North America Drive Shaft Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

5.05 Billion

USD

7.69 Billion

2024

2032

USD

5.05 Billion

USD

7.69 Billion

2024

2032

| 2025 –2032 | |

| USD 5.05 Billion | |

| USD 7.69 Billion | |

|

|

|

|

Segmentação do mercado de eixos de transmissão da América do Norte, por componentes (garfos deslizantes, eixos de garfo, garfos finais, flanges complementares, garfos de flange, garfos soldados, garfos centrais, pontas deslizantes estriadas, pontas intermediárias e outros), tipo de projeto (eixo oco e eixo sólido), tipo de eixo de transmissão (eixo de transmissão Hotchkiss, eixo de transmissão do tubo de torque, eixo de transmissão flexível e eixo de transmissão Slip-In-Tube), tipo de posição (eixo dianteiro e eixo traseiro), tipo de material ( aço carbono , alumínio, aço inoxidável , materiais compostos, fibra de carbono e outros), tipo de veículo (carros de passeio e veículos comerciais), canal de vendas (OEM e pós-venda) - Tendências do setor e previsão até 2032.

Tamanho do mercado de eixos de transmissão na América do Norte

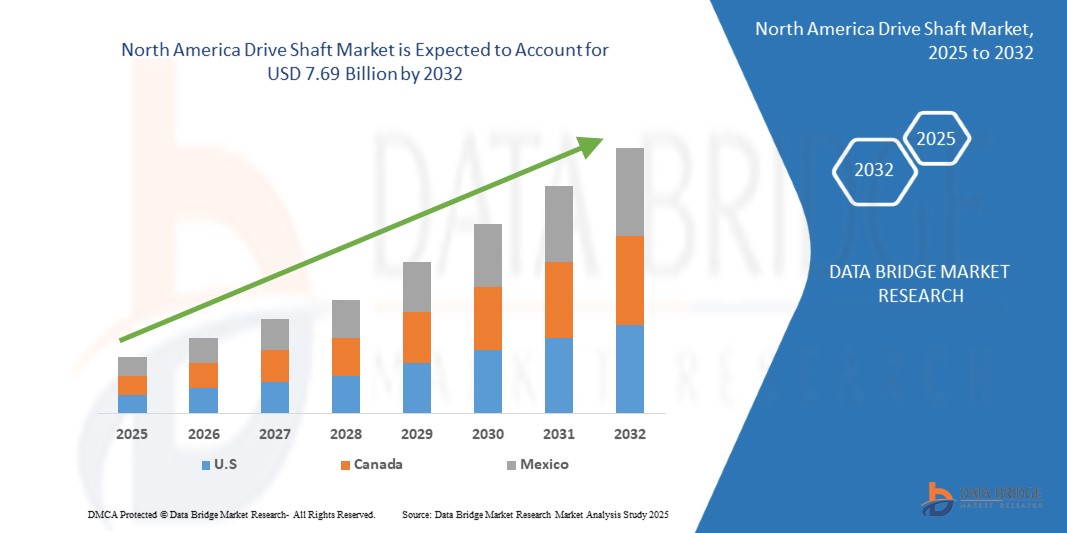

- O tamanho do mercado global de eixos de transmissão da América do Norte foi avaliado em US$ 5,05 bilhões em 2024 e deve atingir US$ 7,69 bilhões até 2032 , com um CAGR de 5,40% durante o período previsto.

- O crescimento do mercado é impulsionado principalmente pelo aumento da produção de veículos, pela mudança para componentes automotivos leves para melhor eficiência de combustível e pela crescente demanda por sistemas de tração nas quatro rodas (AWD) e tração nas quatro rodas (4WD) em veículos de passageiros e comerciais.

- Além disso, os avanços em materiais como fibra de carbono e alumínio, juntamente com as crescentes expectativas dos consumidores quanto ao desempenho dos veículos e à redução das emissões, estão aprimorando o design e a durabilidade do eixo de transmissão, alimentando assim a expansão do mercado a longo prazo.

Análise do mercado de eixos de transmissão na América do Norte

- O mercado de eixos de transmissão na América do Norte, essencial para a transmissão de torque e rotação em veículos, desempenha um papel crucial no desempenho automotivo, especialmente em veículos comerciais, automóveis de passageiros e aplicações off-road, devido à sua eficiência, durabilidade e capacidade de suportar sistemas de transmissão de alto desempenho.

- O crescimento do mercado de eixos de transmissão norte-americanos é impulsionado principalmente pelo aumento da produção de veículos, pela crescente demanda por componentes leves e com baixo consumo de combustível e pela mudança acelerada em direção a veículos elétricos e híbridos que exigem soluções especializadas de eixos de transmissão.

- Os EUA dominaram o mercado de eixos de transmissão da América do Norte com a maior participação na receita de 76,12% no mercado de eixos de transmissão da América do Norte em 2024, impulsionado pela alta demanda por SUVs, caminhões e veículos de alto desempenho equipados com sistemas de transmissão complexos

- O mercado de eixos de transmissão do Canadá deverá crescer a uma CAGR mais rápida de 6,08% no período previsto, apoiado por uma forte relação comercial automotiva com os EUA sob o USMCA e uma preferência crescente por veículos comerciais leves em logística urbana.

- O segmento de garfos deslizantes dominou o mercado com a maior participação de receita de 38,4% em 2024, devido ao seu amplo uso para acomodar o movimento do eixo de transmissão durante o curso da suspensão e seu papel crítico em garantir uma transmissão de potência suave.

Escopo do Relatório e Segmentação do Mercado de Eixos de Transmissão

|

Atributos |

Principais insights de mercado sobre eixos de transmissão |

|

Segmentos abrangidos |

|

|

Países abrangidos |

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além de insights de mercado, como valor de mercado, taxa de crescimento, segmentos de mercado, cobertura geográfica, participantes do mercado e cenário de mercado, o relatório de mercado selecionado pela equipe de pesquisa de mercado da Data Bridge inclui análise aprofundada de especialistas, análise de importação/exportação, análise de preços, análise de consumo de produção e análise pilão. |

Tendências do mercado de eixos de transmissão na América do Norte

Materiais leves e fabricação avançada para desempenho aprimorado

- Uma tendência notável e crescente no mercado de eixos cardã da América do Norte é a mudança para materiais leves, como alumínio e fibra de carbono, combinada com técnicas de fabricação de precisão para aprimorar a eficiência de combustível, o desempenho e a durabilidade dos veículos. Essa tendência está sendo acelerada pela pressão regulatória para reduzir as emissões e pela busca das montadoras por uma dinâmica veicular aprimorada.

- Por exemplo, a Dana Incorporated oferece eixos de transmissão avançados em fibra de carbono, até 70% mais leves do que as variantes tradicionais de aço, ajudando as montadoras a atingir as metas de economia de combustível sem comprometer a resistência. Da mesma forma, a American Axle & Manufacturing (AAM) desenvolveu eixos de transmissão de alumínio de alto desempenho, utilizados em uma variedade de caminhões leves e veículos de alto desempenho na América do Norte.

- A integração da engenharia de precisão e do projeto auxiliado por computador (CAD) permitiu aos fabricantes otimizar a geometria do eixo, melhorar o equilíbrio e reduzir as vibrações, resultando em viagens mais suaves e níveis mais baixos de NVH (ruído, vibração e aspereza).

- Essas inovações são particularmente significativas na América do Norte, onde SUVs e caminhonetes dominam o mercado de veículos. As montadoras estão cada vez mais optando por eixos de transmissão avançados para suportar maiores saídas de torque de motores elétricos e híbridos sem sacrificar o peso ou a confiabilidade.

- A tendência também está remodelando o setor de reposição, com entusiastas de desempenho e operadores de frotas buscando sistemas de eixo de transmissão atualizados para melhor eficiência e transmissão de potência.

- À medida que os OEMs e fornecedores de nível 1 continuam a investir em P&D para atender aos padrões em evolução, o uso de materiais avançados e tecnologias de fabricação deve se tornar uma característica definidora da indústria de eixos de transmissão da região nos próximos anos.

Dinâmica do mercado de eixos de transmissão na América do Norte

Motorista

Aumento da produção de veículos e demanda por sistemas AWD/4WD

- O aumento consistente na produção de veículos, especialmente SUVs, crossovers e caminhões, na América do Norte, juntamente com a crescente preferência do consumidor por sistemas de tração nas quatro rodas (AWD) e tração nas quatro rodas (4WD), é um dos principais impulsionadores do mercado de eixos de transmissão

- À medida que os consumidores priorizam a versatilidade, a capacidade off-road e a segurança em diversas condições de direção, os fabricantes estão equipando um número maior de veículos com sistemas de transmissão avançados, todos os quais exigem eixos de transmissão duráveis e eficientes.

- Por exemplo, a Ford e a General Motors expandiram suas ofertas de tração integral e integral em modelos mais novos de SUV e picapes, contribuindo diretamente para o aumento da demanda por eixos de transmissão OEM e de reposição.

- Além disso, o crescimento do segmento de veículos comerciais leves (LCV), muito utilizado para logística e entregas de comércio eletrônico, está aumentando ainda mais os requisitos do eixo de transmissão devido ao uso frequente e à necessidade de transmissão de energia confiável.

- Juntamente com as crescentes expectativas dos consumidores, os mandatos regulatórios para melhor eficiência de combustível estão levando as montadoras a redesenhar os eixos de transmissão com materiais mais leves e eficientes, aumentando as taxas de substituição e inovação no setor.

- No geral, a combinação de volumes crescentes de produção, melhorias no sistema de transmissão e inovação tecnológica continua a fortalecer o mercado de eixos de transmissão da América do Norte.

Restrição/Desafio

Volatilidade dos preços das matérias-primas e desafios de integração em veículos elétricos

- Um dos principais desafios para o mercado de eixos de transmissão da América do Norte é a volatilidade dos preços das matérias-primas, especialmente aço, alumínio e compostos de fibra de carbono, o que pode impactar significativamente os custos de produção e as margens de lucro.

- Por exemplo, as flutuações nos mercados globais de matérias-primas, exacerbadas pelas tensões comerciais e pelas interrupções na cadeia de abastecimento, conduzem frequentemente a preços inconsistentes para materiais essenciais, afetando tanto os OEMs como os fornecedores de nível 1 na sua capacidade de escalar soluções rentáveis.

- Além disso, a crescente mudança para veículos elétricos (VEs), que normalmente têm diferentes arquiteturas de transmissão, como motores nas rodas ou menos componentes móveis, representa desafios de integração para projetos de eixos de transmissão tradicionais.

- Embora algumas plataformas de VE ainda utilizem eixos de transmissão (particularmente em configurações de motor duplo ou tração integral), muitos novos projetos de trem de força elétrico eliminam a necessidade de sistemas convencionais, reduzindo potencialmente a demanda de longo prazo em segmentos específicos de veículos.

- Os fabricantes estão, portanto, sob pressão para se adaptarem, inovando soluções de eixo de transmissão compatíveis com os layouts dos VE, ao mesmo tempo que controlam os custos de produção em meio ao aumento dos preços dos materiais.

- Abordar essas restrições por meio de estratégias de design com visão de futuro, integração vertical para melhor fornecimento de materiais e investimentos em componentes compatíveis com veículos elétricos será fundamental para sustentar a competitividade no cenário automotivo norte-americano em evolução.

Escopo do mercado de eixos de transmissão na América do Norte

O mercado de eixos de transmissão automotivos é segmentado em sete segmentos notáveis com base no componente, tipo de design, tipo de eixo de transmissão, tipo de posição, tipo de material, tipo de veículo e canal de vendas.

- Por componente

Com base nos componentes, o mercado é segmentado em garfos deslizantes, eixos de garfo, garfos de extremidade, flanges de acoplamento, garfos de flange, garfos soldados, garfos centrais, pontas deslizantes estriadas, pontas intermediárias e outros. O segmento de garfos deslizantes dominou o mercado, com a maior participação na receita, de 38,4% em 2024, devido à sua ampla utilização para acomodar o movimento do eixo cardã durante o curso da suspensão e ao seu papel crítico em garantir uma transmissão de potência suave. Os garfos deslizantes são altamente preferidos em automóveis de passeio e veículos comerciais leves por sua durabilidade e custo-benefício.

O segmento de garfos de flange deverá registrar o CAGR mais rápido, de 8,9%, entre 2025 e 2032, impulsionado pela crescente demanda por caminhões pesados, veículos fora de estrada e frotas comerciais. Sua capacidade de suportar altas cargas de torque e fornecer conexões de junta estáveis os torna essenciais em sistemas de transmissão modernos, onde desempenho e confiabilidade são primordiais.

- Por tipo de design

Com base no tipo de projeto, o mercado é segmentado em eixo oco e eixo sólido. O segmento de eixo oco dominou o mercado, com uma participação de 53,5% na receita em 2024, principalmente devido à sua estrutura leve, inércia reduzida e benefícios superiores em termos de eficiência de combustível. As montadoras preferem eixos ocos em veículos de passeio e veículos elétricos para melhorar o desempenho geral do veículo, ao mesmo tempo em que atendem às normas regulatórias de emissões.

Prevê-se que o segmento de eixos sólidos apresente o CAGR mais rápido, de 7,6%, entre 2025 e 2032, impulsionado por sua crescente adoção em aplicações pesadas que exigem maior resistência e capacidade de torque. Eixos sólidos são particularmente populares em caminhões, ônibus e veículos industriais, onde a robustez e a capacidade de carga superam a redução de peso.

- Por tipo de eixo de transmissão

Com base no tipo de eixo cardã, o mercado é segmentado em eixo cardã Hotchkiss, eixo cardã com tubo de torque, eixo cardã flexível e eixo cardã slip-in-tube. O eixo cardã Hotchkiss dominou, com uma participação de 31,7% na receita em 2024, devido ao seu amplo uso em automóveis de passeio e caminhões leves com tração traseira. Seu design simples, eficiência de custos e confiabilidade comprovada impulsionam sua forte presença no mercado.

Espera-se que o segmento de eixos de transmissão flexíveis registre o CAGR mais rápido, de 9,3%, entre 2025 e 2032, impulsionado pela crescente demanda por veículos elétricos, veículos híbridos e máquinas industriais especializadas. Eixos flexíveis permitem uma transmissão de torque mais suave, melhor absorção de vibração e integração de design compacto, tornando-os ideais para aplicações automotivas leves.

- Por tipo de posição

Com base no tipo de posição, o mercado é segmentado em eixo dianteiro e eixo traseiro. O segmento de eixo traseiro dominou o mercado, com uma participação de 48,2% na receita em 2024, impulsionado pela forte prevalência de configurações de tração traseira em caminhões leves, SUVs e veículos comerciais. Os eixos traseiros exigem eixos de transmissão robustos para transferência eficiente de torque em distâncias maiores.

O segmento de eixos dianteiros deverá crescer à taxa composta de crescimento anual (CAGR) mais rápida, de 8,1%, entre 2025 e 2032, em grande parte devido à crescente adoção de veículos com tração integral e dianteira em automóveis de passeio. A crescente demanda dos consumidores por maior estabilidade, eficiência de combustível e tração em carros compactos e crossovers está impulsionando a demanda por semi-eixos dianteiros.

- Por tipo de material

Com base no tipo de material, o mercado é segmentado em aço carbono, alumínio, aço inoxidável, materiais compósitos, fibra de carbono e outros. O segmento de aço carbono foi responsável pela maior participação na receita, 56,9% em 2024, sendo favorecido por sua resistência, durabilidade e custo-benefício em veículos de passeio e comerciais. Eixos cardã de aço carbono continuam sendo uma escolha padrão em veículos a combustão tradicionais.

Espera-se que o segmento de fibra de carbono se expanda a uma taxa composta de crescimento anual (CAGR) de 10,4% entre 2025 e 2032, impulsionado pela crescente adoção em carros de alto desempenho, veículos de luxo e veículos elétricos. Sua leveza e excelente relação resistência-peso a tornam ideal para melhorar a eficiência de combustível e reduzir as emissões, em linha com as metas globais de sustentabilidade.

- Por tipo de veículo

Com base no tipo de veículo, o mercado é segmentado em automóveis de passeio e veículos comerciais. O segmento de automóveis de passeio dominou o mercado, com uma participação de receita de 51,4% em 2024, impulsionado pelo aumento da produção de sedãs, SUVs e hatchbacks em todo o mundo. O aumento da urbanização, da renda disponível e da mudança para veículos conectados impulsiona ainda mais a adoção.

A previsão é de que o segmento de veículos comerciais registre o CAGR mais rápido, de 7,8%, entre 2025 e 2032, com a expansão dos setores globais de logística e construção. Caminhões e ônibus pesados exigem eixos de transmissão duráveis e de alto desempenho, capazes de suportar altas cargas de torque e longas horas de operação.

- Por canal de vendas

Com base no canal de vendas, o mercado é segmentado em OEM e pós-venda. O segmento OEM dominou o mercado, com participação de 58,7% na receita em 2024, devido ao aumento da produção global de automóveis e à preferência dos fabricantes por integrar eixos de transmissão avançados e leves durante a montagem inicial. O fornecimento OEM garante qualidade consistente, conformidade regulatória e garantia para os usuários finais.

O segmento de reposição deverá registrar o CAGR mais rápido, de 8,6%, entre 2025 e 2032, impulsionado pelo aumento do envelhecimento dos veículos, maiores taxas de substituição e demanda por personalização. Frotas comerciais e proprietários de veículos individuais estão recorrendo a soluções de reposição para eficiência de custos e disponibilidade de componentes especializados.

Análise regional do mercado de eixos de transmissão na América do Norte

- Os EUA dominaram o mercado de eixos de transmissão da América do Norte com a maior participação na receita de 76,12% no mercado de eixos de transmissão da América do Norte em 2024, impulsionado pela alta demanda por SUVs, caminhões e veículos de alto desempenho equipados com sistemas de transmissão complexos

- O aumento da produção de modelos AWD/4WD, aliado ao crescente interesse por veículos off-road e utilitários, está impulsionando o crescimento do mercado. Além disso, os investimentos em plataformas para veículos elétricos e materiais compostos leves estão incentivando os fabricantes nacionais a atualizarem suas tecnologias de eixo de transmissão.

- Um setor de pós-venda bem desenvolvido e taxas crescentes de substituição de frotas contribuem ainda mais para o crescimento sustentado

Visão Geral do Mercado de Eixos de Transmissão no Canadá:

O mercado de eixos de transmissão do Canadá deverá crescer a uma taxa composta de crescimento anual (CAGR) de 6,08% durante o período previsto, impulsionado por uma forte relação comercial automotiva com os EUA, no âmbito do USMCA, e por uma crescente preferência por veículos comerciais leves na logística urbana. As condições rigorosas de inverno e os terrenos acidentados também impulsionam a demanda por veículos com tração integral (AWD) e tração integral (4WD), reforçando a necessidade de eixos de transmissão duráveis e de alto desempenho. Além disso, o crescente interesse por veículos elétricos e híbridos está impulsionando o aumento do investimento em soluções de eixos de transmissão leves.

Visão Geral do Mercado de Eixos de Transmissão no México:

O México está emergindo como um player-chave no mercado de eixos de transmissão da América do Norte, com rápido crescimento previsto até 2032. Como um importante polo de manufatura para montadoras globais, o país se beneficia de uma produção com boa relação custo-benefício e mão de obra qualificada. A forte atividade de OEMs, particularmente na montagem de veículos e exportação de peças, impulsiona a demanda local por eixos de transmissão. A expansão contínua das unidades de produção automotiva, aliada a investimentos em infraestrutura e vantagens comerciais, deve aumentar significativamente a contribuição do México para o mercado regional.

Participação no mercado de eixos de transmissão na América do Norte

Os líderes de mercado de eixos de transmissão que operam no mercado são:

- Johnson Power, Ltd. (EUA)

- ACPT Inc. (EUA)

- American Axle & Manufacturing, Inc. (EUA)

- Eixos cardã D&F (Reino Unido)

- Cummins Inc. (EUA)

- Neapco Inc. (EUA)

- Nexteer Automotive (EUA)

- Produtos Dorman (EUA)

- HYUNDAI WIA CORP (Coreia do Sul)

- JTEKT Corporation (Japão)

- THE TIMKEN COMPANY (EUA)

- Hitachi Astemo, Ltd. (Japão)

- GSP EUROPE GmbH (Alemanha)

- TUNGALOY CORPORATION (Japão)

- GKN Automotive Limited (Reino Unido)

Últimos desenvolvimentos no mercado global de eixos de transmissão da América do Norte

- Em abril de 2023, a Dana Incorporated, fabricante líder de sistemas de transmissão e propulsão elétrica com sede nos EUA, anunciou a expansão de sua unidade de produção de eixos de transmissão leves em Ohio para atender à crescente demanda de fabricantes de veículos elétricos (VE) e híbridos. A nova unidade se concentra em eixos de transmissão avançados de alumínio e compósito, apoiando os esforços dos fabricantes de equipamentos originais (OEMs) para melhorar a eficiência de combustível e reduzir o peso dos veículos. Essa expansão reforça a posição estratégica da Dana no fornecimento de eixos de transmissão de última geração em toda a América do Norte.

- Em março de 2023, a American Axle & Manufacturing (AAM) lançou uma nova linha de sistemas de eixo de transmissão modular projetados especificamente para sistemas de transmissão eletrificados e híbridos. Os sistemas proporcionam melhor manuseio do torque e redução de NVH (ruído, vibração e aspereza), tornando-os adequados tanto para veículos elétricos leves quanto para veículos de alto desempenho. A inovação destaca o compromisso da AAM em alinhar seu portfólio de produtos à transição da indústria automotiva rumo à eletrificação.

- Em março de 2023, a Neapco Holdings LLC, importante fornecedora de sistemas de transmissão com sede em Michigan, revelou seus recém-desenvolvidos eixos de transmissão em polímero reforçado com fibra de carbono (CFRP) em uma importante feira automotiva em Detroit. Esses eixos de transmissão, voltados para o mercado de veículos de luxo e desempenho, oferecem maior durabilidade, menor massa rotacional e melhor eficiência de combustível. Este lançamento marca o foco contínuo da Neapco na integração de materiais premium e soluções leves.

- Em fevereiro de 2023, a GKN Automotive expandiu seu centro de engenharia na América do Norte em Auburn Hills, Michigan, para apoiar os esforços de P&D no desenvolvimento de tecnologias avançadas de eixo de transmissão para veículos elétricos e com tração integral (AWD). A expansão inclui instalações de teste para gerenciamento térmico e simulação de durabilidade, refletindo o investimento da empresa em soluções de transmissão preparadas para o futuro, adaptadas às necessidades em constante evolução dos fabricantes de equipamentos originais (OEMs).

- Em janeiro de 2023, a Spicer Drivetrain (uma marca da Dana) lançou uma série de eixos cardã de reposição com foco em desempenho para proprietários de Jeep e veículos off-road em toda a América do Norte. A nova linha inclui eixos cardã de aço e alumínio para serviços pesados, projetados para suspensões elevadas e terrenos de alta resistência, visando entusiastas do off-road e a crescente demanda por atualizações personalizadas de sistemas de transmissão no segmento de reposição.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.