North America Immunoassay Gamma Counters Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

33.27 Million

USD

50.29 Million

2025

2033

USD

33.27 Million

USD

50.29 Million

2025

2033

| 2026 –2033 | |

| USD 33.27 Million | |

| USD 50.29 Million | |

|

|

|

|

Segmentação do mercado de contadores gama para imunoensaios na América do Norte, porTipo de produto (automatizado e manual/semiautomatizado), poço (multipoços e poço único), aplicação (radioimunoensaios, ensaios de medicina nuclear e outros), condição da doença (biomarcadores de câncer, doenças infecciosas, monitoramento terapêutico de medicamentos, hormônios endócrinos, alergia, triagem neonatal, marcadores cardíacos, doenças autoimunes e outras), modalidade de compra (compra direta e aluguel), usuário final (laboratórios, hospitais, institutos de pesquisa e acadêmicos, empresas farmacêuticas e de biotecnologia, bancos de sangue e outros), canal de distribuição (licitação direta e distribuidores terceirizados) - Tendências e previsões do setor até 2033

Tamanho do mercado de contadores gama para imunoensaios na América do Norte

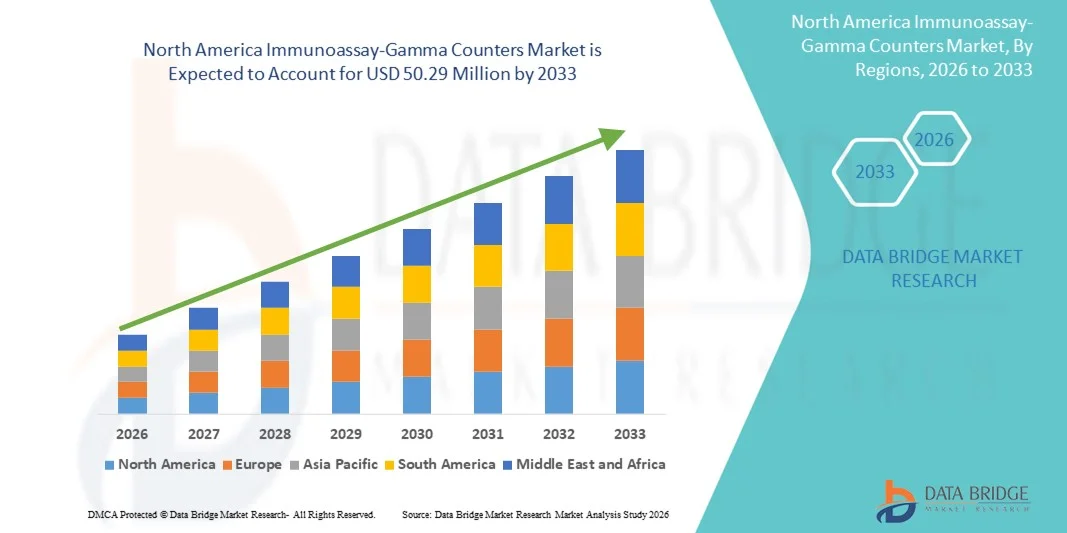

- O mercado de contadores gama para imunoensaios na América do Norte foi avaliado em US$ 33,27 milhões em 2025 e deverá atingir US$ 50,29 milhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 5,3% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela infraestrutura de saúde avançada da região, pelo aumento do financiamento para pesquisa biomédica e pela presença de fabricantes líderes de equipamentos de diagnóstico.

- Além disso, a crescente demanda por ferramentas de diagnóstico altamente sensíveis e automatizadas para aplicações como endocrinologia, oncologia e testes de doenças infecciosas está consolidando os contadores gama para imunoensaios como instrumentos essenciais em laboratórios clínicos e instituições de pesquisa. Esses fatores convergentes estão acelerando a adoção de soluções de contadores gama, impulsionando significativamente o crescimento do setor.

Análise do mercado de contadores gama para imunoensaios na América do Norte

- Os contadores gama para imunoensaios, utilizados para medir a radioatividade em amostras biológicas, são componentes cada vez mais vitais em laboratórios modernos de diagnóstico clínico e pesquisa, devido à sua alta sensibilidade, precisão e compatibilidade com sistemas automatizados de ensaio.

- A crescente demanda por contadores gama para imunoensaios é impulsionada principalmente pela prevalência cada vez maior de doenças crônicas e infecciosas, pela adoção crescente da medicina nuclear e dos radioimunoensaios e pela necessidade cada vez maior de diagnósticos laboratoriais rápidos, precisos e automatizados.

- Os Estados Unidos dominaram o mercado norte-americano de contadores gama para imunoensaios, com a maior participação de mercado, de 64,6% em 2025. Esse desempenho foi caracterizado por uma infraestrutura de saúde avançada, forte financiamento para pesquisa e uma presença expressiva de importantes fabricantes de equipamentos de diagnóstico.

- Prevê-se que o Canadá seja o país de crescimento mais rápido no mercado norte-americano de contadores gama para imunoensaios durante o período de previsão, devido ao aumento dos investimentos em infraestrutura de saúde, à crescente adoção de diagnósticos laboratoriais automatizados e à demanda cada vez maior por soluções de testes de alto rendimento em laboratórios clínicos e de pesquisa.

- O segmento automatizado dominou o mercado de contadores gama para imunoensaios, com uma participação de 45,5% em 2025, impulsionado por sua eficiência, reprodutibilidade e capacidade de integração em ambientes de laboratório clínico e de pesquisa de alto volume.

Escopo do relatório e segmentação do mercado de contadores gama para imunoensaios na América do Norte.

|

Atributos |

Principais informações de mercado sobre contadores gama de imunoensaios na América do Norte |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais players, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, epidemiologia de pacientes, análise de projetos em desenvolvimento, análise de preços e estrutura regulatória. |

Tendências do mercado de contadores gama para imunoensaios na América do Norte

Avanços em Automação e Capacidades de Alto Rendimento

- Uma tendência significativa e crescente no mercado norte-americano de contadores gama para imunoensaios é a adoção de sistemas automatizados de múltiplas cavidades que aumentam a produtividade, a precisão e a reprodutibilidade em laboratórios clínicos e de pesquisa.

- Por exemplo, o contador gama Wizard2 da PerkinElmer oferece contagem de múltiplos poços totalmente automatizada e integração de dados, reduzindo o manuseio manual e melhorando a eficiência do fluxo de trabalho em laboratórios de alto volume.

- A integração com sistemas de gerenciamento de informações laboratoriais (LIMS) e o manuseio automatizado de amostras permitem a coleta de dados em tempo real, a redução de erros e a melhoria da precisão dos relatórios, aumentando a eficiência operacional e a tomada de decisões.

- A combinação perfeita da contagem gama automatizada com plataformas de software avançadas permite que os laboratórios gerenciem múltiplos ensaios e tipos de amostra por meio de uma interface unificada, melhorando a padronização e a consistência do fluxo de trabalho.

- Essa tendência em direção a sistemas de contagem gama de alto rendimento, integrados e automatizados está transformando fundamentalmente as operações laboratoriais, com empresas como Hidex e Wallac desenvolvendo soluções que suportam carregamento automatizado de amostras, contagem rápida e integração direta com LIMS.

- A demanda por contadores gama automatizados e de alto rendimento está crescendo rapidamente em hospitais, institutos de pesquisa e laboratórios farmacêuticos, à medida que os operadores priorizam cada vez mais a eficiência, a precisão e a escalabilidade em seus fluxos de trabalho de diagnóstico e pesquisa. Por exemplo, a adoção do carregamento de amostras sem contato e da validação de dados baseada em IA em alguns contadores gama está melhorando a biossegurança e minimizando o erro humano, uma tendência que está sendo rapidamente adotada em laboratórios clínicos.

- A miniaturização contínua e os designs compactos dos contadores gama estão permitindo seu uso em laboratórios menores e em ambientes de pesquisa no ponto de atendimento, expandindo a penetração no mercado para além de instalações de grande escala.

Dinâmica do mercado de contadores gama para imunoensaios na América do Norte

Motorista

Crescente demanda por testes de diagnóstico rápidos e precisos

- A crescente prevalência de doenças crônicas e infecciosas, aliada à adoção cada vez maior da medicina nuclear e dos radioimunoensaios, é um fator significativo para o aumento da demanda por contadores gama para imunoensaios.

- Por exemplo, em março de 2025, a PerkinElmer lançou contadores gama de alto rendimento aprimorados para acelerar os testes de hormônios oncológicos e endócrinos em hospitais dos EUA, com o objetivo de reduzir o tempo de resposta dos ensaios.

- À medida que os laboratórios enfrentam volumes de testes cada vez maiores e exigem resultados precisos e reproduzíveis, os contadores gama oferecem contagem automatizada, processamento de múltiplas amostras e saída de dados em tempo real, representando uma melhoria significativa em relação aos métodos manuais.

- Além disso, o crescente investimento em pesquisa clínica e desenvolvimento biofarmacêutico está tornando os contadores gama uma ferramenta essencial para a descoberta de fármacos, validação de biomarcadores e estudos de monitoramento de doenças.

- A eficiência, a reprodutibilidade e a integração com os fluxos de trabalho laboratoriais oferecidas pelos contadores gama modernos são fatores-chave que impulsionam sua adoção em hospitais, institutos de pesquisa e laboratórios farmacêuticos em toda a América do Norte. Por exemplo, o uso crescente de contadores gama em testes de doenças infecciosas, incluindo COVID-19 e outros patógenos emergentes, levou os laboratórios a investir em sistemas de contagem mais rápidos e confiáveis.

- A integração de contadores gama com plataformas de análise digital permite obter insights preditivos e monitorar tendências nas operações de laboratório, incentivando ainda mais a adoção em instalações de pesquisa tecnologicamente avançadas.

- Os recursos de geração de relatórios automatizados e rastreamento de conformidade em contadores gama modernos reduzem a carga administrativa, tornando-os mais atraentes para grandes redes hospitalares e laboratórios de testes centralizados.

Restrição/Desafio

Alto custo e obstáculos à conformidade regulatória

- As preocupações com os elevados custos iniciais de aquisição e o cumprimento das normas regulamentares representam desafios significativos para uma maior penetração no mercado, especialmente para laboratórios de menor dimensão com orçamentos limitados.

- Por exemplo, contadores gama automatizados e de múltiplas cavidades avançados de empresas como Hidex e PerkinElmer podem custar várias vezes mais do que sistemas manuais básicos, limitando sua adoção em laboratórios sensíveis a preços.

- A conformidade com as regulamentações da FDA e da CLIA, juntamente com os padrões de calibração e segurança radiológica, aumenta a complexidade operacional e pode atrasar a aquisição e a implantação em ambientes clínicos.

- Embora os modelos de leasing e aluguel estejam ganhando força gradualmente, o custo adicional percebido para sistemas automatizados de alto rendimento ainda pode dificultar a adoção, especialmente entre instalações de pesquisa menores ou laboratórios acadêmicos.

- Superar esses desafios por meio de modelos econômicos, suporte regulatório simplificado e treinamento em operações seguras e em conformidade com as normas será crucial para o crescimento sustentado do mercado norte-americano de contadores gama para imunoensaios. Por exemplo, atrasos na obtenção das aprovações necessárias para o manuseio de radiação e na certificação de laboratórios podem impedir a instalação e a implantação oportunas de contadores gama, principalmente em laboratórios novos ou em expansão.

- A necessidade de calibração regular, manutenção e treinamento especializado para operadores aumenta ainda mais os custos operacionais e a complexidade, desencorajando a adoção por laboratórios de pequeno e médio porte.

- As preocupações com a segurança cibernética e a integridade dos dados em contadores gama conectados, incluindo o monitoramento remoto e a integração com o LIMS, continuam sendo um desafio crescente para as equipes de TI e de gerenciamento de laboratório.

Escopo do mercado de contadores gama para imunoensaios na América do Norte

O mercado é segmentado com base no tipo de produto, tipo de poço, aplicação, condição da doença, modo de compra, usuário final e canal de distribuição.

- Por tipo de produto

Com base no tipo de produto, o mercado de contadores gama para imunoensaios é segmentado em sistemas automatizados e manuais/semiautomatizados. O segmento automatizado dominou o mercado com a maior participação na receita, de 45,5% em 2025, impulsionado pelo alto rendimento, redução de erros humanos e integração com sistemas de gerenciamento de informações laboratoriais (LIMS). Os laboratórios priorizam cada vez mais os contadores automatizados devido à sua eficiência no processamento de grandes volumes de amostras e múltiplos tipos de ensaios simultaneamente. Hospitais e institutos de pesquisa estão adotando sistemas automatizados para atender às crescentes demandas de testes e aos padrões de conformidade regulatória. Os contadores gama automatizados dão suporte a fluxos de trabalho complexos em testes de oncologia, endocrinologia e doenças infecciosas, oferecendo resultados padronizados e maior reprodutibilidade. Inovações contínuas em análise de amostras baseada em IA, geração de relatórios automatizados e validação de dados reforçam ainda mais a dominância dos sistemas automatizados.

Prevê-se que o segmento de sistemas manuais/semiautomatizados apresente o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente adoção em laboratórios menores e instituições de pesquisa acadêmica com orçamentos limitados. Esses sistemas são valorizados pelo menor custo inicial, portabilidade e flexibilidade na execução de ensaios personalizados. Os contadores manuais e semiautomatizados também são preferidos em laboratórios de treinamento e projetos de pesquisa especializados, onde sistemas totalmente automatizados não são viáveis. Sua simplicidade permite a instalação em laboratórios com espaço limitado e em ambientes de pesquisa no ponto de atendimento. A crescente conscientização sobre soluções de baixo custo entre laboratórios acadêmicos e clínicos de menor porte também impulsiona a adoção desses sistemas.

- Por tipo de poço

Com base no tipo de poço, o mercado é segmentado em contadores gama de múltiplos poços e de poço único. O segmento de múltiplos poços dominou o mercado com a maior participação na receita em 2025 devido à sua capacidade de processar um grande número de amostras simultaneamente, o que é crucial para laboratórios de alto rendimento. Os sistemas de múltiplos poços são amplamente utilizados em hospitais, institutos de pesquisa e laboratórios farmacêuticos para testes de oncologia, endocrinologia e doenças infecciosas. O segmento se beneficia da integração com sistemas automatizados de manuseio de amostras e LIMS (Sistema de Gerenciamento de Informação Laboratorial), que otimizam o fluxo de trabalho e reduzem erros humanos. Os laboratórios preferem os contadores de múltiplos poços por sua eficiência, rapidez na obtenção de resultados e capacidade de processar múltiplos formatos de ensaio em uma única execução. Os avanços contínuos em software e análises de IA (Inteligência Artificial) reforçam ainda mais a atratividade dos contadores de múltiplos poços. A integração com plataformas de relatórios digitais também permite que os laboratórios mantenham a conformidade regulatória e o controle de qualidade.

O segmento de placas de poço único deverá apresentar o crescimento mais rápido entre 2026 e 2033, devido à crescente adoção em laboratórios menores, aplicações de pesquisa especializadas e instalações de teste descentralizadas. As placas de poço único são econômicas, fáceis de manter e adequadas para testes de baixo volume. Seu design compacto permite a instalação em laboratórios com espaço limitado e unidades móveis de pesquisa. A simplicidade e a flexibilidade das placas de poço único as tornam a escolha preferida para protocolos de ensaio personalizados e instituições acadêmicas. O crescente interesse em estudos de pesquisa de nicho e projetos piloto impulsiona ainda mais a adoção de sistemas de poço único.

- Por meio de aplicação

Com base na aplicação, o mercado é segmentado em radioimunoensaios, ensaios de medicina nuclear e outros. O segmento de radioimunoensaios dominou o mercado em 2025, impulsionado por seu papel crucial na análise de biomarcadores de câncer, monitoramento de níveis hormonais e avaliação de medicamentos terapêuticos. Os laboratórios dependem cada vez mais de contadores gama para a quantificação precisa de amostras radiomarcadas utilizadas em ensaios diagnósticos. O segmento se beneficia da ampla adoção de sistemas automatizados de múltiplas placas que aumentam a precisão e a reprodutibilidade. Institutos de pesquisa e empresas farmacêuticas preferem os radioimunoensaios devido à sua sensibilidade e confiabilidade em estudos clínicos. Inovações contínuas em protocolos de ensaio e softwares de contagem gama consolidam ainda mais a dominância desse segmento. Hospitais e laboratórios especializados integram cada vez mais os radioimunoensaios em diagnósticos de rotina, fortalecendo ainda mais sua adoção.

O segmento de ensaios de medicina nuclear deverá apresentar o crescimento mais rápido entre 2026 e 2033, devido à crescente demanda por exames de imagem diagnóstica, monitoramento terapêutico e estudos com traçadores radioativos. Hospitais e centros de diagnóstico especializados estão investindo cada vez mais em contadores gama para dar suporte às aplicações da medicina nuclear. O crescimento do segmento é impulsionado pela necessidade de medições precisas e de alto rendimento, bem como pela conformidade regulatória em testes radiofarmacêuticos. Os ensaios de medicina nuclear estão ganhando espaço na medicina personalizada e na pesquisa de terapias direcionadas. A crescente conscientização sobre o diagnóstico precoce e o monitoramento do tratamento também contribui para o crescimento do segmento.

- Por condição de doença

Com base na condição da doença, o mercado é segmentado em biomarcadores de câncer, doenças infecciosas, monitoramento terapêutico de medicamentos, hormônios endócrinos, alergias, triagem neonatal, marcadores cardíacos, doenças autoimunes e outros. O segmento de biomarcadores de câncer dominou em 2025 devido à crescente prevalência do câncer e à necessidade crítica de ensaios diagnósticos e de monitoramento precisos em laboratórios clínicos e de pesquisa. Os contadores gama oferecem alta sensibilidade e reprodutibilidade na quantificação de biomarcadores de câncer radiomarcados, auxiliando na detecção precoce e em estratégias de tratamento personalizadas. O segmento se beneficia de sistemas automatizados de múltiplas cavidades que processam grandes volumes de amostra com eficiência. Empresas farmacêuticas e de biotecnologia dependem de contadores gama para o desenvolvimento de medicamentos oncológicos e para ensaios clínicos. Hospitais integram esses contadores para diagnósticos de rotina de câncer. Os avanços tecnológicos contínuos na contagem gama e na análise de dados reforçam a dominância das aplicações de biomarcadores de câncer.

O segmento de doenças infecciosas deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pelo aumento de surtos de patógenos infecciosos e pela crescente demanda por testes diagnósticos rápidos e precisos. Hospitais, laboratórios de saúde pública e institutos de pesquisa estão adotando contadores gama para detectar e monitorar doenças infecciosas. Contadores automatizados de alto rendimento permitem testes em larga escala com mínima intervenção manual, melhorando a eficiência e a biossegurança. A integração de LIMS (Sistemas de Gestão de Informação Laboratorial) e análises de IA (Inteligência Artificial) aprimora ainda mais o fluxo de trabalho e a confiabilidade dos resultados no diagnóstico de doenças infecciosas. O aumento de programas governamentais e financiamento para o monitoramento de epidemias também impulsiona a adoção dessa tecnologia.

- Por meio do modo de compra

Com base na modalidade de compra, o mercado é segmentado em compra direta e aluguel. O segmento de compra direta dominou em 2025 devido aos fortes investimentos de capital realizados por hospitais, institutos de pesquisa e empresas farmacêuticas em infraestrutura permanente de contagem gama. A propriedade direta proporciona controle operacional a longo prazo, flexibilidade de manutenção e integração com os fluxos de trabalho existentes do laboratório. Laboratórios de grande porte preferem a compra direta para garantir disponibilidade contínua e conformidade com os protocolos de teste. O segmento é reforçado por atualizações tecnológicas em sistemas automatizados e de múltiplas placas, que oferecem alta produtividade e confiabilidade. A adoção contínua de contratos de serviço e planos de manutenção de longo prazo também contribui para a dominância desse segmento. Os fabricantes geralmente oferecem serviços de treinamento e calibração como parte dos contratos de compra.

O segmento de locação com opção de compra deverá apresentar o crescimento mais rápido entre 2026 e 2033, principalmente em laboratórios acadêmicos e de pesquisa de menor porte com orçamentos limitados. As opções de locação permitem que os laboratórios acessem contadores gama de última geração sem a necessidade de investimento inicial. Planos de locação flexíveis incentivam a adoção para projetos de pesquisa temporários, picos sazonais de testes e estudos piloto. O crescimento do segmento é ainda impulsionado por empresas que oferecem serviços de manutenção, calibração e treinamento como parte dos contratos de locação. A locação proporciona acesso à tecnologia de ponta sem o compromisso financeiro de longo prazo.

- Por usuário final

Com base no usuário final, o mercado é segmentado em laboratórios, hospitais, institutos de pesquisa e acadêmicos, empresas farmacêuticas e de biotecnologia, bancos de sangue e outros. O segmento de laboratórios dominou em 2025 devido à adoção em larga escala de contadores gama em laboratórios de diagnóstico clínico e instalações de pesquisa de alto rendimento. Os laboratórios dependem de contadores automatizados de múltiplas placas para processar inúmeras amostras com eficiência e manter a reprodutibilidade entre os ensaios. Os laboratórios farmacêuticos e de diagnóstico reforçam ainda mais a dominância desse segmento ao integrarem contadores gama ao desenvolvimento de medicamentos e ensaios clínicos. Os avanços tecnológicos contínuos e a integração com sistemas de gerenciamento de dados reforçam a preferência dos laboratórios. Grandes laboratórios comerciais investem cada vez mais em sistemas automatizados para lidar com volumes crescentes de amostras.

O segmento de institutos de pesquisa e acadêmicos deverá apresentar o crescimento mais rápido entre 2026 e 2033, devido ao aumento dos investimentos em pesquisa biomédica, à adoção de contadores gama para ensino, treinamento e estudos especializados, e ao crescente número de projetos de pesquisa acadêmica que exigem a quantificação precisa de amostras radiomarcadas. O segmento se beneficia de contadores compactos, de poço único e semiautomatizados, adequados para aplicações educacionais e de pesquisa em pequena escala. O aumento do financiamento e das bolsas para pesquisa acadêmica acelera a adoção. Universidades e laboratórios de treinamento priorizam cada vez mais a experiência prática com contadores gama modernos.

- Por canal de distribuição

Com base no canal de distribuição, o mercado é segmentado em licitação direta e distribuidores terceirizados. O segmento de licitação direta dominou em 2025 devido às fortes compras por parte de hospitais, institutos de pesquisa e laboratórios governamentais por meio de contratos diretos com fabricantes. As licitações diretas garantem conformidade regulatória, cobertura de garantia e suporte técnico confiável. Grandes compradores institucionais preferem a compra direta para otimizar as cadeias de suprimentos e manter o controle operacional a longo prazo. Os fabricantes geralmente oferecem pacotes de instalação, treinamento e manutenção como parte dos contratos de licitação direta. A adoção contínua de sistemas automatizados de alto rendimento reforça a dominância desse segmento. Os contratos de licitação direta também facilitam compras em grande volume e o planejamento a longo prazo.

O segmento de distribuidores terceirizados deverá apresentar o crescimento mais rápido entre 2026 e 2033, principalmente entre laboratórios menores, instituições acadêmicas e instalações de teste descentralizadas. Os distribuidores oferecem opções flexíveis de aquisição, suporte técnico local e serviços de manutenção, facilitando a adoção de contadores gama por laboratórios menores. O segmento se beneficia de parcerias crescentes entre fabricantes e distribuidores regionais para expandir o alcance de mercado. Os distribuidores proporcionam tempos de resposta mais rápidos e suporte localizado para manutenção e calibração. O número crescente de laboratórios de pequeno e médio porte na América do Norte impulsiona ainda mais o crescimento do segmento.

Análise Regional do Mercado de Contadores Gama para Imunoensaios na América do Norte

- Os Estados Unidos dominaram o mercado norte-americano de contadores gama para imunoensaios, com a maior participação de mercado, de 64,6% em 2025. Esse desempenho foi caracterizado por uma infraestrutura de saúde avançada, forte financiamento para pesquisa e uma presença expressiva de importantes fabricantes de equipamentos de diagnóstico.

- Laboratórios clínicos, hospitais e institutos de pesquisa do país valorizam muito a precisão, o alto rendimento e a automação oferecidos pelos modernos contadores gama, que agilizam o processamento de amostras e aumentam a confiabilidade diagnóstica.

- Essa ampla adoção é ainda mais impulsionada por iniciativas governamentais, pela crescente prevalência de doenças crônicas e infecciosas e pela demanda cada vez maior por diagnósticos laboratoriais de alta precisão, consolidando os imunoensaios com contadores gama como uma ferramenta essencial tanto em contextos clínicos quanto de pesquisa.

Análise do Mercado de Contadores Gama para Imunoensaios nos EUA

O mercado de contadores gama para imunoensaios dos EUA detinha a maior participação de mercado na América do Norte em 2025, com 64,6% da receita, impulsionado por infraestrutura de saúde avançada, investimentos robustos em P&D e a presença de fabricantes líderes de equipamentos de diagnóstico. Laboratórios clínicos, hospitais e institutos de pesquisa estão priorizando cada vez mais contadores gama automatizados de alto rendimento para maior precisão, reprodutibilidade e eficiência do fluxo de trabalho. A crescente adoção da medicina nuclear e dos radioimunoensaios, juntamente com a crescente prevalência de doenças crônicas e infecciosas, está impulsionando ainda mais o crescimento do mercado. Além disso, a integração com sistemas de gerenciamento de informações laboratoriais (LIMS) e análises baseadas em IA está permitindo monitoramento em tempo real, insights preditivos e maior eficiência operacional. Iniciativas governamentais que apoiam avanços no diagnóstico e a expansão de programas de pesquisa acadêmica e farmacêutica também estão contribuindo para a expansão do mercado.

Análise do Mercado de Contadores Gama para Imunoensaios no Canadá

O mercado canadense de contadores gama para imunoensaios deverá crescer a uma taxa composta de crescimento anual (CAGR) notável durante o período de previsão, impulsionado pelo aumento dos investimentos em infraestrutura de saúde e instalações de pesquisa. Hospitais e centros de diagnóstico estão adotando contadores gama automatizados e de múltiplas placas para atender à crescente demanda por testes e melhorar a precisão diagnóstica. O foco crescente no monitoramento de doenças infecciosas e em testes de biomarcadores de câncer está fomentando a adoção de sistemas avançados de contagem gama. O apoio regulatório do Canadá e as iniciativas de pesquisa financiadas pelo governo incentivam a adoção de tecnologias laboratoriais inovadoras. Além disso, a presença de mão de obra qualificada em tecnologia e a crescente colaboração entre instituições acadêmicas e farmacêuticas também contribuem para a expansão do mercado.

Análise do Mercado de Contadores Gama para Imunoensaios no México

O mercado mexicano de contadores gama para imunoensaios está preparado para um crescimento constante devido à crescente conscientização sobre testes diagnósticos avançados e à prevalência cada vez maior de doenças crônicas. Hospitais, laboratórios de pesquisa e instituições acadêmicas estão investindo cada vez mais em contadores gama automatizados e de alto rendimento para melhorar a eficiência diagnóstica. O crescente foco do governo na modernização da saúde, aliado à melhoria da infraestrutura laboratorial, está acelerando a adoção pelo mercado. Soluções com boa relação custo-benefício e modelos de locação estão tornando os contadores gama mais acessíveis a laboratórios menores e centros de pesquisa regionais. Além disso, parcerias com fabricantes globais de equipamentos facilitam a transferência de tecnologia e a disponibilidade local de sistemas avançados.

Participação de mercado de contadores gama para imunoensaios na América do Norte

O setor de contadores gama para imunoensaios na América do Norte é liderado principalmente por empresas consolidadas, incluindo:

- PerkinElmer (EUA)

- Hidex (Finlândia)

- Berthold Technologies GmbH & Co. KG (Alemanha)

- LabLogic Systems Ltd (Reino Unido)

- Beckman Coulter, Inc. (EUA)

- Mirion Technologies, Inc. (EUA)

- AMETEK Inc (EUA)

- Stratec SE (Alemanha)

- Thermo Fisher Scientific Inc. (EUA)

- ZECOTEK Photonics Inc. (Canadá)

- COMECER SpA (Itália)

- Kromek Group plc (Reino Unido)

- Scintacor (Reino Unido)

- EuroProbe Ltd (Reino Unido)

- Mediso Ltd (Hungria)

- Elysia-raytest GmbH (Alemanha)

- Canberra Industries (EUA)

- Ludlum Measurements, Inc. (EUA)

- Biodex Medical Systems, Inc. (EUA)

- Grupo IBA (Bélgica)

Quais são os desenvolvimentos recentes no mercado de imunoensaios e contadores gama na América do Norte?

- Em agosto de 2025, a LabLogic posicionou o Hidex AMG como uma ferramenta ideal para laboratórios acadêmicos e de pesquisa, enfatizando novos fluxos de trabalho com manuseio automatizado de amostras, carregamento simplificado, software intuitivo e identificação opcional de frascos por QR Code. A empresa destaca suas capacidades em biodistribuição pré-clínica, radioensaios in vitro e estudos quantitativos (massa + atividade), tornando-o altamente adequado às necessidades da pesquisa moderna.

- Em maio de 2025, a LabLogic anunciou uma atualização que permite ao software Laura Radiopharma controlar diretamente o Hidex AMG, possibilitando aos usuários criar radiocromatogramas em conformidade com as normas regulatórias a partir de dados de coleta de frações por radio-HPLC. Essa atualização elimina a necessidade de entrada manual de dados e fluxos de trabalho baseados em Excel, reduzindo significativamente erros e melhorando a conformidade.

- Em abril de 2025, a Charles River Laboratories divulgou publicamente um estudo de caso sobre como sua unidade de Edimburgo integrou o software Laura LIMS da LabLogic com o hardware da Hidex, garantindo a captura direta e segura de dados e eliminando o risco de edições manuais. Isso destaca um forte incentivo à integridade de dados, rastreabilidade e conformidade regulatória em laboratórios de alto volume.

- Em abril de 2021, a LabLogic lançou um vídeo demonstrando como o contador de cintilação líquida Hidex 600 SL atinge a conformidade com a norma 21 CFR Parte 11 quando usado com o software Laura. A solução inclui trilhas de auditoria, segurança em vários níveis, assinaturas eletrônicas e recursos de bloqueio de projetos essenciais para laboratórios regulamentados.

- Em março de 2021, a LabLogic e a Hidex lançaram uma opção de leitor de código QR para o contador gama automático Hidex AMG, tornando-o o primeiro contador gama disponível comercialmente com identificação direta da amostra na tampa do frasco. Isso permite a leitura de código de barras 1D/2D de cada amostra antes da contagem, o que melhora a rastreabilidade, vincula a identificação aos resultados e fortalece a conformidade com as normas da FDA 21 CFR Parte 11.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.