Mercado de diagnóstico de AVC da América do Norte, por gravidade (moderada, grave, ligeira), tipo (tomografia computorizada (tomografia computorizada), angiografia por tomografia computorizada (CTA), imagem por ressonância magnética (RM), angiografia por ressonância magnética ( MRA), ecografia Doppler transcraniana , Teste de impulso cefálico por vídeo (VHIT), outros), aplicação (AVC isquémico, AVC hemorrágico, ataques isquémicos transitórios (TIAS)), utilizador final (hospitais, clínicas, centros de cirurgia ambulatória, assistência médica domiciliária ), canal de distribuição (concurso direto, terceiros Distribuidores, Outros), Estágio (Pré-operatório, Peri-operatório, Pós-operatório), País (EUA, Canadá, México), Tendências do setor e previsão para 2028

Análise de mercado e insights: Mercado de diagnóstico de AVC da América do Norte

Análise de mercado e insights: Mercado de diagnóstico de AVC da América do Norte

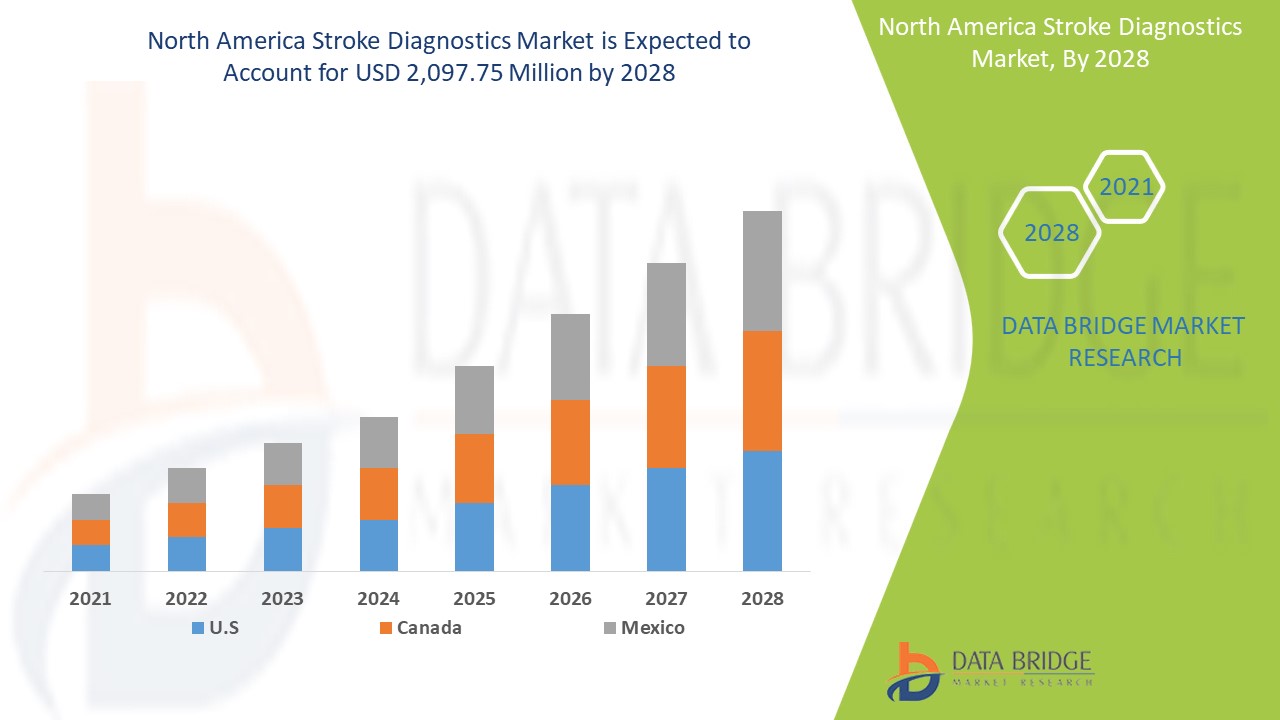

Espera-se que o mercado de diagnóstico de AVC da América do Norte ganhe crescimento de mercado no período de previsão de 2021 a 2028. A Data Bridge Market Research analisa que o mercado está a crescer com um CAGR de 6,6% no período de previsão de 2021 a 2028 e deverá atingir os 2.097,75 milhões de USD até 2028. O crescimento da I&D no setor da saúde e um aumento dos gastos em saúde são os principais impulsionadores que deverão impulsionar a procura do mercado no período de previsão. Em contraste, os recalls de produtos estão a restringir o mercado.

Um acidente vascular cerebral ocorre quando o fornecimento de sangue ao cérebro diminui ou é completamente bloqueado, o que impede o tecido cerebral de obter oxigénio e nutrientes. Existem vários tipos de dispositivos de diagnóstico que estão a ser utilizados para detetar o acidente vascular cerebral e os seus sintomas iniciais, por exemplo, tomografia computorizada (TC SCAN), angiografia por tomografia computorizada (CTA), ressonância magnética (RM), angiografia por ressonância magnética magnética (MRA), ecografia Doppler transcraniana e outros.

A crescente incidência de AVC e de doenças cardiovasculares e neurológicas aumentou a procura de diagnósticos de AVC nos países em desenvolvimento. Além disso, o aumento das despesas com cuidados de saúde está a impulsionar o crescimento do mercado. Por outro lado, o elevado custo do diagnóstico pode dificultar o crescimento do mercado. A presença de players de mercado e o lançamento de novos produtos constituem uma oportunidade. No entanto, a falta de profissionais qualificados pode desafiar o mercado.

O relatório de mercado de diagnóstico de AVC fornece detalhes de quota de mercado, novos desenvolvimentos, o impacto dos participantes do mercado nacionais e localizados, análise de oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações de mercado, aprovações de produtos , decisões estratégicas, lançamentos de produtos, expansões geográficas, e inovações tecnológicas do mercado. Para compreender a análise e o cenário do mercado, contacte-nos para obter um Analyst Brief. A nossa equipa irá ajudá-lo a criar uma solução de impacto na receita para atingir a meta desejada.

Âmbito do mercado de diagnóstico de AVC da América do Norte e tamanho do mercado

Âmbito do mercado de diagnóstico de AVC da América do Norte e tamanho do mercado

O mercado de diagnóstico de AVC da América do Norte está segmentado com base na gravidade, tipo, aplicação, utilizador final, canal de distribuição e fase. O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e a diferença nos seus mercados-alvo.

- Com base na gravidade, o mercado de diagnóstico de AVC da América do Norte está segmentado em moderado, grave e ligeiro. Em 2021, prevê-se que o segmento moderado domine o mercado, com um aumento das crescentes atividades de I&D.

- Com base no tipo, o mercado de diagnóstico de AVC da América do Norte está segmentado em tomografia computorizada (tomografia computorizada), angiografia por tomografia computorizada (CTA), ressonância magnética (MRI), angiografia por ressonância magnética (MRA), ecografia Doppler transcraniano, impulso cefálico de vídeo teste (VHIT), outro. Em 2021, prevê-se que o segmento da tomografia computorizada (TC) domine o mercado com as crescentes iniciativas governamentais para fornecer dispositivos mais avançados.

- Com base na aplicação, o mercado de diagnóstico de AVC da América do Norte está segmentado em AVC isquémico, AVC hemorrágico e ataques isquémicos transitórios (TIAS). Em 2021, prevê-se que o AVC isquémico domine o mercado com o crescente lançamento de produtos pelos principais players do mercado.

- Com base nos utilizadores finais, o mercado de diagnóstico de AVC da América do Norte está segmentado em hospitais, cuidados de saúde domiciliários, centros de cirurgia ambulatória e clínicas. Em 2021, prevê-se que o segmento hospitalar domine o mercado com a presença de profissionais e equipas qualificadas.

- Com base no canal de distribuição, o mercado de diagnóstico de AVC da América do Norte está segmentado em licitação direta, distribuidor terceirizado, entre outros. Em 2021, prevê-se que o concurso direto domine o mercado devido ao crescente número de doentes com AVC.

- Com base no estágio, o mercado de diagnóstico de AVC da América do Norte está segmentado em pré-operatório, perioperatório e pós-operatório. Em 2021, prevê-se que o pré-operatório domine o mercado devido ao crescente avanço no desenvolvimento de produtos.

Análise ao nível do país do mercado de diagnóstico de AVC

O mercado de diagnóstico de AVC é analisado e são fornecidas informações sobre o tamanho do mercado com base na gravidade, tipo, aplicação, utilizadores finais, canal de distribuição e fase.

Os países abordados no relatório de mercado de diagnóstico de AVC da América do Norte são os EUA, o Canadá e o México.

Espera-se que o segmento de diagnóstico de AVC na região da América do Norte cresça com a maior taxa de crescimento no período de previsão de 2021 a 2028 devido ao aumento do desenvolvimento de investigação para melhorar a qualidade do produto. Espera-se que os EUA liderem o crescimento do mercado de diagnóstico de AVC na América do Norte, e o segmento de concurso direto deverá dominar devido à crescente incidência de doenças no país.

A secção do país do relatório também fornece fatores individuais de impacto no mercado e alterações na regulamentação do mercado interno que impactam as tendências atuais e futuras do mercado. Dados como novas vendas, vendas de reposição, demografia do país, atos regulamentares e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e disponibilidade de marcas da América do Norte e os desafios enfrentados devido à concorrência grande ou escassa de marcas locais e nacionais, o impacto dos canais de vendas são considerados ao mesmo tempo que fornecem análises de previsão dos dados do país.

O aumento do avanço e da tecnologia para o desenvolvimento de novos produtos está a impulsionar o crescimento do mercado de diagnósticos de AVC

O mercado de diagnóstico de AVC também fornece análises de mercado detalhadas para o crescimento de cada país na indústria de diagnóstico de AVC com vendas de medicamentos para diagnóstico de AVC, o impacto do avanço na tecnologia de diagnóstico de AVC e as mudanças nos cenários regulamentares com o seu apoio ao mercado de diagnóstico de AVC. Os dados estão disponíveis para o período histórico de 2011 a 2019.

Análise do cenário competitivo e da quota de mercado do diagnóstico de AVC

O panorama competitivo do mercado de diagnóstico de AVC fornece detalhes dos concorrentes. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos, pipelines de testes de produtos, aprovações de produtos, patentes, largura do produto, e amplitude, domínio de aplicação, curva de segurança tecnológica. Os dados fornecidos acima estão apenas relacionados com o foco da empresa relacionado com o mercado de diagnóstico de AVC.

As principais empresas que operam no mercado norte-americano de diagnóstico de AVC são a Siemens, Koninklijke Philips NV, Stryker, Hologic, Inc., ESAOTE SPA, Medtron AG, Shenzhen Anke High-Tech CO., Ltd, Aspect Imaging Ltd, Siemens , FONAR Corp, FUJIFILM Holdings Corporation, General Electric Company, ALPINION MEDICAL SYSTEMS Co., Ltd., Ltd, TERASON DIVISION TERATECH CORPORATION, Analogic Corporation, Carestream Health, IMRIS, Deerfield Imaging Inc., Canon Inc., SAMSUNG, SternMed GmbH entre outros.

Muitos lançamentos e acordos de produtos são também iniciados por empresas de todo o mundo, o que também acelera o mercado de diagnóstico de AVC.

Por exemplo,

- Em fevereiro de 2021, a Koninklijke Philips NV anunciou que tinha concluído com sucesso a aquisição da BioTelemetry, Inc., um fornecedor líder de diagnóstico e monitorização cardíaca remota com sede nos EUA. A aquisição adicionou os novos produtos tecnológicos de deteção wearable ao seu pipeline de produtos

- Em setembro de 2021, a SAMSUNG anunciou que tinha concluído a aquisição da empresa HARMAN. A aquisição aumentou o portefólio de produtos da empresa e o avanço tecnológico

A colaboração, o lançamento de produtos, a expansão do negócio, a atribuição de prémios e reconhecimento, as joint ventures e outras estratégias do player de mercado estão a melhorar o mercado da empresa no mercado de diagnóstico de AVC, o que também oferece o benefício para a organização melhorar a sua oferta de diagnóstico de AVC.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA STROKE DIAGNOSTICS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES MODEL

5 EPIDEMIOLOGY

6 NORTH AMERICA STROKE DIAGNOSTICS MARKET: REGULATIONS

6.1 REGULATION IN THE U.S.

6.2 REGULATION IN EUROPE

6.3 REGULATION IN CHINA

6.4 REGULATION IN JAPAN

6.5 REGULATION IN SOUTH AFRICA

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 TECHNOLOGICAL ADVANCEMENT

7.1.2 INCREASE IN THE INCIDENCE OF STROKE

7.1.3 INCREASE IN THE GERIATRIC POPULATION

7.1.4 INCREASE IN NUMBER OF PATIENTS WITH HYPERTENSION AND CORONARY HEART DISEASES

7.2 RESTRAINTS

7.2.1 HIGH COST OF DIAGNOSIS

7.2.2 INCREASE IN PRODUCT RECALL

7.3 OPPORTUNITIES

7.3.1 RISE IN HEALTHCARE SPENDING

7.3.2 INCREASE IN DIABETIC POPULATION AND OBESITY

7.3.3 INCREASE IN FDA APPROVAL AND PRODUCT LAUNCH

7.3.4 RISE IN AWARENESS REGARDING HEALTH AND STROKE

7.4 CHALLENGES

7.4.1 UNFAVORABLE REIMBURSEMENT SCENARIO

7.4.2 COMPLICATION RELATED TO DIAGNOSTIC DEVICES

8 IMPACT OF COVID-19 ON NORTH AMERICA STROKE DIAGNOSTICS MARKET

8.1 IMPACT ON PRICE

8.2 IMPACT ON DEMAND

8.3 IMPACT ON SUPPLY CHAIN

8.4 STRATEGIC INITIATIVES

8.5 CONCLUSION

9 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY SEVERITY

9.1 OVERVIEW

9.2 MODERATE

9.3 SEVERE

9.4 MILD

10 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY TYPE

10.1 OVERVIEW

10.2 COMPUTED TOMOGRAPHY (CT SCAN)

10.3 COMPUTED TOMOGRAPHY ANGIOGRAPHY (CTA)

10.4 MAGNETIC RESONANCE IMAGING (MRI)

10.5 MAGNETIC RESONANCE ANGIOGRAPHY (MRA)

10.6 TRANSCRANIAL DOPPLER ULTRASOUND

10.7 VIDEO HEAD IMPULSE TEST (VHIT)

10.8 OTHERS

10.8.1 CAROTID ULTRASOUND

10.8.2 CAROTID ANGIOGRAPHY

10.8.3 ELECTROCARDIOGRAPHY (EKG)

10.8.4 ECHOCARDIOGRAPHY

10.8.5 BLOOD TESTS

10.8.6 NUCLEAR NEUROIMAGING

10.8.7 OTHERS

11 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 ISCHEMIC STROKE

11.2.1 THROMBOTIC STROKES

11.2.2 EMBOLIC STROKES

11.3 HEMORRHAGIC STROKE

11.3.1 INTRACEREBRAL HEMORRHAGE

11.3.2 SUBARACHNOID HEMORRHAGE

11.4 TRANSIENT ISCHEMIC ATTACKS (TIAS)

12 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITAL

12.3 CLINICS

12.4 AMBULATORY SURGICAL CENTERS

12.5 HOME HEALTHCARE

12.6 OTHERS

13 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDER

13.3 THIRD PARTY DISTRIBUTORS

13.4 OTHERS

14 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY STAGE

14.1 OVERVIEW

14.2 PRE OPERATIVE

14.3 PERI OPERATIVE

14.4 POST OPERATIVE

15 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY REGION

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 STROKE DIAGNOSTICS MARKET COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 SIEMENS

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 KONINKLIJKE PHILIPS N.V.

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 GENERAL ELECTRIC COMPANY

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 CANON INC

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 ALPINION MEDICAL SYSTEMS CO., LTD

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENTS

18.7 ANALOGIC CORPORATION

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENT

18.8 ASPECT IMAGING LTD

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 BPL MEDICAL TECHNOLOGIES

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENT

18.1 CARESTREAM HEALTH

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 PRODUCT PORTFOLIO

18.10.4 RECENT DEVELOPMENTS

18.11 ESAOTE SPA

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 FONAR CORP

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 RECENT DEVELOPMENT

18.13 FUJIFILM HOLDINGS CORPORATION

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENTS

18.14 HOLOGIC, INC

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENTS

18.15 IMRIS, DEERFIELD IMAGING INC.

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENT

18.16 MEDFIELD DIAGNOSTICS AB

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENT

18.17 MEDTRON AG

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.18 NEUSOFT CORPORATION

18.18.1 COMPANY SNAPSHOT

18.18.2 REVENUE ANALYSIS

18.18.3 PRODUCT PORTFOLIO

18.18.4 RECENT DEVELOPMENT

18.19 SAMSUNG

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT DEVELOPMENTS

18.2 SHENXHEN ANKE HIGH-TECH CO., LTD.

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

18.21 SHIMADZU CORPORATION

18.21.1 COMPANY SNAPSHOT

18.21.2 REVENUE ANALYSIS

18.21.3 PRODUCT PORTFOLIO

18.21.4 RECENT DEVELOPMENTS

18.22 SIUI

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENTS

18.23 STERNMED GMBH

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENT

18.24 STRYKER

18.24.1 COMPANY SNAPSHOT

18.24.2 REVENUE ANALYSIS

18.24.3 PRODUCT PORTFOLIO

18.24.4 RECENT DEVELOPMENTS

18.25 TERASON DIVISION TERATECH CORPORATION

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

Lista de Tabela

TABLE 1 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY SEVERITY, 2019-2028 (USD MILLION)

TABLE 2 NORTH AMERICA MODERATE IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 3 NORTH AMERICA SEVERE IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 4 NORTH AMERICA MILD IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 5 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 6 NORTH AMERICA COMPUTED TOMOGRAPHY (CT SCAN) IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 7 NORTH AMERICA COMPUTED TOMOGRAPHY ANGIOGRAPHY (CTA) IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 8 NORTH AMERICA MAGNETIC RESONANCE IMAGING (MRI) IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 9 NORTH AMERICA MAGNETIC RESONANCE ANGIOGRAPHY (MRA) IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 10 NORTH AMERICA TRANSCRANIAL DOPPLER ULTRASOUND IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 11 NORTH AMERICA VIDEO HEAD IMPULSE TEST (VHIT) IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 12 NORTH AMERICA OTHERS IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 13 NORTH AMERICA OTHERS IN STROKE DIAGNOSTICS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 14 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 15 NORTH AMERICA ISCHEMIC STROKE IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 16 NORTH AMERICA ISCHEMIC STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 17 NORTH AMERICA HEMORRHAGIC STROKE IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 18 NORTH AMERICA HEMORRHAGIC STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 19 NORTH AMERICA TRANSIENT ISCHEMIC ATTACKS (TIAS) IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 20 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 21 NORTH AMERICA HOSPITAL IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 22 NORTH AMERICA CLINICS IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 23 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 24 NORTH AMERICA HOME HEALTHCARE IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 25 NORTH AMERICA OTHERS IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 26 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 27 NORTH AMERICA DIRECT TENDER IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 28 NORTH AMERICA THIRD PARTY DISTRIBUTORS IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 29 NORTH AMERICA OTHERS IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 30 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY STAGE, 2019-2028 (USD MILLION)

TABLE 31 NORTH AMERICA PRE OPERATIVE IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 32 NORTH AMERICA PERI OPERATIVE IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 33 NORTH AMERICA POST OPERATIVE IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 34 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 35 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY SEVERITY, 2019-2028 (USD MILLION)

TABLE 36 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 37 NORTH AMERICA OTHERS IN STROKE DIAGNOSTICS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 38 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 39 NORTH AMERICA ISCHEMIC STROKE IN STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 40 NORTH AMERICA HEMORRHAGIC STROKE IN STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 41 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 42 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 43 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY STAGE, 2019-2028 (USD MILLION)

TABLE 44 U.S. STROKE DIAGNOSTICS MARKET, BY SEVERITY, 2019-2028 (USD MILLION)

TABLE 45 U.S. STROKE DIAGNOSTICS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 46 U.S. OTHERS IN STROKE DIAGNOSTICS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 47 U.S. STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 48 U.S. ISCHEMIC STROKE IN STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 49 U.S. HEMORRHAGIC STROKE IN STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 50 U.S. STROKE DIAGNOSTICS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 51 U.S. STROKE DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 52 U.S. STROKE DIAGNOSTICS MARKET, BY STAGE, 2019-2028 (USD MILLION)

TABLE 53 CANADA STROKE DIAGNOSTICS MARKET, BY SEVERITY, 2019-2028 (USD MILLION)

TABLE 54 CANADA STROKE DIAGNOSTICS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 55 CANADA OTHERS IN STROKE DIAGNOSTICS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 56 CANADA STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 57 CANADA ISCHEMIC STROKE IN STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 58 CANADA HEMORRHAGIC STROKE IN STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 59 CANADA STROKE DIAGNOSTICS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 60 CANADA STROKE DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 61 CANADA STROKE DIAGNOSTICS MARKET, BY STAGE, 2019-2028 (USD MILLION)

TABLE 62 MEXICO STROKE DIAGNOSTICS MARKET, BY SEVERITY, 2019-2028 (USD MILLION)

TABLE 63 MEXICO STROKE DIAGNOSTICS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 64 MEXICO OTHERS IN STROKE DIAGNOSTICS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 65 MEXICO STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 66 MEXICO ISCHEMIC STROKE IN STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 67 MEXICO HEMORRHAGIC STROKE IN STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 68 MEXICO STROKE DIAGNOSTICS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 69 MEXICO STROKE DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 70 MEXICO STROKE DIAGNOSTICS MARKET, BY STAGE, 2019-2028 (USD MILLION)

Lista de Figura

FIGURE 1 NORTH AMERICA STROKE DIAGNOSTICS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA STROKE DIAGNOSTICS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA STROKE DIAGNOSTICS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA STROKE DIAGNOSTICS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA STROKE DIAGNOSTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA STROKE DIAGNOSTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA STROKE DIAGNOSTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA STROKE DIAGNOSTICS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA STROKE DIAGNOSTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA STROKE DIAGNOSTICS MARKET: SEGMENTATION

FIGURE 11 THE INCREASE IN DEMAND FOR STROKE DIAGNOSTISIS EXPECTED TO DRIVE THE NORTH AMERICA STROKE DIAGNOSTICS MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 12 MODERATE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA STROKE DIAGNOSTICS MARKET IN 2021 & 2028

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE NORTH AMERICA STROKE DIAGNOSTICS MARKET, AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA STROKE DIAGNOSTICS MARKET

FIGURE 15 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY SEVERITY, 2020

FIGURE 16 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY SEVERITY, 2020-2028 (USD MILLION)

FIGURE 17 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY SEVERITY, CAGR (2021-2028)

FIGURE 18 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY SEVERITY, LIFELINE CURVE

FIGURE 19 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY TYPE, 2020

FIGURE 20 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY TYPE, 2020-2028 (USD MILLION)

FIGURE 21 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY TYPE, CAGR (2021-2028)

FIGURE 22 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 23 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY APPLICATION, 2020

FIGURE 24 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY APPLICATION, 2020-2028 (USD MILLION)

FIGURE 25 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY APPLICATION, CAGR (2021-2028)

FIGURE 26 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 27 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY END USER, 2020

FIGURE 28 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY END USER, 2020-2028 (USD MILLION)

FIGURE 29 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY END USER, CAGR (2021-2028)

FIGURE 30 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY END USER, LIFELINE CURVE

FIGURE 31 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, 2020

FIGURE 32 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, 2020-2028 (USD MILLION)

FIGURE 33 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2021-2028)

FIGURE 34 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 35 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY STAGE, 2020

FIGURE 36 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY STAGE, 2020-2028 (USD MILLION)

FIGURE 37 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY STAGE, CAGR (2021-2028)

FIGURE 38 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY STAGE, LIFELINE CURVE

FIGURE 39 NORTH AMERICA STROKE DIAGNOSTICS MARKET: SNAPSHOT (2020)

FIGURE 40 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY COUNTRY (2020)

FIGURE 41 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY COUNTRY (2021 & 2028)

FIGURE 42 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY COUNTRY (2020 & 2028)

FIGURE 43 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY SEVERITY (2021-2028)

FIGURE 44 STROKE DIAGNOSTICS MARKET COMPANY SHARE 2020 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.