North America Corneal Transplant Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

219.85 Million

USD

355.74 Million

2024

2032

USD

219.85 Million

USD

355.74 Million

2024

2032

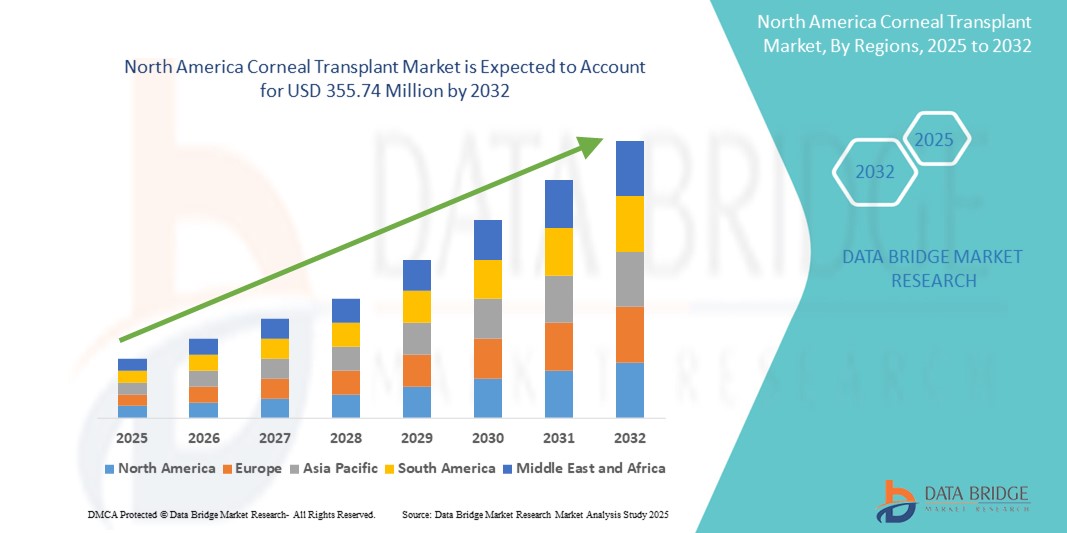

| 2025 –2032 | |

| USD 219.85 Million | |

| USD 355.74 Million | |

|

|

|

|

Segmentação do mercado de transplante de córnea na América do Norte, por tipo de procedimento (ceratoplastia endotelial, ceratoplastia penetrante, ceratoplastia lamelar anterior (ALK), transplante de células-tronco do limbo da córnea, transplante de córnea artificial e outros), tipo (córnea humana e sintética), tipo de doador (autoenxerto e aloenxerto), tipo de enxerto (enxertos de espessura parcial (lamelares) e enxertos de espessura total (penetrantes)), tipo de cirurgia (cirurgia convencional e cirurgia assistida a laser), indicação (distrofia endotelial de Fuchs, ceratite infecciosa, ceratopatia bolhosa, ceratocone, procedimentos de enxerto, cicatrização da córnea, úlceras da córnea e outros), gênero (feminino e masculino), faixa etária (geriátrica, adulta e pediátrica), usuário final (hospitais, clínicas oftalmológicas, centros cirúrgicos ambulatoriais, institutos acadêmicos e de pesquisa, e outros) - Tendências e previsões da indústria até 2032

Tamanho do mercado de transplante de córnea na América do Norte

- O tamanho do mercado de transplante de córnea da América do Norte foi avaliado em US$ 219,85 milhões em 2024 e deve atingir US$ 355,74 milhões até 2032 , com um CAGR de 6,20% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente prevalência de doenças da córnea, avanços nas técnicas de transplante e maior disponibilidade de tecidos de doadores em toda a região

- Além disso, a crescente conscientização sobre a saúde ocular, estruturas de reembolso de apoio e a crescente adoção de procedimentos cirúrgicos minimamente invasivos estão consolidando o transplante de córnea como o tratamento preferencial para a restauração da visão. Esses fatores convergentes estão acelerando a adoção de procedimentos de transplante de córnea, impulsionando significativamente o crescimento do mercado na região.

Análise do mercado de transplante de córnea na América do Norte

- Os transplantes de córnea, que envolvem a substituição de tecido corneano danificado ou doente por tecido de doador saudável, são procedimentos cada vez mais vitais no atendimento oftalmológico em ambientes de saúde públicos e privados devido à sua eficácia na restauração da visão e na melhoria da qualidade de vida do paciente.

- A crescente demanda por transplantes de córnea é alimentada principalmente pela prevalência crescente de doenças da córnea, como ceratocone e distrofia de Fuchs, juntamente com os avanços nas técnicas cirúrgicas e a maior disponibilidade de tecidos doadores.

- Os EUA dominaram o mercado de transplante de córnea na América do Norte, com a maior participação na receita, de 42,8% em 2024, caracterizado por uma infraestrutura de saúde bem desenvolvida, políticas de reembolso favoráveis e a presença de bancos de olhos e centros de transplante líderes. O país está testemunhando um forte volume de procedimentos, impulsionado por iniciativas de conscientização e inovações em técnicas de ceratoplastia endotelial.

- Espera-se que o Canadá seja o país com crescimento mais rápido no mercado de transplante de córnea da América do Norte durante o período previsto, devido à expansão do acesso a cuidados oftalmológicos especializados e ao aumento dos investimentos em tecnologias cirúrgicas oftálmicas.

- O segmento de ceratoplastia penetrante dominou o mercado de transplante de córnea da América do Norte com uma participação de mercado de 47,2% em 2024, impulsionado por seu amplo uso, resultados clínicos estabelecidos e capacidade de tratar danos corneanos de espessura total.

Escopo do relatório e segmentação do mercado de transplante de córnea na América do Norte

|

Atributos |

Principais insights do mercado de transplante de córnea na América do Norte |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de transplante de córnea na América do Norte

“Avanços Tecnológicos em Técnicas de Ceratoplastia”

- Uma tendência significativa e crescente no mercado de transplante de córnea na América do Norte é a mudança para técnicas avançadas e minimamente invasivas de ceratoplastia, como a Ceratoplastia Endotelial de Membrana de Descemet (DMEK) e a Ceratoplastia Endotelial de Descemet (DSEK). Esses procedimentos oferecem melhores resultados visuais, tempos de recuperação mais rápidos e riscos de complicações reduzidos em comparação aos transplantes tradicionais de espessura total.

- Por exemplo, os centros de transplantes sediados nos EUA estão adotando cada vez mais o DMEK para tratar a disfunção endotelial, apoiados por avanços na instrumentação cirúrgica e na preparação de tecidos de doadores por bancos de olhos especializados.

- Essas técnicas mais recentes preservam mais da estrutura da córnea do paciente, contribuindo para uma melhor sobrevida do enxerto a longo prazo e reduzindo a probabilidade de rejeição imunológica. Além disso, melhorias na visualização intraoperatória e procedimentos assistidos por laser aumentam ainda mais a precisão cirúrgica e as taxas de sucesso.

- A tendência também é reforçada pela crescente preferência dos cirurgiões por técnicas que ofereçam reabilitação mais rápida e menos complicações pós-operatórias. Como resultado, a demanda por tecido pré-descolado e pré-carregado de bancos de olhos, como o Lions Eye Institute for Transplant & Research, está aumentando.

- Este movimento em direção aos procedimentos de transplante de córnea de última geração está remodelando as práticas clínicas e estabelecendo novos padrões em cuidados oftalmológicos em toda a América do Norte. Consequentemente, empresas de dispositivos médicos e bancos de tecidos de doadores estão investindo em programas de treinamento e infraestrutura avançada para apoiar a ampla adoção.

- Espera-se que a crescente disponibilidade de treinamento cirúrgico especializado, a logística aprimorada de tecidos de doadores e a prontidão do sistema de saúde solidifiquem ainda mais essa tendência como um pilar fundamental do cenário de transplante de córnea em evolução nos EUA e Canadá.

Dinâmica do mercado de transplante de córnea na América do Norte

Motorista

“Aumento da prevalência de doenças da córnea e melhor acesso a tecidos de doadores”

- A crescente incidência de doenças da córnea, como ceratocone, distrofia endotelial de Fuchs e cicatrizes na córnea, é um dos principais impulsionadores da expansão do mercado de transplante de córnea na América do Norte.

- Por exemplo, a Eye Bank Association of America (EBAA) relatou mais de 80.000 transplantes de córnea realizados nos EUA em 2023, destacando uma forte demanda por procedimentos

- A disponibilidade aprimorada de tecidos de doadores, apoiada por uma rede bem organizada de bancos de olhos e campanhas de conscientização sobre doações, garante acesso oportuno a enxertos de qualidade, melhorando significativamente os resultados do transplante.

- Além disso, estruturas de reembolso fortes e maior cobertura de seguro para procedimentos oftalmológicos nos EUA e Canadá estão tornando os transplantes de córnea mais acessíveis a uma base de pacientes mais ampla.

- As iniciativas dos setores público e privado para promover o diagnóstico precoce e o tratamento oportuno de doenças da córnea contribuem ainda mais para o aumento da adesão aos procedimentos de transplante, especialmente em centros urbanos com instalações de saúde avançadas.

Restrição/Desafio

“Escassez de cirurgiões qualificados e disparidades regionais no acesso”

- Apesar do progresso tecnológico, a escassez de cirurgiões oftalmológicos treinados em técnicas avançadas de ceratoplastia representa um desafio para a ampla adoção de procedimentos modernos de transplante de córnea na América do Norte

- Por exemplo, as áreas rurais, tanto nos EUA como no Canadá, enfrentam frequentemente um acesso limitado a cuidados especializados, o que resulta em tempos de espera mais longos e em menos opções cirúrgicas para os pacientes em regiões carenciadas.

- Além disso, embora os hospitais urbanos possam estar bem equipados, as disparidades no financiamento e na infra-estrutura médica entre províncias e estados dificultam o acesso uniforme a cuidados de saúde de alta qualidade.

- Garantir uma formação mais ampla para os cirurgiões, aumentar o financiamento para serviços oftalmológicos em áreas remotas e fortalecer as redes inter-regionais de partilha de tecidos será essencial para superar estas restrições e garantir o acesso equitativo aos cuidados de transplante de córnea.

- Embora os transplantes de córnea sejam cobertos pelo seguro em muitos casos, o custo total - incluindo avaliações pré-operatórias, ferramentas cirúrgicas avançadas, processamento de tecido do doador e cuidados pós-operatórios pode ser alto

- O ônus financeiro é particularmente significativo para procedimentos que envolvem técnicas de ponta, como DMEK ou ceratoplastia assistida por laser de femtosegundo. Para pacientes sem seguro abrangente ou em regiões com políticas de reembolso limitadas, o custo torna-se uma barreira crítica ao acesso.

Escopo do mercado de transplante de córnea na América do Norte

O mercado é segmentado com base no tipo de procedimento, tipo, tipo de doador, tipo de enxerto, tipo de cirurgia, indicação, gênero, faixa etária e usuário final.

- Por tipo de procedimento

Com base no tipo de procedimento, o mercado de transplante de córnea na América do Norte é segmentado em ceratoplastia endotelial, ceratoplastia penetrante, ceratoplastia lamelar anterior (ALK), transplante de células-tronco límbicas da córnea, transplante de córnea artificial e outros. O segmento de ceratoplastia penetrante dominou o mercado, com a maior participação na receita de 47,2% em 2024, devido à sua utilidade clínica e eficácia comprovadas no tratamento de doenças da córnea de espessura total. Continua sendo amplamente adotado para casos graves de cicatrizes corneanas e ceratocone.

Prevê-se que o segmento de ceratoplastia endotelial apresentará a maior taxa de crescimento entre 2025 e 2032, impulsionado por avanços em técnicas cirúrgicas como DMEK e DSAEK. Essas abordagens oferecem melhor recuperação visual, redução de complicações e crescente preferência dos cirurgiões no tratamento de distúrbios endoteliais, como a distrofia de Fuchs.

- Por tipo

Com base no tipo, o mercado de transplante de córnea na América do Norte é segmentado em córnea humana e sintética. O segmento de córnea humana deteve a maior participação de mercado em 2024, impulsionado pela forte presença de bancos de olhos e pelo amplo uso de tecido de doadores em procedimentos de transplante. Altas taxas de sobrevivência de enxertos e a disponibilidade por meio de sistemas nacionais de doação contribuem para o domínio desse segmento.

Espera-se que o segmento sintético se expanda em ritmo constante de 2025 a 2032, impulsionado pela inovação em implantes de córnea artificial para pacientes com rejeições múltiplas de enxertos ou aqueles inadequados para enxertos de córnea humana. O aumento da pesquisa em materiais biocompatíveis também está impulsionando esse crescimento.

- Por tipo de doador

Com base no tipo de doador, o mercado de transplante de córnea na América do Norte é segmentado em enxerto autógeno e aloenxerto. O segmento de aloenxerto foi responsável pela maior fatia da receita de mercado em 2024, devido à sua ampla aplicação com tecido de doadores cadavéricos em procedimentos de espessura total e parcial.

Espera-se que o segmento de enxerto autólogo testemunhe um crescimento moderado durante o período previsto, particularmente em aplicações de nicho, como transplantes de células-tronco do limbo e reconstrução da superfície ocular, onde tecido derivado do paciente é utilizado.

- Por tipo de enxerto

Com base no tipo de enxerto, o mercado de transplante de córnea na América do Norte é segmentado em enxertos de espessura parcial (lamelar) e enxertos de espessura total (penetrante). O segmento de enxertos de espessura total dominou o mercado em 2024, principalmente devido à contínua dependência da ceratoplastia penetrante para casos avançados de degeneração corneana e trauma.

Espera-se que o segmento de enxertos de espessura parcial cresça na taxa mais rápida de 2025 a 2032, impulsionado pela crescente adoção de técnicas endoteliais e lamelares anteriores que oferecem melhores resultados pós-operatórios e menores taxas de rejeição.

- Por tipo de cirurgia

Com base no tipo de cirurgia, o mercado de transplante de córnea na América do Norte é segmentado em cirurgia convencional e cirurgia assistida a laser. O segmento de cirurgia convencional deteve a maior fatia da receita de mercado em 2024 devido à sua longa utilização, custo-benefício e ampla acessibilidade em centros cirúrgicos oftalmológicos gerais.

Espera-se que o segmento de cirurgia assistida a laser testemunhe a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente adoção da tecnologia de laser femtossegundo , que aumenta a precisão, reduz o tempo operatório e melhora o alinhamento da interface enxerto-hospedeiro.

- Por Indicação

Com base na indicação, o mercado de transplante de córnea na América do Norte é segmentado em distrofia endotelial de Fuchs, ceratite infecciosa, ceratopatia bolhosa, ceratocone, procedimentos de reenxerto, cicatrizes corneanas, úlceras corneanas e outros. O segmento de distrofia endotelial de Fuchs dominou o mercado em 2024, devido à sua alta prevalência entre a população idosa e à crescente preferência por técnicas de ceratoplastia endotelial.

A projeção é de que o segmento de ceratocone cresça na taxa mais rápida de 2025 a 2032, apoiado pela detecção precoce da doença, conscientização crescente e um número crescente de procedimentos seletivos de enxerto lamelar em grupos de pacientes mais jovens.

- Por gênero

Com base no gênero, o mercado de transplante de córnea na América do Norte é segmentado em masculino e feminino. O segmento masculino deteve a maior fatia da receita de mercado em 2024, principalmente devido à maior incidência de lesões na córnea relacionadas a traumas e à exposição ocupacional a riscos oculares.

Espera-se que o segmento feminino registre um crescimento notável durante o período previsto, apoiado pelo aumento do diagnóstico de distrofia de Fuchs entre mulheres mais velhas e pela conscientização crescente sobre a saúde ocular.

- Por faixa etária

Com base na faixa etária, o mercado de transplante de córnea na América do Norte é segmentado em geriátrico, adulto e pediátrico. O segmento adulto representou a maior fatia da receita de mercado em 2024, visto que a maioria dos procedimentos de transplante é realizada nesse grupo demográfico, impulsionado por ceratocone e ceratite infecciosa.

A projeção é de que o segmento geriátrico cresça na taxa mais rápida entre 2025 e 2032, devido à maior prevalência de disfunções endoteliais e doenças oculares degenerativas em populações idosas, principalmente nos EUA e Canadá.

- Por usuário final

Com base no usuário final, o mercado de transplante de córnea na América do Norte é segmentado em hospitais, clínicas oftalmológicas, centros cirúrgicos ambulatoriais, institutos acadêmicos e de pesquisa, entre outros. O segmento hospitalar dominou o mercado, com a maior participação na receita em 2024, impulsionado pela presença de equipamentos cirúrgicos oftalmológicos avançados e pelo alto fluxo de pacientes para atendimento completo.

Espera-se que o segmento de centros cirúrgicos ambulatoriais cresça no ritmo mais rápido durante o período previsto, devido aos tempos de procedimento mais curtos, eficiência de custos e maior preferência dos pacientes por intervenções cirúrgicas ambulatoriais em oftalmologia.

Análise regional do mercado de transplante de córnea na América do Norte

- Os EUA dominaram o mercado de transplante de córnea da América do Norte com a maior participação na receita de 42,8% em 2024, caracterizado por uma infraestrutura de saúde bem desenvolvida, políticas de reembolso de suporte e a presença de bancos de olhos e centros de transplante líderes.

- Pacientes dos EUA se beneficiam do acesso simplificado ao tecido da córnea do doador, da disponibilidade de cirurgiões oftalmológicos altamente qualificados e da conscientização crescente do público sobre procedimentos de restauração da visão, como DMEK e DSAEK

- Esta posição de liderança é ainda apoiada por uma cobertura de seguro favorável, investimentos crescentes em cuidados oftalmológicos e ampla adoção de técnicas inovadoras de transplante, posicionando os EUA como um centro central para procedimentos de transplante de córnea na região.

Visão do mercado de transplante de córnea nos EUA

O mercado de transplante de córnea dos EUA capturou a maior fatia da receita em 2024 na América do Norte, impulsionado pela crescente prevalência de doenças da córnea e pela forte presença de bancos de olhos e centros cirúrgicos especializados. A avançada infraestrutura de saúde do país, aliada à ampla disponibilidade de tecidos de doadores e ao alto volume de procedimentos de transplante, sustenta um desempenho robusto do mercado. Além disso, a crescente adoção de técnicas de ceratoplastia endotelial, como DMEK e DSAEK, juntamente com estruturas de reembolso favoráveis, impulsionam ainda mais o mercado. Inovações contínuas no processamento de enxertos de córnea e a crescente conscientização dos pacientes contribuem significativamente para o crescimento sustentado.

Visão geral do mercado de transplante de córnea no Canadá

O mercado canadense de transplante de córnea deverá crescer a uma taxa composta de crescimento anual (CAGR) significativa durante o período previsto, impulsionado por melhorias na prestação de serviços de saúde, serviços oftalmológicos financiados pelo governo e pela expansão do acesso a cuidados oftalmológicos em áreas urbanas e remotas. O crescente foco nacional na saúde ocular, aliado ao crescimento dos programas de treinamento cirúrgico e às colaborações com bancos de olhos dos EUA, está aprimorando a capacidade dos procedimentos. A crescente demanda por opções de transplante minimamente invasivo, as iniciativas de conscientização pública e o crescente investimento em pesquisa oftalmológica estão contribuindo para o avanço constante do mercado em todo o Canadá.

Visão geral do mercado de transplante de córnea no México

Prevê-se que o mercado mexicano de transplante de córnea cresça de forma constante durante o período previsto, impulsionado pelo aumento dos investimentos públicos e privados em serviços de saúde oftalmológica, pelo aumento da prevalência de cegueira corneana e pela melhoria gradual na acessibilidade aos cuidados de saúde. Programas governamentais que promovem a doação de órgãos e tecidos, juntamente com a expansão da capacidade cirúrgica oftalmológica em hospitais urbanos, estão apoiando o desenvolvimento do mercado. Embora o acesso a córneas de doadores continue sendo um desafio em algumas regiões, colaborações internacionais e iniciativas sem fins lucrativos estão ajudando a preencher lacunas na disponibilidade de tecidos e no treinamento cirúrgico. À medida que a conscientização e a infraestrutura de saúde melhoram, o México está pronto para testemunhar um crescimento sustentado nos procedimentos de transplante de córnea.

Participação no mercado de transplante de córnea na América do Norte

O setor de transplante de córnea da América do Norte é liderado principalmente por empresas bem estabelecidas, incluindo:

- CorneaGen, Inc. (EUA)

- KeraLink International (EUA)

- SightLife (EUA)

- Eversight (EUA)

- Instituto Oftalmológico Lions para Transplante e Pesquisa (EUA)

- Bausch + Lomb (EUA)

- Alcon Inc. (Suíça)

- Aurolab (Índia)

- Bancos de Tecidos Internacionais (EUA)

- Banco de Olhos para Restauração da Visão (EUA)

- Banco de Olhos de San Diego (EUA)

- Lions VisionGift (EUA)

- Wills Eye Hospital (EUA)

- New World Medical, Inc. (EUA)

- AJL Ophthalmic SA (Espanha)

- Banco de Olhos para Restauração da Visão (EUA)

- DIOPTEX GmbH (Áustria)

- Rede para Compartilhamento de Órgãos Pancreáticos (EUA)

- Keramed, Inc. (EUA)

- Stryker (EUA)

Quais são os desenvolvimentos recentes no mercado de transplante de córnea na América do Norte?

- Em maio de 2024, a Eye Bank Association of America (EBAA) lançou uma campanha nacional de conscientização nos EUA para promover a doação de córneas e educar o público sobre o impacto transformador dos transplantes. A iniciativa visa atender à crescente demanda por tecidos de doadores e aumentar as taxas de doação. Ao colaborar com hospitais, centros de transplante e grupos de defesa, a campanha reforça a importância da saúde da córnea e fortalece a cadeia de suprimentos de doadores para procedimentos de transplante.

- Em abril de 2024, a Universidade da Colúmbia Britânica, no Canadá, anunciou a aplicação clínica bem-sucedida de um novo implante corneano de bioengenharia, desenvolvido em colaboração com pesquisadores internacionais. Essa inovação oferece uma alternativa promissora para pacientes com baixo acesso a tecidos de doadores, particularmente aqueles com ceratocone avançado. O avanço representa um avanço significativo na oftalmologia regenerativa e expande as possibilidades futuras para o transplante de córnea sintética na América do Norte.

- Em março de 2024, a CorneaGen, Inc., empresa americana de fornecimento e inovação em tecido corneano, expandiu sua rede de distribuição no Canadá e no México, com o objetivo de otimizar o acesso a tecidos pré-desmoldados e pré-carregados para ceratoplastia endotelial. Essa iniciativa aumenta a eficiência do procedimento e oferece suporte aos cirurgiões oftalmológicos com enxertos prontos para uso, padronizando ainda mais o atendimento de transplantes de alta qualidade em toda a América do Norte.

- Em fevereiro de 2024, o Toronto Western Hospital inaugurou um Centro de Cirurgia Avançada da Córnea, com foco no treinamento de oftalmologistas em técnicas de ponta, como DMEK e DALK. Esta iniciativa aborda a escassez de cirurgiões especializados no Canadá e reforça os esforços regionais para melhorar os resultados por meio da excelência cirúrgica e da educação.

- Em janeiro de 2024, a SightLife, um banco de olhos global sem fins lucrativos com sede nos EUA, firmou uma parceria com o Ministério da Saúde do México para fortalecer a estrutura nacional de doação de córneas. O programa inclui treinamento técnico, conscientização pública e sistemas de garantia de qualidade para o manuseio de tecidos — marcando um passo significativo para a melhoria da infraestrutura e dos resultados de transplantes em regiões carentes da América do Norte.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.