North America Obsessive Compulsive Disorder Ocd Drugs Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

688.41 Million

USD

321.14 Million

2025

2033

USD

688.41 Million

USD

321.14 Million

2025

2033

| 2026 –2033 | |

| USD 688.41 Million | |

| USD 321.14 Million | |

|

|

|

|

Segmentação do mercado de medicamentos para Transtorno Obsessivo-Compulsivo (TOC) na América do Norte, por gravidade (leve a moderada e moderada a grave), subtipo (obsessões de contaminação com compulsão por lavar/limpar, obsessões de dano com compulsões de verificação, obsessões sem compulsões visíveis, obsessões de simetria com compulsões de ordenar, organizar e contar, acumulação e outras), medicamentos (antidepressivos, antipsicóticos, bloqueadores de NMDA e outros), via de administração (oral e parenteral), tipo de população (pediátrica e adulta), usuário final (hospitais, clínicas especializadas, assistência domiciliar e outros), canal de distribuição (farmácia hospitalar, farmácia de varejo, farmácia online e outros) - Tendências e previsões do setor até 2033.

Tamanho do mercado de medicamentos para transtorno obsessivo-compulsivo (TOC) na América do Norte

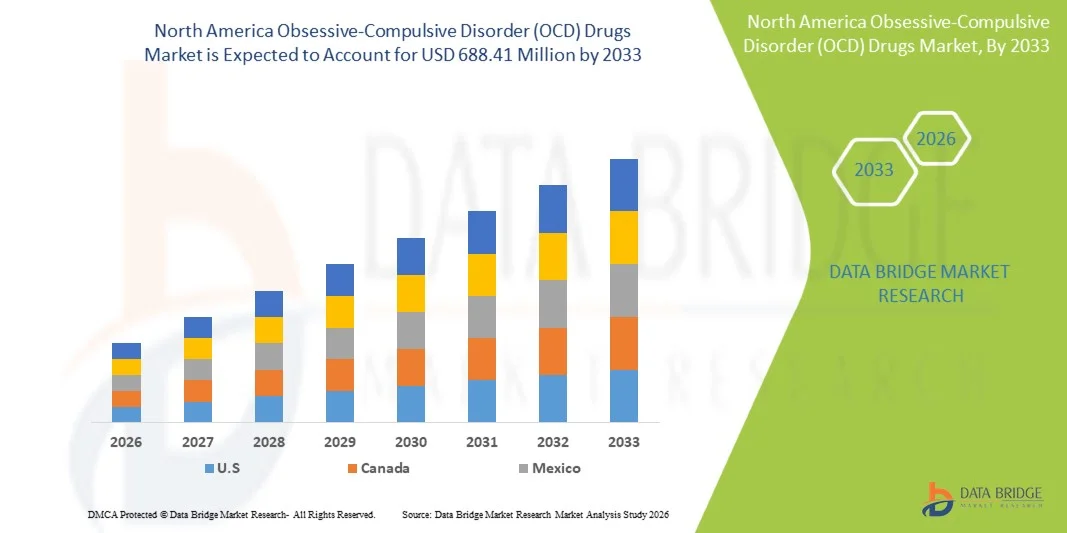

- O mercado de medicamentos para Transtorno Obsessivo-Compulsivo (TOC) na América do Norte foi avaliado em US$ 321,14 milhões em 2025 e deverá atingir US$ 688,41 milhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 10,0% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela crescente prevalência do TOC em populações adultas e adolescentes, juntamente com os avanços em terapias farmacológicas e abordagens de tratamento personalizadas.

- Além disso, a crescente conscientização sobre saúde mental, o aumento dos gastos com saúde e a preferência dos pacientes por terapias medicamentosas eficazes, bem toleradas e acessíveis estão impulsionando a adoção de medicamentos para TOC em toda a região. Esses fatores estão acelerando a entrada no mercado, impulsionando significativamente o crescimento do setor.

Análise do mercado de medicamentos para transtorno obsessivo-compulsivo (TOC) na América do Norte

- Os medicamentos para TOC, incluindo antidepressivos, antipsicóticos, bloqueadores de NMDA e outras terapias farmacológicas emergentes, são cada vez mais importantes para o tratamento do transtorno obsessivo-compulsivo em populações adultas e pediátricas, devido à sua eficácia na redução dos sintomas e na melhoria da qualidade de vida.

- A crescente demanda por medicamentos para TOC é impulsionada principalmente pela prevalência cada vez maior do transtorno, pela maior conscientização sobre saúde mental e pela preferência crescente por tratamentos farmacológicos clinicamente validados em detrimento de intervenções não medicamentosas.

- Os Estados Unidos dominaram o mercado de medicamentos para TOC, com a maior participação na receita, de 55,8% em 2025. Esse desempenho foi caracterizado por uma infraestrutura de saúde bem estabelecida, altos gastos com saúde e forte presença de importantes empresas farmacêuticas, além de um crescimento substancial nas prescrições, principalmente em hospitais e clínicas especializadas, impulsionado por inovações em formulações de medicamentos e terapias direcionadas.

- Prevê-se que o Canadá seja o país com o crescimento mais rápido no mercado de medicamentos para TOC durante o período de previsão, devido ao aumento dos programas de conscientização, à expansão das iniciativas de saúde mental e à melhoria do acesso aos cuidados psiquiátricos.

- O segmento de antidepressivos dominou o mercado de medicamentos para TOC com uma participação de 52,9% em 2025, impulsionado por sua eficácia comprovada, ampla adoção como terapia de primeira linha e perfil de segurança estabelecido em populações adultas e pediátricas.

Escopo do relatório e segmentação do mercado de medicamentos para transtorno obsessivo-compulsivo (TOC) na América do Norte

|

Atributos |

Principais informações sobre o mercado de medicamentos para o Transtorno Obsessivo-Compulsivo (TOC) na América do Norte |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais players, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, epidemiologia de pacientes, análise de projetos em desenvolvimento, análise de preços e estrutura regulatória. |

Tendências do mercado de medicamentos para transtorno obsessivo-compulsivo (TOC) na América do Norte

“Abordagens de tratamento personalizadas e habilitadas por tecnologia digital”

- Uma tendência significativa e crescente no mercado de medicamentos para TOC na América do Norte é a integração de ferramentas de saúde digital e abordagens de tratamento personalizadas, permitindo um melhor monitoramento dos sintomas do paciente, da adesão ao tratamento e da resposta à terapia.

- Por exemplo, aplicativos móveis e plataformas de telemedicina agora permitem que os pacientes monitorem a gravidade dos sintomas do TOC, a ingestão de medicamentos e o progresso da terapia, informações que podem ser compartilhadas diretamente com os psiquiatras para ajustes personalizados no tratamento.

- Os avanços na farmacogenômica e nas recomendações de tratamento baseadas em inteligência artificial estão permitindo que os médicos otimizem a seleção de medicamentos para pacientes individuais, minimizando os efeitos adversos e maximizando os resultados terapêuticos.

- Consultas de telepsiquiatria combinadas com o gerenciamento remoto de prescrições estão ampliando o acesso a medicamentos para TOC, principalmente em áreas rurais ou carentes de serviços.

- Ferramentas digitais de adesão, lembretes e monitoramento remoto de pacientes melhoram a adesão ao tratamento, reduzem o risco de recaída e apoiam a continuidade do cuidado em populações adultas e pediátricas.

- Essa tendência em direção ao gerenciamento digital e personalizado do TOC está remodelando as expectativas dos pacientes em relação à terapia, com empresas como Biohaven e Axsome Therapeutics explorando programas integrados de suporte ao paciente combinados com tratamento farmacológico.

- A adoção de soluções digitais e centradas no paciente para o tratamento do TOC está crescendo rapidamente em clínicas ambulatoriais, hospitais especializados e serviços de assistência domiciliar, à medida que pacientes e cuidadores priorizam cada vez mais a conveniência, a segurança e a continuidade do cuidado.

Dinâmica do mercado de medicamentos para transtorno obsessivo-compulsivo (TOC) na América do Norte

Motorista

“A crescente prevalência e conscientização impulsionam a adoção”

- O aumento da prevalência do TOC entre adultos e crianças, aliado à crescente conscientização sobre saúde mental, é um fator significativo para o aumento da demanda por medicamentos para o TOC.

- Por exemplo, pesquisas nacionais de saúde indicam taxas crescentes de diagnóstico, levando os profissionais de saúde a prescreverem ativamente ISRSs, antipsicóticos e bloqueadores de NMDA para o controle eficaz dos sintomas do TOC.

- À medida que pacientes e cuidadores se tornam mais informados sobre as opções de tratamento, a demanda por terapias farmacológicas clinicamente validadas e baseadas em evidências tem fortalecido sua adoção em ambientes ambulatoriais e de atendimento especializado.

- Além disso, o aumento da cobertura e do reembolso por parte dos planos de saúde para tratamentos de saúde mental está facilitando o acesso a medicamentos, tornando a terapia medicamentosa baseada em evidências uma opção preferencial em relação às intervenções não farmacológicas isoladas.

- A conveniência da administração oral, a disponibilidade de múltiplas classes de medicamentos e os programas de apoio ao paciente são fatores-chave que impulsionam a adesão aos medicamentos para TOC em hospitais, clínicas especializadas e serviços de saúde domiciliar.

- A tendência para intervenção precoce, planos de tratamento abrangentes e percursos de cuidados integrados está impulsionando ainda mais a adoção de medicamentos para TOC em populações adultas e pediátricas.

- Parcerias crescentes entre empresas farmacêuticas e provedores de saúde digital estão criando programas centrados no paciente que incentivam a adesão ao tratamento e otimizam os resultados. Campanhas de conscientização pública e iniciativas de saúde mental estão ajudando a reduzir o estigma associado ao TOC, resultando em maior diagnóstico e adesão ao tratamento.

Restrição/Desafio

“Problemas de irritação da pele e obstáculos de conformidade regulatória”

- As preocupações com os efeitos colaterais, as potenciais interações medicamentosas e a adesão ao tratamento a longo prazo representam um desafio significativo para uma maior penetração no mercado de medicamentos para TOC.

- Por exemplo, efeitos adversos comuns, como distúrbios gastrointestinais, problemas de sono ou alterações de peso, podem levar à interrupção da terapia e reduzir a adesão do paciente ao tratamento.

- Aprovações regulatórias rigorosas, requisitos para ensaios clínicos e vigilância pós-comercialização aumentam a complexidade para as empresas farmacêuticas que buscam lançar novos medicamentos para TOC na América do Norte.

- Os elevados custos diretos para o paciente em algumas terapias de marca e a disponibilidade limitada de formulações avançadas de medicamentos em certas regiões podem restringir ainda mais o acesso do paciente e o crescimento do mercado.

- Embora os medicamentos genéricos e os programas de assistência ao paciente estejam melhorando a acessibilidade, a percepção do fardo do tratamento e as preocupações com os efeitos colaterais podem dificultar a adoção generalizada entre pacientes sensíveis ao preço ou hesitantes.

- Preocupações com interações medicamentosas, particularmente em pacientes com comorbidades psiquiátricas ou clínicas, podem limitar a confiança dos médicos prescritores e o uso de certos medicamentos.

- A variabilidade nas políticas de cobertura de seguro e nos requisitos de autorização prévia pode atrasar o início do tratamento e reduzir a adesão do paciente. Abordar esses desafios por meio de educação do paciente, programas de apoio à adesão, formulações de medicamentos mais seguras e conformidade regulatória robusta será vital para o crescimento sustentado do mercado.

Escopo do mercado de medicamentos para transtorno obsessivo-compulsivo (TOC) na América do Norte

O mercado é segmentado com base na gravidade, subtipo, medicamentos, via de administração, tipo de população, usuário final e canal de distribuição.

- Por gravidade

Com base na gravidade, o mercado de medicamentos para TOC é segmentado em leve a moderado e moderado a grave. O segmento de casos moderados a graves dominou o mercado em 2025, com a maior participação na receita, impulsionado pela maior necessidade clínica de intervenção farmacológica em casos graves. Os pacientes frequentemente necessitam de doses mais elevadas ou terapia combinada com ISRSs e antipsicóticos, aumentando o consumo geral de medicamentos e a receita do mercado. Hospitais e clínicas especializadas gerenciam ativamente os casos moderados a graves, oferecendo acompanhamento estruturado e terapia de longo prazo. Ferramentas digitais de monitoramento do paciente aprimoram a adesão e os resultados do tratamento. Programas de conscientização que enfatizam os riscos do TOC grave não tratado incentivam ainda mais o início do tratamento. O diagnóstico precoce e o gerenciamento hospitalar também apoiam a terapia contínua, reforçando a dominância do mercado.

Espera-se que o segmento de sintomas leves a moderados apresente o crescimento mais rápido durante o período de previsão, devido ao foco crescente em programas de diagnóstico e intervenção precoces. A telepsiquiatria e os serviços de saúde domiciliar estão melhorando o acesso para pacientes com sintomas leves a moderados. A crescente conscientização entre pais, escolas e a população adulta está levando ao início mais precoce do tratamento farmacológico. Ferramentas digitais de monitoramento de sintomas aprimoram a adesão e o acompanhamento da terapia. Opções de medicamentos genéricos e acessíveis estão tornando a terapia acessível a uma população mais ampla. A integração da terapia comportamental com o tratamento farmacológico também contribui para a sua adoção nesse segmento.

- Por subtipo

Com base no subtipo, o mercado é segmentado em obsessões de contaminação com compulsão por lavar/limpar, obsessões de dano com compulsões de verificação, obsessões sem compulsões visíveis, obsessões de simetria com compulsões de ordenar/organizar/contar, acumulação e outras. O segmento de obsessões de contaminação com compulsão por lavar/limpar dominou o mercado devido à sua alta prevalência e resposta previsível aos ISRSs. Pacientes com esse subtipo frequentemente necessitam de terapia de longo prazo para controlar recaídas, o que aumenta o consumo de medicamentos. Hospitais e clínicas especializadas costumam priorizar o tratamento para esse subtipo. Ferramentas de monitoramento digital e aplicativos móveis melhoram a adesão ao tratamento e o controle dos sintomas. A cobertura e o reembolso por planos de saúde facilitam a adesão à terapia. Campanhas de conscientização direcionadas a compulsões relacionadas à higiene aumentam a detecção precoce e o início do tratamento.

O segmento de obsessões por simetria, com compulsões de ordenação, organização e contagem, deverá apresentar o crescimento mais rápido devido ao aumento do reconhecimento tanto em populações pediátricas quanto adultas. O diagnóstico precoce e as abordagens de tratamento direcionadas impulsionam a demanda. A integração da terapia farmacológica com intervenções comportamentais melhora os resultados. As plataformas de telepsiquiatria facilitam o acesso a cuidados especializados. Ferramentas digitais para o rastreamento de sintomas melhoram a adesão e o monitoramento. O crescente número de pesquisas e ensaios clínicos focados nesse subtipo reforça ainda mais a sua adoção pelo mercado. O uso de terapias combinadas também aumenta as taxas de prescrição nesse segmento.

- Por meio de drogas

Com base nos medicamentos, o mercado é segmentado em antidepressivos, antipsicóticos, bloqueadores de NMDA e outros. O segmento de antidepressivos dominou o mercado em 2025, com uma participação de 52,9%, devido aos ISRSs serem a terapia de primeira linha para o TOC. Eles são amplamente prescritos para adultos e crianças devido à sua eficácia e segurança comprovadas. Hospitais, clínicas especializadas e serviços de saúde domiciliar dependem fortemente de antidepressivos orais para terapia de longo prazo. Programas de assistência ao paciente e cobertura de planos de saúde facilitam a adesão. O segmento se beneficia do forte reconhecimento da marca e de ampla evidência clínica. As opções de terapia combinada com antipsicóticos ou bloqueadores de NMDA reforçam ainda mais a dominância do segmento.

O segmento de bloqueadores de NMDA deverá apresentar o crescimento mais rápido durante o período de previsão, devido às evidências emergentes de eficácia no tratamento do TOC resistente. Hospitais e clínicas especializadas estão adotando cada vez mais bloqueadores de NMDA quando a terapia de primeira linha falha. Ensaios clínicos e aprovações regulatórias estão impulsionando essa adoção. Ferramentas digitais de adesão e monitoramento por telepsiquiatria melhoram a adesão do paciente ao tratamento. Terapias combinadas com ISRSs estão se tornando mais comuns. A crescente conscientização dos médicos sobre os benefícios dos bloqueadores de NMDA impulsiona as taxas de prescrição. Programas de apoio ao paciente e a integração com o atendimento domiciliar aceleram ainda mais o crescimento.

- Por via administrativa

Com base na via de administração, o mercado é segmentado em oral e parenteral. O segmento oral dominou o mercado devido à conveniência, facilidade de uso e ampla disponibilidade. Pacientes e cuidadores preferem a administração oral tanto para terapia adulta quanto pediátrica. Hospitais e clínicas especializadas recomendam medicamentos orais para o tratamento a longo prazo. A cobertura de planos de saúde facilita o acesso e a acessibilidade. Programas digitais de adesão ao tratamento e monitoramento domiciliar da saúde aumentam a adesão. As formulações orais também são preferidas para terapia combinada, impulsionando ainda mais a receita do mercado.

Espera-se que o segmento parenteral apresente o crescimento mais rápido devido ao uso em casos agudos ou resistentes ao tratamento do TOC. As formulações injetáveis proporcionam alívio rápido dos sintomas em episódios graves. Hospitais e clínicas especializadas estão adotando cada vez mais essas formulações para pacientes em estado crítico. O monitoramento por telepsiquiatria e as ferramentas digitais de adesão ao tratamento auxiliam na adesão terapêutica. Perfis de segurança aprimorados e tecnologias de monitoramento incentivam a adoção por parte dos médicos. A terapia combinada com medicamentos orais impulsiona a demanda do mercado. O conhecimento das opções injetáveis entre médicos e cuidadores impulsiona ainda mais a adoção.

- Por tipo de população

Com base no tipo de população, o mercado é segmentado em pediátrico e adulto. O segmento adulto dominou o mercado em 2025 devido à maior prevalência, maior duração dos tratamentos e diagnósticos consistentes. Adultos necessitam de doses mais elevadas e terapia mais intensiva, impulsionando a receita. Hospitais, clínicas especializadas e centros psiquiátricos ambulatoriais são responsáveis pela maioria das prescrições para adultos. Planos de saúde e programas de saúde mental no local de trabalho incentivam a adesão à terapia. Programas de adesão ao tratamento garantem a continuidade do tratamento a longo prazo. Campanhas de conscientização promovem a intervenção precoce e reforçam a dominância de mercado.

Espera-se que o segmento de pediatria apresente o crescimento mais rápido devido à crescente conscientização sobre a intervenção e o diagnóstico precoces. A telepsiquiatria e os serviços de saúde domiciliar melhoram o acesso para as crianças. Os programas de psiquiatria pediátrica integram a terapia comportamental ao tratamento farmacológico. O monitoramento digital dos sintomas aprimora a adesão e o acompanhamento da terapia. Programas escolares e campanhas de conscientização para os pais aumentam a detecção precoce. Formulações medicamentosas especializadas para crianças impulsionam ainda mais a adoção. As opções de terapia combinada estão ganhando aceitação, acelerando o crescimento neste segmento.

- Por usuário final

Com base no usuário final, o mercado é segmentado em hospitais, clínicas especializadas, assistência domiciliar e outros. O segmento hospitalar dominou o mercado devido ao grande volume de pacientes e ao atendimento integrado para populações adultas e pediátricas. Os hospitais oferecem tratamento abrangente, incluindo terapia medicamentosa, acompanhamento e monitoramento. A concentração de psiquiatras especialistas em hospitais contribui para o alto volume de prescrições. A cobertura de planos de saúde garante a acessibilidade aos pacientes. Programas de apoio ao paciente e opções de terapia combinada reforçam a adesão ao tratamento. Os hospitais também impulsionam o gerenciamento da terapia a longo prazo, mantendo a liderança em termos de receita.

Espera-se que o segmento de assistência domiciliar apresente o crescimento mais rápido devido à adoção da telepsiquiatria, do monitoramento remoto e à busca por conveniência. Os pacientes podem acessar o tratamento sem visitas frequentes ao hospital. Aplicativos digitais de adesão e rastreamento móvel melhoram a adesão à terapia a longo prazo. Pais e cuidadores preferem a terapia domiciliar para pacientes pediátricos. Serviços de entrega de medicamentos por assinatura garantem a continuidade do cuidado. A integração da terapia comportamental ao tratamento farmacológico aumenta a adesão. Plataformas de telessaúde expandem o acesso a regiões remotas, impulsionando ainda mais o crescimento.

- Por canal de distribuição

Com base no canal de distribuição, o mercado é segmentado em farmácia hospitalar, farmácia de varejo, farmácia online e outros. O segmento de farmácia de varejo domina o mercado devido à ampla disponibilidade, fácil acesso e compras subsidiadas por planos de saúde. Adultos e crianças podem obter seus tratamentos com facilidade. Hospitais e clínicas especializadas frequentemente coordenam o fornecimento de medicamentos com farmácias de varejo. Programas de fidelização de pacientes e a renovação de prescrições garantem receita contínua. O forte reconhecimento da marca impulsiona compras repetidas. Conveniência e presença local reforçam a dominância do mercado.

Espera-se que o segmento de farmácias online apresente o crescimento mais rápido devido à crescente adoção digital e à penetração do comércio eletrônico. Os pacientes podem encomendar medicamentos remotamente com entrega em domicílio. Prescrições de telemedicina integradas ao processamento online aceleram a adoção. Sistemas de entrega e lembretes por assinatura aumentam a adesão ao tratamento. Opções de compra discretas e com privacidade aumentam a preferência dos pacientes. Plataformas digitais permitem o monitoramento da terapia e da adesão ao tratamento. Campanhas de conscientização e a crescente confiança nas farmácias online impulsionam ainda mais a adoção.

Análise Regional do Mercado de Medicamentos para Transtorno Obsessivo-Compulsivo (TOC) na América do Norte

- Os Estados Unidos dominaram o mercado de medicamentos para TOC, com a maior participação na receita, de 55,8% em 2025. Esse desempenho foi caracterizado por uma infraestrutura de saúde bem estabelecida, altos gastos com saúde e forte presença de importantes empresas farmacêuticas, além de um crescimento substancial nas prescrições, principalmente em hospitais e clínicas especializadas, impulsionado por inovações em formulações de medicamentos e terapias direcionadas.

- Pacientes e cuidadores na região valorizam cada vez mais tratamentos farmacológicos clinicamente validados, incluindo ISRSs, antipsicóticos e bloqueadores de NMDA, para o controle eficaz dos sintomas do TOC.

- Essa ampla adoção é ainda mais sustentada por instalações de saúde avançadas, serviços de telepsiquiatria, cobertura de seguro e programas de apoio ao paciente, estabelecendo a terapia farmacológica como a solução preferencial tanto para populações adultas quanto pediátricas.

Análise do Mercado de Medicamentos para Transtorno Obsessivo-Compulsivo (TOC) nos EUA e na América do Norte

O mercado de medicamentos para TOC nos EUA detinha a maior participação de receita, com 55,8% em 2025, na América do Norte, impulsionado pela alta prevalência do TOC e pela infraestrutura de saúde bem estabelecida. Pacientes e cuidadores estão priorizando cada vez mais o tratamento farmacológico eficaz com ISRSs, antipsicóticos e bloqueadores de NMDA para o controle dos sintomas. A crescente adoção de serviços de telepsiquiatria, monitoramento de saúde móvel e ferramentas digitais de adesão ao tratamento está impulsionando ainda mais o mercado. Além disso, a cobertura de planos de saúde e os programas de apoio ao paciente estão melhorando o acesso aos medicamentos. Campanhas de conscientização e iniciativas de diagnóstico precoce estão contribuindo significativamente para a expansão do mercado. O foco crescente em saúde mental pediátrica e adulta sustenta uma forte demanda por medicamentos para TOC em hospitais, clínicas especializadas e serviços de saúde domiciliar.

Análise do mercado de medicamentos para transtorno obsessivo-compulsivo (TOC) no Canadá e na América do Norte

Prevê-se que o mercado de medicamentos para TOC no Canadá cresça a uma taxa composta de crescimento anual (CAGR) constante durante o período de previsão, impulsionado pela crescente conscientização sobre saúde mental e pelo aumento das taxas de diagnóstico de TOC. Os pacientes canadenses demonstram uma preferência crescente por abordagens terapêuticas integradas, que combinam tratamento farmacológico com terapia comportamental. O robusto sistema de saúde do país e as iniciativas governamentais de apoio aos serviços de saúde mental fomentam um maior acesso a medicamentos para TOC. A telepsiquiatria e os serviços de saúde domiciliar estão ampliando a disponibilidade de tratamento em áreas remotas. Além disso, a forte cobertura de seguro e os programas de reembolso estão incentivando uma maior adesão aos medicamentos prescritos para TOC. Campanhas de saúde pública que destacam os sintomas do TOC e a importância da intervenção precoce estão contribuindo para o crescimento consistente do mercado.

Análise do mercado de medicamentos para transtorno obsessivo-compulsivo (TOC) no México e na América do Norte

O mercado de medicamentos para TOC no México deverá expandir a uma taxa composta de crescimento anual (CAGR) notável durante o período de previsão, impulsionado pela crescente conscientização sobre transtornos de saúde mental e pela melhoria da infraestrutura de saúde. Os pacientes no México estão se tornando mais receptivos a terapias farmacológicas baseadas em evidências, incluindo antidepressivos, antipsicóticos e bloqueadores de NMDA. A integração de plataformas de telemedicina está tornando o tratamento do TOC mais acessível, principalmente em regiões rurais. Iniciativas governamentais crescentes para promover a conscientização sobre saúde mental estão apoiando a adoção do mercado. O número crescente de clínicas especializadas e profissionais de saúde mental está facilitando ainda mais a disponibilidade de tratamento. Além disso, o aumento da cobertura de planos de saúde e os programas de assistência ao paciente estão ampliando o acesso a medicamentos e impulsionando o crescimento do mercado.

Participação de mercado de medicamentos para transtorno obsessivo-compulsivo (TOC) na América do Norte

A indústria de medicamentos para o Transtorno Obsessivo-Compulsivo (TOC) na América do Norte é liderada principalmente por empresas consolidadas, incluindo:

- Eli Lilly and Company (EUA)

- Axsome Therapeutics, Inc. (EUA)

- Pfizer Inc. (EUA)

- Johnson & Johnson Services, Inc. (EUA)

- GSK plc (Reino Unido)

- Lundbeck A/S (Dinamarca)

- Otsuka Pharmaceutical Co., Ltd. (Japão)

- Novartis AG (Suíça)

- AstraZeneca (Reino Unido)

- AbbVie (EUA)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Amneal Pharmaceuticals LLC (EUA)

- Grupo Zydus (EUA)

- Sun Pharmaceutical Industries Ltd. (Índia)

- Aurobindo Pharma Limitada (EUA)

- Mallinckrodt (EUA)

- Lannett. (EUA)

- Par Health, Inc. (EUA)

- Alvogen (EUA)

- Apotex Inc. (Canadá)

Quais são os desenvolvimentos recentes no mercado de medicamentos para o Transtorno Obsessivo-Compulsivo (TOC) na América do Norte?

- Em setembro de 2025, um ensaio clínico relatou que o medicamento antiemético ondansetrona, aprovado pelo FDA, quando usado como terapia adjuvante a medicamentos inibidores seletivos da recaptação de serotonina (ISRS), reduziu significativamente a gravidade dos sintomas do Transtorno Obsessivo-Compulsivo (TOC). Os resultados do ensaio destacam o potencial da ondansetrona como estratégia de potencialização no TOC, particularmente para pacientes com sintomas residuais apesar da terapia de primeira linha.

- Em abril de 2025, a cobertura da mídia destacou que as terapias "eletroceuticas", incluindo estimulação cerebral profunda (ECP), estimulação magnética transcraniana (EMT), estimulação do nervo vago (ENV) e ultrassom focalizado, estão sendo cada vez mais reconhecidas para o tratamento do TOC resistente a medicamentos nos EUA. Especificamente, até cerca de 60% dos americanos com TOC são considerados resistentes a tratamentos, tornando essas opções não medicamentosas mais relevantes.

- Em março de 2025, um resumo de pesquisa publicado pela Associação Psiquiátrica Americana destacou a publicação de um ensaio clínico randomizado e controlado com altas doses de ondansetrona para o tratamento do TOC e transtornos de tiques. O ensaio examinou não apenas as alterações nos sintomas clínicos, mas também as alterações na conectividade neural por meio de ressonância magnética funcional (RMf). Isso representa uma mudança significativa em direção a uma farmacoterapia mecanística e orientada por biomarcadores no tratamento do TOC, indicando como futuros medicamentos poderão ser avaliados com base em exames de imagem cerebral.

- Em agosto de 2024, o cenário regulatório e de pesquisa dos EUA para compostos psicodélicos sofreu uma mudança notável, com um artigo destacando que, apesar dos resultados iniciais promissores, a terapia assistida por MDMA para o Transtorno de Estresse Pós-Traumático (TEPT) não foi aprovada pela Food and Drug Administration (FDA) dos EUA, levantando questões sobre como os psicodélicos irão avançar em aplicações mais amplas na área da saúde mental, incluindo o Transtorno Obsessivo-Compulsivo (TOC).

- Em junho de 2023, foi noticiado que o estado de Washington autorizou um importante ensaio clínico com psilocibina na Faculdade de Medicina da Universidade de Washington para estudar seu potencial terapêutico, incluindo para ansiedade, depressão e, por extensão, possivelmente TOC (Transtorno Obsessivo-Compulsivo). Isso sinaliza um crescente impulso legislativo e clínico em torno de terapias alternativas que podem influenciar a farmacoterapia do TOC no futuro, mesmo que ainda não haja aprovação de medicamentos específicos para o TOC.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.