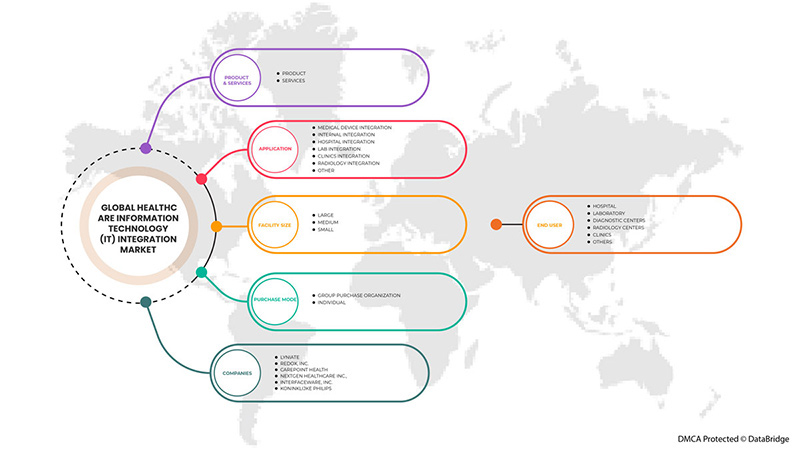

Mercado de integração de tecnologia de informação de saúde (TI) da América do Norte, por produto e serviços (produtos e serviços), aplicação ( integração de dispositivos médicos , integração interna, integração hospitalar, integração de laboratório, integração de clínicas e integração de radiologia), dimensão da instalação (grande, Média e Pequena), Modo de Compra (Organização de Compra em Grupo e Individual), Utilizador Final ( Hospitais , Laboratórios, Centros de Diagnóstico , Centros de Radiologia e Clínicas), Tendências do Sector e Previsão para 2029.

Análise e insights do mercado de integração de tecnologia de informação em saúde (TI) da América do Norte

A integração das TI na área da saúde permite que os sistemas de saúde recolham dados, os troquem com a cloud e comuniquem entre si, permitindo a análise rápida e correta desses dados. A Internet das Coisas (IoT) combina a saída do sensor com comunicações para fornecer tarefas que até recentemente eram consideradas fictícias, desde a monitorização e diagnóstico até aos métodos de entrega. Os sensores podem ser incorporados num dispositivo, baseados na nuvem ou vestíveis. Com o desenvolvimento de tais sensores e das TIC, o sector da saúde dispõe agora de uma recolha dinâmica de dados dos doentes que pode ser utilizada para apoiar os diagnósticos e os cuidados preventivos e para avaliar o provável sucesso do tratamento preventivo.

Além disso, as iniciativas de integração são frequentemente de âmbito limitado. Integram apenas uma pequena parte dos dados disponíveis dos doentes porque é difícil mover a informação entre diferentes aplicações de software clínicos e comerciais, dentro e fora das fronteiras das empresas de cuidados de saúde. Requer uma compreensão profunda da governação de dados, normas especializadas de mensagens de saúde, acesso a tecnologia sofisticada e conhecimentos especializados em integração de sistemas, incluindo arquitectura orientada a serviços (SOA) e gestão de arquitectura empresarial (EAM). O HIIF do CGI define e descreve todos os parâmetros necessários para alcançar a integração que as organizações de saúde exigem.

No entanto, prevê-se que os custos mais elevados associados às soluções integradas de TI e às questões associadas à interoperabilidade restrinjam o crescimento do mercado.

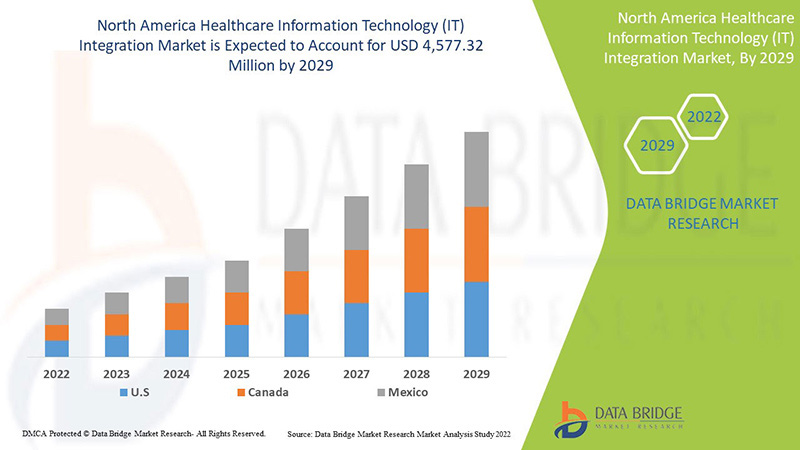

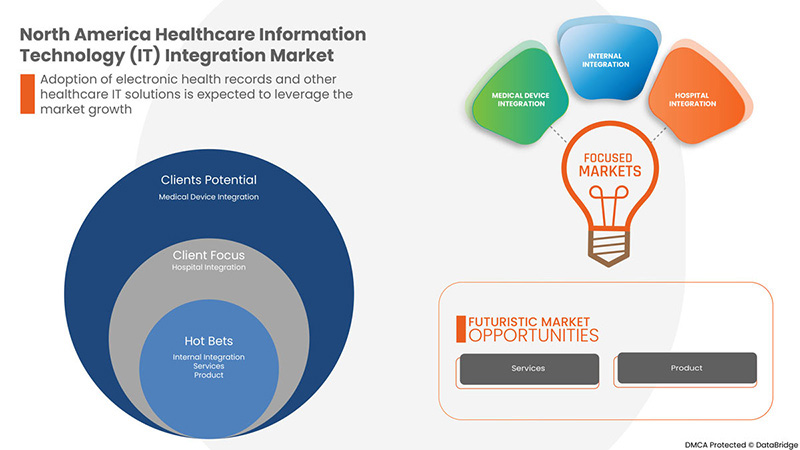

A Data Bridge Market Research analisa que o mercado de integração de tecnologia de informação (TI) em saúde da América do Norte deverá atingir um valor de 4.577,32 milhões de dólares até 2029, com um CAGR de 13,4% durante o período de previsão. Os produtos e serviços representam o maior segmento do mercado devido à rápida procura de soluções e serviços de TI na América do Norte. Este relatório de mercado também abrange análises de preços, análises de patentes e avanços tecnológicos em profundidade.

|

Métrica de reporte |

Detalhes |

|

Período de previsão |

2022 a 2029 |

|

Ano base |

2021 |

|

Anos históricos |

2020 (personalizável para 2019 - 2014) |

|

Unidades Quantitativas |

Receita em milhões de dólares, volumes em unidades, preços em dólares |

|

Segmentos cobertos |

Por produto e serviços (produtos e serviços), aplicação (integração de dispositivos médicos, integração interna, integração hospitalar, integração de laboratório, integração de clínicas e integração de radiologia), dimensão da instalação (grande, média e pequena), modo de compra (compra em grupo Organização e Individual), Utilizador Final (Hospitais, Laboratórios, Centros de Diagnóstico, Centros de Radiologia e Clínicas). |

|

Países abrangidos |

EUA, Canadá e México. |

|

Participantes do mercado abrangidos |

Lyniate, Redox, Inc., carepoint health, Nextgen Healthcare Inc., Interfaceware, Inc. Orion health, Quality syetems, Inc., Cerner corporation, Intersystems corporation, Infor Inc., GE Healthcare, MCKESSON Corporation e Meditech, entre outros. |

Definição do mercado de integração de tecnologia de informação de saúde (TI) da América do Norte

A integração de TI em saúde (tecnologia de informação em saúde) é a área de TI que envolve a conceção, desenvolvimento, criação, utilização e manutenção de sistemas de informação para o setor da saúde. Os sistemas de informação de cuidados de saúde automatizados e interoperáveis continuarão a melhorar os cuidados médicos e a saúde pública, a reduzir custos, a aumentar a eficiência, a reduzir erros e a melhorar a satisfação dos doentes, bem como a otimizar a comparticipação para prestadores de cuidados de saúde ambulatórios e hospitalares. A importância das TI na saúde resulta da combinação da evolução da tecnologia e das mudanças nas políticas governamentais que influenciam a qualidade dos cuidados prestados aos doentes. Alguns dos produtos de integração de tecnologia de informação (TI) de saúde são mecanismos de interface/integração, software de integração de dispositivos médicos e soluções de integração de media, e os serviços são a implementação e integração, suporte e manutenção, formação e educação e consultoria. A TI em saúde permite que os prestadores de cuidados de saúde gerenciem melhor os cuidados prestados aos doentes através da utilização segura e da partilha de informações de saúde. Ao desenvolver registos de saúde eletrónicos seguros e privados para a maioria dos americanos e ao disponibilizar informações de saúde eletronicamente quando e onde for necessário, as TI em saúde podem melhorar a qualidade dos cuidados de saúde, ao mesmo tempo que tornam os cuidados de saúde mais rentáveis. Com a ajuda da TI em saúde, os prestadores de cuidados de saúde terão: Informação precisa e completa sobre a saúde de um paciente. Desta forma, os prestadores podem prestar o melhor atendimento possível, seja durante uma consulta de rotina ou uma emergência médica. Isto é especialmente importante se o paciente tiver uma condição médica grave. É uma forma de partilhar informação de forma segura com os doentes e os seus familiares cuidadores através da Internet, para os doentes que optam por esta comodidade.

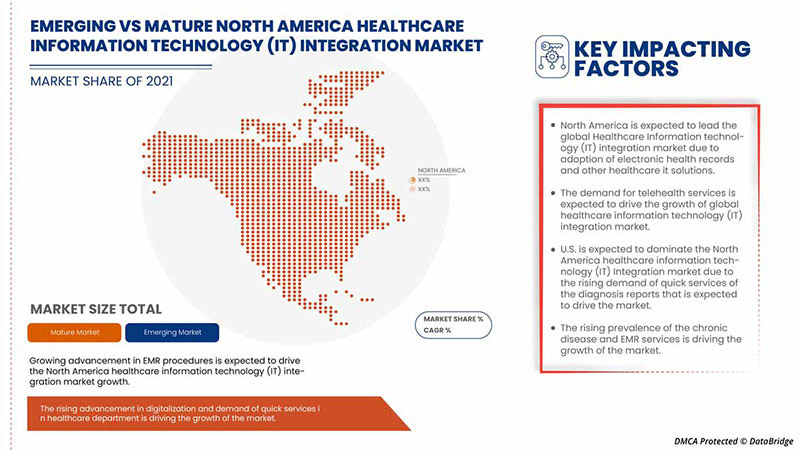

Além disso, a rápida adoção de registos de saúde eletrónicos e outras soluções de TI em saúde é um dos impulsionadores de renderização de alto impacto do mercado. Além disso, a necessidade urgente de integrar os dados dos doentes nos sistemas de saúde e nas políticas governamentais favoráveis, os programas de financiamento e as iniciativas para implementar soluções de integração de TI na saúde são os principais impulsionadores para o crescimento do mercado.

Dinâmica do mercado de integração de tecnologia de informação em saúde (TI) da América do Norte

Esta secção trata da compreensão dos impulsionadores, oportunidades, restrições e desafios do mercado. Tudo isto é discutido em detalhe abaixo:

Motoristas

- Adoção rápida de registos eletrónicos de saúde e outras soluções de TI para a saúde

Os dados dos doentes são complexos, confidenciais e muitas vezes não estruturados. Incorporar esta informação no processo de prestação de cuidados de saúde é um desafio que deve ser enfrentado para aproveitar a oportunidade de melhorar os cuidados prestados aos doentes. Embora o Registo de Saúde Eletrónico (HER) esteja em utilização há mais de uma década, o mercado acelerou recentemente devido às iniciativas governamentais em diferentes países para melhorar a segurança dos dados dos doentes.

Os requisitos regulamentares impostos pela HITECH estimularam a adoção de EHR e EMR. Outro fator importante, que está a alimentar o crescimento do mercado é o crescente número de Organizações de Atuação Responsável (ACOs), aumentando a procura por EHRs e EMRs.

Iniciativas governamentais noutros países, como a Dinamarca, a Suécia, a França e o Canadá, estão também a encorajar a adopção de RSE e a obrigar à sua utilização significativa para controlar os custos dos cuidados de saúde.

Além disso, os serviços de TI ajudam a integrar vários utilizadores finais em todo o sistema de saúde, incluindo hospitais, unidades de enfermagem, farmácias e companhias de seguros de saúde. No entanto, a integração destes dados e a sua disponibilização em tempo real é essencial para que os profissionais de saúde garantam uma tomada de decisão eficaz. Assim sendo, com o crescimento previsto dos sistemas de RSE nos próximos anos, os hospitais irão concentrar-se fortemente no aumento da sua capacidade através da integração de diferentes sistemas hospitalares com os RSE, criando assim oportunidades de desenvolvimento para o mercado de integração de tecnologias de informação (TI) em saúde.

- Procura crescente por serviços de telessaúde e soluções de monitorização remota de pacientes

Atualmente, estão a ser solicitados serviços de telessaúde para fins de monitorização e consultoria. Os avanços nas soluções de saúde ajudaram a fornecer conteúdos educativos e a garantir uma comunicação ininterrupta entre doentes e profissionais de saúde. A operação bem-sucedida de soluções de monitorização remota de doentes depende da integração bem-sucedida de dispositivos médicos e de tecnologia de informação e comunicação (TIC) que permitem a prestação de serviços médicos em longas distâncias.

Como os médicos e enfermeiros passam a maior parte do seu tempo a trabalhar sem computadores nos hospitais, é difícil para eles transportar os registos dos doentes em trânsito. Como resultado, muitos participantes do mercado começaram a oferecer plataformas móveis, como aplicações móveis, para soluções de TI na área da saúde.

Os avanços na computação proporcionaram uma gama cada vez maior de opções, como banda larga avançada, dispositivos móveis e redes, monitorização remota de pacientes, videoconferência de alta definição e EHR. Isto criou oportunidades significativas para os fornecedores de soluções integrarem a tecnologia de informação em saúde. Através de uma rede de saúde IoT que consiste em dispositivos médicos conectados, os pacientes sentados em casa podem ser monitorizados remotamente quanto aos seus sinais vitais, tais como níveis de pressão arterial, peso, nível de glicose no sangue, eletrocardiograma e temperatura corporal, uma vez que os dados do doente são enviados automaticamente para o enfermeiro ou médico.

Um ambiente de saúde ligado permite aos médicos monitorizar e ajustar remotamente a condição do paciente. As tecnologias de saúde conectada envolvem tecnologia de sensores inteligentes, conectividade avançada, melhorias de interface e análise de dados. Estes avanços ajudam a reduzir os custos dos cuidados de saúde, melhorando a aceitação dos doentes e reduzindo as visitas clínicas. Além disso, embora os custos de implementação possam ser elevados, estas tecnologias estão a ajudar a acelerar as operações de muitas empresas.

Com os avanços na tecnologia, estas soluções desempenham um papel importante na melhoria da monitorização remota e da adesão dos doentes e, consequentemente, da sua qualidade de vida. Assim, espera-se que a crescente procura por soluções de monitorização remota e dispositivos remotos impulsione o crescimento dos fornecedores de soluções de integração de tecnologia da informação (TI) de saúde na América do Norte nos próximos anos.

Restrição

- Problemas associados à interoperabilidade

A heterogeneidade dos sistemas de informação em saúde apresenta grandes desafios para o sucesso da implementação e utilização de soluções informáticas em saúde. Muitos países não possuem normas informáticas específicas para o armazenamento e intercâmbio de dados, o que leva a problemas de interoperabilidade. Embora existam muitos padrões diferentes de armazenamento, transporte e segurança de dados, a implementação e integração destes padrões de interoperabilidade representa um grande desafio para os prestadores de cuidados e para os fornecedores de soluções de TI médicas e de saúde. Devido à falta de um sistema único de informação em saúde que satisfaça todos os requisitos administrativos, clínicos, técnicos e laboratoriais dos principais prestadores de cuidados de saúde, os requisitos e normas de interoperabilidade tornaram-se importantes. Os fornecedores também seguem diferentes formatos e padrões de dados devido ao pouco conhecimento ou falta de conhecimento técnico dos padrões definidos, o que dificulta a partilha de dados em tempo real com os sistemas parceiros, o que aumenta o custo da integração das TI na área da saúde . Os problemas com a qualidade e integridade dos dados, o não cumprimento das normas estabelecidas, a falta de profissionais qualificados e a variação do tempo de atividade entre prestadores de cuidados de saúde estão entre os problemas que constituem os principais obstáculos à implementação de uma infraestrutura de TI de cuidados de saúde totalmente interoperável. Espera-se que estes fatores restrinjam o crescimento do mercado.

Oportunidade/ desafios

- Desafios relacionados com a integração de dados

As informações relacionadas com os doentes foram criadas em diferentes departamentos. No entanto, em todos os pontos de tratamento dentro da organização de cuidados de saúde, tornando-a uma indústria com maior intensidade de informação e registos de pacientes fiáveis, é essencial fornecer informações fiáveis através da combinação de grandes quantidades de dados, a fim de produzir registos de pacientes abrangentes e fiáveis, porque um Uma variedade de equipamentos médicos e instrumentos de diagnóstico são usados nos sistemas de saúde e há uma necessidade crescente de conectar todos esses sistemas para ajudar os profissionais de saúde a responder rapidamente em vários pontos de prestação de cuidados.

Diversas aplicações de gestão de informação, incluindo sistemas de gestão de ativos, sistemas de imagem, sistemas de gestão de correio eletrónico, sistemas de gestão de formulários, sistemas de informação clínica, sistemas de gestão de força de trabalho, sistemas de gestão de bancos de dados, sistemas de gestão de conteúdos, sistemas de gestão do ciclo de receitas, sistemas de fluxo de trabalho clínicos e não clínicos, e sistemas de gestão de relacionamento com o cliente nos quais inúmeras organizações de saúde investiram. À medida que as organizações de saúde adotam cada vez mais vários sistemas de TI de saúde, há uma maior necessidade de integrar diferentes tipos de sistemas de TI na arquitetura de TI da organização para garantir a utilização ideal desses sistemas e ajudar na tomada de decisões precisas . A combinação bem-sucedida de sistemas de TI de saúde com outros sistemas é o foco dos projetos de desenvolvimento de infraestruturas de TI nas organizações de saúde.

Assim, cada organização na área da saúde utiliza sistemas diferentes, e há grandes probabilidades de erros de diagnóstico e exame indevido do relatório devido à integração de dados que destrói o uso da tecnologia da informação em saúde, o que pode atuar como um desafio ao crescimento do mercado.

Impacto pós-COVID-19 no mercado de integração de tecnologia de informação (TI) na saúde da América do Norte

O surto de COVID-19 teve efeitos drásticos nos cuidados de saúde na América do Norte, estando o Reino Unido entre os países mais gravemente afectados. Devido ao surto de COVID-19, todas as clínicas de saúde estão sob imensa pressão e as instalações de saúde de todo o mundo têm estado sobrelotadas pelas visitas diárias de numerosos pacientes. A crescente prevalência da doença por coronavírus impulsionou a procura de dispositivos de diagnóstico e tratamento precisos em vários países de todo o mundo. Neste sentido, as tecnologias de cuidados conectados revelaram-se muito úteis. Permitem que os profissionais de saúde monitorizem os doentes utilizando dispositivos não invasivos ligados digitalmente, como monitores domésticos de pressão arterial e oxímetros de pulso. Além disso, a rápida propagação desta doença na América do Norte levou à escassez de camas hospitalares e de profissionais de saúde. Como resultado, os dispositivos médicos conectados foram cada vez mais adotados para monitorizar os sinais vitais, e é provável que se observe uma tendência semelhante nos próximos anos.

Os fabricantes estão a tomar várias decisões estratégicas para recuperar após a COVID-19. Os participantes estão a conduzir diversas atividades de I&D e lançamentos de produtos, bem como parcerias estratégicas para melhorar a tecnologia e os resultados dos testes envolvidos no mercado de testes farmacogenéticos.

Desenvolvimentos recentes

- Em agosto de 2022, a Cognizant anunciou que foi selecionada pela AXA UK & Ireland como parceiro tecnológico para ajudar a consolidar, modernizar e gerir parte das suas operações de TI. A AXA UK & Ireland está a transformar o seu ecossistema tecnológico para criar um ambiente de TI mais digital, moderno e ágil, rico em dados, seguro e sustentável, com custos globais mais baixos. A Cognizant irá fornecer serviços de TI integrados, abrangendo suporte e manutenção de service desk, computação para utilizadores finais, desenvolvimento e manutenção de aplicações, operações na cloud e gestão de infraestruturas de TI. Isso ajudou a empresa a expandir o seu negócio.

- Em julho de 2022, a NXGN Management, LLC, demonstrou o seu premiado NextGen Office, o único Registo de Saúde Eletrónico (RSE) integrado no Registo da American Podiatric Medical Association (APMA), na conferência anual do grupo realizada de 28 a 31 de julho em Orlando. A NextGen Healthcare é parceira fundadora do APMA Registry, que forneceu insights clinicamente relevantes aos clientes da NextGen Healthcare. Isto tem ajudado a empresa a expor os seus produtos na APMA e a obter reconhecimento.

Âmbito do mercado de integração de tecnologia de informação de saúde (TI) da América do Norte

O mercado de integração de tecnologia de informação de saúde (TI) da América do Norte está segmentado em produtos e serviços, aplicação, tamanho da instalação, modo de compra e utilizador final. O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e a diferença nos seus mercados-alvo.

Por produto e serviços

- Produto

- Serviços

Com base em produtos e serviços, o mercado norte-americano de integração de tecnologia de informação (TI) na área da saúde está segmentado em produtos e serviços.

Por aplicações

- Integração de dispositivos médicos

- Integração Interna

- Integração Hospitalar

- Integração de Laboratório

- Integração de Clínicas

- Integração Radiológica

- Outro

Com base na aplicação, o mercado de integração de tecnologia de informação de saúde (TI) da América do Norte está segmentado em integração de dispositivos médicos, integração interna, integração hospitalar, integração laboratorial, integração clínica, integração radiológica e outros.

Por tamanho da instalação

- Grande

- Médio

- Pequeno

Com base no tamanho das instalações, o mercado norte-americano de integração de tecnologia de informação (TI) na área da saúde está segmentado em grande, médio e pequeno.

Por modo de compra

- Organização de compras em grupo

- Individual

Com base no modo de compra, o mercado de integração de tecnologia de informação (TI) em saúde da América do Norte está segmentado em compras em grupo e individuais.

Por utilizador final

- Hospital

- Laboratório

- Centros de diagnóstico

- Centros de Radiologia

- Clínicas

- Outros

Com base nos utilizadores finais, o mercado norte-americano de integração de tecnologia de informação (TI) em saúde está segmentado em hospitais, laboratórios, centros de diagnóstico, centros de radiologia, clínicas, entre outros.

Análise/perspetivas regionais do mercado de integração de tecnologia de informação em saúde (TI) da América do Norte

O mercado de integração de tecnologia de informação (TI) em saúde da América do Norte é analisado, e a informação sobre o tamanho do mercado é fornecida por produtos e serviços, aplicação, tamanho da instalação, modo de compra e utilizador final.

Os países abordados neste relatório de mercado são os EUA, o Canadá e o México.

Em 2022, a América do Norte domina devido à presença dos principais players do mercado no maior mercado consumidor com um PIB elevado. Espera-se que os EUA cresçam devido ao aumento do avanço tecnológico nas TI de saúde.

A secção de países do relatório também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado interno que impactam as tendências atuais e futuras do mercado. Dados como novas vendas, vendas de reposição, demografia do país, atos regulamentares e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, são considerados a presença e disponibilidade de marcas da América do Norte e os desafios enfrentados devido à concorrência grande ou escassa de marcas locais e nacionais, e o impacto dos canais de vendas, ao mesmo tempo que se fornece uma análise de previsão dos dados do país.

Cenário competitivo e análise da quota de mercado da integração de tecnologia de informação em saúde (TI) da América do Norte

O panorama competitivo do mercado norte-americano de integração de tecnologia de informação em saúde (TI) fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em I&D, novas iniciativas de mercado, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos, pipelines de testes de produtos, aprovações de produtos, patentes, largura e respiração do produto, domínio da aplicação, curva da linha de vida da tecnologia. Os dados acima estão apenas relacionados com o foco da empresa no mercado de integração de tecnologia de informação (TI) de saúde da América do Norte.

Alguns dos principais players que operam no mercado norte-americano de integração de tecnologia de informação de saúde (TI) são a Lyniate, Redox, Inc., carepoint health, Nextgen Healthcare Inc., Interfaceware, Inc., Koninklijke Philips, Oracle, AVI -SPL, INC. , Allscripts Healthcare solutions Inc., Epic Systems Corporation, Qualcomm life Inc., Capsule Technologies Inc., Orion health, Quality syetems, Inc., Cerner corporation, Intersystems corporation, Infor Inc., GE Healthcare, MCKESSON Corporatio e Meditech, entre outros.

Metodologia de Investigação: Mercado de Integração de Tecnologia da Informação (TI) na Saúde da América do Norte

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Além disso, os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise da quota de mercado da empresa, padrões de medição, América do Norte vs regional e análise da participação dos fornecedores. Solicite uma chamada de analista em caso de dúvidas adicionais.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT AND SERVICES LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 POTENTIAL HEALTHCARE IT TECHNOLOGIES

4.1.1 EHR

4.1.2 EMR

4.1.3 ARTIFICIAL INTELLIGENCE

4.1.4 TELEMEDICINE

5 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET SHARE ANALYSIS-

6 REGULATIONS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RAPID ADOPTION OF ELECTRONIC HEALTH RECORDS AND OTHER HEALTHCARE IT SOLUTIONS

7.1.2 GROWING DEMAND FOR TELEHEALTH SERVICES AND REMOTE PATIENT MONITORING SOLUTIONS

7.1.3 GROWING REQUIREMENT OF TELEHEALTH SERVICES ACROSS HEALTHCARE SECTOR

7.2 RESTRAINS

7.2.1 ISSUES ASSOCIATED WITH INTEROPERABILITY

7.2.2 HIGH COSTS ASSOCIATED WITH INTEGRATED IT SOLUTIONS

7.3 OPPORTUNITIES

7.3.1 EARLY MEDICAL DECISIONS AND CLINICAL DECISION SUPPORT

7.3.2 DATA UNIFORMITY AND STANDARDIZED DATA EXCHANGE

7.3.3 INCREASING AWARENESS AMONG PEOPLE

7.4 CHALLENGES

7.4.1 DATA INTEGRATION RELATED CHALLENGES

7.4.2 RISING HEALTHCARE FRAUDS

8 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT AND SERVICES

8.1 OVERVIEW

8.2 SERVICES

8.2.1 SUPPORT & MAINTENANCE

8.2.2 IMPLEMENTATION & INTEGRATION

8.2.3 TRAINING & EDUCATION

8.2.4 CONSULTING

8.3 PRODUCT

8.3.1 INTERFACE/INTEGRATION ENGINES

8.3.1.1 GROUP PURCHASE ORGANIZATION

8.3.1.2 INDIVIDUAL

8.3.2 MEDICAL DEVICE INTEGRATION SOFTWARE

8.3.2.1 GROUP PURCHASE ORGANIZATION

8.3.2.2 INDIVIDUAL

8.3.3 MEDIA INTEGRATION SOLUTIONS

8.3.3.1 GROUP PURCHASE ORGANIZATION

8.3.3.2 INDIVIDUAL

8.3.4 OTHER INTEGRATION TOOLS

9 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 MEDICAL DEVICE INTEGRATION

9.3 HOSPITAL INTEGRATION

9.4 INTERNAL INTEGRATION

9.5 RADIOLOGY INTEGRATION

9.6 LAB INTEGRATION

9.7 CLINICS INTEGRATION

9.8 OTHERS

10 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE

10.1 OVERVIEW

10.2 LARGE

10.3 MEDIUM

10.4 SMALL

11 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE

11.1 OVERVIEW

11.2 GROUP PURCHASE ORGANIZATION

11.3 INDIVIDUAL

12 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITAL

12.3 DIAGNOSTIC CENTERS

12.4 RADIOLOGY CENTERS

12.5 LABORATORY

12.6 CLINICS

12.7 OTHERS

13 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 EMR PROVIDERS

16.2 ALLSCRIPTS HEALTHCARE, LLC AND/OR ITS AFFILIATES.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 NXGN MANAGEMENT, LLC

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 EPIC SYSTEMS CORPORATION

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 MEDICAL INFORMATION TECHNOLOGY, INC.

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENTS

16.6 TEGRATION PROVIDERS

16.7 INFOR.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 LYNIATE

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 QVERA

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 INTERSYSTEM CORPORATION

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 GENERAL ELECTRIC HEALTHCARE

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 COMPANY SHARE ANALYSIS

16.11.4 PRODUCT PORTFOLIO

16.11.5 RECENT DEVELOPMENTS

16.12 INTERFACEWARE INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 ORION HEALTH GROUP

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 IBM (2021)

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 COMPANY SHARE ANALYSIS

16.14.4 PRODUCT PORTFOLIO

16.14.5 RECENT DEVELOPMENTS

16.15 SUMMIT HEALTHCARE SERVICES, INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 MASIMO (2021)

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENT

16.17 MDI SOLUTIONS

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 COGNIZANT

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 SIEMENS HEALTHCARE GMBH

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 COMPANY SHARE ANALYSIS

16.19.4 PRODUCT PORTFOLIO

16.19.5 RECENT DEVELOPMENTS

16.2 REDOX, INC.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

16.21 BOTH PROVIDERS

16.22 ORACLE (2021)

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 COMPANY SHARE ANALYSIS

16.22.4 PRODUCT PORTFOLIO

16.22.5 RECENT DEVELOPMENTS

16.23 KONNKLIJKE PHILIPS N.V. (2021)

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tabela

TABLE 1 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA MEDICAL DEVICE INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA HOSPITAL INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA INTERNAL INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA RADIOLOGY INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA LAB INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA CLINICS INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA OTHERS INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA LARGE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA MEDIUM IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA SMALL IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA GROUP PURCHASE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA INDIVIDUAL IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA HOSPITAL IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA DIAGNOSTIC CENTRES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA RADIOLOGY CENTRES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA LABORATORY IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA CLINICS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA OTHERS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION))

TABLE 39 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 42 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 43 U.S. SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 44 U.S. PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 45 U.S. INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 46 U.S. MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 47 U.S. MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 48 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION))

TABLE 49 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 50 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 51 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 52 CANADA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 53 CANADA SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 54 CANADA PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 55 CANADA INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 56 CANADA MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 57 CANADA MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 58 CANADA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION))

TABLE 59 CANADA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 60 CANADA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 61 CANADA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 62 MEXICO HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 63 MEXICO SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 64 MEXICO PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 65 MEXICO INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 66 MEXICO MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 67 MEXICO MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 68 MEXICO HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION))

TABLE 69 MEXICO HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 70 MEXICO HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 71 MEXICO HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

Lista de Figura

FIGURE 1 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: SEGMENTATION

FIGURE 11 GROWING DEMAND FOR HEALTHCARE IT SOLUTION, TELEHEALTH SERVICES AND REMOTE PATIENT MONITORING SOLUTIONS ARE EXPECTED TO DRIVE THE NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET

FIGURE 14 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT AND SERVICES, 2021

FIGURE 15 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT AND SERVICES, 2022-2029 (USD MILLION)

FIGURE 16 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT AND SERVICES, CAGR (2022-2029)

FIGURE 17 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT AND SERVICES, LIFELINE CURVE

FIGURE 18 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY APPLICATION, 2021

FIGURE 19 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 20 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY APPLICATION, CAGR (2022-2029)

FIGURE 21 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY APPLICATION, LIFELINE CURVE

FIGURE 22 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY FACILITY SIZE, 2021

FIGURE 23 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY FACILITY SIZE, 2022-2029 (USD MILLION)

FIGURE 24 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY FACILITY SIZE, CAGR (2022-2029)

FIGURE 25 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY FACILITY SIZE, LIFELINE CURVE

FIGURE 26 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY PURCHASE MODE, 2021

FIGURE 27 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY PURCHASE MODE, 2022-2029 (USD MILLION)

FIGURE 28 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY PURCHASE MODE, CAGR (2022-2029)

FIGURE 29 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY PURCHASE MODE, LIFELINE CURVE

FIGURE 30 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY END USER, 2021

FIGURE 31 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY END USER, 2022-2029 (USD MILLION)

FIGURE 32 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY END USER, CAGR (2022-2029)

FIGURE 33 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY END USER, LIFELINE CURVE

FIGURE 34 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: SNAPSHOT (2021)

FIGURE 35 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY COUNTRY (2021)

FIGURE 36 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 37 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 38 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT & SERVICES (2022-2029)

FIGURE 39 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: COMPANY SHARE 2021 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.