Mercado de software automóvel da América do Norte, oferecendo (soluções e serviços), tamanho da organização (organizações de grande escala, organização de média escala e organização de pequena escala), camada de software (sistema operativo, middleware e software de aplicação), utilitário EV (gestão de carregamento, gestão de bateria e V2G), tipo de veículo (automóveis de passageiros, veículos elétricos , veículos comerciais ligeiros e pesados), utilizador final (ADAS e sistemas de segurança, sistemas de comunicação, sistemas de infoentretenimento, controlo de carroçaria e sistema de conforto, gestão do motor e do grupo motopropulsor, gestão de veículos e Telemática, condução autónoma, aplicação HMI e outros) - Tendências e previsões do setor para 2029.

Análise e tamanho do mercado de software automóvel da América do Norte

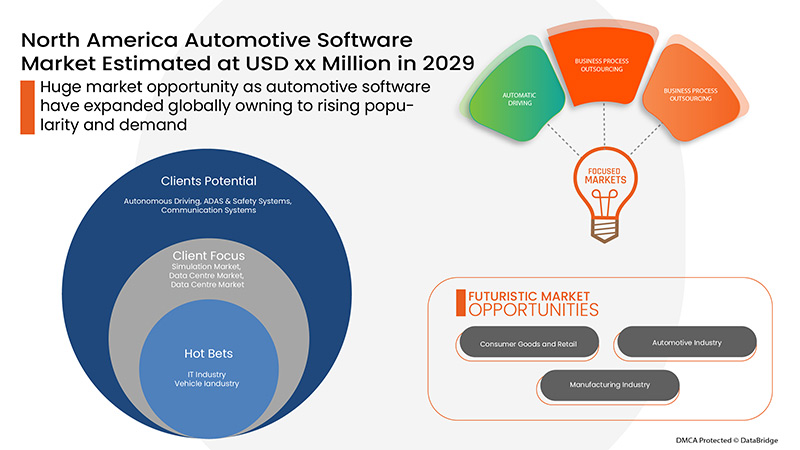

Os prestadores de serviços tentavam continuamente descobrir formas de aumentar a precisão do trabalho, melhorar os serviços, a segurança e trabalhar com tecnologia crescente. A exigência por estes motivos está a ser satisfeita através da implementação de software automóvel, uma vez que são utilizados para fornecer serviços melhorados, ininterruptos, gratuitos e oportunos nas operações industriais. O software automóvel em diversos setores está a ser amplamente utilizado devido à crescente procura pela experiência do cliente. Permite que as indústrias melhorem as suas operações e produtividade. O software automóvel ajuda os utilizadores finais, fornecendo melhores soluções automatizadas sem interferência humana e proporcionando uma melhor experiência de condução. O mercado norte-americano de software automóvel está numa fase de crescimento rápido devido à crescente procura de eletrificações nos veículos, o que impulsiona a procura de software automóvel. As empresas estão até a lançar novos produtos para ganhar maior quota de mercado.

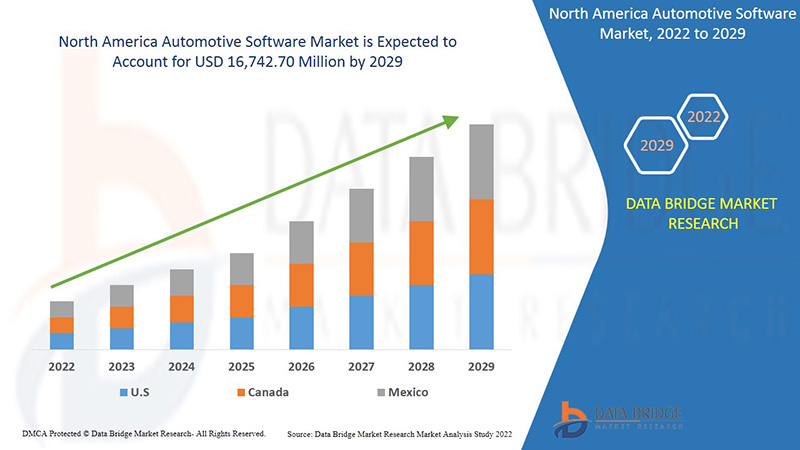

A Data Bridge Market Research analisa que o mercado de software automóvel deverá atingir o valor de 16.742,70 milhões de dólares até 2029, com um CAGR de 17,6% no período de previsão. A "North America Services" representa o maior segmento de oferta no mercado de software automóvel. O serviço da América do Norte fornece informações precisas que são utilizadas para desenvolver redes IoT de alta precisão. O relatório do mercado de software automóvel também abrange a análise de preços, a análise de patentes e os avanços tecnológicos em profundidade.

|

Métrica de reporte |

Detalhes |

|

Período de previsão |

2022 a 2029 |

|

Ano base |

2021 |

|

Anos históricos |

2020 |

|

Unidades Quantitativas |

Receita em milhões de dólares, preços em dólares |

|

Segmentos cobertos |

Por oferta (soluções e serviços), dimensão da organização (organizações de grande escala, organização de média escala e organização de pequena escala), camada de software (sistema operativo, middleware e software de aplicação), utilitário EV (gestão de carregamento, gestão de bateria e V2G), tipo de veículo (Automóveis de passageiros, veículos elétricos, veículos comerciais ligeiros e pesados), utilizador final (ADAS e sistemas de segurança, sistemas de comunicação, sistemas de infoentretenimento, controlo da carroçaria e sistema de conforto, gestão de motor e grupo motopropulsor, gestão de veículos e telemática, condução autónoma, HMI App e outros) |

|

Países abrangidos |

EUA, Canadá e México na América do Norte |

|

Participantes do mercado abrangidos |

LUXOFT, A DXC TECHNOLOGY COMPANY, Vector Informatik GmbH, Sigma Software, NVIDIA Corporation, Aptiv, Elektrobit, KPIT, NXP Semiconductors, aiMotive, Siemens, Intellias, Hexagon AB, OXBOTICA, Lynx Software Technologies, Renesas Electronics Corporation, Intel Corporation, Blackberry Limited , Airbiquity Inc., Green Hills Software, Robert Bosch GmbH, Wind River Systems, Inc., Alphabet Inc., Autonet Mobile, Inc, MONTAVISTA SOFTWARE LLC., Microsoft entre outros. |

Definição de mercado

A indústria automóvel compreende uma vasta gama de empresas e organizações envolvidas no design, desenvolvimento, fabrico, comercialização e venda de veículos motorizados. É uma das maiores indústrias do mundo em termos de receitas. É também a indústria com maiores gastos em Investigação e Desenvolvimento. A NXP oferece uma vasta gama de ferramentas de software automóvel concebidas para o ajudar a simplificar e reduzir o tempo necessário para construir ECUs baseadas em microcontroladores (MCU) NXP. Isto inclui software embebido e de tempo de execução, software, caixas de ferramentas compatíveis com MATLAB/Simulink, uma vasta gama de controladores, bibliotecas, pilhas e software de carregador de arranque. A NXP também fornece ferramentas de arranque de MCU e suporte de geração automática de código para camadas de abstração de microcontroladores (MCAL) e sistemas operativos (SO) AUTOSAR. de desenvolvimento e personalização numa vasta gama de espaços de aplicação e tecnologias.

Dinâmica do mercado de software automóvel

Esta secção trata da compreensão dos impulsionadores do mercado, vantagens, oportunidades, restrições e desafios. Tudo isto é discutido em detalhe abaixo:

Esta secção trata da compreensão dos impulsionadores do mercado, vantagens, oportunidades, restrições e desafios. Tudo isto é discutido em detalhe abaixo:

- Aumento da adoção de recursos ADAS em automóveis

A indústria automóvel tem assistido a enormes desenvolvimentos, no entanto, os sistemas avançados de assistência ao condutor (ADAS) são um dos principais desenvolvimentos. Este sistema garante mais medidas de segurança para os veículos, razão pela qual a procura de ADAS aumenta ano após ano. Esta inovação tecnológica para a indústria automóvel criou uma popularidade para a segurança e os benefícios envolvidos com o novo sistema, o que criou a procura por adoções de eletrónica integrada através de aplicações de software.

- Aumento do número de veículos conectados

Hoje em dia, os veículos conectados parecem ser uma nova norma na indústria automóvel, equipados com características inteligentes e convenientes. Os veículos são embarcados com cartões SIM ou chipset com acesso à internet e aplicação para automóvel operada através de smartphones que permite operar remotamente as funções de um veículo como o fecho / destrancamento de portas, controlo de temperatura, localização do veículo, entre muitas outras funcionalidades.

- Aumento da procura por veículos elétricos

Os veículos elétricos (VE) são concebidos para serem uma tecnologia promissora para alcançar um transporte sustentável com zero emissões de carbono, baixo ruído e alta eficiência. Além disso, os veículos eléctricos evoluíram no século XIX, mas devido à falta de avanço na tecnologia, os veículos com motor de combustão interna tiveram uma enorme procura em comparação com os veículos eléctricos.

Os veículos elétricos estão altamente integrados no software automóvel e têm diversos benefícios que estão concentrados em vários países e na formulação de regulamentos e políticas para impulsionar os veículos elétricos que ajudam a controlar as emissões de carbono e a evitar o aquecimento da América do Norte.

- Protocolos standard inadequados para o desenvolvimento de plataformas de software

O avanço tecnológico está a crescer ano após ano, resultando na evolução de melhor software automóvel sem um conjunto específico de normas para o desenvolvimento de software, o que leva a uma variedade de protocolos e interfaces de utilizador que podem ser difíceis de integrar as operações que levam à restrição do mercado de software automóvel.

- Falta de infraestruturas de conectividade

O investimento para o desenvolvimento da conectividade para veículos inclui a infraestrutura que suporta a tecnologia e a operação. Isto inclui cidades e estradas inteligentes que possuem mapeamento baseado na visão ou de alta frequência, o que ajudará a facilitar o funcionamento da condução autónoma equipada com sistemas de condução autónoma, com a exigência de informações atualizadas para uma melhor navegação dos veículos e conectividade.

- Necessidade de elevada manutenção de software

A atualização regular de software permite o desenvolvimento de uma nova arquitetura de software que leva ainda a alterações na interface, protocolos e tecnologia que podem não integrar operações com componentes mecânicos antigos e resultando na criação de problemas na utilização que dificultam a segurança e a facilidade de conectividade de os veículos.

Assim, é muito claro que a manutenção de software automóvel está limitada a um certo nível, após o qual o custo de manutenção aumenta rapidamente devido à manutenção de outros componentes e dispositivos relacionados, sem os quais o veículo pode ser considerado impróprio e inseguro para utilização .

Impacto pós-COVID-19 no mercado de software automóvel

A COVID-19 criou um grande impacto no mercado de software automóvel, uma vez que quase todos os países optaram pelo encerramento de todas as instalações de produção, exceto as que se dedicam à produção de bens essenciais. O governo tomou algumas medidas rigorosas, como o encerramento da produção e venda de bens não essenciais, bloqueou o comércio internacional e muitas outras para impedir a propagação da COVID-19. O único negócio que está a tratar nesta situação de pandemia são os serviços essenciais que estão autorizados a abrir e gerir os processos.

O crescimento do mercado de software automóvel deve-se ao aumento da utilização de equipamentos eletrónicos nos veículos e também à promoção de várias organizações governamentais para a utilização de veículos elétricos para reduzir as emissões. No entanto, a COVID-19 teve um efeito adverso no mercado de software automóvel, uma vez que as vendas dos veículos em muitos países foram interrompidas e a maioria das empresas encerraram as suas operações temporariamente durante quase meses.

Além disso, após a situação pandémica, os consumidores não estavam dispostos a comprar veículos novos devido à economia perturbada em muitos países, o que afetou diretamente o crescimento das vendas automóveis e resultou em impacto no crescimento do mercado de software automóvel.

Desenvolvimento recente

- Em janeiro de 2022, a Aptiv anunciou a colaboração com Sophia Velastegui. A colaboração foi anunciada para acelerar as tecnologias de software de mobilidade. As empresas irão aproveitar a sua experiência em inteligência artificial (IA) para o desenvolvimento de produtos. A empresa poderá comercializar e expandir o seu portfólio de produtos com produtos melhorados.

- Em junho de 2019, a Alphabet Inc. anunciou a aquisição da Looker por 2,6 mil milhões de dólares. Esta aquisição ajudou a empresa a melhorar as suas ofertas de plataformas para business intelligence, aplicações de dados e análises incorporadas, o que permitiu aos clientes impulsionar a transformação digital.

Âmbito do mercado de software automóvel da América do Norte

O mercado de software automóvel é segmentado com base nas ofertas, tamanho da organização, camada de software, utilidade EV, tipo de veículo e utilizador final. O crescimento entre estes segmentos irá ajudá-lo a analisar os escassos segmentos de crescimento nas indústrias e fornecer aos utilizadores uma valiosa visão geral do mercado e insights de mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Oferta

- Soluções

- Serviços

Com base na oferta, o mercado de software automóvel da América do Norte está segmentado em soluções e serviços.

Tamanho da organização

- As organizações de grande escala

- Organizações de média escala

- As organizações de pequena escala

Com base no tamanho da organização, o mercado de software automóvel da América do Norte foi segmentado em organizações de grande escala, organizações de média escala e organizações de pequena escala.

Camada de software

- Sistemas Operacionais

- Middleware

- Software aplicativo

Com base na camada de software, o mercado de software automóvel da América do Norte foi segmentado em sistemas operativos, middleware e software de aplicação.

Tipo de veículo

- Automóveis de passageiros

- Veículos Elétricos

- Veículos Comerciais Ligeiros

- Veículos Pesados

Com base no tipo de veículo, o mercado de software automóvel da América do Norte foi segmentado em automóveis de passageiros, veículos elétricos, veículos comerciais ligeiros e veículos pesados.

Utilitário EV

- Gestão de carregamento

- Gestão de bateria

- V2G

Com base na utilidade EV, o mercado de software automóvel da América do Norte foi segmentado em gestão de carregamento, gestão de baterias e V2G.

Utilizador final

- ADAS e sistemas de segurança

- Sistemas de Comunicação

- Sistemas de informação e lazer

- Gestão de motor e trem de força

- Gestão de Veículos e Telemática

- Sistema de controlo corporal e conforto

- Condução Autónoma

- Aplicação IHM

- Outros

Com base no utilizador final, o mercado de software automóvel da América do Norte foi segmentado em ADAS e sistemas de segurança, sistemas de comunicação, sistemas de infoentretenimento, gestão de motores e de cadeia cinemática, gestão de veículos e telemática, controlo corporal e sistema de conforto, condução autónoma, aplicação hmi e outros.

Análise/perspetivas regionais do mercado de software automóvel

O mercado de software automóvel é analisado e são fornecidos insights e tendências de tamanho de mercado por país, oferta, tipo de veículo, camada de software, utilidade EV, tamanho da organização e indústria de utilização final, como mencionado acima.

Os países abrangidos no mercado de software automóvel reportam os EUA, o Canadá e o México na América do Norte.

Os EUA dominam a região da América do Norte devido ao aumento do sistema de condução autónoma e ao desenvolvimento de soluções de luxo para os veículos.

A secção do país do relatório também fornece fatores individuais de impacto no mercado e alterações na regulamentação do mercado que impactam as tendências atuais e futuras do mercado. Pontos de dados como a análise da cadeia de valor a jusante e a montante, tendências técnicas e análise das cinco forças de Porter, estudos de caso são alguns dos indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, são considerados a presença e disponibilidade de marcas da América do Norte e os desafios enfrentados devido à concorrência grande ou escassa de marcas locais e nacionais, o impacto das tarifas domésticas e das rotas comerciais, ao mesmo tempo que se fornece uma análise de previsão dos dados do país.

Análise do cenário competitivo e da quota de mercado de software automóvel

O panorama competitivo do mercado de software automóvel fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença na América do Norte, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento de produtos, largura e amplitude do produto, domínio da aplicação. Os dados fornecidos acima estão apenas relacionados com o foco das empresas relacionado com o mercado de software automóvel.

Alguns dos principais players que operam no mercado de software automóvel são a LUXOFT, A DXC TECHNOLOGY COMPANY, Vector Informatik GmbH, Sigma Software, NVIDIA Corporation, Aptiv, Elektrobit, KPIT, NXP Semiconductors, aiMotive, Siemens, Intellias, Hexagon AB, OXBOTICA, Lynx Software Technologies, Renesas Electronics Corporation, Intel Corporation, Blackberry Limited, Airbiquity Inc., Green Hills Software, Robert Bosch GmbH, Wind River Systems, Inc., Alphabet Inc., Autonet Mobile, Inc, MONTAVISTA SOFTWARE LLC., Microsoft entre outros.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OFFERING TIMELINE CURVE

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TOP AUTOMOTIVE SOFTWARE COMPANIES

4.1.1 CASE STUDIES-

4.1.2 IDENTIFYING THE PROBLEM:

4.1.3 SOLUTION:

4.1.4 IDENTIFYING THE PROBLEM:

4.1.5 SOLUTIONS:

4.1.6 RND (RESEARCH AND DEVELOPMENT) AND NRE (NON-RECURRING ENGINEERING) STRUCTURES ON VARIED DEVELOPMENT PHASES ON TOP PLAYERS

4.1.7 ALPHABET INC.

4.1.8 NXP SEMICONDUCTORS

4.1.9 MICROSOFT

4.1.10 NVIDIA CORPORATION

4.2 TREND ANALYSIS:

4.2.1 ADVANCED CONNECTIVITY

4.2.2 ARTIFICIAL INTELLIGENCE

4.2.3 AUTONOMOUS DRIVING

4.2.4 SAFETY ENHANCEMENTS

4.2.5 AUGMENTED REALITY

4.2.6 PRICING ANALYSIS

5 PORTER’S FIVE FORCES MODEL

6 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY REGION

6.1 ASIA-PACIFIC

6.2 EUROPE

6.3 NORTH AMERICA

6.4 THE MIDDLE EAST AND AFRICA

6.5 SOUTH AMERICA

7 REGULATORY FRAMEWORK

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 RISE IN ADOPTION OF ADAS FEATURES IN AUTOMOBILES

8.1.2 RISE IN THE NUMBER OF CONNECTED VEHICLES

8.1.3 RISING DEMAND FOR ELECTRIC VEHICLES

8.2 RESTRAINTS

8.2.1 IMPROPER STANDARD PROTOCOLS FOR THE DEVELOPMENT OF SOFTWARE PLATFORMS

8.2.2 LACK OF CONNECTIVITY INFRASTRUCTURES

8.2.3 NEED FOR HIGH MAINTENANCE OF SOFTWARE

8.3 OPPORTUNITIES

8.3.1 RISE IN THE POTENTIAL FOR ARTIFICIAL INTELLIGENCE

8.3.2 REQUIREMENT OF CONNECTIVITY FOR BETTER FLEET MANAGEMENT

8.3.3 UPSURGE OF ELECTRONIC APPLICATIONS IN VEHICLES

8.4 CHALLENGES

8.4.1 LACK OF QUALITY AND SECURITY CONCERNS

8.4.2 EXPONENTIAL GROWTH OF SOFTWARE COSTS FOR VEHICLES

8.4.3 RISE IN COMPLEXITY FOR THE DEVELOPMENT

9 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY OFFERING

9.1 OVERVIEW

9.2 SERVICES

9.2.1 INTEGRATION & IMPLEMENTATION

9.2.2 DESIGNING

9.2.3 TESTING

9.2.3.1 UNIT TESTING

9.2.3.2 SYSTEM TESTING

9.2.3.3 INTEGRATION TESTING

9.2.3.4 VALIDATION & VERIFICATION

9.2.4 OTHERS

9.3 SOLUTION

10 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY ORGANIZATION SIZE

10.1 OVERVIEW

10.2 LARGE SCALE ORGANIZATIONS

10.3 MEDIUM SCALE ORGANIZATIONS

10.4 SMALL SCALE ORGANIZATIONS

11 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE

11.1 OVERVIEW

11.2 PASSENGER CARS

11.2.1 HATCHBACK

11.2.2 SEDAN

11.2.3 COMPACT

11.2.4 OTHERS

11.3 ELECTRIC VEHICLES

11.3.1 BATTERY ELECTRIC VEHICLES (BEVS)

11.3.2 HYBRID ELECTRIC VEHICLES (HEVS)

11.3.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

11.4 LIGHT COMMERCIAL VEHICLES

11.4.1 MINIVANS

11.4.2 PICK-UP TRUCKS

11.4.3 AUTORICKSHAWS

11.4.4 OTHERS

11.5 HEAVY DUTY VEHICLES

11.5.1 EXCAVATOR

11.5.2 SUPER LOADER

11.5.3 CRANES

11.5.4 OTHERS

12 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY SOFTWARE LAYER

12.1 OVERVIEW

12.2 OPERATING SYSTEM

12.3 APPLICATION SOFTWARE

12.4 MIDDLEWARE

13 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY EV UTILITY

13.1 OVERVIEW

13.2 CHARGING MANAGEMENT

13.3 BATTERY MANAGEMENT

13.4 V2G

14 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY END USE

14.1 OVERVIEW

14.2 ADAS & SAFETY SYSTEMS

14.2.1 PASSENGER CARS

14.2.1.1 HATCHBACK

14.2.1.2 SEDAN

14.2.1.3 COMPACT

14.2.1.4 OTHERS

14.2.2 ELECTRIC VEHICLES

14.2.2.1 BATTERY ELECTRIC VEHICLES (BEVS)

14.2.2.2 HYBRID ELECTRIC VEHICLES (HEVS)

14.2.2.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

14.2.3 LIGHT COMMERCIAL VEHICLES

14.2.3.1 MINIVANS

14.2.3.2 PICK-UP TRUCKS

14.2.3.3 AUTORICKSHAWS

14.2.3.4 OTHERS

14.2.4 HEAVY DUTY VEHICLES

14.2.4.1 EXCAVATOR

14.2.4.2 SUPER LOADER

14.2.4.3 CRANES

14.2.4.4 OTHERS

14.3 COMMUNICATION SYSTEMS

14.3.1 PASSENGER CARS

14.3.1.1 HATCHBACK

14.3.1.2 SEDAN

14.3.1.3 COMPACT

14.3.1.4 OTHERS

14.3.2 ELECTRIC VEHICLES

14.3.2.1 BATTERY ELECTRIC VEHICLES (BEVS)

14.3.2.2 HYBRID ELECTRIC VEHICLES (HEVS)

14.3.2.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

14.3.3 LIGHT COMMERCIAL VEHICLES

14.3.3.1 MINIVANS

14.3.3.2 PICK-UP TRUCKS

14.3.3.3 AUTORICKSHAWS

14.3.3.4 OTHERS

14.3.4 HEAVY DUTY VEHICLES

14.3.4.1 EXCAVATOR

14.3.4.2 SUPER LOADER

14.3.4.3 CRANES

14.3.4.4 OTHERS

14.4 INFOTAINMENT SYSTEMS

14.4.1 PASSENGER CARS

14.4.1.1 HATCHBACK

14.4.1.2 SEDAN

14.4.1.3 COMPACT

14.4.1.4 OTHERS

14.4.2 ELECTRIC VEHICLES

14.4.2.1 BATTERY ELECTRIC VEHICLES (BEVS)

14.4.2.2 HYBRID ELECTRIC VEHICLES (HEVS)

14.4.2.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

14.4.3 LIGHT COMMERCIAL VEHICLES

14.4.3.1 MINIVANS

14.4.3.2 PICK-UP TRUCKS

14.4.3.3 AUTORICKSHAWS

14.4.3.4 OTHERS

14.4.4 HEAVY DUTY VEHICLES

14.4.4.1 EXCAVATOR

14.4.4.2 SUPER LOADER

14.4.4.3 CRANES

14.4.4.4 OTHERS

14.5 VEHICLE MANAGEMENT & TELEMATICS SYSTEMS

14.5.1 PASSENGER CARS

14.5.1.1 HATCHBACK

14.5.1.2 SEDAN

14.5.1.3 COMPACT

14.5.1.4 OTHERS

14.5.2 ELECTRIC VEHICLES

14.5.2.1 BATTERY ELECTRIC VEHICLES (BEVS)

14.5.2.2 HYBRID ELECTRIC VEHICLES (HEVS)

14.5.2.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

14.5.3 LIGHT COMMERCIAL VEHICLES

14.5.3.1 MINIVANS

14.5.3.2 PICK-UP TRUCKS

14.5.3.3 AUTORICKSHAWS

14.5.3.4 OTHERS

14.5.4 HEAVY DUTY VEHICLES

14.5.4.1 EXCAVATOR

14.5.4.2 SUPER LOADER

14.5.4.3 CRANES

14.5.4.4 OTHERS

14.6 ENGINE MANAGEMENT & POWERTRAIN

14.6.1 PASSENGER CARS

14.6.1.1 HATCHBACK

14.6.1.2 SEDAN

14.6.1.3 COMPACT

14.6.1.4 OTHERS

14.6.2 ELECTRIC VEHICLES

14.6.2.1 BATTERY ELECTRIC VEHICLES (BEVS)

14.6.2.2 HYBRID ELECTRIC VEHICLES (HEVS)

14.6.2.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

14.6.3 LIGHT COMMERCIAL VEHICLES

14.6.3.1 MINIVANS

14.6.3.2 PICK-UP TRUCKS

14.6.3.3 AUTORICKSHAWS

14.6.3.4 OTHERS

14.6.4 HEAVY DUTY VEHICLES

14.6.4.1 EXCAVATOR

14.6.4.2 SUPER LOADER

14.6.4.3 CRANES

14.6.4.4 OTHERS

14.7 BODY CONTROL & COMFORT SYSTEM

14.7.1 PASSENGER CARS

14.7.1.1 HATCHBACK

14.7.1.2 SEDAN

14.7.1.3 COMPACT

14.7.1.4 OTHERS

14.7.2 ELECTRIC VEHICLES

14.7.2.1 BATTERY ELECTRIC VEHICLES (BEVS)

14.7.2.2 HYBRID ELECTRIC VEHICLES (HEVS)

14.7.2.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

14.7.3 LIGHT COMMERCIAL VEHICLES

14.7.3.1 MINIVANS

14.7.3.2 PICK-UP TRUCKS

14.7.3.3 AUTORICKSHAWS

14.7.3.4 OTHERS

14.7.4 HEAVY DUTY VEHICLES

14.7.4.1 EXCAVATOR

14.7.4.2 SUPER LOADER

14.7.4.3 CRANES

14.7.4.4 OTHERS

14.8 HMI APPLICATION

14.8.1 PASSENGER CARS

14.8.1.1 HATCHBACK

14.8.1.2 SEDAN

14.8.1.3 COMPACT

14.8.1.4 OTHERS

14.8.2 6.2.2 ELECTRIC VEHICLES

14.8.2.1 BATTERY ELECTRIC VEHICLES (BEVS)

14.8.2.2 HYBRID ELECTRIC VEHICLES (HEVS)

14.8.2.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

14.8.3 LIGHT COMMERCIAL VEHICLES

14.8.3.1 MINIVANS

14.8.3.2 PICK-UP TRUCKS

14.8.3.3 AUTORICKSHAWS

14.8.3.4 OTHERS

14.8.4 HEAVY DUTY VEHICLES

14.8.4.1 EXCAVATOR

14.8.4.2 SUPER LOADER

14.8.4.3 CRANES

14.8.4.4 OTHERS

14.9 AUTONOMOUS DRIVING

14.9.1 PASSENGER CARS

14.9.1.1 HATCHBACK

14.9.1.2 SEDAN

14.9.1.3 COMPACT

14.9.1.4 OTHERS

14.9.2 ELECTRIC VEHICLES

14.9.2.1 BATTERY ELECTRIC VEHICLES (BEVS)

14.9.2.2 HYBRID ELECTRIC VEHICLES (HEVS)

14.9.2.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

14.9.3 LIGHT COMMERCIAL VEHICLES

14.9.3.1 MINIVANS

14.9.3.2 PICK-UP TRUCKS

14.9.3.3 AUTORICKSHAWS

14.9.3.4 OTHERS

14.9.4 HEAVY DUTY VEHICLES

14.9.4.1 EXCAVATOR

14.9.4.2 SUPER LOADER

14.9.4.3 CRANES

14.9.4.4 OTHERS

14.1 OTHERS

14.10.1 PASSENGER CARS

14.10.1.1 HATCHBACK

14.10.1.2 SEDAN

14.10.1.3 COMPACT

14.10.1.4 OTHERS

14.10.2 ELECTRIC VEHICLES

14.10.2.1 BATTERY ELECTRIC VEHICLES (BEVS)

14.10.2.2 HYBRID ELECTRIC VEHICLES (HEVS)

14.10.2.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

14.10.3 LIGHT COMMERCIAL VEHICLES

14.10.3.1 MINIVANS

14.10.3.2 PICK-UP TRUCKS

14.10.3.3 AUTORICKSHAWS

14.10.3.4 OTHERS

14.10.4 HEAVY DUTY VEHICLES

14.10.4.1 EXCAVATOR

14.10.4.2 SUPER LOADER

14.10.4.3 CRANES

14.10.4.4 OTHERS

15 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY REGION

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 APTIV

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 ALPHABET INC.

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENT

18.3 NXP SEMICONDUCTORS.

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 MICROSOFT

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 NVIDIA CORPORATION.

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 AIMOTIVE

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENTS

18.7 AIRBIQUITY INC.

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENTS

18.8 AUTONET MOBILE, INC.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 BLACKBERRY LIMITED

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 ELEKTROBIT

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENTS

18.11 GREEN HILLS SOFTWARE

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 HEXAGON AB

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 INTEL CORPORATION

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENTS

18.14 INTELLIAS

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 KPIT

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENT

18.16 LUXOFT, A DXC TECHNOLOGY COMPANY

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENTS

18.17 LYNX SOFTWARE TECHNOLOGIES

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 1.1RECENT DEVELOPMENT

18.18 MONTAVISTA SOFTWARE, LLC.

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENTS

18.19 OXBOTICA

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 RENESAS ELECTRONICS CORPORATION

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 PRODUCT PORTFOLIO

18.20.4 RECENT DEVELOPMENTS

18.21 ROBERT BOSCH GMBH

18.21.1 COMPANY SNAPSHOT

18.21.2 REVENUE ANALYSIS

18.21.3 PRODUCT PORTFOLIO

18.21.4 RECENT DEVELOPMENTS

18.22 SIEMENS

18.22.1 COMPANY SNAPSHOT

18.22.2 REVENUE ANALYSIS

18.22.3 PRODUCT PORTFOLIO

18.22.4 RECENT DEVELOPMENTS

18.23 SIGMA SOFTWARE

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENTS

18.24 VECTOR INFORMATIK GMBH

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENTS

18.25 WIND RIVER SYSTEMS, INC.

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

Lista de Tabela

TABLE 1 THE BELOW TABLE CLEARLY SHOWS THE OEM INVESTING SOFTWARE RESEARCH AND DEVELOPMENT AND ACCORDINGLY, THE COMPANIES FACE DISRUPTION IN COMPETING WITH THE MARKET PLAYERS.

TABLE 2 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA SERVICES IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA SERVICES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA TESTING IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA SOLUTION IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA LARGE SCALE ORGANIZATIONS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA MEDIUM SCALE ORGANIZATIONS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA SMALL SCALE ORGANIZATIONS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE , 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY SOFTWARE LAYER, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA OPERATING SYSTEM IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA APPLICATION SOFTWARE IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA MIDDLEWARE IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY EV UTILITY, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA CHARGING MANAGEMENT IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA BATTERY MANAGEMENT IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA V2G IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY END USER , 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA ADAS & SAFETY SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA ADAS & SAFETY SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA COMMUNICATION SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA COMMUNICATION SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA INFOTAINMENT SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA INFOTAINMENT SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA VEHICLE MANAGEMENT & TELEMATICS SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA VEHICLE MANAGEMENT & TELEMATICS SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA ENGINE MANAGEMENT & POWERTRAIN SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA ENGINE MANAGEMENT & POWERTRAIN SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA BODY CONTROL & COMFORT SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA BODY CONTROL & COMFORT SYSTEM IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA HMI APPLICATION IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA HMI APPLICATION IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA AUTONOMOUS DRIVING IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA AUTONOMOUS DRIVING IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 73 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 NORTH AMERICA OTHERS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 78 NORTH AMERICA OTHERS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 79 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 84 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 85 NORTH AMERICA SERVICES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 NORTH AMERICA TESTING IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 88 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 NORTH AMERICA LIGHT COMMERCIAL VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY SOFTWARE LAYER, 2020-2029 (USD MILLION)

TABLE 93 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY EV UTILITY, 2020-2029 (USD MILLION)

TABLE 94 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 95 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 96 NORTH AMERICA ADAS & SAFETY SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 97 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 NORTH AMERICA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 NORTH AMERICA LIGHT COMMERCIAL VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 NORTH AMERICA COMMUNICATION SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 102 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 NORTH AMERICA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 NORTH AMERICA INFOTAINMENT SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 107 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 NORTH AMERICA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 NORTH AMERICA VEHICLE MANAGEMENT & TELEMATICS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 112 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 NORTH AMERICA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 NORTH AMERICA ENGINE MANAGEMENT & POWERTRAIN IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 117 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 NORTH AMERICA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 NORTH AMERICA BODY CONTROL & COMFORT SYSTEM IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 122 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 NORTH AMERICA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 NORTH AMERICA HMI APPLICATION IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 127 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 NORTH AMERICA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 NORTH AMERICA AUTONOMOUS DRIVING IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 132 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 NORTH AMERICA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 136 NORTH AMERICA OTHERS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 137 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 NORTH AMERICA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 U.S. AUTOMOTIVE SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 142 U.S. SERVICES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 U.S. TESTING IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 U.S. AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 145 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 U.S. ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 U.S. LIGHT COMMERCIAL VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 U.S. AUTOMOTIVE SOFTWARE MARKET, BY SOFTWARE LAYER, 2020-2029 (USD MILLION)

TABLE 150 U.S. AUTOMOTIVE SOFTWARE MARKET, BY EV UTILITY, 2020-2029 (USD MILLION)

TABLE 151 U.S. AUTOMOTIVE SOFTWARE MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 152 U.S. AUTOMOTIVE SOFTWARE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 153 U.S. ADAS & SAFETY SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 154 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 155 U.S. ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 U.S. LIGHT COMMERCIAL VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 U.S. COMMUNICATION SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 159 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 U.S. ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 161 U.S. LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 163 U.S. INFOTAINMENT SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 164 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 165 U.S. ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 U.S. LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 168 U.S. VEHICLE MANAGEMENT & TELEMATICS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 169 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 U.S. ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 171 U.S. LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 172 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 173 U.S. ENGINE MANAGEMENT & POWERTRAIN IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 174 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 175 U.S. ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 U.S. LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 177 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 U.S. BODY CONTROL & COMFORT SYSTEM IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 179 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 U.S. ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 181 U.S. LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 182 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 183 U.S. HMI APPLICATION IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 184 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 185 U.S. ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 186 U.S. LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 187 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 188 U.S. AUTONOMOUS DRIVING IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 189 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 190 U.S. ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 U.S. LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 192 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 193 U.S. OTHERS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 194 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 195 U.S. ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 196 U.S. LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 197 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 198 CANADA AUTOMOTIVE SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 199 CANADA SERVICES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 200 CANADA TESTING IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 201 CANADA AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 202 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 203 CANADA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 204 CANADA LIGHT COMMERCIAL VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 205 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 206 CANADA AUTOMOTIVE SOFTWARE MARKET, BY SOFTWARE LAYER, 2020-2029 (USD MILLION)

TABLE 207 CANADA AUTOMOTIVE SOFTWARE MARKET, BY EV UTILITY, 2020-2029 (USD MILLION)

TABLE 208 CANADA AUTOMOTIVE SOFTWARE MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 209 CANADA AUTOMOTIVE SOFTWARE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 210 CANADA ADAS & SAFETY SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 211 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 212 CANADA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 213 CANADA LIGHT COMMERCIAL VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 214 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 215 CANADA COMMUNICATION SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 216 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 217 CANADA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 218 CANADA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 219 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 220 CANADA INFOTAINMENT SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 221 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 222 CANADA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 223 CANADA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 224 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 225 CANADA VEHICLE MANAGEMENT & TELEMATICS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 226 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 227 CANADA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 228 CANADA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 229 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 230 CANADA ENGINE MANAGEMENT & POWERTRAIN IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 231 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 232 CANADA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 233 CANADA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 234 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 235 CANADA BODY CONTROL & COMFORT SYSTEM IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 236 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 237 CANADA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 238 CANADA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 239 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 240 CANADA HMI APPLICATION IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 241 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 242 CANADA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 243 CANADA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 244 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 245 CANADA AUTONOMOUS DRIVING IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 246 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 247 CANADA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 248 CANADA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 249 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 250 CANADA OTHERS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 251 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 252 CANADA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 253 CANADA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 254 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 255 MEXICO AUTOMOTIVE SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 256 MEXICO SERVICES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 257 MEXICO TESTING IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 258 MEXICO AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 259 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 260 MEXICO ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 261 MEXICO LIGHT COMMERCIAL VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 262 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 263 MEXICO AUTOMOTIVE SOFTWARE MARKET, BY SOFTWARE LAYER, 2020-2029 (USD MILLION)

TABLE 264 MEXICO AUTOMOTIVE SOFTWARE MARKET, BY EV UTILITY, 2020-2029 (USD MILLION)

TABLE 265 MEXICO AUTOMOTIVE SOFTWARE MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 266 MEXICO AUTOMOTIVE SOFTWARE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 267 MEXICO ADAS & SAFETY SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 268 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 269 MEXICO ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 270 MEXICO LIGHT COMMERCIAL VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 271 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 272 MEXICO COMMUNICATION SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 273 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 274 MEXICO ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 275 MEXICO LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 276 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 277 MEXICO INFOTAINMENT SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 278 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 279 MEXICO ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 280 MEXICO LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 281 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 282 MEXICO VEHICLE MANAGEMENT & TELEMATICS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 283 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 284 MEXICO ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 285 MEXICO LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 286 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 287 MEXICO ENGINE MANAGEMENT & POWERTRAIN IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 288 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 289 MEXICO ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 290 MEXICO LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 291 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 292 MEXICO BODY CONTROL & COMFORT SYSTEM IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 293 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 294 MEXICO ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 295 MEXICO LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 296 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 297 MEXICO HMI APPLICATION IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 298 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 299 MEXICO ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 300 MEXICO LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 301 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 302 MEXICO AUTONOMOUS DRIVING IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 303 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 304 MEXICO ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 305 MEXICO LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 306 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 307 MEXICO OTHERS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 308 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 309 MEXICO ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 310 MEXICO LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 311 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

Lista de Figura

FIGURE 1 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: MARKET END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: SEGMENTATION

FIGURE 11 RISE IN ADOPTION OF ADAS FEATURES IN AUTOMOBILES IS EXPECTED TO DRIVE NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 OFFERING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST GROWING REGION IN THE NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 AVAILABILITY OF ADAS TECHNOLOGY IN NEW VEHICLE MODELS

FIGURE 15 AUTOMOTIVE AI MARKET SIZE

FIGURE 16 WORLDWIDE ELECTRONIC SYSTEM CAGR (IN %)

FIGURE 17 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: BY OFFERING, 2021

FIGURE 18 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: BY ORGANIZATION SIZE, 2021

FIGURE 19 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: BY VEHICLE TYPE, 2021

FIGURE 20 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: BY SOFTWARE LAYER, 2021

FIGURE 21 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: BY EV UTILITY, 2021

FIGURE 22 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY END USER

FIGURE 23 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: SNAPSHOT (2021)

FIGURE 24 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: BY COUNTRY (2021)

FIGURE 25 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: BY OFFERING (2022-2029)

FIGURE 28 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: COMPANY SHARE 2021 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.