North America Lumber Pallet Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

2.17 Billion

USD

3.42 Billion

2025

2033

USD

2.17 Billion

USD

3.42 Billion

2025

2033

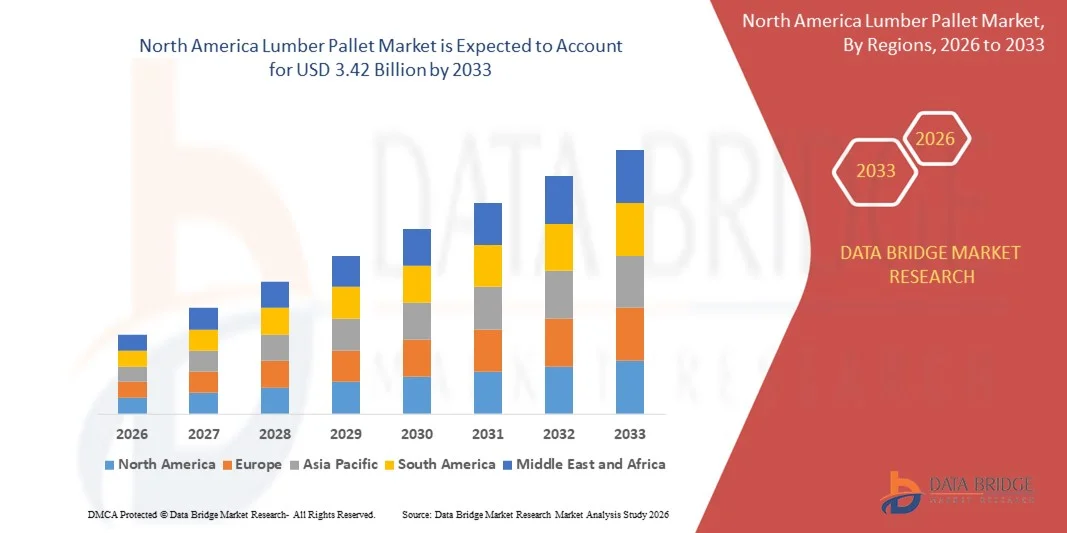

| 2026 –2033 | |

| USD 2.17 Billion | |

| USD 3.42 Billion | |

|

|

|

|

Segmentação do mercado de paletes de madeira na América do Norte, por tipo de produto (paletes de madeira serrada com longarinas, paletes de madeira serrada em bloco, paletes de dupla face, paletes de dupla aba e outros), tipo de madeira (madeira macia e madeira dura), tamanho (800 x 1200 mm, 1000 x 1200 mm, 800 x 600 mm, 914 x 914 mm, 1118 x 1118 mm, 1200 x 1000 mm e outros), canal de distribuição (offline e online), usuário final (alimentos e bebidas, produtos farmacêuticos, produtos químicos, varejo, automotivo e outros) - Tendências e previsões do setor até 2033

Tamanho do mercado de paletes de madeira na América do Norte

- O mercado de paletes de madeira na América do Norte foi avaliado em US$ 2,17 bilhões em 2025 e deverá atingir US$ 3,42 bilhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 5,8% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela expansão constante do comércio global, das atividades de armazenagem e logística, o que continua a aumentar a demanda por soluções de movimentação de materiais confiáveis e econômicas em diversos setores.

- Além disso, o aumento do uso de paletes nos setores de alimentos e bebidas, varejo e manufatura para armazenamento e transporte seguros de mercadorias está fortalecendo a demanda do mercado. Esses fatores combinados estão sustentando o consumo consistente de paletes de madeira e influenciando positivamente o crescimento geral do mercado.

Análise do mercado de paletes de madeira na América do Norte

- Os paletes de madeira, que servem como plataformas essenciais de suporte de carga para armazenamento e transporte, continuam sendo cruciais para as operações da cadeia de suprimentos em toda a logística nacional e internacional devido à sua durabilidade, reutilização e compatibilidade com equipamentos de movimentação padrão.

- A crescente necessidade de manuseio eficiente de grandes volumes, a ênfase cada vez maior em embalagens padronizadas e a movimentação contínua de mercadorias nas cadeias de suprimentos industriais estão, em conjunto, sustentando a demanda por paletes de madeira e reforçando sua importância no ecossistema logístico global.

- Os EUA dominaram o mercado de paletes de madeira em 2025, devido à extensa escala de operações logísticas, ao alto volume de comércio nacional e internacional e à forte demanda dos setores de varejo, alimentos e bebidas e manufatura.

- Prevê-se que o Canadá seja o país com o crescimento mais rápido no mercado de paletes de madeira durante o período de previsão, devido à expansão do comércio transfronteiriço com os EUA, ao crescimento das indústrias de processamento de alimentos e farmacêutica e ao aumento das iniciativas de modernização de armazéns.

- O segmento de paletes de madeira serrada dominou o mercado com uma participação de 58,5% em 2025, devido ao seu baixo custo, construção simples e ampla utilização em armazenagem e logística doméstica. Esses paletes são fáceis de reparar e adequados para transporte de alto volume com requisitos de carga moderados. Sua leveza facilita o manuseio e o transporte. Projetos padronizados aprimoram ainda mais a eficiência operacional. A forte disponibilidade de matéria-prima de madeira macia permite a produção em larga escala. Essa demanda sustentada garante sua posição de liderança no mercado.

Escopo do relatório e segmentação do mercado de paletes de madeira

|

Atributos |

Principais informações de mercado sobre paletes de madeira |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de produção e consumo, análise de tendências de preços, cenário de mudanças climáticas, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de paletes de madeira na América do Norte

Adoção crescente de paletes de madeira sustentáveis e recicladas

- Uma tendência fundamental no mercado de paletes de madeira é a crescente adoção de paletes de madeira sustentável e reciclada, impulsionada pelo aumento das regulamentações ambientais e pelos compromissos corporativos com a sustentabilidade em todas as cadeias de suprimentos globais. As empresas estão priorizando paletes fabricados com madeira reciclada e madeira de origem responsável para reduzir a geração de resíduos e a pegada de carbono associada às operações logísticas.

- Por exemplo, a UFP Industries expandiu seu portfólio de paletes fabricados com materiais de madeira reciclada e reaproveitada, apoiando as metas de sustentabilidade de grandes clientes dos setores de varejo e distribuição de alimentos. Essas iniciativas estão fortalecendo as práticas de economia circular na indústria de paletes e incentivando uma adoção mais ampla de soluções ecológicas para paletes.

- Grandes empresas de gestão e armazenamento de paletes estão integrando ativamente paletes de madeira reciclada em sistemas de ciclo fechado para prolongar o ciclo de vida dos paletes e minimizar o consumo de matéria-prima. Essa abordagem permite a otimização de custos e, ao mesmo tempo, está alinhada com os requisitos de relatórios de sustentabilidade impostos por marcas globais.

- O setor de alimentos e bebidas está cada vez mais optando por paletes de madeira reciclada que atendam aos padrões de higiene e segurança, além de cumprirem as metas de sustentabilidade. Essa mudança está reforçando a demanda por paletes que equilibrem durabilidade, conformidade e responsabilidade ambiental.

- Os fabricantes também estão investindo em soluções de paletes de madeira engenheirada e composta que utilizam resíduos e subprodutos da madeira. Essa tendência está melhorando a eficiência dos materiais e reduzindo a dependência de recursos de madeira virgem.

- De modo geral, a crescente ênfase no fornecimento sustentável, na redução de resíduos e na conformidade regulatória está remodelando as práticas de fabricação de paletes. Essa tendência está fortalecendo a transição do mercado para soluções de paletes de madeira ecologicamente responsáveis em diversos setores.

Dinâmica do mercado de paletes de madeira na América do Norte

Motorista

Expansão das atividades globais de logística, armazenagem e comércio eletrônico

- A rápida expansão das redes logísticas globais, da infraestrutura de armazenagem e das operações de comércio eletrônico é um dos principais impulsionadores do mercado de paletes de madeira, visto que os paletes continuam sendo essenciais para o armazenamento e transporte eficientes de mercadorias. O aumento da movimentação de bens de consumo, produtos industriais e matérias-primas mantém a alta demanda por soluções padronizadas de paletes.

- Por exemplo, a CHEP continua a expandir seus serviços de compartilhamento de paletes e logística para dar suporte a cadeias de suprimentos de varejo e comércio eletrônico em larga escala, permitindo o manuseio eficiente de materiais em centros de distribuição. Essa expansão destaca o papel crucial dos paletes em ambientes logísticos de alto volume.

- O crescimento do varejo organizado e dos provedores de logística terceirizada impulsiona ainda mais o consumo de paletes, visto que os armazéns centralizados dependem fortemente deles para o gerenciamento de estoque e o processamento de pedidos. Essa dependência sustenta o uso consistente de paletes no comércio nacional e internacional.

- As indústrias de manufatura também estão ampliando suas capacidades de produção e distribuição, aumentando a necessidade de suportes de carga confiáveis que resistam ao manuseio repetido. Os paletes de madeira oferecem durabilidade e compatibilidade com sistemas automatizados de movimentação, o que contribui para sua ampla adoção.

- Em conjunto, a expansão da infraestrutura de logística, armazenagem e comércio eletrônico está reforçando o papel fundamental dos paletes de madeira nas cadeias de suprimentos globais e impulsionando o crescimento sustentado do mercado.

Restrição/Desafio

Volatilidade nos preços da madeira e disponibilidade de matéria-prima

- O mercado de paletes de madeira enfrenta desafios significativos devido à volatilidade dos preços da madeira e às flutuações na disponibilidade da matéria-prima, que impactam diretamente os custos de produção e as margens de lucro. Alterações no fornecimento de madeira, restrições regulatórias e demanda de mercado criam incertezas para os fabricantes de paletes.

- Por exemplo, empresas como a Greif têm sofrido pressões de custos relacionadas à flutuação dos preços da madeira, o que exige ajustes de preços e medidas de eficiência operacional para manter as margens de lucro. Essas variações de custos tornam os acordos de preços de longo prazo com os clientes mais complexos.

- Os fabricantes também precisam lidar com a crescente concorrência da indústria da construção civil e moveleira no mercado de madeira, o que intensifica os desafios de aquisição de matéria-prima. Essa concorrência exerce pressão adicional sobre as estratégias de fornecimento.

- Os esforços para mitigar a volatilidade de preços por meio de soluções de paletes de madeira reciclada e compósitos exigem investimento em novas capacidades de processamento, aumentando os custos de capital. Equilibrar o controle de custos com as iniciativas de sustentabilidade continua sendo um desafio.

- De modo geral, a instabilidade dos preços da madeira e os desafios no fornecimento de matéria-prima continuam a restringir a flexibilidade do mercado. Esses fatores obrigam os fabricantes a otimizar o fornecimento, diversificar os materiais e ajustar as estratégias de preços para manter as operações em um ambiente de custos flutuantes.

Escopo do mercado de paletes de madeira na América do Norte

O mercado é segmentado com base no tipo de produto, tipo de madeira, tamanho, canal de distribuição e usuário final.

- Por tipo de produto

Com base no tipo de produto, o mercado de paletes de madeira é segmentado em paletes de longarinas, paletes de blocos, paletes de dupla face, paletes de dupla aba e outros. O segmento de paletes de longarinas dominou o mercado com a maior participação, de 58,5% em 2025, devido ao seu baixo custo, construção simples e ampla utilização em armazenagem e logística doméstica. Esses paletes são fáceis de reparar e adequados para transporte de alto volume com requisitos de carga moderados. Sua leveza facilita o manuseio e o transporte. Projetos padronizados aprimoram ainda mais a eficiência operacional. A forte disponibilidade de matéria-prima de madeira macia permite a produção em larga escala. Essa demanda sustentada garante sua posição de liderança no mercado.

O segmento de paletes de madeira maciça deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente demanda por aplicações de carga pesada e exportação. Os paletes de madeira maciça oferecem acesso por quatro lados, melhorando o manuseio de materiais em armazéns automatizados. Sua maior resistência e estabilidade atendem às necessidades de transporte internacional. O uso crescente na logística farmacêutica e alimentícia também contribui para a sua adoção. O crescimento da automação de armazéns acelera ainda mais a demanda. Esses fatores posicionam os paletes de madeira maciça como um segmento de crescimento fundamental.

- Por tipo de madeira

Com base no tipo de madeira, o mercado de paletes de madeira é segmentado em madeira macia e madeira dura. O segmento de madeira macia dominou o mercado em 2025, impulsionado por custos mais baixos, peso mais leve e fácil disponibilidade. Os paletes de madeira macia permitem uma produção mais rápida e são amplamente utilizados na logística de varejo e bens de consumo de massa. Sua capacidade de carga adequada atende à maioria das aplicações padrão. As certificações de sustentabilidade incentivam ainda mais a adoção. Altos ciclos de substituição impulsionam uma demanda consistente. Esses fatores mantêm a dominância do segmento.

Prevê-se que o segmento de madeira maciça apresente o crescimento mais rápido durante o período de previsão, impulsionado pela demanda por paletes duráveis e de longa vida útil. A madeira maciça oferece maior resistência e capacidade de suportar impactos, sendo ideal para indústrias pesadas. Uma vida útil mais longa reduz os custos gerais de substituição. O crescimento das remessas voltadas para exportação também contribui para a adoção desse segmento. Os setores automotivo e industrial têm demonstrado crescente preferência por paletes de madeira maciça, o que impulsiona um crescimento mais acelerado para o segmento.

- Por tamanho

Com base no tamanho, o mercado de paletes de madeira é segmentado em 800 x 1200 mm, 1000 x 1200 mm, 800 x 600 mm, 914 x 914 mm, 1118 x 1118 mm, 1200 x 1000 mm e outros. O segmento de 1200 x 1000 mm dominou o mercado em 2025 devido à sua compatibilidade com os padrões globais de transporte marítimo e de contêineres. Esse tamanho permite uma utilização eficiente do espaço em armazéns e sistemas de transporte. É amplamente utilizado na distribuição de alimentos, bebidas e varejo. A padronização reduz a complexidade de manuseio. A alta aceitação regional impulsiona a demanda por volume. Esses fatores sustentam sua liderança no mercado.

O segmento de 800 x 1200 mm deverá registrar o crescimento mais rápido entre 2026 e 2033, impulsionado pelo aumento do comércio europeu e da logística transfronteiriça. A conformidade com os padrões Europalete facilita a integração. O crescimento do varejo organizado e do comércio eletrônico impulsiona a demanda. A distribuição eficiente da carga melhora a segurança. A expansão das exportações apoia a adoção. Isso posiciona o segmento para um forte crescimento.

- Por canal de distribuição

Com base no canal de distribuição, o mercado de paletes de madeira é segmentado em offline e online. O segmento offline detinha a maior participação em 2025, sustentado por relacionamentos consolidados com fornecedores e práticas de compra em grande volume. O fornecimento offline permite personalização e inspeção de qualidade. Grandes fabricantes preferem a compra direta para garantir a confiabilidade do fornecimento. A disponibilidade imediata permite a continuidade das operações. Contratos de longo prazo estabilizam os preços. Esses fatores sustentam o domínio do segmento offline.

Espera-se que o segmento online cresça à taxa mais rápida durante o período de previsão, impulsionado pelas compras digitais e pela expansão do comércio eletrônico B2B. As plataformas online oferecem preços transparentes e maior acesso a fornecedores. As PMEs adotam cada vez mais o fornecimento digital para economizar tempo. A maior confiabilidade logística gera confiança. A digitalização da cadeia de suprimentos acelera a adoção, o que alimenta o rápido crescimento online.

- Por usuário final

Com base no usuário final, o mercado de paletes de madeira é segmentado em alimentos e bebidas, produtos farmacêuticos, produtos químicos, varejo, automotivo e outros. O segmento de alimentos e bebidas dominou o mercado em 2025 devido ao alto volume de movimentação de produtos embalados e perecíveis. Os paletes são essenciais para o armazenamento e transporte em cadeias de frio. A demanda contínua de centros de processamento e distribuição sustenta os volumes. A conformidade com os padrões de higiene impulsiona a substituição frequente. O forte consumo no varejo sustenta o uso. Esses fatores reforçam a liderança de mercado.

Prevê-se que o segmento farmacêutico apresente o crescimento mais acelerado entre 2026 e 2033, impulsionado pela expansão da produção de produtos para a saúde e pela distribuição global de medicamentos. Cadeias de suprimentos regulamentadas exigem paletes padronizados e duráveis. O crescimento da logística com temperatura controlada sustenta a demanda. O aumento das exportações de produtos médicos impulsiona ainda mais a adoção. A ênfase no manuseio seguro acelera o uso. Isso posiciona o setor farmacêutico como o segmento de usuários finais de crescimento mais rápido.

Análise Regional do Mercado de Paletes de Madeira na América do Norte

- Os EUA dominaram o mercado de paletes de madeira com a maior participação na receita em 2025, impulsionados pela extensa escala de operações logísticas, alto volume de comércio nacional e internacional e forte demanda dos setores de varejo, alimentos e bebidas e manufatura.

- A crescente dependência do transporte paletizado em centros de distribuição de comércio eletrônico, provedores de logística terceirizados e grandes instalações de armazenagem continua a sustentar a demanda por paletes de madeira em todas as cadeias de suprimentos industriais e comerciais.

- A forte presença de importantes players do mercado, como a UFP Industries, a Greif e a Kamps Pallets, juntamente com redes bem estabelecidas de reciclagem e compartilhamento de paletes, incluindo a CHEP, reforça a posição de liderança dos EUA. Espera-se que os investimentos contínuos em infraestrutura logística, soluções de paletes preparadas para automação e sistemas eficientes de movimentação de materiais mantenham o papel dominante do país durante o período de previsão.

Análise do Mercado de Paletes de Madeira no Canadá

Prevê-se que o Canadá registre a taxa de crescimento anual composta (CAGR) mais rápida no mercado de paletes de madeira da América do Norte entre 2026 e 2033, impulsionado pela expansão do comércio transfronteiriço com os EUA, pelo crescimento das indústrias de processamento de alimentos e farmacêutica e pelo aumento das iniciativas de modernização de armazéns. Por exemplo, a CHEP e fornecedores regionais de paletes apoiam varejistas e fabricantes canadenses por meio de programas de compartilhamento e reutilização de paletes, que melhoram a eficiência da cadeia de suprimentos. A crescente demanda por paletes padronizados na logística da cadeia de frio, a forte disponibilidade de recursos florestais e a ênfase crescente em soluções de embalagens de madeira sustentáveis e recicláveis estão acelerando o crescimento do mercado, posicionando o Canadá como o mercado de crescimento mais rápido da região.

Análise do Mercado de Paletes de Madeira no México

Prevê-se que o mercado mexicano de paletes cresça de forma constante entre 2026 e 2033, impulsionado pela expansão de polos industriais, pelo aumento da produção automotiva e eletrônica e pela expansão das atividades logísticas voltadas para a exportação. Empresas como a UFP Industries e a CHEP atendem à demanda por paletes por meio de instalações fabris, serviços de compartilhamento de carga e integração logística transfronteiriça. O crescimento de parques industriais, o aumento do investimento estrangeiro direto e a adequação aos padrões da cadeia de suprimentos norte-americana continuam a sustentar a adoção consistente de paletes para madeira. O aumento do uso em exportações agrícolas e na distribuição no varejo contribui ainda mais para o crescimento estável do mercado durante todo o período previsto.

Participação de mercado de paletes de madeira na América do Norte

O setor de paletes de madeira é liderado principalmente por empresas consolidadas, incluindo:

- Greif (EUA)

- UFP Industries, Inc. (EUA)

- PALLETBIZ (Alemanha)

- Grupo PGS (França)

- Pacote UAB Vigidas (Lituânia)

- LOSCAM (Austrália)

- Paletes JGD (Reino Unido)

- Palcon LLC (EUA)

- Falkenhahn AG (Alemanha)

- Conquest Joinery (Reino Unido)

- Fabricantes de caixas e paletes SandS (EUA)

- Imperial Timber (Reino Unido)

- HG Timber Ltda. (Reino Unido)

- Madeira e Caixas de Joanesburgo (África do Sul)

- Premier Pallets, Inc. (EUA)

- Rowlinsons Packaging Ltd. (Reino Unido)

- Christie's Industries (Reino Unido)

Novidades no mercado de paletes de madeira na América do Norte

- Em julho de 2024, a WestRock expandiu seu portfólio de embalagens sustentáveis, aumentando a capacidade de produção de paletes de madeira com conteúdo de fibra reciclada, fortalecendo sua posição em soluções logísticas ecologicamente conscientes. Esse desenvolvimento atende à crescente demanda das cadeias de suprimentos de varejo e alimentos que buscam menor impacto ambiental, ao mesmo tempo que reforça a concorrência em torno das ofertas de paletes sustentáveis e influencia as decisões de compra de grandes compradores.

- Em setembro de 2023, a CHEP expandiu sua presença na Ásia com a inauguração de um novo centro de distribuição no Vietnã, aprimorando sua capacidade de atender ao crescente mercado de logística do Sudeste Asiático. Essa iniciativa melhora a disponibilidade de paletes na região e reduz os prazos de entrega, permitindo que a CHEP fortaleça o relacionamento com os clientes e conquiste vantagem competitiva em um polo logístico de alto crescimento.

- Em agosto de 2023, a UFP Industries anunciou o lançamento de uma nova linha de paletes ecológicos fabricados com materiais reciclados, atendendo diretamente às crescentes exigências de sustentabilidade em toda a cadeia de suprimentos industrial. Essa iniciativa posiciona a empresa como líder em soluções de paletes ambientalmente responsáveis, ajudando a atrair clientes focados em sustentabilidade e apoiando a expansão da participação de mercado a longo prazo.

- Em julho de 2023, a Kamps Pallets firmou uma parceria estratégica com um importante provedor de logística para aprimorar a eficiência da cadeia de suprimentos e o desempenho de entrega. Essa colaboração melhora a confiabilidade do serviço e os prazos de entrega, que são diferenciais cruciais no mercado de paletes de madeira, contribuindo assim para uma maior fidelização de clientes e uma penetração de mercado mais expressiva.

- Em setembro de 2022, a ArbaBlox investiu US$ 51,34 milhões em uma fábrica de blocos para paletes em Winona, Mississippi, marcando sua primeira operação em larga escala de blocos de paletes compostos. Ao utilizar resíduos de serrarias, o projeto fortalece o fornecimento sustentável de materiais para paletes, ao mesmo tempo que atende à demanda dos setores alimentício e industrial. Com o apoio de autoridades estaduais e locais, a fábrica aumenta a capacidade de produção regional, apoia a criação de empregos e reforça a tendência do mercado em direção a soluções de paletes de madeira engenheirada e composta.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.