North America Cancer Supportive Care Products Market

Tamanho do mercado em biliões de dólares

CAGR :

%

| 2021 –2028 | |

| USD 11,043.65 Million | |

| USD 15,822.55 Million | |

|

|

|

Mercado de produtos de apoio ao cancro da América do Norte, por tipo de medicamento (fator estimulador de colónias de granulócitos (GCSFs), agentes estimuladores de eritropoietina (ESA’S), analgésicos opióides, anticorpos monoclonais, anti-inflamatórios não esteróides (AINEs), bifosfonatos, antieméticos, anti-histamínicos e Outros), Tipo (de marca e genéricos), Tipo de cancro (cancro do pulmão, cancro da mama, cancro da próstata, cancro do fígado, cancro da bexiga, leucemia, melanoma, cancro do ovário e outros tipos de cancro), utilizador final (hospitais, clínicas, hospitais e instituições académicas e outros), canal de distribuição (farmácias hospitalares, farmácias de retalho e farmácias de manipulação), país (EUA, Canadá, México), tendências da indústria e previsão para 2028

Análise de mercado e insights: Mercado de produtos de apoio ao cancro da América do Norte

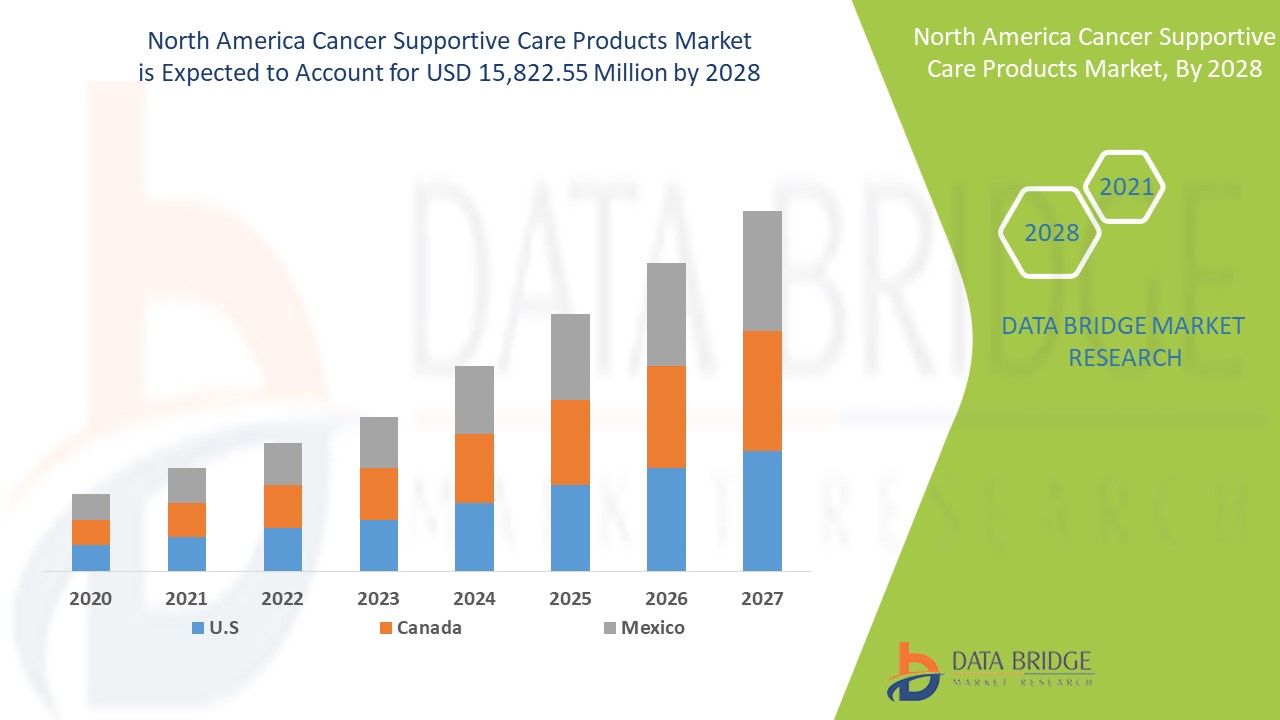

Espera-se que o mercado de produtos de cuidados de apoio ao cancro ganhe crescimento de mercado no período de previsão de 2021 a 2028. A Data Bridge Market Research analisa que o mercado está a crescer com um CAGR de 4,7% no período de previsão de 2021 a 2028 e deverá atingir os 15.822,55 milhões de dólares até 2028, contra os 11.043,65 milhões de dólares em 2020. O aumento da utilização de produtos de cuidados de suporte oncológico, a crescente incidência de doenças oncológicas são os principais impulsionadores que impulsionaram a procura do mercado no período de previsão.

Os produtos de cuidados de suporte oncológico são os medicamentos administrados durante o tratamento do cancro para melhorar a qualidade de saúde dos doentes. Os produtos de tratamento de suporte ao cancro são essenciais durante o tratamento quimioterápico do cancro, uma vez que o tratamento do cancro está associado a efeitos secundários graves. Os produtos de cuidados de apoio ao cancro são fornecidos aos doentes para aliviar, controlar ou prevenir os efeitos adversos e acelerar o conforto do doente durante o tratamento do cancro.

Prevê-se que a crescente carga de doentes com cancro nos países desenvolvidos e em desenvolvimento acelere a procura de produtos de cuidados de suporte ao cancro. Consequentemente, ajudará a impulsionar o crescimento do mercado de produtos de cuidados de apoio ao cancro. Prevê-se que a elevada prevalência e a carga de doença oncológica sejam um importante fator impulsionador do crescimento do mercado de produtos de cuidados de suporte oncológico. Os crescentes efeitos secundários dos medicamentos de apoio ao cancro estão a funcionar como uma restrição para dificultar a procura do mercado de produtos de apoio ao cancro.

O acordo e a aquisição são a oportunidade de ouro para os participantes do mercado de produtos de apoio ao cancro elevarem o seu crescimento de receitas. O desenvolvimento de versões mais recentes do fármaco poderá alterar significativamente o composto do composto original. Esta abordagem pode também levar a novos ensaios clínicos e reaplicações de patentes, pelo que a expiração da patente do medicamento está a funcionar como um desafio para o mercado de produtos de cuidados de suporte ao cancro.

O relatório de mercado de produtos de cuidados de apoio ao cancro fornece detalhes de quota de mercado, novos desenvolvimentos e análise de pipeline de produtos, impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações de mercado, aprovações de produtos, decisões estratégicas, lançamentos de produtos, expansões geográficas e inovações tecnológicas no mercado. Para compreender a análise e o cenário do mercado de produtos de apoio ao cancro, contacte a Data Bridge Market Research para obter um resumo do analista, a nossa equipa irá ajudá-lo a criar uma solução de impacto na receita para atingir o objetivo desejado.

Âmbito do mercado de produtos de cuidados de apoio ao cancro e tamanho do mercado

O mercado de produtos de apoio ao cancro está categorizado em cinco segmentos notáveis que se baseiam no tipo de medicamento, tipo, tipo de cancro, utilizador final e canal de distribuição. O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e a diferença nos seus mercados-alvo.

- Com base no tipo de medicamento, o mercado de produtos de apoio ao cancro está segmentado em fator estimulador de colónias de granulócitos (GCSFs), agentes estimuladores de eritropoietina (ESA’s) , analgésicos opióides, anticorpos monoclonais , anti-inflamatórios não esteróides (AINEs), bifosfonatos , anti- eméticos, anti-histamínicos e outros. Em 2021, o segmento do fator estimulador de colónias de granulócitos (GCSFs) está a dominar o mercado dos produtos de apoio ao cancro, uma vez que estimula a medula óssea e gera células estaminais, bem como granulócitos para a descarregar na corrente sanguínea. Além disso, o fator estimulador de colónias de granulócitos (GCSFS) é utilizado principalmente para tratar e curar a neutropenia causada pelo tratamento quimioterápico do cancro.

- Com base no tipo, o mercado de produtos de apoio ao cancro está segmentado em marcas e genéricos. Em 2021, o segmento dos genéricos está a dominar o mercado de produtos de cuidados de apoio ao cancro, uma vez que é económico, facilmente acessível e recomendado principalmente por médicos para doenças de produtos de cuidados de apoio ao cancro.

- Com base no tipo de cancro, o mercado de produtos de apoio ao cancro está segmentado em cancro do pulmão, cancro da mama, cancro da próstata, cancro do fígado, cancro da bexiga, leucemia, melanoma, cancro do ovário e outros tipos de cancro . Em 2021, o segmento do cancro do pulmão está a dominar o mercado dos produtos de cuidados de apoio ao cancro devido aos crescentes hábitos tabágicos entre a população dos países desenvolvidos e em desenvolvimento.

- Com base no utilizador final, o mercado de produtos de apoio ao cancro está segmentado em hospitais, clínicas, hospitais e instituições académicas e outros. Em 2021, o segmento hospitalar está a dominar o mercado dos produtos de apoio ao cancro, uma vez que oferece aos doentes os melhores serviços de saúde. Além disso, os hospitais são os principais prestadores de cuidados de saúde aos doentes que sofrem de cancro.

- On the basis of distribution channel, the cancer supportive care products market is segmented into hospital pharmacies, retail pharmacies and compounding pharmacies. In 2021, hospital pharmacies segment is dominating the cancer supportive care products market as most of the medicines are procured through hospital pharmacies. The increasing adoption of prescription based medicines, also acts as driver for the cancer supportive care products market growth.

Cancer Supportive Care Products Market Country Level Analysis

The cancer supportive care products market is analysed and market size information is provided by country, drug type, type, cancer type, end user and distribution channel as referenced above.

The countries covered in North America cancer supportive care products market are U.S., Canada and Mexico.

North America is expected to dominate the market due to the high adoption of cancer supportive care products by the patients in the region. The U.S is dominating in the market and leading the growth in the North America due to increased presence of key market players in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Strategic Initiatives by Manufacturers is Creating New Opportunities for Players in the Cancer Supportive Care Products Market

Cancer supportive care products Market also provides you with detailed market analysis for every country growth. Additionally, it provides data regarding acquisition and agreement among the major market plyers and start-up companies. Moreover, growing impact of research and development activities on cancer supportive care products increases market growth pace. The data is available for historic period 2010 to 2019.

Competitive Landscape and Cancer Supportive Care Products Market Share Analysis

The cancer supportive care products market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to cancer supportive care products market.

Os principais participantes abordados no relatório Amgen Inc., Janssen Pharmaceuticals, Inc. (uma subsidiária da Johnson & Johnson Services, Inc.), Pfizer Inc., APR, Novartis AG, F. Hoffmann-La Roche Ltd., Acacia Pharma Group Plc ., Baxter, Bayer AG, Helsinn Healthcare SA., Heron Therapeutics, Inc., Kyowa Kirin Co., Ltd., Acrotech Biopharma, Spectrum Pharmaceuticals, Inc., Oxford Pharmascience Ltd, Merck Sharp & Dohme Corp. Inc.), Teva (uma subsidiária da Teva Pharmaceutical Industries Ltd.), Tersera Therapeutics Llc., Mylan NV, Sun Pharmaceutical Industries Ltd., outros players nacionais e globais. Os analistas DBMR compreendem os pontos fortes competitivos e fornecem análises competitivas para cada concorrente em separado.

Muitas aprovações e acordos de produtos são também iniciados pelas empresas de todo o mundo, que também estão a acelerar o mercado de produtos de apoio ao cancro.

Por exemplo,

- Em janeiro de 2020, a Novartis AG declarou a aquisição da Medicines Company. Esta aquisição proporcionou à empresa uma nova oportunidade de aumentar a sua presença geográfica em todo o mundo, bem como ajudou a atualizar o portfólio de produtos da empresa.

- Em outubro de 2019, a Heron Therapeutics, Inc. anunciou a aprovação pela US Food and Drug Administration do pedido suplementar de novo medicamento (sNDA) da Heron para a emulsão injetável CINVANTI (aprepitanto). Esta aprovação ajudou a reforçar a presença da empresa no mercado dos EUA.

A colaboração, as joint ventures e outras estratégias dos participantes do mercado estão a melhorar a impressão da empresa no mercado de produtos de apoio ao cancro, o que também oferece o benefício para a organização melhorar o seu crescimento de vendas.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 DRUG TYPE LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 REGULATORY

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING CANCER BURDEN WORLDWIDE

5.1.2 INCREASING INITIATIVES BY GOVERNMENT AND OTHER HEALTHCARE ORGANIZATIONS

5.1.3 GROWING GERIATRIC POPULATION

5.1.4 RISING NUMBER OF PRODUCT APPROVAL

5.1.5 RISING EXPENDITURE ON HEALTHCARE

5.2 RESTRAINTS

5.2.1 ADVERSE EFFECTS AND RISKS ASSOCIATED WITH CANCER SUPPORTIVE DRUGS

5.2.2 LACK OF EARLY DETECTION

5.3 OPPORTUNITIES

5.3.1 ACQUISITION AND AGREEMENT BY MAJOR PLAYERS

5.3.2 RISING PRODUCT LAUNCHES

5.3.3 GROWING R&D ACTIVITIES

5.4 CHALLENGES

5.4.1 STRINGENT REGULATION POLICY

5.4.2 PATENT EXPIRY OF DRUGS

6 COVID-19 IMPACT ON NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET

6.1 PRICE IMPACT

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON DEMAND

6.4 STRATEGIC DECISIONS FOR MANUFACTURERS

6.5 CONCLUSION

7 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE

7.1 OVERVIEW

7.2 GRANULOCYTE COLONY STIMULATING FACTOR (GCSFS)

7.2.1 LONG ACTING FILGRASTIM

7.2.2 FILGRASTIM

7.2.3 LENOGRASTIM

7.3 ERYTHROPOIETIN STIMULATING AGENTS (ESA’S)

7.3.1 EPO-Α/Β

7.3.2 DPO

7.3.3 CERA

7.3.4 EPO-Κ

7.4 OPIOID ANALGESICS

7.4.1 FENTANYL

7.4.2 METHADONE

7.4.3 TRAMADOL

7.4.4 OTHERS

7.5 MONOCLONAL ANTIBODIES

7.6 NONSTEROIDAL ANTI-INFLAMMATORY DRUGS (NSAIDS)

7.6.1 OTC NSAIDS

7.6.1.1 ASPIRIN

7.6.1.2 IBUPROFEN

7.6.1.3 NAPROXEN SODIUM

7.6.2 PRESCRIPTION NSAIDS

7.6.2.1 CELECOXIB

7.6.2.2 DICLOFENAC

7.6.2.3 INDOMETHACIN

7.6.2.4 KETOROLAC

7.6.2.5 MELOXICAM

7.6.2.6 NABUMETONE

7.6.2.7 NAPROXEN

7.6.2.8 OXAPROZIN

7.6.2.9 PIROXICAM

7.6.2.10 SULINDAC

7.6.2.11 OTHERS

7.7 BISPHOSPHONATES

7.7.1 ZOLEDRONIC ACID OR ZOLEDRONATE

7.7.2 DISODIUM PAMIDRONATE

7.7.3 IBANDRONIC ACID OR IBANDRONATE

7.7.4 SODIUM CLODRONATE

7.8 ANTI-EMETICS

7.8.1 APREPITANT

7.8.2 DEXAMETHASONE

7.8.3 DOLASETRON

7.8.4 GRANISETRON

7.8.5 ONDANSETRON

7.8.6 PALONOSETRON

7.8.7 PROCHLORPERAZINE

7.8.8 ROLAPITANT

7.8.9 OTHERS

7.9 ANTIHISTAMINES

7.9.1 HYDROXYZINE

7.9.2 DIPHENHYDRAMINE

7.9.3 OTHERS

7.1 OTHERS

8 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY TYPE

8.1 OVERVIEW

8.2 BRANDED

8.2.1 NEULASTA

8.2.2 ARANESP

8.2.3 PROLIA

8.2.4 XGEVA

8.2.5 EPOGEN

8.2.6 EPREX

8.2.7 NEUPOGEN

8.2.8 OTHERS

8.3 GENERICS

9 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY CANCER TYPE

9.1 OVERVIEW

9.2 LUNG CANCER

9.3 BREAST CANCER

9.4 PROSTATE CANCER

9.5 LIVER CANCER

9.6 BLADDER CANCER

9.7 LEUKAEMIA

9.8 MELANOMA

9.9 OVARIAN CANCER

9.1 OTHER CANCERS

10 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY END USER

10.1 OVERVIEW

10.2 HOSPITALS

10.2.1 ACUTE CARE HOSPITALS

10.2.2 LONG-TERM CARE HOSPITALS

10.2.3 NURSING FACILITIES

10.3 CLINICS

10.4 HOSPITALS & ACADEMIC INSTITUTIONS

10.5 OTHERS

11 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 HOSPITAL PHARMACIES

11.3 RETAIL PHARMACIES

11.4 COMPOUNDING PHARMACIES

12 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY GEOGRAPHY

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT

15 COMPANY PROFILES

15.1 AMGEN INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 PFIZER INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 JANSSEN PHARMACEUTICALS, INC. (A SUBSIDIARY OF JOHNSON & JOHNSON SERVICES, INC.)

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 NOVARTIS AG

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 ACACIA PHARMA GROUP PLC

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENTS

15.6 ACROTECH BIOPHARMA

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 APR

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 BAXTER

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 BAYER AG

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 F. HOFFMANN-LA ROCHE LTD

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENTS

15.11 HELSINN HEALTHCARE SA

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 HERON THERAPEUTICS, INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENTS

15.13 KYOWA KIRIN CO., LTD.

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 MERCK SHARP & DOHME CORP. (A SUBSIDIARY OF MERCK & CO., INC.)

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENTS

15.15 MYLAN N.V.

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENTS

15.16 OXFORD PHARMASCIENCE LTD

15.16.1 COMPANY SNAPSHOT

15.16.2 TECHNOLOGY PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 SPECTRUM PHARMACEUTICALS, INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENT

15.18 SUN PHARMACEUTICAL INDUSTRIES LTD.

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENTS

15.19 TERSERA THERAPEUTICS LLC

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 TEVA PHARMACEUTICALS USA, INC. (A SUBSIDIARY OF TEVA PHARMACEUTICAL INDUSTRIES LTD.)

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tabela

LIST OF TABLES

TABLE 1 NEW CANCER CASES, AGES 85+, IN THE U.S.

TABLE 2 MORTALITY DUE TO CANCER, AGES 85+, IN THE U.S.

TABLE 3 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE 2020-2028 (USD MILLION)

TABLE 4 NORTH AMERICA GRANULOCYTE COLONY STIMULATING FACTOR (GCSFS) IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 5 NORTH AMERICA GRANULOCYTE COLONY STIMULATING FACTOR (GCSFS) IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 6 NORTH AMERICA ERYTHROPOIETIN STIMULATING AGENTS (ESA’S) IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 7 NORTH AMERICA ERYTHROPOIETIN STIMULATING AGENTS (ESA’S) IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 8 NORTH AMERICA OPIOID ANALGESICS IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 9 NORTH AMERICA OPIOID ANALGESICS IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 10 NORTH AMERICA MONOCLONAL ANTIBODIES IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 11 NORTH AMERICA NONSTEROIDAL ANTI-INFLAMMATORY DRUGS (NSAIDS) IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 12 NORTH AMERICA NONSTEROIDAL ANTI-INFLAMMATORY DRUGS (NSAIDS) IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 13 NORTH AMERICA OTC NSAIDS IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 14 NORTH AMERICA PRESCRIPTION NSAIDS IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 15 NORTH AMERICA BISPHOSPHONATES IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 16 NORTH AMERICA BISPHOSPHONATES IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 17 NORTH AMERICA ANTI-EMETICS IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 18 NORTH AMERICA ANTI-EMETICS IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 19 NORTH AMERICA ANTIHISTAMINES IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 20 NORTH AMERICA ANTIHISTAMINES IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 21 NORTH AMERICA OTHERS IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 22 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY TYPE 2020-2028 (USD MILLION)

TABLE 23 NORTH AMERICA BRANDED IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 24 NORTH AMERICA BRANDED IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 25 NORTH AMERICA GENERICS IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 26 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY CANCER TYPE, 2020-2028 (USD MILLION)

TABLE 27 NORTH AMERICA LUNG CANCER IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 28 NORTH AMERICA BREAST CANCER IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 29 NORTH AMERICA PROSTATE CANCER IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 30 NORTH AMERICA LIVER CANCER IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 31 NORTH AMERICA BLADDER CANCER IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 32 NORTH AMERICA LEUKAEMIA IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 33 NORTH AMERICA MELANOMA IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 34 NORTH AMERICA OVARIAN CANCER IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 35 NORTH AMERICA OTHER CANCERS IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 36 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY END USER, 2020-2028 (USD MILLION)

TABLE 37 NORTH AMERICA HOSPITALS IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 38 NORTH AMERICA HOSPITALS IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 39 NORTH AMERICA CLINICS IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 40 NORTH AMERICA HOSPITALS & ACADEMIC INSTITUTIONS IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 41 NORTH AMERICA OTHERS IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 42 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2028 (USD MILLION)

TABLE 43 NORTH AMERICA HOSPITAL PHARMACIES IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 44 NORTH AMERICA RETAIL PHARMACIES IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 45 NORTH AMERICA COMPOUNDING PHARMACIES IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 46 NORTH-AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY COUNTRY 2019-2028 (USD MILLION)

TABLE 47 NORTH-AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 48 NORTH-AMERICA GRANULOCYTE COLONY STIMULATING FACTOR (GCSFS) IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 49 NORTH-AMERICA OPIOID ANALGESICS IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 50 NORTH-AMERICA ERYTHROPOIETIN STIMULATING AGENTS (ESA’S) IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 51 NORTH-AMERICA NONSTEROIDAL ANTI-INFLAMMATORY DRUGS (NSAIDS) IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 52 NORTH-AMERICA OTC NSAIDS IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 53 NORTH-AMERICA PRESCRIPTION NSAIDS IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 54 NORTH-AMERICA BISPHOSPHONATES IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 55 NORTH-AMERICA ANTI-EMETICS IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 56 NORTH-AMERICA ANTIHISTAMINES IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 57 NORTH-AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 58 NORTH-AMERICA BRANDED IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 59 NORTH-AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY CANCER TYPE, 2019-2028 (USD MILLION)

TABLE 60 NORTH-AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 61 NORTH-AMERICA HOSPITALS IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 62 NORTH-AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 63 U.S.CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 64 U.S.GRANULOCYTE COLONY STIMULATING FACTOR (GCSFS) IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 65 U.S.OPIOID ANALGESICS IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 66 U.S. ERYTHROPOIETIN STIMULATING AGENTS (ESA’S) IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 67 U.S.NONSTEROIDAL ANTI-INFLAMMATORY DRUGS (NSAIDS) IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 68 U.S. OTC NSAIDS IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 69 U.S. PRESCRIPTION NSAIDS IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 70 U.S. BISPHOSPHONATES IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 71 U.S. ANTI-EMETICS IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 72 U.S. ANTIHISTAMINES IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 73 U.S. CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 74 U.S. BRANDED IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 75 U.S. CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY CANCER TYPE, 2019-2028 (USD MILLION)

TABLE 76 U.S. CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 77 U.S. HOSPITALS IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 78 U.S. CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 79 CANADA CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 80 CANADA GRANULOCYTE COLONY STIMULATING FACTOR (GCSFS) IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 81 CANADA OPIOID ANALGESICS IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 82 CANADA ERYTHROPOIETIN STIMULATING AGENTS (ESA’S) IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 83 CANADA NONSTEROIDAL ANTI-INFLAMMATORY DRUGS (NSAIDS) IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 84 CANADA OTC NSAIDS IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 85 CANADA PRESCRIPTION NSAIDS IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 86 CANADA BISPHOSPHONATES IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 87 CANADA ANTI-EMETICS IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 88 CANADA ANTIHISTAMINES IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 89 CANADA CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 90 CANADA BRANDED IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 91 CANADA CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY CANCER TYPE, 2019-2028 (USD MILLION)

TABLE 92 CANADA CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 93 CANADA HOSPITALS IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 94 CANADA CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 95 MEXICO CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 96 MEXICO GRANULOCYTE COLONY STIMULATING FACTOR (GCSFS) IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 97 MEXICO OPIOID ANALGESICS IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 98 MEXICO ERYTHROPOIETIN STIMULATING AGENTS (ESA’S) IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 99 MEXICO NONSTEROIDAL ANTI-INFLAMMATORY DRUGS (NSAIDS) IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 100 MEXICO OTC NSAIDS IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 101 MEXICO PRESCRIPTION NSAIDS IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 102 MEXICO BISPHOSPHONATES IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 103 MEXICO ANTI-EMETICS IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 104 MEXICO ANTIHISTAMINES IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 105 MEXICO CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 106 MEXICO BRANDED IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 107 MEXICO CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY CANCER TYPE, 2019-2028 (USD MILLION)

TABLE 108 MEXICO CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 109 MEXICO HOSPITALS IN CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 110 MEXICO CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

Lista de Figura

LIST OF FIGURES

FIGURE 1 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET: SEGMENTATION

FIGURE 10 GROWING CANCER BUREN WORLDWIDE IS EXPECTED TO DRIVE THE NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 11 GRANULOCYTE COLONY STIMULATING FACTOR (GCSFS) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET IN 2021 & 2028

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET

FIGURE 13 ESTIMATED NUMBER OF NEW CASES IN 2018, WORLDWIDE, BOTH SEXES, ALL AGES

FIGURE 14 ESTIMATED AGE-STANDARDIZED INCIDENCE RATES (WORLD) IN 2018, WORLDWIDE, BOTH SEXES, ALL AGES

FIGURE 15 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET: BY DRUG TYPE, 2020

FIGURE 16 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET: BY DRUG TYPE, 2020-2028 (USD MILLION)

FIGURE 17 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET: BY DRUG TYPE, CAGR (2021-2028)

FIGURE 18 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET: BY DRUG TYPE, LIFELINE CURVE

FIGURE 19 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET: BY TYPE, 2020

FIGURE 20 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET: BY TYPE 2020-2028 (USD MILLION)

FIGURE 21 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET: BY TYPE, CAGR (2021-2028)

FIGURE 22 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 23 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET: BY CANCER TYPE, 2020

FIGURE 24 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET: BY CANCER TYPE, 2020-2028 (USD MILLION)

FIGURE 25 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET: BY CANCER TYPE, CAGR (2021-2028)

FIGURE 26 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET: BY CANCER TYPE, LIFELINE CURVE

FIGURE 27 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET: BY END USER, 2020

FIGURE 28 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET: BY END USER, 2020-2028 (USD MILLION)

FIGURE 29 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET: BY END USER, CAGR (2021-2028)

FIGURE 30 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET: BY END USER, LIFELINE CURVE

FIGURE 31 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET: BY DISTRIBUTION CHANNEL, 2020

FIGURE 32 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET: BY DISTRIBUTION CHANNEL, 2020-2028 (USD MILLION)

FIGURE 33 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2021-2028)

FIGURE 34 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 35 NORTH-AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET: SNAPSHOT (2020)

FIGURE 36 NORTH-AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET: BY COUNTRY (2020)

FIGURE 37 NORTH-AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET: BY COUNTRY (2021 & 2028)

FIGURE 38 NORTH-AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET: BY COUNTRY (2021 & 2028)

FIGURE 39 NORTH-AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET: BY TYPE (2021-2028)

FIGURE 40 NORTH AMERICA CANCER SUPPORTIVE CARE PRODUCTS MARKET: COMPANY SHARE 2020 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.