North America Exosome Therapeutic Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

117.55 Million

USD

418.45 Million

2025

2033

USD

117.55 Million

USD

418.45 Million

2025

2033

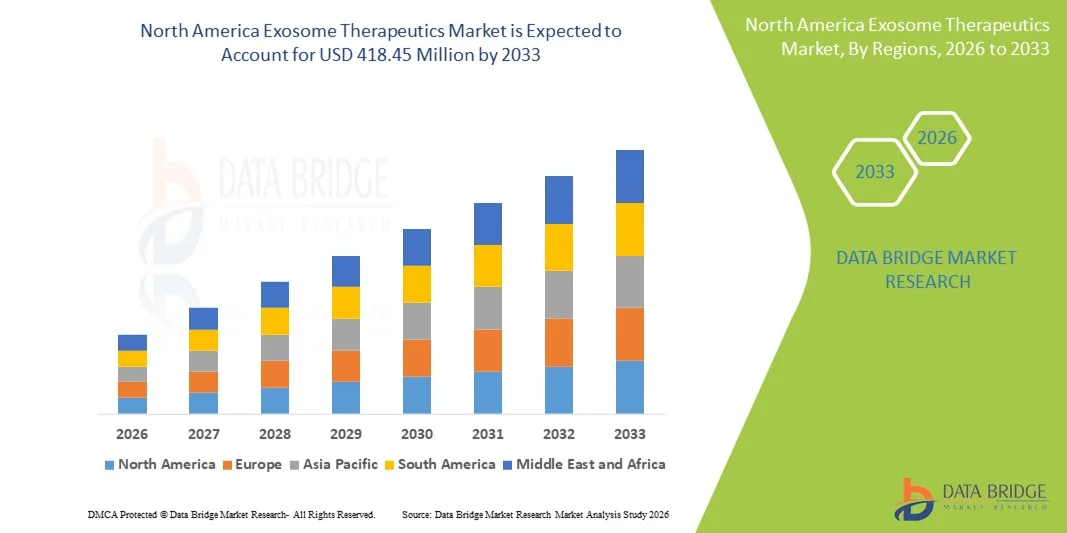

| 2026 –2033 | |

| USD 117.55 Million | |

| USD 418.45 Million | |

|

|

|

|

Segmentação do Mercado de Terapias com Exossomos na América do Norte, por Tipo (Exossomos Naturais e Exossomos Híbridos), Fonte (Células-Tronco Mesenquimais, Sangue, Fluidos Corporais, Urina, Células Dendríticas, Saliva, Leite e Outros), Terapia (Imunoterapia, Terapia Gênica e Quimioterapia), Capacidade de Transporte (Biomacromoléculas e Pequenas Moléculas), Aplicação (Distúrbios Metabólicos, Oncologia, Distúrbios Cardíacos, Neurologia, Distúrbios Inflamatórios, Transplante de Órgãos, Distúrbios Ginecológicos, Distúrbios Sanguíneos e Outros), Via de Administração (Parenteral e Oral), Usuário Final (Institutos de Pesquisa e Acadêmicos, Hospitais e Centros de Diagnóstico) - Tendências e Previsões do Setor até 2033

Tamanho do mercado de terapias com exossomos na América do Norte

- O mercado de terapias com exossomos na América do Norte foi avaliado em US$ 117,55 milhões em 2025 e espera-se que alcance US$ 418,45 milhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 17,20% durante o período de previsão.

- Esse crescimento regional é impulsionado principalmente pelo aumento dos investimentos em pesquisa e desenvolvimento, pela crescente prevalência de doenças inflamatórias crônicas e autoimunes e pelo progresso tecnológico em soluções terapêuticas baseadas em exossomos, que aprimoram a administração direcionada e as abordagens de tratamento regenerativo.

- Além disso, a forte demanda do consumidor por terapias inovadoras e minimamente invasivas, juntamente com a presença expressiva de empresas de biotecnologia e instituições de pesquisa líderes nos EUA e no Canadá, estão consolidando a terapêutica com exossomos como um segmento emergente chave na biofarmacêutica moderna, acelerando a adoção e a expansão do mercado na América do Norte.

Análise do Mercado de Terapias com Exossomos na América do Norte

- A terapêutica com exossomos engloba tratamentos biológicos avançados que utilizam vesículas extracelulares para administrar moléculas terapêuticas no tratamento de doenças e na medicina regenerativa. Essas terapias são cada vez mais reconhecidas por sua capacidade de direcionamento preciso, baixa imunogenicidade e potencial em aplicações oncológicas, neurológicas e de imunomodulação em contextos clínicos e de pesquisa.

- A crescente demanda por terapias com exossomos nos EUA é impulsionada principalmente por investimentos substanciais em pesquisa e desenvolvimento em biotecnologia, pela alta prevalência de doenças crônicas e complexas, como câncer e distúrbios neurodegenerativos, e pela crescente adoção de abordagens de medicina de precisão e personalizada que utilizam plataformas terapêuticas e de administração de fármacos baseadas em exossomos.

- Os EUA dominaram o mercado norte-americano de terapias com exossomos, com a maior participação de receita, de 80% em 2025. Esse desempenho foi caracterizado por uma infraestrutura de saúde robusta, forte financiamento federal para pesquisa e uma concentração de importantes atores da indústria e colaborações acadêmicas, fatores que, em conjunto, aceleram os ensaios clínicos, a inovação de produtos e a adoção comercial de terapias baseadas em exossomos.

- Prevê-se que o Canadá seja o segundo maior mercado da América do Norte durante o período de previsão, devido ao crescimento das iniciativas de pesquisa em biotecnologia, às políticas de saúde favoráveis e à crescente adoção clínica de terapias avançadas.

- O segmento de oncologia dominou o mercado com uma participação de 40,5%, impulsionado por extensos ensaios clínicos e pelo crescente investimento em terapias com exossomos voltadas para o câncer, que permitem a administração direcionada de medicamentos e melhores resultados de tratamento.

Escopo do relatório e segmentação do mercado de terapias com exossomos na América do Norte

|

Atributos |

Principais informações sobre o mercado de terapias com exossomos na América do Norte |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais players, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, epidemiologia de pacientes, análise de projetos em desenvolvimento, análise de preços e estrutura regulatória. |

Tendências do mercado de terapias com exossomos na América do Norte

Avanços na administração direcionada de medicamentos e na medicina de precisão

- Uma tendência significativa e crescente no mercado de terapias com exossomos nos EUA é o uso cada vez maior de exossomos como veículos de administração de medicamentos direcionados e plataformas de medicina de precisão, possibilitando terapias personalizadas para a biologia e o perfil da doença de cada paciente, em vez de tratamentos padronizados.

- Por exemplo, a pesquisa clínica está expandindo o uso de exossomos em oncologia e medicina regenerativa devido à sua capacidade de penetrar eficientemente nos microambientes tumorais e transportar cargas terapêuticas com alta especificidade.

- Esses avanços são sustentados por melhorias na engenharia de exossomos, tecnologias de isolamento microfluídico e ferramentas de sequenciamento de nova geração que aprimoram a consistência e o direcionamento terapêutico das formulações de exossomos.

- As terapias com exossomos estão sendo cada vez mais integradas em regimes de tratamento personalizados para doenças crônicas, como câncer e distúrbios neurodegenerativos, oferecendo menos efeitos colaterais e melhores resultados em comparação com os medicamentos biológicos tradicionais.

- A tendência em direção à terapia de precisão e a produtos de exossomos específicos para cada doença está remodelando as expectativas do mercado, com empresas de biotecnologia priorizando linhas de desenvolvimento que atendam às necessidades clínicas mais desafiadoras.

- A demanda por terapias com exossomos que combinam alta especificidade com mecanismos de administração personalizáveis está crescendo rapidamente tanto na pesquisa quanto nos ensaios clínicos, à medida que os sistemas de saúde buscam modelos de tratamento mais eficazes e centrados no paciente.

- A crescente colaboração entre startups de biotecnologia e instituições acadêmicas para o desenvolvimento de novas terapias baseadas em exossomos está acelerando ainda mais a inovação no setor.

- A expansão das plataformas digitais para caracterização de exossomos e análise de dados clínicos está ajudando a otimizar a pesquisa e acelerar as aprovações regulatórias.

Dinâmica do Mercado de Terapias com Exossomos na América do Norte

Motorista

Aumento da incidência de doenças crônicas e adoção da medicina personalizada

- A crescente prevalência de doenças crônicas e complexas, como câncer, distúrbios neurológicos e doenças autoimunes, é um dos principais impulsionadores do mercado de terapias com exossomos, visto que as terapias convencionais frequentemente apresentam eficácia e segurança insuficientes.

- Por exemplo, a crescente incidência de câncer e a demanda por opções de tratamento minimamente invasivas e direcionadas estão incentivando a adoção clínica de estratégias terapêuticas baseadas em exossomos com maior eficiência de administração.

- A crescente integração de práticas de medicina de precisão na área da saúde, priorizando tratamentos otimizados para pacientes individuais, está expandindo significativamente o interesse de investidores e clínicos em plataformas de exossomos.

- Além disso, o forte investimento federal e privado em P&D em biotecnologia nos EUA apoia a inovação no isolamento de exossomos, na engenharia de exossomos e no avanço de ensaios clínicos.

- Esses fatores, em conjunto, impulsionam o desenvolvimento de novas terapias em oncologia, medicina regenerativa e imunomodulação, reforçando o papel dos exossomos como terapêutica de próxima geração na prática clínica.

- A crescente conscientização e aceitação, por parte dos pacientes, das terapias baseadas em exossomos como alternativas mais seguras e eficazes aos medicamentos biológicos convencionais está impulsionando o crescimento do mercado.

- A expansão das parcerias público-privadas e das subvenções governamentais destinadas à pesquisa de terapias avançadas está permitindo uma translação clínica mais rápida das inovações baseadas em exossomos.

- A crescente presença de organizações de desenvolvimento e fabricação por contrato (CDMOs) especializadas em terapias com exossomos está facilitando uma comercialização mais rápida.

Restrição/Desafio

Complexidades regulatórias e de fabricação

- Um desafio significativo para o mercado de terapias com exossomos é o rigoroso cenário regulatório e os complexos requisitos de fabricação que dificultam a aprovação do produto e a comercialização em larga escala.

- Por exemplo, alcançar qualidade, pureza e segurança consistentes em produtos de exossomos de grau clínico exige a adesão às Boas Práticas de Fabricação (BPF) e a protocolos complexos de purificação subsequente, o que pode atrasar as revisões regulatórias.

- A necessidade de métodos padronizados de isolamento, caracterização e controle de qualidade em todos os laboratórios e instalações de produção aumenta a incerteza regulatória e retarda a adoção clínica em larga escala.

- Esses desafios de conformidade e fabricação aumentam os custos de desenvolvimento e podem limitar a velocidade com que novas terapias com exossomos chegam ao mercado, principalmente para empresas de biotecnologia menores, sem infraestrutura de produção extensa.

- Superar essas barreiras exigirá esforços coordenados entre as partes interessadas do setor, os órgãos reguladores e os inovadores tecnológicos para estabelecer diretrizes claras e soluções de produção escaláveis.

- A escassez de dados clínicos e de evidências de segurança a longo prazo para terapias com exossomos pode tornar os órgãos reguladores e os médicos cautelosos, retardando a adoção dessas terapias.

- Os elevados custos de produção e as complexas questões de escalabilidade dos exossomos de grau comercial continuam a restringir a sua ampla penetração no mercado.

- A variabilidade nas fontes de doadores e na qualidade da matéria-prima pode afetar a consistência terapêutica, criando obstáculos adicionais para a padronização e o cumprimento das normas regulamentares.

Escopo do mercado de terapias com exossomos na América do Norte

O mercado está segmentado com base no tipo, fonte, terapia, capacidade de transporte, aplicação, via de administração e usuário final.

- Por tipo

Com base no tipo, o mercado de terapias com exossomos é segmentado em exossomos naturais e exossomos híbridos. Os exossomos naturais dominaram o mercado com a maior participação na receita em 2025, impulsionados por seu perfil de segurança estabelecido e extensa validação clínica. Pesquisadores e desenvolvedores preferem os exossomos naturais porque eles carregam carga terapêutica endógena, mantêm alta biocompatibilidade e apresentam atividade biológica previsível. Instituições acadêmicas e empresas de biotecnologia têm historicamente focado em exossomos naturais para aplicações em oncologia e medicina regenerativa. A familiaridade com as regulamentações e os protocolos de isolamento padronizados também contribuem para sua ampla adoção. Seu domínio é reforçado pelo forte financiamento para pesquisa translacional e ensaios clínicos. O mercado também apresenta alta demanda por exossomos naturais devido à sua aplicabilidade imediata em estudos pré-clínicos e clínicos de fase inicial.

Prevê-se que os exossomos híbridos apresentem a taxa de crescimento mais rápida durante o período de previsão, devido às suas características projetadas que permitem maior capacidade de carga e entrega direcionada. Esses exossomos combinam vesículas naturais com materiais sintéticos ou ligantes para aumentar a estabilidade e a especificidade. Os avanços em bioengenharia e nanotecnologia aceleram o desenvolvimento de exossomos híbridos. Investidores e startups de biotecnologia estão financiando ativamente plataformas híbridas para terapias de próxima geração. Sua rápida adoção é impulsionada por resultados pré-clínicos promissores que demonstram farmacocinética aprimorada. A capacidade de adaptar os exossomos híbridos a alvos teciduais específicos contribui para o crescimento acelerado do mercado.

- Por Fonte

Com base na origem, o mercado é segmentado em células-tronco mesenquimais (MSC), sangue, fluidos corporais, urina, células dendríticas, saliva, leite e outras. Os exossomos derivados de MSC dominaram o mercado em 2025 devido às suas propriedades regenerativas e imunomoduladoras. Eles são amplamente estudados para aplicações em oncologia, ortopedia e terapias autoimunes. Os exossomos de MSC podem replicar os benefícios terapêuticos de suas células de origem sem os riscos associados ao transplante de células-tronco. Protocolos de isolamento padronizados e dados clínicos pré-estabelecidos tornam os exossomos de MSC a escolha preferencial para pesquisa e desenvolvimento. A alta versatilidade dos exossomos de MSC em diversas indicações de doenças reforça sua liderança no mercado. Seu domínio reflete a forte confiança tanto de participantes acadêmicos quanto comerciais.

Prevê-se que os exossomos derivados do sangue apresentem o crescimento mais rápido durante o período de previsão, devido à sua coleta minimamente invasiva e ao potencial para terapias personalizadas. Os exossomos derivados do sangue são adequados para administração sistêmica e carregam biomarcadores específicos da doença. Os avanços nas tecnologias de isolamento e purificação aprimoram a eficácia terapêutica e a escalabilidade. A rápida expansão da medicina de precisão e das aplicações baseadas em biomarcadores impulsiona a adoção de exossomos sanguíneos. O crescente interesse em biópsia líquida e diagnósticos não invasivos acelera ainda mais o crescimento. A colaboração entre centros clínicos e empresas de biotecnologia fomenta a pesquisa em terapias com exossomos derivados do sangue.

- Por meio da terapia

Com base na terapia, o mercado é segmentado em imunoterapia, terapia gênica e quimioterapia. A imunoterapia dominou o mercado com a maior participação na receita em 2025, devido à capacidade dos exossomos de modular as respostas imunes e apresentar antígenos de forma eficiente. Eles são amplamente explorados em oncologia para estimular a atividade antitumoral. Os exossomos imunoterapêuticos são alternativas mais seguras às terapias celulares tradicionais e reduzem a toxicidade sistêmica. O forte foco clínico e de pesquisa na modulação imunológica garante uma demanda sustentada. O investimento de empresas de biotecnologia e farmacêuticas reforça sua dominância. O segmento se beneficia da familiaridade com as regulamentações e da validação clínica contínua.

A terapia gênica mediada por exossomos deverá apresentar o crescimento mais rápido durante o período de previsão, devido à sua capacidade de administrar ácidos nucleicos, como siRNA, mRNA e componentes CRISPR, com segurança. Os exossomos reduzem a imunogenicidade em comparação com vetores virais, permitindo doses repetidas. Tecnologias de carregamento aprimoradas e ligantes de direcionamento aumentam a eficácia terapêutica. O crescente interesse em tratamentos baseados em RNA e edição genética acelera a adoção dessa tecnologia. Sucessos pré-clínicos e parcerias estratégicas impulsionam a expansão do mercado. O segmento oferece oportunidades substanciais para terapias genéticas de próxima geração.

- Por meio da capacidade de transporte

Com base na capacidade de transporte, o mercado é segmentado em biomacromoléculas e pequenas moléculas. As biomacromoléculas dominaram o mercado em 2025, visto que a maioria das terapias com exossomos se concentra na administração de proteínas, peptídeos e ácidos nucleicos. Os exossomos protegem as macromoléculas frágeis durante a administração sistêmica, garantindo a eficácia terapêutica. Protocolos e métodos analíticos estabelecidos permitem a administração de macromoléculas em larga escala. A maioria dos ensaios clínicos atualmente utiliza exossomos para o transporte de macromoléculas. A demanda é impulsionada por aplicações em oncologia, neurologia e medicina regenerativa. Seu domínio é reforçado pela familiaridade com os requisitos regulatórios para produtos biológicos.

Espera-se que o segmento de pequenas moléculas apresente o crescimento mais rápido durante o período de previsão, devido à maior biodisponibilidade e à capacidade de administração direcionada oferecida pelos exossomos. Os medicamentos de pequenas moléculas se beneficiam da redução dos efeitos colaterais e da melhoria da solubilidade. Os avanços no encapsulamento e na engenharia de exossomos aceleram a adoção dessa tecnologia. O interesse tanto de empresas farmacêuticas quanto de instituições acadêmicas impulsiona o rápido crescimento do mercado. A escalabilidade dos exossomos carregados com pequenas moléculas também contribui para o crescimento do segmento. O aumento das pesquisas sobre a reutilização de medicamentos aprovados por meio da administração de exossomos impulsiona essa tendência.

- Por meio de aplicação

Com base na aplicação, o mercado é segmentado em distúrbios metabólicos, oncologia, distúrbios cardíacos, neurologia, distúrbios inflamatórios, transplante de órgãos, distúrbios ginecológicos, distúrbios sanguíneos e outros. A oncologia dominou o mercado em 2025, com uma participação de 40,5%, devido à alta prevalência de câncer e à necessidade urgente de terapias direcionadas. Os exossomos melhoram a administração de agentes quimioterápicos e imunoterápicos diretamente aos tumores, minimizando a toxicidade sistêmica. Um sólido pipeline clínico e investimentos em pesquisa sustentam a adoção contínua. As abordagens de tratamento personalizado em oncologia estão alinhadas com as vantagens da terapia baseada em exossomos. O segmento se beneficia de altos níveis de financiamento público e do setor privado. A demanda é ainda impulsionada pela melhoria dos resultados para os pacientes e pela redução dos efeitos colaterais em comparação com as terapias convencionais.

A neurologia é a aplicação de crescimento mais rápido durante o período de previsão, visto que os exossomos demonstram a capacidade de atravessar a barreira hematoencefálica com eficácia. Pesquisadores estão explorando os exossomos para administrar agentes neuroprotetores e terapias genéticas para Alzheimer, Parkinson e outros distúrbios do SNC. Dados pré-clínicos iniciais indicam melhor direcionamento e redução da inflamação. A crescente prevalência de doenças neurodegenerativas impulsiona a demanda do mercado. Avanços na formulação e nos métodos de administração aceleram a adoção. Este segmento apresenta alto potencial tanto para ensaios clínicos quanto para comercialização.

- Por via administrativa

Com base na via de administração, o mercado é segmentado em parenteral e oral. A administração parenteral dominou em 2025 devido à administração sistêmica confiável e à biodistribuição previsível. A maioria dos estudos clínicos prefere as vias intravenosa (IV) ou intramuscular (IM) para garantir concentrações terapêuticas. Os precedentes regulatórios para produtos biológicos injetáveis tornam essa via favorável. A administração parenteral garante maior segurança ao paciente e eficácia terapêutica. A familiaridade estabelecida entre os médicos apoia a adoção generalizada. O segmento se beneficia da robusta infraestrutura de ensaios clínicos nos EUA.

A administração oral é o segmento de crescimento mais rápido durante o período de previsão, visto que as inovações em encapsulamento preservam a integridade dos exossomos no trato digestivo. A administração oral melhora a conveniência e a adesão do paciente. Essa via tem alto potencial para o manejo de doenças crônicas. Pesquisas emergentes corroboram a biodisponibilidade e a liberação direcionada por meio de formulações orais. A crescente preferência do consumidor por terapias não invasivas acelera a adoção. Os avanços nas tecnologias de administração oral sustentam o rápido crescimento do mercado.

- Por usuário final

Com base no usuário final, o mercado é segmentado em institutos de pesquisa e acadêmicos, hospitais e centros de diagnóstico. Os institutos de pesquisa e acadêmicos dominam devido ao seu papel na descoberta, elucidação de mecanismos e validação pré-clínica. Eles são responsáveis pela maior parte do desenvolvimento inicial e da preparação para ensaios clínicos. O financiamento e as colaborações com empresas de biotecnologia reforçam sua dominância no mercado. Esses institutos geram propriedade intelectual e formam cientistas qualificados. Eles impulsionam a inovação em diversas áreas terapêuticas. O segmento permanece o maior devido à extensa atividade de pesquisa fundamental.

Hospitais e centros de diagnóstico são o segmento de crescimento mais rápido durante o período de previsão, à medida que as terapias com exossomos entram em uso clínico. Eles fornecem administração, monitoramento e gerenciamento de pacientes em ensaios clínicos e programas comerciais iniciais. A demanda é impulsionada pela adoção de protocolos de medicina personalizada. A expansão da infraestrutura clínica sustenta o rápido crescimento. A maior integração com plataformas de diagnóstico acelera a utilização. A crescente aceitação das terapias baseadas em exossomos pelos pacientes impulsiona ainda mais a penetração no mercado.

Análise Regional do Mercado de Terapias com Exossomos na América do Norte

- Os EUA dominaram o mercado norte-americano de terapias com exossomos, com a maior participação de receita, de 80% em 2025. Esse desempenho foi caracterizado por uma infraestrutura de saúde robusta, forte financiamento federal para pesquisa e uma concentração de importantes atores da indústria e colaborações acadêmicas, fatores que, em conjunto, aceleram os ensaios clínicos, a inovação de produtos e a adoção comercial de terapias baseadas em exossomos.

- Pacientes e profissionais de saúde da região valorizam cada vez mais as terapias com exossomos devido à sua capacidade de direcionamento específico, baixa imunogenicidade e potencial em oncologia, medicina regenerativa e modulação imunológica, tornando-as uma opção preferencial para tratamentos de próxima geração.

- Essa ampla adoção é ainda mais sustentada pelo forte financiamento federal e privado para inovação em biotecnologia, pela concentração de importantes atores do setor, pela infraestrutura de saúde avançada e por programas ativos de ensaios clínicos, estabelecendo as terapias com exossomos como um segmento líder em medicina de precisão, tanto em pesquisa quanto em aplicações clínicas.

Análise do Mercado de Terapias com Exossomos nos EUA

O mercado de terapias com exossomos nos EUA detinha a maior participação de receita, com 80% em 2025, na América do Norte, impulsionado por um robusto ecossistema de biotecnologia e pela crescente adoção clínica de terapias de última geração. Instituições de pesquisa, hospitais e empresas de biotecnologia estão priorizando cada vez mais soluções baseadas em exossomos para administração direcionada de medicamentos, medicina regenerativa e imunoterapia. A crescente prevalência de doenças crônicas, como câncer e distúrbios neurodegenerativos, está impulsionando a demanda por terapias mais seguras e eficazes. Além disso, o forte investimento público e privado em pesquisa e desenvolvimento em biotecnologia, juntamente com uma ativa linha de ensaios clínicos, está acelerando a comercialização. A crescente conscientização sobre medicina personalizada e abordagens terapêuticas avançadas contribui ainda mais para a expansão do mercado. Ademais, as colaborações entre a academia e a indústria estão fomentando a inovação, posicionando os EUA como o principal polo de desenvolvimento de terapias com exossomos.

Análise do Mercado de Terapias com Exossomos no Canadá

Prevê-se que o mercado canadense de terapias com exossomos cresça a uma taxa composta de crescimento anual (CAGR) substancial durante o período de previsão, impulsionado pelo aumento do investimento em pesquisa biotecnológica e por iniciativas governamentais de apoio que promovem terapias avançadas. Prestadores de serviços de saúde e instituições de pesquisa canadenses estão adotando terapias baseadas em exossomos em oncologia e medicina regenerativa, refletindo uma crescente conscientização clínica. A urbanização, a expansão da infraestrutura de saúde e o foco na medicina personalizada estão fomentando a adoção em hospitais e centros acadêmicos. A disponibilidade de profissionais qualificados e a colaboração entre empresas de biotecnologia locais e instituições acadêmicas impulsionam ainda mais o crescimento. O apoio regulatório do Canadá para terapias avançadas facilita a translação clínica, criando um ambiente favorável para o lançamento de novos produtos.

Análise do Mercado de Terapias com Exossomos no México

O mercado mexicano de terapias com exossomos deverá expandir a uma taxa de crescimento anual composta (CAGR) notável durante o período de previsão, impulsionado pelo aumento dos investimentos em pesquisa clínica e infraestrutura de biotecnologia. A crescente conscientização sobre o manejo de doenças crônicas e modalidades de tratamento avançadas está incentivando a adoção de terapias baseadas em exossomos. Hospitais e centros de diagnóstico estão participando cada vez mais de ensaios clínicos para aplicações em oncologia e imunoterapia. Políticas governamentais favoráveis, juntamente com startups de biotecnologia emergentes, estão contribuindo para o crescimento do mercado. O foco do México na expansão do acesso à saúde e nas capacidades de pesquisa aumenta a adoção tanto em regiões urbanas quanto semiurbanas. Colaborações com empresas internacionais de biotecnologia também aceleram o desenvolvimento do mercado e a transferência de conhecimento.

Participação de mercado de terapias com exossomos na América do Norte

O setor de terapêutica com exossomos na América do Norte é liderado principalmente por empresas consolidadas, incluindo:

- Direct Biologics LLC (EUA)

- AEGLE Therapeutics (EUA)

- NurExone Biologic Inc. (Canadá)

- Kimera Labs (EUA)

- Xsome Biotech (EUA)

- Capricor Therapeutics, Inc. (EUA)

- Organicell (EUA)

- Aruna Bio (EUA)

- RION (EUA)

- Creative Biolabs (EUA)

- Biopartículas CD (EUA)

- Elevai Labs Inc. (EUA)

- Dinâmica Biológica (EUA)

- ExoCoBio (EUA)

- Vescell (EUA)

- PureTech Saúde (EUA)

- Bio-Techne Corporation (EUA)

- System Biosciences LLC (EUA)

- Merck KGaA (EUA)

- NanoSomiX, Inc. (EUA)

Quais são os desenvolvimentos recentes no mercado de terapias com exossomos na América do Norte?

- Em setembro de 2025, foi anunciado que a 7ª Cúpula de Desenvolvimento de Terapias Baseadas em Exossomos aconteceria em Boston, reunindo líderes da indústria, pesquisadores e inovadores biofarmacêuticos para discutir a translação clínica, a fabricação em escala e os avanços na administração terapêutica — temas cruciais para a comercialização de terapias baseadas em exossomos.

- Em fevereiro de 2025, a NurExone Biologic Inc. estabeleceu a Exo‑Top Inc., uma subsidiária sediada nos EUA focada na produção e fabricação de exossomos em conformidade com as Boas Práticas de Fabricação (GMP), fortalecendo a infraestrutura da América do Norte para o fornecimento escalável de terapias com exossomos e acelerando a preparação do pipeline clínico.

- Em novembro de 2024, a Capricor Therapeutics apresentou novos dados pré-clínicos para sua plataforma de terapia com exossomos StealthX na Reunião Anual da Associação Americana de Vesículas Extracelulares (AAEV) de 2024, destacando o potencial terapêutico da administração baseada em exossomos em múltiplos modelos de doenças, incluindo distúrbios imunológicos e degenerativos.

- Em janeiro de 2024, o AB126, terapia com exossomos neurais da Aruna Bio, recebeu aprovação da Food and Drug Administration (FDA) dos EUA para iniciar um ensaio clínico de Fase 1b/2a para o tratamento de acidente vascular cerebral isquêmico agudo, marcando a primeira vez que uma terapia baseada em exossomos entrou em ensaios clínicos em humanos para uma indicação neurológica e demonstrando o progresso na translação clínica de terapias com exossomos.

- Em maio de 2023, a Direct Biologics relatou resultados clínicos convincentes de um programa de acesso expandido utilizando seu produto de exossomos ExoFlo™ em pacientes adultos hospitalizados com COVID-19 e SDRA moderada a grave, demonstrando segurança favorável e potenciais benefícios de sobrevida. Esse marco ressaltou a aplicação terapêutica da tecnologia de exossomos no mundo real na América do Norte.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.