North America Gene Synthesis Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

1.35 Billion

USD

7.28 Billion

2024

2032

USD

1.35 Billion

USD

7.28 Billion

2024

2032

| 2025 –2032 | |

| USD 1.35 Billion | |

| USD 7.28 Billion | |

|

|

|

|

Segmentação do mercado de síntese de genes na América do Norte por componente (sintetizador, consumíveis e software e serviços), tipo de gene (gene padrão, gene expresso, gene complexo e outros), tipo de síntese de genes (síntese de biblioteca de genes e síntese de genes personalizados), aplicação ( biologia sintética , engenharia genética, desenvolvimento de vacinas , anticorpos terapêuticos e outros), método (síntese em fase sólida, baseado em chip, síntese de DNA e síntese de enzimas baseada em PCR), usuário final (institutos acadêmicos e de pesquisa, laboratórios de diagnóstico, empresas de biotecnologia e farmacêuticas e outros) e canal de distribuição (licitação direta, distribuição online e distribuição por terceiros) - Tendências e previsões do setor até 2032.

Tamanho do mercado de síntese de genes na América do Norte

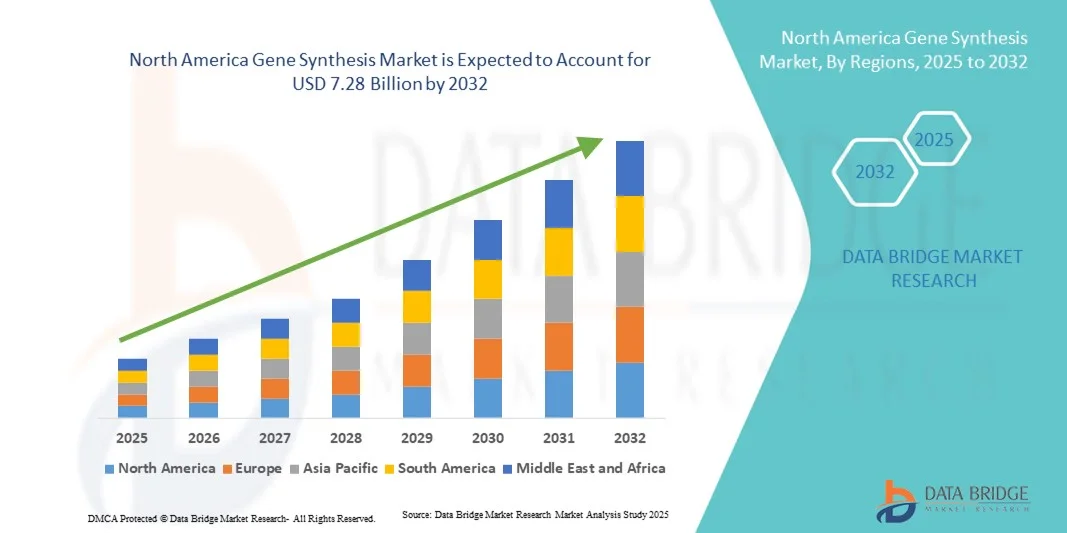

- O mercado de síntese de genes na América do Norte foi avaliado em US$ 1,35 bilhão em 2024 e espera-se que alcance US$ 7,28 bilhões até 2032 , com uma taxa de crescimento anual composta (CAGR) de 23,40% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pelos rápidos avanços na biologia sintética, nas tecnologias de sequenciamento de DNA e na automação, que, em conjunto, aprimoraram a velocidade, a precisão e a relação custo-benefício da síntese de genes. Esse progresso permitiu que pesquisadores projetassem e produzissem estruturas genéticas complexas para aplicações em diversas áreas, como a farmacêutica, a biotecnologia e a pesquisa agrícola .

- Além disso, a crescente demanda por genes personalizados para apoiar o desenvolvimento de vacinas, a medicina personalizada e a pesquisa em terapia gênica está acelerando a adoção de soluções de síntese de genes em todo o mundo. Esses fatores convergentes estão impulsionando significativamente o crescimento do mercado de síntese de genes, posicionando-o como um facilitador crucial da inovação em genômica, diagnóstico molecular e biologia sintética.

Análise do Mercado de Síntese de Genes na América do Norte

- O mercado de síntese de genes testemunhou uma expansão significativa, impulsionada principalmente pela crescente demanda por genes sintéticos nos setores de biotecnologia, farmacêutico e de pesquisa acadêmica. Os avanços contínuos na tecnologia de síntese de DNA, automação e bioinformática reduziram os custos de produção e os prazos de entrega, permitindo uma inovação mais rápida no desenvolvimento de vacinas, terapia gênica e produtos biológicos.

- O crescimento do mercado é ainda mais impulsionado pela rápida adoção da biologia sintética e da medicina de precisão, bem como pela crescente necessidade de sequências genéticas personalizadas na descoberta de medicamentos, biotecnologia agrícola e diagnósticos.

- Os EUA dominaram o mercado de síntese de genes com a maior participação de receita, de 41,6% em 2024, impulsionados por fortes investimentos em P&D, uma presença robusta de empresas-chave como Thermo Fisher Scientific, Twist Bioscience e GenScript, e amplas aplicações em pesquisa genômica, fabricação biofarmacêutica e medicina personalizada.

- Prevê-se que o Canadá seja o país com o crescimento mais rápido no mercado de síntese de genes durante o período de previsão, com uma taxa de crescimento anual composta (CAGR) esperada, impulsionada pelo aumento do financiamento da pesquisa em biotecnologia, pelo surgimento de startups de biologia sintética e pela expansão das colaborações com empresas líderes internacionais de biotecnologia.

- O segmento de síntese de genes personalizados dominou o mercado em 2024, com uma participação de 52,8%, impulsionado pela crescente necessidade de sequências de DNA sob medida para pesquisa, desenvolvimento de vacinas e descoberta de medicamentos.

Escopo do relatório e segmentação do mercado de síntese de genes

|

Atributos |

Principais informações de mercado sobre síntese de genes |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, epidemiologia de pacientes, análise de projetos em desenvolvimento, análise de preços e estrutura regulatória. |

Tendências do mercado de síntese de genes na América do Norte

Avanços por meio da integração de IA e automação

- Uma tendência significativa e crescente no mercado de síntese de genes na América do Norte é a integração de inteligência artificial (IA) e tecnologias avançadas de automação para melhorar a eficiência, a precisão e a escalabilidade dos processos de síntese de DNA. Essa convergência está transformando os fluxos de trabalho tradicionais de laboratório, permitindo uma construção de genes mais rápida, taxas de erro reduzidas e maior flexibilidade de projeto.

- Por exemplo, empresas como a Twist Bioscience e a Thermo Fisher Scientific estão implementando algoritmos baseados em IA para otimizar o projeto de sequências genéticas, prever taxas de sucesso de síntese e minimizar custos. Essas tecnologias permitem que os cientistas projetem sequências complexas rapidamente e as personalizem para diversas aplicações em biologia sintética, terapêutica e diagnóstico.

- Plataformas de automação com inteligência artificial também auxiliam na correção de erros e na validação da qualidade, garantindo construções genéticas de alta fidelidade. Essa automação reduz a intervenção manual e a variabilidade, melhorando assim a reprodutibilidade e o rendimento em aplicações de pesquisa e industriais.

- A integração da automação permite o monitoramento em tempo real e mecanismos de feedback durante a síntese, minimizando atrasos e melhorando a precisão. Isso também viabiliza a fabricação de DNA personalizada em larga escala para empresas farmacêuticas e de biotecnologia envolvidas em engenharia genética e desenvolvimento de vacinas.

- A integração da robótica com análises baseadas em IA está impulsionando os laboratórios em direção a fluxos de trabalho de síntese genética totalmente automatizados. Por exemplo, diversas empresas de biotecnologia estão utilizando sistemas automatizados de manipulação de líquidos que se integram diretamente a plataformas de IA para prever a eficiência das reações e otimizar as condições para cada sequência gênica.

- Essa tendência em direção à síntese inteligente, automatizada e de alto rendimento está remodelando as expectativas em todo o setor de biotecnologia. Consequentemente, empresas como GenScript, Twist Bioscience e Integrated DNA Technologies (IDT) estão expandindo suas plataformas de síntese de genes baseadas em IA para oferecer tempos de resposta mais rápidos e soluções econômicas para pesquisa e uso terapêutico.

- A demanda por síntese de genes integrada à IA e à automação está aumentando rapidamente em instituições de pesquisa, empresas farmacêuticas e organizações de fabricação por contrato (CMOs), à medida que buscam aumentar a produtividade e acelerar a inovação nas ciências da vida.

Dinâmica do mercado de síntese de genes na América do Norte

Motorista

Crescente demanda por biologia sintética e medicina personalizada.

- A crescente aplicação da biologia sintética e da medicina personalizada é um dos principais impulsionadores do crescimento do mercado de síntese de genes. A síntese de genes permite a criação de sequências genéticas personalizadas para uso no desenvolvimento de medicamentos, produção de vacinas e pesquisa genômica.

- Por exemplo, em março de 2024, a Twist Bioscience Corporation anunciou avanços em sua capacidade de produção de DNA sintético para atender à crescente demanda global por pesquisa genética e produção de produtos biológicos. Espera-se que esses desenvolvimentos acelerem a expansão do mercado.

- A crescente prevalência de doenças genéticas e câncer está impulsionando a pesquisa em terapias personalizadas, nas quais genes sintéticos são projetados para atender às necessidades individuais de cada paciente.

- Além disso, a crescente adoção de genes sintéticos na biotecnologia industrial — para a produção de enzimas, geração de biocombustíveis e melhorias agrícolas — está contribuindo ainda mais para o crescimento do mercado.

- A praticidade da síntese gênica rápida, precisa e econômica permite que pesquisadores ignorem os métodos tradicionais de clonagem, acelerando os cronogramas de desenvolvimento e inovação de produtos. O aumento nas pesquisas com CRISPR e terapia celular também amplifica a demanda por genes sintéticos de alta qualidade.

- Além disso, o crescimento da P&D biofarmacêutica, apoiado por iniciativas governamentais e investimentos privados, está fomentando um ambiente propício à expansão do mercado de síntese de genes.

Restrição/Desafio

Altos custos e complexidades técnicas nos processos de síntese de genes

- Apesar dos avanços tecnológicos, o alto custo associado à síntese de genes continua sendo um grande desafio, especialmente para pequenos laboratórios e instituições acadêmicas. Sequências genéticas complexas e a necessidade de alta precisão contribuem para os elevados custos de produção.

- Além disso, desafios técnicos como erros de sequenciamento, dificuldades na síntese de longos fragmentos de DNA e formação de estruturas secundárias continuam a dificultar a eficiência.

- Por exemplo, sequências longas ou repetitivas geralmente exigem múltiplas etapas de síntese e montagem, aumentando o tempo e o custo.

- As empresas estão focando em superar essas limitações por meio de sínteses químicas inovadoras, métodos aprimorados de correção de erros e automação para reduzir os custos operacionais.

- Além disso, as complexidades regulatórias relacionadas ao uso de genes sintéticos em aplicações terapêuticas e agrícolas podem atrasar a comercialização e aumentar os custos de conformidade.

- Garantir a biossegurança e os padrões éticos na pesquisa em biologia sintética também continua sendo uma preocupação crescente.

- Abordar esses desafios por meio de avanços nas tecnologias de síntese, economias de escala e estruturas regulatórias favoráveis será fundamental para o crescimento sustentado do mercado de síntese de genes.

Escopo do mercado de síntese de genes na América do Norte

O mercado é segmentado com base em componente, tipo de gene, tipo de síntese de gene, aplicação, método, usuário final e canal de distribuição.

- Por componente

Com base nos componentes, o mercado de síntese de genes é segmentado em sintetizadores, consumíveis e software e serviços. O segmento de consumíveis dominou o mercado com a maior participação na receita, de 46,5% em 2024, impulsionado principalmente pela demanda contínua e recorrente por materiais essenciais, como reagentes, primers, nucleotídeos e enzimas usados em vários processos de síntese e amplificação. Os consumíveis são fundamentais em todas as etapas da construção e teste de genes, tornando-os indispensáveis em laboratórios acadêmicos, clínicos e industriais. O crescente número de projetos de pesquisa genética, a expansão das aplicações da biologia sintética e o foco cada vez maior na medicina de precisão impulsionaram significativamente a demanda. Além disso, o aumento no número de testes diagnósticos e ensaios de terapia gênica amplifica ainda mais o consumo de reagentes de síntese, contribuindo para a dominância do segmento no mercado.

Prevê-se que o segmento de software e serviços apresente a taxa de crescimento anual composta (CAGR) mais rápida, de 19,8%, entre 2025 e 2032, impulsionado pela crescente utilização de ferramentas de bioinformática e plataformas de design baseadas em nuvem, que auxiliam na análise precisa de sequências, otimização e minimização de erros. O surgimento de algoritmos baseados em inteligência artificial para o design automatizado de genes e gerenciamento de síntese acelerou a adoção desses serviços por instituições de pesquisa e farmacêuticas. A crescente terceirização de serviços de síntese de genes por laboratórios menores com infraestrutura deficiente e a integração de plataformas digitais para gerenciamento de dados devem impulsionar ainda mais a expansão desse segmento durante o período previsto.

- Por tipo de gene

Com base no tipo de gene, o mercado de síntese de genes é segmentado em genes padrão, genes expressos, genes complexos e outros. O segmento de genes padrão dominou o mercado com uma participação de 41,3% em 2024, devido ao seu amplo uso em pesquisa básica de biologia molecular, produção de proteínas recombinantes e estudos de modificação genética. Os genes padrão são econômicos, confiáveis e adequados para sistemas de clonagem e expressão, tornando-os a escolha preferida em laboratórios de pesquisa acadêmicos e industriais. O aumento nos projetos de biologia sintética e no financiamento acadêmico para experimentos de clonagem de genes fortaleceu a liderança desse segmento. Além disso, a crescente demanda por genes padrão no desenvolvimento de diagnósticos e terapias continua impulsionando a expansão do mercado globalmente.

Prevê-se que o segmento de genes complexos registre a taxa de crescimento anual composta (CAGR) mais rápida, de 20,4%, entre 2025 e 2032, devido aos avanços nas tecnologias de síntese que permitem a criação eficiente de sequências de DNA grandes, ricas em GC ou repetitivas. Os genes complexos desempenham um papel vital em produtos biológicos de próxima geração, no desenvolvimento de vacinas e na engenharia metabólica. A crescente adoção de plataformas de síntese de alta fidelidade e métodos de correção de erros tornou viável a construção de sequências intrincadas com maior precisão. Espera-se que o aumento das aplicações no design de circuitos genéticos e em terapias de precisão acelere ainda mais o crescimento desse segmento.

- Por tipo de síntese gênica

Com base no tipo de síntese gênica, o mercado de síntese de genes é segmentado em síntese de bibliotecas gênicas e síntese gênica personalizada. O segmento de síntese gênica personalizada dominou o mercado em 2024, com uma participação de 52,8%, impulsionado pela crescente necessidade de sequências de DNA sob medida para pesquisa, desenvolvimento de vacinas e descoberta de fármacos. A síntese personalizada oferece flexibilidade para projetar sequências gênicas específicas, otimizadas para diversos organismos e sistemas de expressão proteica. A crescente tendência da medicina de precisão, o aumento das colaborações acadêmicas e as inovações em tecnologias de otimização de códons impulsionaram a demanda. A conveniência de terceirizar a síntese personalizada para provedores de serviços especializados também contribuiu para sua posição de liderança no mercado.

O segmento de síntese de bibliotecas de genes deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de 18,7%, entre 2025 e 2032, impulsionado pela crescente adoção de técnicas de triagem de alto rendimento e engenharia de proteínas. As bibliotecas de genes permitem o estudo simultâneo de múltiplas variantes genéticas, acelerando a descoberta de fármacos e a pesquisa em genômica funcional. Os avanços na automação e na síntese baseada em chips facilitaram a criação de grandes bibliotecas de forma eficiente e com baixo custo. O aumento das pesquisas em otimização de enzimas e inovações em biologia sintética deverá impulsionar ainda mais o crescimento robusto desse segmento.

- Por meio de aplicação

Com base na aplicação, o mercado de síntese de genes é segmentado em biologia sintética, engenharia genética, desenvolvimento de vacinas, anticorpos terapêuticos e outros. O segmento de biologia sintética dominou o mercado com a maior participação, de 39,6% em 2024, impulsionado pelo aumento dos investimentos no desenvolvimento de organismos geneticamente modificados, vias metabólicas e circuitos biológicos. A biologia sintética depende fortemente da síntese de genes para projetar e montar novos sistemas biológicos para aplicações industriais, farmacêuticas e agrícolas. Governos e entidades privadas estão financiando fortemente a pesquisa em biologia sintética, especialmente para a produção sustentável de biomateriais e o desenvolvimento de biocombustíveis. A versatilidade das aplicações da biologia sintética e sua integração à bioeconomia circular continuam a reforçar sua dominância.

Prevê-se que o segmento de desenvolvimento de vacinas registre a taxa de crescimento anual composta (CAGR) mais rápida, de 21,3%, entre 2025 e 2032, impulsionado pela crescente demanda por plataformas de desenvolvimento rápido de vacinas e tecnologias de genes sintéticos que permitem uma resposta rápida a doenças infecciosas emergentes. Após o sucesso das vacinas de DNA e mRNA, muitas empresas farmacêuticas estão investindo em ferramentas de genes sintéticos para desenvolver vacinas de próxima geração. A evolução contínua dos patógenos e a ênfase global na preparação para pandemias continuam a estimular a demanda neste segmento. Além disso, iniciativas governamentais que promovem a pesquisa e o desenvolvimento de vacinas e parcerias entre empresas de biotecnologia e agências de saúde pública estão acelerando a inovação nesta área. A integração da modelagem orientada por inteligência artificial e da síntese automatizada de genes está aprimorando ainda mais a precisão do desenvolvimento de vacinas e reduzindo os prazos de desenvolvimento.

- Por método

Com base no método, o mercado de síntese de genes é segmentado em síntese em fase sólida, síntese baseada em chips, síntese de DNA e síntese enzimática baseada em PCR. O segmento de síntese em fase sólida detinha a maior participação de mercado, com 44,8% em 2024, devido à sua precisão, confiabilidade e escalabilidade para a produção de longas sequências de DNA. Essa técnica minimiza os riscos de contaminação e permite a síntese automatizada e paralela, tornando-a adequada para operações de alto rendimento em ambientes farmacêuticos e de pesquisa. A inovação contínua na química de oligonucleotídeos e nos sistemas de purificação aprimorou o rendimento e a precisão. Sua ampla aplicabilidade em diagnósticos, terapêutica e biotecnologia industrial consolida sua posição de liderança no mercado.

Prevê-se que o segmento de síntese baseada em chips apresente o crescimento mais rápido, com uma taxa composta de crescimento anual (CAGR) de 20,9% entre 2025 e 2032, devido à sua capacidade de permitir a produção simultânea de milhares de oligonucleotídeos a um custo menor e com maior velocidade. A capacidade de miniaturização desse método viabiliza aplicações em armazenamento de dados de DNA, diagnóstico molecular e genômica de alto rendimento. A crescente demanda por plataformas de síntese rápidas e econômicas em pesquisa e bioinformática fortalece ainda mais as perspectivas para esse segmento. Além disso, os avanços nas tecnologias de síntese baseadas em microarrays e semicondutores estão aprimorando a escalabilidade e a precisão na produção de oligonucleotídeos. Colaborações estratégicas entre empresas de biotecnologia e desenvolvedores de tecnologia estão impulsionando ainda mais a inovação e acelerando a adoção de soluções de síntese baseadas em chips em todo o mundo.

- Por usuário final

Com base no usuário final, o mercado de síntese de genes é segmentado em instituições acadêmicas e de pesquisa, laboratórios de diagnóstico, empresas de biotecnologia e farmacêuticas, e outros. O segmento de empresas de biotecnologia e farmacêuticas dominou o mercado em 2024, com uma participação de 47,2%, impulsionado por extensas atividades de P&D em produtos biológicos, vacinas e medicina personalizada. Essas empresas dependem do DNA sintético para validação de alvos, terapia gênica e desenvolvimento de anticorpos. O aumento dos investimentos em genômica, a expansão dos portfólios de produtos biofarmacêuticos e as parcerias com provedores de serviços de síntese impulsionaram ainda mais a adoção. A integração de ferramentas de automação e otimização de sequências baseadas em IA está aumentando a produtividade, sustentando a dominância do segmento.

Prevê-se que o segmento de instituições acadêmicas e de pesquisa registre a taxa de crescimento anual composta (CAGR) mais rápida, de 19,4%, entre 2025 e 2032, impulsionado pela expansão do financiamento governamental para projetos de genômica, pelo crescimento de programas de biologia molecular e pela acessibilidade a serviços de síntese de genes de baixo custo. O crescente foco em treinamento e pesquisa colaborativa em biologia sintética e engenharia genética tem incentivado a adoção de tecnologias de síntese em universidades e organizações de pesquisa em todo o mundo. O aumento das parcerias entre a academia e empresas de biotecnologia para o desenvolvimento de genes personalizados e estudos funcionais está acelerando ainda mais a demanda. Além disso, espera-se que o estabelecimento de infraestruturas de pesquisa avançadas e polos regionais de inovação genômica aprimore a utilização de ferramentas de síntese de genes em ambientes acadêmicos.

- Por canal de distribuição

Com base no canal de distribuição, o mercado de síntese de genes é segmentado em licitação direta, distribuição online e distribuição por terceiros. O segmento de licitação direta representou a maior participação de mercado, com 49,5% em 2024, visto que a maioria dos grandes laboratórios, hospitais e empresas biofarmacêuticas prefere contratos de fornecimento de longo prazo para garantir o fornecimento consistente e a qualidade. As licitações diretas facilitam relações transparentes com os fornecedores, reduzem custos por meio de compras em grande volume e asseguram a confiabilidade nos cronogramas de pesquisa. O uso crescente de sistemas de compras centralizados em projetos governamentais e institucionais continua a fortalecer a dominância desse segmento.

Estima-se que o segmento de distribuição online apresente o crescimento mais rápido, com uma taxa composta de crescimento anual (CAGR) de 18,9% entre 2025 e 2032, impulsionado pela rápida digitalização dos canais de aquisição e pela crescente adoção de plataformas de e-commerce para suprimentos de laboratório. Os sistemas online oferecem conveniência, processamento de pedidos mais rápido e rastreamento de entregas em tempo real. Startups e pequenas instalações de pesquisa preferem plataformas online devido ao fácil acesso a uma ampla gama de produtos e preços competitivos, tornando-se uma das áreas de crescimento mais dinâmicas do mercado. O surgimento de marketplaces eletrônicos especializados em biotecnologia, que oferecem kits de síntese personalizados e serviços de entrega por assinatura, está impulsionando ainda mais a adoção. Além disso, medidas aprimoradas de segurança de dados e a integração de sistemas de recomendação baseados em inteligência artificial estão melhorando a eficiência de compra e a experiência do usuário em todos os canais de distribuição online.

Análise Regional do Mercado de Síntese de Genes na América do Norte

- O mercado de síntese de genes na América do Norte representou uma parcela significativa do mercado global em 2024.

- Impulsionada por infraestrutura biotecnológica avançada, altos investimentos em P&D e forte adoção da biologia sintética na indústria farmacêutica e na pesquisa acadêmica.

- O crescimento do mercado na região é ainda mais impulsionado pela presença de empresas líderes e por iniciativas governamentais para promover a pesquisa e a inovação genética.

Análise do Mercado de Síntese de Genes nos EUA

O mercado de síntese de genes dos EUA dominou o mercado global, com a maior participação de receita, de 41,6% em 2024, impulsionado por fortes investimentos em P&D, presença robusta de empresas-chave como Thermo Fisher Scientific, Twist Bioscience e GenScript, e ampla aplicação em pesquisa genômica, fabricação biofarmacêutica e medicina personalizada. Os avanços tecnológicos na síntese automatizada de DNA e a crescente colaboração entre instituições acadêmicas e empresas de biotecnologia impulsionaram ainda mais o crescimento do mercado no país.

Análise do Mercado de Síntese de Genes no Canadá

Prevê-se que o mercado de síntese de genes no Canadá seja o de crescimento mais rápido no período de previsão, impulsionado pelo aumento do financiamento da pesquisa em biotecnologia, pelo surgimento de startups de biologia sintética e pela expansão das colaborações com empresas líderes internacionais de biotecnologia. Espera-se que o aumento dos investimentos em inovação em ciências da vida e a demanda por serviços personalizados de síntese de genes acelerem o crescimento do mercado no país e fortaleçam sua posição regional.

Participação de mercado da síntese de genes na América do Norte

O setor de síntese de genes é liderado principalmente por empresas consolidadas, incluindo:

• Thermo Fisher Scientific Inc. (EUA)

• Twist Bioscience Corporation (EUA)

• GenScript Biotech Corporation (China)

• Integrated DNA Technologies, Inc. (EUA)

• Boster Biological Technology (EUA)

• ProteoGenix (França)

• OriGene Technologies, Inc. (EUA)

• Bio Basic Inc. (Canadá)

• ATUM (EUA)

• Eurofins Genomics (Alemanha)

• Bioneer Corporation (Coreia do Sul)

• Synbio Technologies (EUA)

• SGI-DNA (EUA)

• BlueHeron Biotech (EUA)

• Evonetix Ltd. (Reino Unido)

• DNA2.0 (EUA)

• Theragen Bio (Coreia do Sul)

• Genewiz (EUA)

• Takara Bio Inc. (Japão)

• Codex DNA (EUA)

Últimos desenvolvimentos no mercado de síntese de genes na América do Norte

- Em maio de 2023, a GenScript Biotech Corporation lançou seu serviço GenTitan Gene Fragments, que utiliza uma plataforma baseada em chip para a geração de fragmentos de DNA sintéticos em larga escala, permitindo pesquisa e desenvolvimento mais rápidos para os setores de biotecnologia e farmacêutico.

- Em novembro de 2023, a Twist Bioscience Corporation lançou seu serviço Express Genes, que oferece síntese rápida de genes (aproximadamente 5 a 7 dias úteis) utilizando sua plataforma baseada em chips de silício, reduzindo assim o tempo de resposta para construções genéticas personalizadas em aplicações de pesquisa e biofarmacêuticas.

- Em junho de 2024, a GenScript (empresa) lançou seu serviço FLASH Gene, que oferece síntese de genes a partir de sequências (S2P) com prazo de entrega de quatro dias úteis e preço fixo, visando acelerar a inovação na descoberta de medicamentos à base de anticorpos, pesquisa e desenvolvimento de vacinas e terapias celulares/gênicas.

- Em março de 2025, a Syngoi Technologies e a Ribbon Bio GmbH anunciaram uma colaboração estratégica para produzir DNA sintético de alta pureza em escala de gramas para terapias genéticas, combinando as capacidades de fabricação de DNA em larga escala da Syngoi com a plataforma de síntese genética orientada por algoritmos da Ribbon Bio.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.