North America Essential Oils Market

Tamanho do mercado em biliões de dólares

CAGR :

%

| 2023 –2030 | |

| USD 6,998.52 | |

|

|

|

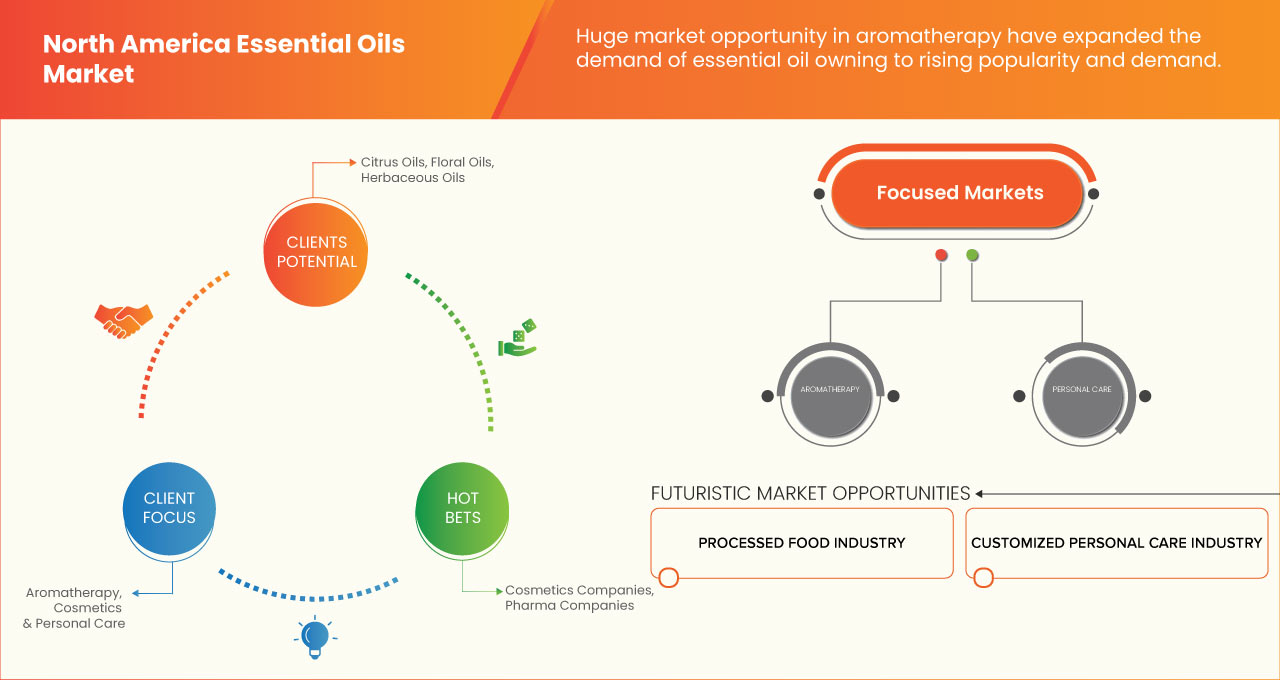

>Mercado de óleos essenciais da América do Norte, por produto ( óleos cítricos , óleos florais, óleos herbáceos, óleos canforáceos, óleos mentolados, óleos picantes, óleos resinosos/almiscarados e óleos lenhosos/terrosos), tipos (singles e misturas), categoria ( convencional e Orgânico), Método de Extração (Hidrodestilação ou a vapor, Hidrodifusão, Extração por prensa a frio, Destilação de água, Extração de fluido supercrítico, Extração por solvente, Processo assistido por micro-ondas, Extração de dióxido de carbono e outros) , Aplicação (Aromaterapia, Cosméticos e Cuidados Pessoais , Produtos de Higiene Pessoal e Produtos de Limpeza, Cuidados Domésticos, Agricultura, Alimentos e Bebidas, Energias Alternativas e Medicina, Têxteis, Purificador de Ar para Automóveis, Material de Embalagem de Alimentos e Outros), Utilizador Final (Empresas de Cosmética, Empresas Farmacêuticas, Spa Médico, Clínicas de Dermatologia e Outros) ), Canal de Distribuição (Direto e Indireto), Tendências do Setor e Previsão para 2030.

Análise e insights do mercado norte-americano de óleos essenciais

Os óleos essenciais podem ser definidos como produtos ou misturas de substâncias perfumadas ou como misturas de substâncias perfumadas e inodoras. Estas substâncias perfumadas são compostos quimicamente puros que proporcionam a respectiva distinguibilidade. São extraídos através de vários métodos, como a destilação, a extração por prensa a frio, a extração por solvente, a extração enzimática e muitos outros. A utilização de óleos essenciais está a aumentar devido à procura da indústria alimentar e de bebidas para a preparação de diversos produtos, como refrigerantes, produtos de panificação, bebidas desportivas, entre muitos outros. Além disso, os óleos essenciais ganharam procura devido aos spas e centros de relaxamento espalhados pelo país. No entanto, certos óleos essenciais podem causar efeitos alergénicos, especialmente em pessoas propensas a erupções cutâneas, e aqueles que têm alergias ao pólen podem dificultar o crescimento do mercado.

A Data Bridge Market Research analisa que o mercado norte-americano de óleos essenciais deverá atingir os 6.998,52 milhões de dólares até 2030, com um CAGR de 9,7% durante o período de previsão.

|

Métrica de reporte |

Detalhes |

|

Período de previsão |

2023 a 2030 |

|

Ano base |

2022 |

|

Anos históricos |

2021 (personalizável para 2020-2016) |

|

Unidades Quantitativas |

Receita em milhões de dólares |

|

Segmentos cobertos |

Por produto (óleos cítricos, óleos florais, óleos herbáceos, óleos canforáceos, óleos mentolados, óleos picantes, óleos resinosos/almiscarados e óleos lenhosos/terrosos), tipos (simples e misturas), categoria (convencional e biológico), método de extração ( hidrodestilação ou vapor, hidrodifusão, extracção por prensa a frio, destilação de água, extracção de fluido supercrítico, extracção por solvente, processo assistido por micro-ondas, extracção de dióxido de carbono e outros), aplicação ( aromaterapia , cosmética e cuidados pessoais, produtos de higiene pessoal e produtos de limpeza, cuidados para o lar, Agricultura, Alimentação e Bebidas, Energias Alternativas e Medicina, Têxteis, Purificadores de Ar para Automóveis, Material de Embalagem Alimentar e Outros), Utilizador Final (Empresas de Cosméticos, Empresas Farmacêuticas, Spa Médico, Clínicas de Dermatologia e Outros), Canal de Distribuição (Direto e indireto). |

|

Países abrangidos |

EUA, Canadá e México |

|

Participantes do mercado abrangidos |

Lebermuth, Inc., Óleo Essencial Floral, Kelvin Natural Mint Pvt Ltd, Aromaterapia Orgânica e Cuidados da Pele SOiL, dōTERRA, Clive Teubes Group, Óleos Essenciais Young Living, LC., Floracopeia, Robertet, Rocky Mountain Oils, LLC, Vigon International , LLC, Frontier Co-op., Synthite Industries Ltd., Silverline Chemicals, Phoenix Aromas & Essential Oils, LLC, entre outros. |

Definição de mercado

Os óleos essenciais são extratos concentrados de plantas que retêm o cheiro, o sabor e a essência naturais da sua fonte. Compostos aromáticos únicos conferem a cada óleo essencial a sua essência característica. Os óleos essenciais são obtidos por destilação (via vapor e água) ou por métodos mecânicos, como a prensagem a frio. Os óleos captam o aroma, o sabor e a essência da planta. Recebem principalmente o nome da planta da qual são derivados. As aplicações dos óleos essenciais são diversas. Amplamente utilizados em cosméticos , perfumes , alimentos e bebidas, apresentam também aplicações medicinais devido às suas propriedades terapêuticas e usos agroalimentares devido aos seus efeitos antimicrobianos e antioxidantes.

Dinâmica do mercado de óleos essenciais da América do Norte

Esta secção trata da compreensão dos impulsionadores do mercado, vantagens, oportunidades, restrições e desafios. Tudo isto é discutido em detalhe abaixo:

Motoristas

AUMENTO DA PROCURA DE ÓLEOS ESSENCIAIS NA INDÚSTRIA DE CUIDADOS PESSOAIS E FARMACÊUTICA

As indústrias cosmética, de higiene pessoal e farmacêutica utilizam amplamente óleos essenciais para a formulação de produtos de beleza, uma vez que conferem propriedades anti-envelhecimento, antioxidantes e anti-inflamatórias, contribuindo para o crescimento do mercado.

Espera-se que o aumento da procura de produtos de base biológica nas indústrias de cuidados pessoais e cosméticos aumente significativamente o crescimento do mercado de óleos essenciais durante o período de previsão. Os óleos essenciais têm propriedades benéficas significativas, tais como alto valor nutricional, versatilidade de temperatura, alto teor de esqualeno e propriedades idênticas à pele. A utilização de óleos essenciais na indústria de cuidados pessoais oferece uma variedade de benefícios. A principal razão da sua utilização em cosmética é o seu aroma agradável. A aplicação de diversos óleos essenciais, como a lavanda e o óleo da árvore do chá, na pele proporciona bastante hidratação. Os óleos essenciais também podem ser adicionados a loções, cremes, champôs e muitos outros.

Assim, prevê-se que o crescimento dos segmentos de aplicação e a crescente procura de óleos essenciais impulsionem o crescimento do mercado norte-americano de óleos essenciais.

AUMENTO DA ACEITAÇÃO PELO CONSUMIDOR DE PRODUTOS NATURAIS PARA UMA VIDA SAUDÁVEL

Os consumidores que mudam os hábitos alimentares estão mais inclinados para a indulgência consciente, o que significa que, embora queiram comer fora e comer bem, querem estar atentos ao que comem e escolherão os seus lugares após uma análise cuidadosa. Por exemplo, cerca de 78% dos millennials preferem comprar alimentos saudáveis, o que representa mais 8% do que o mercado total. Cerca de 54% dos millennials preferem alimentos vegetarianos, o que é 15% superior ao mercado total.

O resultado desta mudança de estilo de vida tem sido mais simples nos consumidores naturais de alto crescimento. Categorias de produtos como cuidados para bebés, cuidados pessoais, produtos domésticos e cosméticos também fizeram a transição das suas ofertas para atender a esta nova geração de consumidores.

Restrição

FALTA DE DISPONIBILIDADE DE MATÉRIAS-PRIMAS

A falta de disponibilidade de matéria-prima pode ser provocada pelas condições climatéricas. Em condições climáticas desfavoráveis, é difícil para os agricultores cultivar e cultivar plantas como ervas, especiarias, hortelã, citrinos e outras, havendo assim menos matérias-primas disponíveis.

A produção flutuante destas plantas resultou no fornecimento volátil destas plantas sob a forma de sementes, raízes, folhas e outros. A oferta volátil de matérias-primas também impulsiona os preços do produto final, estes óleos essenciais. Espera-se que a disponibilidade limitada de matérias-primas prejudique a cadeia de valor global do mercado, um fator chave de restrição do mercado norte-americano de óleos essenciais.

Oportunidade

MUDANÇA PARA AROMATERAPIA

Aromatherapy is increasingly considered a popular therapy, with more spas opening in various areas, increasing consumer awareness of well-being, higher demand for natural products, and its benefits in psychological and physiological health. Using essential oils in aromatherapy for personal and therapeutic purposes offers tremendous growth potential. This alternative therapy utilizes various combinations of essential oils to relieve ailments like depression, indigestion, headache, insomnia, muscular pain, respiratory problems, and others. For example, Thyme essential oil is widely used in aromatherapy to help reduce fatigue, nervousness, and stress. The availability of a wide range of aroma oils is expected to boost the North America essential oils market. Thus, the demand for essential oil enables manufacturers to launch new products to expand further, which may promote market growth in the forecast period.

Challenge

LOW PRODUCTION VOLUMES OF ESSENTIAL OILS AND INCREASING CONSUMER DEMAND

Low production volumes of essential oils and increasing consumer demand are expected to affect the market growth of North America essential oils market. High transportation rates, increased variability in rainfall, and intensive summer drought can be considered the main constraints to these crop productions. Under such conditions, adopting sustainable agricultural practices and introducing new/ underutilized crops, able to diversify cropping systems and mitigate climate changes, can represent promising strategies in addressing cropping system sustainability, crop improvement, and food security.

Thus, the increasing demand for essential oil cannot be fulfilled by the low production volumes and is expected to affect the market growth due to uncertainty in weather and the time-consuming extraction process, as well as the low content of oil after extraction. Moreover, it is expected to restrain the growth of North America's essential oils market.

Post-COVID-19 Impact on North America Essential Oils Market

Post the pandemic, the demand for essential oils has increased as there won't be more restrictions on movement, so the supply of products would be easy. In addition, the growing trend of using essential oils for their therapeutic properties and natural ingredients may propel the market's growth.

The increased demand for essential oils enables manufacturers to launch innovative and multifunctional essential oils, which ultimately increases the demand for essential oils and has helped the market grow.

Moreover, the high demand for essential oils for food and beverages and personal care products will drive the market's growth. Furthermore, the increased demand for products that boost the immune system after the COVID-19 pandemic resulted in market growth, as consumers were more concerned about their health and wellness. Additionally, consumers' interest in new flavors and enhanced fragrances is expected to fuel the growth of the North America essential oils market.

Recent Developments

- In August 2020, Young Living Essential Oils launched new products in the happy, healthy home category, including Cassia oil, Ecuadorian oregano oil, one heart essential oil.

- In October 2020, Neptune Wellness Solutions launched a brand called Forest Remedies with a collection of products developed in collaboration with IFF, which launched six essential oils lemon, sweet orange, bergamot, peppermint, eucalyptus, and tea tree oil.

North America Essential Oils Market Scope

The North America essential oils market is segmented into seven segments based on product, types, category, method of extraction, application, end user, and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product

- Citrus Oils

- Minty Oils

- Floral Oils

- Herbaceous Oils

- Camphoraceous Oils

- Spicy Oils

- Resinous/Musky Oils

- Woody/Earthy Oils

On the basis of product, the North America essential oils market is segmented into citrus oils, herbaceous oils, floral oils, minty oils, spicy oils, camphoraceous oils, resinous/musky oils, and woody/earthy oils.

Method of Extraction

- Hydro- Or- Steam- Distillation

- Water Distillation

- Cold Press Extraction

- Carbondioxide Extraction

- Solvent Extraction

- Hydrodiffusion

- Supercritical Fluid Extraction

- Microwave Assisted Process (Map)

- Others

On the basis of method of extraction, the North America essential oils market is segmented into cold pressed, solvent extraction, supercritical extraction, carbondioxide extraction, hydro-or-steam distillation, water distillation, hydrodiffusion, microwave assisted process (MAP), and others.

Category

- Organic

- Conventional

On the basis of category, the North America essential oils market is segmented into organic and conventional.

Types

- Singles

- Blends

On the basis of types, the North America essential oils market is segmented into singles and blends.

Application

- Food & Beverages

- Aromatherapy

- Cosmetics & Personal Care

- Home Care

- Toiletries and Cleaners

- Alternative Energy and Medical

- Textiles

- Automobile Air Fresher

- Agriculture

- Food Packaging Material

- Others

On the basis of application, the North America essential oils market is segmented into food & beverages, aromatherapy, cosmetic & personal care, home care, toiletries & cleaners, alternative energy and medical, textiles, automobile air fresher, agriculture, food packaging material, and others.

End User

- Empresas de cosméticos

- Empresas farmacêuticas

- Spa Médico

- Clínicas Dermatológicas

- Outros

Com base no utilizador final, o mercado norte-americano de óleos essenciais está segmentado em empresas cosméticas, empresas farmacêuticas, spa médico, clínicas dermatológicas, entre outras.

Canal de distribuição

- Direto

- Indireto

Com base no canal de distribuição, o mercado norte-americano de óleos essenciais está segmentado em direto e indireto.

Análise/perspetivas regionais do mercado de óleos essenciais da América do Norte

O mercado norte-americano de óleos essenciais é analisado, e são fornecidos insights e tendências de tamanho de mercado com base no produto, tipos, categoria, método de extração, aplicação, utilizador final e canal de distribuição, como mencionado acima.

Os países abrangidos no relatório sobre os mercados de óleos essenciais da América do Norte são os EUA, o Canadá e o México. Espera-se que os EUA dominem o mercado devido à crescente consciencialização dos benefícios dos óleos essenciais para a saúde. A secção do país do relatório também fornece fatores individuais de impacto no mercado e alterações nas regulamentações do mercado que impactam as tendências atuais e futuras do mercado. Pontos de dados, como vendas de novos e de reposição, demografia do país, epidemiologia de doenças e tarifas de importação e exportação, são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, são considerados a presença e disponibilidade de marcas da América do Norte e os desafios enfrentados devido à elevada concorrência de marcas locais e nacionais e o impacto dos canais de vendas, ao mesmo tempo que se fornece uma análise de previsão dos dados do país.

Análise do panorama competitivo e da quota de mercado dos óleos essenciais da América do Norte

O panorama competitivo do mercado norte-americano de óleos essenciais fornece detalhes dos concorrentes. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença na América do Norte, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento de produtos, largura e amplitude do produto, e domínio de aplicação. Os dados acima referidos referem-se apenas às empresas focadas no mercado norte-americano de óleos essenciais.

Alguns dos principais players que operam no mercado norte-americano de óleos essenciais são a Lebermuth, Inc., Floral Essential Oil, Kelvin Natural Mint Pvt Ltd, SOiL Organic Aromatherapy and Skincare, dōTERRA, Clive Teubes Group, Young Living Essential Oils, LC. , Floracopeia , Robertet, Rocky Mountain Oils, LLC, Vigon International, LLC, Frontier Co-op., Synthite Industries Ltd., Silverline Chemicals, Phoenix Aromas & Essential Oils, LLC, entre outros.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA ESSENTIAL OILS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE ANALYSIS

4.2.1 BARGAINING POWER OF BUYERS/CONSUMERS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 THE THREAT OF NEW ENTRANTS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 RIVALRY AMONG EXISTING COMPETITORS

4.3 KEY PRICING STRATEGIES

4.3.1 MINIMUM ADVERTISED PRICING "MAP" POLICY

4.3.2 PRIORITIZING PURITY AND POTENCY

4.4 MERGERS & ACQUISITION

4.5 PATIENT TREATMENT SUCCESS RATES

5 REGULATORY SCENARIO

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING AWARENESS RELATED TO THE HEALTH BENEFITS OF ESSENTIAL OILS

6.1.2 RISING DEMAND FOR ESSENTIAL OILS IN THE PERSONAL CARE AND PHARMACEUTICAL INDUSTRY

6.1.3 INCREASING DEMAND FOR ESSENTIAL OILS IN THE FOOD & BEVERAGE INDUSTRY

6.1.4 INCREASE IN CONSUMER ACCEPTANCE OF NATURAL PRODUCTS FOR HEALTHY LIVING

6.2 RESTRAINTS

6.2.1 LACK OF AVAILABILITY OF RAW MATERIALS

6.2.2 HIGH PRODUCTION COST FOR ESSENTIAL OILS

6.3 OPPORTUNITIES

6.3.1 SHIFT TOWARDS AROMATHERAPY

6.3.2 GROWING APPLICATION OF ESSENTIAL OIL IN-HOME CARE

6.3.3 INTRODUCTION OF NEW MANUFACTURING TECHNOLOGIES

6.4 CHALLENGES

6.4.1 ALLERGIES FROM ESSENTIAL OILS DUE TO UNAWARENESS AMONG CONSUMERS

6.4.2 LOW PRODUCTION VOLUMES OF ESSENTIAL OILS AND INCREASING CONSUMER DEMAND

7 NORTH AMERICA ESSENTIAL OILS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 CITRUS OILS

7.2.1 CITRUS OILS, BY CATEGORY

7.2.1.1 CONVENTIONAL

7.2.1.2 ORGANIC

7.2.2 CITRUS OILS, BY TYPE

7.2.2.1 ORANGE OIL

7.2.2.2 LEMON OIL

7.2.2.3 LIME OIL

7.2.2.4 BERGAMOT OIL

7.2.2.5 GRAPEFRUIT OIL

7.2.2.6 LEMONGRASS OIL

7.2.2.7 MANDARIN OIL

7.2.2.8 TANGERINE OIL

7.2.2.9 CITROELLA OIL

7.2.2.10 LITSEA CUBEBA OIL

7.2.2.11 TAGETES OIL

7.3 MINTY OILS

7.3.1 MINTY OILS, BY CATEGORY

7.3.1.1 CONVENTIONAL

7.3.1.2 ORGANIC

7.3.2 MINTY OILS, BY TYPE

7.3.2.1 PEPPERMINT OIL

7.3.2.2 SPEARMINT OIL

7.3.2.3 WINTERGREEN OIL

7.3.2.4 OTHERS

7.4 FLORAL OILS

7.4.1 FLORAL OILS, BY CATEGORY

7.4.1.1 CONVENTIONAL

7.4.1.2 ORGANIC

7.4.2 FLORAL OILS, BY TYPE

7.4.2.1 LAVENDER OIL

7.4.2.2 ROSE OIL

7.4.2.3 JASMINE OIL

7.4.2.4 CHAMOMILE OIL

7.4.2.5 GERANIUM OIL

7.4.2.6 NEROLI OIL

7.4.2.7 ROSEWOOD OIL

7.4.2.8 YLANG-YLANG OIL

7.4.2.9 PETITGRAIN OIL

7.5 SPICY OILS

7.5.1 SPICY OILS, BY CATEGORY

7.5.1.1 CONVENTIONAL

7.5.1.2 ORGANIC

7.5.2 SPICY OILS, BY TYPE

7.5.2.1 CLOVE BUD OIL

7.5.2.2 BASIL OIL

7.5.2.3 CORIANDER OIL

7.5.2.4 GINGER OIL

7.5.2.5 CUMIN OIL

7.5.2.6 CINNAMON OIL

7.5.2.7 CARDAMOM OIL

7.5.2.8 BLACK PEPPER OIL

7.5.2.9 ALLSPICE OIL

7.5.2.10 NUTMEG OIL

7.5.2.11 ANISEED OIL

7.5.2.12 CASSIA OIL

7.5.2.13 OTHERS

7.6 CAMPHORACEOUS OILS

7.6.1 CAMPHORACEOUS OILS, BY CATEGORY

7.6.1.1 CONVENTIONAL

7.6.1.2 ORGANIC

7.6.2 CAMPHORACEOUS OILS, BY TYPE

7.6.2.1 CAMPHOR OIL

7.6.2.2 EUCALYPTUS OIL

7.6.2.3 LAVANDIN OIL

7.6.2.4 LAUREL LEAF OIL

7.6.2.5 PANNYROYAL OIL

7.6.2.6 CAJEPUT OIL

7.6.2.7 OTHERS

7.7 HERBACEOUS OILS

7.7.1 HERBACEOUS OILS, BY CATEGORY

7.7.1.1 CONVENTIONAL

7.7.1.2 ORGANIC

7.7.2 HERBACEOUS OILS, BY TYPE

7.7.2.1 OREGANO OIL

7.7.2.2 ROSEMARY OIL

7.7.2.3 THYME OIL

7.7.2.4 CHAMOMILE OIL

7.7.2.5 TEA TREE OIL

7.7.2.6 CLARY SAGE OIL

7.7.2.7 EUCALYTUS OIL

7.7.2.8 FENNEL OIL

7.7.2.9 SAGE DALMATIAN OIL

7.7.2.10 PARSLEY OIL

7.7.2.11 ANGELICA ROOT OIL

7.7.2.12 BAY LAUREL OIL

7.7.2.13 CATNIP OIL

7.7.2.14 HYSSOP OIL

7.7.2.15 MARJORAM OIL

7.7.2.16 MELISSA OIL

7.7.2.17 YARROW OIL

7.7.2.18 OTHERS

7.8 RESINOUS/MUSKY OILS

7.8.1 RESINOUS/MUSKY OILS, BY CATEGORY

7.8.1.1 CONVENTIONAL

7.8.1.2 ORGANIC

7.8.2 RESINOUS/MUSKY OILS, BY TYPE

7.8.2.1 BENZOIN OIL

7.8.2.2 ELEMI OIL

7.8.2.3 FRANKINCENSE OIL

7.8.2.4 MYRRH OIL

7.8.2.5 PERU BALSAM OIL

7.8.2.6 OTHERS

7.9 WOODY/EARTHY OILS

7.9.1 WOODY/EARTHY OILS, BY CATEGORY

7.9.1.1 CONVENTIONAL

7.9.1.2 ORGANIC

7.9.2 WOODY/EARTHY OILS, BY TYPE

7.9.2.1 ROSEWOOD OIL

7.9.2.2 SANDALWOOD OIL

7.9.2.3 VETIVER OIL

7.9.2.4 PINE OIL

7.9.2.5 CARROT SEED OIL

7.9.2.6 CEDARWOOD OIL

7.9.2.7 JUNIPER BERRY OIL

7.9.2.8 FIR OIL

7.9.2.9 VALERIAN OIL

7.9.2.10 CYPRESS OIL

7.9.2.11 PALO SANTO OIL

7.9.2.12 OTHERS

8 NORTH AMERICA ESSENTIAL OILS MARKET, BY TYPES

8.1 OVERVIEW

8.2 SINGLES

8.3 BLENDS

9 NORTH AMERICA ESSENTIAL OILS MARKET, BY CATEGORY

9.1 OVERVIEW

9.2 CONVENTIONAL

9.3 ORGANIC

10 NORTH AMERICA ESSENTIAL OILS MARKET, BY METHOD OF EXTRACTION

10.1 OVERVIEW

10.2 HYDRO- OR- STEAM- DISTILLATION

10.3 WATER DISTILLATION

10.4 COLD PRESS EXTRACTION

10.5 CARBONDIOXIDE EXTRACTION

10.6 SOLVENT EXTRACTION

10.7 HYDRODIFFUSION

10.8 SUPERCRITICAL FLUID EXTRACTION

10.9 MICROWAVE ASSISTED PROCESS (MAP)

10.1 OTHERS

11 NORTH AMERICA ESSENTIAL OILS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 FOOD & BEVERAGES

11.2.1 CONFECTIONERY

11.2.2 BEVERAGES

11.2.2.1 CARBONATED DRINKS

11.2.2.2 ALMOND MILK

11.2.2.3 ICED TEA

11.2.2.4 OTHERS

11.2.3 BAKERY

11.2.3.1 BREAD & BUNS

11.2.3.2 PASTRY

11.2.3.3 MUFFIN & CUPCAKES

11.2.3.4 OTHERS

11.2.4 DAIRY PRODUCTS

11.2.5 RTE MEALS

11.2.6 SNACKS & NUTRITIONAL BARS

11.2.7 MEAT, POULTRY & SEAFOOD

11.2.8 OTHERS

11.3 AROMATHERAPY

11.3.1 SPA & RELAXATION THERAPY

11.3.2 INSOMNIA THERAPY

11.3.3 PAIN MANAGEMENT

11.3.4 SKIN & HAIR CARE THERAPY

11.3.5 SCAR MANAGEMENT

11.3.6 COUGH & COLD THERAPY

11.4 COSMETICS & PERSONAL CARE

11.4.1 PERFUMES & BODY SPRAYS/MISTS

11.4.2 SKIN CARE

11.4.3 HAIR CARE

11.4.4 MAKEUP AND COLOR COSMETICS

11.4.5 SOAPS

11.5 HOME CARE

11.5.1 AIR FRESHER

11.5.2 SCENTED CANDLES

11.5.3 OTHERS

11.6 TOILETRIES AND CLEANERS

11.6.1 FABRIC CARE

11.6.2 DETERGENTS

11.6.3 HANDWASH

11.6.4 KITCHEN CLEANERS

11.6.5 BATHROOM CLEANER

11.6.6 FLOOR CLEANER

11.6.7 OTHERS

11.7 ALTERNATIVE ENERGY AND MEDICAL

11.7.1 INFLAMMATORY DISEASE

11.7.2 NERVOUS SYSTEM

11.7.3 MICROBIAL INFECTIONS

11.7.4 ALLERGIES

11.8 TEXTILES

11.9 AUTOMOBILE AIR FRESHER

11.1 AGRICULTURE

11.11 FOOD PACKAGING MATERIAL

11.12 OTHERS

12 NORTH AMERICA ESSENTIAL OILS MARKET, BY END USER

12.1 OVERVIEW

12.2 COSMETIC COMPANIES

12.3 PHARMA COMPANIES

12.4 MEDICAL SPA

12.5 DERMATOLOGY CLINICS

12.6 OTHERS

13 NORTH AMERICA ESSENTIAL OILS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT

13.3 INDIRECT

13.3.1 STORE-BASED RETAILING

13.3.1.1 WHOLESALERS

13.3.1.2 CONVENIENCE STORES

13.3.1.3 SPECIALTY STORES

13.3.1.4 SUPERMARKETS/HYPERMARKETS

13.3.1.5 GROCERY STORES

13.3.1.6 OTHERS

13.3.2 NON-STORE RETAILING

13.3.2.1 ONLINE

13.3.2.2 VENDING

14 NORTH AMERICA ESSENTIAL OILS MARKET, BY COUNTRY

14.1 U.S.

14.2 CANADA

14.3 MEXICO

15 COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 DOTERRA

17.1.1 COMPANY SNAPSHOT

17.1.2 PRODUCT PORTFOLIO

17.1.3 RECENT DEVELOPMENTS

17.2 YOUNG LIVING ESSENTIAL OILS.

17.2.1 COMPANY SNAPSHOT

17.2.2 PRODUCT PORTFOLIO

17.2.3 RECENT DEVELOPMENTS

17.3 ROBERTET

17.3.1 COMPANY SNAPSHOT

17.3.2 RECENT FINANCIALS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENTS

17.4 SYNTHITE INDUSTRIES LTD.

17.4.1 COMPANY SNAPSHOT

17.4.2 PRODUCT PORTFOLIO

17.4.3 RECENT DEVELOPMENT

17.5 FRONTIER CO-OP.

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 RECENT DEVELOPMENT

17.6 ARBRESSENCE

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 FLORACOPEIA

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 FLORAL ESSENTIAL OIL

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 KELVIN NATURAL MINT PVT. LTD.

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 LEBERMUTH, INC

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 PHOENIX AROMAS & ESSENTIAL OILS, LLC

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 ROCKY MOUNTAIN OILS, LLC

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 SILVERLINE CHEMICALS.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 SOIL ORGANIC AROMATHERAPY AND SKINCARE

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 VIGON INTERNATION LLC

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tabela

TABLE 1 MERGERS & ACQUISITION

TABLE 2 NORTH AMERICA ESSENTIAL OILS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA ESSENTIAL OILS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 4 NORTH AMERICA ESSENTIAL OILS MARKET, BY PRODUCT, 2021-2030 (USD/TONS)

TABLE 5 NORTH AMERICA CITRUS OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA CITRUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA CITRUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 8 NORTH AMERICA CITRUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 9 NORTH AMERICA MINTY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA MINTY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA MINTY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 12 NORTH AMERICA MINTY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 13 NORTH AMERICA FLORAL OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA FLORAL OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA FLORAL OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 16 NORTH AMERICA FLORAL OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 17 NORTH AMERICA SPICY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA SPICY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA SPICY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 20 NORTH AMERICA SPICY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 21 NORTH AMERICA CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 24 NORTH AMERICA CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 25 NORTH AMERICA HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 28 NORTH AMERICA HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 29 NORTH AMERICA RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 32 NORTH AMERICA RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 33 NORTH AMERICA WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 36 NORTH AMERICA WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 37 NORTH AMERICA ESSENTIAL OILS MARKET, BY TYPES, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA ESSENTIAL OILS MARKET, BY METHOD OF EXTRACTION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA ESSENTIAL OILS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA FOOD & BEVERAGES IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA BEVERAGES IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA BAKERY IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA AROMATHERAPY IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA COSMETICS & PERSONAL CARE IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA HOME CARE IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA TOILETRIES AND CLEANERS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA ALTERNATIVE ENERGY AND MEDICAL IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA ESSENTIAL OILS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA ESSENTIAL OILS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA INDIRECT IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA STORE-BASED RETAILING IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 53 NORTH AMERICA NON-STORE RETAILING IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA ESSENTIAL OILS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA ESSENTIAL OILS MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 56 NORTH AMERICA ESSENTIAL OILS MARKET, BY COUNTRY, 2021-2030 (ASP/TONS)

TABLE 57 U.S. ESSENTIAL OILS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 58 U.S. ESSENTIAL OILS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 59 U.S. ESSENTIAL OILS MARKET, BY PRODUCT, 2021-2030 (USD/TONS)

TABLE 60 U.S. CITRUS OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 61 U.S. CITRUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 62 U.S. CITRUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 63 U.S. CITRUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 64 U.S. FLORAL OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 65 U.S. FLORAL OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 U.S. FLORAL OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 67 U.S. FLORAL OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 68 U.S. HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 69 U.S. HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 U.S. HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 71 U.S. HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 72 U.S. CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 73 U.S. CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 74 U.S. CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 75 U.S. CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 76 U.S. MINTY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 77 U.S. MINTY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 U.S. MINTY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 79 U.S. MINTY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 80 U.S. SPICY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 81 U.S. SPICY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 U.S. SPICY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 83 U.S. SPICY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 84 U.S. RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 85 U.S. RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 U.S. RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 87 U.S. RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 88 U.S. WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 89 U.S. WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 90 U.S. WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 91 U.S. WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 92 U.S. ESSENTIAL OILS MARKET, BY TYPES, 2021-2030 (USD MILLION)

TABLE 93 U.S. ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 94 U.S. ESSENTIAL OILS MARKET, BY METHOD OF EXTRACTION, 2021-2030 (USD MILLION)

TABLE 95 U.S. ESSENTIAL OILS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 96 U.S. FOOD & BEVERAGES IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 U.S. BAKERY IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 U.S. BEVERAGES IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 U.S. AROMATHERAPY IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 U.S. COSMETICS & PERSONAL CARE IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 101 U.S. TOILETRIES AND CLEANERS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 102 U.S. HOME CARE IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 103 U.S. ALTERNATIVE ENERGY AND MEDICAL IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 104 U.S. ESSENTIAL OILS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 105 U.S. ESSENTIAL OILS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 106 U.S. INDIRECT IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 U.S. STORE-BASED RETAILING IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 108 U.S. NON-STORE RETAILING IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 109 CANADA ESSENTIAL OILS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 110 CANADA ESSENTIAL OILS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 111 CANADA ESSENTIAL OILS MARKET, BY PRODUCT, 2021-2030 (USD/TONS)

TABLE 112 CANADA CITRUS OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 113 CANADA CITRUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 114 CANADA CITRUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 115 CANADA CITRUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 116 CANADA FLORAL OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 117 CANADA FLORAL OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 118 CANADA FLORAL OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 119 CANADA FLORAL OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 120 CANADA HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 121 CANADA HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 122 CANADA HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 123 CANADA HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 124 CANADA CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 125 CANADA CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 126 CANADA CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 127 CANADA CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 128 CANADA MINTY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 129 CANADA MINTY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 130 CANADA MINTY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 131 CANADA MINTY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 132 CANADA SPICY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 133 CANADA SPICY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 134 CANADA SPICY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 135 CANADA SPICY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 136 CANADA RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 137 CANADA RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 138 CANADA RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 139 CANADA RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 140 CANADA WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 141 CANADA WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 142 CANADA WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 143 CANADA WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 144 CANADA ESSENTIAL OILS MARKET, BY TYPES, 2021-2030 (USD MILLION)

TABLE 145 CANADA ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 146 CANADA ESSENTIAL OILS MARKET, BY METHOD OF EXTRACTION, 2021-2030 (USD MILLION)

TABLE 147 CANADA ESSENTIAL OILS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 148 CANADA FOOD & BEVERAGES IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 149 CANADA BAKERY IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 150 CANADA BEVERAGES IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 151 CANADA AROMATHERAPY IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 152 CANADA COSMETICS & PERSONAL CARE IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 153 CANADA TOILETRIES AND CLEANERS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 154 CANADA HOME CARE IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 155 CANADA ALTERNATIVE ENERGY AND MEDICAL IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 156 CANADA ESSENTIAL OILS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 157 CANADA ESSENTIAL OILS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 158 CANADA INDIRECT IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 159 CANADA STORE-BASED RETAILING IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 160 CANADA NON-STORE RETAILING IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 161 MEXICO ESSENTIAL OILS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 162 MEXICO ESSENTIAL OILS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 163 MEXICO ESSENTIAL OILS MARKET, BY PRODUCT, 2021-2030 (USD/TONS)

TABLE 164 MEXICO CITRUS OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 165 MEXICO CITRUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 166 MEXICO CITRUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 167 MEXICO CITRUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 168 MEXICO FLORAL OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 169 MEXICO FLORAL OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 170 MEXICO FLORAL OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 171 MEXICO FLORAL OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 172 MEXICO HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 173 MEXICO HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 174 MEXICO HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 175 MEXICO HERBACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 176 MEXICO CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 177 MEXICO CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 178 MEXICO CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 179 MEXICO CAMPHORACEOUS OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 180 MEXICO MINTY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 181 MEXICO MINTY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 182 MEXICO MINTY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 183 MEXICO MINTY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 184 MEXICO SPICY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 185 MEXICO SPICY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 186 MEXICO SPICY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 187 MEXICO SPICY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 188 MEXICO RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 189 MEXICO RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 190 MEXICO RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 191 MEXICO RESINOUS/MUSKY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 192 MEXICO WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 193 MEXICO WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 194 MEXICO WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 195 MEXICO WOODY/EARTHY OILS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD/TONS)

TABLE 196 MEXICO ESSENTIAL OILS MARKET, BY TYPES, 2021-2030 (USD MILLION)

TABLE 197 MEXICO ESSENTIAL OILS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 198 MEXICO ESSENTIAL OILS MARKET, BY METHOD OF EXTRACTION, 2021-2030 (USD MILLION)

TABLE 199 MEXICO ESSENTIAL OILS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 200 MEXICO FOOD & BEVERAGES IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 201 MEXICO BAKERY IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 202 MEXICO BEVERAGES IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 203 MEXICO AROMATHERAPY IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 204 MEXICO COSMETICS & PERSONAL CARE IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 205 MEXICO TOILETRIES AND CLEANERS IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 206 MEXICO HOME CARE IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 207 MEXICO ALTERNATIVE ENERGY AND MEDICAL IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 208 MEXICO ESSENTIAL OILS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 209 MEXICO ESSENTIAL OILS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 210 MEXICO INDIRECT IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 211 MEXICO STORE-BASED RETAILING IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 212 MEXICO NON-STORE RETAILING IN ESSENTIAL OILS MARKET, BY TYPE, 2021-2030 (USD MILLION)

Lista de Figura

FIGURE 1 NORTH AMERICA ESSENTIAL OILS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ESSENTIAL OILS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ESSENTIAL OILS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ESSENTIAL OILS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ESSENTIAL OILS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ESSENTIAL OILS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA ESSENTIAL OILS MARKET: DBMR SAFETY MARKET POSITION GRID

FIGURE 8 NORTH AMERICA ESSENTIAL OILS MARKET: APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA ESSENTIAL OILS MARKET: SEGMENTATION

FIGURE 10 INCREASE IN AWARENESS RELATED TO THE HEALTH BENEFITS OF ESSENTIAL OILS IS EXPECTED TO DRIVE THE NORTH AMERICA ESSENTIAL OILS MARKET IN THE FORECAST PERIOD

FIGURE 11 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ESSENTIAL OILS MARKET IN 2022 & 2029

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA ESSENTIAL OILS MARKET

FIGURE 13 NORTH AMERICA ESSENTIAL OILS MARKET: BY PRODUCT, 2022

FIGURE 14 NORTH AMERICA ESSENTIAL OILS MARKET: BY TYPES, 2022

FIGURE 15 NORTH AMERICA ESSENTIAL OILS MARKET: BY CATEGORY, 2022

FIGURE 16 NORTH AMERICA ESSENTIAL OILS MARKET: BY METHOD OF EXTRACTION, 2022

FIGURE 17 NORTH AMERICA ESSENTIAL OILS MARKET: BY APPLICATION, 2022

FIGURE 18 NORTH AMERICA ESSENTIAL OILS MARKET: BY END USER, 2022

FIGURE 19 NORTH AMERICA ESSENTIAL OILS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 20 NORTH AMERICA ESSENTIAL OILS MARKET: SNAPSHOT (2022)

FIGURE 21 NORTH AMERICA ESSENTIAL OILS MARKET: BY COUNTRY (2022)

FIGURE 22 NORTH AMERICA ESSENTIAL OILS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 23 NORTH AMERICA ESSENTIAL OILS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 24 NORTH AMERICA ESSENTIAL OILS MARKET: BY PRODUCT (2023-2030)

FIGURE 25 NORTH AMERICA ESSENTIAL OILS MARKET: COMPANY SHARE 2022 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.