>Mercado de embalagens ecológicas da América do Norte, por tipo (embalagens de conteúdo reciclado, embalagens reutilizáveis e embalagens degradáveis), tipo de material (papel e cartão, plástico, metal, vidro, materiais à base de amido e outros), tipo de produto (sacos , Bolsas e Saquetas, Caixas, Recipientes, Filmes, Tabuleiros, Tubos, Garrafas e Frascos, Latas e Outros), Técnica (Embalagem Ativa, Embalagem Moldada, Embalagem de Fibra Alternativa e Outros), Camada (Embalagem Primária, Embalagem Secundária e Embalagens terciárias), Aplicação (Alimentos, Bebidas, Farmacêutica, Cuidados Pessoais, Cuidados Domésticos e Outros), País (EUA, Canadá, México) Tendências e Previsão da Indústria para 2029

Análise de mercado e insights : Mercado de embalagens ecológicas da América do Norte

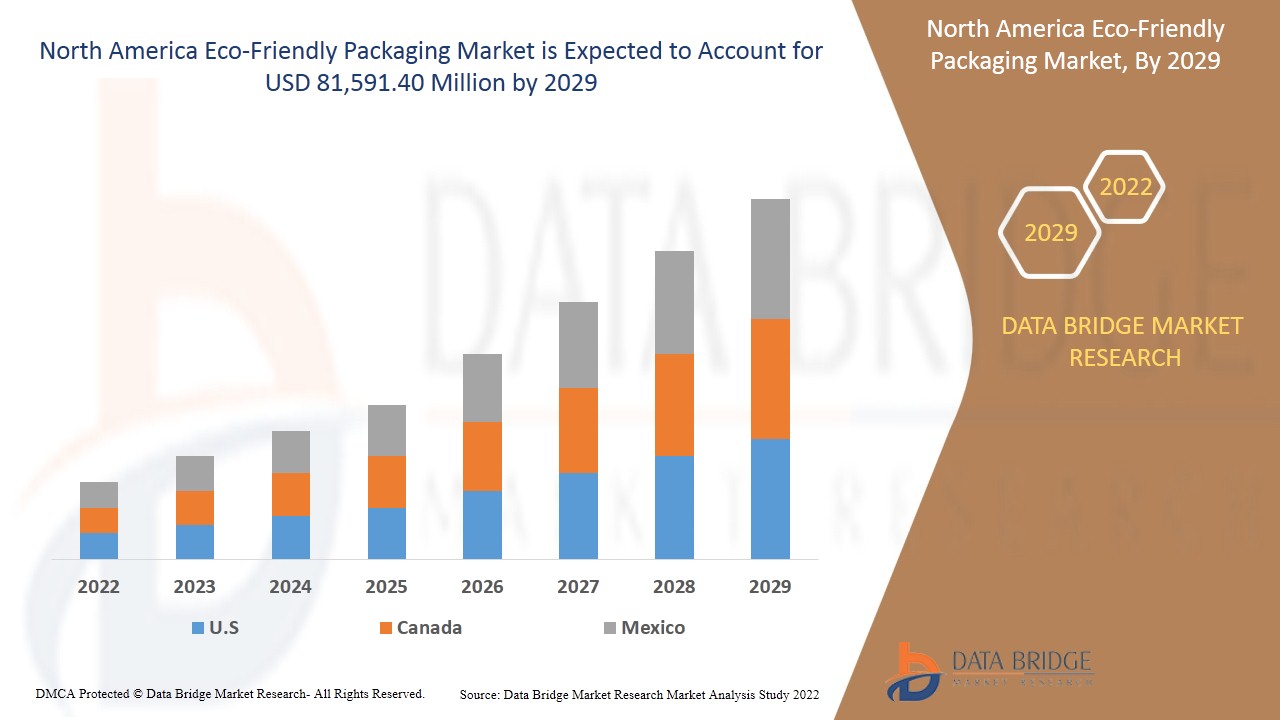

Espera-se que o mercado norte-americano de embalagens ecológicas ganhe crescimento de mercado no período de previsão de 2022 a 2029. A Data Bridge Market Research analisa que o mercado está a crescer a um CAGR de 4,6% no período de previsão de 2022 a 2029 e prevê-se atingir os 81.591,40 milhões de dólares até 2029.

As embalagens ecológicas são fáceis de reciclar, seguras para os indivíduos e para o ambiente e são feitas de materiais reciclados. Utiliza materiais e práticas de fabrico com impacto mínimo no consumo de energia e nos recursos naturais. Os consumidores estão cada vez mais preocupados com as consequências ambientais das embalagens. As empresas estão sob pressão dos consumidores e dos governos para utilizarem embalagens ecológicas nos seus produtos.

As soluções de embalagens ecológicas visam: Diminuir a quantidade de embalagens de produtos, promover a utilização de materiais renováveis/reutilizáveis, reduzir as despesas relacionadas com as embalagens, eliminar a utilização de materiais tóxicos na produção de embalagens e fornecer opções para reciclar embalagens facilmente.

A crescente consciencialização pública sobre as preocupações ambientais e a poluição causada pelas embalagens convencionais, como o plástico, resultou numa maior procura de embalagens ecológicas, o que deverá impulsionar o crescimento no mercado norte-americano de embalagens ecológicas. A principal restrição pode ser a falta de sensibilização para os benefícios das embalagens de produtos amigos do ambiente. Espera-se que inovações consideráveis nos produtos de embalagem proporcionem oportunidades no mercado. O elevado custo e a deficiente infraestrutura para os processos de reciclagem podem desafiar o mercado norte-americano de embalagens ecológicas.

Este relatório de mercado de embalagens ecológicas da América do Norte fornece detalhes de quota de mercado, novos desenvolvimentos e análise de pipeline de produtos, o impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, mudanças nas regulamentações de mercado, aprovações de produtos, estratégias decisões, lançamentos de produtos, expansões geográficas e inovações tecnológicas no mercado. Para compreender a análise e o cenário do mercado, contacte-nos para obter um Analyst Brief; a nossa equipa irá ajudá-lo a criar uma solução de impacto na receita para atingir a meta desejada.

Âmbito do mercado de embalagens ecológicas da América do Norte e dimensão do mercado

O mercado norte-americano de embalagens ecológicas está segmentado em seis segmentos notáveis, com base no tipo, tipo de material, tipo de produto, técnica, camada e aplicação. O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e a diferença nos seus mercados-alvo.

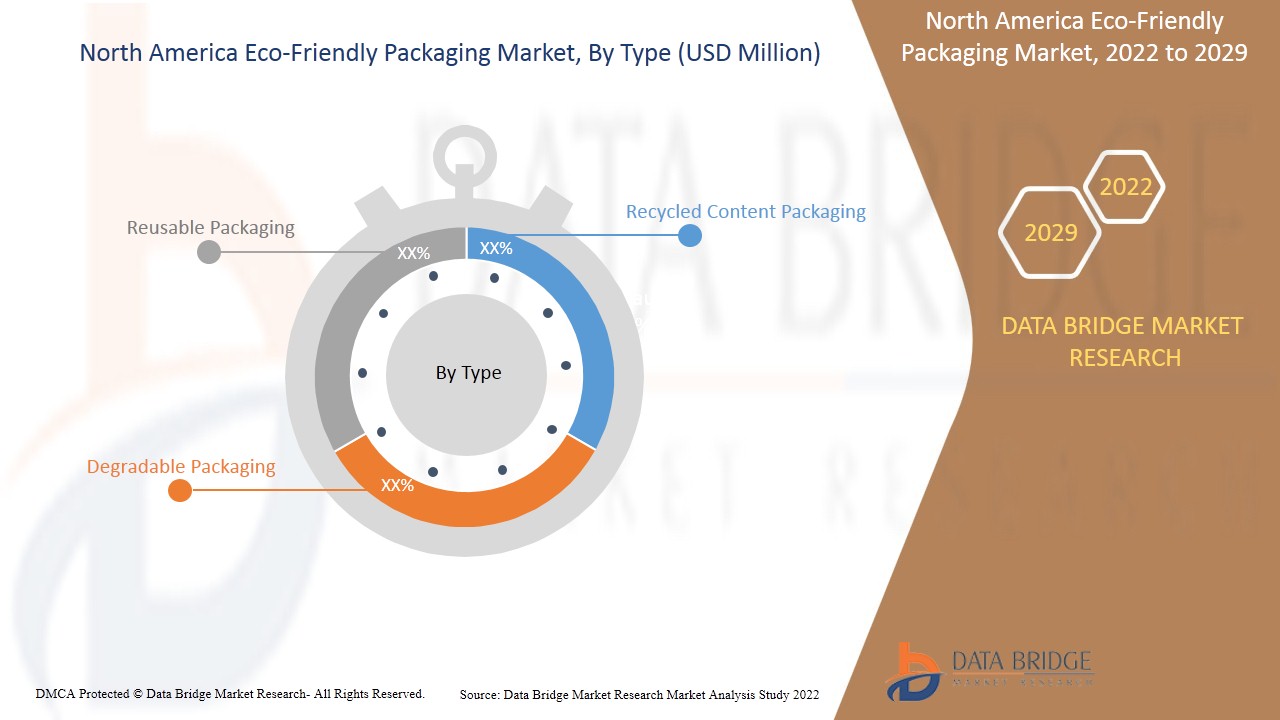

- Com base no tipo, o mercado das embalagens ecológicas está segmentado em embalagens de conteúdo reciclado, embalagens reutilizáveis e embalagens degradáveis. Em 2022, prevê-se que o segmento das embalagens reutilizáveis domine o mercado norte-americano de embalagens ecológicas porque são económicas. Como as embalagens reutilizáveis são concebidas para uma utilização repetida, são mais resistentes e duráveis do que as embalagens descartáveis.

- Com base no tipo de material, o mercado norte-americano de embalagens ecológicas está segmentado em papel e cartão, plástico, metal, vidro, materiais à base de amido, entre outros. Em 2022, prevê-se que o segmento de papel e cartão domine o mercado norte-americano de embalagens ecológicas, pela vantagem de ser, na maioria dos casos, o material estrutural mais barato para embalagens e uma fonte renovável.

- Com base no tipo de produto, o mercado norte-americano de embalagens ecológicas está segmentado em sacos, bolsas e saquetas, caixas, recipientes, filmes, tabuleiros, tubos, garrafas e frascos, latas, entre outros. Em 2022, espera-se que o segmento das caixas domine, uma vez que as caixas têm uma boa relação resistência-peso e fazem um excelente trabalho na proteção do que está no seu interior.

- Com base na técnica, o mercado norte-americano de embalagens ecológicas está segmentado em embalagens ativas, embalagens moldadas, embalagens de fibras alternativas, entre outros. Em 2022, espera-se que o segmento das embalagens de fibras alternativas domine o mercado norte-americano de embalagens ecológicas, uma vez que se revelam uma alternativa ecológica ao papel. Também fornece uma alternativa muito necessária ao poliestireno , que é prejudicial para a saúde humana.

- Com base na camada, o mercado norte-americano de embalagens ecológicas está segmentado em embalagens primárias, embalagens secundárias e embalagens terciárias. Em 2022, prevê-se que o segmento das embalagens primárias domine o mercado norte-americano de embalagens ecológicas, uma vez que mantém o produto selado contra danos externos.

- Com base na aplicação, o mercado norte-americano de embalagens ecológicas está segmentado em alimentos, bebidas, produtos farmacêuticos, cuidados pessoais, cuidados domiciliários, entre outros. Em 2022, prevê-se que o segmento alimentar domine, uma vez que as embalagens são amplamente utilizadas na indústria alimentar para prevenir ou reduzir os danos nos produtos e a deterioração dos alimentos.

Análise a nível de país do mercado norte-americano de embalagens ecológicas

O mercado norte-americano de embalagens ecológicas é analisado e são fornecidas informações sobre o tamanho do mercado por país, tipo, tipo de material, tipo de produto, técnica, camada e aplicação.

Os países abrangidos pelo relatório do mercado de embalagens ecológicas da América do Norte são os EUA, o Canadá e o México. Espera-se que os EUA dominem o mercado norte-americano de embalagens ecológicas devido ao aumento do crescimento das embalagens ecológicas na região devido à elevada procura de bens de consumo de rápida movimentação e à inclinação da preferência dos consumidores por embalagens ecológicas. Espera-se que o Canadá cresça devido a indústrias como as embalagens de alimentos e bebidas, os cuidados pessoais e os medicamentos que mostram um grande interesse em materiais ecológicos e verdes, vendo os clientes mudarem para embalagens sustentáveis. Espera-se que o México cresça no mercado norte-americano de embalagens ecológicas devido ao aumento da consciência dos consumidores em relação à proteção ambiental.

A secção do país do relatório também fornece fatores individuais de impacto no mercado e alterações na regulamentação do mercado que impactam as tendências atuais e futuras do mercado. Dados como novas vendas, vendas de reposição, demografia do país, atos regulamentares e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e disponibilidade de marcas norte-americanas e os desafios enfrentados devido à concorrência grande ou escassa de marcas locais e nacionais, o impacto dos canais de vendas são considerados ao mesmo tempo que fornecem análises de previsão dos dados do país.

Crescimento no mercado norte-americano de embalagens ecológicas

O mercado norte-americano de embalagens ecológicas também fornece uma análise de mercado detalhada para o crescimento de cada país na base instalada de diferentes tipos de produtos para o mercado, o impacto da tecnologia utilizando curvas de linha de vida e as mudanças nos cenários regulamentares de fórmulas infantis e o seu impacto no mercado das embalagens ecológicas. Os dados estão disponíveis para o período histórico de 2011 a 2019.

Análise do cenário competitivo e da quota de mercado das embalagens ecológicas na América do Norte

O panorama competitivo do mercado norte-americano de embalagens ecológicas fornece detalhes do concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença na América do Norte, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento do produto, pipeline de ensaios clínicos, análise de marca, aprovações do produto, patentes, largura e amplitude do produto, domínio de aplicação, curva de segurança da tecnologia. Os dados fornecidos acima estão apenas relacionados com o foco da empresa relacionado com o mercado de embalagens ecológicas da América do Norte.

Alguns dos principais participantes abordados no relatório sobre embalagens ecológicas da América do Norte são a WestRock Company, Berry Global Inc., Crown Holdings, Inc., Amcor plc, Sonoco Products Company, Ardagh Group SA, DS Smith, Tetra Pak, Sealed Air, Smurfit Kappa, Huhtamaki, Pactiv Evergreen Inc., Ball Corporation, Printpack, Plastipak Holdings, Inc., Elopak, UFlex Limited, EMERALD PACKAGING, Mondi, Nampak Ltd. e outros. Os analistas DBMR compreendem os pontos fortes competitivos e fornecem análises competitivas para cada concorrente em separado.

Por exemplo,

- Em novembro de 2021, o Ardagh Group SA anunciou que tinha acordado adquirir a Consol Holdings Proprietary Limited, o principal produtor de embalagens de vidro no continente africano, por um valor patrimonial de 10,1 mil milhões de ZAR (635 milhões de dólares). Serve uma vasta gama de clientes líderes internacionais, regionais e nacionais, principalmente nos setores da cerveja, vinho, bebidas espirituosas, alimentos e bebidas não alcoólicas. Isto fortalecerá a posição da empresa no mercado internacional

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SINGLE-USE PLASTIC BAN HAS HEIGHTENED DEMAND FOR ECO-FRIENDLY PACKAGING

5.1.2 CHANGING CONSUMER PREFERENCES TOWARDS CONVENIENCE AND PACKAGED FOODS

5.1.3 RISE IN AWARENESS REGARDING ENVIRONMENTAL CONSERVATION AND SUSTAINABLE LIVING

5.1.4 STRINGENT GOVERNMENT REGULATIONS REGARDING ENVIRONMENTAL SUSTAINABILITY

5.2 RESTRAINTS

5.2.1 PRICE VOLATILITY OF RAW MATERIALS

5.2.2 CONSTRAINT IN PRODUCTION CAPACITIES

5.2.3 LACK OF KNOWLEDGE AND LOW ACCEPTANCE FOR SUSTAINABLE PACKAGING IN DEVELOPING ECONOMIES

5.3 OPPORTUNITIES

5.3.1 CONSIDERABLE INNOVATIONS IN PACKAGING PRODUCTS

5.3.2 SIGNIFICANT GOVERNMENT INITIATIVES TO PROMOTE USE OF ECO-FRIENDLY PACKAGING

5.3.3 INCREASE IN GROWTH POTENTIAL IN PACKAGING MARKET AND RISING R&D ACTIVITIES

5.4 CHALLENGES

5.4.1 HIGH COST OF ECO-FRIENDLY PACKAGING AS COMPARED TO CONVENTIONAL PRODUCTS

5.4.2 HIGH COST AND POOR INFRASTRUCTURE FOR RECYCLING PROCESSES

6 COVID 19 IMPACT ON THE NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON PRICE

6.4 IMPACT ON DEMAND

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY TYPE

7.1 OVERVIEW

7.2 REUSABLE PACKAGING

7.3 RECYCLED CONTENT PACKAGING

7.4 DEGRADABLE PACKAGING

8 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE

8.1 OVERVIEW

8.2 PAPER & PAPER BOARD

8.2.1 PAPER & PAPER BOARD, BY MATERIAL TYPE

8.2.1.1 RECYCLED (COATED AND UNCOATED)

8.2.1.2 SOLID BLEACH SULFATE (SBS)

8.2.1.3 COATED UNBLEACHED KRAFT (CUK)

8.2.1.4 OTHERS

8.3 PLASTIC

8.3.1 PLASTIC, BY MATERIAL TYPE

8.3.1.1 BIO-BASED PLASTIC

8.3.1.2 BIODEGRADABLE PLASTIC

8.3.1.3 OTHERS

8.4 GLASS

8.4.1 GLASS, BY MATERIAL TYPE

8.4.1.1 SODA ASH

8.4.1.2 SAND

8.4.1.3 LIMESTONE

8.5 METAL

8.5.1 METAL, BY MATERIAL TYPE

8.5.1.1 ALUMINIUM

8.5.1.2 STEEL

8.5.1.3 OTHER

8.6 STARCH-BASED MATERIALS

8.7 OTHERS

9 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 BOXES

9.3 BAGS

9.4 POUCHES & SACHETS

9.5 CONTAINERS

9.6 BOTTLES & JARS

9.7 CANS

9.8 FILMS

9.9 TUBES

9.1 TRAYS

9.11 OTHERS

10 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE

10.1 OVERVIEW

10.2 ALTERNATE FIBER PACKAGING

10.2.1 ALTERNATE FIBER PACKAGING, BY TECHNIQUE

10.2.1.1 BAMBOO FIBER

10.2.1.2 MUSHROOM PACKAGING

10.2.1.3 OTHERS

10.3 MOLDED PACKAGING

10.3.1 MOLDED PACKAGING, BY TECHNIQUE

10.3.1.1 TRANSFER MOLDED PULP PACKAGING

10.3.1.2 THICK WALL PULP PACKAGING

10.3.1.3 THERMOFORMED PULP PACKAGING

10.3.1.4 PROCESSED PULP PACKAGING

10.4 ACTIVE PACKAGING

10.4.1 ACTIVE PACKAGING, BY TECHNIQUE

10.4.1.1 MODIFIED ATMOSPHERE PACKAGING (MAP)

10.4.1.2 ANTIMICROBIAL PACKAGING

10.4.1.3 BARRIER PACKAGING

10.5 OTHERS

11 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY LAYER

11.1 OVERVIEW

11.2 PRIMARY PACKAGING

11.3 SECONDARY PACKAGING

11.4 TERTIARY PACKAGING

12 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FOOD

12.2.1 FOOD, BY APPLICATION

12.2.1.1 BAKERY & CONFECTIONARY

12.2.1.2 DAIRY PRODUCTS

12.2.1.3 READY TO EAT FOOD

12.2.1.4 FROZEN FOOD

12.2.1.5 FRUITS & VEGETABLES

12.2.1.6 MEAT PRODUCTS

12.2.1.7 OTHERS

12.2.2 FOOD, BY TYPE

12.2.2.1 REUSABLE PACKAGING

12.2.2.2 RECYCLED CONTENT PACKAGING

12.2.2.3 DEGRADABLE PACKAGING

12.3 BEVERAGES

12.3.1 BEVERAGES, BY APPLICATION

12.3.1.1 NON-ALCOHOLIC

12.3.1.2 ALCOHOLIC

12.3.2 BEVERAGES, BY TYPE

12.3.2.1 REUSABLE PACKAGING

12.3.2.2 RECYCLED CONTENT PACKAGING

12.3.2.3 DEGRADABLE PACKAGING

12.4 PHARMACEUTICALS

12.4.1 PHARMACEUTICALS, BY TYPE

12.4.1.1 REUSABLE PACKAGING

12.4.1.2 RECYCLED CONTENT PACKAGING

12.4.1.3 DEGRADABLE PACKAGING

12.5 PERSONAL CARE

12.5.1 PERSONAL CARE, BY TYPE

12.5.1.1 REUSABLE PACKAGING

12.5.1.2 RECYCLED CONTENT PACKAGING

12.5.1.3 DEGRADABLE PACKAGING

12.6 HOME CARE

12.6.1 HOME CARE, BY TYPE

12.6.1.1 REUSABLE PACKAGING

12.6.1.2 RECYCLED CONTENT PACKAGING

12.6.1.3 DEGRADABLE PACKAGING

12.7 OTHERS

12.7.1 OTHERS, BY TYPE

12.7.1.1 REUSABLE PACKAGING

12.7.1.2 RECYCLED CONTENT PACKAGING

12.7.1.3 DEGRADABLE PACKAGING

13 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.2 MERGER & ACQUISITION

14.3 EXPANSIONS

14.4 NEW PRODUCT DEVELOPMENT

14.5 AWARD

14.6 PARTNERSHIP

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 WEST ROCK COMPANY

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT UPDATES

16.2 CROWN HOLDING, INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT UPDATES

16.3 AMCOR PLC

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT UPDATES

16.4 TETRA PAK

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT UPDATES

16.5 BERRY NORTH AMERICA INC.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT UPDATES

16.6 SMUFIT KAPPA

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT UPDATES

16.7 DS SMITH

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT UPDATES

16.8 MONDI

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT UPDATES

16.9 ARDAGH GROUP S.A.

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT UPDATES

16.1 BALL CORPORATION

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT UPDATES

16.11 ELOPAK

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT UPDATES

16.12 EMERALD PACKAGING

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT UPDATES

16.13 HUHTAMAKI

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT UPDATES

16.14 NAMPAK LTD.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT UPDATES

16.15 PACTIV EVERGREEN INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT UPDATES

16.16 PLASTIPAK HOLDINGS, INC.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT UPDATES

16.17 PRINTPACK

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT UPDATE

16.18 SEALED AIR

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT UPDATES

16.19 SONOCO PRODUCTS COMPANY

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT UPDATES

16.2 UFLEX LIMITED

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT UPDATES

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tabela

TABLE 1 IMPORT DATA OF CARTONS, BOXES, CASES, BAGS AND OTHER PACKING CONTAINERS, OF PAPER, PAPERBOARD, CELLULOSE WADDING; HS CODE - 4819 (USD THOUSAND)

TABLE 2 EXPORT DATA OF CARTONS, BOXES, CASES, BAGS AND OTHER PACKING CONTAINERS, OF PAPER, PAPERBOARD, CELLULOSE WADDING; HS CODE – 4819 (USD THOUSAND)

TABLE 3 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 5 NORTH AMERICA REUSABLE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA REUSABLE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 7 NORTH AMERICA RECYCLED CONTENT PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA RECYCLED CONTENT PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 9 NORTH AMERICA DEGRADABLE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA DEGRADABLE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 11 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA PAPER & PAPER BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA PAPER & PAPER BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA METAL IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA METAL IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA STARCH-BASED MATERIALS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA BOXES IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA BAGS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA POUCHES & SACHETS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA CONTAINERS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA BOTTLES & JARS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA CANS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA FILMS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA TUBES IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA TRAYS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA PRIMARY PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA SECONDARY PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA TERTIARY PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA PHARMACEUTICALS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA PHARMACEUTICALS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA PERSONAL CARE IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA PERSONAL CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY COUNTRY , 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY COUNTRY, 2020-2029 (MILLION UNITS)

TABLE 62 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 64 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA PAPER & PAPER-BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA METAL IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 73 NORTH AMERICA ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 74 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2020-2029 (USD MILLION)

TABLE 75 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 76 NORTH AMERICA FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 77 NORTH AMERICA FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 NORTH AMERICA BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 79 NORTH AMERICA BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 NORTH AMERICA PHARMACEUTICALS ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 NORTH AMERICA PERSONAL CARE ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 NORTH AMERICA HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 NORTH AMERICA OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 U.S. ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 U.S. ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 ( MILLION UNITS)

TABLE 86 U.S. ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 87 U.S. PAPER & PAPER-BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 88 U.S. PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 89 U.S. METAL IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 90 U.S. GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 91 U.S. ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 92 U.S. ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 93 U.S. ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 94 U.S. MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 95 U.S. ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 96 U.S. ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2020-2029 (USD MILLION)

TABLE 97 U.S. ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 U.S. FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 99 U.S. FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 U.S. BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 101 U.S. BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 U.S. PHARMACEUTICALS ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 U.S. PERSONAL CARE ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 U.S. HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 U.S. OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 CANADA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 CANADA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 108 CANADA ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 109 CANADA PAPER & PAPER-BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 110 CANADA PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 111 CANADA METAL IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 112 CANADA GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 113 CANADA ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 114 CANADA ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 115 CANADA ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 116 CANADA MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 117 CANADA ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 118 CANADA ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2020-2029 (USD MILLION)

TABLE 119 CANADA ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 120 CANADA FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 121 CANADA FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 CANADA BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 123 CANADA BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 CANADA PHARMACEUTICALS ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 CANADA PERSONAL CARE ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 CANADA HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 CANADA OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 MEXICO ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 MEXICO ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 130 MEXICO ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 131 MEXICO PAPER & PAPER-BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 132 MEXICO PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 133 MEXICO METAL IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 134 MEXICO GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 135 MEXICO ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 136 MEXICO ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 137 MEXICO ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 138 MEXICO MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 139 MEXICO ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 140 MEXICO ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2020-2029 (USD MILLION)

TABLE 141 MEXICO ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 142 MEXICO FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 143 MEXICO FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 MEXICO BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 145 MEXICO BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 MEXICO PHARMACEUTICALS ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 MEXICO PERSONAL CARE ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 MEXICO HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 MEXICO OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

Lista de Figura

FIGURE 1 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET

FIGURE 2 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 CHANGING CONSUMER PREFERENCES TOWARDS CONVENIENCE AND PACKAGED FOODS IS DRIVING NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 REUSABLE PACKAGING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET IN 2022 & 2029

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET

FIGURE 18 PLASTIC WASTE GENERATED BY KEY COUNTRIES, 2021

FIGURE 19 CARDBOARD COSTS IN MONTH OF MAY 2020 & 2021

FIGURE 20 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2021

FIGURE 21 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2021

FIGURE 22 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2021

FIGURE 23 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2021

FIGURE 24 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2021

FIGURE 25 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2021

FIGURE 26 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 27 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 28 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 30 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET: BY TYPE (2022-2029)

FIGURE 31 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET: COMPANY SHARE 2021 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.