North America Api Intermediates Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

192.65 Billion

USD

314.07 Billion

2024

2032

USD

192.65 Billion

USD

314.07 Billion

2024

2032

| 2025 –2032 | |

| USD 192.65 Billion | |

| USD 314.07 Billion | |

|

|

|

|

Segmentação do mercado de intermediários de API na América do Norte, por tipo (intermediários para medicamentos veterinários e intermediários farmacêuticos/de fármacos a granel), produto (composto bromado, o-benzil salbutamol, hemisulfato, oxirano, base de bisoprolol, PCBHP quiral, base de feniramina, base de clorfeniramina, base de bromfeniramina, base de mepiramina/pirilamina, 6-amino-1,3-dimetiluracila, teofilina, acefilina, xantina, nitrilas e outros), tipo terapêutico (doenças autoimunes, oncologia, doenças metabólicas, oftalmologia, doenças cardiovasculares, doenças infecciosas, neurologia, distúrbios respiratórios, dermatologia, urologia e outros), clientes (usuários diretos/empresas farmacêuticas, comerciantes/atacadistas/distribuidores, associações/governo e instituições/instituições privadas), usuário final (fabricante de API e fabricante de produto acabado), distribuição. Canais (Licitação Direta, Vendas no Varejo e Outros) -- Tendências e Previsões do Setor até 2032

Tamanho do mercado de intermediários de API na América do Norte

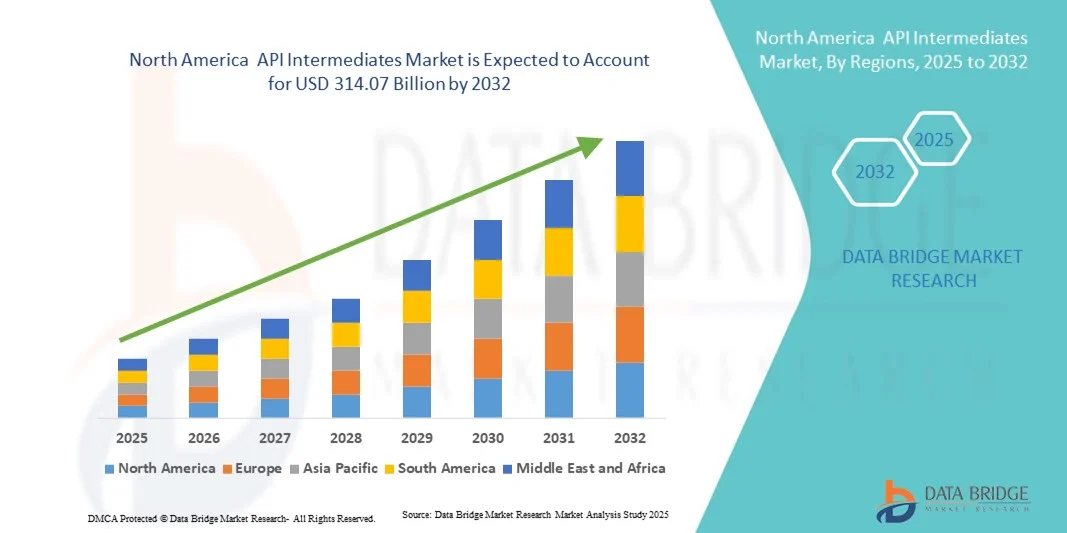

- O mercado de intermediários de API na América do Norte foi avaliado em US$ 192,65 bilhões em 2024 e espera-se que alcance US$ 314,07 bilhões até 2032 , com uma taxa de crescimento anual composta (CAGR) de 6,30% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela crescente demanda por produtos farmacêuticos e biofarmacêuticos , juntamente com a terceirização cada vez maior da fabricação de IFA (Ingrediente Farmacêutico Ativo) para produtores especializados, o que está impulsionando a produção em larga escala e a inovação em intermediários de IFA.

- Além disso, os avanços nas tecnologias de síntese química, a crescente adoção de práticas de química verde e a prevalência cada vez maior de doenças crônicas estão acelerando a utilização de intermediários de IFA (Ingrediente Farmacêutico Ativo) em diversas áreas terapêuticas, impulsionando significativamente o crescimento do setor.

Análise do mercado de intermediários de API na América do Norte

- Os intermediários de IFA (Ingredientes Farmacêuticos Ativos), compostos químicos especializados que servem como blocos de construção essenciais na síntese de IFAs, desempenham um papel crucial no processo de fabricação farmacêutica. Sua importância cresceu significativamente devido à crescente demanda por medicamentos inovadores e genéricos, aliada à rápida expansão dos serviços de fabricação por contrato em todo o mundo.

- A crescente demanda por intermediários de IFA (Ingredientes Farmacêuticos Ativos) é impulsionada por diversos fatores-chave, incluindo a prevalência cada vez maior de doenças crônicas como distúrbios cardiovasculares, diabetes e câncer; o aumento dos investimentos em pesquisa e desenvolvimento (P&D) farmacêutico; e uma acentuada mudança do setor em direção à terceirização da produção de IFA para regiões com custos competitivos que possam manter altos padrões de qualidade, reduzindo os custos de fabricação.

- Os EUA mantiveram a posição dominante no mercado de intermediários de IFA (Ingredientes Farmacêuticos Ativos), representando a maior participação na receita, com 38,7% em 2024. Essa liderança é impulsionada pela infraestrutura avançada de fabricação farmacêutica do país, pela forte presença dos principais produtores de IFA e por sistemas regulatórios bem estabelecidos, como o FDA (Administração de Alimentos e Medicamentos dos EUA). Os EUA continuam liderando a produção de intermediários de alto valor agregado e especializados, utilizados em segmentos terapêuticos complexos, incluindo tratamentos oncológicos e cardiovasculares.

- Prevê-se que o Canadá seja o país com o crescimento mais rápido no mercado de intermediários de IFA (Ingredientes Farmacêuticos Ativos) durante o período de previsão. Essa rápida expansão é impulsionada pelo aumento dos investimentos na produção farmacêutica nacional, por iniciativas governamentais favoráveis ao fortalecimento da cadeia de suprimentos local de IFA e pela crescente colaboração com empresas farmacêuticas internacionais. O foco do Canadá em sustentabilidade e inovação na síntese química também o posiciona como um importante polo emergente no cenário de IFA da América do Norte.

- O segmento de intermediários farmacêuticos/de fármacos a granel dominou o mercado com a maior participação na receita, de 68,4% em 2024, impulsionado por sua ampla aplicação na fabricação de medicamentos em larga escala em áreas terapêuticas como oncologia, doenças cardiovasculares e infecciosas. O segmento se beneficia da forte demanda de produtores de medicamentos genéricos e de marca em todo o mundo.

Escopo do relatório e segmentação do mercado de intermediários de API

|

Atributos |

Principais informações de mercado sobre intermediários de API |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marcas, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de intermediários de API na América do Norte

A crescente importância dos intermediários de IFA (Ingrediente Farmacêutico Ativo) na fabricação farmacêutica moderna.

- Uma tendência significativa e crescente no mercado de intermediários de IFA (Ingrediente Farmacêutico Ativo) na América do Norte é a adoção cada vez maior de tecnologias avançadas de fabricação, automação e ferramentas digitais de otimização de processos. Essa integração de métodos de produção inovadores está aprimorando a eficiência, a qualidade e a escalabilidade da produção de intermediários de IFA.

- Por exemplo, os principais fabricantes farmacêuticos estão implementando técnicas de fabricação contínua para intermediários de IFA (Ingrediente Farmacêutico Ativo), permitindo qualidade consistente do produto, redução dos prazos de produção e melhor controle sobre os parâmetros críticos do processo. Da mesma forma, tecnologias avançadas de análise de processos (PAT) estão sendo utilizadas para monitorar reações em tempo real, garantindo a conformidade com os rigorosos requisitos regulatórios.

- A automação e a manufatura orientada por dados permitem a manutenção preditiva de equipamentos, a otimização do uso de matéria-prima e a redução do tempo de inatividade. Por exemplo, algumas instalações agora utilizam análises baseadas em IA para prever gargalos de produção e ajustar o planejamento de lotes para atender às demandas urgentes de IFA (Ingrediente Farmacêutico Ativo). Além disso, esses avanços ajudam a reduzir os custos de fabricação e a melhorar o rendimento, tornando a produção mais competitiva na América do Norte.

- A integração dos princípios da Indústria 4.0 com a fabricação de intermediários de IFA (Ingrediente Farmacêutico Ativo) também está facilitando o controle e a supervisão centralizados em várias unidades de produção. Por meio de uma única interface digital, os fabricantes podem acompanhar o progresso dos lotes, monitorar as métricas de qualidade e garantir a transparência da cadeia de suprimentos, desde as matérias-primas até os IFAs finais.

- Essa tendência em direção a processos de fabricação mais precisos, eficientes e conectados está remodelando fundamentalmente as cadeias de suprimentos farmacêuticas. Consequentemente, grandes empresas como Lonza e Cambrex estão investindo fortemente na expansão de instalações de produção de intermediários de alta pureza, equipadas com sistemas modernos e automatizados.

- A demanda por intermediários de IFA (Ingrediente Farmacêutico Ativo) de alta qualidade, produzidos por meio de métodos de fabricação avançados, está crescendo rapidamente tanto no segmento de medicamentos de marca quanto no de genéricos, à medida que as empresas farmacêuticas priorizam cada vez mais a qualidade consistente, a relação custo-benefício e a conformidade regulatória.

Dinâmica do mercado de intermediários de API na América do Norte

Motorista

A crescente importância dos intermediários de IFA (Ingrediente Farmacêutico Ativo) na fabricação farmacêutica moderna.

- A crescente demanda por uma produção farmacêutica eficiente e de alta qualidade, aliada à necessidade de cronogramas de desenvolvimento de medicamentos mais rápidos, está impulsionando significativamente o crescimento do mercado de intermediários de IFA (Ingredientes Farmacêuticos Ativos). Esses intermediários, que são matérias-primas essenciais na síntese de IFA, desempenham um papel indispensável para garantir a eficácia, a segurança e a estabilidade das formulações farmacêuticas finais.

- Por exemplo, em abril de 2024, a Divis Laboratories Ltd. anunciou a expansão de sua capacidade de produção de intermediários de IFA (Ingrediente Farmacêutico Ativo) na Índia, visando atender tanto à demanda interna quanto aos mercados de exportação. O investimento da empresa em tecnologias avançadas de síntese química e práticas de química verde reflete uma mudança mais ampla do setor em direção à fabricação sustentável e escalável de IFA. Espera-se que essas expansões estratégicas impulsionem o crescimento do mercado de intermediários de IFA durante o período de previsão.

- Com o aumento da demanda por medicamentos genéricos, biossimilares e especiais no setor farmacêutico da América do Norte, os intermediários de IFA (Ingrediente Farmacêutico Ativo) tornam-se essenciais para viabilizar uma produção eficiente em termos de custos e dentro do prazo. Seu papel na minimização de impurezas, no aumento do rendimento e no suporte a processos de síntese complexos os transforma em um pilar da fabricação farmacêutica.

- Além disso, a crescente ênfase na resiliência da cadeia de suprimentos e a redução da dependência de fornecedores de um único país estão incentivando os fabricantes a diversificar suas capacidades de produção de intermediários de IFA (Ingredientes Farmacêuticos Ativos). Essa tendência é sustentada por incentivos governamentais em diversos países para impulsionar a produção nacional de ingredientes farmacêuticos.

- A integração de tecnologias de fabricação contínua, os avanços na química de processos e o aumento do investimento em P&D para intermediários de alta pureza estão criando novas oportunidades no mercado. Com sua adaptabilidade a diversas áreas terapêuticas — incluindo oncologia, doenças cardiovasculares e doenças infecciosas — os intermediários de IFA (Ingrediente Farmacêutico Ativo) estão testemunhando uma expansão de aplicações que aprimoram tanto a eficiência da fabricação quanto a qualidade do produto.

Restrição/Desafio

Preocupações com relação ao rigoroso cumprimento das normas regulamentares e aos elevados custos de produção.

- A indústria de intermediários de IFA (Ingrediente Farmacêutico Ativo) enfrenta desafios relacionados a requisitos regulatórios rigorosos em diferentes regiões, o que pode prolongar os prazos de aprovação de produtos e aumentar os custos operacionais. A adesão às Boas Práticas de Fabricação (BPF) e o atendimento aos padrões da farmacopeia exigem investimentos significativos em sistemas de controle de qualidade, mão de obra qualificada e infraestrutura de conformidade.

- Por exemplo, auditorias recentes realizadas por órgãos reguladores como a FDA (Administração de Alimentos e Medicamentos dos EUA) e a EMA (Agência Europeia de Medicamentos) resultaram no fechamento temporário de fábricas de alguns fabricantes que não atendiam aos padrões ambientais e de segurança. Esses incidentes destacam a necessidade de estruturas de conformidade robustas para evitar interrupções no fornecimento.

- Além disso, o custo relativamente elevado de intermediários de IFA (Ingrediente Farmacêutico Ativo) avançados — particularmente aqueles que exigem síntese em múltiplas etapas ou catalisadores especializados — pode ser uma barreira para empresas farmacêuticas menores ou para mercados sensíveis a custos. Fatores como a volatilidade dos preços das matérias-primas, a dependência de precursores importados e os processos de produção com alto consumo de energia contribuem ainda mais para os elevados custos de fabricação.

- Embora a otimização de processos e as economias de escala estejam gradualmente reduzindo os custos, o preço elevado percebido para intermediários de API de alta pureza ou de nicho ainda pode limitar a adoção em larga escala, especialmente em regiões de baixa e média renda.

- Superar esses desafios exigirá não apenas avanços tecnológicos na química de processos, mas também maior colaboração entre fabricantes, agências reguladoras e fornecedores de matérias-primas para criar um ecossistema de fornecimento mais econômico e em conformidade com as normas para intermediários de IFA (Ingrediente Farmacêutico Ativo).

Escopo do mercado de intermediários de API na América do Norte

O mercado de intermediários de API na América do Norte é segmentado com base no tipo, produto, tipo terapêutico, clientes, usuário final e canal de distribuição.

- Por tipo

Com base no tipo, o mercado de intermediários de IFA (Ingrediente Farmacêutico Ativo) é segmentado em intermediários para medicamentos veterinários e intermediários farmacêuticos/de fármacos a granel. O segmento de intermediários farmacêuticos/de fármacos a granel dominou o mercado com a maior participação na receita, de 68,4% em 2024, impulsionado por sua ampla aplicação na fabricação de medicamentos em larga escala em áreas terapêuticas como oncologia, doenças cardiovasculares e infecciosas. O segmento se beneficia da forte demanda de produtores de medicamentos genéricos e de marca em todo o mundo. O crescimento é impulsionado pelos avanços tecnológicos na síntese química e pelas capacidades de fabricação em larga escala. A crescente adoção de processos de fabricação contínua melhora a eficiência e a consistência dos intermediários. O segmento é fortalecido por estruturas regulatórias robustas que garantem a produção de alta qualidade. Parcerias estratégicas entre empresas farmacêuticas globais e fabricantes terceirizados aumentam ainda mais a capacidade. A crescente demanda por pequenas moléculas complexas e IFAs especiais sustenta a dominância do mercado. A disponibilidade de produção com custo-benefício em regiões emergentes também contribui para o crescimento. A pesquisa e o desenvolvimento contínuos em novas formulações de medicamentos impulsionam o consumo consistente de intermediários. O aumento da terceirização da América do Norte e da Europa aumenta a demanda de produção. Práticas de química verde e sustentável adotadas pelos fabricantes melhoram a produtividade e a conformidade. O segmento continua a beneficiar-se de elevadas barreiras de entrada devido a processos que exigem grande investimento de capital. As capacidades de produção em larga escala garantem um fornecimento confiável para as necessidades farmacêuticas globais.

Prevê-se que o segmento de intermediários para medicamentos veterinários apresente a taxa de crescimento anual composta (CAGR) mais rápida, de 9,7%, entre 2025 e 2032, impulsionado pelo crescente foco na saúde animal, pelo aumento da indústria pecuária e pelo crescente número de aprovações de produtos farmacêuticos veterinários na América do Norte. O crescimento é impulsionado pela crescente conscientização sobre saúde animal e prevenção de doenças zoonóticas. A expansão dos mercados de cuidados com animais de companhia contribui para o aumento da demanda por IFAs veterinários. Iniciativas governamentais que promovem a saúde animal incentivam a produção nacional. Os avanços tecnológicos na síntese de medicamentos veterinários aumentam o rendimento e reduzem os custos. Parcerias entre empresas de saúde animal e produtores de intermediários aumentam a capacidade de fornecimento. O aumento das exportações para mercados emergentes aumenta o potencial de receita. A fabricação por contrato de IFAs veterinários facilita o acesso para empresas menores. Aprovações regulatórias e processos simplificados aceleram a entrada no mercado. O aumento dos investimentos em saúde animal preventiva expande ainda mais a demanda. O desenvolvimento de novas formulações para animais de produção e de estimação sustenta o crescimento. A adoção de mercado na América do Norte, Europa e Ásia oferece oportunidades adicionais.

- Por produto

Com base no produto, o mercado de intermediários de APIs inclui compostos bromados, O-benzil salbutamol, hemisulfato, oxirano, base de bisoprolol, PCBHP quiral, base de feniramina, base de clorfeniramina, base de bromfeniramina, base de mepiramina/pirilamina, 6-amino-1,3-dimetiluracila, teofilina, acefilina, xantina, nitrilas e outros. O segmento de compostos bromados representou a maior participação de mercado, com 21,3% em 2024, devido à sua ampla aplicação na produção de ingredientes farmacêuticos ativos para medicamentos cardiovasculares, respiratórios e oncológicos. O domínio do segmento é sustentado pela alta demanda tanto de grandes fabricantes farmacêuticos quanto de fabricantes especializados. Os compostos bromados são essenciais para a síntese química complexa, permitindo formulações de alta potência. Inovações contínuas em bromação e química verde melhoram a eficiência da produção. A disponibilidade de matérias-primas com custo-benefício aumenta a lucratividade. A expansão dos pipelines de medicamentos oncológicos, cardiovasculares e respiratórios aumenta o consumo. A conformidade regulatória e os padrões de qualidade impulsionam a preferência por fornecedores confiáveis. Colaborações estratégicas entre fabricantes terceirizados (CMOs) e empresas farmacêuticas fortalecem as cadeias de suprimentos. A crescente demanda global por medicamentos que salvam vidas sustenta a participação de mercado. Os avanços tecnológicos reduzem os custos de produção e melhoram o rendimento. A integração com sistemas de produção automatizados garante a consistência. O segmento permanece crucial devido à sua alta versatilidade de aplicação e escalabilidade.

Prevê-se que o segmento de PCBHP quiral registre a taxa de crescimento anual composta (CAGR) mais rápida, de 10,8%, de 2025 a 2032, impulsionado pela crescente demanda por síntese quiral em medicamentos terapêuticos de alto valor agregado, onde a pureza enantiomérica é crucial para a eficácia e segurança. O crescimento é sustentado pela adoção da síntese assimétrica e da catálise estereosseletiva. A medicina de precisão e as terapias direcionadas exigem intermediários quirais de alta pureza. A expansão dos pipelines de oncologia, neurologia e doenças cardiovasculares impulsiona o aumento do uso. Organizações de fabricação por contrato atendem à crescente demanda de pequenas e médias empresas farmacêuticas. Incentivos regulatórios para medicamentos enantiomericamente puros aceleram a penetração no mercado. Colaborações entre empresas de biotecnologia e farmacêuticas aumentam a capacidade de produção. Inovações tecnológicas melhoram o rendimento, reduzem o desperdício e diminuem os custos de produção. O aumento na expiração de patentes de medicamentos racêmicos incentiva alternativas quirais. A maior adoção em biossimilares e formulações farmacêuticas avançadas contribui para o crescimento. Práticas de sustentabilidade e química verde atraem clientes com consciência ambiental. A expansão do mercado global em regiões emergentes também impulsiona o crescimento da receita. A demanda por produção em pequenos lotes por parte de laboratórios de pesquisa e desenvolvimento também impulsiona o crescimento do segmento.

- Por tipo terapêutico

Com base no tipo terapêutico, o mercado é segmentado em doenças autoimunes, oncologia, doenças metabólicas, oftalmologia, doenças cardiovasculares, doenças infecciosas, neurologia, distúrbios respiratórios, dermatologia, urologia e outras. O segmento de oncologia liderou o mercado em 2024, com uma participação de 27,9% na receita, devido à crescente prevalência de câncer, ao aumento das aprovações de terapias direcionadas e à demanda por intermediários de alta pureza para formulações complexas. O domínio é sustentado por investimentos globais em pesquisa oncológica e desenvolvimento de medicamentos. O aumento da população de pacientes e a crescente conscientização sobre o câncer impulsionam a demanda. A adoção de produtos biológicos, ADCs (conjugados anticorpo-fármaco) e pequenas moléculas direcionadas requer intermediários de alta qualidade. A expansão dos ensaios clínicos fortalece a posição no mercado. Parcerias entre empresas farmacêuticas e CMOs (Organizações de Fabricação por Contrato) aprimoram as capacidades de produção. As aprovações regulatórias para novas terapias contra o câncer aumentam o consumo. A inovação contínua em compostos anticancerígenos impulsiona a demanda. A América do Norte e a Europa continuam sendo os principais mercados contribuintes devido à infraestrutura de P&D. A fabricação por contrato focada em oncologia garante a consistência do fornecimento. O crescimento de medicamentos oncológicos especializados alimenta as necessidades de intermediários. A integração de técnicas avançadas de fabricação garante a eficiência do processo. O alto valor agregado e a complexidade técnica dos IFA (Ingredientes Farmacêuticos Ativos) oncológicos sustentam a liderança de mercado.

O segmento de doenças autoimunes deverá apresentar o crescimento mais rápido, com uma taxa composta de crescimento anual (CAGR) de 11,2% entre 2025 e 2032, impulsionado pela crescente incidência de distúrbios autoimunes na América do Norte e pela robusta linha de pesquisa e desenvolvimento (P&D) em produtos biológicos e pequenas moléculas para o tratamento dessas condições. O aumento dos investimentos em medicamentos imunomoduladores expande as necessidades de produção. Produtos biológicos e biossimilares impulsionam a demanda por intermediários de alta qualidade. A fabricação por contrato para medicamentos especiais aumenta a disponibilidade. Os avanços tecnológicos melhoram a eficiência e o rendimento na síntese de intermediários. A expansão das terapias com peptídeos e pequenas moléculas aumenta as oportunidades de mercado. As aprovações regulatórias para tratamentos autoimunes aceleram o crescimento. A crescente prevalência de doenças como lúpus, artrite reumatoide e esclerose múltipla impulsiona o consumo. Ensaios clínicos e formulações inovadoras de medicamentos sustentam ainda mais a demanda. Colaborações entre empresas de biotecnologia e farmacêuticas melhoram as capacidades de produção. O crescimento da população idosa aumenta a base de pacientes. A adoção em mercados emergentes cria novas fontes de receita. A adoção de estratégias de medicina personalizada reforça a demanda por intermediários. Práticas de fabricação sustentáveis fornecem suporte adicional ao crescimento.

- Por clientes

Com base nos clientes, o mercado de intermediários de APIs é categorizado em usuários diretos/empresas farmacêuticas, comerciantes/atacadistas/distribuidores e associações/instituições governamentais e privadas. O segmento de usuários diretos/empresas farmacêuticas dominou em 2024, com 62,1% de participação de mercado, visto que os fabricantes de produtos farmacêuticos preferem a aquisição direta para garantir o controle de qualidade, a rastreabilidade e a conformidade com as normas regulatórias. Grandes empresas mantêm contratos de longo prazo para assegurar o fornecimento ininterrupto. A adesão às normas regulatórias por parte dos fornecedores garante a segurança e a conformidade. A integração com os cronogramas de produção otimiza a gestão da cadeia de suprimentos. Ferramentas digitais de compras melhoram o rastreamento e a eficiência. Intermediários de alta pureza são priorizados para formulações de medicamentos especiais. A fabricação por contrato e a terceirização fortalecem a consistência do fornecimento. O domínio é reforçado pela alta demanda de fabricantes de medicamentos genéricos e de marca. Parcerias estratégicas com fornecedores melhoram a capacidade e a escalabilidade. Sistemas avançados de controle de qualidade garantem a mínima variação entre lotes. A automação na fabricação aumenta a produtividade e a confiabilidade. O segmento se beneficia de um crescente pipeline de pequenas moléculas complexas. A expansão nos mercados farmacêuticos globais sustenta a liderança de mercado.

Prevê-se que o segmento de comerciantes/atacadistas/distribuidores apresente a maior taxa de crescimento anual composta (CAGR) de 8,9% entre 2025 e 2032, impulsionado pela crescente presença de fornecedores regionais que atendem a pequenas e médias empresas farmacêuticas. O crescimento é impulsionado pela flexibilidade nas quantidades de pedidos e pela distribuição com boa relação custo-benefício. Plataformas digitais B2B simplificam as compras para empresas emergentes. Centros regionais reduzem os prazos de entrega e melhoram a logística. As CROs (Organizações de Pesquisa Clínica) obtêm cada vez mais intermediários por meio de distribuidores. Parcerias com CMOs (Organizações de Fabricação por Contrato) ampliam o alcance do fornecimento. Fabricantes de pequena escala têm acesso a compostos de alta qualidade. O aumento da P&D farmacêutica cria demanda adicional por fornecimento. O suporte à conformidade regulatória fortalece a confiança. A expansão em mercados emergentes impulsiona a penetração no mercado. Canais de distribuição no varejo e online aumentam a acessibilidade. Colaborações de fabricação por contrato melhoram ainda mais a disponibilidade. As redes de distribuição atendem às necessidades tanto do mercado interno quanto do mercado externo. A logística reforçada garante a entrega pontual e a continuidade do fornecimento.

- Por usuário final

Com base no usuário final, o mercado é segmentado em fabricantes de IFA (Ingrediente Farmacêutico Ativo) e fabricantes de produtos acabados. Os fabricantes de IFA representaram a maior participação na receita do mercado, com 54,7% em 2024, impulsionados pela crescente terceirização da produção de intermediários para instalações especializadas que oferecem soluções econômicas e escaláveis. O crescimento é sustentado pela demanda por intermediários de alta qualidade para IFAs genéricos e especiais. A fabricação por contrato aumenta a eficiência da produção. Instalações em conformidade com as Boas Práticas de Fabricação (BPF) mantêm a confiabilidade do produto. Os avanços tecnológicos melhoram o rendimento do processo e a relação custo-benefício. A produção de IFA em larga escala atende às necessidades globais de fornecimento. A adoção da fabricação contínua fortalece a capacidade. Fortes colaborações entre empresas farmacêuticas e CMOs (Organizações de Fabricação por Contrato) garantem o fornecimento. A integração vertical por parte dos fabricantes de IFA reduz os prazos de entrega. A expansão na América do Norte e na Europa aumenta o consumo. A automação de processos aprimora a qualidade e a consistência. Práticas de produção sustentáveis atraem a preferência do mercado. Alianças estratégicas com empresas de biotecnologia impulsionam ainda mais o crescimento.

Prevê-se que os fabricantes de produtos acabados apresentem a taxa de crescimento anual composta (CAGR) mais rápida, de 9,4%, entre 2025 e 2032, impulsionados pela integração da produção de produtos intermediários em cadeias de produção verticalizadas, o que garante a qualidade e acelera o lançamento de produtos no mercado. A integração permite um controle mais rigoroso da cadeia de suprimentos e a otimização de custos. A adoção da síntese interna reduz a dependência de fornecedores externos. A medicina personalizada impulsiona a produção de produtos intermediários sob medida. A expansão de formulações de medicamentos especiais e complexos aumenta a demanda. A conformidade regulatória e a garantia da qualidade fortalecem a posição no mercado. Tecnologias avançadas melhoram a eficiência da produção. Esforços colaborativos com Organizações de Fabricação Contratada (CMOs) aprimoram a expertise técnica. A crescente demanda global por produtos farmacêuticos apoia uma adoção mais rápida. Práticas de fabricação sustentáveis reforçam a confiança do mercado. A integração vertical reduz os prazos de produção e os riscos operacionais. A adoção de produtos acabados em mercados emergentes aumenta o uso de produtos intermediários. Investimentos em P&D impulsionam a inovação nos processos de produção.

- Por canal de distribuição

Com base no canal de distribuição, o mercado é segmentado em licitação direta, vendas no varejo e outros. O segmento de licitação direta detinha a maior participação, com 48,6% em 2024, devido às compras em grande volume por grandes empresas farmacêuticas e agências governamentais para a produção de medicamentos em larga escala. A licitação direta garante fornecimento consistente, custo-benefício e qualidade padronizada. Contratos de fornecimento de longo prazo com governos estabilizam a receita. Pedidos em grande volume atendem às necessidades de produção em larga escala. Parcerias estratégicas com fornecedores melhoram a confiabilidade das entregas. A conformidade regulatória e a garantia da qualidade reforçam a preferência. Compras globais para o preparo para pandemias aumentam a demanda. A integração com as cadeias de suprimentos de Organizações de Fabricação por Contrato (CMOs) fortalece a eficiência das compras. Grandes empresas farmacêuticas dependem de licitações para o fornecimento ininterrupto de Ingrediente Farmacêutico Ativo (IFA). Compras em grande volume reduzem o risco operacional e a volatilidade de preços. Logística e planejamento avançados melhoram o cumprimento das licitações. Iniciativas de sustentabilidade nas cadeias de suprimentos apoiam as decisões de compras. Contratos de licitação direta aumentam a visibilidade do mercado e a continuidade dos negócios.

Prevê-se que as vendas no varejo cresçam à taxa composta de crescimento anual (CAGR) mais rápida, de 8,7%, de 2025 a 2032, impulsionadas pela crescente demanda de fabricantes de pequena escala e organizações de pesquisa contratadas (CROs) que adquirem intermediários em quantidades menores. Os canais de varejo oferecem tamanhos de lote flexíveis e acesso conveniente. As plataformas digitais B2B simplificam os pedidos e a logística. Os fabricantes de pequeno e médio porte se beneficiam da redução dos requisitos mínimos de pedido. As CROs dependem cada vez mais dos canais de varejo para intermediários especializados. As plataformas de comércio eletrônico aumentam a disponibilidade de produtos. Os centros de distribuição regionais reduzem os prazos de entrega. Os mercados emergentes impulsionam a demanda adicional no varejo. O acesso a intermediários de nicho e especializados apoia a inovação. Os canais de varejo permitem prazos de entrega e personalização mais rápidos. As colaborações de fabricação por contrato aumentam a eficiência do fornecimento no varejo. O crescimento das atividades de P&D alimenta a demanda no varejo. A flexibilidade na aquisição no varejo complementa as redes de fornecimento por licitação e direto.

Análise Regional do Mercado de Intermediários de API na América do Norte

- A América do Norte dominou o mercado de intermediários de IFA (Ingredientes Farmacêuticos Ativos) com a maior participação na receita, de 39,5% em 2024, impulsionada principalmente pela crescente demanda por medicamentos inovadores e genéricos, bem como pela ênfase da região em capacidades avançadas de fabricação.

- O mercado se beneficia de uma forte supervisão regulatória, extensas iniciativas de pesquisa e desenvolvimento e da presença de vários fabricantes líderes de intermediários de IFA (Ingrediente Farmacêutico Ativo) na América do Norte. Além disso, colaborações estratégicas entre empresas de biotecnologia e organizações de fabricação por contrato (CMOs) estão fortalecendo a posição competitiva da América do Norte, possibilitando a produção de intermediários de alta pureza e especializados, essenciais para o desenvolvimento moderno de medicamentos.

- O crescimento é ainda impulsionado pelos elevados gastos com saúde, um setor farmacêutico bem estabelecido e uma sólida linha de medicamentos especializados, incluindo moléculas complexas e de alta potência, que exigem intermediários altamente purificados para garantir a eficácia terapêutica.

Análise do Mercado de Intermediários de APIs nos EUA

O mercado de intermediários de IFA (Ingrediente Farmacêutico Ativo) dos EUA manteve a posição dominante no mercado de intermediários de IFA, representando a maior participação na receita, com 38,7% em 2024. Essa liderança é sustentada pela infraestrutura avançada de fabricação farmacêutica do país, pela presença de importantes produtores de IFA e por estruturas regulatórias bem estabelecidas, como a FDA (Administração de Alimentos e Medicamentos dos EUA). Os EUA se destacam na produção de intermediários de alto valor agregado e especializados para áreas terapêuticas complexas, incluindo oncologia, doenças cardiovasculares e tratamentos para doenças infecciosas. A rápida adoção de tecnologias de fabricação contínua aumenta a eficiência, o rendimento e a qualidade da produção. A forte proteção da propriedade intelectual atrai investimentos em pesquisa e desenvolvimento. A terceirização para CMOs (Organizações de Fabricação por Contrato) nacionais garante uma cadeia de suprimentos robusta e flexível. A capacidade de produção em larga escala, aliada à expertise avançada em síntese química, reforça a competitividade global. A expansão dos pipelines de medicamentos direcionados e especializados impulsiona o aumento do consumo de intermediários. Parcerias estratégicas entre empresas farmacêuticas e CMOs fortalecem a capacidade de produção. Práticas de fabricação sustentáveis e ecológicas melhoram a eficiência operacional e reduzem o impacto ambiental. Altos padrões de controle de qualidade garantem a conformidade com as regulamentações nacionais e internacionais. Em suma, esses fatores, em conjunto, mantêm a posição dominante dos EUA na América do Norte.

Análise do Mercado de Intermediários de APIs no Canadá

Prevê-se que o mercado canadense de intermediários de IFA (Ingredientes Farmacêuticos Ativos) seja o de crescimento mais rápido durante o período de previsão. O crescimento é impulsionado pelo aumento dos investimentos na produção farmacêutica nacional e por iniciativas governamentais de apoio destinadas a fortalecer a cadeia de suprimentos local de IFA. O Canadá está emergindo como um polo de síntese química sustentável e inovadora, atraindo colaborações internacionais e transferências de tecnologia de empresas farmacêuticas globais. A expansão em segmentos terapêuticos especializados e de alto valor agregado, como oncologia, doenças cardiovasculares e doenças raras, está impulsionando a demanda por intermediários produzidos localmente. A modernização das instalações de fabricação e a adoção de práticas ambientalmente responsáveis melhoram a eficiência da produção. O país se beneficia do apoio regulatório e de incentivos fiscais que estimulam a produção nacional. Parcerias com CMOs (Organizações de Fabricação por Contrato) permitem o acesso a técnicas avançadas de síntese e garantem um fornecimento consistente. O desenvolvimento de cadeias de suprimentos integradas fortalece a confiabilidade e a escalabilidade. As oportunidades de exportação para a América do Norte e para os mercados globais contribuem para o crescimento da receita. Profissionais qualificados em ciências farmacêuticas apoiam a P&D (Pesquisa e Desenvolvimento) e a inovação de processos. O foco do Canadá em qualidade, sustentabilidade e inovação o posiciona como um importante polo emergente de intermediários de IFA no mercado norte-americano.

Participação de mercado de intermediários de API na América do Norte

O setor de intermediários de API é liderado principalmente por empresas consolidadas, incluindo:

- HIKAL Ltda. (Índia)

- Cambrex Corporation (EUA)

- Grupo Ganesh (Índia)

- AlzChem Group AG (Índia)

- Vasudha Pharma (Índia)

- Anyang General Chemical Co., Ltd. (China)

- Sarex (Índia)

- Sandoo Pharmaceuticals and Chemicals Co., Ltd (Índia)

- Atul Ltd (Índia)

- Sandoz International GmbH (uma subsidiária da Novartis AG) (Alemanha)

- Aceto (EUA)

- Supriya Lifescience Ltd. (Índia)

- LEVACHEM COMPANY LIMITED (China)

- Vertellus (EUA)

- Dishman Carbogen Amcis Ltd (Índia)

- Divi's Laboratories Limited (Índia)

- AARTI INDUSTRIES LIMITADA (Índia)

- Aurobindo Pharma (Índia)

- BASF SE (Alemanha)

Últimos desenvolvimentos no mercado de intermediários de API na América do Norte

- Em junho de 2025, o jornal The Economic Times noticiou uma queda significativa nos preços dos ingredientes farmacêuticos ativos (IFAs) na Índia. Essa queda trouxe um alívio muito necessário para a indústria farmacêutica do país, reduzindo os custos de produção para os fabricantes de medicamentos que vinham sofrendo pressão devido aos altos preços das matérias-primas nos últimos anos. Espera-se que a queda nos preços dos IFAs aumente a lucratividade e estabilize a cadeia de suprimentos do setor, que é um componente crucial da economia indiana, tanto em termos de saúde quanto de exportação.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.