial necessário para tecnologias avançadas de WMS — incluindo licenças de software, hardware e treinamento — pode ser uma barreira para empresas sensíveis a custos, especialmente pequenas e médias empresas (PMEs).

- Embora os modelos WMS baseados em nuvem reduzam os gastos de capital ao oferecer preços baseados em assinatura, o custo e a complexidade percebidos continuam sendo uma restrição para alguns usuários em potencial.

- Superar esses desafios por meio de interfaces aprimoradas e fáceis de usar, estruturas de integração padronizadas e modelos de preços flexíveis será crucial para acelerar a adoção do WMS e dar suporte ao crescimento de longo prazo no mercado norte-americano.

Escopo de mercado do sistema de gerenciamento de armazém na América do Norte

O mercado é segmentado com base no componente, modo de implantação, tipo de camada, função e uso final.

- Por componente

Com base nos componentes, o mercado de sistemas de gestão de armazéns na América do Norte é segmentado em software e serviços. O segmento de software dominou o mercado, com a maior participação na receita, de 64,7% em 2024, impulsionado pela crescente dependência de plataformas WMS baseadas em nuvem e on-premise para visibilidade em tempo real, atendimento de pedidos e automação. Esses sistemas integram-se perfeitamente com ERP, TMS e plataformas de cadeia de suprimentos, permitindo maior produtividade e precisão de estoque em todos os armazéns. À medida que as indústrias digitalizam suas operações, a demanda por soluções de software escaláveis e configuráveis continua a crescer.

O segmento de serviços deverá apresentar o CAGR mais rápido entre 2025 e 2032, impulsionado pelo aumento dos investimentos em consultoria, implementação, integração e suporte. Empresas que adotam WMS frequentemente exigem serviços profissionais para configuração de sistemas, treinamento de equipe e otimização contínua. A tendência crescente de terceirização de operações de armazém e a complexidade das redes logísticas modernas também contribuem para a crescente demanda por serviços gerenciados no mercado norte-americano.

- Por modo de implantação

Com base no modo de implantação, o mercado de WMS na América do Norte é segmentado em nuvem e on-premise. O segmento de nuvem foi responsável pela maior participação na receita, 70,1% em 2024, devido à sua flexibilidade, escalabilidade e menores custos iniciais de infraestrutura. Soluções de WMS baseadas em nuvem são amplamente adotadas por pequenas e médias empresas (PMEs) e provedores 3PL, oferecendo visibilidade em tempo real, acessibilidade remota e atualizações contínuas. A integração com dispositivos de IoT e análises de IA aprimora ainda mais a tomada de decisões e a eficiência do armazém, impulsionando a adoção da nuvem em todos os setores.

Espera-se que o segmento on-premise apresente o CAGR mais rápido entre 2025 e 2032, especialmente entre grandes empresas e setores como defesa, farmacêutico e automotivo, onde o controle de dados, a personalização e a conformidade regulatória são cruciais. Implantações on-premise oferecem segurança mais robusta e a capacidade de adaptar soluções a fluxos de trabalho complexos, tornando-as ideais para sistemas legados ou operações de alta segurança onde a conectividade com a internet pode ser limitada ou restrita.

- Por tipo de nível

Com base no tipo de nível, o mercado de WMS na América do Norte é segmentado em avançado, intermediário e básico. O segmento avançado liderou o mercado com a maior participação na receita, de 47,6% em 2024, impulsionado pela demanda por automação com tecnologia de IA, integração de aprendizado de máquina, robótica e análise preditiva em operações de armazém. Esses sistemas atendem a empresas e grandes 3PLs que buscam otimização em tempo real, alocação dinâmica e gerenciamento multisite, especialmente em e-commerce e manufatura.

O segmento intermediário deverá apresentar o CAGR mais rápido entre 2025 e 2032, equilibrando funcionalidade robusta com acessibilidade. Os sistemas WMS intermediários oferecem recursos essenciais como gerenciamento de pedidos, leitura de código de barras e rastreamento de estoque, tornando-os atraentes para empresas de médio porte e armazéns regionais. Com implantação em nuvem e opções modulares, os sistemas intermediários são cada vez mais escolhidos por organizações em crescimento que buscam atualizar softwares legados ou processos manuais para aumentar a eficiência operacional sem grandes investimentos.

- Por função

Com base na funcionalidade, o mercado de WMS na América do Norte é segmentado em sistemas de gestão de mão de obra, análise e otimização, gestão de faturamento, controle de estoque e gestão de pátio/doca. O segmento de controle de estoque dominou o mercado, com uma participação de receita de 34,9% em 2024, visto que a gestão precisa do estoque é a base das operações de armazém. O rastreamento de estoque em tempo real ajuda a reduzir rupturas, agilizar os processos de separação e aumentar a precisão dos pedidos, beneficiando setores como varejo, e-commerce e manufatura.

Espera-se que o segmento de análise e otimização apresente o CAGR mais rápido entre 2025 e 2032, impulsionado pela crescente necessidade de tomada de decisões baseada em dados em logística. As empresas estão utilizando análises de WMS para monitorar KPIs, prever demanda, otimizar rotas e reduzir custos operacionais. À medida que os armazéns se tornam mais automatizados, a integração de IA e aprendizado de máquina para análise preditiva e otimização do fluxo de trabalho está impulsionando esse segmento para um rápido crescimento na América do Norte.

- Por uso final

Com base no uso final, o mercado de WMS na América do Norte é segmentado em 3PL, automotivo, manufatura, alimentos e bebidas, saúde, e-commerce, produtos químicos, elétricos e eletrônicos, metais e máquinas, entre outros. O segmento de e-commerce deteve a maior participação de mercado na receita, com 19,8% em 2024, impulsionado pelo aumento das compras online e pela demanda por atendimento em tempo real, precisão de estoque e otimização da entrega de última milha. Os players do e-commerce investem fortemente em automação de armazéns, robótica e plataformas WMS escaláveis para gerenciar picos de demanda na alta temporada e ciclos rápidos de pedidos.

O segmento de saúde deverá registrar o CAGR mais rápido entre 2025 e 2032, devido à rigorosa conformidade regulatória, à logística da cadeia fria e à natureza crítica dos suprimentos médicos. Hospitais, empresas farmacêuticas e distribuidores contam com o WMS para rastreabilidade, controle de validade e armazenamento seguro. A pandemia de COVID-19 e a consequente ênfase em cadeias de suprimentos resilientes na área da saúde aceleraram ainda mais a adoção do WMS neste setor em toda a América do Norte.

Análise regional do mercado de sistemas de gerenciamento de armazéns na América do Norte

- Os EUA dominaram o mercado de sistemas de gerenciamento de armazém (WMS) com a maior participação de receita de 35% em 2024, impulsionados pela rápida adoção de tecnologias de automação e pela crescente demanda por gerenciamento eficiente da cadeia de suprimentos em todos os setores.

- As empresas da região priorizam a eficiência operacional, a visibilidade do estoque em tempo real e a otimização da mão de obra, fatores essenciais que impulsionam a adoção de soluções avançadas de WMS.

- Essa ampla adoção é apoiada por uma infraestrutura logística bem estabelecida, alto investimento em transformação digital e a presença de importantes players do mercado focados em inovação. Além disso, a crescente penetração do e-commerce e a ascensão do varejo omnicanal aceleram ainda mais a demanda por sistemas sofisticados de gestão de armazéns nos setores de manufatura e distribuição.

Visão do mercado de sistemas de gerenciamento de armazéns do Canadá

O mercado canadense de sistemas de gestão de armazéns detinha uma participação significativa de aproximadamente 18% na América do Norte em 2024, impulsionado pelo aumento dos investimentos em infraestrutura logística e transformação digital em setores-chave, como varejo, manufatura e comércio eletrônico. A demanda por maior visibilidade da cadeia de suprimentos e gestão de estoque em tempo real está impulsionando a adoção de soluções WMS. Além disso, as empresas canadenses estão se concentrando em melhorar a eficiência operacional e a conformidade com rigorosos padrões de segurança e regulatórios. O crescente setor de comércio eletrônico do país e as crescentes expectativas dos consumidores por entregas mais rápidas estão incentivando ainda mais a automação de armazéns e a integração de plataformas WMS baseadas em nuvem, que oferecem escalabilidade e flexibilidade. Iniciativas governamentais que apoiam a logística inteligente e a adoção da Indústria 4.0 também desempenham um papel crucial na expansão do mercado.

Visão do mercado de sistemas de gerenciamento de armazéns no México

O mercado de sistemas de gestão de armazéns no México deverá crescer a um CAGR robusto ao longo do período previsto, impulsionado pela expansão da base fabril do país e pela crescente participação nas cadeias de suprimentos globais. Os crescentes setores automotivo, eletrônico e de bens de consumo no México exigem operações de armazém e controle de estoque eficientes, impulsionando a adoção do WMS. Além disso, a posição geográfica estratégica do México como um polo comercial com os EUA e o Canadá facilita os investimentos na modernização logística. Mão de obra com boa relação custo-benefício e a tendência crescente de nearshoring também são fatores-chave que incentivam a implementação de soluções avançadas de WMS. As implantações baseadas em nuvem estão ganhando força devido aos menores custos iniciais e à facilidade de escalabilidade, tornando o WMS acessível para pequenas e médias empresas nos setores de logística e distribuição do México.

Participação de mercado do sistema de gerenciamento de armazéns na América do Norte

O setor de Sistemas de Gestão de Armazéns é liderado principalmente por empresas bem estabelecidas, incluindo:

- Manhattan Associates (EUA)

- Blue Yonder Group, Inc. (EUA)

- Oracle (EUA)

- IBM (EUA)

- SAP SE (Alemanha)

- ACL Digital (EUA)

- Broadcom (EUA)

- Telefonaktiebolaget LM Ericsson (Suécia)

- Hewlett Packard Enterprise Development LP (EUA)

- Softeon (EUA)

- Sistemas de telecomunicações (EUA)

- NEC Corporation (Japão)

- Juniper Networks Inc. (EUA)

- Infor (EUA)

- Versa Networks Inc. (EUA)

- Cisco Systems Inc. (EUA)

Quais são os desenvolvimentos recentes no mercado de sistemas de gerenciamento de armazéns na América do Norte?

- Em abril de 2023, a Manhattan Associates, líder global em soluções de gestão de cadeia de suprimentos e armazéns, lançou uma plataforma WMS de última geração projetada para otimizar a gestão de mão de obra e a precisão do estoque para centros de distribuição na América do Norte. Esta iniciativa estratégica enfatiza o compromisso da Manhattan Associates em aprimorar a eficiência dos armazéns por meio de análises baseadas em IA e visibilidade em tempo real, atendendo às crescentes demandas do setor por velocidade e flexibilidade.

- Em março de 2023, a Blue Yonder, importante empresa de software para cadeia de suprimentos, lançou seu sistema aprimorado de gestão de armazéns baseado em nuvem, desenvolvido especialmente para os setores de varejo e e-commerce. A nova plataforma integra recursos de aprendizado de máquina para aprimorar a previsão de demanda e automatizar os processos de reabastecimento, permitindo que os armazéns atendam às crescentes expectativas dos consumidores por um atendimento rápido de pedidos.

- Em março de 2023, a Oracle implantou com sucesso o Oracle Warehouse Management Cloud (WMS) para um grande provedor de logística no Canadá, permitindo a integração perfeita das operações de armazém com os sistemas de transporte e estoque. Essa implantação destaca o foco da Oracle em fornecer soluções escaláveis e nativas em nuvem para otimizar fluxos de trabalho operacionais e reduzir custos em cadeias de suprimentos complexas.

- Em fevereiro de 2023, a HighJump (agora parte da Körber Supply Chain) anunciou uma parceria estratégica com um fornecedor líder de logística terceirizada (3PL) na América do Norte para implementar sua solução modular de WMS. A colaboração visa aprimorar a automação de armazéns, melhorar a utilização da mão de obra e otimizar a gestão de pedidos, reforçando a posição da HighJump como parceira confiável na transformação digital de armazéns.

- Em janeiro de 2023, a JDA Software (agora Blue Yonder) revelou seu módulo atualizado de gestão de mão de obra para armazéns no evento ProMat Supply Chain. A solução oferece análises avançadas e monitoramento da produtividade dos trabalhadores em tempo real para aumentar a produtividade do armazém e reduzir os custos operacionais. Este lançamento reflete a dedicação contínua da Blue Yonder em integrar tecnologia de ponta às ofertas de WMS para impulsionar a eficiência e a lucratividade dos operadores de armazém.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.