North America Potting And Encapsulating Compounds Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

804.00 Million

USD

1,108.83 Million

2025

2033

USD

804.00 Million

USD

1,108.83 Million

2025

2033

| 2026 –2033 | |

| USD 804.00 Million | |

| USD 1,108.83 Million | |

|

|

|

|

Mercado de compostos de encapsulamento e encapsulamento da América do Norte, por tipo (epóxi, poliuretano, silicone, sistema de poliéster, poliamida, poliolefina e outros), tipo de substrato (vidro, metal, cerâmica, outros), função (isolamento elétrico, dissipação de calor, proteção contra a corrosão, Resistência ao choque, proteção química, outros), técnica de cura (curado à temperatura ambiente, curado a alta temperatura ou termicamente, curado por UV), canal de distribuição (offline, online), aplicação ( eletrónica, elétrica) e indústria do utilizador final (eletrónica, automóvel, Aeroespacial, Marítima, Energia e Eletricidade, Telecomunicações, Saúde, Outros), País (EUA, Canadá, México), Tendências do Setor e Previsão até 2028.

Análise e Insights de Mercado: Mercado de Compostos de Encapsulamento e Encapsulamento da América do Norte

Análise e Insights de Mercado: Mercado de Compostos de Encapsulamento e Encapsulamento da América do Norte

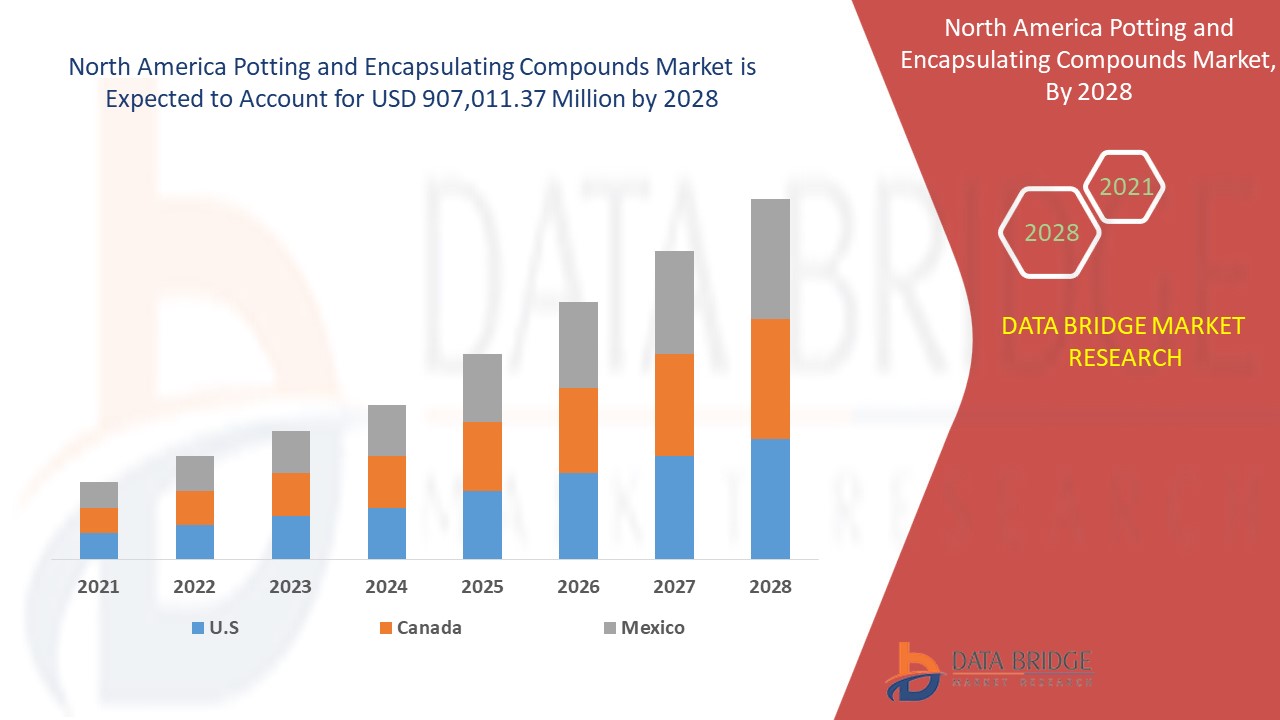

Espera-se que o mercado norte-americano de compostos de encapsulamento e enchimento da América do Norte ganhe crescimento de mercado no período previsto de 2021 a 2028. A Data Bridge Market Research analisa que o mercado está a crescer a um CAGR de 4,1% no período previsto de 2021 a 2028 e prevê-se que atinja os 907.011,37 milhões de USD até 2028.

O enchimento é o processo de enchimento de um conjunto eletrónico completo com um composto sólido ou gelatinoso , como o acrílico, o silicone ou as resinas, que melhora a resistência à vibração e ao choque, protegendo contra substâncias corrosivas e humidade. Por outro lado, o encapsulamento utiliza um molde reutilizável para construir uma estrutura em torno de um item e preencher a lacuna entre a estrutura e o objeto com produtos químicos . A principal função do encapsulamento é construir uma camada protetora em torno do conjunto eletrónico.

O aumento dos gastos dos consumidores em todo o mundo está a acelerar a expansão do setor eletrónico. A procura dos consumidores por produtos eletrónicos aumenta em resposta ao crescimento dos países em desenvolvimento. Os países produtores de eletrónica têm grandes bases de clientes que podem pagar por artigos eletrónicos inovadores, resultando no crescimento do mercado de compostos para encapsulamento e encapsulamento na América do Norte.

Este relatório de mercado de compostos de encapsulamento e encapsulamento fornece detalhes sobre a quota de mercado, novos desenvolvimentos e análise de pipeline de produtos, impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, mudanças nas regulamentações de mercado , aprovações de produtos, decisões estratégicas, produtos lançamentos, expansões geográficas e inovações tecnológicas no mercado. Para compreender a análise e o cenário de mercado, contacte-nos para um Briefing de Analista.

Âmbito e dimensão do mercado de compostos para encapsulamento e enchimento na América do Norte

Âmbito e dimensão do mercado de compostos para encapsulamento e enchimento na América do Norte

O mercado de compostos para encapsulamento e envasamento da América do Norte está segmentado e categorizado em tipo, tipo de substrato, função , técnica de cura, canal de distribuição, aplicação e utilizador final. O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e a diferença nos seus mercados-alvo.

- Com base no tipo, o mercado norte-americano de compostos de encapsulamento e enchimento da América do Norte está segmentado em epóxi, poliuretano, silicone, poliéster, poliamida, poliolefina e outros. Na América do Norte, a procura pelo segmento epóxi está a aumentar, uma vez que estes produtos oferecem mais durabilidade para o fabrico de compostos de enchimento.

- Com base no tipo de substrato, o mercado norte-americano de compostos para encapsulamento e enchimento está segmentado em vidro, metal, cerâmica e outros. Na América do Norte, o tipo de substrato metálico é dominante, uma vez que o metal tem uma excelente resistência para suportar quaisquer dificuldades ambientais.

- Com base na função, o mercado norte-americano de compostos para encapsulamento e encapsulamento está segmentado em isolamento elétrico, dissipação de calor, proteção contra a corrosão, resistência ao choque, proteção química e outros. Na América do Norte, o segmento de isolamento elétrico está a dominar o mercado devido ao aumento da procura de compostos de enchimento com maior retenção de humidade na região.

- Com base na técnica de cura, o mercado norte-americano de compostos para encapsulamento e enchimento está segmentado em cura à temperatura ambiente, cura a alta temperatura ou termicamente e cura por UV. Na América do Norte, o segmento de cura UV está a dominar o mercado devido ao aumento da procura de compostos de encapsulamento mais retentores de corrosão na região.

- Com base no canal de distribuição, o mercado norte-americano de compostos para encapsulamento e enchimento está segmentado em offline e online. Na América do Norte, o segmento offline está a dominar o mercado devido à crescente necessidade de sensibilização entre os consumidores da região.

- Com base na aplicação, o mercado de compostos para encapsulamento e encapsulamento da América do Norte está segmentado em eletrónica e elétrica. Na América do Norte, o segmento elétrico está a dominar o mercado devido à crescente procura de compostos de enchimento mais económicos na região.

- Com base na utilização final, o mercado norte-americano de compostos para encapsulamento e enchimento está segmentado em eletrónica, automóvel, aeroespacial, marítima, energia e eletricidade, telecomunicações, saúde e outros. Na América do Norte, o setor eletrónico está a dominar o mercado devido ao aumento da construção de caminhos-de-ferro na região.

Análise ao nível do país do mercado de compostos para encapsulamento e enchimento na América do Norte

O mercado de compostos para encapsulamento e enchimento da América do Norte é analisado e são fornecidas informações sobre o tamanho do mercado por país, tipo, tipo de substrato, função, técnica de cura, canal de distribuição, aplicação e utilizador final.

Os países abrangidos pelo relatório de mercado de compostos para enchimento e encapsulamento na América do Norte são os EUA, o Canadá e o México.

- Na América do Norte, espera-se que os EUA dominem devido à crescente procura de dispositivos eletrónicos mais duráveis, utilizados na maioria das indústrias.

A secção do relatório sobre os países também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado nacional que impactam as tendências atuais e futuras do mercado. Pontos de dados como novas vendas, vendas de reposição, demografia do país, atos regulamentares e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e disponibilidade de marcas da América do Norte e os desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, bem como o impacto dos canais de vendas, são considerados ao fornecer uma análise de previsão dos dados do país.

Crescimento no Setor de Eletrónica de Consumo

O aumento dos gastos dos consumidores em todo o mundo está a acelerar a expansão do setor eletrónico. A procura dos consumidores por produtos eletrónicos aumenta em resposta ao crescimento dos países em desenvolvimento. Os países produtores de eletrónica têm grandes bases de clientes que podem pagar por artigos eletrónicos inovadores, resultando no crescimento do mercado de compostos para encapsulamento e encapsulamento na América do Norte.

Análise do cenário competitivo e da quota de mercado dos compostos para encapsulação e encapsulação

O panorama competitivo do mercado de compostos para encapsulamento e enchimento na América do Norte fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença na América do Norte, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento do produto, pipelines de ensaios clínicos, análise de marca, aprovações do produto, patentes, amplitude e amplitude do produto, domínio da aplicação, curva de vida da tecnologia. Os pontos de dados fornecidos acima estão apenas relacionados com o foco da empresa no mercado de compostos para encapsulamento e enchimento na América do Norte.

Os principais participantes do mercado global de compostos de encapsulação e encapsulamento são a Wacker Chemie AG, CHT Germany GmbH, Showa Denko Materials Co., Ltd. (uma subsidiária da Hitachi, Ltd.), 3M, Electrolube, Epoxies Etc., Dymax, Master Bond Inc., DELO, ALTANA, EFI POLYMERS, Resinas Epic, MG Chemicals, Nagase America LLC., DuPont, Avantor, Inc., United Resin Corporation, Copps Industries, Aremco, Creative Materials Inc., Henkel AG & Co. KGaA, GS Polymers, RBC Industries, Inc, PARKER HANNIFIN CORP, Panacol-USA (uma subsidiária da Dr. Hönle AG), Momentive, HERNON MANUFACTURING INC.

Por exemplo,

- Em maio de 2020, a Electrolube revelou o sucesso da sua resina ER2221, utilizada para proteger as baterias de veículos elétricos nos veículos de duas rodas mais populares da Índia. O lançamento do produto foi implementado para ajudar os clientes indianos a melhorar os problemas de gestão térmica.

- Em outubro de 2020, a Epoxies Etc. formulou um novo produto epóxi, 20-3305, que foi desenvolvido para suportar necessidades eletrónicas de alta tensão e proteger conjuntos eletrónicos de ciclos de calor e stress. Este produto foi lançado para trazer variedade ao portfólio de produtos em termos de resistência ao choque térmico.

- Em abril de 2021, a Master Bond Inc. lançou um novo produto, o MasterSil 153AO, um silicone bicomponente curado por adição com propriedade auto-ferrante e estrutura termicamente condutora e eletricamente isolante. O lançamento do produto foi feito para trazer variedade ao seu portfólio de produtos existente.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.