North America Aroma Chemicals Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

1.40 Billion

USD

2.52 Billion

2025

2033

USD

1.40 Billion

USD

2.52 Billion

2025

2033

| 2026 –2033 | |

| USD 1.40 Billion | |

| USD 2.52 Billion | |

|

|

|

|

Segmentação do mercado de produtos químicos aromáticos na América do Norte, por tipo de substância química (terpenos, benzenoides, compostos de almíscar, ésteres, cetonas e outros), tipo de aroma (floral, amadeirado, cítrico, frutado, herbal, tropical e outros), cor (incolor, branco, amarelado e outros), origem (natural e sintética), forma (líquida e seca), aplicação (produtos de higiene pessoal, fragrâncias finas/perfumes, cuidados pessoais, bebidas, alimentos e outros), tipo de produto (baunilha de Madagascar, Tixosil 38 x, Vainilina, Carvacrol, Propilenoglicol USP, Dipropilenoglicol, Éter metílico de Dipropilenoglicol, Dihidromircenol, Cis-3-hexenol, Aldeído C-18, Linalol, Lysmeral, Aldeído cinâmico, Citronelol, Galaxolide, Iso E Super, Geraniol, Hexilcinâmico). Aldeído, Aldeído C-14, Acetato de Isobornila, Álcool Feniletílico, Anetol, Eugenol, Furaneol, Cetona de Framboesa, Gama-Decalactona, Timbersilk, Delta-Dodecalactona, Óxido de Difenila, Eucaliptol, Anisaldeído, Cetalox, Hediona // MDJ, Alfa Ionona, Yara Yara, Ionona Beta, Acetato de Linalila, Acetato de Isoamila, Butirato de Etilo, Triol 91 Kosher, Etil Vainilina, Canphor, Citral, Terpinoleonas, Bromélia, Jasmacicleno / Acetato de Verdila, Aldeído c-12 MNA, Verdox // Acetato de OTBC, Gama-Octalactona, Triacetina, Acetato de Benzila, Citronelal, Álcool Benzílico, Heliotropina, Gama Metil Ionona, Terpineóis, Bourgeonal, Dinascona, Bacdanol, Timol, Cumarina, Dihidrocumarina, Salicilato de Amila, Salicilato de Hexila, Salicilato de Metila, Propionato de Verdila, Undecavertol, Citrnelil Nitrila, Antranilato de Metila, Acetato de Terpinila, Metil Ciclopentenolona, Acetato de PTBC, Etilciclopentenolona, Ácido Butírico, Aldeídos C-12 (MOA, MNA, etc.), Aldeídos C-11, Rosalina, Óxido de Rosa 90:10, Maltol, Etil Maltol, Triplal, Caproato de Etila, Hexanoatos e Heptanoatos de Etila e Metila, Mentol Natural, Sintético, Hortelã-verde 60% e 80%, Nerol, Exaltolida, Acetato de Estralila, Tetraidrolinalol. Tetrahidromircenol, alil amil glicolato, borneol cristalizado, isoborneol, tonalid, violiff, tibutyirine, javanol e outros), e canal de distribuição (indireto e direto) - Tendências e previsões do setor até 2033

Qual é o tamanho e a taxa de crescimento do mercado de produtos químicos aromáticos na América do Norte?

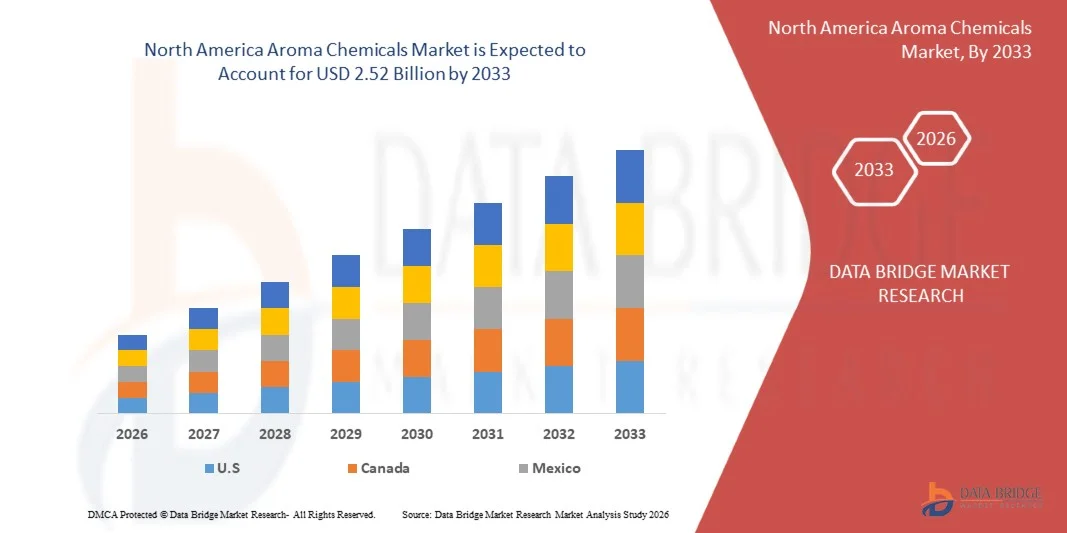

- O mercado de produtos químicos aromáticos na América do Norte foi avaliado em US$ 1,40 bilhão em 2025 e espera-se que alcance US$ 2,52 bilhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 7,6% durante o período de previsão.

- O aumento das atividades de construção e infraestrutura, incluindo projetos comerciais, residenciais e industriais, está impulsionando a demanda por produtos químicos aromáticos para proteger estruturas contra infiltrações de água, umidade e degradação ambiental, sustentando assim o crescimento do mercado.

- O elevado custo inicial das membranas premium e da instalação, aliado à necessidade de mão de obra qualificada e maquinário especializado, aumenta o custo total do projeto, o que pode limitar a sua adoção em projetos de pequena escala ou com orçamento limitado.

Quais são os principais destaques do mercado de produtos químicos aromáticos?

- Os avanços nas tecnologias de impermeabilização, como membranas autoadesivas, soluções líquidas e mantas sintéticas de alto desempenho, estão aprimorando a durabilidade e a facilidade de instalação, apresentando oportunidades significativas de crescimento para os participantes do mercado.

- Desafios como problemas de vazamento, instalação inadequada e requisitos de manutenção continuam a impactar a relação custo-benefício e o desempenho, representando obstáculos importantes para a adoção generalizada de produtos químicos aromáticos na América do Norte.

- Os EUA dominaram o mercado de aromas químicos na América do Norte, com uma participação de 36,2% na receita em 2025, impulsionados pela ampla adoção de aromas químicos de alta qualidade em fragrâncias, produtos de higiene pessoal, alimentos e bebidas.

- Prevê-se que o Canadá registre a taxa de crescimento anual composta (CAGR) mais rápida, de 9,9%, entre 2026 e 2033, impulsionada pela adoção de aromas químicos inovadores em perfumaria, cuidados pessoais e aplicações em alimentos e bebidas.

- O segmento de terpenos dominou o mercado com uma participação de 42,5% da receita em 2025, impulsionado pela alta demanda em fragrâncias finas, cuidados pessoais e aplicações alimentícias devido à sua versatilidade e perfil de aroma natural.

Escopo do relatório e segmentação do mercado de produtos químicos aromáticos

|

Atributos |

Principais informações de mercado sobre produtos químicos aromáticos |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marcas, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Qual é a principal tendência no mercado de produtos químicos aromáticos?

“ Crescente demanda por produtos químicos aromáticos sustentáveis e de alto desempenho ”

- O mercado de aromas químicos na América do Norte está testemunhando uma tendência importante: a crescente adoção de ingredientes aromáticos multifuncionais, ecológicos e com rótulos limpos. Essa tendência é impulsionada pela crescente conscientização do consumidor sobre saúde, bem-estar e sustentabilidade, principalmente em aplicações nas áreas de alimentos, bebidas, cosméticos e cuidados pessoais.

- Por exemplo, empresas como a Firmenich e a Givaudan estão desenvolvendo aromas químicos biodegradáveis derivados de plantas, com maior estabilidade e perfis sensoriais superiores, para atender a padrões regulatórios rigorosos e às expectativas dos consumidores.

- A crescente demanda por aromas químicos naturais, hipoalergênicos e com rótulo limpo está acelerando a adoção em toda a indústria de alimentos, bebidas e cuidados pessoais da América do Norte.

- Os fabricantes estão integrando tecnologias avançadas de extração, microencapsulação e processamento sem solventes para melhorar o desempenho, a vida útil e a segurança.

- O aumento dos investimentos em pesquisa e desenvolvimento de novos compostos de sabor, fornecimento sustentável e tecnologias de mascaramento de odores está fomentando a inovação.

- À medida que os consumidores continuam a priorizar o bem-estar, a sustentabilidade e experiências sensoriais de alta qualidade, espera-se que os aromas químicos premium e naturais permaneçam essenciais para o desenvolvimento de produtos.

Quais são os principais fatores que impulsionam o mercado de produtos químicos aromáticos?

- A crescente ênfase em ingredientes naturais, sustentáveis e com rótulos limpos é um dos principais impulsionadores da expansão do mercado.

- Por exemplo, em 2025, a DSM e a Symrise lançaram aromas químicos à base de plantas e isentos de alérgenos para alimentos, bebidas e produtos de higiene pessoal, visando consumidores preocupados com a saúde.

- A crescente demanda por aromas e fragrâncias premium e funcionais em alimentos embalados, bebidas e cosméticos está impulsionando a adoção.

- Os avanços tecnológicos em extração, purificação e encapsulamento estão permitindo que os fabricantes produzam ingredientes aromáticos mais estáveis e potentes.

- O crescente foco regulatório em segurança, rotulagem e fornecimento sustentável está impulsionando o crescimento do mercado.

- Com investimentos contínuos em P&D, fornecimento sustentável e inovação orientada pelo consumidor, espera-se que o mercado de aromas químicos da América do Norte mantenha um forte ritmo de crescimento nos próximos anos.

Que fator está desafiando o crescimento do mercado de produtos químicos aromáticos?

- O alto custo dos aromas químicos naturais e à base de plantas de alta qualidade limita sua adoção, principalmente para pequenos fabricantes e produtos sensíveis ao preço.

- Por exemplo, durante o período de 2024–2025, as flutuações nos preços das matérias-primas, nos custos de extração e na conformidade regulatória impactaram a produção e os preços das principais empresas do setor.

- Requisitos regulamentares rigorosos para segurança, rotulagem de alérgenos e conformidade ambiental aumentam a complexidade operacional e os custos.

- O conhecimento limitado dos consumidores sobre os benefícios dos aromas químicos naturais e funcionais pode restringir a sua adoção em massa.

- A concorrência de aromas químicos sintéticos, alternativas locais de baixo custo e substitutos importados cria pressão sobre os preços e afeta a penetração no mercado.

- Para enfrentar esses desafios, os fabricantes estão se concentrando em métodos de extração economicamente eficientes, fornecimento sustentável, produtos com certificação ecológica e programas de educação para fornecer soluções de aromas químicos de alta qualidade, seguras e sustentáveis.

Como o mercado de produtos químicos aromáticos está segmentado?

O mercado é segmentado com base no tipo de substância química, nó de aroma, cor, origem, forma, aplicação, tipo de produto e canal de distribuição .

• Por tipo químico

Com base no tipo de substância química, o mercado é segmentado em terpenos, benzenoides, compostos de almíscar, ésteres, cetonas e outros. O segmento de terpenos dominou o mercado com uma participação de 42,5% da receita em 2025, impulsionado pela alta demanda em fragrâncias finas, cuidados pessoais e aplicações alimentícias devido à sua versatilidade e perfil de aroma natural.

Prevê-se que os compostos químicos derivados do almíscar apresentem o crescimento anual composto mais rápido entre 2026 e 2033, impulsionados pela crescente preferência por fragrâncias premium e de longa duração em perfumes de luxo e produtos de higiene pessoal. A inovação contínua na extração de terpenos sintéticos e naturais sustenta a expansão do mercado, enquanto os terpenos continuam sendo a opção preferida para aplicações funcionais e com rótulos limpos.

• Por Aroma Node

Com base no tipo de aroma, o mercado é segmentado em Floral, Amadeirado, Cítrico, Frutado, Herbal, Tropical e Outros. O segmento Floral dominou com 38,6% da receita em 2025, devido ao seu uso generalizado em perfumes, produtos de higiene pessoal e cosméticos.

Prevê-se que os compostos aromáticos amadeirados apresentem o crescimento anual composto mais rápido entre 2026 e 2033, impulsionados pela crescente demanda por fragrâncias quentes e terrosas em produtos de luxo e de nicho. Inovações em técnicas de encapsulamento e estabilização garantem a retenção consistente do aroma em diversas aplicações.

• Por cor

Com base na cor, o mercado é segmentado em incolor, branco, amarelado e outros. O segmento de incolor dominou o mercado com uma participação de 46,2% da receita em 2025, visto que esses produtos químicos são altamente versáteis, mais fáceis de misturar e preferidos em aplicações nas indústrias de bebidas, cosméticos e alimentos.

Prevê-se que os compostos aromáticos amarelados apresentem o crescimento anual composto mais rápido entre 2026 e 2033, impulsionados pela preferência do consumidor por ingredientes naturais e visualmente atraentes, bem como pela expansão de suas aplicações na perfumaria especializada.

• Por Fonte

Com base na fonte, o mercado é segmentado em Natural e Sintético. O segmento Sintético dominou com uma participação de 51,3% na receita em 2025, devido à qualidade consistente, escalabilidade e menor custo em comparação com os extratos naturais.

Prevê-se que os aromas químicos naturais apresentem o crescimento anual composto mais rápido entre 2026 e 2033, impulsionados pela crescente preferência dos consumidores por soluções de fragrâncias com rótulos limpos, orgânicas e sustentáveis nos setores de alimentos, bebidas e cuidados pessoais.

• Por formulário

Com base na forma, o mercado é segmentado em Líquido e Seco. O segmento Líquido dominou com uma participação de 57,4% da receita em 2025, impulsionado pela facilidade de formulação, alta solubilidade e ampla aplicabilidade industrial.

Prevê-se que os compostos aromáticos secos apresentem o crescimento anual composto mais rápido entre 2026 e 2033, impulsionados pelos avanços nas tecnologias de encapsulamento, mistura de pós e estabilidade para alimentos e bebidas funcionais.

• Mediante inscrição

Com base na aplicação, o mercado é segmentado em Artigos de Higiene Pessoal, Perfumes/Fragrâncias Finas, Cuidados Pessoais, Bebidas, Alimentos e Outros. O segmento de Perfumes/Fragrâncias Finas dominou o mercado com 44,7% da receita em 2025, impulsionado pela crescente demanda por fragrâncias de luxo e de nicho.

Prevê-se que o setor de bebidas apresente o crescimento anual composto mais rápido entre 2026 e 2033, impulsionado por bebidas funcionais, água aromatizada e bebidas premium que exigem perfis aromáticos únicos.

• Por tipo de produto

Com base no tipo de produto, o mercado é segmentado em Vainilla Vainas Madagascar, Tixosil 38 x, Vainilina, Carvacrol, Propilenglicol USP, Dipropilenglicol, Éter Metílico de Dipropilenglicol, Dihidromircenol, Cis-3-Hexenol, Aldeído C-18, Linalol, Lysmeral, Aldeído Cinâmico, Citronelol, Galaxolide, Iso E Super, Geraniol, Aldeído Hexilcinâmico, Aldeído C-14, Acetato de Isobornila, Álcool Feniletílico, Anetol, Eugenol, Furaneol, Cetona de Framboesa, Gama-Decalactona, Timbersilk, Delta-Dodecalactona, Óxido de Difenila, Eucaliptol, Anisaldeído, Cetalox, Hedione // MDJ, Alfa Ionona, Yara Yara, Ionona Beta, Linalil Acetato, Acetato de Isoamila, Butirato de Etilo, Triol 91 Kosher, Etil Vainilina, Canphor, Citral, Terpinoleonas, Bromelia, Jasmacicleno / Acetato de Verdila, Aldeído c-12 MNA, Verdox // Acetato de OTBC, Gama-Octalactona, Triacetina, Acetato de Benzila, Citronelal, Álcool Benzílico, Heliotropina, Gama Metil Ionona, Terpineóis, Bourgeonal, Dinascona, Bacdanol, Timol, Cumarina, Dihidrocumarina, Salicilato de Amila, Salicilato de Hexila, Salicilato de Metila, Propionato de Verdila, Undecavertol, Citrnelil Nitrila, Antranilato de Metila, Acetato de Terpinila, Metil Ciclopentenolona, Acetato de Ptbc, Etilciclopentenolona, Butírico Ácidos, Aldeídos c-12 (MOA, MNA, etc.), Aldeídos c-11, Rosalina, Óxido de Rosa 90:10, Maltol, Etil Maltol, Triplal, Caproato de Etila, Hexanoatos e Heptanoatos de Etila e Metila, Mentol Natural, Mentol Sintético, Hortelã-verde 60% e 80%, Nerol, Exaltolida, Acetato de Estralila, Tetraidrolinalol, Tetraidromircenol, Glicolato de Alila Amil, Borneol Cristalizado, Isoborneol, Tonalida, Violif, Tibutiririna, Javanol e Outros. O segmento de Vanilina dominou com 36,8% da receita em 2025, devido ao seu uso generalizado em confeitaria, bebidas e perfumaria.

Prevê-se que a Hedione apresente o crescimento anual composto mais rápido entre 2026 e 2033, impulsionada pelas tendências da perfumaria de alta gama e pela crescente preferência por composições olfativas sofisticadas.

• Por canal de distribuição

Com base no canal de distribuição, o mercado é segmentado em indireto e direto. O segmento direto dominou com 53,6% da receita em 2025, visto que os fabricantes fornecem aromas químicos diretamente para grandes empresas de alimentos, bebidas e cuidados pessoais, garantindo qualidade e rastreabilidade.

Prevê-se que os canais indiretos apresentem o crescimento anual composto mais rápido entre 2026 e 2033, impulsionados por marketplaces online, distribuidores e fornecedores especializados que expandem seu alcance para pequenas e médias empresas.

Qual região detém a maior participação no mercado de produtos químicos aromáticos?

- Os EUA dominaram o mercado de aromas químicos na América do Norte, com uma participação de 36,2% na receita em 2025, impulsionados pela ampla adoção de aromas químicos de alta qualidade em fragrâncias, produtos de higiene pessoal, alimentos e bebidas. A crescente demanda do consumidor por perfumes premium, produtos com rótulos limpos e bebidas funcionais impulsiona o crescimento regional.

- As regulamentações governamentais sobre rotulagem, segurança e conformidade ambiental incentivam os fabricantes a adotarem o fornecimento sustentável, formulações ecológicas e técnicas de produção inovadoras. A crescente urbanização, a expansão dos canais de comércio eletrônico e o aumento da produção industrial aceleram ainda mais a adoção dessas práticas pelo mercado.

- Os principais players do mercado estão aproveitando os avanços tecnológicos em extração, encapsulamento e desenvolvimento de aromas sintéticos para atender às preferências do consumidor e aprimorar a consistência do produto.

Análise do Mercado de Aromas Químicos no Canadá

Prevê-se que o Canadá registre a taxa de crescimento anual composta (CAGR) mais rápida, de 9,9%, entre 2026 e 2033, impulsionada pela adoção de aromas químicos inovadores em perfumaria, cuidados pessoais e aplicações em alimentos e bebidas. A ênfase em ingredientes naturais, sustentáveis e com rótulos limpos, juntamente com investimentos em instalações de produção e práticas de química verde, impulsiona o crescimento a longo prazo.

Quais são as principais empresas no mercado de produtos químicos aromáticos?

A indústria de produtos químicos aromáticos é liderada principalmente por empresas consolidadas, incluindo:

- Corporação Internacional Takasago (Japão)

- BASF SE (Alemanha)

- DSM (Países Baixos)

- Firmenich SA (Suíça)

- Symrise (Alemanha)

- Aromáticos Orientais (Índia)

- Bordas SA (França)

- Privi Speciality Chemicals Limited (Índia)

- Sabores e fragrâncias Bell (EUA)

- Hindustan Mint & Agro Products Pvt. Ltd. (Índia)

- Treatt Plc (Reino Unido)

- Vigon International, Inc. (EUA)

- Cedarome (EUA)

- INOUE Perfume MFG. CO., LTD. (Japão)

- MANE (França)

- De Monchy Aromatics (Holanda)

- Givaudan (Suíça)

- Corporação Kao (Japão)

Quais são os desenvolvimentos recentes no mercado de produtos químicos aromáticos na América do Norte?

- Em abril de 2025, a Eternis Fine Chemicals e a ChainCraft BV firmaram uma parceria estratégica histórica para impulsionar o desenvolvimento de aromas químicos de base biológica e com baixa emissão de carbono. Essa colaboração combina a linha de produtos inovadora SensiCraft da ChainCraft, que utiliza tecnologia de fermentação vegetal, com a expertise em fabricação e a robusta cadeia de suprimentos da Eternis, estabelecendo um novo padrão de sustentabilidade na indústria de fragrâncias. Espera-se que a parceria acelere a adoção de ingredientes de fragrâncias ecológicos de última geração.

- Em abril de 2025, a BASF lançou ingredientes aromáticos com pegadas de carbono reduzidas, permitindo que os clientes alcancem suas metas de sustentabilidade e reduzam o impacto ambiental em suas formulações. Essa iniciativa reforça o foco em aromas químicos ecologicamente conscientes e de alto desempenho.

- Em outubro de 2024, a Prigiv iniciou as operações em sua recém-criada fábrica de ingredientes para fragrâncias em Mahad, uma joint venture entre a Givaudan (49%) e a Prigiv (51%). A unidade foi projetada para produzir uma ampla gama de produtos de fragrâncias aprimoradas, com planos de expansão das operações nos próximos anos, apoiando a expansão do mercado de produtos químicos aromáticos de alta qualidade.

- Em maio de 2023, a Firmenich International SA concluiu sua fusão com a DSM, formando a DSM-Firmenich, uma parceira líder em inovação nas áreas de nutrição, saúde, beleza e aromas químicos. Essa consolidação fortalece as capacidades globais e expande o desenvolvimento de ingredientes sustentáveis.

- Em abril de 2023, a Bedoukian Research Inc. firmou parceria com a Inscripta para desenvolver e comercializar ingredientes naturais com qualidade superior, consistência e menor impacto ambiental. Utilizando a plataforma GenoScaler da Inscripta para otimizar cepas microbianas, a BRI agora consegue produzir ingredientes ecológicos em grande volume de forma eficiente, reforçando as práticas sustentáveis no setor de aromas químicos.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.