North America Mobility As A Service Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

80.45 Billion

USD

764.30 Billion

2025

2033

USD

80.45 Billion

USD

764.30 Billion

2025

2033

| 2026 –2033 | |

| USD 80.45 Billion | |

| USD 764.30 Billion | |

|

|

|

|

Segmentação do mercado de Mobilidade como Serviço na América do Norte, por tipo de serviço (compartilhamento de carros, compartilhamento de ônibus, trem, transporte por aplicativo, compartilhamento de bicicletas, carros autônomos e outros), solução (soluções de navegação, soluções de bilhetagem, plataformas tecnológicas, serviços de seguros, provedores de conectividade de telecomunicações e motores de pagamento), tipo de transporte (público e privado), tipo de veículo (carros, ônibus, trem e micromobilidade), plataforma de aplicativo (iOS, Android e outras), tipo de necessidade (conectividade de primeira e última milha, deslocamento fora do horário de pico e em turnos, deslocamento diário, viagens para aeroporto ou estações de transporte público, viagens interurbanas e outras), porte da organização (grandes empresas e pequenas e médias empresas (PMEs)), uso (comercial e pessoal) - Tendências e previsões do setor até 2033

Tamanho do mercado de Mobilidade como Serviço na América do Norte

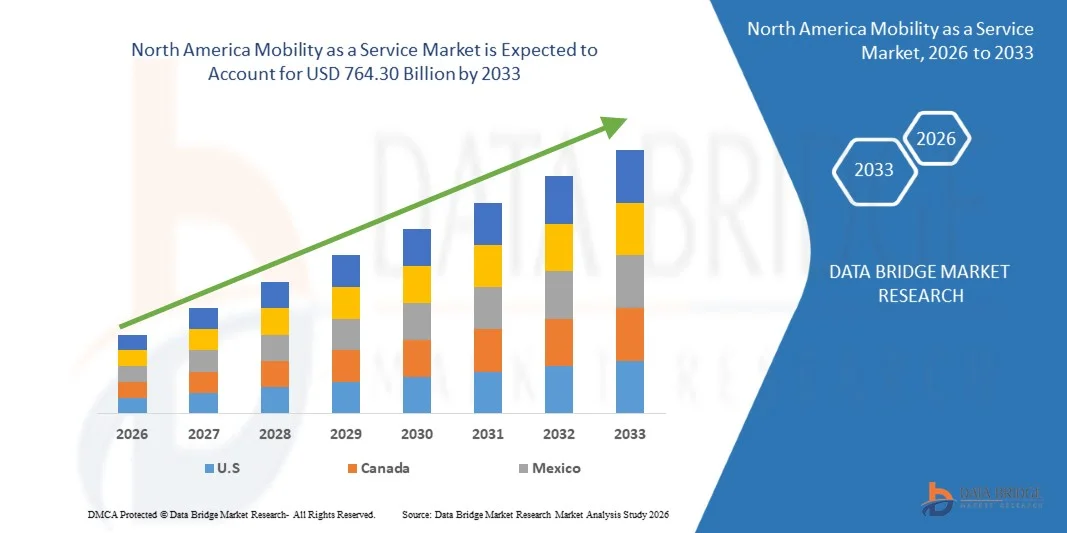

- O mercado de mobilidade como serviço na América do Norte foi avaliado em US$ 80,45 bilhões em 2025 e deverá atingir US$ 764,30 bilhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 32,50% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela crescente adoção de soluções de mobilidade compartilhada, incluindo serviços de transporte por aplicativo, compartilhamento de carros e micromobilidade, que oferecem alternativas econômicas e convenientes à propriedade de veículos particulares.

- A crescente urbanização, o congestionamento do trânsito e as preocupações ambientais estão impulsionando os setores público e privado a integrar serviços de transporte multimodal em plataformas MaaS, aprimorando a eficiência geral do transporte.

Análise do mercado de Mobilidade como Serviço na América do Norte

- O mercado está testemunhando investimentos significativos de fornecedores de tecnologia, operadores de transporte e montadoras, com foco na integração de IA, IoT e análise de dados para otimizar os serviços de mobilidade e melhorar a experiência do usuário.

- A crescente preferência do consumidor por transporte sob demanda e por assinatura, juntamente com o crescimento de aplicativos para smartphones para planejamento de rotas, reservas e pagamentos, estão impulsionando ainda mais a adoção do mercado em toda a região.

- O mercado de MaaS (Mobilidade como Serviço) dos EUA detinha a maior participação de receita na América do Norte em 2025, impulsionado pela alta penetração de smartphones, pela expansão das populações urbanas e pela crescente demanda por opções de transporte flexíveis e eficientes.

- Prevê-se que o Canadá registre a maior taxa de crescimento anual composta (CAGR) no mercado de mobilidade como serviço da América do Norte, devido à crescente urbanização, à maior adoção de soluções de mobilidade compartilhada, à expansão de iniciativas de cidades inteligentes e aos crescentes investimentos em infraestrutura de transporte digital.

Escopo do relatório e segmentação do mercado de Mobilidade como Serviço na América do Norte

|

Atributos |

Principais insights de mercado sobre Mobilidade como Serviço na América do Norte |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além de informações de mercado como valor de mercado, taxa de crescimento, segmentos de mercado, cobertura geográfica, participantes do mercado e cenário de mercado, o relatório de mercado elaborado pela equipe da Data Bridge Market Research inclui análises aprofundadas de especialistas, análises de importação/exportação, análises de preços, análises de produção e consumo e análises PESTEL. |

Tendências do mercado de Mobilidade como Serviço na América do Norte

“Ascensão das Plataformas Integradas de Mobilidade Digital”

- A crescente adoção de plataformas digitais integradas de mobilidade está transformando o cenário dos transportes, possibilitando experiências de viagem multimodais contínuas e sob demanda. Os usuários podem planejar, reservar e pagar por viagens em ônibus, trens, serviços de transporte por aplicativo e micromobilidade por meio de um único aplicativo, aumentando a conveniência e a eficiência das viagens. As plataformas também fornecem análises preditivas para previsão de demanda e otimização de rotas, ajudando as operadoras a reduzir o congestionamento e aprimorar o planejamento da mobilidade urbana.

- A alta demanda por soluções de mobilidade flexíveis e personalizadas em áreas urbanas está acelerando a implantação de plataformas MaaS (Mobilidade como Serviço). Essas plataformas são particularmente eficazes na redução do congestionamento do tráfego, na diminuição das emissões de carbono e na promoção de modelos de transporte compartilhado, com o apoio de iniciativas de cidades inteligentes e autoridades municipais de transporte. A integração com veículos elétricos e autônomos aprimora ainda mais a sustentabilidade ambiental e a eficiência operacional.

- A integração de IA, IoT e análise de dados em tempo real em plataformas MaaS está aprimorando a otimização de rotas, a precificação dinâmica e a manutenção preditiva. Os operadores se beneficiam com o aumento da eficiência operacional e melhores experiências para o cliente, o que leva a maiores taxas de adoção e melhoria na qualidade do serviço. Além disso, o feedback em tempo real e os dados de uso permitem melhorias contínuas na plataforma e expansões de serviço direcionadas.

- Por exemplo, em 2023, diversas cidades metropolitanas dos EUA relataram um aumento no uso de aplicativos de Mobilidade como Serviço (MaaS), resultando em redução do tempo de deslocamento, melhoria da conectividade do último quilômetro e maior adoção de serviços de transporte compartilhado. Essa adoção também incentivou parcerias entre provedores de mobilidade privada e autoridades de transporte público, criando redes de mobilidade urbana mais coesas e fáceis de usar.

- Embora o MaaS esteja remodelando a mobilidade urbana, seu impacto depende de avanços tecnológicos contínuos, apoio regulatório e colaborações público-privadas. Os provedores devem se concentrar na interoperabilidade, em interfaces amigáveis e em soluções de pagamento confiáveis para aproveitar ao máximo o crescimento do mercado. A inovação contínua em aplicativos móveis, recomendações baseadas em IA e integração multimodal permanecem cruciais para a adoção sustentada.

Dinâmica do mercado de Mobilidade como Serviço na América do Norte

Motorista

“Preferência crescente por transporte compartilhado e sob demanda”

- A crescente conscientização ambiental, os congestionamentos e o aumento dos preços dos combustíveis estão levando os consumidores a preferirem soluções de transporte compartilhadas e sob demanda em vez de veículos particulares. Essa tendência está acelerando os investimentos em plataformas de mobilidade que integram múltiplos modais de transporte para uma experiência perfeita. Essa mudança também contribui para a redução da poluição urbana e promove uma cultura de mobilidade na economia compartilhada.

- Autoridades de transporte e operadores privados estão adotando cada vez mais soluções digitais de MaaS (Mobilidade como Serviço) para melhorar a eficiência, otimizar o planejamento de rotas e reduzir custos operacionais. Informações aprimoradas baseadas em dados ajudam os operadores a ajustar a oferta para atender à demanda em tempo real, melhorando a confiabilidade do serviço e a satisfação do usuário. A integração com sistemas de pagamento e programas de fidelidade incentiva ainda mais a adoção e o engajamento do usuário.

- Iniciativas governamentais que promovem a mobilidade urbana sustentável, o desenvolvimento de cidades inteligentes e a adoção de veículos elétricos impulsionam ainda mais o crescimento do MaaS (Mobilidade como Serviço). Políticas que incentivam a mobilidade compartilhada, reduzem o uso de veículos com apenas um ocupante e integram o transporte público às plataformas de MaaS criam um ambiente favorável à expansão do mercado. Programas de financiamento para projetos de infraestrutura digital e mobilidade verde também aceleram a implantação de tecnologias.

- Por exemplo, em 2022, diversas cidades norte-americanas lançaram programas piloto para aplicativos integrados de Mobilidade como Serviço (MaaS) que conectam transporte público, compartilhamento de bicicletas e compartilhamento de viagens, o que impulsionou a adoção e incentivou o deslocamento multimodal. Os primeiros resultados mostraram maior uso do transporte público e aumento da satisfação com a mobilidade compartilhada entre os usuários, destacando os benefícios de plataformas coordenadas.

- Embora as tendências de mobilidade compartilhada estejam impulsionando o crescimento do mercado, as operadoras precisam enfrentar desafios como interoperabilidade de pagamentos, conformidade regulatória e confiança do usuário para garantir a adoção e a escalabilidade a longo prazo. O engajamento contínuo com órgãos reguladores, autoridades públicas e parceiros de tecnologia é essencial para expandir a cobertura e a confiabilidade dos serviços.

Restrição/Desafio

“Altos custos de infraestrutura e complexidades de integração”

- O elevado investimento de capital necessário para implementar e manter plataformas integradas de MaaS (Mobilidade como Serviço), incluindo infraestrutura digital, desenvolvimento de aplicativos e sistemas de pagamento, limita a adoção por operadores menores e municípios. O custo continua sendo uma barreira significativa para a implantação em larga escala, principalmente em regiões com financiamento público-privado limitado. A manutenção operacional a longo prazo e as atualizações tecnológicas aumentam ainda mais a pressão financeira.

- Muitas regiões enfrentam desafios na integração de múltiplos modais de transporte em uma plataforma digital unificada, incluindo problemas de compatibilidade técnica, padronização de dados e interoperabilidade. Essas complexidades podem dificultar a prestação de serviços contínuos e atrasar os prazos de adoção. Sistemas de transporte legados e redes fragmentadas complicam ainda mais a integração e exigem soluções de TI abrangentes.

- O crescimento do mercado também é afetado por obstáculos regulatórios, preocupações com a segurança cibernética e resistência dos provedores de transporte tradicionais. As operadoras devem investir em segurança de rede, conformidade legal e engajamento das partes interessadas para alcançar uma integração tranquila e operações confiáveis. Treinamento adequado da equipe e capacitação dos usuários são igualmente importantes para garantir o uso seguro e eficiente da plataforma.

- Por exemplo, em 2023, diversas cidades dos EUA e do Canadá sofreram atrasos na implementação de soluções unificadas de MaaS devido à complexa coordenação entre as autoridades de transporte público e os provedores de mobilidade privada, o que evidenciou a necessidade de um planejamento robusto e da colaboração entre as partes interessadas. Esses atrasos também afetaram as taxas de adoção pelos usuários e exigiram investimentos adicionais em atualizações de sistemas e testes de interoperabilidade.

- Embora as soluções de MaaS continuem a evoluir, lidar com os altos custos, os desafios de integração técnica e a conformidade regulatória permanece crucial. Os provedores devem se concentrar em plataformas escaláveis, modulares e seguras para desbloquear todo o potencial do mercado de mobilidade da América do Norte. Parcerias com fornecedores de tecnologia, provedores de serviços em nuvem e municípios são essenciais para alcançar implantações de MaaS perfeitas, sustentáveis e eficientes.

Escopo do mercado de Mobilidade como Serviço na América do Norte

O mercado é segmentado com base no tipo de serviço, solução, tipo de transporte, tipo de veículo, plataforma de aplicação, tipo de requisito, tamanho da organização e utilização.

• Por tipo de serviço

Com base no tipo de serviço, o mercado de Mobilidade como Serviço (MaaS) da América do Norte é segmentado em compartilhamento de carros, compartilhamento de ônibus, trens, transporte por aplicativo, compartilhamento de bicicletas, carros autônomos e outros. O segmento de transporte por aplicativo detinha a maior participação na receita de mercado em 2025, impulsionado pela alta demanda urbana, conveniência e ampla adoção de serviços de mobilidade sob demanda baseados em aplicativos. As plataformas de transporte por aplicativo também permitem a integração perfeita com outros modais de transporte, aprimorando as experiências de viagem multimodais para passageiros diários e viajantes urbanos.

O segmento de compartilhamento de carros deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente conscientização sobre transporte sustentável, pela redução da posse de carros particulares e por incentivos governamentais que promovem a mobilidade compartilhada. Os serviços de compartilhamento de carros também oferecem acesso flexível a veículos para usuários urbanos, sem o ônus dos custos de propriedade, tornando-se cada vez mais populares em regiões metropolitanas.

• Por solução

Com base na solução, o mercado é segmentado em soluções de navegação, soluções de bilhetagem, plataformas tecnológicas, serviços de seguros, provedores de conectividade de telecomunicações e motores de pagamento. As plataformas tecnológicas detiveram a maior participação na receita em 2025, devido ao seu papel na integração de múltiplos modais de transporte, no fornecimento de atualizações de viagens em tempo real e na viabilização de opções de pagamento seguras em todos os serviços.

Espera-se que as soluções de navegação apresentem o crescimento mais rápido entre 2026 e 2033, impulsionadas pela otimização de rotas baseada em IA, análises preditivas de tráfego e orientações aprimoradas para passageiros. Essas soluções melhoram a eficiência das viagens, reduzem o congestionamento e aumentam a satisfação do usuário, favorecendo uma maior adoção de plataformas de Mobilidade como Serviço (MaaS).

• Por tipo de transporte

Com base no tipo de transporte, o mercado é segmentado em público e privado. O transporte público representou a maior participação em 2025 devido à integração de ônibus, trens e sistemas de metrô em plataformas MaaS, possibilitando experiências de deslocamento mais fluidas para os usuários.

Prevê-se que o transporte privado registre o crescimento mais rápido entre 2026 e 2033, impulsionado por serviços de transporte por aplicativo, compartilhamento de carros e serviços emergentes de micromobilidade. Essas opções oferecem acesso flexível e sob demanda a veículos, atendendo às necessidades de mobilidade urbana e reduzindo a dependência da propriedade de carros particulares.

• Por tipo de veículo

Com base no tipo de veículo, o mercado é segmentado em veículos de quatro rodas, ônibus, trens e micromobilidade. Os veículos de quatro rodas dominaram o mercado em 2025, impulsionados pela ampla utilização de serviços de transporte por aplicativo e compartilhamento de carros.

A micromobilidade, incluindo bicicletas e scooters elétricas, deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionada pelo congestionamento urbano, pelo aumento da demanda por viagens de curta distância e por iniciativas governamentais que promovem o transporte ecológico de última milha.

• Por plataforma de aplicativos

Com base na plataforma de aplicativos, o mercado é segmentado em iOS, Android e outros. Os aplicativos Android detiveram a maior participação na receita em 2025, devido à maior penetração de smartphones e à acessibilidade em áreas urbanas e semiurbanas.

Prevê-se que as plataformas iOS apresentem o crescimento mais rápido entre 2026 e 2033, impulsionadas pela adoção por usuários de alto nível e pela integração com serviços MaaS premium, oferecendo maior segurança e experiências de pagamento móvel perfeitas.

• Por tipo de requisito

Com base no tipo de necessidade, o mercado é segmentado em conectividade de primeira e última milha, deslocamento fora do horário de pico e para trabalhadores em turnos, deslocamento diário, viagens para aeroportos ou estações de transporte público, viagens interurbanas e outros. Os serviços de deslocamento diário detinham a maior participação em 2025, impulsionados pela crescente dependência da força de trabalho urbana em relação ao transporte público e às soluções de mobilidade compartilhada.

A conectividade do primeiro e do último quilômetro deverá apresentar a taxa de crescimento mais rápida entre 2026 e 2033, impulsionada por plataformas MaaS que otimizam o acesso contínuo entre áreas residenciais e os principais centros de transporte, melhorando a conveniência e a eficiência geral dos passageiros.

• Por tamanho da organização

Com base no porte da organização, o mercado é segmentado em grandes empresas e pequenas e médias empresas (PMEs). As grandes empresas representaram a maior participação em 2025 devido à adoção precoce de programas de mobilidade corporativa e soluções de transporte para funcionários.

Prevê-se que as PMEs registarão o crescimento mais rápido entre 2026 e 2033, à medida que as soluções digitais de MaaS se tornam cada vez mais acessíveis, económicas e escaláveis para organizações mais pequenas, melhorando a eficiência operacional e a mobilidade da força de trabalho.

• Por uso

Com base no uso, o mercado é segmentado em comercial e pessoal. O uso comercial detinha a maior participação em 2025, impulsionado pela integração com autoridades de transporte público, programas de viagens corporativas e serviços de mobilidade logística urbana.

Prevê-se que o uso pessoal registre o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente adoção de serviços de transporte por aplicativo, compartilhamento de carros e micromobilidade para deslocamentos diários, lazer e viagens urbanas.

Análise Regional do Mercado de Mobilidade como Serviço na América do Norte

- O mercado de MaaS (Mobilidade como Serviço) dos EUA detinha a maior participação de receita na América do Norte em 2025, impulsionado pela alta penetração de smartphones, pela expansão das populações urbanas e pela crescente demanda por opções de transporte flexíveis e eficientes.

- Os consumidores estão cada vez mais priorizando a conveniência e a mobilidade com boa relação custo-benefício por meio de plataformas digitais multimodais. A crescente integração de aplicativos de Mobilidade como Serviço (MaaS) com transporte público, aplicativos de transporte e soluções de micromobilidade, juntamente com recursos como rastreamento em tempo real, preços dinâmicos e pagamentos sem dinheiro, está contribuindo significativamente para a expansão do mercado.

Análise do Mercado de Mobilidade como Serviço no Canadá

O mercado canadense de MaaS deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente urbanização, pela maior penetração de smartphones e pela crescente conscientização sobre soluções de transporte compartilhadas e sustentáveis. Iniciativas governamentais que promovem cidades inteligentes, sistemas integrados de transporte público e opções de mobilidade de baixa emissão estão incentivando a adoção de plataformas de MaaS. A crescente demanda por soluções de transporte multimodal convenientes, flexíveis e econômicas, combinada com investimentos em infraestrutura digital e aplicativos de mobilidade em tempo real, está impulsionando significativamente o crescimento do mercado nos segmentos residencial e comercial no Canadá.

Participação de mercado de Mobilidade como Serviço na América do Norte

O setor de mobilidade como serviço na América do Norte é liderado principalmente por empresas consolidadas, incluindo:

- Uber Technologies, Inc. (EUA)

- Lyft, Inc. (EUA)

- Bird Rides, Inc. (EUA)

- Lima (EUA)

- Via Transportation, Inc. (EUA)

- Zipcar, Inc. (EUA)

- Motivar (EUA)

- Masabi (Reino Unido)

- TransLoc (EUA)

- Bridj (EUA)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.