North America Bioinformatics Market

Tamanho do mercado em biliões de dólares

CAGR :

%

| 2015 –0 | |

|

|

|

|

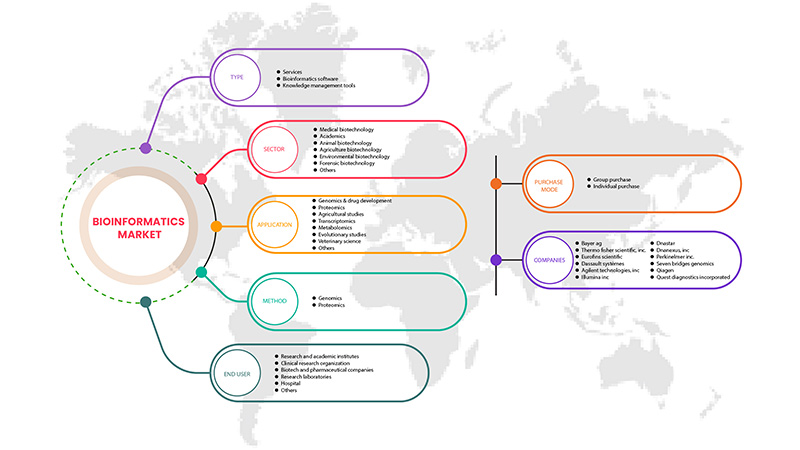

Mercado de Bioinformática da América do Norte, por tipo (ferramentas de gestão de conhecimento, software e serviços de bioinformática), setor (biotecnologia médica, académicos, biotecnologia animal, biotecnologia agrícola, biotecnologia ambiental, biotecnologia forense e outros), aplicação (genómica e desenvolvimento de medicamentos, proteómica, evolucionária Estudos, Estudos Agrícolas, Ciências Veterinárias, Metabolômica , Transcriptômica e Outros), Modo de Compra (Compra em Grupo e Compra Individual), Método (Genómica e Proteómica) Utilizador Final, (Institutos Académicos e de Investigação, Organização de Investigação Clínica, Empresas de Biotecnologia e Farmacêuticas, Laboratórios de Investigação, Hospital e Outros) - Tendências e Previsões do Setor para 2029.

Análise e insights do mercado de bioinformática da América do Norte

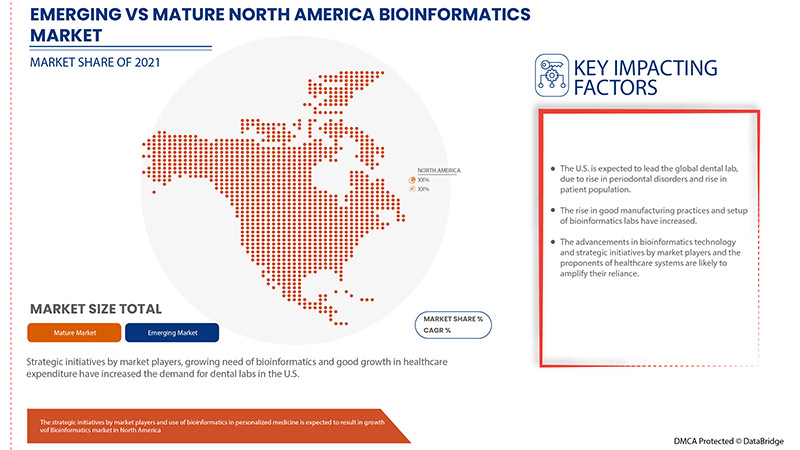

Os impulsionadores responsáveis pelo crescimento do mercado da bioinformática são o menor custo do sequenciamento genético por base, a crescente necessidade de bioinformática, amplo portfólio de produtos oferecido pelos principais players do mercado e o uso da bioinformática na medicina personalizada e o aumento do financiamento do setor público-privado para a bioinformática. No entanto, os fatores que deverão conter o crescimento do mercado são o aumento do custo da instrumentação, a dificuldade na análise de bioinformática clínica e a cibersegurança em bioinformática.

Por outro lado, as iniciativas estratégicas dos players do mercado, o desenvolvimento de produtos, os avanços na tecnologia bioinformática e o aumento dos gastos em saúde podem funcionar como uma oportunidade para o crescimento do mercado bioinformática. No entanto, a necessidade de conhecimentos especializados, os desafios na implementação da tecnologia bioinformática nos laboratórios clínicos e a aprovação regulamentar podem criar desafios para o mercado bioinformático. Existem desenvolvimentos recentes relacionados com o mercado mundial de bioinformática.

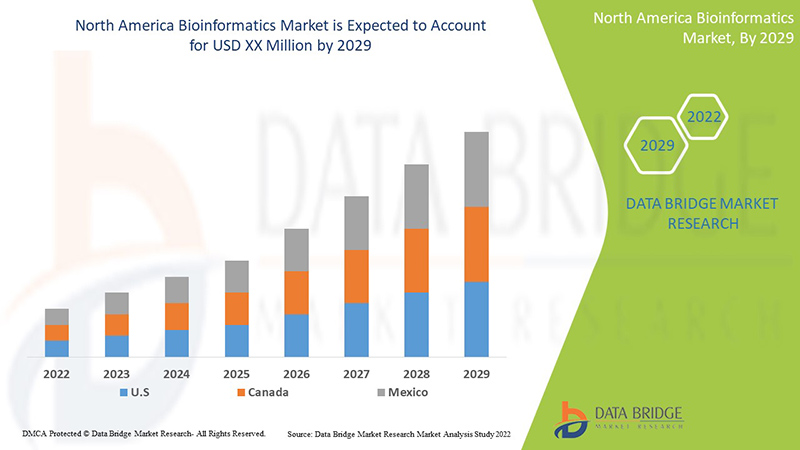

Espera-se que a crescente procura pelo uso de bioinformática no desenvolvimento e design de medicamentos impulsione o crescimento do mercado na América do Norte. A Data Bridge Market Research analisa que o mercado de Bioinformática da América do Norte crescerá a um CAGR de 21,8% durante o período de previsão de 2022 a 2029.

|

Métrica de reporte |

Detalhes |

|

Período de previsão |

2022 a 2029 |

|

Ano base |

2021 |

|

Anos históricos |

2020 (personalizável para 2019 - 2014) |

|

Unidades Quantitativas |

Receita em milhões de dólares, preços em dólares |

|

Segmentos cobertos |

Por Tipo (Ferramentas de Gestão do Conhecimento, Software e Serviços de Bioinformática), Setor (Biotecnologia Médica, Académico, Biotecnologia Animal, Biotecnologia Agrícola, Biotecnologia Ambiental, Biotecnologia Forense e Outros), Aplicação (Genómica e Desenvolvimento de Medicamentos, Proteómica, Estudos Evolutivos , Estudos Agrícolas, Ciência Veterinária, Metabolómica, Transcriptómica e Outros), Modo de Compra (Compra em Grupo e Compra Individual), Método (Genómica e Proteómica) Utilizador Final, (Institutos Académicos e de Investigação, Organização de Investigação Clínica, Empresas Biotecnológicas e Farmacêuticas, Laboratórios de Investigação, Hospitalar e Outros) |

|

Países abrangidos |

EUA, Canadá e México |

|

Market Players Covered |

Thermo Fisher Scientific Inc., Illumina, Inc., Agilent Technologies, Inc., QIAGEN, SOPHiA GENETICS., BGI, Eurofins Scientific, Water Corporation, Partek Incorporated, DNASTAR, Dassault Systèmes, Bayer AG, DNANEXUS, INC., PerkinElmer Inc., Seven Bridges Genomics, Quest Diagnostics Incorporated., AstridBio Technologies Inc., BioBam, GenoFAB, Inc. Among others |

Market Definition

Bioinformatics combines computer programming, big data, and Molecular Biology, which enables scientists to understand and identify patterns in biological data. It is particularly useful in studying genomes and DNA sequencing, as it allows scientists to organize large amounts of data.

From genetics to toxicology to mycology and radiobiology, there are scores of branches of Biology to specialize in. And out of the many, Bioinformatics is one of the intriguing fields which enables you to identify, evaluate, store, and retrieve biological information. Being an interdisciplinary field of study, it incorporates various applications of Computer Science, Statistics, and Biology to develop software applications for understanding biological data like DNA sequencing, protein analysis, evolutionary genetics, etc.

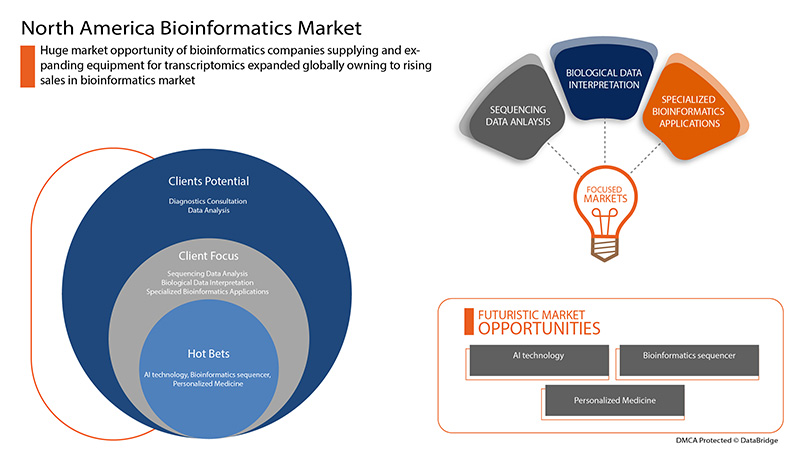

In the coming future, important decisions related to bioinformatics on drug discovery will be made by individuals who not only understand the biology but can also use the bioinformatics tools and the knowledge they release to develop hypotheses and identify quality targets

North America Bioinformatics Market Dynamics

Drivers

- Decrease in The Cost of Genetic Sequencing Per Base

Oral health is one of the most important aspects of maintaining the health of gums, teeth and the oral-facial system, which allows for speaking, chewing and smiling. According to World Health Organization's report on March 25th, 2020, around 2.3 billion people worldwide are suffering from caries of a permanent tooth, among which around 530 million children suffer from caries of the primary tooth. In North America, periodontal disease has a high prevalence among all age groups. Thereby due to rising periodontal dental disorders, the availability and usage of intraoral scanners are anticipated to boost the market's growth.

- Growing Need for Bioinformatics

As genomics-focused pharmacology continues to play a greater role in the treatment of various chronic diseases, especially cancer, next-generation sequencing (NGS) is evolving as a powerful tool for providing a deeper and more precise insight into the molecular underpinnings of individual tumors and specific receptors. Informatics is essential in biological research involving biologists who learn programming, computer programmers, mathematicians, or database managers who learn the foundations of biology.

Opportunities

- Product Development in Recent Years

The growth curve for bioinformatics market clinical applications is following an upward trend as established applications are gaining momentum and new ones are finding a foothold. Product development in the past years has helped the market size to grow. This also shows the support of the regulatory agency for allowing these products in the market.

For instance-

- In June 2021, Agilent Technologies, Inc. released a new exome design called Sure Select Human All Exon V8 that offers specific content and current coverage of protein-coding areas from Refuses, CCDS and GENCODE. Additionally, it includes exons that are challenging to capture and the TERT promoter, which are neglected by competing exomes

The product development in recent years has shown the potential of these technologies and the companies working in this market are trying to get the more advanced product in the market, which is expected to create a lucrative opportunity for market growth in the forecast period.

- Strategic Initiatives by Market Players

The demand for bioinformatics is increasing in the market owing to the increased levels of research and development along with the growth of the bioinformatics services market aided by the desire for innovative medications. Thus, the top market players have implemented a new strategy by developing new products and collaborating with other market players to improve business operations and profitability.

For instance-

- In January 2020, Charles River underwent a strategic alliance with FiOS Genomics to acquire knowledge in bioinformatics, statistics and biology to help with the collection and analysis of high-dimensional, multi-variant datasets related to drug development, such as microarrays, next-generation sequencing (NGS), proteomics, metabolomics and epigenetics, as well as the related meta-data

These strategic initiatives by the market players, including acquisition, conferences and focused segment product launches, are helping them grow and improve the company's product portfolio, ultimately leading to more revenue generation. Hence, these strategic initiatives by the market players may be expected to as an opportunity that is expected to drive market growth.

Restraints/Challenges

- Difficulty in Clinical Bioinformatics Analysis

O potencial largamente inexplorado da análise de big data é um burburinho que tem sido exacerbado pela produção de muitos conjuntos de dados da próxima geração que procuram responder a questões de longa data sobre a biologia das doenças humanas. Embora estas abordagens sejam provavelmente um meio poderoso de revelar novos conhecimentos biológicos, vários desafios significativos dificultam actualmente os esforços para aproveitar o poder dos big data. Os desafios típicos incluem a avaliação eficaz de ferramentas de software analítico, a aceleração do processo global utilizando tecnologia de paralelização e aceleração de computação paralela híbrida (HPC), o avanço de estratégias de automatização, alternativas de armazenamento de dados e, finalmente, o desenvolvimento de novos métodos para a utilização total dos resultados em múltiplas condições experimentais.

- Desafios para a implementação da tecnologia bioinformática nos laboratórios clínicos

As tecnologias de bioinformática podem realizar análises de dados biológicos extremamente complicadas. Esta capacidade facilita simultaneamente as ferramentas computacionais de organização e análise de dados biológicos, o que ajuda a melhorar o rastreio diagnóstico. A aplicação destas poderosas tecnologias num laboratório clínico representa um desafio devido ao âmbito, quantidade e consequências médico-técnicas dos dados.

Vários desafios da implementação do sequenciamento de nova geração no laboratório clínico são os seguintes:

- Uma das primeiras áreas onde podem surgir problemas é, muitas vezes, a mais negligenciada: “qualidade da amostra”. Embora as plataformas sejam frequentemente testadas e comparadas utilizando amostras altamente selecionadas (como o material de referência do Genome in a Bottle Consortium), as amostras do mundo real apresentam frequentemente um desafio muito maior e, portanto, atuam como um desafio para o aumento da procura.

- O elevado tempo de resposta é também um grande desafio para os instrumentos que trabalham neste mercado

Impacto do COVID-19 no mercado de bioinformática da América do Norte

Durante a pandemia, o setor de Bioinformática do Norte é aquele que se concentra na utilização de uma combinação de biologia e tecnologia da informação. No centro da indústria estão os dados biológicos, que são analisados e transformados através de técnicas de TI. A bioinformática sempre teve um enorme potencial no apoio essencial a muitas áreas da investigação científica. As ferramentas que a Bioinformática pode fornecer permitem aos cientistas lidar com conjuntos de dados maiores e extraí-los e analisá-los para descobrir informações cruciais que podem levar a descobertas importantes. A genética e os genomas têm sido o foco principal da Bioinformática nos últimos anos, incluindo a genómica comparativa, os microarranjos de ADN e a genómica funcional.

Desenvolvimentos recentes

- Em março de 2022, a Thermo Fisher Scientific Inc lançou o instrumento de sequenciação de nova geração (NGS) com marcação CE-IVD para utilização em laboratórios clínicos. O instrumento de sequenciação de última geração com marcação CE-IVD é utilizado para realizar testes de diagnóstico e investigação clínica num único instrumento. O lançamento do instrumento resultou na adição de um novo produto na gama de produtos e na distribuição do instrumento NGS, o que deverá aumentar a receita do produto.

Âmbito do mercado de bioinformática da América do Norte

O mercado de bioinformática da América do Norte está segmentado com base em seis segmentos: tipo, setor, aplicação, modo de compra, genómica e utilizador final. O crescimento entre estes segmentos irá ajudá-lo a analisar segmentos de crescimento escasso nas indústrias e fornecer aos utilizadores uma valiosa visão geral do mercado e insights de mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Tipo

- Ferramentas de gestão do conhecimento

- Software de Bioinformática

- Serviços

Com base no tipo, o mercado de bioinformática da América do Norte está segmentado em ferramentas de gestão de conhecimento, software de bioinformática e serviços.

Setor

- Biotecnologia médica

- Acadêmicos

- Biotecnologia Animal

- Biotecnologia agrícola

- Biotecnologia Ambiental

- Biotecnologia forense

- Outros

Com base no setor, o mercado de bioinformática da América do Norte está segmentado em biotecnologia médica, académicos, biotecnologia animal, biotecnologia agrícola, biotecnologia ambiental, biotecnologia forense, entre outros.

Aplicação

- Genómica e Desenvolvimento de Medicamentos

- Proteómica

- Estudos Evolutivos

- Estudos Agrícolas

- Ciência Veterinária

- Metabolômica

- Transcriptômica

- Outros

Com base na aplicação, o mercado de bioinformática da América do Norte está segmentado em genómica e desenvolvimento de medicamentos, proteómica, estudos evolutivos, estudos agrícolas, ciências veterinárias, metabolómica, transcriptómica , entre outros.

Modo de compra

- Compra em Grupo

- Compra individual

Com base no modo de compra, o mercado de bioinformática da América do Norte está segmentado em compras em grupo e compras individuais.

Método

- Genômica

- Proteómica

Com base no método, o mercado de bioinformática da América do Norte está segmentado em genómica e proteómica.

Utilizador final

- Institutos Académicos e de Investigação

- Organização de investigação clínica

- Empresas de biotecnologia e farmacêuticas

- Laboratórios de Investigação

- Hospital

- Outros

Com base no utilizador final, o mercado norte-americano de Bioinformática está segmentado em institutos de investigação e académicos, organizações de investigação clínica, empresas de biotecnologia e farmacêuticas, laboratórios de investigação, hospitais, entre outros.

Análise de pipeline

Análise/perspetivas regionais do mercado de bioinformática da América do Norte

O mercado de bioinformática da América do Norte é analisado, e são fornecidos insights e tendências de tamanho de mercado por regiões, tipo, setor, aplicação, modo de compra, genómica e utilizador final. conforme acima referenciado.

Os países abordados no relatório sobre o mercado de bioinformática da América do Norte são os EUA, o Canadá e o Novo México. Espera-se que os EUA dominem o mercado devido ao aumento da incidência de doenças periodontais, ao aumento do turismo médico, ao crescimento das inovações tecnológicas em bioinformática e ao aumento da atividade de investigação e desenvolvimento.

A secção do país do relatório também fornece fatores individuais de impacto no mercado e alterações nas regulamentações do mercado interno que impactam as tendências atuais e futuras do mercado. Pontos de dados como novas vendas, vendas de reposição, demografia do país, epidemiologia de doenças e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, são considerados a presença e a disponibilidade das marcas e os desafios enfrentados devido à concorrência grande ou escassa do impacto das marcas locais e nacionais nos canais de vendas, ao mesmo tempo que se fornece uma análise de previsão dos dados do país.

Cenário competitivo e análise da quota de mercado da bioinformática na América do Norte

O panorama competitivo do mercado de bioinformática da América do Norte fornece detalhes sobre o concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença na América do Norte, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento de produto, largura do produto, e amplitude e domínio de aplicação. Os dados acima fornecidos estão apenas relacionados com o foco das empresas relacionado com o mercado de Bioinformática da América do Norte.

Alguns dos principais players que operam no mercado norte-americano de Bioinformática são a Thermo Fisher Scientific Inc., Illumina, Inc., Agilent Technologies, Inc., QIAGEN, SOPHiA GENETICS., BGI, Eurofins Scientific, Water Corporation, Partek Incorporated, DNASTAR , Dassault Systèmes, Bayer AG, DNANEXUS, INC., PerkinElmer Inc., Seven Bridges Genomics, Quest Diagnostics Incorporated., AstridBio Technologies Inc., BioBam, GenoFAB, Inc., entre outros.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA BIOINFORMATICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHIC SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 RESEARCH METHODOLOGY

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 MULTIVARIATE MODELLING

2.8 TYPE SEGMENT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 THE CATEGORY VS TIME GRID

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.2 PORTER'S FIVE FORCES MODEL

5 REGULATIONS OF THE NORTH AMERICA BIOINFORMATICS MARKET

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 DECREASE IN THE COST OF GENETIC SEQUENCING PER BASE

6.1.2 GROWING NEED FOR BIOINFORMATICS

6.1.3 WIDE PRODUCT PORTFOLIO OFFERED BY MAJOR PLAYERS

6.1.4 USE OF BIOINFORMATICS IN PERSONALIZED MEDICINE

6.1.5 INCREASING PUBLIC-PRIVATE SECTOR FUNDING FOR BIOINFORMATICS

6.2 RESTRAINTS

6.2.1 HIGH COST OF INSTRUMENTATION

6.2.2 DIFFICULTY IN CLINICAL BIOINFORMATICS ANALYSIS

6.2.3 CYBER SECURITY CONCERNS IN BIOINFORMATICS

6.3 OPPORTUNITIES

6.3.1 STRATEGIC INITIATIVES BY THE KEY MARKET PLAYER

6.3.2 PRODUCT DEVELOPMENT IN RECENT YEARS

6.3.3 ADVANCEMENT IN BIOINFORMATICS TECHNOLOGY

6.4 CHALLENGES

6.4.1 LACK OF SKILLED PROFESSIONALS TO PERFORM BIOINFORMATICS TECHNOLOGY

6.4.2 CHALLENGES TO IMPLEMENTING BIOINFORMATICS TECHNOLOGY IN THE CLINICAL LABS

7 NORTH AMERICA BIOINFORMATICS MARKET, BY TYPE

7.1 OVERVIEW

7.2 SERVICES

7.2.1 DIAGNOSTICS CONSULTATION

7.2.2 DATA ANALYSIS

7.2.2.1 STRUCTURAL

7.2.2.2 FUNCTIONAL

7.3 BIOINFORMATICS SOFTWARE

7.3.1 INFORMATICS INFRASTRUCTURE AND PIPELINE SETUP

7.3.2 SAMPLE AND EXPERIMENT MANAGEMENT

7.3.3 SEQUENCING DATA ANALYSIS

7.3.3.1 SEQUENCE ANALYSIS PLATFORM

7.3.3.2 SEQUENCE ALIGNMENT PLATFORM

7.3.3.3 SEQUENCE MANIPULATION PLATFORM

7.3.3.4 STRUCTURAL ANALYSIS PLATFORM

7.3.3.5 OTHERS

7.3.4 BIOLOGICAL DATA INTERPRETATION

7.3.5 SPECIALIZED BIOINFORMATICS APPLICATIONS

7.3.5.1 SINGLE CELL GENE EXPRESSION

7.3.5.2 GENE EXPRESSION

7.3.5.3 VARIANT DETECTION

7.3.5.4 CNV ANALYSIS

7.3.5.5 METAGENOMICS

7.3.5.6 METHYLATION

7.3.5.7 CHIP-SEQ

7.3.5.8 NON-CODING RNA EXPRESSION

7.3.5.9 OTHERS

7.3.6 OTHERS

7.4 KNOWLEDGE MANAGEMENT TOOLS

7.4.1 GENERALIZED KNOWLEDGE MANAGEMENT TOOLS

7.4.2 SPECIALIZED KNOWLEDGE MANAGEMENT TOOLS

8 NORTH AMERICA BIOINFORMATICS MARKET, BY SECTOR

8.1 OVERVIEW

8.2 MEDICAL BIOTECHNOLOGY

8.3 ACADEMICS

8.4 ANIMAL BIOTECHNOLOGY

8.5 AGRICULTURAL BIOTECHNOLOGY

8.6 ENVIRONMENTAL BIOTECHNOLOGY

8.7 FORENSIC BIOTECHNOLOGY

8.8 OTHERS

9 NORTH AMERICA BIOINFORMATICS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 GENOMICS & DRUG DEVELOPMENT

9.2.1 SERVICES

9.2.2 SEQUENCING PLATFORMS

9.2.3 KNOWLEDGE MANAGEMENT TOOLS

9.2.4 GENOMICS & DRUG DEVELOPMENT BY TYPE

9.2.4.1 PREVENTIVE MEDICINE

9.2.4.2 MOLECULAR MEDICINE

9.2.4.3 PERSONALIZED MEDICINE

9.2.4.4 CHEMOINFORMATICS AND DRUG DESIGN

9.2.4.5 ANTIBIOTIC RESISTANCE

9.3 PROTEOMICS

9.3.1 SERVICES

9.3.2 SERVICES SEQUENCING PLATFORMS

9.3.3 KNOWLEDGE MANAGEMENT TOOLS

9.4 AGRICULTURAL STUDIES

9.4.1 SERVICES

9.4.2 SERVICES SEQUENCING PLATFORMS

9.4.3 KNOWLEDGE MANAGEMENT TOOLS

9.5 TRANSCRIPTOMICS

9.5.1 SERVICES

9.5.2 SERVICES SEQUENCING PLATFORMS

9.5.3 KNOWLEDGE MANAGEMENT TOOLS

9.6 METABOLOMICS

9.6.1 SERVICES

9.6.2 SERVICES SEQUENCING PLATFORMS

9.6.3 KNOWLEDGE MANAGEMENT TOOLS

9.7 EVOLUTIONARY STUDIES

9.7.1 SERVICES

9.7.2 SERVICES SEQUENCING PLATFORMS

9.7.3 KNOWLEDGE MANAGEMENT TOOLS

9.8 VETERINARY SCIENCE

9.8.1 SERVICES

9.8.2 SERVICES SEQUENCING PLATFORMS

9.8.3 KNOWLEDGE MANAGEMENT TOOLS

9.9 OTHERS

9.9.1 SERVICES

9.9.2 SERVICES SEQUENCING PLATFORMS

9.9.3 KNOWLEDGE MANAGEMENT TOOLS

10 NORTH AMERICA BIOINFORMATICS MARKET, BY PURCHASE MODE

10.1 OVERVIEW

10.2 GROUP PURCHASE

10.3 INDIVIDUAL PURCHASE

11 NORTH AMERICA BIOINFORMATICS MARKET, BY METHOD

11.1 OVERVIEW

11.2 GENOMICS

11.2.1 DNA

11.2.2 RNA

11.3 PROTEOMICS

12 NORTH AMERICA BIOINFORMATICS MARKET, BY END USER

12.1 OVERVIEW

12.2 RESEARCH AND ACADEMIC INSTITUTES

12.3 CLINICAL RESEARCH ORGANIZATION

12.4 BIOTECH AND PHARMACEUTICAL COMPANIES

12.5 RESEARCH LABORATORIES

12.6 HOSPITALS

12.7 OTHERS

13 NORTH AMERICA BIOINFORMATICS MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA BIOINFORMATICS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 BAYER AG

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 THERMO FISHER SCIENTIFIC INC

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 EUROFINS SCIENTIFIC

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 DASSAULT SYSTÈMES

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 AGILENT TECHNOLOGIES, INC

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ASTRIDBIO TECHNOLOGIES INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 BGI (A SUBSIDIARY OF BGI GROUP)

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 BIOBAM

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 DNANEXUS INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 DNASTAR

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 GENOFAB, INC

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 ILLUMINA, INC

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 PARTEK INCORPORATED

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 PERKINELMER INC.

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 QIAGEN

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 QUEST DIAGNOSTICS INCORPORATED (2021)

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 SEVEN BRIDGES GENOMICS

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 SOPHIA GENETICS

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 STRAND LIFE SCIENCES

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 WATERS CORPORATION

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tabela

TABLE 1 BIOINFORMATICSCOST PER SAMPLE

TABLE 2 NORTH AMERICA BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA SERVICES IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA SERVICES IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA BIOINFORMATICS SOFTWARE IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA BIOINFORMATICS SOFTWARE IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA SEQUENCING DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA SPECIALIZED BIOINFORMATICS APPLICATIONS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA KNOWLEDGE MANAGEMENT TOOLS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA KNOWLEDGE MANAGEMENT TOOLS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA MEDICAL BIOTECHNOLOGY IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA ACADEMICS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA ANIMAL TECHNOLOGY IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA AGRICULTURAL BIOTECHNOLOGY IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA ENVIRONMENTAL BIOTECHNOLOGY IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA FORENSIC BIOTECHNOLOGY IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA OTHERS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA GENOMICS & DRUG DEVELOPMENT IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA GENOMICS & DRUG DEVELOPMENT IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA GENOMICS & DRUG DEVELOPMENT BY TYPE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA PROTEOMICS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA PROTEOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA TRANSCRIPTOMICS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA TRANSCRIPTOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA METABOLOMICS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA METABOLOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA EVOLUTIONARY STUDIES IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA EVOLUTIONARY STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA VETERINARY SCIENCE IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA VETERINARY SCIENCE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA OTHERS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA OTHERS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA BIOINFORMATICS MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA GROUP PURCHASE IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA INDIVIDUAL PURCHASE IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA GENOMICS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA GENOMICS IN BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA PROTEOMICS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA BIOINFORMATICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA RESEARCH AND ACADEMIC INSTITUTES IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA CLINICAL RESEARCH ORGANIZATION IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA BIOTECH AND PHARMACEUTICAL COMPANIES IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA RESEARCH LABORATORIES IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA HOSPITALS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA OTHERS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA BIOINFORMATICS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA SERVICES IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA BIOINFORMATICS SOFTWARE IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA SEQUENCING DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA SPECIALIZED BIOINFORMATICS APPLICATIONS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA KNOWLEDGE MANAGEMENT TOOLS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA GENOMICS & DRUG DEVELOPMENT IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA GENOMICS & DRUG DEVELOPMENT BY TYPE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA PROTEOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA METABOLOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA EVOLUTIONARY STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA VETERINARY SCIENCE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA OTHERS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA BIOINFORMATICS MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 73 NORTH AMERICA GENOMICS IN BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 74 NORTH AMERICA. BIOINFORMATICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 75 U.S. BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 U.S. SERVICES IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 U.S. DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 U.S. BIOINFORMATICS SOFTWARE IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 U.S. SEQUENCING DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 U.S. SPECIALIZED BIOINFORMATICS APPLICATIONS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 U.S. KNOWLEDGE MANAGEMENT TOOLS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 U.S. BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 83 U.S. BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 U.S. GENOMICS & DRUG DEVELOPMENT IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 85 U.S. GENOMICS & DRUG DEVELOPMENT BY TYPE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 86 U.S. PROTEOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 87 U.S. AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 88 U.S. TRANSCRIPTOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 89 U.S. METABOLOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 U.S. EVOLUTIONARY STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 91 U.S. VETERINARY SCIENCE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 92 U.S. OTHERS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 93 U.S. BIOINFORMATICS MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 94 U.S. BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 95 U.S GENOMICS IN BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 96 U.S. BIOINFORMATICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 97 CANADA BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 CANADA SERVICES IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 CANADA DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 CANADA BIOINFORMATICS SOFTWARE IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 CANADA SEQUENCING DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 CANADA SPECIALIZED BIOINFORMATICS APPLICATIONS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 CANADA KNOWLEDGE MANAGEMENT TOOLS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 CANADA BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 105 CANADA BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 106 CANADA GENOMICS & DRUG DEVELOPMENT IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 107 CANADA GENOMICS & DRUG DEVELOPMENT BY TYPE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 108 CANADA PROTEOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 109 CANADA AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 110 CANADA TRANSCRIPTOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 111 CANADA METABOLOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 112 CANADA EVOLUTIONARY STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 113 CANADA VETERINARY SCIENCE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 114 CANADA OTHERS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 115 CANADA BIOINFORMATICS MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 116 CANADA BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 117 CANADA GENOMICS IN BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 118 CANADA BIOINFORMATICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 119 MEXICO BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 MEXICO SERVICES IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 MEXICO DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 MEXICO BIOINFORMATICS SOFTWARE IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 MEXICO SEQUENCING DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 MEXICO SPECIALIZED BIOINFORMATICS APPLICATIONS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 MEXICO KNOWLEDGE MANAGEMENT TOOLS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 MEXICO BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 127 MEXICO BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 128 MEXICO GENOMICS & DRUG DEVELOPMENT IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 129 MEXICO GENOMICS & DRUG DEVELOPMENT BY TYPE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 130 MEXICO PROTEOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 131 MEXICO AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 132 MEXICO TRANSCRIPTOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 133 MEXICO METABOLOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 MEXICO EVOLUTIONARY STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 135 MEXICO VETERINARY SCIENCE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 136 MEXICO OTHERS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 137 MEXICO BIOINFORMATICS MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 138 MEXICO BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 139 MEXICO GENOMICS IN BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 140 MEXICO BIOINFORMATICS MARKET, BY END USER, 2020-2029 (USD MILLION)

Lista de Figura

FIGURE 1 NORTH AMERICA BIOINFORMATICS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA BIOINFORMATICS MARKET: GEOGRAPHIC SCOPE

FIGURE 3 NORTH AMERICA BIOINFORMATICS MARKET: DATA TRIANGULATION

FIGURE 4 NORTH AMERICA BIOINFORMATICS MARKET: SNAPSHOT

FIGURE 5 NORTH AMERICA BIOINFORMATICS MARKET: BOTTOM-UP APPROACH

FIGURE 6 NORTH AMERICA BIOINFORMATICS MARKET: TOP-DOWN APPROACH

FIGURE 7 NORTH AMERICA BIOINFORMATICS MARKET: INTERVIEWS BY REGION AND DESIGNATION

FIGURE 8 NORTH AMERICA BIOINFORMATICS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA BIOINFORMATICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA BIOINFORMATICS MARKET: APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA BIOINFORMATICS MARKET: THE CATEGORY VS TIME GRID

FIGURE 12 NORTH AMERICA BIOINFORMATICS MARKET SEGMENTATION

FIGURE 13 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE NORTH AMERICA DENTAL LABMARKET AND IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 GROWING APPLICATIONS OF BIOINFORMATICS AND LOW COST OF BIOINFORMATICS SEQUENCING ARE EXPECTED TO DRIVE THE MARKET FOR NORTH AMERICA BIOINFORMATICS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 SERVICES SEGMENT ARE EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA BIOINFORMATICS MARKET IN 2019 & 2026

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA BIOINFORMATICS MARKET

FIGURE 17 DECREASE IN COST OF PER BASE SEQUENCING

FIGURE 18 GROWING NEED FOR BIOINFORMATICS IN VITAL APPLICATIONS

FIGURE 19 NORTH AMERICA BIOINFORMATICS MARKET: BY TYPE, 2021

FIGURE 20 NORTH AMERICA BIOINFORMATICS MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 21 NORTH AMERICA BIOINFORMATICS MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 22 NORTH AMERICA BIOINFORMATICS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 23 NORTH AMERICA BIOINFORMATICS MARKET: BY SECTOR, 2021

FIGURE 24 NORTH AMERICA BIOINFORMATICS MARKET: BY SECTOR, 2022-2029 (USD MILLION)

FIGURE 25 NORTH AMERICA BIOINFORMATICS MARKET: BY SECTOR, CAGR (2022-2029)

FIGURE 26 NORTH AMERICA BIOINFORMATICS MARKET: BY SECTOR, LIFELINE CURVE

FIGURE 27 NORTH AMERICA BIOINFORMATICS MARKET: BY APPLICATION, 2021

FIGURE 28 NORTH AMERICA BIOINFORMATICS MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 29 NORTH AMERICA BIOINFORMATICS MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 30 NORTH AMERICA BIOINFORMATICS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 31 NORTH AMERICA BIOINFORMATICS MARKET: BY PURCHASE MODE, 2021

FIGURE 32 NORTH AMERICA BIOINFORMATICS MARKET: BY PURCHASE MODE, 2022-2029 (USD MILLION)

FIGURE 33 NORTH AMERICA BIOINFORMATICS MARKET: BY PURCHASE MODE, CAGR (2022-2029)

FIGURE 34 NORTH AMERICA BIOINFORMATICS MARKET: BY PURCHASE MODE, LIFELINE CURVE

FIGURE 35 NORTH AMERICA BIOINFORMATICS MARKET: BY METHOD, 2021

FIGURE 36 NORTH AMERICA BIOINFORMATICS MARKET: BY METHOD, 2022-2029 (USD MILLION)

FIGURE 37 NORTH AMERICA BIOINFORMATICS MARKET: BY METHOD, CAGR (2022-2029)

FIGURE 38 NORTH AMERICA BIOINFORMATICS MARKET: BY METHOD, LIFELINE CURVE

FIGURE 39 NORTH AMERICA BIOINFORMATICS MARKET: BY END USER, 2021

FIGURE 40 NORTH AMERICA BIOINFORMATICS MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 41 NORTH AMERICA BIOINFORMATICS MARKET: BY END USER, CAGR (2022-2029)

FIGURE 42 NORTH AMERICA BIOINFORMATICS MARKET: BY END USER, LIFELINE CURVE

FIGURE 43 NORTH AMERICA BIOINFORMATICS MARKET: SNAPSHOT (2021)

FIGURE 44 NORTH AMERICA BIOINFORMATICS MARKET: BY COUNTRY (2021)

FIGURE 45 NORTH AMERICA BIOINFORMATICS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 46 NORTH AMERICA BIOINFORMATICS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 47 NORTH AMERICA BIOINFORMATICS MARKET: BY TYPE (2022-2029)

FIGURE 48 NORTH AMERICA BIOINFORMATICS MARKET: COMPANY SHARE 2021 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.