North America Medical Clothing Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

94.30 Billion

USD

179.78 Billion

2021

2029

USD

94.30 Billion

USD

179.78 Billion

2021

2029

| 2022 –2029 | |

| USD 94.30 Billion | |

| USD 179.78 Billion | |

|

|

|

North America Medical Clothing Market, By Product (Professional Apparel, Patient Apparel, Specialty Apparel, First Aid Clothing, Wraps and Towels, Others), Usage (Reusable and Disposable), End User (Hospitals, Specialty Clinics, Ambulatory Centres, Home Care Settings, Research & Clinical Laboratories and Others), Distribution Channel (Direct Tender, Retail Sales, Third Party Distributor, Others) – Industry Trends and Forecast to 2029

Market Analysis and Size

Scrubs for doctors are frequently provided to hospitals by medical clothing vendors. Patients' apparel is also included in the medical attire and is composed of cotton for comfort and practicality. To enter a hospital, a medical practitioner must dress appropriately.

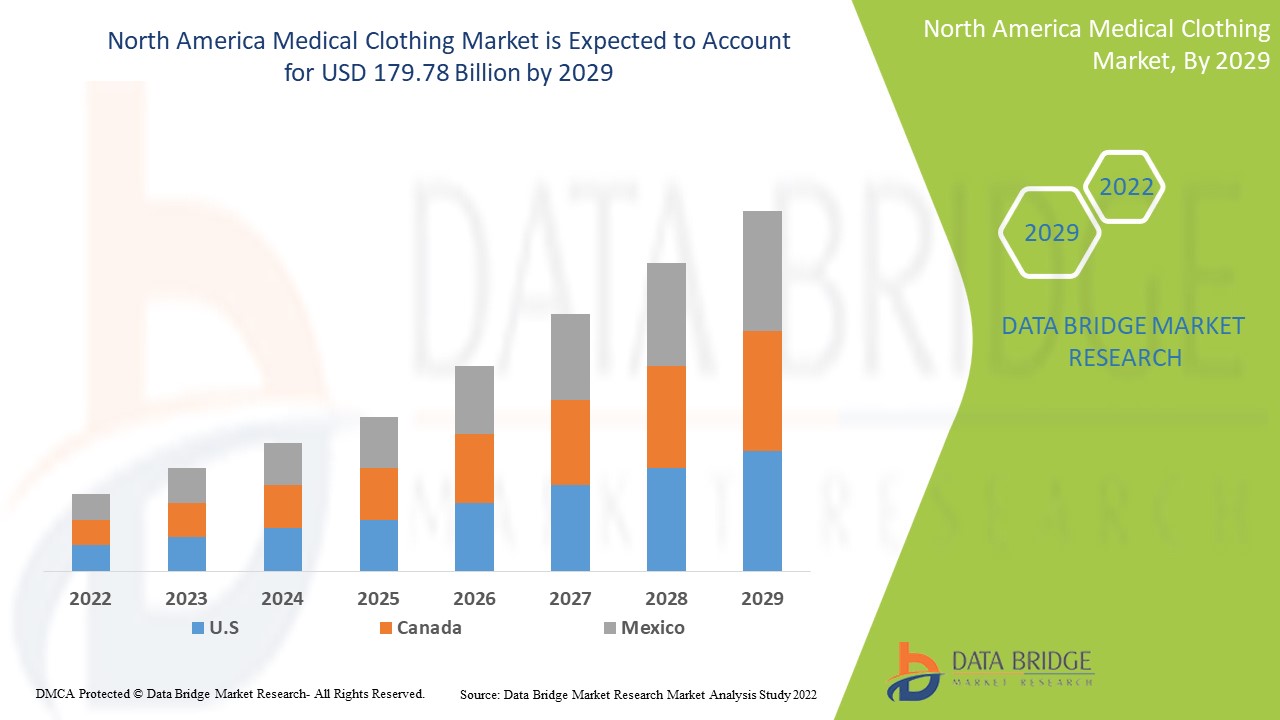

Data Bridge Market Research analyses that the medical clothing market which was USD 94.3 billion in 2021, would rocket up to USD 179.78 billion by 2029, and is expected to undergo a CAGR of 8.4% during the forecast period 2022 to 2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product (Professional Apparel, Patient Apparel, Specialty Apparel, First Aid Clothing, Wraps & Towels, Others), Usage (Reusable and Disposable), End User (Hospitals, Specialty Clinics, Ambulatory Centres, Home Care Settings, Research & Clinical Laboratories and Others), Distribution Channel (Direct Tender, Retail Sales, Third Party Distributor, Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America |

|

Market Players Covered |

Cardinal Health, Inc. (U.S.), Mölnlycke Health Care AB (Sweden), 3M (U.S.), Smith+Nephew (U.K.), Ansell Ltd. (Australia), Superior Group of Companies (U.S.), Semperit AG Holding (Austria), Henry Schein, Inc. (U.S.), Narang Medical Ltd. (India), Healing Hands (New Jersey), BARCO UNIFORMS (U.S.), CHEROKEE UNIFORMS (U.S.), Aramark Uniform & Career Apparel (U.S.), Carhartt, Inc. (U.S.), LynkTrac Technologies LLC (U.S.), Owens & Minor, Inc. (U.S.), Prestige Medical (C.A.), Landau Uniforms (U.S.), Medline Industries, Inc. (U.S.) |

|

Market Opportunities |

|

Market Definition

Scrubs are the attire worn by those working in hospitals. Scrubs for doctors, nurses, and medical workers come in various styles. Doctors are health care providers who work in hospitals. They must dress in neat, sanitary attire. A doctor's attire should be practical and available at all times.

Medical Clothing Market Dynamics

Drivers

- Rise in chronic diseases

The research of the rise in this prevalent and expensive long-term health issue is influenced by social behaviour changes and an ageing population. Long-term health issues will raise the number of patients visiting hospitals and clinics, which could directly increase the market for medical apparel. Decent quality medical apparel, such as gloves, masks, and coats will be used to provide a good and hygienic medical treatment, which will grow the market and demand in the future.

- Increase in the population of elderly people

Longer life expectancies have led to a steady rise in the population of adults 60 and older. The prevalence of chronic diseases is maximum in the elderly, which drives up demand for medical apparel. By 2050, there will be 1.5 billion older people worldwide, up from 750 million in 2021. The market for medical garments will see an increase in demand as a result in the upcoming years.

- Incidence of zoonotic illnesses rising

Zoonotic infections are those that spread spontaneously from animals to people and vice versa. These illnesses can be spread either directly through direct contact with infected people or animals or through the consumption of tainted food and water that has been exposed to the pathogen during preparation. Over 75% of newly emerging infectious diseases in humans have animal origins. In January 2020, a coronavirus was responsible for the pandemic epidemic. This virus was labelled a public health emergency of international concern and is thought to have come from bats or snakes. The need for medical clothes is anticipated to increase as the prevalence of infectious diseases rises.

Opportunities

Medical wearables are using the most recent advancements in technology, including A.I., to identify abnormal physiological states and alert the appropriate parties. The development of the medical apparel industry may benefit from opportunities provided by technology. Additionally, during the projection period, there will be more chances for the growth of the medical apparel market due to the rising number of service providers and expanding markets.

Restraints/Challenges

- Rigid government regulations

Medical devices include scrubs, gloves, masks, and gowns, all of which need FDA approval. They are often made to meet levels of protection ranging from minimal risk to high risk, depending on the dangers involved. The clearance of medical apparel is subject to a number of stringent requirements, including infection resistance, tensile strength, tear resistance, and barrier levels. The manufacturing of the product is made more expensive by these stringent regulations and permits, which may impede market expansion.

This medical clothing market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the medical clothing market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Medical Clothing Market

The healthcare industry has entirely shifted its focus to patient care as a result of the rising number of COVID-19 cases in different parts of the world. The primary goal is to lessen the virus's effects, and vigorous government efforts to promote safety and hygiene have led to substantial investments in medical gear. For instance, China declared in April 2020 that it will increase mask production to 116 million per day, or 12 times the pre-pandemic level. The COVID-19 virus outbreak has opened up a number of opportunities for players and producers in the global medical apparel market. The demand for medical-grade PPE gloves, masks, and kits has increased recently, pushing the medical clothing industry.

Recent Development

- In July 2020 due to the rising need for PPE, Herida Healthcare teamed together with North Tees, Hartlepool Solutions, and the NHS to manufacture extremely sterile medical gowns.

North America Medical Clothing Market Scope

The medical clothing market is segmented on the basis of product, usage, distribution channel, and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Professional Apparel

- Patient Apparel

- Specialty Apparel

- First Aid Clothing

- Wraps and Towels

- Others

Usage

- Reusable

- Disposable

End User

- Hospitals

- Specialty Clinics

- Ambulatory Centres

- Home Care Settings

- Research and Clinical Laboratories

- Others

Distribution Channel

- Direct Tender

- Retail Sales

- Third Party Distributor

- Others

Medical Clothing Market Regional Analysis/Insights

The medical clothing market is analysed and market size insights and trends are provided by country, product, usage, distribution channel, and end-user as referenced above.

The countries covered in the medical clothing market report are U.S., Canada and Mexico in North America.

U.S. is dominating in the market and leading the growth due to increased presence of key market players in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Medical Clothing Market Share Analysis

The medical clothing market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to medical clothing market.

Some of the major players operating in the medical clothing market are:

- Cardinal Health, Inc. (U.S.)

- Mölnlycke Health Care AB (Sweden)

- 3M (U.S.)

- Smith+Nephew (U.K.)

- Ansell Ltd. (Australia)

- Superior Group of Companies (U.S.)

- Semperit AG Holding (Austria)

- Henry Schein, Inc. (U.S.)

- Narang Medical Ltd. (India)

- Healing Hands (New Jersey)

- BARCO UNIFORMS (U.S.)

- CHEROKEE UNIFORMS (U.S.)

- Aramark Uniform & Career Apparel (U.S.)

- Carhartt, Inc. (U.S.)

- LynkTrac Technologies LLC (U.S.)

- Owens & Minor, Inc. (U.S.)

- Prestige Medical (C.A.)

- Landau Uniforms (U.S.)

- Medline Industries, Inc. (U.S.)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA MEDICAL CLOTHING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET END USER COVERAGE GRID

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 REGULATORY

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 PANDEMIC OUTBREAK OF COVID-19

5.1.2 ESCALATION IN NUMBER OF SURGERIES

5.1.3 GROWING DEMAND FOR BETTER QUALITY HEALTHCARE AND HYGIENE

5.1.4 INCREASING GERIATRIC POPULATION

5.1.5 UPSURGE IN INCIDENCES OF CHRONIC DISEASES

5.2 RESTRAINTS

5.2.1 HIGH NUMBER PROBLEMS ASSOCIATED DURING DONNING AND DOFFING OF PPE

5.2.2 POOR COMFORT ABILITY

5.2.3 ALLERGIC REACTIONS ASSOCIATED WITH LATEX AND POWDERED GLOVES

5.3 OPPORTUNITIES

5.3.1 INTRODUCTION OF INNOVATIVE PRODUCT LAUNCHES

5.3.2 PARTNERSHIP AGREEMENT AND ACQUISITION

5.3.3 INCREASING PRODUCTION CAPACITY

5.4 CHALLENGES

5.4.1 STRINGENT REGULATION POLICIES

6 COVID-19 IMPACT ON NORTH AMERICA MEDICAL CLOTHING MARKET

6.1 PRICE IMPACT

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON DEMAND

6.4 STRATEGIC DECISIONS FOR MANUFACTURERS

6.5 CONCLUSION

7 NORTH AMERICA MEDICAL CLOTHING MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 PROFESSIONAL APPAREL

7.2.1 FACE MASKS

7.2.1.1 NON-WOVEN MASK

7.2.1.2 CLOTH MASK

7.2.2 SCRUBS

7.2.2.1 TYPE

7.2.2.1.1 TOPS

7.2.2.1.2 PANTS

7.2.2.1.3 JACKETS

7.2.2.1.4 CAPS

7.2.2.1.5 OTHERS

7.2.2.2 MATERIAL

7.2.2.2.1 WOVEN MEDICAL SCRUBS

7.2.2.2.2 NON-WOVEN MEDICAL SCRUBS

7.2.3 LAB COATS

7.2.3.1 Length

7.2.3.1.1 HIP LENGTH

7.2.3.1.2 KNEE LENGTH

7.2.3.2 TYPE

7.2.3.2.1 FLUID-RESISTANT LAB COAT

7.2.3.2.2 STATIC-RESISTANT LAB COAT

7.2.4 HEADWEAR

7.2.4.1 BOUFFANT CAPS

7.2.4.1.1 COMFORT BOUFFANT CAPS

7.2.4.1.2 PREMIUM BOUFFANT CAPS

7.2.4.1.3 OTHERS

7.2.4.2 BEARD COVERS

7.2.5 SHOE COVERS

7.2.5.1 NON-CONDUCTIVE

7.2.5.2 NON-SKID

7.3 PATIENT APPAREL

7.3.1 TYPE

7.3.1.1 IV GOWN WITH SNAP SLEEVE CLOSURE

7.3.1.2 PLUS SIZE TEAL GOWNS

7.3.1.3 COMPLETE COVERAGE GOWNS

7.3.1.4 PEDIATRIC GOWN

7.3.1.5 OTHERS

7.3.2 MATERIAL

7.3.2.1 REINFORCED TISSUE

7.3.2.2 NON-WOVEN

7.3.2.3 OTHERS

7.4 SPECIALTY APPAREL

7.4.1 ISOLATION GOWNS

7.4.1.1 AAMI ISOLATION GOWN

7.4.1.1.1 LEVEL 1

7.4.1.1.2 LEVEL 4

7.4.1.1.3 LEVEL 3

7.4.1.1.4 LEVEL 2

7.4.1.2 TRI-LAYER SMS GOWN

7.4.1.3 SPUNBOND POLYPROPYLENE GOWN

7.4.1.4 OTHERS

7.4.2 COVERALLS

7.4.2.1 TYPE

7.4.2.1.1 MEDIUM WEIGHT COVERALLS

7.4.2.1.2 HEAVY WEIGHT COVERALLS

7.4.2.2 MATERIAL

7.4.2.2.1 POLYETHYLENE

7.4.2.2.2 SMS MATERIAL

7.4.2.2.3 OTHERS

7.4.3 APRONS

7.4.3.1 COTTON APRON

7.4.3.2 PLASTIC APRON

7.4.3.3 NON-WOVEN APRON

7.4.3.4 OTHERS

7.4.4 OTHERS

7.5 FIRST AID CLOTHING

7.5.1 HEALTHCARE EMERGENCIES

7.5.2 CIVIL PROTECTION

7.6 WRAPS & TOWELS

7.6.1 WASH TOWELS

7.6.2 DOCTOR TOWELS

7.6.3 SURGICAL TOWELS

7.7 OTHERS

8 NORTH AMERICA MEDICAL CLOTHING MARKET, BY USAGE

8.1 OVERVIEW

8.2 DISPOSABLE

8.3 REUSABLE

9 NORTH AMERICA MEDICAL CLOTHING MARKET, BY END USER

9.1 OVERVIEW

9.2 HOSPITALS

9.3 SPECIALTY CLINICS

9.4 AMBULATORY CENTERS

9.5 RESEARCH & CLINICAL LABORATORIES

9.6 HOME CARE SETTINGS

9.7 OTHERS

10 NORTH AMERICA MEDICAL CLOTHING MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 DIRECT TENDER

10.3 THIRD PARTY DISTRIBUTOR

10.4 RETAIL SALES

10.5 OTHERS

11 NORTH AMERICA MEDICAL CLOTHING MARKET, BY GEOGRAPHY

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA MEDICAL CLOTHING MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT

14 COMPANY PROFILES

14.1 CARDINAL HEALTH

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 MEDLINE INDUSTRIES, INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 OWENS & MINOR, INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 ARAMARK UNIFORM & CAREER APPAREL (A SUBSIDIARY OF ARAMARK)

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 MÖLNLYCKE HEALTH CARE AB (A SUBSIDIARY OF INVESTOR AB)

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENTS

14.6 LANDAU UNIFORMS

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 3M

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 ABG UNIFORMS

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 ANSELL LTD.

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 BARCO UNIFORMS

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 BBN MEDICAL EQUIPMENT

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 CARHARTT, INC.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 CHEROKEE UNIFORMS.

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 HEALING HANDS

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 HENRY SCHEIN, INC.

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENTS

14.16 LYNKTRAC TECHNOLOGIES LLC

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 NARANG MEDICAL LTD.

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 SEMPERIT AG HOLDING

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENTS

14.19 SUPERIOR GROUP OF COMPANIES

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENTS

14.2 PRESTIGE MEDICAL.

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tabela

LIST OF TABLES

TABLE 1 POPULATION AGES 65 AND ABOVE

TABLE 2 NORTH AMERICA MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 3 NORTH AMERICA MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (UNITS)

TABLE 4 NORTH AMERICA PROFESSIONAL APPAREL IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 5 NORTH AMERICA PROFESSIONAL APPAREL IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 6 NORTH AMERICA FACE MASKS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 7 NORTH AMERICA SCRUBS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 8 NORTH AMERICA SCRUBS IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 9 NORTH AMERICA LAB COATS IN MEDICAL CLOTHING MARKET, BY LENGTH, 2018-2027 (USD MILLION)

TABLE 10 NORTH AMERICA LAB COATS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 11 NORTH AMERICA HEADWEAR IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 12 NORTH AMERICA BOUFFANT CAPS HEADWEAR IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 13 NORTH AMERICA SHOE COVERS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 14 NORTH AMERICA PATIENT APPAREL IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 15 NORTH AMERICA PATIENT APPAREL IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 16 NORTH AMERICA PATIENT APPAREL IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 17 NORTH AMERICA SPECIALTY APPAREL IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 18 NORTH AMERICA SPECIALTY APPAREL IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 19 NORTH AMERICA ISOLATION GOWNS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 20 NORTH AMERICA AAMI ISOLATION GOWNS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 21 NORTH AMERICA COVERALLS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 22 NORTH AMERICA COVERALLS IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 23 NORTH AMERICA APRONS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 24 NORTH AMERICA FIRST AID CLOTHING IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 25 NORTH AMERICA FIRST AID CLOTHING IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 26 NORTH AMERICA WRAPS & TOWELS IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 27 NORTH AMERICA WRAPS & TOWELS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 28 NORTH AMERICA OTHERS IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 29 NORTH AMERICA MEDICAL CLOTHING MARKET, BY USAGE, 2018-2027 (USD MILLION)

TABLE 30 NORTH AMERICA DISPOSABLE IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 31 NORTH AMERICA REUSABLE IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 32 NORTH AMERICA MEDICAL CLOTHING MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 33 NORTH AMERICA HOSPITALS IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 34 NORTH AMERICA SPECIALTY CLINICS IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 35 NORTH AMERICA AMBULATORY CENTERS IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 36 NORTH AMERICA RESEARCH & CLINICAL LABORATORIES IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 37 NORTH AMERICA HOME CARE SETTINGS IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 38 NORTH AMERICA OTHERS IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 39 NORTH AMERICA MEDICAL CLOTHING MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 40 NORTH AMERICA DIRECT TENDER IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 41 NORTH AMERICA THIRD PARTY DISTRIBUTOR IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 42 NORTH AMERICA RETAIL SALES IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 43 NORTH AMERICA OTHERS IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 44 NORTH AMERICA MEDICAL CLOTHING MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 45 NORTH AMERICA MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 46 NORTH AMERICA MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (UNITS)

TABLE 47 NORTH AMERICA PROFESSIONAL APPAREL IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 48 NORTH AMERICA FACE MASKS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 49 NORTH AMERICA SCRUBS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 50 NORTH AMERICA SCRUBS IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 51 NORTH AMERICA LAB COATS IN MEDICAL CLOTHING MARKET, BY LENGTH, 2018-2027 (USD MILLION)

TABLE 52 NORTH AMERICA LAB COATS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 53 NORTH AMERICA HEADWEAR IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 54 NORTH AMERICA BOUFFANT CAPS HEADWEAR IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 55 NORTH AMERICA SHOE COVERS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 56 NORTH AMERICA PATIENT APPAREL IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 57 NORTH AMERICA PATIENT APPAREL IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 58 NORTH AMERICA SPECIALTY APPAREL IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 59 NORTH AMERICA ISOLATION GOWNS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 60 NORTH AMERICA AAMI ISOLATION IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 61 NORTH AMERICA COVERALLS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 62 NORTH AMERICA COVERALLS IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 63 NORTH AMERICA APRONS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 64 NORTH AMERICA FIRST AID CLOTHING IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 65 NORTH AMERICA WRAPS & TOWELS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 66 NORTH AMERICA MEDICAL CLOTHING MARKET, BY USAGE, 2018-2027 (USD MILLION)

TABLE 67 NORTH AMERICA MEDICAL CLOTHING MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 68 NORTH AMERICA MEDICAL CLOTHING MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 69 U.S. MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 70 U.S. MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (UNITS)

TABLE 71 U.S. PROFESSIONAL APPAREL IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 72 U.S. FACE MASKS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 73 U.S. SCRUBS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 74 U.S. SCRUBS IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 75 U.S. LAB COATS IN MEDICAL CLOTHING MARKET, BY LENGTH, 2018-2027 (USD MILLION)

TABLE 76 U.S. LAB COATS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 77 U.S. HEADWEAR IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 78 U.S. BOUFFANT CAPS HEADWEAR IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 79 U.S. SHOE COVERS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 80 U.S. PATIENT APPAREL IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 81 U.S. PATIENT APPAREL IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 82 U.S. SPECIALTY APPAREL IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 83 U.S. ISOLATION GOWNS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 84 U.S. AAMI ISOLATION IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 85 U.S. COVERALLS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 86 U.S. COVERALLS IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 87 U.S. APRONS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 88 U.S. FIRST AID CLOTHING IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 89 U.S. WRAPS & TOWELS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 90 U.S. MEDICAL CLOTHING MARKET, BY USAGE, 2018-2027 (USD MILLION)

TABLE 91 U.S. MEDICAL CLOTHING MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 92 U.S. MEDICAL CLOTHING MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 93 CANADA MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 94 CANADA MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (UNITS)

TABLE 95 CANADA PROFESSIONAL APPAREL IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 96 CANADA FACE MASKS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 97 CANADA SCRUBS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 98 CANADA SCRUBS IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 99 CANADA LAB COATS IN MEDICAL CLOTHING MARKET, BY LENGTH, 2018-2027 (USD MILLION)

TABLE 100 CANADA LAB COATS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 101 CANADA HEADWEAR IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 102 CANADA BOUFFANT CAPS HEADWEAR IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 103 CANADA SHOE COVERS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 104 CANADA PATIENT APPAREL IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 105 CANADA PATIENT APPAREL IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 106 CANADA SPECIALTY APPAREL IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 107 CANADA ISOLATION GOWNS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 108 CANADA AAMI ISOLATION IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 109 CANADA COVERALLS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 110 CANADA COVERALLS IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 111 CANADA APRONS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 112 CANADA FIRST AID CLOTHING IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 113 CANADA WRAPS & TOWELS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 114 CANADA MEDICAL CLOTHING MARKET, BY USAGE, 2018-2027 (USD MILLION)

TABLE 115 CANADA MEDICAL CLOTHING MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 116 CANADA MEDICAL CLOTHING MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 117 MEXICO MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 118 MEXICO MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (UNITS)

TABLE 119 MEXICO PROFESSIONAL APPAREL IN MEXICO MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 120 MEXICO FACE MASKS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 121 MEXICO SCRUBS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 122 MEXICO SCRUBS IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 123 MEXICO LAB COATS IN MEDICAL CLOTHING MARKET, BY LENGTH, 2018-2027 (USD MILLION)

TABLE 124 MEXICO LAB COATS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 125 MEXICO HEADWEAR IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 126 MEXICO BOUFFANT CAPS HEADWEAR IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 127 MEXICO SHOE COVERS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 128 MEXICO PATIENT APPAREL IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 129 MEXICO PATIENT APPAREL IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 130 MEXICO SPECIALTY APPAREL IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 131 MEXICO ISOLATION GOWNS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 132 MEXICO AAMI ISOLATION IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 133 MEXICO COVERALLS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 134 MEXICO COVERALLS IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 135 MEXICO APRONS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 136 MEXICO FIRST AID CLOTHING IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 137 MEXICO WRAPS & TOWELS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 138 MEXICO MEDICAL CLOTHING MARKET, BY USAGE, 2018-2027 (USD MILLION)

TABLE 139 MEXICO MEDICAL CLOTHING MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 140 MEXICO MEDICAL CLOTHING MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

Lista de Figura

LIST OF FIGURES

FIGURE 1 NORTH AMERICA MEDICAL CLOTHING MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA MEDICAL CLOTHING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA MEDICAL CLOTHING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA MEDICAL CLOTHING MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA MEDICAL CLOTHING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA MEDICAL CLOTHING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA MEDICAL CLOTHING MARKET: MARKET END USER COVERAGE GRID

FIGURE 8 NORTH AMERICA MEDICAL CLOTHING MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA MEDICAL CLOTHING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA MEDICAL CLOTHING MARKET: SEGMENTATION

FIGURE 11 PROFESSIONAL APPAREL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA MEDICAL CLOTHING MARKET IN 2020 & 2027

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF NORTH AMERICA MEDICAL CLOTHING MARKET

FIGURE 13 NORTH AMERICA MEDICAL CLOTHING MARKET: BY PRODUCT, 2019

FIGURE 14 NORTH AMERICA MEDICAL CLOTHING MARKET: BY PRODUCT, 2019-2027 (USD MILLION)

FIGURE 15 NORTH AMERICA MEDICAL CLOTHING MARKET: BY PRODUCT, CAGR (2020-2027)

FIGURE 16 NORTH AMERICA MEDICAL CLOTHING MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 17 NORTH AMERICA MEDICAL CLOTHING MARKET: BY USAGE, 2019

FIGURE 18 NORTH AMERICA MEDICAL CLOTHING MARKET: BY USAGE, 2019-2027 (USD MILLION)

FIGURE 19 NORTH AMERICA MEDICAL CLOTHING MARKET: BY USAGE, CAGR (2020-2027)

FIGURE 20 NORTH AMERICA MEDICAL CLOTHING MARKET: BY USAGE, LIFELINE CURVE

FIGURE 21 NORTH AMERICA MEDICAL CLOTHING MARKET: BY END USER, 2019

FIGURE 22 NORTH AMERICA MEDICAL CLOTHING MARKET: BY END USER, 2019-2027 (USD MILLION)

FIGURE 23 NORTH AMERICA MEDICAL CLOTHING MARKET: BY END USER, CAGR (2020-2027)

FIGURE 24 NORTH AMERICA MEDICAL CLOTHING MARKET: BY END USER, LIFELINE CURVE

FIGURE 25 NORTH AMERICA MEDICAL CLOTHING MARKET: BY DISTRIBUTION CHANNEL, 2019

FIGURE 26 NORTH AMERICA MEDICAL CLOTHING MARKET: BY DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

FIGURE 27 NORTH AMERICA MEDICAL CLOTHING MARKET: BY DISTRIBUTION CHANNEL, CAGR (2020-2027)

FIGURE 28 NORTH AMERICA MEDICAL CLOTHING MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 29 NORTH AMERICA MEDICAL CLOTHING MARKET: SNAPSHOT (2019)

FIGURE 30 NORTH AMERICA MEDICAL CLOTHING MARKET: BY COUNTRY (2019)

FIGURE 31 NORTH AMERICA MEDICAL CLOTHING MARKET: BY COUNTRY (2020 & 2027)

FIGURE 32 NORTH AMERICA MEDICAL CLOTHING MARKET: BY COUNTRY (2020 & 2027)

FIGURE 33 NORTH AMERICA MEDICAL CLOTHING MARKET: BY PRODUCT (2018-2027)

FIGURE 34 NORTH AMERICA MEDICAL CLOTHING MARKET: COMPANY SHARE 2019 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.