>Mercado de caldeiras industriais da América do Norte , por métodos de tubagem (caldeiras de tubo de fogo transportador, caldeiras de tubo de água), pressão de vapor (caldeiras de alta pressão, caldeiras de média pressão, caldeiras de baixa pressão), utilização de vapor (caldeiras de processo, caldeiras utilitárias, caldeiras marítimas), forno Posição (Caldeiras de Alimentação Externa, Caldeiras de Alimentação Interna), Eixo Shell (Caldeiras Horizontais, Caldeiras Verticais), Tubos em Caldeiras (Caldeiras Multitubos, Caldeiras Simples), Circulação de Água e Vapor em Caldeiras (Caldeiras de Circulação Forçada, Caldeiras de Circulação Natural), Tipo de combustível (caldeiras a carvão, caldeiras a petróleo, caldeiras a gás, caldeiras a biomassa, outros), tipo de produto (caldeira de condensação de água quente , caldeira de condensação de água quente integrada, caldeira de vapor de condensação integrada, caldeira de vapor de condensação dividida, caldeira de vapor elétrica aquecida , caldeiras elétricas de água quente, outros), potência da caldeira (10-150 BHP, 151 -300 BHP, 301 - 600 BHP), indústria (indústria alimentar, cervejarias, lavandarias e empresas de limpeza, construção, farmacêutica, automóvel, papel e celulose, Hospitais, Agricultura, Embalagem, Outros) – Tendências e Previsões do Setor para 2029

Análise e dimensão do mercado

Um aumento da necessidade de geração de energia foi testemunhado em todo o mundo devido ao rápido aumento da população. As caldeiras industriais estão a ser muito utilizadas em diversos setores, como a metalurgia e mineração, química, refinação e alimentar, entre outros.

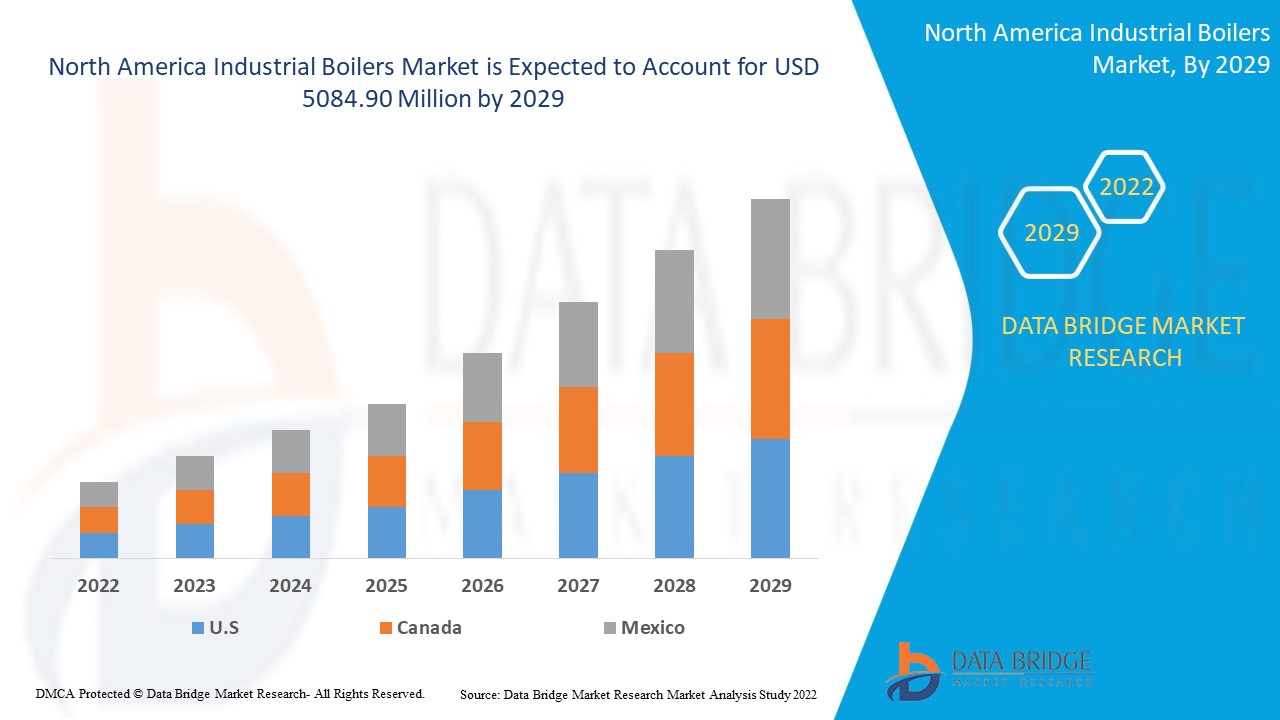

O mercado norte-americano de caldeiras industriais foi avaliado em 2.962,22 milhões de dólares em 2021 e deverá atingir os 5.084,90 milhões de dólares até 2029, registando um CAGR de 5,90% durante o período de previsão de 2022-2029. A Indústria Alimentar é responsável pelos maiores segmentos do setor de utilização final no respetivo mercado devido ao consumo de produtos de panificação e fast food. O relatório de mercado com curadoria da equipa de pesquisa de mercado da Data Bridge inclui análise especializada aprofundada, análise de importação/exportação, análise de preços, análise de consumo de produção e análise de pilão.

Definição de mercado

Uma caldeira industrial é uma chaleira a vapor ou a água de alta temperatura que utiliza gás combustível, biomassa, petróleo ou carvão como combustível. As caldeiras modernas aquecem ou arrefecem a água e distribuem-na aos clientes através das estruturas de linha.

Âmbito do relatório e segmentação de mercado

|

Métrica de reporte |

Detalhes |

|

Período de previsão |

2022 a 2029 |

|

Ano base |

2021 |

|

Anos históricos |

2020 (personalizável para 2019 - 2014) |

|

Unidades Quantitativas |

Receita em milhões de dólares, volumes em unidades, preços em dólares |

|

Segmentos cobertos |

Tubing Methods (Carrier Fire Tube Boilers, Water Tube Boilers), Steam Pressure (High Pressure Boilers, Medium Pressure Boilers, Low Pressure Boilers), Steam Usage (Process Boilers, Utility Boilers, Marine Boilers), Furnace Position (Externally Fired Boilers, Internally Fired Boilers), Shell Axis (Horizontal Boilers, Vertical Boilers), Tubes in Boilers (Multi-Tube Boilers, Single Boilers), Water and Steam Circulation in Boilers (Forced Circulation Boilers, Natural Circulation Boilers), Fuel Type (Coal-Fired Boilers, Oil Fired Boilers, Gas Fired Boilers, Biomass Boilers, Others), Product Type (Condensing Hot Water Boiler, Integrated Condensing Hot Water Boiler, Integrated Condensing Steam Boiler, Split Condensing Steam Boiler, Electric Heated Steam Boiler, Electric Hot Water Boilers, Others), Boiler Horsepower (10-150 BHP, 151 -300 BHP, 301 - 600 BHP), Industry (Food Industry, Breweries, Laundries and Cleaning Firm, Construction, Pharmaceutical, Automotive, Pulp and Paper, Hospitals, Agriculture, Packaging, Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America. |

|

Market Players Covered |

Babcock & Wilcox Enterprises, Inc. (US), John Wood Group PLC (UK), Bharat Heavy Electricals Limited (India), IHI Corporation (Japan), Mitsubishi Hitachi Power Systems, Ltd. (Europe), Thermax Limited (India), ANDRITZ (Austria), Siemens (Germany), ALFA LAVAL (Sweden), General Electric Company (US), Hurst Boiler & Welding Co, Inc. (US), Bryan Steam (US), Superior Boiler Works, Inc. (US), Vapor Power (US), Sofinter S.p.a (Italy), Cleaver-Brooks, Inc (US) and ZOZEN boiler Co., Ltd. (China), among others |

|

Market Opportunities |

|

North America Industrial Boilers Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Technological advancements

The market will be stimulated by the robust growth of industrial facilities in line with state and federal government expansion programs.

- Stringent government regulations

Strict government rules aimed at reducing greenhouse gas emissions, as well as a growing focus on reducing fuel usage, will bolster the market.

- Rising adoption of efficient units

The chemical industry's increased acceptance of efficient units, owing to their safe operations, high efficiency, and low maintenance, will drive product adoption which will further influence the market growth.

Opportunities

Furthermore, growing adoption of new smart boiler technology in the plant operations and constant development by providers extend profitable opportunities to the market players in the forecast period of 2022 to 2029.

Restraints/Challenges

On the other hand, increased initial investment is expected to obstruct market growth. Also, corrosion, inability to achieve required life, and other technological issues will require more research and investment in research and development efforts is projected to challenge the central vacuum cleaner market in the forecast period of 2022-2029.

This North America industrial boilers market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on North America industrial boilers market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on North America Industrial Boilers Market

The COVID-19 had a negative impact on the industrial boilers market. The COVID-19 epidemic has caused a number of initiatives to be postponed, including infrastructure construction, reorganization, and renovation. Increased government attention on overcompensating for impacts by enhancing operations when opportunities occur would accelerate industry growth. Government actions to reopen major industries, manufacturing facilities, and infrastructure projects, on the other hand, will support corporate growth.

Recent Developments

In January 2020, a new contract for roughly USD 5.00 million has been granted to Babcock & Wilcox Enterprises, Inc. for the installation of retrofit boiler equipment. The innovative technique is being used to retrofit boiler equipment at American coal-fired power plants. This contract aided the organization in expanding their market presence and customer base in the United States.

North America Industrial Boilers Market Scope and Market Size

The North America industrial boilers market is segmented on the basis of tubing methods, steam pressure, steam usage, furnace position, shell axis, tubes in boilers, water and steam circulation in boilers, fuel type, product type, boiler horsepower and industry. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Tubing Methods

- Carrier Fire Tube Boilers

- Water Tube Boilers

Steam Pressure

- High Pressure Boilers

- Medium Pressure Boilers

- Low Pressure Boilers

Steam Usage

- Process Boilers

- Utility Boilers

- Marine Boilers

Furnace Position

- Externally Fired Boilers

- Internally Fired Boilers

Shell Axis

- Caldeiras Horizontais

- Caldeiras Verticais

Tubos em Caldeiras

- Caldeiras Multitubos

- Caldeiras Simples

Circulação de Água e Vapor em Caldeiras

- Caldeiras de Circulação Forçada

- Caldeiras de Circulação Natural

Tipo de combustível

- Caldeiras a Carvão

- Caldeiras a óleo

- Caldeiras a Gás

- Caldeiras de Biomassa

- Outros

Tipo de produto

- Caldeira de condensação de água quente

- Caldeira de água quente de condensação integrada

- Caldeira de Vapor de Condensação Integrada

- Caldeira a vapor de condensação dividida

- Caldeira a vapor elétrica aquecida

- Caldeiras elétricas de água quente

- Outros

Potência da caldeira

- 10-150 CV

- 151-300 CV

- 301 - 600 CV

Indústria

- Indústria Alimentar

- Cervejarias

- Lavandarias e empresa de limpeza

- Construção

- Farmacêutico

- Automotivo

- Celulose e Papel

- Hospitais

- Agricultura

- Embalagem

- Outros

Análise/perspetivas regionais do mercado de caldeiras industriais da América do Norte

O mercado norte-americano de caldeiras industriais é analisado e são fornecidos insights e tendências do tamanho do mercado por país, métodos de tubagem, pressão de vapor, utilização de vapor, posição do forno, eixo do casco, tubos em caldeiras, circulação de água e vapor nas caldeiras, tipo de combustível, tipo de produto , potência da caldeira e indústria como acima referido.

Os países abrangidos no relatório do mercado de caldeiras industriais da América do Norte são os EUA, o Canadá e o México na América do Norte.

Os EUA dominam o mercado norte-americano de caldeiras industriais devido à robusta proficiência financeira para aceitar novas tecnologias ou ao aumento das tecnologias necessárias de capital.

A secção do país do relatório também fornece fatores individuais de impacto no mercado e alterações na regulamentação do mercado interno que impactam as tendências atuais e futuras do mercado. Pontos de dados como a análise da cadeia de valor a jusante e a montante, tendências técnicas e análise das cinco forças de Porter, estudos de caso são alguns dos indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, são considerados a presença e disponibilidade de marcas globais e os desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, o impacto das tarifas nacionais e das rotas comerciais, ao mesmo tempo que se fornece uma análise de previsão dos dados do país.

Cenário competitivo e mercado de caldeiras industriais da América do Norte

O panorama competitivo do mercado norte-americano de caldeiras industriais fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença global, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa , lançamento de produto, largura e amplitude do produto, aplicação domínio. Os dados fornecidos acima estão apenas relacionados com o foco das empresas relacionado com o mercado de caldeiras industriais da América do Norte.

Alguns dos principais players que operam no mercado norte-americano de Caldeiras industriais são

- Babcock & Wilcox Enterprises, Inc.

- John Wood Group PLC (Reino Unido)

- Bharat Heavy Electricals Limited (Índia)

- Corporação IHI (Japão)

- Mitsubishi Hitachi Power Systems, Ltd. (Europa)

- Thermax Limited (Índia)

- ANDRITZ (Áustria)

- Siemens (Alemanha)

- ALFA LAVAL (Suécia)

- Companhia General Electric (EUA)

- Hurst Boiler & Welding Co, Inc.

- Bryan Steam (EUA)

- Superior Boiler Works, Inc.

- Potência de vapor (EUA)

- Spa Sofinter (Itália)

- Cleaver-Brooks, Inc (EUA)

- Caldeira ZOZEN Co., Ltd. (China)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA INDUSTRIAL BOILERS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TUBING METHODS TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR LOW EMISSION INDUSTRIAL BOILERS

5.1.2 GROWING DEMAND FOR ADVANCED BOILER SOLUTION FROM INDUSTRIAL VERTICALS

5.1.3 RISING DEMAND FROM THE FOOD AND BEVERAGES INDUSTRY

5.1.4 RAPID ADOPTION OF INDUSTRIAL BOILER FROM ASIAN COUNTRIES

5.2 RESTRAINT

5.2.1 HIGH INVESTMENT COST

5.3 OPPORTUNITIES

5.3.1 DIGITALISATION OF THE INDUSTRIAL BOILER FOR IMPROVING EFFICIENCY

5.3.2 GROWING DEMAND FOR THE BIOMASS BOILERS

5.3.3 ADVENT OF PORTABLE, RENTAL AND TEMPORARY INDUSTRIAL BOILERS

5.4 CHALLENGES

5.4.1 TECHNICAL CHALLENGES TO IMPROVE THE PERFORMANCE AND LIFE

5.4.2 UNCERTAINTY AMONGST CUSTOMERS ABOUT INDUSTRIAL BOILER SAFETY AT PLANT

6 IMPACT ANALYSIS OF COVID-19 ON THE MARKET

6.1 IMPACT ON THE MANUFACTURING INDUSTRY AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.2 STRATEGIC DECISIONS FOR MARKET PLAYERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON DEMAND

6.4 CONSLUSION

7 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY TUBING METHODS

7.1 OVERVIEW

7.2 WATER TUBE BOILERS

7.3 FIRE TUBE BOILERS

8 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY STEAM PRESSURE

8.1 OVERVIEW

8.2 HIGH PRESSURE BOILERS

8.3 MEDIUM PRESSURE BOILERS

8.4 LOW PRESSURE BOILERS

9 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY STEAM USAGE

9.1 OVERVIEW

9.2 PROCESS BOILERS

9.3 UTILITY BOILERS

9.4 MARINE BOILERS

10 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY FURNACE POSITION

10.1 OVERVIEW

10.2 EXTERNALLY FIRED BOILERS

10.3 INTERNALLY FIRED BOILERS

11 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY SHELL AXIS

11.1 OVERVIEW

11.2 HORIZONTAL BOILERS

11.3 VERTICAL BOILERS

12 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY TUBES IN BOILERS

12.1 OVERVIEW

12.2 MULTI TUBE BOILERS

12.3 SINGLE TUBE BOILERS

13 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY WATER AND STEAM CIRCULATION IN BOILERS

13.1 OVERVIEW

13.2 FORCED CIRCULATION BOILERS

13.3 NATURAL CIRCULATION BOILERS

14 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BYFUEL TYPE

14.1 OVERVIEW

14.2 GAS FIRED BOILERS

14.3 COAL FIRED BOILERS

14.4 BIOMASS BOILERS

14.5 OIL FIRED BOILERS

14.6 OTHERS

15 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY PRODUCT TYPE

15.1 OVERVIEW

15.2 CONDENSING HOT WATER BOILER

15.3 INTEGRATED CONDENSING HOT WATER BOILER

15.4 INTEGRATED CONDENSING STEAM BOILER

15.5 SPLIT CONDENSING STEAM BOILER

15.6 ELECTRIC HEATED STEAM BOILER

15.7 ELECTRIC HOT WATER BOILERS

15.8 OTHERS

16 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY BOILER HORSEPOWER

16.1 OVERVIEW

16.2-150 BHP

16.3 -300 BHP

16.4 - 600 BHP

17 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY INDUSTRY

17.1 OVERVIEW

17.2 FOOD INDUSTRY

17.2.1 CONDENSING HOT WATER BOILER

17.2.2 INTEGRATED CONDENSING HOT WATER BOILER

17.2.3 SPLIT CONDENSING STEAM BOILER

17.2.4 INTEGRATED CONDENSING STEAM BOILER

17.2.5 ELECTRIC HEATED STEAM BOILER

17.2.6 ELECTRIC HOT WATER BOILERS

17.2.7 OTHERS

17.3 BREWERIES

17.3.1 CONDENSING HOT WATER BOILER

17.3.2 INTEGRATED CONDENSING HOT WATER BOILER

17.3.3 SPLIT CONDENSING STEAM BOILER

17.3.4 INTEGRATED CONDENSING STEAM BOILER

17.3.5 ELECTRIC HEATED STEAM BOILER

17.3.6 ELECTRIC HOT WATER BOILERS

17.3.7 OTHERS

17.4 LAUNDRIES AND CLEANING FIRM

17.4.1 SPLIT CONDENSING STEAM BOILER

17.4.2 INTEGRATED CONDENSING STEAM BOILER

17.4.3 CONDENSING HOT WATER BOILER

17.4.4 INTEGRATED CONDENSING HOT WATER BOILER

17.4.5 ELECTRIC HEATED STEAM BOILER

17.4.6 ELECTRIC HOT WATER BOILERS

17.4.7 OTHERS

17.5 PHARMACEUTICAL

17.5.1 INTEGRATED CONDENSING HOT WATER BOILER

17.5.2 CONDENSING HOT WATER BOILER

17.5.3 INTEGRATED CONDENSING STEAM BOILER

17.5.4 ELECTRIC HOT WATER BOILERS

17.5.5 ELECTRIC HEATED STEAM BOILER

17.5.6 SPLIT CONDENSING STEAM BOILER

17.5.7 OTHERS

17.6 HOSPITALS

17.6.1 INTEGRATED CONDENSING STEAM BOILER

17.6.2 CONDENSING HOT WATER BOILER

17.6.3 INTEGRATED CONDENSING HOT WATER BOILER

17.6.4 ELECTRIC HOT WATER BOILERS

17.6.5 ELECTRIC HEATED STEAM BOILER

17.6.6 SPLIT CONDENSING STEAM BOILER

17.6.7 OTHERS

17.7 CONSTRUCTION

17.7.1 INTEGRATED CONDENSING STEAM BOILER

17.7.2 CONDENSING HOT WATER BOILER

17.7.3 INTEGRATED CONDENSING HOT WATER BOILER

17.7.4 ELECTRIC HEATED STEAM BOILER

17.7.5 SPLIT CONDENSING STEAM BOILER

17.7.6 ELECTRIC HOT WATER BOILERS

17.7.7 OTHERS

17.8 PULP AND PAPER

17.8.1 CONDENSING HOT WATER BOILER

17.8.2 SPLIT CONDENSING STEAM BOILER

17.8.3 INTEGRATED CONDENSING HOT WATER BOILER

17.8.4 ELECTRIC HOT WATER BOILERS

17.8.5 ELECTRIC HEATED STEAM BOILER

17.8.6 INTEGRATED CONDENSING STEAM BOILER

17.8.7 OTHERS

17.9 AUTOMOTIVE

17.9.1 CONDENSING HOT WATER BOILER

17.9.2 INTEGRATED CONDENSING HOT WATER BOILER

17.9.3 INTEGRATED CONDENSING STEAM BOILER

17.9.4 ELECTRIC HOT WATER BOILERS

17.9.5 ELECTRIC HEATED STEAM BOILER

17.9.6 SPLIT CONDENSING STEAM BOILER

17.9.7 OTHERS

17.1 AGRICULTURE

17.10.1 SPLIT CONDENSING STEAM BOILER

17.10.2 INTEGRATED CONDENSING HOT WATER BOILER

17.10.3 CONDENSING HOT WATER BOILER

17.10.4 INTEGRATED CONDENSING STEAM BOILER

17.10.5 ELECTRIC HEATED STEAM BOILER

17.10.6 ELECTRIC HOT WATER BOILERS

17.10.7 OTHERS

17.11 PACKAGING

17.11.1 ELECTRIC HEATED STEAM BOILER

17.11.2 INTEGRATED CONDENSING STEAM BOILER

17.11.3 SPLIT CONDENSING STEAM BOILER

17.11.4 INTEGRATED CONDENSING HOT WATER BOILER

17.11.5 CONDENSING HOT WATER BOILER

17.11.6 ELECTRIC HOT WATER BOILERS

17.11.7 OTHERS

17.12 OTHERS

18 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY GEOGRAPHY

18.1 NORTH AMERICA

18.1.1 U.S.

18.1.2 CANADA

18.1.3 MEXICO

19 NORTH AMERICA INDUSTRIAL BOILERS MARKET, COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

20 NORTH AMERICA INDUSTRIAL BOILERS MARKET, SWOT

21 COMPANY PROFILE

21.1 GENERAL ELECTRIC

21.1.1 COMPANY SNAPSHOT

21.1.2 REVENUE ANALYSIS

21.1.3 COMPANY SHARE ANALYSIS

21.1.4 PRODUCT PORTFOLIO

21.1.5 RECENT DEVELOPMENTS

21.2 MITSUBISHI HITACHI POWER SYSTEMS, LTD.

21.2.1 COMPANY SNAPSHOT

21.2.2 COMPANY PROFILE

21.2.3 PRODUCT PORTFOLIO

21.2.4 RECENT DEVELOPMENTS

21.3 ANDRITZ

21.3.1 COMPANY SNAPSHOT

21.3.2 REVENUE ANALYSIS

21.3.3 COMPANY SHARE ANALYSIS

21.3.4 PRODUCT PORTFOLIO

21.3.5 RECENT DEVELOPMENTS

21.4 ALFA LAVAL

21.4.1 COMPANY SNAPSHOT

21.4.2 REVENUE ANALYSIS

21.4.3 COMPANY SHARE ANALYSIS

21.4.4 PRODUCT PORTFOLIO

21.4.5 RECENT DEVELOPMENTS

21.5 IHI CORPORATION

21.5.1 COMPANY SNAPSHOT

21.5.2 REVENUE ANALYSIS

21.5.3 COMPANY SHARE ANALYSIS

21.5.4 PRODUCT PORTFOLIO

21.5.5 RECENT DEVELOPMENTS

21.6 THERMAX LIMITED

21.6.1 COMPANY SNAPSHOT

21.6.2 REVENUE ANALYSIS

21.6.3 PRODUCT PORTFOLIO

21.6.4 RECENT DEVELOPMENTS

21.7 AB&CO GROUP

21.7.1 COMPANY SNAPSHOT

21.7.2 PRODUCT PORTFOLIO

21.7.3 RECENT DEVELOPMENT

21.8 BABCOCK & WILCOX ENTERPRISES, INC.

21.8.1 COMPANY SNAPSHOT

21.8.2 REVENUE ANALYSIS

21.8.3 PRODUCT PORTFOLIO

21.8.4 RECENT DEVELOPMENTS

21.9 BHARAT HEAVY ELECTRICALS LIMITED

21.9.1 COMPANY SNAPSHOT

21.9.2 REVENUE ANALYSIS

21.9.3 PRODUCT PORTFOLIO

21.9.4 RECENT DEVELOPMENTS

21.1 BRYAN STEAM

21.10.1 COMPANY SNAPSHOT

21.10.2 PRODUCT PORTFOLIO

21.10.3 RECENT DEVELOPMENTS

21.11 CLEAVER-BROOKS, INC

21.11.1 COMPANY SNAPSHOT

21.11.2 PRODUCT PORTFOLIO

21.11.3 RECENT DEVELOPMENTS

21.12 DEC

21.12.1 COMPANY SNAPSHOT

21.12.2 REVENUE ANALYSIS

21.12.3 PRODUCT PORTFOLIO

21.12.4 RECENT DEVELOPMENTS

21.13 HURST BOILER & WELDING CO, INC.

21.13.1 COMPANY SNAPSHOT

21.13.2 PRODUCT PORTFOLIO

21.13.3 RECENT DEVELOPMENTS

21.14 JOHN WOOD GROUP PLC

21.14.1 COMPANY SNAPSHOT

21.14.2 REVENUE ANALYSIS

21.14.3 PRODUCT PORTFOLIO

21.14.4 RECENT DEVELOPMENTS

21.15 SIEMENS

21.15.1 COMPANY SNAPSHOT

21.15.2 REVENUE ANALYSIS

21.15.3 PRODUCT PORTFOLIO

21.15.4 RECENT DEVELOPMENT

21.16 SOFINTER S.P.A

21.16.1 COMPANY SNAPSHOT

21.16.2 PRODUCT PORTFOLIO

21.16.3 RECENT DEVELOPMENTS

21.17 SUPERIOR BOILER WORKS, INC.

21.17.1 COMPANY SNAPSHOT

21.17.2 PRODUCT PORTFOLIO

21.17.3 RECENT DEVELOPMENTS

21.18 SUZHOU HAILU HEAVY INDUSTRY CO., LTD

21.18.1 COMPANY SNAPSHOT

21.18.2 PRODUCT PORTFOLIO

21.18.3 RECENT DEVELOPMENTS

21.19 VAPOR POWER

21.19.1 COMPANY SNAPSHOT

21.19.2 PRODUCT PORTFOLIO

21.19.3 RECENT DEVELOPMENT

21.2 ZOZEN BOILER CO., LTD.

21.20.1 COMPANY SNAPSHOT

21.20.2 PRODUCT PORTFOLIO

21.20.3 RECENT DEVELOPMENTS

22 QUESTIONNAIRE

23 RELATED REPORTS

Lista de Tabela

LIST OF TABLES

TABLE 1 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY TUBING METHODS, 2018-2027 (USD MILLION)

TABLE 2 NORTH AMERICA WATER TUBE BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 3 NORTH AMERICA FIRE TUBE BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 4 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY STEAM PRESSURE, 2018-2027 (USD MILLION)

TABLE 5 NORTH AMERICA HIGH PRESSURE BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 6 NORTH AMERICA MEDIUM PRESSURE BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 7 NORTH AMERICA MEDIUM PRESSURE BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 8 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY STEAM USAGE, 2018-2027 (USD MILLION)

TABLE 9 NORTH AMERICA PROCESS BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 10 NORTH AMERICA UTILITY BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 11 NORTH AMERICA MARINE BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 12 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY FURNACE POSITION, 2018-2027 (USD MILLION)

TABLE 13 NORTH AMERICA EXTERNALLY FIRED BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 14 NORTH AMERICA INTERNALLY FIRED BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 15 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY SHELL AXIS, 2018-2027 (USD MILLION)

TABLE 16 NORTH AMERICA HORIZONTAL BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 17 NORTH AMERICA VERTICAL BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 18 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY TUBES IN BOILERS, 2018-2027 (USD MILLION)

TABLE 19 NORTH AMERICA MULTI TUBE BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 20 NORTH AMERICA SINGLE TUBE BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 21 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY WATER AND STEAM CIRCULATION IN BOILERS, 2018-2027 (USD MILLION)

TABLE 22 NORTH AMERICA FORCED CIRCULATION BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 23 NORTH AMERICA NATURAL CIRCULATION BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 24 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 25 NORTH AMERICA GAS FIRED BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 26 NORTH AMERICA COAL FIRED BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 27 NORTH AMERICA BIOMASS BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 28 NORTH AMERICA OIL FIRED BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 29 NORTH AMERICA OTHERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 30 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 31 NORTH AMERICA CONDENSING HOT WATER BOILER IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 32 NORTH AMERICA INTEGRATED CONDENSING HOT WATER BOILER IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 33 NORTH AMERICA INTEGRATED CONDENSING STEAM BOILER IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 34 NORTH AMERICA SPLIT CONDENSING STEAM BOILERIN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 35 NORTH AMERICA ELECTRIC HEATED STEAM BOILER IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 36 NORTH AMERICA ELECTRIC HOT WATER BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 37 NORTH AMERICA OTHERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 38 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY BOILER HORSEPOWER, 2018-2027 (USD MILLION)

TABLE 39 NORTH AMERICA 10-150 BHP IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 40 NORTH AMERICA 151 -300 BHPIN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 41 NORTH AMERICA 301 - 600 BHPIN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 42 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY INDUSTRY, 2018-2027 (USD MILLION)

TABLE 43 NORTH AMERICA FOOD INDUSTRY IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 44 NORTH AMERICA FOOD INDUSTRY IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 45 NORTH AMERICA BREWERIES IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 46 NORTH AMERICA BREWERIES IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 47 NORTH AMERICA LAUNDRIES AND CLEANING FIRM IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 48 NORTH AMERICA LAUNDRIES AND CLEANING FIRM IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 49 NORTH AMERICA PHARMACEUTICAL IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 50 NORTH AMERICA PHARMACEUTICAL IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 51 NORTH AMERICA HOSPITALS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 52 NORTH AMERICA HOSPITALS IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 53 NORTH AMERICA CONSTRUCTION IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 54 NORTH AMERICA CONSTRUCTION IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 55 NORTH AMERICA PULP AND PAPER IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 56 NORTH AMERICA PULP AND PAPER IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 57 NORTH AMERICA AUTOMOTIVE IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 58 NORTH AMERICA AUTOMOTIVE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 59 NORTH AMERICA AGRICULTURE IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 60 NORTH AMERICA AGRICULTURE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 61 NORTH AMERICA PACKAGING IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 62 NORTH AMERICA PACKAGING IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 63 NORTH AMERICA FOOD INDUSTRY IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 64 NORTH AMERICAINDUSTRIAL BOILERS MARKET,BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 65 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY TUBING METHODS, 2018-2027 (USD MILLION)

TABLE 66 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY STEAM PRESSURE, 2018-2027 (USD MILLION)

TABLE 67 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY STEAM USAGE, 2018-2027 (USD MILLION)

TABLE 68 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY FURNACE POSITION, 2018-2027 (USD MILLION)

TABLE 69 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY SHELL AXIS, 2018-2027 (USD MILLION)

TABLE 70 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY TUBES IN BOILERS, 2018-2027 (USD MILLION)

TABLE 71 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY WATER AND STEAM CIRCULATION IN BOILERS, 2018-2027 (USD MILLION)

TABLE 72 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 73 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 74 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY BOILER HORSEPOWER, 2018-2027 (USD MILLION)

TABLE 75 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY INDUSTRY, 2018-2027 (USD MILLION)

TABLE 76 NORTH AMERICA FOOD INDUSTRY IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 77 NORTH AMERICA BREWERIES IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 78 NORTH AMERICA LAUNDRIES AND CLEANING FIRM IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 79 NORTH AMERICA PHARMACEUTICAL IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 80 NORTH AMERICA HOSPITALS IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 81 NORTH AMERICA CONSTRUCTION IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 82 NORTH AMERICA PULP AND PAPER IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 83 NORTH AMERICA AUTOMOTIVE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 84 NORTH AMERICA AGRICULTURE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 85 NORTH AMERICA PACKAGING IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 86 U.S. INDUSTRIAL BOILERS MARKET,BY TUBING METHODS, 2018-2027 (USD MILLION)

TABLE 87 U.S. INDUSTRIAL BOILERS MARKET,BY STEAM PRESSURE, 2018-2027 (USD MILLION)

TABLE 88 U.S. INDUSTRIAL BOILERS MARKET,BY STEAM USAGE, 2018-2027 (USD MILLION)

TABLE 89 U.S. INDUSTRIAL BOILERS MARKET,BY FURNACE POSITION, 2018-2027 (USD MILLION)

TABLE 90 U.S. INDUSTRIAL BOILERS MARKET,BY SHELL AXIS, 2018-2027 (USD MILLION)

TABLE 91 U.S. INDUSTRIAL BOILERS MARKET,BY TUBES IN BOILERS, 2018-2027 (USD MILLION)

TABLE 92 U.S. INDUSTRIAL BOILERS MARKET,BY WATER AND STEAM CIRCULATION IN BOILERS, 2018-2027 (USD MILLION)

TABLE 93 U.S. INDUSTRIAL BOILERS MARKET,BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 94 U.S. INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 95 U.S. INDUSTRIAL BOILERS MARKET,BY BOILER HORSEPOWER, 2018-2027 (USD MILLION)

TABLE 96 U.S. INDUSTRIAL BOILERS MARKET,BY INDUSTRY, 2018-2027 (USD MILLION)

TABLE 97 U.S. FOOD INDUSTRY IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 98 U.S. BREWERIES IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 99 U.S. LAUNDRIES AND CLEANING FIRM IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 100 U.S. PHARMACEUTICAL IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 101 U.S. HOSPITALS IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 102 U.S. CONSTRUCTION IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 103 U.S. PULP AND PAPER IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 104 U.S. AUTOMOTIVE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 105 U.S. AGRICULTURE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 106 U.S. PACKAGING IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 107 CANADA INDUSTRIAL BOILERS MARKET,BY TUBING METHODS, 2018-2027 (USD MILLION)

TABLE 108 CANADA INDUSTRIAL BOILERS MARKET,BY STEAM PRESSURE, 2018-2027 (USD MILLION)

TABLE 109 CANADA INDUSTRIAL BOILERS MARKET,BY STEAM USAGE, 2018-2027 (USD MILLION)

TABLE 110 CANADA INDUSTRIAL BOILERS MARKET,BY FURNACE POSITION, 2018-2027 (USD MILLION)

TABLE 111 CANADA INDUSTRIAL BOILERS MARKET,BY SHELL AXIS, 2018-2027 (USD MILLION)

TABLE 112 CANADA INDUSTRIAL BOILERS MARKET,BY TUBES IN BOILERS, 2018-2027 (USD MILLION)

TABLE 113 CANADA INDUSTRIAL BOILERS MARKET,BY WATER AND STEAM CIRCULATION IN BOILERS, 2018-2027 (USD MILLION)

TABLE 114 CANADA INDUSTRIAL BOILERS MARKET,BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 115 CANADA INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 116 CANADA INDUSTRIAL BOILERS MARKET,BY BOILER HORSEPOWER, 2018-2027 (USD MILLION)

TABLE 117 CANADA INDUSTRIAL BOILERS MARKET,BY INDUSTRY, 2018-2027 (USD MILLION)

TABLE 118 CANADA FOOD INDUSTRY IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 119 CANADA BREWERIES IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 120 CANADA LAUNDRIES AND CLEANING FIRM IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 121 CANADA PHARMACEUTICAL IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 122 CANADA HOSPITALS IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 123 CANADA CONSTRUCTION IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 124 CANADA PULP AND PAPER IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 125 CANADA AUTOMOTIVE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 126 CANADA AGRICULTURE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 127 CANADA PACKAGING IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 128 MEXICO INDUSTRIAL BOILERS MARKET,BY TUBING METHODS, 2018-2027 (USD MILLION)

TABLE 129 MEXICO INDUSTRIAL BOILERS MARKET,BY STEAM PRESSURE, 2018-2027 (USD MILLION)

TABLE 130 MEXICO INDUSTRIAL BOILERS MARKET,BY STEAM USAGE, 2018-2027 (USD MILLION)

TABLE 131 MEXICO INDUSTRIAL BOILERS MARKET,BY FURNACE POSITION, 2018-2027 (USD MILLION)

TABLE 132 MEXICO INDUSTRIAL BOILERS MARKET,BY SHELL AXIS, 2018-2027 (USD MILLION)

TABLE 133 MEXICO INDUSTRIAL BOILERS MARKET,BY TUBES IN BOILERS, 2018-2027 (USD MILLION)

TABLE 134 MEXICO INDUSTRIAL BOILERS MARKET,BY WATER AND STEAM CIRCULATION IN BOILERS, 2018-2027 (USD MILLION)

TABLE 135 MEXICO INDUSTRIAL BOILERS MARKET,BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 136 MEXICO INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 137 MEXICO INDUSTRIAL BOILERS MARKET,BY BOILER HORSEPOWER, 2018-2027 (USD MILLION)

TABLE 138 MEXICO INDUSTRIAL BOILERS MARKET,BY INDUSTRY, 2018-2027 (USD MILLION)

TABLE 139 MEXICO FOOD INDUSTRY IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 140 MEXICO BREWERIES IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 141 MEXICO LAUNDRIES AND CLEANING FIRM IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 142 MEXICO PHARMACEUTICAL IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 143 MEXICO HOSPITALS IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 144 MEXICO CONSTRUCTION IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 145 MEXICO PULP AND PAPER IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 146 MEXICO AUTOMOTIVE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 147 MEXICO AGRICULTURE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 148 MEXICO PACKAGING IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

Lista de Figura

LIST OF FIGURES

FIGURE 1 NORTH AMERICA INDUSTRIAL BOILERS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA INDUSTRIAL BOILERS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA INDUSTRIAL BOILERS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA INDUSTRIAL BOILERS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA INDUSTRIAL BOILERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA INDUSTRIAL BOILERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA INDUSTRIAL BOILERS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA INDUSTRIAL BOILERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA INDUSTRIAL BOILERS MARKET: SEGMENTATION

FIGURE 10 INCREASING DEMAND FOR LOW EMISSION INDUSTRIAL BOILERS AND GROWING DEMAND FOR ADVANCED BOILER SOLUTION FROM INDUSTRIAL VERTICALS ARE DRIVING THE NORTH AMERICA INDUSTRIAL BOILERS MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 11 WATER TUBE BOILERS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA INDUSTRIAL BOILERS MARKET IN 2020 & 2027

FIGURE 12 DRIVERS, RESTRAINT, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA INDUSTRIAL BOILERS MARKET

FIGURE 13 THERMODYNE MARKET SHARE OF FOOD INDUSTRY BOILERS

FIGURE 14 FUEL LOSS IN BOILER WITH SCALE BUILD UP

FIGURE 15 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY TUBING METHODS, 2019

FIGURE 16 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BYSTEAM PRESSURE, 2019

FIGURE 17 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY STEAM USAGE, 2019

FIGURE 18 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY FURNACE POSITION, 2019

FIGURE 19 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY SHELL AXIS, 2019

FIGURE 20 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY TUBES IN BOILERS, 2019

FIGURE 21 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY WATER AND STEAM CIRCULATION IN BOILERS, 2019

FIGURE 22 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BYFUEL TYPE, 2019

FIGURE 23 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY PRODUCT TYPE, 2019

FIGURE 24 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY BOILER HORSEPOWER, 2019

FIGURE 25 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY INDUSTRY, 2019

FIGURE 26 NORTH AMERICAINDUSTRIAL BOILERS MARKET: SNAPSHOT (2019)

FIGURE 27 NORTH AMERICAINDUSTRIAL BOILERS MARKET: BY COUNTRY(2019)

FIGURE 28 NORTH AMERICAINDUSTRIAL BOILERS MARKET: BY COUNTRY(2020& 2027)

FIGURE 29 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY COUNTRY (2019& 2027)

FIGURE 30 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY TUBING METHODS (2020-2027)

FIGURE 31 NORTH AMERICA INDUSTRIAL BOILERS MARKET: COMPANY SHARE 2019 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.