North America Anti Nuclear Antibody Test Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

1.63 Billion

USD

4.42 Billion

2025

2033

USD

1.63 Billion

USD

4.42 Billion

2025

2033

| 2026 –2033 | |

| USD 1.63 Billion | |

| USD 4.42 Billion | |

|

|

|

|

Segmentação do mercado de testes de anticorpos antinucleares na América do Norte, por tipo de anticorpo (antígenos nucleares extraíveis (ENA), anti-DSDNA e histonas, anticorpos anti-DFS70, anti-PM-SCL, anticorpos anti-centrômero, anti-SP100 e outros), produto (instrumentos, consumíveis e reagentes e serviços), técnica (ELISA, imunofluorescência indireta (IFI), teste de blotting, microarranjo de antígenos, técnicas baseadas em gel, ensaio multiplex, citometria de fluxo, hemaglutinação passiva (PHA) e outras), aplicação (doenças autoimunes e doenças infecciosas), por usuário final (hospitais, laboratórios, centros de diagnóstico, institutos de pesquisa e outros), canal de distribuição (licitação direta, vendas no varejo, distribuidores terceirizados e outros) - Tendências e previsões do setor até 2033.

Tamanho do mercado de testes de anticorpos antinucleares na América do Norte

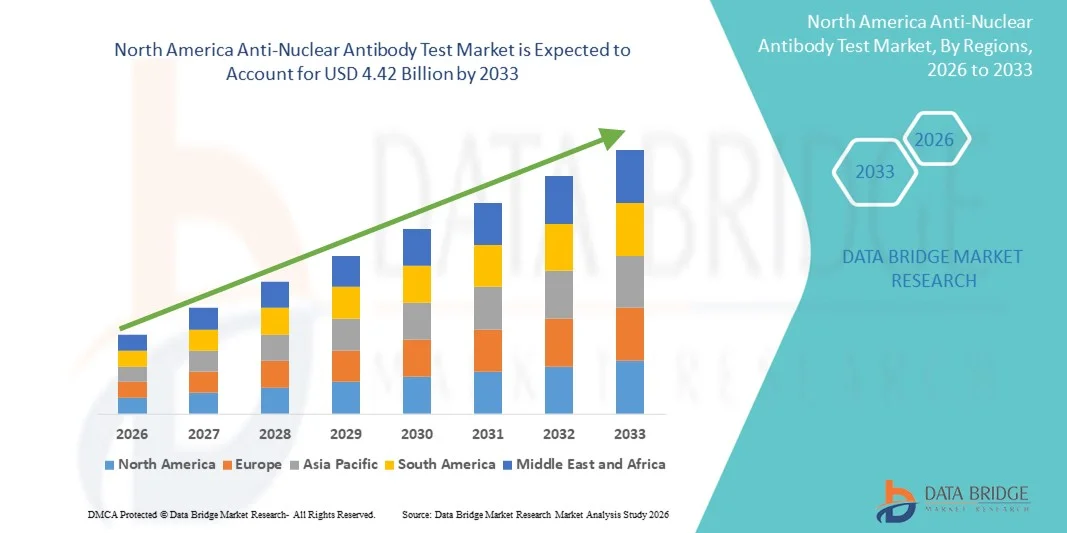

- O mercado de testes de anticorpos antinucleares na América do Norte foi avaliado em US$ 1,63 bilhão em 2025 e deverá atingir US$ 4,42 bilhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 13,30% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela crescente prevalência de doenças autoimunes, pela maior conscientização sobre o diagnóstico precoce e preciso e pelos avanços contínuos nas tecnologias de testes laboratoriais, o que leva a uma maior adoção dos testes de anticorpos antinucleares (ANA) em hospitais, laboratórios de diagnóstico e clínicas especializadas.

- Além disso, a crescente demanda por soluções de diagnóstico rápidas, confiáveis e com boa relação custo-benefício para doenças autoimunes como lúpus, artrite reumatoide e esclerodermia está consolidando o teste de anticorpos antinucleares como uma ferramenta essencial de triagem de primeira linha em ambientes de saúde de rotina e especializados. Esses fatores convergentes estão acelerando a adoção de soluções de teste de anticorpos antinucleares, impulsionando significativamente o crescimento do setor.

Análise do mercado de testes de anticorpos antinucleares na América do Norte

- Os testes de anticorpos antinucleares (ANA), utilizados para detectar autoanticorpos associados a doenças autoimunes, estão se tornando ferramentas cada vez mais essenciais no diagnóstico moderno, tanto em hospitais quanto em laboratórios especializados, devido ao seu papel crucial na identificação precoce e no monitoramento de distúrbios autoimunes sistêmicos.

- A crescente demanda por testes de ANA é impulsionada principalmente pela prevalência global cada vez maior de doenças como lúpus eritematoso sistêmico, artrite reumatoide e esclerodermia, juntamente com a maior conscientização entre profissionais de saúde e pacientes sobre a importância da detecção precoce e precisa de doenças autoimunes.

- Os EUA dominaram o mercado de testes de anticorpos antinucleares, com a maior participação de receita, de 34,6% em 2025, impulsionados por uma infraestrutura de saúde avançada, altas taxas de testes diagnósticos, sistemas de reembolso robustos e a presença de grandes empresas de diagnóstico.

- Prevê-se que o Canadá seja o país com o crescimento mais rápido no mercado de testes de anticorpos antinucleares durante o período de previsão, registrando uma taxa de crescimento anual composta (CAGR) de 11,8%, impulsionada pela melhoria do acesso aos cuidados de saúde, expansão das redes de laboratórios de diagnóstico, aumento da conscientização sobre doenças autoimunes e crescentes investimentos governamentais em infraestrutura de saúde.

- O segmento de Doenças Autoimunes representou a maior fatia da receita de mercado, com cerca de 58,9% em 2025, impulsionado pela crescente prevalência global de doenças como lúpus eritematoso sistêmico, artrite reumatoide, síndrome de Sjögren e esclerodermia.

Escopo do relatório e segmentação do mercado de testes de anticorpos antinucleares

|

Atributos |

Principais informações de mercado sobre o teste de anticorpos antinucleares |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, epidemiologia de pacientes, análise de projetos em desenvolvimento, análise de preços e estrutura regulatória. |

Tendências do mercado de testes de anticorpos antinucleares na América do Norte

Crescente ênfase na detecção precoce de doenças autoimunes e na adoção de diagnósticos avançados.

- Uma tendência significativa e crescente no mercado de testes de anticorpos antinucleares (ANA) na América do Norte é a ênfase cada vez maior na detecção precoce de doenças autoimunes e inflamatórias sistêmicas, como lúpus eritematoso sistêmico, artrite reumatoide e esclerodermia. Esse foco clínico crescente está aumentando significativamente a demanda por testes de ANA confiáveis e de alta precisão em ambientes de diagnóstico e pesquisa.

- Por exemplo, um número crescente de hospitais e laboratórios de diagnóstico na América do Norte está incorporando plataformas avançadas de testes de ANA baseadas em imunofluorescência e ensaio imunoenzimático (ELISA) para melhorar a sensibilidade de detecção e reduzir o tempo de resposta do diagnóstico. Essa integração generalizada está fortalecendo o papel dos testes de ANA na triagem de rotina de doenças autoimunes e no diagnóstico precoce.

- A adoção de automação laboratorial aprimorada e sistemas de teste de alto rendimento também está permitindo que os laboratórios gerenciem volumes maiores de testes, mantendo a precisão dos resultados. Algumas plataformas avançadas agora são capazes de detectar múltiplos padrões de autoanticorpos simultaneamente, fornecendo informações mais abrangentes sobre a atividade autoimune subjacente e apoiando decisões clínicas mais direcionadas.

- A crescente colaboração entre laboratórios clínicos, institutos de pesquisa e empresas farmacêuticas está impulsionando ainda mais o desenvolvimento e a adoção de kits avançados para testes de ANA. Por meio dessas colaborações, os profissionais de saúde podem aprimorar o monitoramento da doença, analisar a resposta ao tratamento com mais eficácia e melhorar o manejo geral dos pacientes com doenças autoimunes.

- Essa mudança em direção a ferramentas de diagnóstico autoimune mais eficientes, sensíveis e confiáveis está remodelando as expectativas para a detecção precoce e o manejo a longo prazo da doença. Consequentemente, empresas especializadas em imunodiagnóstico estão desenvolvendo cada vez mais kits de teste de ANA aprimorados, projetados para fornecer resultados consistentes, reproduzíveis e clinicamente precisos, tanto em ambientes hospitalares quanto em laboratórios de referência.

- A demanda por soluções avançadas para testes de ANA continua a crescer em hospitais, centros de diagnóstico e clínicas especializadas, à medida que os sistemas de saúde priorizam diagnósticos precisos, melhores resultados para os pacientes e o manejo eficaz a longo prazo de doenças autoimunes.

Dinâmica do mercado de testes de anticorpos antinucleares na América do Norte

Motorista

Crescente prevalência de doenças autoimunes e maior conscientização sobre o diagnóstico.

- A crescente prevalência de doenças autoimunes, aliada à maior conscientização sobre o diagnóstico precoce e o manejo da doença, é um dos principais impulsionadores do mercado de testes de anticorpos antinucleares (ANA). O aumento no número de pessoas que realizam avaliações reumatológicas impulsiona a demanda por testes de ANA como ferramenta diagnóstica primária.

- Por exemplo, nos últimos anos, autoridades de saúde e associações médicas têm enfatizado a importância da triagem precoce de doenças autoimunes, incentivando médicos de atenção primária e especialistas a incluírem o teste de ANA em protocolos diagnósticos para pacientes que apresentam sintomas crônicos inexplicáveis, como fadiga, dor articular e inflamação. Espera-se que essas iniciativas sustentem um crescimento constante do mercado durante o período de previsão.

- À medida que os pacientes se tornam mais conscientes das condições de saúde crônicas e de longo prazo, há uma crescente preferência por exames de sangue abrangentes que possam identificar anormalidades subjacentes do sistema imunológico. Os testes de ANA oferecem um primeiro passo crucial na identificação da atividade autoimune, tornando-se um componente essencial dos processos diagnósticos.

- Além disso, a expansão de clínicas especializadas em reumatologia e laboratórios de diagnóstico está melhorando o acesso aos serviços de teste de ANA. O aumento do investimento em infraestrutura de saúde e capacidade laboratorial está possibilitando uma maior disponibilidade desses testes tanto em regiões urbanas quanto semiurbanas.

- O uso crescente de testes de ANA em pesquisas clínicas, desenvolvimento de medicamentos e monitoramento de doenças autoimunes também contribui para o crescimento sustentado do mercado. As empresas farmacêuticas dependem cada vez mais desses testes durante os ensaios clínicos para avaliar a elegibilidade dos pacientes e a eficácia do tratamento em estudos relacionados ao sistema imunológico.

Restrição/Desafio

Preocupações com a interpretação dos testes e os altos custos de diagnóstico.

- Preocupações relacionadas à interpretação dos resultados do teste ANA representam um desafio significativo para a sua adoção em larga escala no mercado. Como resultados positivos para ANA podem, por vezes, ocorrer em indivíduos saudáveis, a interpretação errônea pode levar a ansiedade desnecessária, diagnósticos incorretos ou exames adicionais, gerando hesitação entre médicos e pacientes quanto à dependência excessiva desse teste isoladamente.

- Por exemplo, a variabilidade nos resultados dos testes, baseada em técnicas laboratoriais, qualidade dos reagentes e interpretação subjetiva em testes de imunofluorescência, causou inconsistência nos resultados em alguns casos. Essa variabilidade pode complicar a tomada de decisões clínicas e reduzir a confiança no uso exclusivo de testes de ANA sem evidências diagnósticas complementares.

- Abordar esses desafios por meio de protocolos de teste padronizados, treinamento aprimorado para profissionais de laboratório e maior precisão dos ensaios é essencial para fortalecer a confiança entre os profissionais de saúde. Além disso, o custo relativamente alto dos métodos avançados de teste de ANA, particularmente para sistemas multiplex ou automatizados, pode limitar o acesso a clínicas menores e instalações de saúde com orçamentos limitados, especialmente em regiões em desenvolvimento. Embora opções básicas de teste estejam disponíveis, plataformas mais abrangentes e altamente sensíveis muitas vezes permanecem financeiramente inacessíveis para muitas instituições.

- Embora os avanços tecnológicos e a concorrência entre os fabricantes estejam reduzindo gradualmente os custos, as limitações orçamentárias nos sistemas públicos de saúde e os desafios de reembolso ainda podem restringir o uso generalizado. Muitos profissionais de saúde precisam equilibrar cuidadosamente a acessibilidade financeira com a precisão diagnóstica ao escolher soluções para testes de ANA para uso rotineiro.

- Superar esses desafios por meio de melhor padronização, desenvolvimento de produtos com boa relação custo-benefício, maior treinamento clínico e melhor financiamento da saúde será essencial para a expansão sustentada do mercado global de testes de anticorpos antinucleares.

Escopo do mercado de testes de anticorpos antinucleares na América do Norte

O mercado é segmentado com base no tipo de anticorpo, produto, técnica, aplicação, usuário final e canal de distribuição.

- Por tipo de anticorpo

Com base no tipo de anticorpo, o mercado de testes de anticorpos antinucleares é segmentado em Antígenos Nucleares Extraíveis (ENA), Anti-dsDNA e Histonas, Anticorpos Anti-DFS70, Anti-PM-SCL, Anticorpos Anti-Centrômero, Anti-SP100 e Outros. O segmento de Anti-dsDNA e Histonas dominou a maior participação de mercado em receita, com aproximadamente 36,8% em 2025, impulsionado por seu papel crucial no diagnóstico de doenças autoimunes sistêmicas, como o lúpus eritematoso sistêmico (LES). Esses anticorpos são amplamente utilizados em ambientes hospitalares e laboratórios de diagnóstico devido à sua alta especificidade e relevância clínica. A maior conscientização dos médicos, a alta precisão dos testes e a inclusão rotineira em painéis de doenças autoimunes têm contribuído ainda mais para a dominância desse segmento. A crescente prevalência global de lúpus e artrite reumatoide também contribui para maiores taxas de adoção. Além disso, melhorias na sensibilidade e padronização dos ensaios aumentaram a confiança nos resultados, incentivando um uso clínico mais amplo.

Prevê-se que o segmento de Anti-ENA apresente a taxa de crescimento anual composta (CAGR) mais rápida, em torno de 10,7%, de 2026 a 2033, devido à sua crescente aplicação na detecção de múltiplas doenças do tecido conjuntivo, como a síndrome de Sjögren, a esclerodermia e a polimiosite. Os painéis de ENA permitem a detecção precoce e a diferenciação de condições autoimunes complexas, tornando-os extremamente valiosos em diagnósticos avançados. A crescente adoção de plataformas multiplex e a disponibilidade de painéis de testes de ENA abrangentes estão impulsionando o crescimento. Além disso, o aumento dos investimentos em saúde, a expansão da infraestrutura de diagnóstico e o aumento dos programas de triagem em economias em desenvolvimento estão acelerando a demanda. A integração dos testes de ENA com plataformas automatizadas também está melhorando a eficiência, contribuindo ainda mais para sua rápida trajetória de crescimento.

- Por produto

Com base no produto, o mercado é segmentado em Instrumentos, Consumíveis e Reagentes e Serviços. O segmento de Consumíveis e Reagentes detinha a maior participação na receita, com aproximadamente 47,3% em 2025, visto que esses produtos são necessários para todos os testes realizados. A necessidade recorrente de reagentes, soluções tampão, anticorpos e kits de ensaio torna esse segmento uma fonte consistente de receita para os fabricantes. O aumento no volume de testes, a crescente prevalência de doenças autoimunes e a expansão das redes de laboratórios impulsionaram significativamente a demanda. Além disso, os avanços contínuos nas formulações de reagentes e na confiabilidade dos kits fortaleceram seu uso em diagnósticos de rotina. A tendência de hospitais e laboratórios realizarem testes internamente também contribui para o crescimento a longo prazo desse segmento.

Prevê-se que o segmento de Serviços registre a taxa de crescimento anual composta (CAGR) mais rápida, de cerca de 11,2%, entre 2026 e 2033, impulsionado pela crescente tendência de terceirização de testes diagnósticos para laboratórios especializados. A infraestrutura interna limitada em hospitais e clínicas menores está incentivando a dependência de provedores de serviços terceirizados. A expansão das cadeias de serviços de diagnóstico e os investimentos em laboratórios de alto rendimento estão alimentando o rápido crescimento. Além disso, o avanço da medicina personalizada e a crescente demanda por serviços avançados de interpretação de exames desempenham um papel fundamental. A integração digital e os modelos de testes remotos também estão aprimorando a acessibilidade e a expansão deste segmento.

- Por técnica

Com base na técnica, o mercado é segmentado em ELISA, Imunofluorescência Indireta (IFI), Teste de Blotting, Microarranjo de Antígenos, Técnicas Baseadas em Gel, Ensaio Multiplex, Citometria de Fluxo, Hemaglutinação Passiva (HPP) e Outros. O segmento de Imunofluorescência Indireta (IFI) dominou o mercado com uma participação de receita de quase 41,5% em 2025, mantendo-se como o padrão ouro para testes de ANA em todo o mundo. A IFI oferece alta sensibilidade para a detecção de uma ampla gama de autoanticorpos e proporciona uma visualização nítida do padrão, o que é crucial para a interpretação diagnóstica. A maioria das diretrizes clínicas continua a recomendar a IFI como o método de triagem primário. Sua ampla adoção em laboratórios hospitalares e o forte apoio de reembolso reforçam ainda mais sua dominância.

O segmento de Ensaios Multiplex deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de aproximadamente 12,4%, entre 2026 e 2033, devido à sua capacidade de detectar múltiplos anticorpos simultaneamente. Essa técnica reduz significativamente o tempo de resposta, melhora a eficiência do fluxo de trabalho e diminui os custos gerais dos testes. A crescente adoção de plataformas automatizadas e a demanda cada vez maior por testes de alto rendimento em grandes laboratórios estão acelerando seu crescimento. Além disso, os avanços tecnológicos e a integração com ferramentas de análise baseadas em inteligência artificial estão aprimorando a precisão e aumentando a aceitação entre os médicos.

- Por meio de aplicação

Com base na aplicação, o mercado de testes de anticorpos antinucleares (ANA) é segmentado em doenças autoimunes e doenças infecciosas. O segmento de doenças autoimunes representou a maior participação na receita do mercado, com cerca de 58,9% em 2025, impulsionado pela crescente prevalência global de doenças como lúpus eritematoso sistêmico, artrite reumatoide, síndrome de Sjögren e esclerodermia. Os testes de ANA desempenham um papel fundamental no diagnóstico e monitoramento clínico dessas doenças e, portanto, são rotineiramente prescritos em hospitais e clínicas especializadas. A crescente conscientização entre pacientes e médicos, o acesso facilitado a programas de triagem precoce e a maior ênfase na identificação rápida da doença estão impulsionando significativamente a demanda. Além disso, os avanços contínuos na descoberta de biomarcadores e as pesquisas em andamento em patologias autoimunes ampliaram o valor clínico dos testes de ANA no acompanhamento da progressão da doença, na avaliação da resposta ao tratamento e no manejo de pacientes a longo prazo.

Prevê-se que o segmento de Doenças Infecciosas apresente o crescimento mais rápido, com uma taxa composta de crescimento anual (CAGR) de aproximadamente 9,6% entre 2026 e 2033, à medida que novas pesquisas continuam a destacar a complexa relação entre infecções e desregulação do sistema imunológico. O maior foco na compreensão das respostas imunes, particularmente após surtos virais generalizados e complicações pós-infecção, ampliou a relevância clínica dos testes de anticorpos antinucleares (ANA). Além disso, a integração dos testes de ANA em painéis imunológicos e diagnósticos abrangentes, juntamente com o aumento do investimento global em pesquisa de doenças infecciosas e programas de vigilância, está contribuindo para a rápida expansão desse segmento.

- Por usuário final

Com base no usuário final, o mercado é segmentado em Hospitais, Laboratórios, Centros de Diagnóstico, Institutos de Pesquisa e Outros. O segmento de Hospitais dominou o mercado com uma participação de aproximadamente 39,4% em 2025, impulsionado pelo alto fluxo de pacientes e pela disponibilidade de sistemas de diagnóstico integrados em ambientes hospitalares. Os testes de ANA são comumente realizados como parte das avaliações clínicas de rotina para doenças autoimunes e inflamatórias crônicas. A presença de profissionais de saúde qualificados, recursos laboratoriais avançados e ambientes de atendimento multidisciplinares garantem testes precisos e interpretação correta dos resultados. Além disso, os investimentos contínuos do governo em infraestrutura de saúde, modernização hospitalar e expansão de departamentos especializados reforçam ainda mais a liderança desse segmento.

O segmento de Centros de Diagnóstico deverá registrar a taxa de crescimento anual composta (CAGR) mais rápida, de aproximadamente 10,9%, entre 2026 e 2033, impulsionado pela crescente demanda por serviços de diagnóstico especializados, confiáveis e com boa relação custo-benefício. Esses centros priorizam a entrega de resultados mais rápidos por meio do uso de tecnologias automatizadas e plataformas de teste avançadas. Sua presença crescente em áreas urbanas, semiurbanas e até mesmo em regiões carentes está melhorando significativamente o acesso aos testes de ANA. Além disso, parcerias estratégicas com hospitais, clínicas e instituições de pesquisa estão fortalecendo sua posição no mercado e acelerando o crescimento nesse segmento.

- Por canal de distribuição

Com base no canal de distribuição, o mercado é segmentado em Licitação Direta, Vendas no Varejo, Distribuidores Terceirizados e Outros. O segmento de Licitação Direta detinha a maior participação de mercado, com aproximadamente 44,6% em 2025, impulsionado por compras em grande escala por hospitais governamentais, organizações de saúde pública e grandes grupos de saúde. Esse canal garante eficiência de custos, contratos de fornecimento de longo prazo e disponibilidade consistente de produtos. Os fabricantes se beneficiam da demanda estável, enquanto as instituições de saúde obtêm melhores preços e garantia de qualidade. Além disso, as licitações diretas reduzem as margens dos intermediários, ajudando as instituições a alocar recursos de forma mais eficaz. O número crescente de programas de diagnóstico financiados pelo governo e iniciativas nacionais de triagem de doenças está fortalecendo ainda mais o domínio desse segmento.

Prevê-se que o segmento de distribuidores terceirizados apresente o crescimento mais rápido, com uma taxa composta de crescimento anual (CAGR) de cerca de 11,5% entre 2026 e 2033, à medida que os distribuidores continuam a expandir seu alcance regional e a melhorar a eficiência geral da cadeia de suprimentos. Suas redes locais bem estabelecidas permitem uma disponibilidade mais rápida dos produtos e um serviço aprimorado em áreas rurais e subdesenvolvidas, anteriormente mal atendidas pelos fabricantes diretos. A crescente dependência dos distribuidores para gerenciamento de estoque, manutenção da cadeia de frio e entrega final está fortalecendo significativamente seu papel no mercado de testes de ANA. Além disso, os distribuidores terceirizados geralmente oferecem soluções integradas, incluindo suporte técnico, treinamento e serviço pós-venda, o que aumenta a satisfação e a fidelização do cliente. O número crescente de pequenos e médios laboratórios de diagnóstico que não possuem capacidade de aquisição direta também está impulsionando a dependência desses distribuidores.

Análise Regional do Mercado de Testes de Anticorpos Antinucleares na América do Norte

- A América do Norte dominou o mercado de testes de anticorpos antinucleares, com a maior participação na receita, de 41,8% em 2025, impulsionada por uma infraestrutura de saúde avançada, um alto volume de testes diagnósticos, estruturas de reembolso robustas e a presença de grandes empresas de diagnóstico.

- A região se beneficia da ampla adoção de métodos avançados de teste de ANA, incluindo imunofluorescência indireta (IFI) e ensaios baseados em ELISA. A crescente prevalência de doenças autoimunes, como lúpus, artrite reumatoide e síndrome de Sjögren, aumentou ainda mais a demanda por triagem de ANA de rotina e em estágios iniciais.

- A liderança da região também é reforçada pelos altos níveis de conscientização entre médicos e pacientes, pelas redes de laboratórios bem estabelecidas e pelos avanços tecnológicos contínuos em testes imunológicos. Os sistemas integrados de hospitais e laboratórios de diagnóstico da América do Norte garantem acesso rápido aos testes e monitoramento preciso da doença, tornando o teste de ANA um componente rotineiro do manejo de doenças autoimunes.

Análise do Mercado de Testes de Anticorpos Antinucleares nos EUA

O mercado de testes de anticorpos antinucleares (ANA) nos EUA detinha a maior participação na receita em 2025, impulsionado pelo crescente impacto das doenças autoimunes e pela forte presença de instalações de diagnóstico avançadas. O uso extensivo das tecnologias de imunofluorescência e ELISA, combinado com os altos gastos com saúde e políticas de reembolso favoráveis, continua a sustentar a ampla adoção dos testes de ANA. Além disso, a pesquisa contínua sobre biomarcadores autoimunes, o foco crescente no diagnóstico precoce e a expansão das abordagens de medicina personalizada estão contribuindo significativamente para o crescimento sustentado do mercado nos EUA.

Análise do Mercado de Testes de Anticorpos Antinucleares no Canadá

O mercado canadense de testes de anticorpos antinucleares deverá ser o de crescimento mais rápido no período de previsão, registrando uma taxa de crescimento anual composta (CAGR) de 11,8%. Esse crescimento é atribuído à melhoria do acesso à saúde, à expansão da infraestrutura de laboratórios de diagnóstico, à crescente conscientização sobre doenças autoimunes e ao aumento dos investimentos governamentais no desenvolvimento da saúde. A ênfase crescente do país na detecção precoce de doenças, juntamente com a expansão das atividades de pesquisa e a maior disponibilidade de tecnologias avançadas de imunodiagnóstico, está acelerando a adoção de testes de ANA em hospitais, centros de diagnóstico e instituições de pesquisa.

Participação de mercado dos testes de anticorpos antinucleares na América do Norte

O setor de testes de anticorpos antinucleares é liderado principalmente por empresas consolidadas, incluindo:

• F. Hoffmann-La Roche Ltd. (Suíça)

• Abbott (EUA)

• Siemens Healthineers (Alemanha)

• Danaher Corporation (EUA)

• bioMérieux SA (França)

• Thermo Fisher Scientific Inc. (EUA)

• Becton, Dickinson and Company (EUA)

• QuidelOrtho Corporation (EUA)

• Werfen (Espanha)

• EUROIMMUN AG (Alemanha)

• Bio-Rad Laboratories, Inc. (EUA)

• Inova Diagnostics (EUA)

• Trinity Biotech (Irlanda)

• Genway Biotech, Inc. (EUA)

• Arlington Scientific, Inc. (EUA)

• Erba Diagnostics (Alemanha)

• Hycor Biomedical LLC (EUA)

• Diagnostic Automation, Inc. (EUA)

• Creative Diagnostics (EUA)

• Snibe Diagnostic (China)

Últimos desenvolvimentos no mercado de testes de anticorpos antinucleares na América do Norte

- Em março de 2021, o mercado global de testes de ANA registrou um aumento na adoção de plataformas automatizadas de ELISA e imunofluorescência indireta (IFI) em hospitais e laboratórios de diagnóstico, melhorando a precisão e reduzindo erros humanos na triagem de doenças autoimunes.

- Em julho de 2022, várias empresas líderes em diagnóstico expandiram suas capacidades de produção de kits de teste ANA, impulsionadas pela crescente conscientização sobre doenças autoimunes como lúpus eritematoso sistêmico, artrite reumatoide e esclerodermia, particularmente na América do Norte e na Europa.

- Em abril de 2023, a EUROIMMUN introduziu perfis de teste ANA aprimorados, permitindo que os laboratórios detectem um espectro mais amplo de autoanticorpos com maior precisão, auxiliando assim no diagnóstico precoce e na melhoria do manejo de pacientes com doenças autoimunes.

- Em agosto de 2024, a Thermo Fisher Scientific lançou plataformas de teste ANA automatizadas e atualizadas, com sensibilidade aprimorada e fluxos de trabalho laboratoriais simplificados, permitindo tempos de resposta mais rápidos para centros de teste de alto volume.

- Em janeiro de 2025, analistas do setor relataram um aumento contínuo na adoção do teste ANA, impulsionado pela crescente prevalência de doenças autoimunes em todo o mundo e pela ênfase cada vez maior no diagnóstico precoce e no monitoramento da doença.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.