North America Denim Jeans Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

27.50 Billion

USD

47.61 Billion

2025

2033

USD

27.50 Billion

USD

47.61 Billion

2025

2033

| 2026 –2033 | |

| USD 27.50 Billion | |

| USD 47.61 Billion | |

|

|

|

|

North America Denim Jeans Market, By Type (Cotton Denim/100% Cotton Denim, Stretch Denim, Raw Denim/Dry Denim, Crushed Denim, Cotton Serge Denim, Waxed Reverse Denim, Printed Denim, Washed Denim/Acid Wash Denim, Colored Denim, Selvedge Denim, ECRU Denim, Sanforized Denim, Bubblegum Denim, Poly Denim, Bull Denim, Thermo Denim, Ramie Cotton Denim, Slub Denim, Vintage Denim, Fox Fiber Denim, Marble Denim, Reverse Denim, Ring Spun Denim/Dual Ring Spun Denim, and Others), Consumer Type (Men, Women, and Kids), Distribution Channel (Direct Sales/B2B/WholesaleE-Commerce, Specialty Store, Supermarket/Hypermarket, Convenience Stores, and Others), Price Range (Mid, Economy, and Premium), Country (U.S., Canada, and Mexico) Industry Trends and Forecast to 2028

Market Analysis and Insights: North America Denim Jeans Market

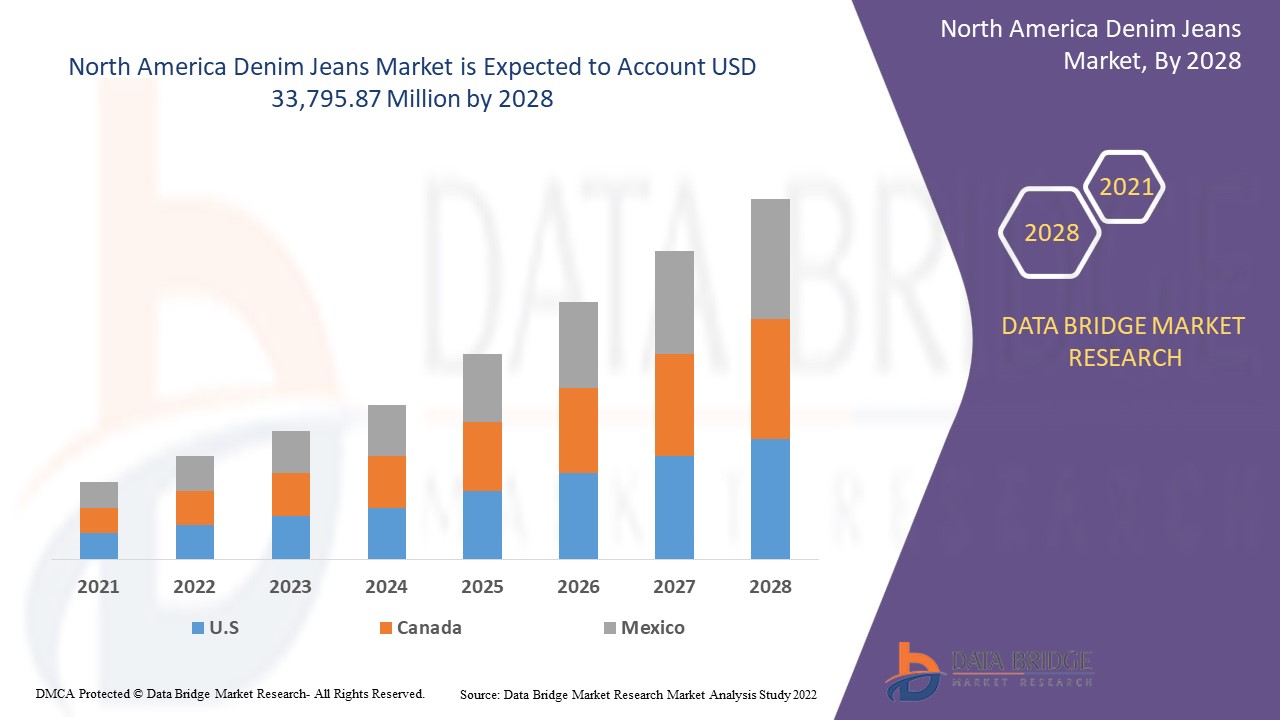

The North America denim jeans market is expected to gain market growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing with a CAGR of 7.1% in the forecast period of 2021 to 2028 and is expected to reach USD 33,795.87 million by 2028. The rise in urbanization and disposable income is boosting the North America denim jeans market.

Jeans are a type of bottom wear or pants, traditionally made from denim. Denim is a durable cotton fabric with a modest diagonal ribbing pattern created by a twill weave. The weft threads go under two or more warp threads, and the warp yarns are more noticeable on the right side of the cotton twill fabric, which is warp facing. The diagonal ribbing distinguishes denim fabric from canvas or cotton duck, durable woven cotton fabrics.

The excellent durability of denim jeans can be a good choice for long-term use, making them a major driving factor in the North America denim jeans market. Excess supply of denim jeans in the market is expected to be a challenge as it fluctuates the price too much, making the market unstable and resulting in loss to the company and manufacturers. However, growing awareness for product innovation and an increase in the trend of customized clothing prove to be an opportunity for the North America denim jeans market. Fluctuation in raw material prices, which fluctuates the product pricing, are the restraining factors.

The North America denim jeans market report provides details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the North America denim jeans market scenario, contact Data Bridge Market Research for an Analyst Brief; our team will help you create a revenue impact solution to achieve your desired goal.

North America Denim Jeans Market Scope and Market Size

The North America denim jeans market is segmented based on type, consumer type, distribution channel, price range. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of type, the global denim jeans market is segmented into cotton denim/100% cotton denim, stretch denim, raw denim/dry denim, crushed denim, cotton serge denim, waxed reverse denim, printed denim, washed denim/acid wash denim, colored denim, selvedge denim, ECRU denim, sanforized denim, bubblegum denim, poly denim, bull denim, thermo denim, ramie cotton denim, slub denim, vintage denim, fox fiber denim, marble denim, reverse denim, ring spun denim/dual ring spun denim, and others. In 2021, cotton denim/100% cotton denim segment is expected to dominate the North America denim jeans market due to its acceptance and use around the region and suitability for climatic conditions.

- On the basis of consumer type, the global denim jeans market has been segmented into men, women, and kids. In 2021, the men segment is expected to dominate the North America denim jeans market as most men prefer jeans for their comfort and can be worn in any environment.

- On the basis of distribution channel, the global denim jeans market has been segmented into direct sales/b2b/wholesale, e-commerce, specialty store, supermarket/hypermarket, convenience stores, and others. In 2021, the direct sales/ b2b/wholesale segment is expected to dominate the North America denim jeans market as B2B is the importer of denim jeans and procured in bulk from manufacturers worldwide.

- On the basis of price range, the global denim jeans market has been segmented into mid, economy, and premium. In 2021, the mid segment is expected to dominate the North America denim jeans market as these jeans' quality is excellent and look stylish when worn. In addition, it can be worn for outings, offices, or functions, making it suitable for any occasion, and it also provides good quality for a minimum price hike.

North America Denim Jeans Market Country Level Analysis

The North America denim jeans market is analyzed, and market size information is provided by the country, type, consumer type, distribution channel, price range as referenced above.

The countries covered in the North America denim jeans market report are the U.S., Canada, and Mexico. The U.S. dominates the North America denim jeans market due to the high demand and presence of major brands for denim jeans.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North American brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of sales channels are considered while providing forecast analysis of the country data.

Rise in Urbanization and Disposable Income is Boosting the Market Growth of North America Denim Jeans Market

The North America denim jeans market also provides you with a detailed market analysis for every country's growth in the particular market. Additionally, it provides detailed information regarding the market players’ strategy and their geographical presence. The data is available for the historical period 2010 to 2019.

Competitive Landscape and North America Denim Jeans Market Share Analysis

The North America denim jeans market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width, and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to the North America denim jeans market.

The major companies dealing in the North America denim jeans market are Gap Inc., FAST RETAILING CO., LTD., H&M Group, VF Corporation, Levi Strauss & Co, AG Adriano Goldschmied, A.P.C., BESTSELLER A/S, Carhartt, Inc., EDWIN Europe GmbH, Everlane, Kontoor Brands, Inc., Nudie Jeans Co., OTB, Pepe Jeans, PVH Corp., RALPH LAUREN, U.S. Polo Assn. among others in domestic players. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many contracts and agreements are also initiated by the companies worldwide, which also accelerates the North America denim jeans market.

For instances,

- In May 2021, BESTSELLER A/S announced that they had successfully delivered Olympic and Paralympic collections. As the official clothing partner for the Danish Olympic and Paralympic teams, the company has designed an entire collection for all non-competition situations for the global sporting events in Japan. With this, the company will be able to attract more international customers

- In September 2020, Carhartt, Inc. announced that they are teaming up with Guinness to release its limited-edition fall collection. This is the third collaboration between the two companies. The new Yukon Extremes collection has less bulk for the cold weather defense while adding warmth, increased movement, and improved functionality. Thus the company was able to provide a new winter collection to its customer

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.