North America Interventional Cardiology Peripheral Vascular Devices Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

9,596.92 Million

USD

3.27 Million

2022

2029

USD

9,596.92 Million

USD

3.27 Million

2022

2029

| 2023 –2029 | |

| USD 9,596.92 Million | |

| USD 3.27 Million | |

|

|

|

|

Mercado de dispositivos vasculares periféricos e cardiologia intervencionista na América do Norte, por produto ( balões de angioplastia , stents, cateteres, enxertos de stent para reparo de aneurisma endovascular, filtros de veia cava inferior (VCI), dispositivos de modificação de placa, acessórios e dispositivos de alteração de fluxo hemodinâmico), tipo (convencional e padrão), procedimento (intervenção ilíaca, intervenções femoropoplíteas, intervenções tibiais (abaixo do joelho), angioplastia periférica, trombectomia arterial e aterectomia periférica), indicação ( doença arterial periférica e intervenção coronária), faixa etária (geriátrica, adulta e pediátrica), usuário final (hospitais, centros cirúrgicos ambulatoriais , instalações de enfermagem, clínicas e outros), canal de distribuição (licitação direta, distribuidores terceirizados e outros), país (EUA, Canadá e México), tendências e previsões do setor até 2029

Análise e Insights de Mercado: Mercado de Cardiologia Intervencionista e Dispositivos Vasculares Periféricos na América do Norte

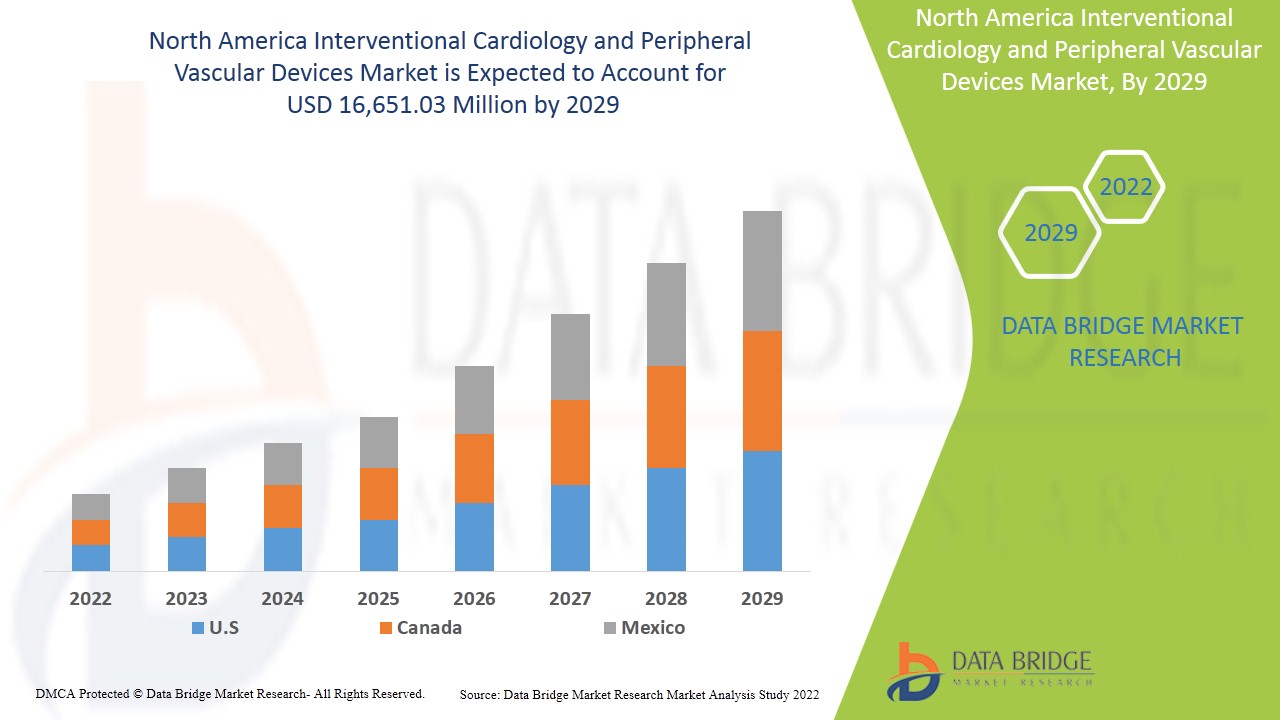

Espera-se que o mercado de cardiologia intervencionista e dispositivos vasculares periféricos da América do Norte ganhe crescimento de mercado no período previsto de 2022 a 2029. A Data Bridge Market Research analisa que o mercado está crescendo com um CAGR de 7,7% no período previsto de 2022 a 2029 e deve atingir US$ 16.651,03 milhões até 2029, de US$ 9.596,92 milhões em 2021. O aumento da prevalência de doenças arteriais coronárias , doença cardíaca isquêmica e doença vascular, o aumento da conscientização sobre o tratamento oportuno e o uso dos dispositivos provavelmente serão os principais impulsionadores que impulsionam a demanda do mercado no período previsto.

O termo cardiologia intervencionista é uma área da medicina dentro da subespecialidade de cardiologia e dispositivos vasculares periféricos que utiliza técnicas diagnósticas avançadas, convencionais e avançadas, além de outras, para avaliar o fluxo sanguíneo e a pressão nas artérias coronárias e câmaras do coração, bem como procedimentos técnicos e medicamentos para tratar anormalidades que prejudicam a função do sistema cardiovascular. A cardiologia intervencionista e os dispositivos vasculares periféricos são utilizados porque promovem mudanças no estilo de vida sedentário, reduzindo as complicações de doenças cardíacas crônicas, como doença arterial coronariana, doença cardíaca isquêmica e doenças vasculares.

A doença cardíaca coronária é a principal causa de morte entre as mulheres. O conhecimento sobre doenças cardíacas e vasculares pode contribuir para um estilo de vida saudável. A conscientização adequada sobre os sintomas e seus fatores de risco pode ajudar a reduzir a exposição da população a fatores de risco modificáveis e contribuir para estratégias de prevenção e controle. A conscientização sobre os sintomas das doenças cardiovasculares e vasculares resultaria em tratamento oportuno.

Os impulsionadores responsáveis pelo crescimento do mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte são o aumento da prevalência de doenças arteriais coronárias, doença cardíaca isquêmica e doença vascular, o aumento da conscientização sobre o tratamento e uso oportunos dos dispositivos, os avanços tecnológicos na cardiologia e dispositivos vasculares periféricos, o aumento do interesse por cirurgias não invasivas e políticas de reembolso favoráveis. No entanto, os fatores que devem restringir o mercado são o aumento do custo dos dispositivos, os riscos observados durante o uso dos dispositivos, o aumento do recall de produtos e a disponibilidade de tratamentos alternativos. Por outro lado, iniciativas estratégicas de participantes do mercado, o aumento dos gastos com saúde e o aumento das atividades de pesquisa e desenvolvimento, e o crescimento da população geriátrica podem atuar como uma oportunidade para o crescimento do mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte. A necessidade de expertise qualificada, a falta de infraestrutura hospitalar e aprovação regulatória podem criar desafios para o mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte.

O relatório de mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte fornece detalhes sobre participação de mercado, novos desenvolvimentos e análise do pipeline de produtos, impacto de participantes do mercado nacional e local, além de analisar oportunidades em termos de fontes de receita emergentes, mudanças nas regulamentações de mercado, aprovações de produtos, decisões estratégicas, lançamentos de produtos, expansões geográficas e inovações tecnológicas no mercado. Para entender a análise e o cenário de mercado, entre em contato conosco para um Briefing de Analista. Nossa equipe ajudará você a criar uma solução de impacto na receita para atingir sua meta desejada.

Escopo e tamanho do mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte

O mercado de cardiologia intervencionista e dispositivos vasculares periféricos da América do Norte é categorizado em sete segmentos: produto, tipo, procedimento, indicação, faixa etária, usuário final e canal de distribuição.

- Com base no produto, o mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte é segmentado em balões de angioplastia, stents, cateteres, enxertos de stent para reparo endovascular de aneurismas, filtros de veia cava inferior (VCI), dispositivos de modificação de placa, acessórios e dispositivos de alteração do fluxo hemodinâmico. Em 2022, espera-se que o segmento de balões de angioplastia domine o mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte devido ao aumento de casos de doenças arteriais periféricas, ao aumento do risco de sedentarismo, aos avanços tecnológicos nos balões de angioplastia e à existência de políticas de reembolso na área da saúde nos EUA para o tratamento de doenças cardíacas.

- Com base no tipo, o mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte é segmentado em convencional e padrão. Em 2022, espera-se que o segmento convencional domine o mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte devido à crescente prevalência de doenças cardiovasculares, como doenças das artérias coronárias e doenças da artéria carótida, e à disponibilidade e preferência por cardiologia intervencionista convencional e dispositivos vasculares periféricos por médicos e cardiologistas que trabalham em hospitais dos EUA e Canadá.

- Com base no procedimento, o mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte é segmentado em intervenção ilíaca, intervenções femoropoplíteas, intervenções tibiais (abaixo do joelho), angioplastia periférica, trombectomia arterial e aterectomia periférica. Em 2022, espera-se que o segmento de angioplastia periférica domine o mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte, devido ao avanço tecnológico da última década com dispositivos avançados de angioplastia periférica.

- Com base na indicação, o mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte é segmentado em doença arterial periférica e intervenção coronária. Em 2022, espera-se que o segmento de doença arterial periférica domine o mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte devido ao aumento das doenças arteriais periféricas, ao aumento da população idosa e ao aumento nas aprovações de produtos.

- Com base na faixa etária, o mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte é segmentado em geriátrico, adulto e pediátrico. Em 2022, espera-se que o segmento geriátrico domine o mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte. Nos EUA, esses segmentos são mais vulneráveis, com baixa imunidade a diversas doenças vasculares e disponibilidade de políticas de reembolso, como o Medicare, para tratamento da população idosa a custo mínimo.

- Com base no usuário final, o mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte é segmentado em hospitais, centros cirúrgicos ambulatoriais, enfermarias, clínicas e outros. Em 2022, espera-se que o segmento hospitalar domine o mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte, devido ao aumento de doenças cardíacas crônicas, como doença arterial coronariana e doenças vasculares, ao aumento de cirurgias, à disponibilidade de instalações hospitalares avançadas e ao aumento da conscientização sobre o tratamento de morbidades cardíacas crônicas em hospitais.

- Com base no canal de distribuição, o mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte é segmentado em licitações diretas, distribuidores terceirizados e outros. Em 2022, espera-se que o segmento de distribuidores terceirizados domine o mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte devido à crescente preferência do consumidor, aos baixos preços de aquisição e à redução de custos.

Análise do mercado de dispositivos vasculares periféricos e cardiologia intervencionista na América do Norte em nível de país

O mercado de cardiologia intervencionista e dispositivos vasculares periféricos da América do Norte é analisado e informações sobre o tamanho do mercado são fornecidas por produto, tipo, procedimento, indicação, faixa etária, usuário final e canal de distribuição.

Os países abrangidos pelo relatório de mercado de cardiologia intervencionista e dispositivos vasculares periféricos da América do Norte são EUA, Canadá e México.

- Em 2022, espera-se que os EUA dominem o mercado devido à presença do maior mercado consumidor, com PIB elevado. Além disso, os EUA têm os maiores gastos familiares do mundo e oferecem acordos comerciais com diversos países, tornando-se o maior mercado para produtos de consumo, com aumento da população de pacientes, presença de grandes players do mercado e maior avanço tecnológico na região.

A seção sobre países do relatório também apresenta fatores individuais que impactam o mercado e mudanças na regulamentação do mercado doméstico que impactam as tendências atuais e futuras do mercado. Dados como novas vendas, vendas de reposição, demografia do país, regulamentações e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para cada país. Além disso, a presença e a disponibilidade de marcas norte-americanas e seus desafios enfrentados devido à concorrência grande ou escassa de marcas locais e nacionais, bem como o impacto dos canais de vendas, são considerados na análise de previsão dos dados do país.

O potencial de crescimento da cardiologia intervencionista e dos dispositivos vasculares periféricos nas economias emergentes e as iniciativas estratégicas dos participantes do mercado estão criando novas oportunidades no mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte.

O mercado de cardiologia intervencionista e dispositivos vasculares periféricos da América do Norte também oferece uma análise detalhada do crescimento de cada país em um setor específico, com informações sobre as vendas de cardiologia intervencionista e dispositivos vasculares periféricos, o impacto dos avanços na área e as mudanças nos cenários regulatórios, com o suporte necessário para o mercado de cardiologia intervencionista e dispositivos vasculares periféricos. Os dados estão disponíveis para o período histórico de 2019 a 2021.

Análise do cenário competitivo e da participação de mercado de dispositivos vasculares periféricos e cardiologia intervencionista na América do Norte

O cenário competitivo do mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte fornece detalhes por concorrente. Os detalhes incluem visão geral da empresa, finanças, receita gerada, potencial de mercado, investimento em pesquisa e desenvolvimento, novas iniciativas de mercado, locais e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos, pipelines de testes de produtos, aprovações de produtos, patentes, abrangência e amplitude do produto, domínio da aplicação e curva de vida da tecnologia. Os pontos de dados fornecidos acima referem-se apenas ao foco da empresa no mercado de cardiologia intervencionista e dispositivos vasculares periféricos.

Algumas das principais empresas que fornecem cardiologia intervencionista e dispositivos vasculares periféricos são Medtronic, BD., Cordis., Abbott., Boston Scientific Corporation, Cook, Cardiovascular Systems, Inc., AngioDynamics., Edwards Lifesciences Corporation., Biosensors International Group, Ltd., OrbusNeich Medical Company Limited, Merit Medical Systems., Terumo Medical Corporation, B. Braun Melsungen AG, MicroPort Scientific Corporation, Lepu Medical Technology(Beijing)Co.,Ltd e Koninklijke Philips NV, entre outras.

Os analistas do DBMR entendem os pontos fortes competitivos e fornecem análises competitivas para cada concorrente separadamente.

As iniciativas estratégicas dos participantes do mercado, juntamente com os novos avanços tecnológicos para cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte, estão preenchendo a lacuna para o tratamento de feridas crônicas.

Por exemplo,

- Em janeiro de 2022, a OrbusNeich Medical Co. Ltd. anunciou o lançamento de seu novo produto, o "Scoreflex NC", com aprovação prévia (PMA) da Food and Drug Administration (FDA) dos EUA. Trata-se de um cateter destinado a ser utilizado como cateter de dilatação na porção estenótica da estenose da artéria coronária, expandindo assim sua linha de produtos para o mercado.

A colaboração, joint ventures e outras estratégias do participante do mercado estão aumentando o mercado da empresa no mercado de cardiologia intervencionista e dispositivos vasculares periféricos, o que também traz o benefício para a organização melhorar sua oferta para o mercado de cardiologia intervencionista e dispositivos vasculares periféricos da América do Norte.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT SEGMENT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.2 PORTER'S FIVE FORCES MODEL

5 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 THE RISE IN PREVALENCE OF CHRONIC DISEASES, SUCH AS CORONARY ARTERY DISEASE, ISCHEMIC HEART DISEASE AND VASCULAR DISEASES

6.1.2 AWARENESS AMONG THE POPULATION ABOUT THE TREATMENT AND USE OF THE DEVICES

6.1.3 TECHNOLOGICAL ADVANCEMENTS IN THE CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES

6.1.4 FAVORABLE REIMBURSEMENT POLICIES

6.1.5 INCREASED INTEREST FOR MINIMALLY INVASIVE PROCEDURES

6.2 RESTRAINTS

6.2.1 RISE IN COST OF THE CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES

6.2.2 RISKS OBSERVED WHILE USING INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES

6.2.3 RISE IN PRODUCT RECALL

6.2.4 AVAILABILITY OF ALTERNATE TREATMENTS

6.3 OPPORTUNITIES

6.3.1 GROWING GERIATRIC POPULATION

6.3.2 RISING HEALTHCARE EXPENDITURE

6.3.3 STRATEGIC INITIATIVES BY MARKET PLAYERS

6.3.4 INCREASING RESEARCH AND DEVELOPMENT ACTIVITIES

6.4 CHALLENGES

6.4.1 STRINGENT RULES & REGULATIONS

6.4.2 LACK OF HOSPITAL INFRASTRUCTURE

7 IMPACT OF COVID-19 PANDEMIC ON THE MARKET

7.1 PRICE IMPACT

7.2 IMPACT ON DEMAND

7.3 IMPACT ON SUPPLY CHAIN

7.4 STRATEGIC DECISIONS FOR MANUFACTURERS/ SERVICE PROVIDERS

7.5 CONCLUSION

8 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 ANGIOPLASTY BALLOONS

8.2.1 OLD/NORMAL BALLOONS

8.2.2 DRUG ELUTING BALLOONS

8.2.3 CUTTING AND SCORING BALLOONS

8.3 STENT

8.3.1 ANGIOPLASTY STENTS

8.3.2 CORONARY STENTS

8.3.2.1 BARE-METAL STENTS

8.3.2.2 DRUG-ELUTING STENTS (DES)

8.3.2.3 BIO ABSORBABLE STENTS

8.3.3 PERIPHERAL STENTS

8.3.4 OTHERS

8.4 CATHETERS

8.4.1 ANGIOGRAPHY CATHETERS

8.4.2 GUIDING CATHETERS

8.4.3 OTHERS

8.5 ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS

8.5.1 ABDOMINAL AORTIC ANEURYSM

8.5.2 THORACIC AORTIC ANEURYSM

8.6 INFERIOR VENA CAVA (IVC) FILTERS

8.6.1 RETRIEVABLE FILTERS

8.6.2 PERMANENT FILTERS

8.7 PLAQUE MODIFICATION DEVICES

8.7.1 THROMBECTOMY DEVICES

8.7.2 ATHERECTOMY DEVICES

8.8 HEMODYNAMIC FLOW ALTERATION DEVICES

8.8.1 EMBOLIC PROTECTION DEVICES

8.8.2 CHRONIC TOTAL OCCLUSION DEVICES

8.9 OTHERS AND ACCESSORIES

8.9.1 GUIDEWIRES

8.9.2 INTRODUCER SHEATHS

8.9.3 BALLOON INFLATION DEVICES

8.9.4 VASCULAR CLOSURE DEVICES

8.9.5 OTHERS

9 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE

9.1 OVERVIEW

9.2 CONVENTIONAL

9.2.1 STENTS

9.2.2 CATHETERS

9.2.3 GUIDEWIRES

9.2.4 VASCULAR CLOSURE DEVICES (VCD)

9.2.5 OTHERS

9.3 ADVANCED

9.3.1 BALLOON CATHETERS

9.3.2 STENT GRAFTS

10 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE

10.1 OVERVIEW

10.2 PERIPHERAL ANGIOPLASTY

10.2.1 ANGIOPLASTY BALLOONS

10.2.2 STENT

10.2.3 CATHETERS

10.2.4 ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS

10.2.5 INFERIOR VENA CAVA (IVC) FILTERS

10.2.6 PLAQUE MODIFICATION DEVICES

10.2.7 HEMODYNAMIC FLOW ALTERATION DEVICES

10.2.8 OTHERS AND ACCESSORIES

10.3 ILIAC INTERVENTION

10.3.1 ANGIOPLASTY BALLOONS

10.3.2 STENT

10.3.3 CATHETERS

10.3.4 ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS

10.3.5 INFERIOR VENA CAVA (IVC) FILTERS

10.3.6 PLAQUE MODIFICATION DEVICES

10.3.7 HEMODYNAMIC FLOW ALTERATION DEVICES

10.3.8 OTHERS AND ACCESSORIES

10.4 TIBIAL (BELOW-THE-KNEE) INTERVENTIONS

10.4.1 ANGIOPLASTY BALLOONS

10.4.2 STENT

10.4.3 CATHETERS

10.4.4 ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS

10.4.5 INFERIOR VENA CAVA (IVC) FILTERS

10.4.6 PLAQUE MODIFICATION DEVICES

10.4.7 HEMODYNAMIC FLOW ALTERATION DEVICES

10.4.8 OTHERS AND ACCESSORIES

10.5 ARTERIAL THROMBECTOMY

10.5.1 ANGIOPLASTY BALLOONS

10.5.2 STENT

10.5.3 CATHETERS

10.5.4 ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS

10.5.5 INFERIOR VENA CAVA (IVC) FILTERS

10.5.6 PLAQUE MODIFICATION DEVICES

10.5.7 HEMODYNAMIC FLOW ALTERATION DEVICES

10.5.8 OTHERS AND ACCESSORIES

10.6 PERIPHERAL ATHERECTOMY

10.6.1 ANGIOPLASTY BALLOONS

10.6.2 STENT

10.6.3 CATHETERS

10.6.4 ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS

10.6.5 INFERIOR VENA CAVA (IVC) FILTERS

10.6.6 PLAQUE MODIFICATION DEVICES

10.6.7 HEMODYNAMIC FLOW ALTERATION DEVICES

10.6.8 OTHERS AND ACCESSORIES

10.7 FEMOROPOPLITEAL INTERVENTIONS

10.7.1 ANGIOPLASTY BALLOONS

10.7.2 STENT

10.7.3 CATHETERS

10.7.4 ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS

10.7.5 INFERIOR VENA CAVA (IVC) FILTERS

10.7.6 PLAQUE MODIFICATION DEVICES

10.7.7 HEMODYNAMIC FLOW ALTERATION DEVICES

10.7.8 OTHERS AND ACCESSORIES

11 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION

11.1 OVERVIEW

11.2 PERIPHERAL ARTERIAL DISEASE

11.2.1 ATHEROSCLEROSIS

11.2.2 ABDOMINAL AORTIC ANEURYSM

11.2.3 LOWER EXTREMITY PERIPHERAL ARTERIAL DISEASE

11.2.4 SUPRA-INGUINAL ARTERIAL DISEASE

11.2.5 INFRA-INGUINAL ARTERIAL DISEASE

11.2.6 INFRA-POPLITEAL DISEASE

11.2.7 UPPER EXTREMITY OCCLUSIVE DISEASE

11.2.8 CAROTID ARTERY DISEASE

11.2.9 OTHERS

11.3 CORONARY INTERVENTION

11.3.1 ISCHEMIC HEART DISEASE

11.3.2 THORACIC AORTIC ANEURYSM

11.3.3 VALVE DISEASE

11.3.4 PERCUTANEOUS VALVE REPAIR OR REPLACEMENT

11.3.5 CONGENITAL HEART ABNORMALITIES

11.3.6 OTHERS

12 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY AGE GROUP

12.1 OVERVIEW

12.2 GERIATRIC

12.3 ADULTS

12.4 PEDIATRIC

13 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER

13.1 OVERVIEW

13.2 HOSPITALS

13.2.1 PRIVATE

13.2.2 PUBLIC

13.3 AMBULATORY SURGICAL CENTERS

13.4 NURSING FACILITIES

13.5 CLINICS

13.6 OTHERS

14 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 THIRD PARTY DISTRIBUTORS

14.3 DIRECT TENDER

14.4 OTHERS

15 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY GEOGRAPHY

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 BOSTON SCIENTIFIC CORPORATION

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENT

18.1.6 ACQUSITION

18.2 CORDIS.

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.2.6 PRODUCT LAUNCHES

18.3 ABBOTT

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.3.6 PRODUCT LAUNCHES

18.4 BD (2021)

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENT

18.5 TERUMO CORPORATION

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.5.6 PARTNERSHIP

18.5.7 PRODUCT LAUNCH

18.6 ANGIODYNAMICS.(2021)

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENTS

18.7 B. BRAUN MELSUNGEN AG (2021)

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENTS

18.8 BIOSENSORS INTERNATIONAL GROUP, LTD.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 CARDIOVASCULAR SYSTEMS, INC. (2021)

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 COOK

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENTS

18.10.4 EXPANSION

18.10.5 PRODUCT LAUNCHES

18.11 EDWARDS LIFESCIENCES CORPORATION

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT DEVELOPMENTS

18.12 KONINKLIJKE PHILIPS N.V.

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 RECENT DEVELOPMENTS

18.12.5 PRODUCT UPDATES

18.13 LEPU MEDICAL TECHNOLOGY (BEIJING) CO., LTD. (2021)

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENT

18.14 MEDTRONIC

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENTS

18.14.5 COLLABORATION

18.14.6 PRODUCT LAUNCH

18.15 MERIT MEDICAL SYSTEM

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENTS

18.16 MICROPORT SCIENTIFIC CORPORATION.

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 PRODUCT PORTFOLIO

18.16.4 RECENT DEVELOPMENTS

18.16.4.1 PRODUCT APPROVALS

18.17 ORBUSNEICH MEDICAL COMPANY LIMITED

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.17.4 PRODUCT LAUNCH

18.18 SMT

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENTS

18.19 TELEFLEX INCORPORATED.

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT DEVELOPMENTS

18.19.5 ACQUISITIONS

18.2 W. L. GORE & ASSOCIATES, INC.

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

Lista de Tabela

TABLE 1 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA ANGIOPLASTY BALLOONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA ANGIOPLASTY BALLOONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA STENT IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA CATHETERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA CATHETERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA INFERIOR VENA CAVA (IVC) FILTERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA INFERIOR VENA CAVA (IVC) FILTERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA PLAQUE MODIFICATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA PLAQUE MODIFICATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA HEMODYNAMIC FLOW ALTERATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA HEMODYNAMIC FLOW ALTERATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA OTHER AND ACCESSORIES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA OTHER AND ACCESSORIES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA CONVENTIONAL IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA CONVENTIONAL IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA ADVANCED IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA ADVANCED IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA PERIPHERAL ANGIOPLASTY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA PERIPHERAL ANGIOPLASTY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA ILIAC INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA ILIAC INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA TIBIAL (BELOW-THE-KNEE) INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA TIBIAL (BELOW-THE-KNEE) INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA ARTERIAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA ARTERIAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA PERIPHERAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA PERIPHERAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA FEMOROPOPLITEAL INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA FEMOROPOPLITEAL INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA PERIPHERAL ARTERIAL DISEASE IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA PERIPHERAL ARTERIAL DISEASE IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA CORONARY INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA CORONARY INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA GERIATRIC IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA ADULTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA PEDIATRIC IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA HOSPITALS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA HOSPITALS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA NURSING FACILITIES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA CLINICS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA OTHERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA THIRD PARTY DISTRIBUTORS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA DIRECT TENDER IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA OTHERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA ANGIOPLASTY BALLOONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA INFERIOR VENA CAVA (IVC) FILTERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA PLAQUE MODIFICATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA HEMODYNAMIC FLOW ALTERATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA OTHERS AND ACCESSORIES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA CONVENTIONAL IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA ADVANCED IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA ILIAC INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 73 NORTH AMERICA FEMOROPOPLITEAL INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 74 NORTH AMERICA TIBIAL (BELOW-THE-KNEE) INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 75 NORTH AMERICA PERIPHERAL ANGIOPLASTY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 76 NORTH AMERICA ARTERIAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 77 NORTH AMERICA PERIPHERAL ATHERECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 78 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 79 NORTH AMERICA PERIPHERAL ARTERIAL DISEASE IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 80 NORTH AMERICA CORONARY INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 81 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 82 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 83 NORTH AMERICA HOSPITALS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 84 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 85 U.S. INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 86 U.S. ANGIOPLASTY BALLOONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 87 U.S. STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 88 U.S. CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 89 U.S. CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 90 U.S. ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 91 U.S. INFERIOR VENA CAVA (IVC) FILTERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 92 U.S. PLAQUE MODIFICATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 93 U.S. HEMODYNAMIC FLOW ALTERATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 94 U.S. OTHERS AND ACCESSORIES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 95 U.S. INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 U.S. CONVENTIONAL IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 U.S. ADVANCED IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 U.S. INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 99 U.S. ILIAC INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 100 U.S. FEMOROPOPLITEAL INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 101 U.S. TIBIAL (BELOW-THE-KNEE) INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 102 U.S. PERIPHERAL ANGIOPLASTY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 103 U.S. ARTERIAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 104 U.S. PERIPHERAL ATHERECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 105 U.S. INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 106 U.S. PERIPHERAL ARTERIAL DISEASE IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 107 U.S. CORONARY INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 108 U.S. INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 109 U.S. INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 110 U.S. HOSPITALS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 111 U.S. INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 112 CANADA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 113 CANADA ANGIOPLASTY BALLOONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 114 CANADA STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 115 CANADA CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 116 CANADA CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 117 CANADA ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 118 CANADA INFERIOR VENA CAVA (IVC) FILTERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 119 CANADA PLAQUE MODIFICATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 120 CANADA HEMODYNAMIC FLOW ALTERATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 121 CANADA OTHERS AND ACCESSORIES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 122 CANADA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 CANADA CONVENTIONAL IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 CANADA ADVANCED IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 CANADA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 126 CANADA ILIAC INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 127 CANADA FEMOROPOPLITEAL INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 128 CANADA TIBIAL (BELOW-THE-KNEE) INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 129 CANADA PERIPHERAL ANGIOPLASTY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 130 CANADA ARTERIAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 131 CANADA PERIPHERAL ATHERECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 132 CANADA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 133 CANADA PERIPHERAL ARTERIAL DISEASE IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 134 CANADA CORONARY INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 135 CANADA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 136 CANADA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 137 CANADA HOSPITALS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 138 CANADA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 139 MEXICO INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 140 MEXICO ANGIOPLASTY BALLOONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 141 MEXICO STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 142 MEXICO CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 143 MEXICO CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 144 MEXICO ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 145 MEXICO INFERIOR VENA CAVA (IVC) FILTERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 146 MEXICO PLAQUE MODIFICATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 147 MEXICO HEMODYNAMIC FLOW ALTERATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 148 MEXICO OTHERS AND ACCESSORIES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 149 MEXICO INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 MEXICO CONVENTIONAL IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 MEXICO ADVANCED IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 152 MEXICO INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 153 MEXICO ILIAC INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 154 MEXICO FEMOROPOPLITEAL INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 155 MEXICO TIBIAL (BELOW-THE-KNEE) INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 156 MEXICO PERIPHERAL ANGIOPLASTY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 157 MEXICO ARTERIAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 158 MEXICO PERIPHERAL ATHERECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 159 MEXICO INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 160 MEXICO PERIPHERAL ARTERIAL DISEASE IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 161 MEXICO CORONARY INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 162 MEXICO INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 163 MEXICO INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 164 MEXICO HOSPITALS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 165 MEXICO INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Lista de Figura

FIGURE 1 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET : SEGMENTATION

FIGURE 2 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 INCREASED PREVALENCE OF CHRONIC CARDIAC DISEASES, RISE IN TECHNOLOGICAL ADVANCEMENTS IN NON-INVASIVE SURGERIES AND PRODUCT APPPROVALS IS EXPECTED TO DRIVE NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET FROM 2022 TO 2029

FIGURE 13 PRODUCT SEGMENT IS EXPECTED TO HAVE THE LARGEST SHARE OF THE NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET FROM 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET

FIGURE 15 NORTH AMERICA PREVALENCE AND DISABILITY RATE OF ISCHEMIC HEART DISEASE (IHD) IN 2021

FIGURE 16 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PRODUCT, 2021

FIGURE 17 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PRODUCT, 2022-2029 (USD MILLION)

FIGURE 18 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PRODUCT, CAGR (2022-2029)

FIGURE 19 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 20 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY TYPE, 2021

FIGURE 21 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 22 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 23 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY TYPE, LIFELINE CURVE

FIGURE 24 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PROCEDURE, 2021

FIGURE 25 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PROCEDURE, 2022-2029 (USD MILLION)

FIGURE 26 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PROCEDURE, CAGR (2022-2029)

FIGURE 27 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PROCEDURE, LIFELINE CURVE

FIGURE 28 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY INDICATION, 2021

FIGURE 29 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY INDICATION, 2022-2029 (USD MILLION)

FIGURE 30 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY INDICATION, CAGR (2022-2029)

FIGURE 31 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY INDICATION, LIFELINE CURVE

FIGURE 32 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY AGE GROUP, 2021

FIGURE 33 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY AGE GROUP, 2022-2029 (USD MILLION)

FIGURE 34 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY AGE GROUP, CAGR (2022-2029)

FIGURE 35 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 36 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY END USER, 2021

FIGURE 37 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 38 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY END USER, CAGR (2022-2029)

FIGURE 39 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY END USER, LIFELINE CURVE

FIGURE 40 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 41 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 42 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 43 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 44 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: SNAPSHOT (2021)

FIGURE 45 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY COUNTRY (2021)

FIGURE 46 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 47 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 48 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PRODUCT (2021-2029)

FIGURE 49 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: COMPANY SHARE 2021 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.