North America Cell And Gene Therapy Thawing Equipment Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

497.65 Billion

USD

1,459.93 Billion

2025

2033

USD

497.65 Billion

USD

1,459.93 Billion

2025

2033

| 2026 –2033 | |

| USD 497.65 Billion | |

| USD 1,459.93 Billion | |

|

|

|

|

Segmentação do mercado de equipamentos de descongelamento para terapia celular e gênica na América do Norte, por modalidade (de bancada e portátil), amostra (terapias celulares e terapias gênicas), tipo (sistema de descongelamento manual e sistema de descongelamento automático), aplicação (processamento upstream e processamento downstream), usuário final (bancos de sangue e centros de transfusão, hospitais e laboratórios de diagnóstico, laboratórios de pesquisa e instituições acadêmicas, indústria biotecnológica e farmacêutica, bancos de sangue de cordão umbilical e células-tronco, bancos de genes e outros), canal de distribuição (licitação direta, distribuidor terceirizado e outros) - Tendências e previsões do setor até 2033.

Tamanho do mercado de equipamentos de descongelamento para terapia celular e gênica na América do Norte

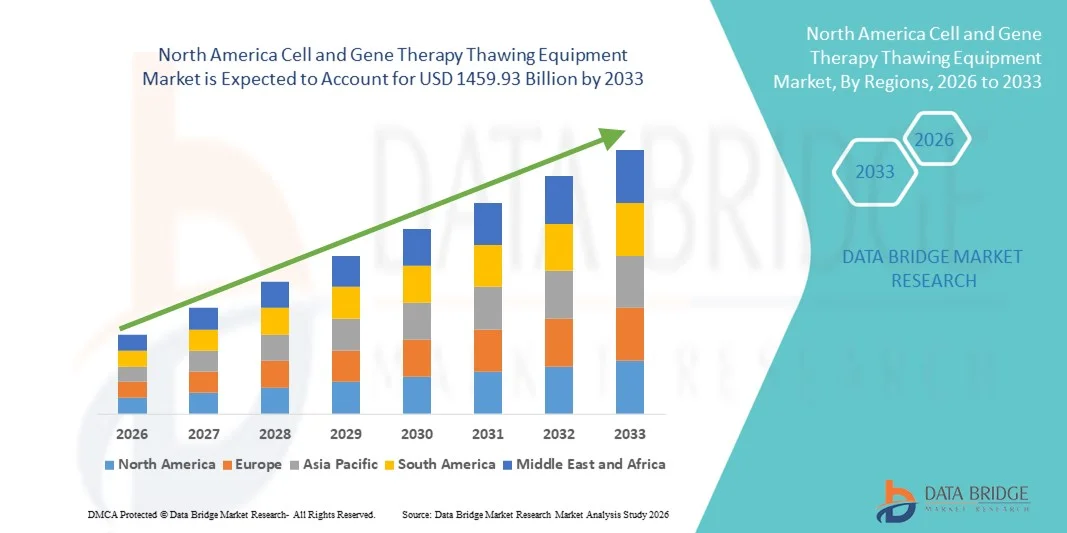

- O mercado de equipamentos de descongelamento para terapia celular e gênica na América do Norte foi avaliado em US$ 497,65 bilhões em 2025 e deverá atingir US$ 1.459,93 bilhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 14,40% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela rápida expansão da pesquisa e comercialização de terapias celulares e gênicas, juntamente com os avanços tecnológicos contínuos em sistemas de descongelamento controlado, que levam a uma maior precisão da temperatura, redução dos danos celulares e maior padronização dos processos em ambientes de fabricação clínica e comercial.

- Além disso, a crescente demanda por soluções de descongelamento seguras, confiáveis e em conformidade com as Boas Práticas de Fabricação (BPF) na fabricação biofarmacêutica e em laboratórios clínicos está posicionando os equipamentos de descongelamento para terapia celular e gênica como um componente crítico dos fluxos de trabalho modernos da medicina regenerativa, impulsionando significativamente o crescimento geral do mercado de equipamentos de descongelamento para terapia celular e gênica.

Análise do mercado de equipamentos de descongelamento para terapia celular e gênica na América do Norte

- Os equipamentos de descongelamento para terapia celular e gênica, projetados para garantir o descongelamento controlado, uniforme e livre de contaminação de materiais biológicos criopreservados, estão se tornando componentes essenciais em fluxos de trabalho clínicos, de pesquisa e comerciais de terapia celular, devido ao seu papel na manutenção da viabilidade celular e da integridade do produto.

- A crescente demanda por equipamentos de descongelamento para terapia celular e gênica é impulsionada principalmente pela rápida expansão dos projetos de terapia celular e gênica, pelo aumento da atividade de ensaios clínicos e pela crescente adoção de soluções de bioprocessamento automatizadas e em conformidade com as Boas Práticas de Fabricação (BPF) para dar suporte à produção em larga escala e reprodutível.

- Os EUA dominaram o mercado de equipamentos de descongelamento para terapia celular e gênica, com a maior participação de receita, de aproximadamente 41,2% em 2025. Esse desempenho foi impulsionado por um forte financiamento federal e privado para pesquisa em terapia celular e gênica, um ecossistema de fabricação biofarmacêutica bem estabelecido, alta concentração de ensaios clínicos, adoção precoce de tecnologias de descongelamento automatizadas e a presença de desenvolvedores de terapias e fabricantes de equipamentos líderes no setor.

- Prevê-se que o Canadá seja o país com o crescimento mais rápido no mercado de equipamentos de descongelamento para terapia celular e gênica durante o período de previsão, impulsionado pelo aumento dos investimentos em medicina regenerativa, expansão de programas de pesquisa acadêmicos e governamentais, crescimento de polos de biofabricação, aumento da atividade de CDMOs (Organizações de Desenvolvimento e Fabricação Contratadas) e iniciativas regulatórias favoráveis ao desenvolvimento de terapias avançadas.

- O segmento de terapias celulares representou a maior fatia da receita de mercado em 2025, com 61,7%, impulsionado pelo crescente número de terapias celulares aprovadas.

Escopo do relatório e segmentação do mercado de equipamentos de descongelamento para terapia celular e gênica

|

Atributos |

Equipamentos de descongelamento para terapia celular e gênica: principais informações de mercado |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, epidemiologia de pacientes, análise de projetos em desenvolvimento, análise de preços e estrutura regulatória. |

Tendências do mercado de equipamentos de descongelamento para terapia celular e gênica na América do Norte

Avanços nas tecnologias de descongelamento controlado e automatizado

- Uma tendência proeminente e crescente no mercado global de equipamentos de descongelamento para terapia gênica é a adoção cada vez maior de sistemas automatizados e precisamente controlados, projetados para manter a viabilidade celular e vetorial durante o manuseio pós-criopreservação. Como as terapias gênicas dependem fortemente de vetores virais termossensíveis e células modificadas, o descongelamento consistente e reprodutível tornou-se um requisito fundamental tanto em ambientes clínicos quanto comerciais.

- Os fabricantes estão cada vez mais focados em tecnologias de descongelamento a seco sem água e em sistemas fechados, que minimizam os riscos de contaminação e garantem uma transferência de calor uniforme.

- Por exemplo, a Sartorius promoveu soluções de descongelamento a seco para fluxos de trabalho de terapia celular e gênica, substituindo os banhos-maria convencionais, enquanto o TheraCube da Cytiva e plataformas de descongelamento controlado relacionadas são cada vez mais utilizadas por CDMOs para dar suporte a processos de manipulação de vetores virais e células em conformidade com as BPF (Boas Práticas de Fabricação), reduzindo os riscos de contaminação cruzada e a variabilidade dependente do operador.

- A integração do monitoramento de temperatura em tempo real, perfis de descongelamento programáveis e recursos de registro de dados está aprimorando ainda mais o controle e a rastreabilidade do processo. Esses recursos permitem que laboratórios e empresas biofarmacêuticas padronizem os protocolos de descongelamento em diversas unidades, garantindo a consistência da qualidade do produto durante os ensaios clínicos e a produção em escala comercial.

- Além disso, a crescente tendência para modelos de fabricação descentralizados e no local de atendimento está impulsionando a demanda por equipamentos de descongelamento compactos, portáteis e fáceis de operar. Esses sistemas são particularmente valiosos em farmácias hospitalares e centros clínicos onde as terapias gênicas são preparadas imediatamente antes da administração ao paciente.

- Essa tendência em direção a soluções de descongelamento mais seguras, rápidas e reproduzíveis está remodelando os padrões operacionais em todo o fluxo de trabalho da terapia gênica, incentivando a inovação contínua por parte dos fabricantes de equipamentos para atender às necessidades em constante evolução da produção de produtos biológicos avançados.

Dinâmica do mercado de equipamentos de descongelamento para terapia celular e gênica na América do Norte

Motorista

Aumento da demanda impulsionado pelo rápido crescimento do desenvolvimento e comercialização da terapia gênica.

- A rápida expansão da pesquisa em terapia gênica, dos ensaios clínicos e das aprovações regulatórias é um dos principais impulsionadores do mercado de equipamentos de descongelamento para terapia gênica. À medida que um número crescente de terapias gênicas avança do desenvolvimento inicial para os ensaios clínicos em estágio final e o lançamento comercial, a necessidade de soluções de descongelamento confiáveis e padronizadas se intensifica.

- Por exemplo, a comercialização de terapias genéticas aprovadas pela FDA, como Zolgensma e Luxturna, aumentou a demanda por sistemas de refrigeração rigorosamente controlados e sistemas de descongelamento em hospitais e centros de tratamento especializados, levando fabricantes e CDMOs a adotarem equipamentos de descongelamento validados para proteger terapias de alto valor antes da administração ao paciente.

- As terapias genéticas frequentemente envolvem materiais valiosos e sensíveis à temperatura, como vetores virais e células geneticamente modificadas, tornando o descongelamento preciso essencial para preservar a eficácia terapêutica e a segurança do paciente. Isso levou empresas biofarmacêuticas e organizações de desenvolvimento e fabricação por contrato (CDMOs) a investir em equipamentos de descongelamento especializados que suportam fluxos de trabalho consistentes e validados.

- A crescente prevalência de distúrbios genéticos, indicações oncológicas e doenças raras está acelerando ainda mais a demanda por terapias gênicas, impulsionando indiretamente a adoção de sistemas avançados de descongelamento em institutos de pesquisa, instalações de produção e centros clínicos.

- Além disso, o aumento do financiamento governamental e de investidores privados para apoiar produtos medicinais de terapia avançada (ATMPs) está fortalecendo o desenvolvimento da infraestrutura, impulsionando assim a aquisição de equipamentos dedicados ao processamento de terapia gênica, incluindo sistemas de descongelamento.

Restrição/Desafio

Altos custos de equipamentos e padronização limitada entre as instalações.

- O custo relativamente elevado dos equipamentos especializados para descongelamento de terapia gênica continua sendo um grande desafio, principalmente para pequenas empresas de biotecnologia, laboratórios de pesquisa acadêmica e participantes de mercados emergentes. Comparados aos métodos de descongelamento convencionais, os sistemas automatizados avançados exigem um investimento inicial maior, o que pode limitar a adoção por usuários sensíveis a custos.

- Por exemplo, pequenas startups de biotecnologia e spin-offs acadêmicos em estágio inicial frequentemente continuam usando abordagens de descongelamento manual ou semiautomatizada devido ao alto custo de capital dos sistemas de descongelamento a seco em conformidade com as Boas Práticas de Fabricação (GMP), o que pode ser difícil de justificar antes que as terapias avancem para os ensaios clínicos de estágio final ou para a comercialização.

- Além disso, a falta de padronização universal nos protocolos de descongelamento entre diferentes produtos de terapia gênica e plataformas de fabricação complica a seleção e implementação de equipamentos. A variabilidade nos formatos, volumes e requisitos de temperatura dos recipientes frequentemente exige soluções personalizadas, aumentando a complexidade operacional.

- Os requisitos de treinamento e os desafios de integração nos fluxos de trabalho de fabricação existentes também podem representar barreiras, especialmente para instalações que estão migrando de métodos tradicionais de manipulação criogênica para sistemas totalmente automatizados.

- Para superar esses desafios, os fabricantes estão se concentrando no desenvolvimento de plataformas de descongelamento escaláveis, versáteis e com boa relação custo-benefício, além de oferecer treinamento aprimorado para os usuários e suporte à validação. Abordar a acessibilidade e a interoperabilidade será fundamental para viabilizar uma adoção mais ampla e sustentar o crescimento do mercado a longo prazo.

Escopo do mercado de equipamentos de descongelamento para terapia celular e gênica na América do Norte

O mercado é segmentado com base na modalidade, amostra, tipo, aplicação, usuário final e canal de distribuição.

- Por modalidade

Com base na modalidade, o mercado de equipamentos de descongelamento para terapia celular e gênica é segmentado em sistemas de bancada e portáteis. O segmento de bancada dominou o mercado com uma participação de 58,4% da receita em 2025, impulsionado por seu uso generalizado em ambientes clínicos e laboratoriais controlados. Os sistemas de bancada oferecem alta precisão, uniformidade de temperatura e reprodutibilidade, que são cruciais para manter a viabilidade celular durante o descongelamento. Esses sistemas são amplamente adotados em hospitais, bancos de sangue e instalações de fabricação farmacêutica. Sua compatibilidade com fluxos de trabalho em conformidade com as Boas Práticas de Fabricação (BPF) fortalece ainda mais a demanda. As unidades de bancada suportam processamento de alto volume, tornando-as adequadas para ensaios clínicos em larga escala. A integração com sistemas automatizados de processamento celular aumenta a eficiência operacional. A forte aceitação regulatória também sustenta a dominância. A alta precisão reduz os riscos de contaminação. As atualizações tecnológicas contínuas melhoram a confiabilidade. A preferência por pessoal qualificado impulsiona ainda mais a adoção. A infraestrutura estabelecida em regiões desenvolvidas reforça a liderança. No geral, a confiabilidade e a escalabilidade impulsionam a dominância.

O segmento de dispositivos portáteis deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de 9,2%, entre 2026 e 2033, impulsionado pela crescente demanda por terapias descentralizadas e de uso no local de atendimento. Os sistemas portáteis oferecem flexibilidade para aplicações à beira do leito e em campo. A crescente adoção de terapias celulares personalizadas alimenta a demanda. Esses sistemas permitem o descongelamento rápido em situações de emergência e em locais remotos. O uso crescente em ensaios clínicos aumenta a sua adoção. O design compacto melhora a mobilidade e a facilidade de uso. Os avanços tecnológicos aprimoram a precisão da temperatura. A expansão de centros de tratamento ambulatorial contribui para o crescimento. A maior adoção em mercados emergentes impulsiona a demanda. A relação custo-benefício em comparação com os sistemas de bancada favorece a penetração no mercado. O aumento do investimento em infraestrutura móvel de saúde acelera a adoção. Em resumo, a portabilidade e a conveniência impulsionam um forte crescimento da CAGR.

- Por exemplo

Com base na amostra, o mercado é segmentado em terapias celulares e terapias gênicas. O segmento de terapias celulares representou a maior participação na receita de mercado, com 61,7% em 2025, impulsionado pelo crescente número de terapias celulares aprovadas. A alta demanda por terapias com células CAR-T e células-tronco contribui significativamente para a dominância do mercado. As terapias celulares exigem um descongelamento preciso para preservar a viabilidade e a funcionalidade. O aumento das aplicações clínicas em oncologia e medicina regenerativa sustenta o crescimento. A crescente adoção em hospitais e centros de pesquisa impulsiona a demanda. Uma sólida linha de produtos de terapia celular fortalece a participação de mercado. O uso frequente em bancos de sangue reforça ainda mais a dominância. Protocolos avançados de descongelamento melhoram os resultados clínicos. As aprovações regulatórias aumentam a confiança. A expansão das instalações de fabricação de terapias celulares aumenta a demanda por equipamentos. O investimento em automação favorece a escalabilidade. Coletivamente, esses fatores sustentam a liderança do mercado.

Prevê-se que o segmento de terapias genéticas cresça à taxa composta de crescimento anual (CAGR) mais rápida, de 10,1%, entre 2026 e 2033, impulsionado pelos rápidos avanços na engenharia genética. O aumento das aprovações para tratamentos baseados em genes sustenta a demanda. As terapias genéticas requerem descongelamento controlado para manter a estabilidade do vetor. A expansão das atividades de ensaios clínicos impulsiona a adoção. O aumento dos investimentos no tratamento de doenças raras acelera o crescimento. Soluções de descongelamento aprimoradas aumentam a segurança e a eficácia. A crescente conscientização entre os médicos apoia a adoção. A expansão dos bancos de genes aumenta o uso de equipamentos. Parcerias entre empresas de biotecnologia impulsionam a inovação. O apoio regulatório para terapia genética acelera a comercialização. A logística aprimorada da cadeia de frio sustenta ainda mais o crescimento. Essas tendências, em conjunto, impulsionam a alta CAGR.

- Por tipo

Com base no tipo, o mercado é segmentado em sistemas de descongelamento manual e sistemas de descongelamento automático. O segmento de sistemas de descongelamento automático dominou o mercado com uma participação de 54,9% da receita em 2025, impulsionado pela consistência superior e pela redução de erros humanos. Os sistemas automatizados garantem um controle preciso da temperatura e protocolos de descongelamento padronizados. A alta adoção em instalações que atendem às Boas Práticas de Fabricação (BPF) sustenta essa dominância. Esses sistemas reduzem significativamente os riscos de contaminação. A crescente preferência pela automação na fabricação biofarmacêutica impulsiona a demanda. A integração com o processamento em sistema fechado aumenta a segurança. A menor dependência de mão de obra melhora a eficiência. A alta capacidade de produção suporta a fabricação em larga escala. A forte demanda das empresas farmacêuticas reforça a liderança. Os órgãos reguladores favorecem os processos automatizados. A inovação contínua aprimora o desempenho do sistema. No geral, a automação impulsiona a dominância.

O segmento de sistemas de descongelamento manual deverá apresentar o crescimento mais rápido, com uma taxa composta de crescimento anual (CAGR) de 8,6% entre 2026 e 2033, impulsionado pela acessibilidade e simplicidade. Os sistemas manuais são amplamente utilizados em pequenos laboratórios e instituições acadêmicas. O baixo investimento inicial favorece a adoção. O aumento das atividades de pesquisa em economias emergentes impulsiona a demanda. A flexibilidade no manuseio de diferentes tipos de amostras também contribui para o crescimento. O aumento dos programas de treinamento aprimora a precisão de uso. A adoção em pesquisas clínicas em estágio inicial impulsiona a expansão. O crescente número de pequenas startups de biotecnologia alimenta a demanda. A facilidade de manutenção reforça a preferência. As vantagens de portabilidade aumentam ainda mais o uso. A crescente descentralização do processamento de terapias também contribui para o crescimento. Em conjunto, esses fatores impulsionam a expansão da CAGR.

- Por meio de aplicação

Com base na aplicação, o mercado é segmentado em processamento upstream e processamento downstream. O segmento de processamento downstream detinha a maior participação na receita de mercado, com 57,3% em 2025, impulsionado por seu papel crucial na preparação final da terapia. O descongelamento preciso durante o processamento downstream garante a integridade do produto. A crescente comercialização de terapias celulares e gênicas impulsiona a demanda. A alta dependência do descongelamento controlado sustenta a dominância. A adoção em instalações de fabricação fortalece a participação na receita. Requisitos rigorosos de controle de qualidade aprimoram o uso de equipamentos. Fluxos de trabalho downstream avançados exigem gerenciamento preciso de temperatura. Volumes de produção crescentes aumentam a frequência de uso. A ênfase regulatória na consistência apoia a adoção. A integração com as operações de envase e acabamento aumenta a demanda. Forte investimento farmacêutico sustenta o crescimento. Esses fatores mantêm a liderança.

Prevê-se que o segmento de processamento upstream apresente o crescimento mais rápido, com uma taxa composta de crescimento anual (CAGR) de 9,0% entre 2026 e 2033, impulsionado pela expansão das atividades de pesquisa. A expansão celular em estágio inicial requer um descongelamento confiável. O aumento do investimento em P&D impulsiona a adoção. O crescimento da pesquisa acadêmica sustenta a demanda. A inovação tecnológica aprimora a eficiência do upstream. O número crescente de ensaios clínicos alimenta o crescimento. A integração da automação aumenta a escalabilidade. O foco crescente na otimização de processos sustenta a expansão. A crescente atividade de startups de biotecnologia impulsiona a demanda. A adoção na fabricação em escala piloto aumenta o uso. A melhoria da reprodutibilidade sustenta a preferência. No geral, a expansão do upstream impulsiona o crescimento da CAGR.

- Por usuário final

Com base no usuário final, o mercado é segmentado em bancos de sangue e centros de transfusão, hospitais e laboratórios de diagnóstico, laboratórios de pesquisa e instituições acadêmicas, indústria biotecnológica e farmacêutica, bancos de sangue de cordão umbilical e células-tronco, bancos de genes e outros. O segmento da indústria biotecnológica e farmacêutica dominou o mercado com uma participação de 36,8% da receita em 2025, impulsionado pela fabricação de terapias em larga escala. A produção em alto volume exige equipamentos de descongelamento avançados. O aumento das aprovações comerciais sustenta a dominância. O investimento em automação aumenta a eficiência. Fortes linhas de pesquisa e desenvolvimento impulsionam a demanda. A expansão global das instalações de fabricação impulsiona a adoção. A conformidade regulatória exige descongelamento preciso. A alta disponibilidade de capital apoia as atualizações de equipamentos. Parcerias estratégicas fortalecem a posição no mercado. O aumento das atividades de terceirização apoia o uso. A otimização contínua de processos sustenta a liderança. Esses fatores mantêm a dominância.

O segmento de bancos de sangue de cordão umbilical e células-tronco deverá apresentar o crescimento mais rápido, com uma taxa composta de crescimento anual (CAGR) de 9,4% entre 2026 e 2033, impulsionado pela crescente conscientização sobre a preservação de células-tronco. O aumento das taxas de natalidade em regiões emergentes impulsiona a demanda por armazenamento. O uso crescente em medicina regenerativa apoia a adoção. Tecnologias de descongelamento aprimoradas aumentam a viabilidade celular. Iniciativas governamentais promovem o armazenamento de células-tronco. A expansão de serviços bancários privados impulsiona o crescimento. O aumento do turismo médico sustenta a demanda. Os avanços tecnológicos melhoram a eficiência operacional. O aumento das aplicações clínicas impulsiona o uso. A expansão da infraestrutura de armazenamento sustenta a CAGR. A crescente conscientização do consumidor aumenta as inscrições. Essas tendências impulsionam um forte crescimento.

- Por canal de distribuição

Com base no canal de distribuição, o mercado é segmentado em licitação direta, distribuidores terceirizados e outros. O segmento de licitação direta dominou o mercado com uma participação de 48,6% da receita em 2025, impulsionado por compras em grande volume por hospitais e empresas farmacêuticas. O fornecimento direto garante eficiência de custos e garantia de qualidade. Instituições financiadas pelo governo preferem compras por meio de licitação. Contratos de fornecimento de longo prazo garantem estabilidade. A padronização de equipamentos contribui para a eficiência operacional. Relacionamentos sólidos entre fornecedores e compradores reforçam a dominância. Instalações de produção em larga escala dependem de compras diretas. Os processos de licitação auxiliam na conformidade regulatória. A inclusão de contratos de serviços agrega valor. A redução dos custos de intermediação reforça a preferência. Compras em alto volume impulsionam a dominância. Esses fatores sustentam a liderança.

Prevê-se que o segmento de distribuidores terceirizados apresente o crescimento mais rápido, com uma taxa composta de crescimento anual (CAGR) de 8,9% entre 2026 e 2033, impulsionado pela expansão em mercados emergentes. Os distribuidores facilitam o acesso para instalações de pequeno e médio porte. A presença local melhora a prestação de serviços. A crescente infraestrutura de saúde privada impulsiona a demanda. Opções de compra flexíveis apoiam a adoção. A logística aprimorada aumenta a disponibilidade. Os fabricantes se beneficiam da redução da carga operacional. O aumento dos gastos com saúde sustenta as redes de distribuição. Um número crescente de startups de biotecnologia depende de distribuidores. O suporte pós-venda aumenta a fidelização de clientes. A expansão do mercado em regiões remotas impulsiona o crescimento. Esses fatores geram uma forte expansão da CAGR.

Análise Regional do Mercado de Equipamentos de Descongelamento para Terapia Celular e Gênica na América do Norte

- O mercado de equipamentos de descongelamento para terapia celular e gênica na América do Norte está preparado para crescer a uma taxa composta de crescimento anual (CAGR) robusta durante o período de previsão, impulsionado pela rápida expansão do setor biofarmacêutico, fortes investimentos em medicina regenerativa e crescente adoção clínica de terapias celulares e gênicas em toda a região. A presença de infraestrutura de saúde avançada, um arcabouço regulatório maduro e uma alta concentração de desenvolvedores de terapias estão acelerando a demanda por soluções de descongelamento precisas e confiáveis.

- O crescente número de ensaios clínicos, ativos em fase final de desenvolvimento e a comercialização de terapias celulares e gênicas aprovadas estão impulsionando significativamente a demanda por equipamentos de descongelamento controlados e livres de contaminação, essenciais para manter a viabilidade celular, a consistência e a eficácia terapêutica durante a fabricação e o preparo para uso no local de atendimento.

- Além disso, o papel da América do Norte como um centro global para a fabricação biofarmacêutica e serviços de desenvolvimento por contrato está acelerando a adoção de sistemas de descongelamento padronizados e em conformidade com as Boas Práticas de Fabricação (BPF) em laboratórios de pesquisa, Organizações de Desenvolvimento e Fabricação Contratadas (CDMOs) e centros de tratamento hospitalares, principalmente à medida que a automação e o processamento em sistema fechado ganham importância nos fluxos de trabalho de terapia avançada.

Análise do Mercado de Equipamentos de Descongelamento para Terapia Celular e Gênica nos EUA

O mercado de equipamentos de descongelamento para terapia celular e gênica dos EUA dominou a região da América do Norte, com a maior participação na receita, de aproximadamente 41,2% em 2025, impulsionado por um forte financiamento federal e privado para pesquisa em terapia celular e gênica e por um ecossistema de fabricação biofarmacêutica bem estabelecido. O país concentra um alto número de ensaios clínicos em oncologia, doenças raras e distúrbios genéticos, o que gera uma demanda constante por equipamentos de descongelamento de precisão tanto em ambientes de fabricação quanto clínicos. A adoção precoce de tecnologias de descongelamento automatizadas e de sistema fechado está fortalecendo ainda mais o crescimento do mercado, à medida que os desenvolvedores de terapias se concentram em escalabilidade, reprodutibilidade e conformidade regulatória. Além disso, a presença de desenvolvedores de terapias, CDMOs (Organizações de Desenvolvimento e Fabricação Contratadas) e fabricantes de equipamentos líderes reforça a posição de liderança dos EUA em infraestrutura avançada para terapia celular e gênica.

Análise do Mercado de Equipamentos de Descongelamento para Terapia Celular e Gênica no Canadá

O mercado canadense de equipamentos de descongelamento para terapia celular e gênica deverá ser o de crescimento mais rápido durante o período de previsão, impulsionado pelo aumento dos investimentos em medicina regenerativa e pela expansão de programas de pesquisa acadêmicos e governamentais. O crescimento de polos de biofabricação e a crescente atividade de CDMOs (Organizações de Desenvolvimento e Fabricação Contratadas) estão criando uma forte demanda por equipamentos de descongelamento padronizados e escaláveis para dar suporte tanto à pesquisa clínica quanto à produção comercial. Iniciativas regulatórias favoráveis ao desenvolvimento de terapias avançadas, juntamente com a crescente colaboração entre universidades, hospitais e empresas de biotecnologia, estão melhorando o acesso a tecnologias modernas de processamento celular. À medida que o Canadá continua a fortalecer seu ecossistema de terapias avançadas, espera-se que a adoção de sistemas de descongelamento confiáveis e automatizados aumente de forma constante.

Participação de mercado de equipamentos de descongelamento para terapia celular e gênica na América do Norte

O setor de equipamentos de descongelamento para terapia celular e gênica é liderado principalmente por empresas consolidadas, incluindo:

- Thermo Fisher Scientific (EUA)

- GE HealthCare (EUA)

- Cytiva (EUA)

- BioLife Solutions (EUA)

- Sartorius (Alemanha)

- Merck KGaA (Alemanha)

- PHC Holdings Corporation (Japão)

- Panasonic Healthcare (Japão)

- Eppendorf (Alemanha)

- Helmer Scientific (EUA)

- B Sistemas Médicos (Luxemburgo)

- Brooks Automation (EUA)

- Assíntota (Reino Unido)

- MedCision (China)

- Haier Biomedical (China)

Últimos desenvolvimentos no mercado de equipamentos de descongelamento para terapia celular e gênica na América do Norte

- Em março de 2023, a BioLife Solutions, Inc. lançou uma versão atualizada do seu sistema de descongelamento inteligente evo, equipado com conectividade sem fio e uma interface de usuário aprimorada, permitindo o monitoramento remoto e a rastreabilidade no descongelamento de terapias celulares criopreservadas — uma melhoria fundamental para o controle de qualidade e a conformidade nos fluxos de trabalho clínicos e de fabricação.

- Em fevereiro de 2023, a Sartorius AG anunciou uma colaboração estratégica com uma importante empresa biofarmacêutica europeia para o desenvolvimento conjunto de uma solução de descongelamento totalmente fechada e automatizada, específica para terapias derivadas de células-tronco. O objetivo é minimizar o risco de contaminação e melhorar a consistência do descongelamento na fabricação de terapias avançadas.

- Em janeiro de 2023, a Thermo Fisher Scientific Inc. lançou o seu Sistema de Descongelamento com Taxa Controlada CryoMed, projetado para garantir o descongelamento consistente de amostras biológicas críticas com alta reprodutibilidade e para dar suporte à conformidade regulatória em fluxos de trabalho de descongelamento em pesquisa clínica e biofarmacêutica.

- Em abril de 2025, a Thermo Fisher Scientific anunciou uma colaboração estratégica com a Miltenyi Biotec para integrar o descongelamento automatizado aos fluxos de trabalho de processamento celular para terapias celulares clínicas, ajudando a reduzir o tempo total de processamento e a melhorar a viabilidade celular na produção de terapias avançadas.

- Em maio de 2025, a Stylus Medicine, uma startup de biotecnologia focada em tecnologias avançadas de fabricação de terapias, captou US$ 85 milhões em financiamento para iniciativas que incluem inovações em descongelamento e fluxos de trabalho de produção, visando solucionar desafios na administração de terapias celulares e gênicas.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.