North America Nutraceutical Excipients Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

1.42 Billion

USD

2.65 Billion

2024

2032

USD

1.42 Billion

USD

2.65 Billion

2024

2032

| 2025 –2032 | |

| USD 1.42 Billion | |

| USD 2.65 Billion | |

|

|

|

|

Segmentação do mercado de excipientes nutracêuticos na América do Norte, por tipo (agentes aromatizantes, corantes, adoçantes, agentes de revestimento, tampões, solventes, transportadores, antiespumantes, agentes deslizantes, agentes umectantes, espessantes/gelificantes, conservantes, aglutinantes, desintegrantes, lubrificantes, enchimentos e diluentes e outros), produto final (prebióticos, probióticos , suplementos de proteína e aminoácidos, suplementos minerais, suplementos vitamínicos, suplementos de ômega-3 e outros suplementos), forma (seca e líquida), fonte de excipiente (natural e sintética), canal de distribuição (licitação direta, vendas no varejo e outros) - tendências do setor e previsão até 2032

Tamanho do mercado de excipientes nutracêuticos na América do Norte

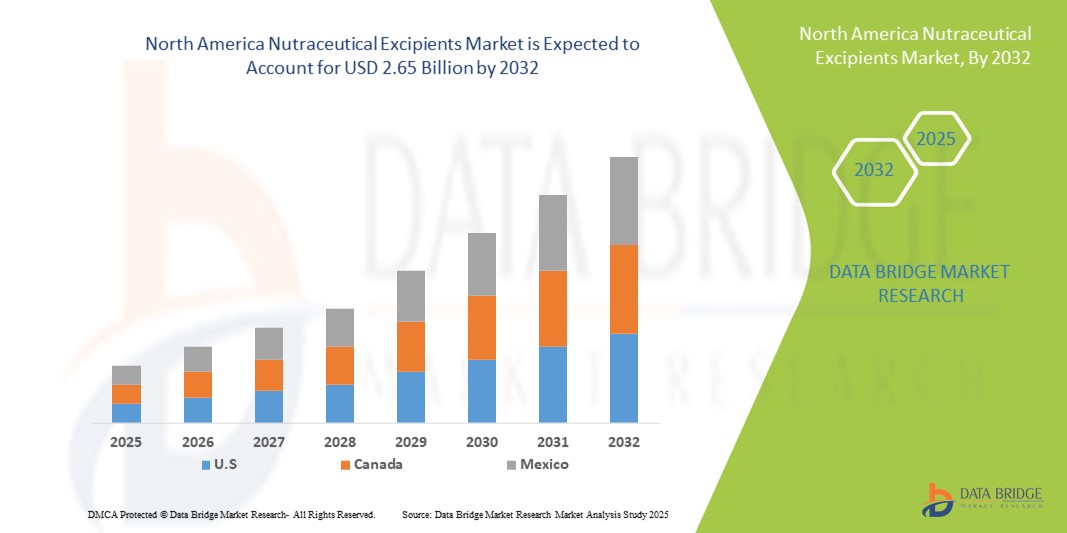

- O tamanho do mercado de excipientes nutracêuticos da América do Norte foi avaliado em US$ 1,42 bilhão em 2024 e deve atingir US$ 2,65 bilhões até 2032 , com um CAGR de 8,00% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente demanda por produtos nutracêuticos, juntamente com avanços tecnológicos em formulações de excipientes, levando a uma maior estabilidade do produto, biodisponibilidade e aceitação do consumidor em suplementos alimentares, alimentos funcionais e bebidas.

- Além disso, a crescente conscientização dos consumidores sobre saúde e bem-estar, juntamente com a crescente preferência por soluções nutracêuticas seguras, eficazes e convenientes, está levando os fabricantes a desenvolver soluções inovadoras de excipientes. Esses fatores convergentes estão acelerando a adoção de excipientes nutracêuticos avançados, impulsionando significativamente o crescimento geral do mercado.

Análise de mercado de excipientes nutracêuticos na América do Norte

- Excipientes nutracêuticos, servindo como ingredientes funcionais em suplementos alimentares, alimentos funcionais e formulações nutracêuticas, são cada vez mais vitais para aumentar a estabilidade, a biodisponibilidade e a eficácia geral dos compostos ativos. Sua adoção é impulsionada pelo crescente foco do consumidor em saúde e bem-estar, pela crescente demanda por produtos fortificados e pela inovação contínua em tecnologias de formulação.

- O crescimento do mercado é amplamente impulsionado pela crescente demanda por excipientes de alta qualidade em suplementos alimentares, alimentos funcionais e formulações nutracêuticas, impulsionado pela crescente conscientização sobre saúde e tendências de assistência médica preventiva nos EUA.

- Os EUA dominaram o mercado de excipientes nutracêuticos, com a maior participação na receita, de 71,5% em 2024, impulsionados por uma sólida infraestrutura de saúde, alta conscientização do consumidor em relação à saúde e bem-estar e a presença de fornecedores líderes de ingredientes. O crescente consumo de suplementos alimentares e alimentos funcionais, juntamente com as inovações contínuas em formulações nutracêuticas, está impulsionando o crescimento do mercado.

- Espera-se que o Canadá seja o país com crescimento mais rápido no mercado de excipientes nutracêuticos durante o período previsto, com projeção de expansão a um CAGR de 11,5% de 2025 a 2032, apoiado pelo foco crescente do governo na saúde, pela crescente disponibilidade de produtos nutracêuticos avançados e pela crescente adoção de soluções de saúde preventiva pelos consumidores.

- O segmento de forma seca dominou o mercado de excipientes nutracêuticos com uma participação de 62,1% em 2024, apoiado por sua facilidade de manuseio, estabilidade e maior vida útil

Escopo do relatório e segmentação do mercado de excipientes nutracêuticos

|

Atributos |

Principais insights de mercado sobre excipientes nutracêuticos |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de excipientes nutracêuticos na América do Norte

Formulação aprimorada e integração funcional

- Uma tendência significativa e crescente no mercado de excipientes nutracêuticos na América do Norte é o foco crescente no desenvolvimento de excipientes que melhorem a estabilidade, a biodisponibilidade e a eficácia dos ingredientes nutracêuticos ativos. Essa tendência está impulsionando a inovação tanto em suplementos alimentares quanto em alimentos funcionais.

- Por exemplo, as empresas estão introduzindo excipientes avançados que melhoram a solubilidade, mascaram sabores desagradáveis e suportam formulações de liberação controlada, aumentando assim o desempenho geral dos produtos nutracêuticos.

- Excipientes inovadores agora permitem que os formuladores combinem vários ingredientes ativos sem comprometer a estabilidade, facilitando o desenvolvimento de produtos de saúde multifuncionais

- A integração perfeita desses excipientes em formulações nutracêuticas permite que os fabricantes atendam às demandas dos consumidores por produtos de alta qualidade, seguros e eficazes, ao mesmo tempo em que cumprem os padrões regulatórios.

- Essa tendência em direção a excipientes mais eficientes, funcionais e versáteis está remodelando fundamentalmente as estratégias de desenvolvimento de produtos na indústria nutracêutica. As empresas estão investindo em P&D para criar excipientes de última geração que promovam a imunidade, a saúde cognitiva, o bem-estar digestivo e outros benefícios à saúde.

- A demanda por excipientes nutracêuticos avançados está crescendo rapidamente nos setores de suplementos alimentares e alimentos funcionais, à medida que os consumidores priorizam cada vez mais a eficácia, a segurança e a conveniência dos produtos.

Dinâmica do mercado de excipientes nutracêuticos na América do Norte

Motorista

Demanda crescente devido à conscientização sobre saúde e adoção de nutracêuticos

- O foco crescente dos consumidores em saúde, bem-estar e nutrição preventiva é um dos principais impulsionadores da crescente demanda por excipientes nutracêuticos. A crescente conscientização sobre os benefícios de suplementos alimentares, alimentos funcionais e bebidas fortificadas está levando os fabricantes a desenvolver excipientes de alta qualidade que melhoram a biodisponibilidade, a estabilidade e o apelo sensorial.

- Por exemplo, em abril de 2024, a Ingredion Incorporated anunciou o lançamento de uma nova linha de excipientes prebióticos naturais, desenvolvida para aumentar a eficácia de suplementos alimentares. Espera-se que tais inovações estratégicas por empresas-chave impulsionem o crescimento do mercado de excipientes nutracêuticos durante o período previsto.

- À medida que os consumidores buscam cada vez mais produtos de saúde funcionais e convenientes, os excipientes que permitem liberação sustentada, solubilidade aprimorada e palatabilidade estão se tornando componentes essenciais nas formulações de produtos.

- Além disso, a crescente preferência por ingredientes naturais, de rótulo limpo e à base de plantas está incentivando a adoção de excipientes especializados que atendem às expectativas regulatórias e dos consumidores em relação à transparência e segurança.

- A versatilidade dos excipientes nutracêuticos em vários formatos de produtos, incluindo pós, cápsulas, líquidos e bebidas funcionais, e sua compatibilidade com tecnologias de formulação avançadas são fatores-chave que impulsionam a expansão do mercado

- O foco dos fabricantes em pesquisa e desenvolvimento, combinado com colaborações com produtores de suplementos, garante a disponibilidade de soluções de excipientes inovadoras e fáceis de usar, impulsionando ainda mais o crescimento do mercado

Restrição/Desafio

Conformidade regulatória e restrições de custo

- Os rigorosos requisitos regulamentares para excipientes de grau alimentício e nutracêutico representam um desafio para os participantes do mercado, pois a conformidade com a FDA, EFSA e outros padrões exige testes e certificação rigorosos.

- Excipientes de alta qualidade geralmente envolvem processos de produção complexos e fornecimento de matéria-prima, o que pode aumentar os custos de produção e impactar os preços dos produtos finais, tornando-os menos acessíveis para fabricantes de pequena escala ou consumidores sensíveis ao preço.

- Garantir a consistência no desempenho funcional, pureza e estabilidade entre os lotes é crucial, pois os desvios podem afetar a eficácia e a segurança dos produtos nutracêuticos, criando um desafio adicional para os fabricantes

- O crescimento do mercado também pode ser dificultado por restrições na cadeia de abastecimento, especialmente para excipientes naturais e vegetais, que dependem da produção agrícola e da disponibilidade sazonal.

- A conscientização limitada entre os fabricantes menores sobre as funcionalidades e inovações avançadas dos excipientes pode retardar a adoção, especialmente para formulações especializadas que exigem conhecimento técnico

- A pressão competitiva dos fornecedores de excipientes genéricos de baixo custo pode reduzir as margens de lucro dos fabricantes de excipientes de qualidade premium, tornando difícil sustentar o investimento de longo prazo em inovação e melhorias de qualidade

- Superar esses desafios por meio de investimentos em P&D, tecnologias avançadas de fabricação, fornecimento estratégico de matérias-primas e educação dos usuários finais será vital para garantir ofertas de excipientes nutracêuticos de alta qualidade, econômicas e compatíveis para o crescimento sustentado do mercado.

Escopo do mercado de excipientes nutracêuticos na América do Norte

O mercado é segmentado com base no tipo, produto final, forma, fonte do excipiente e canal de distribuição.

- Por tipo

Com base no tipo, o mercado de excipientes nutracêuticos é segmentado em agentes aromatizantes, corantes, adoçantes, agentes de revestimento, tampões, solventes, carreadores, antiespumantes, agentes de deslizamento, agentes umectantes, espessantes/gelificantes, conservantes, aglutinantes, desintegrantes, lubrificantes, cargas e diluentes, entre outros. O segmento de adoçantes dominou a maior fatia de receita de mercado, com 28,5% em 2024, impulsionado pela crescente demanda por formulações nutracêuticas sem açúcar e de baixa caloria. Os adoçantes aprimoram os perfis de sabor, mantendo a estabilidade do produto, tornando-os essenciais para suplementos alimentares de fácil utilização pelo consumidor. A crescente preferência por agentes adoçantes naturais e de rótulo limpo fortalece ainda mais o domínio do mercado. Aprovações regulatórias e conformidade com os padrões de segurança também apoiam a ampla adoção. Os adoçantes são compatíveis com diversas formas de administração, como comprimidos, pós e bebidas, aumentando sua utilização em diversas linhas de produtos. Os fabricantes continuam a inovar com novos agentes adoçantes para melhorar a solubilidade, o mascaramento do sabor e os benefícios funcionais, reforçando a posição de liderança deste subsegmento.

Espera-se que o segmento de espessantes/gelificantes apresente o CAGR mais rápido, de 19,6%, entre 2025 e 2032, impulsionado pelo aumento das aplicações em alimentos e bebidas funcionais. Esses agentes melhoram a textura, a sensação na boca e a estabilidade de produtos nutracêuticos, particularmente em formulações prebióticas e proteicas. A crescente preferência do consumidor por bebidas e suplementos prontos para consumo com alta viscosidade e visualmente atraentes acelera a demanda. Inovações em agentes gelificantes naturais e de origem vegetal estão impulsionando ainda mais o crescimento. Espessantes/gelificantes também permitem melhor encapsulamento de ingredientes ativos, melhorando a biodisponibilidade e a vida útil. Os participantes do mercado estão expandindo a P&D para desenvolver espessantes multifuncionais que também atuam como estabilizantes ou carreadores, aumentando seu potencial de mercado.

- Por produto final

Com base no produto final, o mercado de excipientes nutracêuticos é segmentado em prebióticos, probióticos, suplementos de proteínas e aminoácidos, suplementos minerais, suplementos vitamínicos, suplementos de ômega-3 e outros suplementos. O segmento de suplementos vitamínicos dominou, com uma participação de mercado de 34,2% em 2024, impulsionado pela crescente conscientização sobre deficiências de micronutrientes e pelo crescente foco do consumidor na imunidade e no bem-estar geral. As vitaminas são essenciais para todas as faixas etárias e são amplamente incorporadas em formulações multivitamínicas, o que garante alta penetração no mercado. O segmento se beneficia da fácil integração com vários excipientes e formatos de suplementos. O suporte regulatório para fortificação e produtos de rótulo limpo fortalece ainda mais a adoção. As vitaminas são cada vez mais combinadas com outros ingredientes bioativos para proporcionar maiores benefícios à saúde, impulsionando o crescimento da receita.

O segmento de suplementos de proteína e aminoácidos deverá apresentar o CAGR mais rápido, de 17,8%, entre 2025 e 2032, impulsionado pela crescente adoção entre entusiastas do fitness, atletas e idosos. Dietas ricas em proteína para construção muscular, recuperação e controle de peso estão aumentando a demanda. O desenvolvimento de proteínas em pó saborizadas e prontas para misturar impulsiona o crescimento. Avanços em excipientes proteicos naturais que melhoram a solubilidade e a textura aceleram ainda mais a absorção pelo mercado. Os suplementos proteicos também estão se expandindo para bebidas funcionais e substitutos de refeição, aumentando a visibilidade no mercado e impulsionando um rápido crescimento.

- Por Formulário

Com base na forma, o mercado de excipientes nutracêuticos é segmentado em seco e líquido. O segmento de forma seca dominou o mercado com uma participação de 62,1% em 2024, apoiado por sua facilidade de manuseio, estabilidade e maior prazo de validade. Os excipientes secos são altamente versáteis, sendo adequados para comprimidos, cápsulas e produtos em pó, permitindo dosagem precisa e aumentando a eficiência da fabricação. O segmento se beneficia de inovações contínuas em técnicas de granulação, fluidez e compressibilidade, que melhoram a consistência do produto e a eficiência do processo. A demanda de fabricantes farmacêuticos e de suplementos alimentares sustenta o domínio dos excipientes secos na América do Norte, visto que eles constituem a espinha dorsal da produção em larga escala.

Espera-se que o segmento de formas líquidas apresente o CAGR mais rápido, de 15,4%, entre 2025 e 2032, impulsionado pela crescente popularidade de bebidas nutracêuticas prontas para beber e xaropes funcionais. Os excipientes líquidos oferecem vantagens como absorção mais rápida, maior biodisponibilidade e mascaramento eficaz do sabor, tornando-os ideais para produtos de nutrição pediátrica, geriátrica e esportiva. Eles também permitem o encapsulamento e a estabilização de compostos bioativos sensíveis, expandindo as possibilidades de formulação. A crescente demanda por produtos nutracêuticos práticos e prontos para o consumo está acelerando a adoção de excipientes líquidos, impulsionando o rápido crescimento do mercado.

- Por fonte de excipiente

Com base na fonte do excipiente, o mercado de excipientes nutracêuticos é segmentado em naturais e sintéticos. O segmento de origem natural dominou, com uma participação de mercado de 56,3% em 2024, impulsionado pela crescente preferência do consumidor por produtos de rótulo limpo e à base de plantas. Excipientes naturais oferecem segurança, conformidade regulatória e maior apelo de marketing. São amplamente utilizados em formulações de suplementos orgânicos e funcionais. O segmento se beneficia de inovações contínuas em tecnologias de extração e processamento, garantindo consistência e pureza. A conscientização do consumidor sobre os potenciais efeitos colaterais de ingredientes sintéticos reforça ainda mais a dominância.

Espera-se que o segmento de fontes sintéticas testemunhe o CAGR mais rápido de 16,1% de 2025 a 2032, impulsionado pela crescente demanda por excipientes nutracêuticos econômicos, escaláveis e altamente funcionais. Os excipientes sintéticos oferecem vantagens como solubilidade controlada, estabilidade aprimorada e uniformidade consistente em diversas formulações, tornando-os particularmente valiosos para a produção comercial em larga escala. Seu desempenho previsível garante resultados de fabricação confiáveis e ajuda a manter os padrões de qualidade do produto. Pesquisa e desenvolvimento contínuos em carreadores, aglutinantes, estabilizantes e outros excipientes funcionais sintéticos de alto desempenho estão impulsionando a rápida adoção no mercado. Os fabricantes estão cada vez mais aproveitando fontes sintéticas para otimizar a eficiência da formulação, reduzir a variabilidade da produção e atender à crescente demanda por produtos nutracêuticos em todo o mundo. A capacidade de personalizar excipientes sintéticos para requisitos específicos do produto fortalece ainda mais seu apelo e acelera o crescimento do mercado.

- Por canal de distribuição

Com base no canal de distribuição, o mercado de excipientes nutracêuticos é segmentado em licitação direta, vendas no varejo e outros. O segmento de licitação direta dominou o mercado com uma participação de receita de 48,7% em 2024, impulsionado principalmente por acordos de fornecimento em larga escala com grandes fabricantes de suplementos alimentares e empresas farmacêuticas. Este segmento garante um fornecimento consistente e confiável de excipientes nutracêuticos, permitindo que as empresas mantenham ciclos de produção ininterruptos. As licitações diretas oferecem vantagens competitivas de preços, estabilidade contratual de longo prazo e eficiência em pedidos em grandes quantidades, altamente valorizadas pelos principais players do setor. Fortes relacionamentos B2B, processos de aquisição simplificados e a capacidade de atender a demandas de grande volume reforçam ainda mais o domínio deste segmento. Além disso, o segmento se beneficia do acesso preferencial a novas formulações e inovações de excipientes, permitindo que as empresas permaneçam à frente no competitivo cenário do mercado.

Espera-se que o segmento de vendas no varejo apresente o CAGR mais rápido, de 14,9%, entre 2025 e 2032, impulsionado pela rápida expansão dos canais de varejo online e offline, atendendo a fabricantes de nutracêuticos de pequeno e médio porte. A disponibilidade no varejo permite que uma base mais ampla de consumidores acesse formulações pré-misturadas, cápsulas, pós e outros produtos nutracêuticos de forma conveniente. A tendência crescente de plataformas de comércio eletrônico, aliada à crescente preferência do consumidor por produtos prontos para uso e convenientes, está acelerando o crescimento neste segmento. Os canais de varejo também proporcionam maior visibilidade do produto, penetração mais rápida no mercado e a capacidade de atingir nichos e mercados regionais de forma eficaz. A crescente demanda por soluções nutracêuticas personalizadas e em pequenos lotes fortalece ainda mais a adoção de modelos de distribuição no varejo.

Análise regional do mercado de excipientes nutracêuticos na América do Norte

- A América do Norte dominou o mercado de excipientes nutracêuticos com a maior participação na receita em 2024, impulsionada pela crescente conscientização do consumidor sobre saúde e bem-estar, pela crescente demanda por suplementos alimentares e alimentos funcionais e pela presença de importantes fornecedores de ingredientes nutracêuticos na região.

- O crescimento do mercado é ainda mais impulsionado por inovações contínuas em tecnologias de excipientes que melhoram a biodisponibilidade, a estabilidade, o sabor e a solubilidade dos produtos nutracêuticos. Os fabricantes estão investindo em P&D para desenvolver excipientes de rótulo limpo, naturais e à base de plantas, em sintonia com as preferências em constante evolução dos consumidores.

- Altas rendas disponíveis, sólida infraestrutura de saúde e canais de distribuição bem estabelecidos na região apoiam a ampla adoção de excipientes nutracêuticos nos segmentos de suplementos alimentares e alimentos funcionais. O foco crescente em saúde preventiva e nutrição funcional reforça ainda mais a posição de liderança do mercado na América do Norte.

Visão do mercado de excipientes nutracêuticos dos EUA

O mercado de excipientes nutracêuticos dos EUA dominou o mercado de excipientes nutracêuticos, com a maior participação na receita, de 71,5% em 2024, apoiado por uma forte infraestrutura de saúde, alta conscientização do consumidor em relação à saúde e bem-estar e a presença de fornecedores líderes de excipientes e ingredientes. O crescente consumo de suplementos alimentares, formulações de proteínas e aminoácidos, vitaminas e alimentos funcionais, juntamente com as inovações contínuas em tecnologias de excipientes que aumentam a biodisponibilidade, a estabilidade e o apelo sensorial, está impulsionando o crescimento do mercado. O mercado é ainda mais impulsionado pelo aumento das atividades de P&D por parte dos fabricantes para desenvolver excipientes de rótulo limpo, naturais e à base de plantas, adaptados à indústria nutracêutica dos EUA.

Visão geral do mercado de excipientes nutracêuticos do Canadá

Espera-se que o mercado canadense de excipientes nutracêuticos seja o de crescimento mais rápido no mercado de excipientes nutracêuticos durante o período previsto, com uma taxa composta de crescimento anual (CAGR) de 11,5% entre 2025 e 2032. O crescimento é sustentado por iniciativas governamentais crescentes que promovem a saúde preventiva, pela crescente disponibilidade de produtos nutracêuticos avançados e pela crescente adoção de alimentos funcionais e suplementos alimentares pelos consumidores. O crescente interesse por excipientes de rótulo limpo, naturais e à base de plantas, aliado a um forte foco no consumo consciente da saúde, deve impulsionar uma expansão sustentada do mercado no Canadá.

Participação no mercado de excipientes nutracêuticos na América do Norte

A indústria de excipientes nutracêuticos é liderada principalmente por empresas bem estabelecidas, incluindo:

- BASF SE (Alemanha)

- DuPont (EUA)

- Ingredion (EUA)

- WR Grace and Co (EUA)

- Kerry Group plc (Irlanda)

- Sensient Technologies Corporation (EUA)

- Roquette Frères (França)

- Cargill, Incorporated (EUA)

- Ashland (EUA)

- SEPPIC (França)

- Gatefosse (França)

- Pioma Chemicals (Índia)

- Omya International AG (Suíça)

- Gangwal Chemicals Private Limited (Índia)

- Grain Processing Corporation (EUA)

- IMCD (Holanda)

- JRS PHARMA (Alemanha)

- Azelis (Bélgica)

- Jigs Chemical (Índia)

- Sigaichi Industries (Japão)

- Beneo (Alemanha)

- ABITEC (EUA)

Últimos desenvolvimentos no mercado de excipientes nutracêuticos da América do Norte

- Em março de 2024, a International Flavors & Fragrances (IFF) anunciou a venda de sua divisão Pharma Solutions, que inclui excipientes farmacêuticos e a divisão Global Specialty Solutions, para a empresa francesa de ingredientes Roquette por até USD 2,85 bilhões, incluindo dívidas. Essa mudança estratégica permite que a IFF se concentre em suas principais estratégias de crescimento. A transação deverá ser concluída no primeiro semestre de 2025.

- Em abril de 2024, a Glanbia plc, uma corporação global de alimentos irlandesa, anunciou a aquisição da Aroma Holding Company, uma empresa de aromatizantes sediada nos EUA, por US$ 300 milhões (EUR 281 milhões), mais uma contraprestação diferida de até US$ 55 milhões, dependendo do desempenho em 2024. Esta aquisição aprimora as capacidades da Glanbia no mercado de excipientes nutracêuticos, particularmente em sua divisão Glanbia Nutritionals.

- Em agosto de 2023, a Akums Drugs and Pharmaceuticals, uma empresa farmacêutica indiana, lançou uma formulação para o tratamento do diabetes tipo 2 em pacientes idosos, combinando diversos medicamentos para ajudar a controlar os níveis de açúcar no sangue. Além disso, a empresa começou a fabricar gomas nutracêuticas, expandindo sua oferta de produtos no setor de excipientes nutracêuticos.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.